Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Top 10 Mutual Fund Rankings

Top 10 Mutual Fund Rankings June 2014 AF Advisors is part of the A Fortiori Group Content – Introducing AF Advisors – AF Advisors Top 10 rankings – Process – Asset classes • Global Large Cap Equity • Global Emerging Markets Large Cap Equity • US Large Cap Equity • European Large Cap Equity • European Small & Mid Cap Equity • Asia-Pacific ex Japan Large Cap Equity • European Government Bonds • European Corporate Bonds – Disclaimer AF Advisors is part of the A Fortiori Group 2 Introducing AF Advisors AF Advisors is an independent research and consultancy company servicing financial institutions active in asset management. In the evolving financial environment we offer our clients strategic advantages through the combination of our extended knowledge, experience and skills. AF Advisors not only offers advice, but is also capable to implement the advice. AF Advisors strives for a healthier, more transparent financial industry by providing value adding services. Clients value our: • in depth knowledge • thorough listening skills and no-nonsense, hands-on approach • candid advice AF Advisors is part of the A Fortiori Group 3 AF Advisors Top 10 Rankings – For all major asset classes AF Advisors delivers insight in the numerous mutual funds available to Dutch retail investors. – For each asset class the AF Advisors Ranking Model results in a useful apples to apples comparison list of 10 funds offering the best value for Dutch retail investors. – The model is based on several factors, qualitative as well as quantitative, such as cost, performance, risk, the importance of the investment strategy to the provider and the level of service provided to the Dutch market. -

Premium Thresholds for Equity Options Traded at Euronext Amsterdam Premium Based Tick Size

Premium Based Tick Size Premium thresholds for equity options traded at Euronext Amsterdam Trading Trading Premium Company symbol symbol threshold Underlying American European €0.50 €5.00 1 Aalberts AAI x 2 ABN AMRO Bank ABN x 3 Accell Group ACC x 4 Adidas ADQ x 5 Adyen (contract size 10) ADY x 6 Aegon AGN x 7 Ageas AGA x 8 Ahold Delhaize, koninklijke AH AH9 x 9 Air France-KLM AFA x 10 Akzo Nobel AKZ x 11 Allianz AZQ x 12 Altice Europe ATC x 13 AMG AMG x 14 Aperam AP x 15 Arcadis ARC x 16 ArcelorMittal MT MT9 x 17 ASM International ASM x 18 ASML Holding ASL AS9 x 19 ASR Nederland ASR x 20 BAM Groep, koninklijke BAM x 21 Basf BFQ x 22 Bayer REG BYQ x 23 Bayerische Motoren Werke BWQ x 24 BE Semiconductor Industries BES x 25 BinckBank BCK x 26 Boskalis Westminster, koninklijke BOS x 27 Brunel International BI x 28 Coca-Cola European Partners CCE x 29 CSM CSM x 30 Daimler REGISTERED SHARES DMQ x 31 Deutsche Bank DBQ x 32 Deutsche Lufthansa AG LUQ x 33 Deutsche Post REG DPQ x 34 Deutsche Telekom REG TKQ x 35 DSM, koninklijke DSM x 36 E.ON EOQ x 37 Euronext ENX x 38 Flow Traders FLW x 39 Fresenius SE & CO KGAA FSQ x 40 Fugro FUR x 41 Grandvision GVN x 42 Heijmans HEY x 43 Heineken HEI x 44 IMCD IMD x 45 Infineon Technologies NTQ x 46 ING Groep ING IN9 x 47 Intertrust ITR x 48 K+S KSQ x 49 Kiadis Pharma KDS x 50 Klépierre CIO x 51 KPN, koninklijke KPN x 52 Marel MAR x 53 Muenchener Rueckver REG MRQ x 54 NIBC Holding NIB x 55 NN Group NN x 56 NSI NSI x 57 OCI OCI x 58 Ordina ORD x 59 Pharming Group PHA x 60 Philips Electronics, koninklijke PHI -

Investor Presentation Transforming to a Specialist Wealth Manager

Investor Presentation Transforming to a specialist wealth manager March 2016 Van Lanschot at a glance Van Lanschot’s profile Solid performance on all key financials • One strategy: pure-play, independent wealth manager focusing on 2015 2014 preservation and creation of wealth for our clients • Net profit € 42.8m € 108.7m • Underlying result € 60.1m € 54.2m • Two leading brands: Van Lanschot and Kempen & Co • CET I ratio 16.3% 14.6% • CET I ratio, fully loaded 15.4% 13.4% • Total Capital ratio 17.0% 15.2% • Three core activities: Private Banking, Asset Management and • Leverage ratio, fully loaded 6.1% 5.3% Merchant Banking • Funding ratio 94.1% 95.3% • Client assets € 62.6bn € 58.5bn Good progress with strategy Financial targets 2017 • Private Banking: € 0.3 billion net inflow, € 1.5 billion entrusted to Evi Target van Lanschot, commission income +12% 2015 2017 • Asset Management: acquisition of fiduciary management KCM UK as • Common Equity Tier I ratio 16.3% >15% step stone for further international growth, new mandates won early 2016 adding approximately € 2 billion of AuM • Return on Common Equity Tier I 4.9% 10-12% • Merchant Banking: commission income +28%, solid market share in • Efficiency ratio 74.4% 60-65% selected niches, research coverage expanded • Corporate Banking: initial run-off target achieved, run-off continues Van Lanschot Investor Presentation - March 2016 1 1. Profile & Strategy of Van Lanschot 2. Financial Performance FY2015 Agenda Van Lanschot Investor Presentation - March 2016 2 Transforming from small “universal” -

Audit Opinion Robeco QI Global Factor Solution Fund

RobecoQIGlobalFactor Solution Fund Fund for joint account Annual Report 2019 Contents Report by the manager 4 General information 4 Key figures 5 General introduction 5 Investment policy 7 Investment result 8 Risk management 8 Movements in net assets 8 Remuneration policy 9 Sustainable investing 10 In Control Statement 13 Annual financial statements 14 Balance sheet 14 Profit and loss account 15 Cash flow statement 16 Notes 17 General 17 Accounting principles 17 Principles for determining the result 17 Principles for cash flow statement 18 Risk management 18 Risks relating to financial instruments 19 Notes to the balance sheet 23 Notes to the profit and loss account 25 Additional information on investments in Robeco Group funds 28 Robeco QI Global Conservative Equities Z EUR 28 Robeco QI Global Momentum Equities Z EUR 49 Robeco QI Global Value Equities Z EUR 63 Schedule of Investments 80 Other information 81 Provisions regarding appropriation of the result 81 Directors’ interests 81 Auditor’s report by the independent auditor 82 Robeco QI Global Factor Solution Fund 2 Robeco QI Global Factor Solution Fund (fund for joint account incorporated under Dutch law, subject to the definitions contained within the 1969 Dutch Corporation Tax Act, domiciled at the offices of the fund manager in Rotterdam, the Netherlands) Contact details Weena 850 PO Box 973 NL-3000 AZ Rotterdam Telephone +31 (0)10 - 224 12 24 Internet: www.robeco.com Manager Robeco Institutional Asset Management B.V. (‘RIAM’) Policymakers RIAM: Gilbert O.J.M. Van Hassel Karin van Baardwijk Monique D. Donga (until 30 June 2019) Peter J.J. -

Powerpoint Presentatie

Analyst Meeting Amsterdam, 1 December 2010 Programme 2.30 pm Ieko Sevinga Private Banking 3.00 pm Arjan Huisman Operations 3.30 pm – 4.00 pm Break 4.00 pm Constant Korthout Funding and Basel III 4.30 pm Floris Deckers Strategy & Outlook for the sector 5.30 pm Drinks & dinner 1 Analyst Meeting Ieko Sevinga, member of the Board of Managing Directors Van Lanschot’s strategy To offer high-quality financial services to wealthy individuals, Mission director-owners and other select client groups Van Lanschot aims to be the best private bank in the Netherlands Vision and Belgium To be able to measure the achievement of its vision, Van Lanschot Targets has formulated targets relating to clients and employees and 2010-2013 financial targets 1. Focus on private banking 2. Enhance commercial effectiveness Strategy 3. Invest continually in service quality 4. Maintain a solid profile Independent Professional Core values Committed Ambitious 3 Strategic priorities Focus on Full-service offering Private Acquisition focused on high net-worth individuals and Banking entrepreneurs and their businesses Enhance Growth of client satisfaction commercial Growth in number of clients effectiveness Growth in revenues Invest Customer care continually in Transparent and good product and service offering service quality Operational excellence Risk management Maintain Cost control a sound Stricter deployment of capital for clients with a view to expected profile higher capital requirements 4 Focused business model FULL SERVICE OFFERING Business Private Banking -

Invitation and Agenda to the Annual General Meeting of Shareholders Of

invitation and agenda to the annual general meeting of shareholders of van lanschot nv, to be held in the auditorium of the van lanschot tower, leonardo da vinciplein 60, ’s-hertogenbosch, the netherlands, on thursday 15 may 2014 at 2 p.m. 1 invitation and agenda ANNUAL GENERAL MEETING OF 9. Extension of powers of the Board of Managing SHAREHOLDERS OF VAN LANSCHOT NV Directors a) Extension of the power of the Board of Managing Directors to issue ordinary shares (voting item) Van Lanschot NV invites its shareholders and holders of b) Extension of the power of the Board of Managing Directors depositary receipts to attend the Annual General to limit or exclude the pre-emption right in the event of the Meeting, to be held in the auditorium of the Van Lanschot issue of ordinary shares (voting item) Tower, Leonardo Da Vinciplein 60, ’s-Hertogenbosch, the Netherlands, on Thursday 15 May 2014 at 2 p.m. 10. Any other business and closure of meeting Availability of meeting documents 1. Opening Prior to the meeting, the following documents can be obtained by the shareholders and holders of depositary receipts at no cost 2. 2013 annual report from the office of Van Lanschot NV (Leonardo da Vinciplein 60, a) Report of the Supervisory Board (discussion item) 5223 DR, ’s-Hertogenbosch, the Netherlands): b) Report of the Board of Managing Directors for 2013 – the agenda with explanatory notes; (discussion item) – the report of the Supervisory Board; c) Strategy implementation status report (discussion item) – the Report of the Board of Managing Directors for 2013; – the 2013 financial statements and other information; 3. -

Investor Presentation

Investor presentation April 2021 Van Lanschot Kempen at a glance Profile Solid performance on all key financials • Well capitalised, profitable wealth manager with a strong specialist position in the market 2020 2019 • • Strong brand names, reliable reputation, rich history Net result €49.8m €80.2m* • Clear choice for wealth management, targeting private, wholesale & institutional and corporate clients • CET 1 ratio 24.3% 23.8% • • Tailored, personal and professional service Total capital ratio 27.4% 26.9% • Uniform way of servicing our client segments • • Strong track record in transformation processes and de-risking Client assets €115.0bn €102.0bn of the company • AuM €99.0bn €87.7bn • Strong balance sheet and attractive capital strategy • Loan book €8.4bn €8.7bn (excluding provisions) Our wealth management strategy 2025 financial targets Supported by our strong client relationships we are a leading player in our relevant markets and geographies 2020 Target 2025 • Common Equity Tier 1 ratio 24.3% 15 - 17% Our strategic pillars: • Return on CET1 • Accelerate growth – organically and inorganically 4.4% 10 - 12% • Activate our full potential • Efficiency ratio 85.7% 70 - 72% • Advance through digitalisation and advanced analytics • Dividend pay-out • Adapt the workforce 65% 50 - 70%** • Achieve our sustainability ambitions *Adjusted for the sales of our stakes in AIO II and VLC & Partners, and goodwill impairments **Of underlying net result attributable to shareholders 2 Van Lanschot Kempen is a well-capitalised, profitable, independent wealth manager Van Lanschot Kempen’s rich history reaches back over 280 years Acquisition Staalbankiers’ private banking activities Strategic Partnership review Successful with a.s.r. -

Successful NLII Business Loan Fund Continues to Grow

Successful NLII business loan fund continues to grow Another € 480 million available for Dutch SMEs through institutional investors Amsterdam/Rotterdam, 8 March 2017 – Dutch investment institution Nederlandse Investeringsinstelling N.V. (NLII) and Robeco today announce that the SME corporate lending fund Bedrijfsleningenfonds (BLF), created by NLII with Robeco acting as fund manager, has raised € 480 million in the second funding round, bringing the fund total to € 960 million. This will make extra funding from institutional investors available to larger Dutch SMEs. An amount of € 195 million has already been lent to Dutch SMEs since the fund was established. The parties participating in this second round of funding are NN Group, Pensioenfonds Metaal & Techniek (PMT), Pensioenfonds van de Metalektro (PME), a.s.r. and the European Investment Fund (EIF). Most of these parties also participated in the first funding round. NLII CEO Loek Sibbing: “The success of the BLF is clearly highlighted by this second round of funding. Our objective is to enable institutional investors such as pension funds and insurers to invest directly in the Dutch economy and that is exactly what the BLF offers investors. The fund has already enabled a number of Dutch companies to continue to grow. Expanding the fund increases the lending opportunities for SMEs significantly.” Robeco BLF fund manager Erik Hylarides: “The BLF was established to bring about a change in the funding landscape by offering companies access to multiple sources of finance. The current expansion of the fund and the pipeline of transactions we are working on prove that this has been a success. -

RIAM Annual Report 2020 FINAL

Robeco Institutional Asset Management B.V. Annual Report Contents General information 222 Report of the Executive Committee 333 Report of the Supervisory Board 212121 Financial Statements 2020 242424 Income Statement 25 Balance Sheet as at 31 December 26 Notes to the financial statements 27 General information 27 Other information 474747 Articles of Association rules regarding profit appropriation 47 Branches 47 Independent auditor’s report 484848 Annual Report Robeco Institutional Asset Management B.V. 2020 1 GGGeneralGeneral information Executive Committee (‘ExCo’) G.O.J.M. (Gilbert) Van Hassel (CEO)* K. (Karin) van Baardwijk (Deputy CEO)* A.J.M. (Lia) Belilos – Wessels M.C.W. (Mark) den Hollander* M.F. (Mark) van der Kroft (since 1 September 2020) M.O. (Martin) Nijkamp H-Ch.(Christoph) von Reiche V. (Victor) Verberk P.J.J. (Peter) Ferket (until 22 May 2020) * also statutory director Supervisory Board M.F. (Maarten) Slendebroek (since 13 August 2020, Chair) S. (Sonja) Barendregt – Roojers (Vice Chair) S.H. (Stanley) Koyanagi (since 13 August 2020) M.A.A.C. (Mark) Talbot R.R.L. (Radboud) Vlaar J.J.M. (Jeroen) Kremers (until 30 March 2020) More information on the Supervisory Board and the ExCo can be found on the website www.robeco.com. Independent Auditor KPMG Accountants N.V. Papendorpseweg 83 3528 BJ Utrecht The Netherlands Address Robeco Institutional Asset Management B.V. Weena 850, 3014 DA Rotterdam P.O. Box 973, 3000 AZ Rotterdam The Netherlands Tel: +31 10 224 1224 Internet : www.robeco.com E-mail : [email protected] Rotterdam Chamber of Commerce number 24123167 Annual Report Robeco Institutional Asset Management B.V. -

Abn Amro Bank Nv

7 MAY 2020 ABN AMRO ABN AMRO BANK N.V. REGISTRATION DOCUMENT constituting part of any base prospectus of the Issuer consisting of separate documents within the meaning of Article 8(6) of Regulation (EU) 2017/1129 (the "Prospectus Regulation") 250249-4-270-v18.0 55-40738204 CONTENTS Page 1. RISK FACTORS ...................................................................................................................................... 1 2. INTRODUCTION .................................................................................................................................. 26 3. DOCUMENTS INCORPORATED BY REFERENCE ......................................................................... 28 4. SELECTED DEFINITIONS AND ABBREVIATIONS ........................................................................ 30 5. PRESENTATION OF FINANCIAL INFORMATION ......................................................................... 35 6. THE ISSUER ......................................................................................................................................... 36 1.1 History and recent developments ............................................................................................. 36 1.2 Business description ................................................................................................................ 37 1.3 Regulation ............................................................................................................................... 40 1.4 Legal and arbitration proceedings .......................................................................................... -

CFD Type IB Symbol Product Description Symbol Currency Share

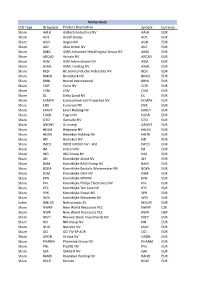

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

Aegon Fixed Income

Executing our strategy April 2014 Fixed income presentation aegon.com Key messages . Focus on executing our strategy is delivering clear results ► Strategic transformation to become a truly customer-centric company is well underway ► Solid business growth is driving increase in profitability ► Risk profile significantly improved . Executing on balanced capital deployment strategy, supporting a sustainable dividend . Making progress towards 2015 targets . Intention to remain on track to be within leverage target ranges by the end of 2014 2 Over 150 Life insurance, pensions years of & asset management history AA- financial Present in more than 25 strength rating markets throughout the Americas, Europe and Asia Underlying earnings before tax Revenue-generating investments Paid out in claims and benefits in 2013 in 2013 Over EUR 1.9 EUR 20 26,500 billion billion EMPLOYEES1 EUR 475 billion1 Aegon at a glance 1) As per December 31, 2013 3 Building on leading market positions United States United Kingdom The Netherlands China of America # 7 Individual pensions # 1 Group pensions # 11 of foreign-owned life # 5 Individual life # 3 Group pensions # 6 Individual life insurers in China # 8 Variable Annuities # 10 Individual protection # 6 Accident & health # 12 Pensions # 10 Annuities # 10 Property & casualty Japan Canada Central & Spain # 1 Variable annuities # 5 Universal life Eastern Europe Historic positions do not reflect # 6 Term life # 1 Household in Hungary current business India # 6 Life in Hungary Start up # 3 Pensions Romania1 Brazil #