One Spencer Dock

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Weekly Planning List 47/20

Dublin City Council Weekly Planning List 47/20 (16/11/2020-20/11/2020) All applications received will be considered by the Planning Authority to determine their validity in accordance with Planning and Development Regulations 2001. Any application pending validation listed hereunder, and subsequently declared to be invalid, will be detailed in the DECISIONS SECTION of the Weekly List in a subsequent publication. 1 | P a g e Area 1 COMMERCIAL Area Area 1 - South East Application Number 2649/20 Application Type Permission Applicant Enda Woods Location 63, Highfield Road, Rathgar, Dublin 6, D06 T9D0 Registration Date 20/11/2020 Additional Information Clarification of Add. Information Recd. Proposal: PROTECTED STRUCTURE: Planning permission to construct a new three-storey, 4- bedroom, 172sqm, semi-detached dwelling to the side (east) of the existing dwelling at 63 Highfield Road. In addition, it is proposed to maintain the existing pedestrian access at Templemore Avenue and to relocate the existing access gateway on Templemore Avenue to provide new vehicular access to the front at Highfield Road, together with associated works and site services, all at 63 Highfield Road, Rathgar, Dublin 6, D06 T9D0, a protected structure (RPS Ref. 3861). ______________________________________________________________________________ Area Area 1 - South East Application Number 2958/20 Application Type Permission Applicant Chevas Securities Ltd Location Unit 3, Sandymount Village Centre, Sandymount Road, Dublin 4, D04 F1P6 Registration Date 16/11/2020 Additional Information Additional Information Received Proposal: Planning permission for change of use from existing first floor office unit to a 1 bedroom apartment. ______________________________________________________________________________ Area Area 1 - South East Application Number 3748/20 Application Type Permission Applicant Dublin Port Company Location At the MTL Terminal on Pigeon House Road, Dublin Port, Dublin 2 and an area to the south of Terminal 5 adjacent to Berth 53, Alexandra Road Extension, Dublin Port, Dublin 1. -

The Process of Urban Regeneration in Dublin: Before the Crisis, After the Crisis

The process of urban regeneration in Dublin: Before the crisis, after the crisis DR NIAMH MOORE SCHOOL OF GEOGRAPHY, PLANNING AND ENVIRONMENTAL POLICY, UNIVERSITY COLLEGE DUBLIN Presentazione al Dipartimento di Architettura, Università degli Studi di Palermo Seminar Overview The urban context The general development of Dublin The ‘urban crisis’ in the 1980s Framing regeneration Entrepreneurialism and governance Changing policy environment: area-based interventions Strategic urban projects & the public-private relationship Before, during and after the boom: Case study: Dublin Docklands After the boom: Where to now? The Urban Context Dublin, Ireland Dublin and Irish urban change 1970s /1980s: Global economic change, decline BUST of inner city Mid-1980s to 2007: Global growth, return to the inner city, redevelopment and regeneration, BOOM gentrification etc. 2007 to present: Global recession, national economic decline, construction slump, recovery? BUST 1950s onwards: Context for change: Global economic transformation National government policy: Wright Plan, 1966 Suburban expansion to the north, west and south Urban decay in 1970s and early-1980s Out-migration of industry to locations on the urban fringe New companies chose to locate operations in attractive suburbs Unprecedented rise in unemployment of 97,000 (1971- 1981) Changing distribution of economic functions and a redundant inner-city. Population change in Dublin Dublin 2011: 1,270,603 Dublin City: 525,383 (+3.8%) Fingal: 273,051 (+13.8%) DunLaogh: 206,995 -

Luas Red Line Customer Notice

Luas Red Line Customer Notice Luas Red Line stops from Abbey Street to The Point are closed until the end of July. Red Line services from Jervis to Tallaght and Saggart are running as normal but inbound trams will terminate at Jervis stop. A replacement bus is serving Jervis and the closed stops during this temporary closure. The bus stops are located on the Quays a short walking distance from the closed Luas stops. The inbound Bus departs from Bachelor’s Walk (close to Jervis stop) and terminates at Castleforbes Road (close to The Point stop) serving stops along The Quays. The outbound bus departs from Mayor Street Upper (close to The Point stop) terminating at Crampton Quay (close to Jervis stop) serving stops along the Quays. You don’t need a ticket for the replacement bus. You do need a valid ticket for tram services. Leap Card customers should Touch On/Off at Jervis stop. Customers who buy tickets from ticket machines should buy a ticket to/from Jervis stop. This temporary closure is necessary to facilitate Luas Cross City construction works on O’Connell Street and Marlborough Street. Thank you for your patience and cooperation during these works. For more info see www.luas.ie & www.luascrosscity.ie Luas Replacement Bus Service Map Due to the temporary closure of Luas Red Line from Abbey Street to The Point, a replacement bus service is in operation from Bachelor’s Walk (close to Jervis Luas stop) to Castleforbes Road (close to The Point closed Luas stop) and back terminating at Crampton Quay (close to Jervis Luas stop) serving a number of stops along the quays. -

From Alternative to Mainstream

CHAPTER 1 From Alternative to Mainstream Alternatives Ascending Foreword The specter of market volatility brought on by large-scale events, such as global pandemic- related lockdowns in early 2020, has had a strong influence on investor approaches to their portfolios. Investors are responding by building resilience into their portfolios to navigate a future with the potential for enormous surprises. Alternative asset managers face a complex mix of opportunities and challenges presented by strong investor appetite for diversification, as well as broader industry pressures. BNY Mellon, in conjunction with Mergermarket, surveyed 100 institutional investors and 100 alternative asset managers on their perceptions of current trends in the space and on whether the two sides are moving in the same direction. The findings show changing investor and asset manager attitudes and behavior, in some cases contrasting with our 2017 research report, The Race for Assets.1 In addition to shifting investor needs, highlighted in Chapter 1 of this study, alternative asset managers face structural changes within their organizations. A majority of alternative asset manager respondents cite forces of increased competition and changing economics as top factors driving structural change. They see increased product innovation as another significant structural game-changer. Like their peers in the broader asset management industry,2 alternative asset managers are deploying digital and data analysis technologies to increase efficiency, overcome regulatory hurdles, promote product innovation and improve reporting. 1 https://www.bnymellon.com/us/en/insights/content-series/the-race-for-assets.html 2 https://www.bnymellon.com/us/en/insights/asset-management-transformation-is-already-here/survey-research-series-overview.html 2 The need for robust data management and analytics is also bringing new complexities to the fore. -

River Dodder Greenway from the Sea to the Mountains

River Dodder Greenway From the Sea to the Mountains Feasibility Study Report January 2013 Client: Consulting Engineer: South Dublin County Council Roughan & O'Donovan Civic Offices Arena House Tallaght Arena Road Dublin 24 Sandyford Dublin 18 Roughan & O'Donovan - AECOM Alliance River Dodder Greenway Consulting Engineers Feasibility Study Report River Dodder Greenway From the Sea to the Mountains Feasibility Study Report Document No: ............. 12.176.10 FSR Made: ........................... Eoin O Catháin (EOC) Checked: ...................... Seamus MacGearailt (SMG) Approved: .................... Revision Description Made Checked Approved Date Feasibility Study Report DRAFT EOC SMG November 2012 A (Implementation and Costs included) DRAFT 2 EOC SMG January 2013 B Issue 1 EOC SMG SMG January 2013 Ref: 12.176.10FSR January 2013 Page i Roughan & O'Donovan - AECOM Alliance River Dodder Greenway Consulting Engineers Feasibility Study Report River Dodder Greenway From the Sea to the Mountains Feasibility Study Report TABLE OF CONTENTS 1. Introduction ......................................................................................................................................................................................................................................................................... 1 2. Background / Planning Context ....................................................................................................................................................................................................................................... -

Customer Service Poster

Improved Route 747 Airlink Express [ Airport ➔ City ] Dublin 2 Terminal 1 International Heuston Terminal 2 Exit road The O Convention Commons Street Talbot Street Gardiner Street Lower Cathal Brugha Street O’Connell Street College Green Christchurch Ushers Quay Dublin Airport Financial Rail Station Dublin Airport Dublin Airport Centre Dublin & Central Bus Station & O'Connell St. Upper & Temple Bar Cathedral Services Centre 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Luas Maldron Hotel Jurys Inn Busáras Maple Hotel The Gresham Hotel Wynns Hotel The Westin Hotel Jurys Inn Christchurch Maldron Hotel, Heuston Central Bus Station Rail Station Red Line Cardiff Lane Custom House Abbot Lodge Academy Plaza Hotel Abbey Court Hostel Barnacles Hostel The Arlington Hotel Smithfield Connolly Rail Station Luas Red line Gibson Hotel Clarion Guesthouse Cassidy's Hotel The Arlington Hotel Blooms Hotel Temple Bar Ellis Quay Apartments IFSC Hotel Luas Red line Ashling Hotel Abraham House Jurys Inn Parnell Street Bachelors Walk The Trinity Capitol Harding Hotel The Four Courts Hostel North Star Hotel Hostel Litton Lane Hostel Kinlay House O'Sheas Merchant The Hilton Lynams Hotel Temple Bar Hotel Kilmainham Airlink Timetable Hotel Isaacs Amberley House The Morrison Hotel Paramount Hotel Park Inn Smithfield Maldron Hotel The Times Hostel Phoenix Park Isaacs Hostel Browns Hotel Parnell Square Clifton Court Hotel The Parliament Hotel Generator Hostel Brooks Hotel Faireld Ave Guesthouse Airlink 747 A irport City Centre Heuston Station Jacobs Inn Dergvale Hotel Smithfield -

Tall Buildings in Dublin

ctbuh.org/papers Title: The Need for Vision: Tall Buildings in Dublin Author: Brian Duffy, Associate, Traynor O'Toole Architects Subject: Urban Design Keywords: Development Master Planning Urban Sprawl Vertical Urbanism Publication Date: 2008 Original Publication: CTBUH 2008 8th World Congress, Dubai Paper Type: 1. Book chapter/Part chapter 2. Journal paper 3. Conference proceeding 4. Unpublished conference paper 5. Magazine article 6. Unpublished © Council on Tall Buildings and Urban Habitat / Brian Duffy The Need for Vision: Tall Buildings in Dublin Brian Duffy Associate, Traynor O’Toole Architects – 49 Upper Mount Street, Dublin 2, Ireland Abstract The Celtic Tiger economy in Ireland has dramatically changed the substance of life in Ireland within a very short space of time. Whilst the infrastructure has struggled to keep up, the urban realm has begun the process of rapidly transforming Dublin from a low rise city of urban sprawl, to a densely woven contemporary modern environment. The appetite to build tall is tempered by an apprehensive planning policy, that reflects the cautious mood of the general public. Such apprehension restricts the possibility of creating an of-its-time City that meets it demands sustainably, whilst fulfilling its high aspirations. The paper examines planning policies and how Dublin architects have pursued tall buildings, most typically in the city centre. This is then contrasted with an alternative approach on the edge of the city, where one major landowner and [email protected] design team have proposed an entire masterplanning vision, premised on the inclusion of tall buildings. This untypical approach yields notable success and, in doing so, highlights the need for a more proactive and interactive approach to Biography Briantall building Duffy qualifiedstrategic planningfrom Queens on behalf University of architects, Belfast, developers Northern Ireland, and planners before alike. -

Mission Statement We Will Develop Dublin Docklands Into a World-Class

Presentation to Delegation from Stockholm 25th April, 2007 Paul Maloney, CEO 1. THE DOCKLANDS PROJECT BACK IN 1987 • Population at 16,000 • Dereliction • Economic deprivation • Educational disadvantage 1. THE DOCKLANDS PROJECT CUSTOM HOUSE DOCKS / IFSC 1997 22.0 hectares 1. THE DOCKLANDS PROJECT STRATEGIC OBJECTIVES Accelerating physical rollout Achieving architectural legacy Fulfilling the potential of the Docklands Realising quality of life Creating a sense of place Physical Development…. 2. PHYSICAL DEVELOPMENT DOCKLANDS NORTH LOTTS Commercial Space Completed 17,288m2 2002 Permitted 62,402m2 Housing units 2007 Completed 343 Permitted 1,606 2. PHYSICAL DEVELOPMENT GRAND CANAL DOCK Commercial Space 2 2002 Completed 55,412m Permitted 184,018m2 Housing units 2007 Completed 910 Permitted 1,516 2. PHYSICAL DEVELOPMENT NEW TENANTS MOVING INTO DOCKLANDS ESRI Dillon Eustace O2 Mason Hayes Curran PWC Mason Hayes Curran McCann Fitzgerald Google Beauchamps Fortis Bank Google PFPC Irish Taxation Institute Anglo Irish Bank MOPS O’Donnell Sweeney Arups U2 Tower Arups 2. PHYSICAL DEVELOPMENT POINT VILLAGE Point Village 2. PHYSICAL DEVELOPMENT PLANNING IN NORTH LOTTS Proposed new Masterplan 2. PHYSICAL DEVELOPMENT POOLBEG PENINSULA New City Quarter • Over 100 acres • Public transport infrastructure • Urban sustainable development • Amenities, cultural & community interventions Review of Heights and Densities 2. PHYSICAL DEVELOPMENT STREETSCAPES Price Waterhouse Coopers McCann Fitzgerald Forbe’s Quay Google Architectural Legacy… 3. Architectural Legacy Dublin’s Architectural Gateway U2 Tower The WatchTower 3. Architectural Legacy SAMUEL BECKETT BRIDGE 3. Architectural Legacy NATIONAL CONFERENCE CENTRE AT SPENCER DOCK 3. Architectural Legacy chq - CONSERVATION 3. Architectural Legacy ROYAL CANAL LINEAR PARK 3. Architectural Legacy GRAND CANAL SQUARE/LIBESKIND THEATRE Realising Quality of Life… 4. -

Eastside Docklands - Construction and Unemployment Changing the Narrative

2020 Construction and Unemployment Changing the Dublin Narrative Eastside + Docklands Local Employment Services A project of St. Andrew’s Resource Centre + Inner City Renewal Group Report on Dublin City Construction Skills Project 2020 Eastside Docklands - Construction and Unemployment Changing the Narrative Employment and Unemployment Trends in Ireland and Impact on Young Workers Increase in Since 2017 Ireland has continued to experience The scale of youth unemployment, and proportion of long- a strengthening labour market, with further its potential for long-term damage to the term unemployed improvements in the number of labour market employment prospects of individuals, highlights indicators. In 2017, the unemployment level the need for policies to actively address youth 2007 declined by 37,000, while the unemployment and young people unemployed. This report rate declined by 1.7% to an annual average deals with the impact on a specified area and of 6.7%. client cohorts. As the thinking about how best 27% to address the issue the youth and Long term The unemployment rate in Ireland is still higher unemployment rates in specific communities than in the period from 2002-2007.1 In Ireland were considered. by 2018, there were 36,000 more people unemployed (and 23,000 more long-term unemployed), than there had been in 2005, with evidence that the employment rate is still far Long Term Unemployed from recovering from the impact of the financial As the development of the project continued 2010 crisis. As is noted by Ciarán Nugent of NERI, this the figures were stark. While the wider lack of recovery in the unemployment figures unemployment rate has declined by 1.7%, it is is due, for the most part, to the collapse of of note that the rate for long term unemployed employment for younger cohorts, particularly declined by only 0.8% to 2.5% in quarter 4 for young men. -

Spencer Dock, Ifsc, Dublin 1

RATES FROM €80 PER NIGHT Discounts for Corporate Lets SPENCER DOCK, IFSC, DUBLIN 1 Located in the heart of Dublin’s Financial District(IFSC), Spencer Dock offers luxurious accommodation in a central location. Minutes walk from a host of trendy restaurants, cafes, pubs as well as the Dublin Convention Centre , O2 Arena, Croke Park & Aviva Stadium. Bright and spacious , all apartments have flat screen LCD TV’s, an open plan lounge area, luxury bathrooms with power showers and fully equipped state-of-the-art kitchens with integrated appliances. Free wi-fi access, weekly linen & cleaning, 24hour security and concierge are all standard. www.morganallen.ie Prime City Location Flat Screen LCD TV Free High Speed Internet Digital TV Weekly Cleaning & linen change Fully Equipped Kitchen Modern Bathrooms 24 hour Security Concierge Service 1 BEDROOM APARTMENTS Perfect for long stay business or leisure traveller. The apartments are set over 2 floors with ensuite & guest bathroom. Bright & Spacious the apartments offer luxurious surroundings Minimum Stay – 7 nights Maximum Occupancy – 2 Rates from €80 per night(ex. Vat) 2 BEDROOM APARTMENTS The ever popular 2 bedroom apartments are perfect for the travelling family, group of friends or for that extra added space. The apartments offer spacious contemporary open plan living with two large double bedrooms. Minimum Stay – 7 nights Maximum Occupancy – 4 www.morganallen.ie Rates from €95 per night(ex.vat) Check In Check In is from 2pm on the day of arrival. For late check ins please contact us at least 48 hours before arrival. Check Out You will be requested to vacate your apartment at 11am on the day of departure. -

Sdz Docklands Study Maps

1 DRAFT SDZ DOCKLANDS STUDY MAPS PUBLIC REALM MASTERPLAN FOR THE NORTH LOTTS & GRAND CANAL DOCK SDZ PLANNING SCHEME 2014 2 Public Realm Masterplan North Lotts & Grand Canal Dock Dublin City Council working group Deirdre Scully (planner) Jeremy Wales (architect) Jason Frehill (planner) Seamus Storan (engineer) Peter Leonard (parks) REDscape Landscape & Urbanism with Howley Hayes, Scott Cawley, Build Cost, O Connor Sutton Team REDscape Landscape & Urbanism: Howley Hayes Architects (heritage) : Fergal Mc Namara. Patrick Mc Cabe, landscape architect Scott Cawley Ecologists: (ecology) Paul Scott. David Habets, landscape designer O Connor Sutton Cronin Engineers: (PSDP) Anthony Horan. Joanne Coughlan, landscape architect Build Cost Quantity Surveyors: Liam Langan. Antoine Fourrier, landscape designer Andreas Mulder, urban designer Cover image: Perspective of the liffey, North Lotts and Grand Canal Dock. Legal This report contains several images and graphics based on creative representations. No legal rights can be given to these representations. All images have been accredited. Where the source is not clear, all efforts have been made to clarify the source. Date: January 2016 Dublin City Council Prepared by REDscape Landscape & Urbanism. 77 Sir John Rogerson’s Quay, Dublin 2. www.redscape.ie 3 Content Parks, squares, play areas Public transport Pedestrian routes Bicycle Routes Car road hierarchy Transport connections Underground infrastructure Tree structure Cultural and community facilities Water activities and facilities Creative hubs Urban development North Lotts shadow study North Lotts underground infrastructure 4 Public Realm Masterplan public green spaces North Lotts & Grand Canal Dock square & plaza football ptich proposed public green spaces 8 - 20+ y/o proposed square & plaza playground open air sport Play Ground Mariners Port Station Square Middle Park 2 - 7 y/o Point Square Pocket Park Source : Comhairle Cathrach Bhaile Átha Cliath - Dublin City Council, Maps & Figures,North Lotts & Grand Canal Dock Planning Scheme, 5th November 2013, Fig. -

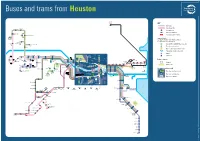

Buses and Trams from Heuston

67x 25. 67. 67 67x 67x 25a 25a 25a.25b 25x. 67x 67x 25. 67. 67 67x 67x 25a 25a 25a.25b 25x. 67x Buses and trams from Heuston Dublin Airport KEY 747 Bus route Collinstown Tram (Luas) line Blakestown (Intel) Principal stop 66x 25 Bus route terminus Maynooth 67 Easton Louisa Bridge Tram (Luas) line terminus 66 Maynooth 66x (Kingsbury) Transfer Points 66 66x Locations where it is possible to change Leixlip to a different form of transport (Castletown- Salesian Hewlett Packard) College 66b 66a Rail (DART, COMMUTER or Intercity) 67x Leixlip (Captain’s Hill) 66a Tram (Luas Green line) Leixlip Bus coach (regional or intercity) Park & Ride (larger car parks) Airport 25 Lucan Village Esker Hill Ballyowen Palmerstown Phoenix Park Ferry Port 67x Backweston 26 and Zoo 66 25.26 M 66.66a 25 26 66 ONTP 66a 66x 1473 ELIE Ballyoulster Lucan Road 66b.67.69 R HI 67 Chapelizod 66a 66b 67 69 LL 66b Points of Interest Aghards (Liffey Valley) 67 Dodsboro Lucan 67x Palmerstown Connolly Celbridge 25 25x Bypass Cemetery 69 O’Connell 26 PARKG Street Ballydowd ATE STR 1474 Hospital 67x 25a Esker Ballyfermot EET Four Abbey Manor Island- 1449 Busáras George’s Mayor Spencer The Lucan Meadow bridge Museum Smithfield Courts Jervis Street Dock Square Dock Point (Esker Church) Public Park 25a 25a Le Fanu 25 25 26 66 Park 26 66a 66b 67 69 7078 The O2/ 79 Kilmainham 66 O’Connell North Wall Point Depot Finnstown Finnstown Griffeen Foxborough Bridge (Beckett Bridge) Abbey Avenue Spiddal Park Cherry 66a R 25a 25b Geographic map inset only Fonthill Road ive 747 90 Orchard 69 66b r Liffe 25x 51d 69x 67 y 51x 66x 4319 Adamstown Station Inchicore 69 1473 25b 67x 69x Dublin Port Bus stop and stop number Cherry 79 79a 4320 145 25a.25b Heuston Arran/Ushers Ormond/ Orchard Heuston 79a Avenue 25x.51d 4413 Quay Essex Quay 66x.67x Station 4425 90 26 Bus route serving stop Parkwest & 69x.79 Cherry Orchard 79a Aston Quay Hawkins Street ST JOHNS ROAD WEST 79 79a 69 69x 145 Bus route terminus S T E Lock View E 2637 V D E 2638 A N O S R 25a 25b 25x ’ Dr.