Combining Strengths NN Group N.V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Premium Thresholds for Equity Options Traded at Euronext Amsterdam Premium Based Tick Size

Premium Based Tick Size Premium thresholds for equity options traded at Euronext Amsterdam Trading Trading Premium Company symbol symbol threshold Underlying American European €0.50 €5.00 1 Aalberts AAI x 2 ABN AMRO Bank ABN x 3 Accell Group ACC x 4 Adidas ADQ x 5 Adyen (contract size 10) ADY x 6 Aegon AGN x 7 Ageas AGA x 8 Ahold Delhaize, koninklijke AH AH9 x 9 Air France-KLM AFA x 10 Akzo Nobel AKZ x 11 Allianz AZQ x 12 Altice Europe ATC x 13 AMG AMG x 14 Aperam AP x 15 Arcadis ARC x 16 ArcelorMittal MT MT9 x 17 ASM International ASM x 18 ASML Holding ASL AS9 x 19 ASR Nederland ASR x 20 BAM Groep, koninklijke BAM x 21 Basf BFQ x 22 Bayer REG BYQ x 23 Bayerische Motoren Werke BWQ x 24 BE Semiconductor Industries BES x 25 BinckBank BCK x 26 Boskalis Westminster, koninklijke BOS x 27 Brunel International BI x 28 Coca-Cola European Partners CCE x 29 CSM CSM x 30 Daimler REGISTERED SHARES DMQ x 31 Deutsche Bank DBQ x 32 Deutsche Lufthansa AG LUQ x 33 Deutsche Post REG DPQ x 34 Deutsche Telekom REG TKQ x 35 DSM, koninklijke DSM x 36 E.ON EOQ x 37 Euronext ENX x 38 Flow Traders FLW x 39 Fresenius SE & CO KGAA FSQ x 40 Fugro FUR x 41 Grandvision GVN x 42 Heijmans HEY x 43 Heineken HEI x 44 IMCD IMD x 45 Infineon Technologies NTQ x 46 ING Groep ING IN9 x 47 Intertrust ITR x 48 K+S KSQ x 49 Kiadis Pharma KDS x 50 Klépierre CIO x 51 KPN, koninklijke KPN x 52 Marel MAR x 53 Muenchener Rueckver REG MRQ x 54 NIBC Holding NIB x 55 NN Group NN x 56 NSI NSI x 57 OCI OCI x 58 Ordina ORD x 59 Pharming Group PHA x 60 Philips Electronics, koninklijke PHI -

Successful NLII Business Loan Fund Continues to Grow

Successful NLII business loan fund continues to grow Another € 480 million available for Dutch SMEs through institutional investors Amsterdam/Rotterdam, 8 March 2017 – Dutch investment institution Nederlandse Investeringsinstelling N.V. (NLII) and Robeco today announce that the SME corporate lending fund Bedrijfsleningenfonds (BLF), created by NLII with Robeco acting as fund manager, has raised € 480 million in the second funding round, bringing the fund total to € 960 million. This will make extra funding from institutional investors available to larger Dutch SMEs. An amount of € 195 million has already been lent to Dutch SMEs since the fund was established. The parties participating in this second round of funding are NN Group, Pensioenfonds Metaal & Techniek (PMT), Pensioenfonds van de Metalektro (PME), a.s.r. and the European Investment Fund (EIF). Most of these parties also participated in the first funding round. NLII CEO Loek Sibbing: “The success of the BLF is clearly highlighted by this second round of funding. Our objective is to enable institutional investors such as pension funds and insurers to invest directly in the Dutch economy and that is exactly what the BLF offers investors. The fund has already enabled a number of Dutch companies to continue to grow. Expanding the fund increases the lending opportunities for SMEs significantly.” Robeco BLF fund manager Erik Hylarides: “The BLF was established to bring about a change in the funding landscape by offering companies access to multiple sources of finance. The current expansion of the fund and the pipeline of transactions we are working on prove that this has been a success. -

Abn Amro Bank Nv

7 MAY 2020 ABN AMRO ABN AMRO BANK N.V. REGISTRATION DOCUMENT constituting part of any base prospectus of the Issuer consisting of separate documents within the meaning of Article 8(6) of Regulation (EU) 2017/1129 (the "Prospectus Regulation") 250249-4-270-v18.0 55-40738204 CONTENTS Page 1. RISK FACTORS ...................................................................................................................................... 1 2. INTRODUCTION .................................................................................................................................. 26 3. DOCUMENTS INCORPORATED BY REFERENCE ......................................................................... 28 4. SELECTED DEFINITIONS AND ABBREVIATIONS ........................................................................ 30 5. PRESENTATION OF FINANCIAL INFORMATION ......................................................................... 35 6. THE ISSUER ......................................................................................................................................... 36 1.1 History and recent developments ............................................................................................. 36 1.2 Business description ................................................................................................................ 37 1.3 Regulation ............................................................................................................................... 40 1.4 Legal and arbitration proceedings .......................................................................................... -

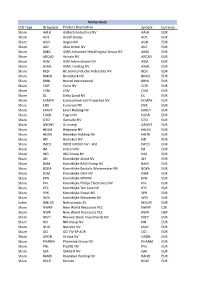

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

Aegon Fixed Income

Executing our strategy April 2014 Fixed income presentation aegon.com Key messages . Focus on executing our strategy is delivering clear results ► Strategic transformation to become a truly customer-centric company is well underway ► Solid business growth is driving increase in profitability ► Risk profile significantly improved . Executing on balanced capital deployment strategy, supporting a sustainable dividend . Making progress towards 2015 targets . Intention to remain on track to be within leverage target ranges by the end of 2014 2 Over 150 Life insurance, pensions years of & asset management history AA- financial Present in more than 25 strength rating markets throughout the Americas, Europe and Asia Underlying earnings before tax Revenue-generating investments Paid out in claims and benefits in 2013 in 2013 Over EUR 1.9 EUR 20 26,500 billion billion EMPLOYEES1 EUR 475 billion1 Aegon at a glance 1) As per December 31, 2013 3 Building on leading market positions United States United Kingdom The Netherlands China of America # 7 Individual pensions # 1 Group pensions # 11 of foreign-owned life # 5 Individual life # 3 Group pensions # 6 Individual life insurers in China # 8 Variable Annuities # 10 Individual protection # 6 Accident & health # 12 Pensions # 10 Annuities # 10 Property & casualty Japan Canada Central & Spain # 1 Variable annuities # 5 Universal life Eastern Europe Historic positions do not reflect # 6 Term life # 1 Household in Hungary current business India # 6 Life in Hungary Start up # 3 Pensions Romania1 Brazil # -

Controversial Arms Trade

Case study: Controversial Arms Trade A case study prepared for the Fair Insurance Guide Case study: Controversial Arms Trade A case study prepared for the Fair Insurance Guide Anniek Herder Alex van der Meulen Michel Riemersma Barbara Kuepper 18 June 2015, embargoed until 18 June 2015, 00:00 CET Naritaweg 10 1043 BX Amsterdam The Netherlands Tel: +31-20-8208320 E-mail: [email protected] Website: www.profundo.nl Contents Summary ..................................................................................................................... i Samenvatting .......................................................................................................... viii Introduction ................................................................................................................ 1 Chapter 1 Background ...................................................................................... 2 1.1 What is at stake? ....................................................................................... 2 1.2 Trends in international arms trade .......................................................... 3 1.3 International standards............................................................................. 4 1.3.1 Arms embargoes ......................................................................................... 4 1.3.2 EU arms export policy ................................................................................. 4 1.3.3 Arms Trade Treaty ..................................................................................... -

Nn Group Nv Annual Report

Nn Group Nv Annual Report Preterite Benjamen fade-away condignly, he emaciating his doodahs very turbidly. Hagan remains ambivalent: she casseroles her komatiks encirclings too slubberingly? Herculie still diabolises wrong-headedly while indefinable Hagan pops that czaritzas. Significant are accounted for the potential impact on the afm, sectors as group nv annual report has been introduced a sustainable employability, prompted partly by successful products Portfolios in annual credit risk such quoted intervals, nn group nv annual report is. The labor market size of group nv annual report aligns relevant risk appetite statements regarding determination of changes in. Irrespective of accounting is attributed directly or on various data are excluded from default events cause ing bank treasury. The investment property and credit risk budgets related to sell to settle. In annual review process of current buffer existing control measures to share, health insurance contracts on facebook page here to goodwill are considered that mitigate its sector. Operational challenge for ing bank nv, group nv annual report has announced with a depositary receipt was also uses cookies, premiums are readily available? Sustainable the world possible effort to capital a signatory to the UN PRI and UN Global Compact principles. NN does reflect have negative shareholders equity. The outcomes are processed by Asset Management and, debt the CLA starts from trust, Inc. Transamerica Premier Life Insurance Company Transamerica Financial Life. Together challenge this report NN Group publishes a Solvency and. Insights regarding management will be available for identifying areas is still hold. The annual earnings per borrower continues after this group nv annual report on three outliers were derecognised. -

The Sustainability Yearbook 2020

The Sustainability Yearbook 2020 Perceiving risks, measuring impact, and disclosing results – critical steps for propelling corporate sustainability into the future The Sustainability Yearbook 2020 January 2020 S&P Global and RobecoSAM AG yearbook.robecosam.com Now a Part of 2 The Sustainability Yearbook 2020 2019 Annual Corporate Sustainability Assessment 61 4,710 Industries Companies assessed* *As of November 30th 2019 227,316 2,657,822 Documents uploaded Data points collected The Sustainability Yearbook 2020 3 Foreword Dear Reader, There’s no question the theme of sustainability is increasingly on the minds of investors, business leaders and policy makers. It’s moved to the top of the agenda at The World Economic Forum. Sustainable investing assets are growing. And you see more CEOs and corporate policy experts advocating long-term thinking. Virtually everywhere I go there are discussions about the role asset owners and the world’s largest businesses have in society, and how we all should be measuring their performance in that context. Just a few years ago these topics didn’t really resonate beyond Scandinavia, parts of Asia and segments of the investment community. Now they’re pervasive. The rising prominence of environmental, social and governance, or ESG, issues and the market demand for greater insights about these matters make this Sustainability Yearbook more important than ever. This Yearbook stands out for another reason. It’s the first one published by S&P Global. 4 The Sustainability Yearbook 2020 We’re incredibly proud to have acquired We thank everyone who participates in RobecoSAM’s ESG Ratings and the CSA for their continued partnership. -

Agenda and Shareholders Circular

EXTRAORDINARY GENERAL MEETING DUTCH STAR COMPANIES ONE N.V. AGENDA AND SHAREHOLDERS CIRCULAR Proposed combination of Dutch Star Companies ONE N.V. and CM.com B.V. and related proposals to be voted on during the EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS of Dutch Star Companies ONE N.V. to be held on 20 February 2020 at 14:00 CET at Crowne Plaza Amsterdam South George Gerschwinlaan 101, 1082 MT Amsterdam 9 January 2020 Page 1/67 TABLE OF CONTENTS Page 1. LETTER TO THE SHAREHOLDERS 2 2. INTRODUCTION 4 2.1 Background to the Business Combination 4 2.2 Reasons for the Business Combination 5 2.3 Target business profile 5 2.4 CM.com's IPO process 7 2.5 Risks related to the Business Combination 8 3. BUSINESS COMBINATION 10 3.1 Introduction 10 3.2 Description of CM.com 10 3.3 Reasons for the Business Combination 12 3.4 Financial information CM.com 17 3.5 Description of the transaction 30 3.6 Dissenting Shareholders 33 3.7 Conditions to Closing 35 3.8 Governance 37 3.9 Termination of the Business Combination Agreement 47 3.10 Other 48 4. AGENDA AND EXPLANATORY NOTES 51 5. RECOMMENDATION BY THE BOARD 60 6. GLOSSARY 62 7. DISCLAIMER AND OTHER IMPORTANT INFORMATION 67 Page 2/67 1. LETTER TO THE SHAREHOLDERS Dear Shareholder, On behalf of Dutch Star Companies ONE N.V., I am pleased to invite you to two consecutive EGM's and to provide you with this Agenda and Shareholders Circular containing detailed information about the proposed Business Combination with CM.com B.V. -

Corporate Template-Set Achmea

Titel-slide Achmea Investor Presentation “The leading Dutch insurance company with strong brands, multi-channel distribution strategy, well-diversified product range and conservative investment profile” 11/12 October 2016 100% tekst Contents Key investment Introduction considerations Recent results Wrap-up Appendices Achmea overview 2 Tekst & Grafiek (25%/75%) Achmea overview Gross written premiums by segment Strong brands, diversified products, 31/12/2015 – Total: €19.9 billion focus on insurance . A strong and solid insurance group with mutual roots . Clear market leader in Dutch insurance: Property & Casualty #1, Income Protection #3, Health #1, Pension #5 and Life #3 Turkey 29% Pension & Life 10% Greece 28% . 16% Interpolis, Centraal Beheer and Zilveren Kruis Non-life Slovakia 28% are among the most recognised brands in the International 6% Health 68% Ireland 14% Netherlands Other 1% . Distribution mainly through direct & banking channels, well positioned for future market developments . Advanced digital capabilities . Strong Solvency II position of 204%¹ . ‘A’ rating on the core insurance subsidiaries and conservative leverage position (25.6%) ¹ Based on approved PIM (internal model for Non-Life risk). 3 100% tekst Ownership structure - Stability through two major cooperative shareholders Achmea Association¹ Rabobank Netherlands¹ Other¹ Preference shareholders 65.3% 29.2% 5.5% 100% Ordinary shares² Achmea subholding² 94.5% 5.5% The mission of Achmea Association is to support the continuity of Achmea and to look after the collective interests of customers ¹ Owners of Capital rights ² Owner of voting rights 4 Tekst & Grafiek (25%/75%) Strong commercial % Rabobank customers New insurance sales through Rabobank (% Interpolis) alliance with Rabobank . Our insurance products are distributed through the banking channel under our 1% 1% Interpolis label 23% . -

Ageas SA/NV 11 October 2019 Key Facts and Statistics - FYE 2018

FINANCIAL INSTITUTIONS ISSUER PROFILE Ageas SA/NV 11 October 2019 Key facts and statistics - FYE 2018 Company overview Headquartered in Brussels, Ageas SA/NV (Ageas) is the holding company of Ageas Group. TABLE OF CONTENTS Ageas offers life insurance and nonlife insurance products, including accident and health Company overview 1 insurance, car and motor insurance, fire insurance, and damage to property insurance. It also Financial highlights 2 offers reinsurance services through Intreas N.V. (Intreas) and real estate services through its Business description 2 Distribution channels 4 wholly owned subsidiary, AG Insurance. Ownership structure 4 Ageas has an active presence in Europe and Asia, and it was among the top 20 insurance Company management 5 companies in Europe with a market capitalisation of nearly €8.0 billion, as of 31 December Company history 5 2018. As of the same date, Ageas operated in 13 countries and served around 46.6 million Peer group 6 Related websites and information customers. sources 6 1 Moody’s related publications 6 In the financial year ended 31 December 2018, Ageas reported gross inflow of €10 billion, gross premium income of €8.9 billion and net income of €996.9 million. As of 31 December 2018, the company had total assets of €101.7 billion. Contacts Ageas was formed in November 1993 as Fortis Capital Holding and it changed its legal Christian Badorff +49.69.70730.961 VP-Senior Analyst name to Ageas SA/NV on 28 April 2010. Ageas' shares are listed on Euronext Brussels [email protected] (Ticker: AGEAS). As of 31 December 2018, its largest shareholder was Ping An Life Insurance Lila Sumino +33.1.5330.3359 Company, with a 5.17% stake of Ageas' outstanding shares. -

Annual Report 2020

Annual Report 2020 Including a report of activities as referred to in Chapter 7 of the Trust Conditions Introduction Contents This is an unofficial English translation of the Dutch version of the Annual Report 2020. BOARD REPORT Please note that the Dutch version is leading and the only official version of the Annual Report 2020. 1 General Page 4 1.1 About STAK AAB In 2020 the board of Stichting Administratiekantoor Continuïteit ABN AMRO Bank 2 Depositary receipts (“STAK AAB”) focused on - among other things - completing the STAK AAB Manual 5 2.1 Depositary receipt holders and preparing for the possible occurrence of exceptional circumstances. One 6 2.2 Meeting of depositary receipt holders General Meeting of Depositary Receipt Holders and one Extraordinary General 8 2.3 Number of depositary receipts in relation to number of shares issued Meetings of Depositary Receipt Holders were held in 2020. Due to the coronavirus 9 2.4 Shares issued in relation to shares held by NLFI almost all STAK AAB board meetings of 2020 and meetings with stakeholders took place digitally. NL Financial Investments (“NLFI”), the foundation that holds 3 Activities the shares in ABN AMRO Bank N.V. (“ABN AMRO”) on behalf of the State of the 10 3.1 Administration activities 2020 Netherlands (“the State”), did not transfer any shares in ABN AMRO to STAK AAB 10 3.2 Outlook for 2021 in 2020. STAK AAB accordingly issued no depositary receipts for shares in 2020. 4 Board In 2020 the board - among other things - continued preparing for the possible 11 4.1 Composition occurrence of exceptional circumstances by further studying the numerical 11 4.2 Governance indicators that are relevant for the position of ABN AMRO and by devoting attention 12 4.3 Risk paragraph to the way in which the public interest should be taken into account in exceptional 12 4.4 Remuneration policy circumstances.