James Feltman

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

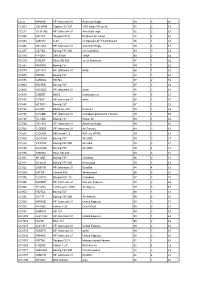

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Approve Airline Lease with Allegiant Air LLC

DRAFT Agenda Item 3 AGENDA STAFF REPORT ASR Control 20-00 l 077 MEETING DATE: 01 /1 2/21 LEGAL ENTITY TAKING ACTION: Board ofSupervisors BOARD OF SUPERVISORS DISTRICT(S): 2 SUBMITTING AGENCY/DEPARTMENT: John Wayne Airport (Approved) DEPARTMENT CONTACT PERSON(S): Barry A. Rondinella (949) 252-5183 Dave Pfeiffer (949) 252-5291 SUBJECT: Approve Airline Lease with Allegiant Air LLC CEO CONCUR COUNTY COUNSEL REVIEW CLERK OF THE BOARD Concur Approved Agreement to Form Discussion 4/5 Vote Budgeted: Yes Current Year Cost: NI A Annual Cost: NIA Staffing Impact: No # of Positions: Sole Source: No Current Fiscal Year Revenue: $614,681 Funding Source: Airport Operating Fund 280: 100% County Audit in last 3 years: No Prior Board Action: 11/03/2020 #6 RECOMMENDED ACTION(S): 1. Approve and execute the Certificated Passenger Airline Lease with Allegiant Air LLC, for a term effective February 1, 2021, through December 31, 2025. 2. Authorize John Wayne Airport to allocate three Regulated Class A Average Daily Departures and seat capacity, effective February I, 2021, through December 31, 2025, consistent with the terms of the Phase 2 Commercial Airline Access Plan and Regulation. 3. Authorize the Airport Director or designee to make minor modifications and amendments to the lease that do not materially alter the terms or financial obligations to the County and perform all activities specified under the terms ofthe lease. SUMMARY: Approval of the Certificated Passenger Airline Lease between the County of Orange and Allegiant Air LLC and approval of the allocation of operating capacity will allow Allegiant Air LLC, a new carrier from the commercial air carrier new entrant waiting list, to initiate operations at John Wayne Airport. -

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June Cincinnati/Northern Kentucky International Airport AIRCRAFT NOISE AND OPERATIONS REPORT 2014 BI-ANNUAL SUMMARY JANUARY - JUNE Table of Contents and Summary of Reports Aircraft Noise Report Page 1 This report details the locations of all complaints for the reporting period. Comparisons include state, county and areas within each county. Quarterly & Annual Comparison of Complaints Page 2 This report shows the trends of total complaints comparing the previous five years by quarter to the current year. Complaints by Category Page 3 Complaints received for the reporting period are further detailed by fourteen types of complaints, concerns or questions. A complainant may have more than one complaint, concern or question per occurrence. Complaint Locations and Frequent Complainants Page 4 This report shows the locations of the complainants on a map and the number of complaints made by the most frequent/repeat complainants for the reporting period. Total Runway Usage - All Aircraft Page 5 This report graphically shows the total number and percentage of departures and arrivals on each runway for the reporting period. Nighttime Usage by Large Jets Page 6 This report graphically shows the total number and percentage of large jet departures and arrivals on each runway during the nighttime hours of 10:00 p.m. to 7:00 a.m. for the reporting period. Nighttime Usage by Small Jets and Props Page 7 This report graphically shows the total number and percentage of small jet and prop departures and arrivals on each runway during the nighttime hours of 10:00 p.m. -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

News Release

Contacts: SJC - Rosemary Barnes 408-392-1199 / [email protected] Alaska Airlines – Media Relations 206-304-0008 / [email protected] April 4, 2018 NEWS RELEASE New Daytime, Nonstop Service to New York’s JFK on Alaska Airlines from Silicon Valley’s Airport -- No. 1 Requested Domestic Market by Silicon Valley Travelers; Daily, Daytime Nonstop Flight Begins July 6, 2018 -- San José, Calif. – Alaska Airlines today announced plans to begin daily, nonstop service to New York’s John F. Kennedy Airport (JFK) from Mineta San José International Airport (SJC) beginning July 6, 2018. The new service is significant as it marks the first daytime nonstop flight from SJC to JFK, the No. 1 requested domestic market by Silicon Valley travelers. Tickets are on sale now at www.alaskaair.com. Silicon Valley business and leisure travelers will love the addition of a direct, daytime flight to New York,” said San José Mayor Sam Liccardo. “I thank CEO Brad Tilden and his team at Alaska Airlines for launching this new nonstop service to New York-JFK, and for continuing to invest in destinations that are a high priority for our travelers.” Alaska will operate the daily service using modern Airbus A320 aircraft as follows: City Pair Departs Arrives San José – New York/JFK 7:05 a.m. 3:43 p.m. New York/JFK – San José 4:45 p.m. 8:23 p.m. Times are local. Average flight time is 6 hours. “We continue to add exciting new destinations from San Jose, providing our valued guests more nonstop options to meet their business and leisure needs,” said John Kirby, Alaska’s vice president of capacity planning. -

Integrated Report 2020 Index

INTEGRATED REPORT 2020 INDEX 4 28 70 92 320 PRESENTATION CORPORATE GOVERNANCE SECURITY METHODOLOGY SWORN STATEMENT 29 Policies and practices 71 Everyone’s commitment 93 Construction of the report 31 Governance structure 96 GRI content index 35 Ownership structure 102 Global Compact 5 38 Policies 103 External assurance 321 HIGHLIGHTS 74 104 Glossary CORPORATE STRUCTURE LATAM GROUP EMPLOYEES 42 75 Joint challenge OUR BUSINESS 78 Who makes up LATAM group 105 12 81 Team safety APPENDICES 322 LETTER FROM THE CEO 43 Industry context CREDITS 44 Financial results 47 Stock information 48 Risk management 83 50 Investment plan LATAM GROUP CUSTOMERS 179 14 FINANCIAL INFORMATION INT020 PROFILE 84 Connecting people This is a 86 More digital travel experience 180 Financial statements 2020 navigable PDF. 15 Who we are 51 270 Affiliates and subsidiaries Click on the 17 Value generation model SUSTAINABILITY 312 Rationale buttons. 18 Timeline 21 Fleet 52 Strategy and commitments 88 23 Passenger operation 57 Solidary Plane program LATAM GROUP SUPPLIERS 25 LATAM Cargo 62 Climate change 89 Partner network 27 Awards and recognition 67 Environmental management and eco-efficiency Presentation Highlights Letter from the CEO Profile Corporate governance Our business Sustainability Integrated Report 2020 3 Security Employees Customers Suppliers Methodology Appendices Financial information Credits translated at the exchange rate of each transaction date, • Unless the context otherwise requires, references to “TAM” although a monthly rate may also be used if exchange rates are to TAM S.A., and its consolidated affiliates, including do not vary widely. TAM Linhas Aereas S.A. (“TLA”), which operates under the name “LATAM Airlines Brazil”, Fidelidade Viagens e Turismo Conventions adopted Limited (“TAM Viagens”), and Transportes Aéreos Del * Unless the context otherwise requires, references to Mercosur S.A. -

European Airports Fact Sheet

European Airports from the 1960s to the 1980s To support the commentary on this DVD, AVION VIDEO has produced this complimentary Fact Sheet listing all the aircraft featured, in the order of their first appearance. PLEASE RETURN THE SLIP BELOW TO RECEIVE A FREE CATALOGUE KLM Viscount V803 Pan American 707-121 BEA Vanguard V953 G-APEK USAF C9A Nightingale Trans Arabia Airways DC6B 9K-ABB Air France 727-200 TAP Caravelle VI-R CS-TCB Laker Airways DC10-10 G-AZZD Air Ceylon Comet 4 G-APDH Pan American 707-121 Air France L1049G Super Constellation F-BHBG Laker Airways BAC1-11 320AZ G-AVBY Iberia Caravelle VI-R EC-ARK Aeroamerica 720-027 KLM L188 Electra II Dan Air BAC 1-11 401AK G-AXCK Air France Caravelle III F-BHRU French A.F. Nord 262 Sabena CV440 Dan Air BAC 1-11 Qantas 707-138 VH-EBA French A.F. Noratlas 312 BA British Westpoint Airlines DC3 G-AJHY Intl. Caribbean Airways 707-138B G-AVZZ BOAC [Nigeria Airways] 707-436 G-ARRA French A.F. DC6A KLM Viscount V803 PH-VIA Jersey Airlines Herald Finnair Caravelle III Derby Airways DC3 Aer Lingus DC3 EI-AFA KLM Viscount V803 Iraqi Airways Viscount V735 YI-ACL Fairways Rotterdam DC3 PH-SCC JAT Caravelle VI-N YU-AHB Channel Airways Viking US Navy R4Y Channel Airways DC3 TWA 707-331 N763TW Aer Lingus F27 BOAC Comet 4 G-APDR Aer Lingus 720-048 EI-ALA Cunard Eagle Viscount V755 G-AOCB Sabena DC6B South African Airways 707-344 British Eagle Viscount 700 East African Airways Comet 4 VP-KPK Channel Airways Viscount 812 Dan Air 707-321 G-AZTG BKS Avro 748 Air France Concorde F-BVFA Dan Air DC3 Air France -

Adaptive Connected.Xlsx

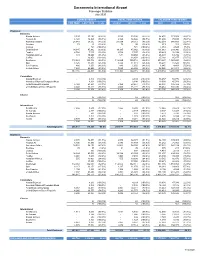

Sacramento International Airport Passenger Statistics July 2020 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % +/(-) 2020/21 2019/20 % +/(-) 2020 2019 % +/(-) Enplaned Domestic Alaska Airlines 3,593 33,186 (89.2%) 3,593 33,186 (89.2%) 54,432 173,858 (68.7%) Horizon Air 6,120 14,826 (58.7%) 6,120 14,826 (58.7%) 31,298 75,723 (58.7%) American Airlines 28,089 54,512 (48.5%) 28,089 54,512 (48.5%) 162,319 348,689 (53.4%) Boutique 79 95 (16.8%) 79 95 (16.8%) 613 201 205.0% Contour - 721 (100.0%) - 721 (100.0%) 4,461 2,528 76.5% Delta Airlines 14,185 45,962 (69.1%) 14,185 45,962 (69.1%) 111,063 233,946 (52.5%) Frontier 4,768 7,107 (32.9%) 4,768 7,107 (32.9%) 25,423 38,194 (33.4%) Hawaiian Airlines 531 10,660 (95.0%) 531 10,660 (95.0%) 26,393 64,786 (59.3%) Jet Blue - 16,858 (100.0%) - 16,858 (100.0%) 25,168 85,877 (70.7%) Southwest 112,869 300,716 (62.5%) 112,869 300,716 (62.5%) 899,647 1,963,253 (54.2%) Spirit 8,425 11,318 (25.6%) 8,425 11,318 (25.6%) 38,294 15,526 146.6% Sun Country 886 1,650 (46.3%) 886 1,650 (46.3%) 1,945 4,401 (55.8%) United Airlines 7,620 46,405 (83.6%) 7,620 46,405 (83.6%) 98,028 281,911 (65.2%) 187,165 544,016 (65.6%) 187,165 544,016 (65.6%) 1,479,084 3,288,893 (55.0%) Commuters Alaska/Skywest - 4,304 (100.0%) - 4,304 (100.0%) 36,457 50,776 (28.2%) American/Skywest/Compass/Mesa - 8,198 (100.0%) - 8,198 (100.0%) 18,030 45,781 (60.6%) Delta/Skywest/Compass 5,168 23,651 (78.1%) 5,168 23,651 (78.1%) 62,894 146,422 (57.0%) United/Skywest/GoJet/Republic 4,040 16,221 (75.1%) 4,040 16,221 (75.1%) -

Bankruptcy Tilts Playing Field Frank Boroch, CFA 212 272-6335 [email protected]

Equity Research Airlines / Rated: Market Underweight September 15, 2005 Research Analyst(s): David Strine 212 272-7869 [email protected] Bankruptcy tilts playing field Frank Boroch, CFA 212 272-6335 [email protected] Key Points *** TWIN BANKRUPTCY FILINGS TILT PLAYING FIELD. NWAC and DAL filed for Chapter 11 protection yesterday, becoming the 20 and 21st airlines to do so since 2000. Now with 47% of industry capacity in bankruptcy, the playing field looks set to become even more lopsided pressuring non-bankrupt legacies to lower costs further and low cost carriers to reassess their shrinking CASM advantage. *** CAPACITY PULLBACK. Over the past 20 years, bankrupt carriers decreased capacity by 5-10% on avg in the year following their filing. If we assume DAL and NWAC shrink by 7.5% (the midpoint) in '06, our domestic industry ASM forecast goes from +2% y/y to flat, which could potentially be favorable for airline pricing (yields). *** NWAC AND DAL INTIMATE CAPACITY RESTRAINT. After their filing yesterday, NWAC's CEO indicated 4Q:05 capacity could decline 5-6% y/y, while Delta announced plans to accelerate its fleet simplification plan, removing four aircraft types by the end of 2006. *** BIGGEST BENEFICIARIES LIKELY TO BE LOW COST CARRIERS. NWAC and DAL account for roughly 26% of domestic capacity, which, if trimmed by 7.5% equates to a 2% pt reduction in industry capacity. We believe LCC-heavy routes are likely to see a disproportionate benefit from potential reductions at DAL and NWAC, with AAI, AWA, and JBLU in particular having an easier path for growth. -

Department of Transportation Bureau of Transportation Statistics Office of Airline Information

DEPARTMENT OF TRANSPORTATION BUREAU OF TRANSPORTATION STATISTICS OFFICE OF AIRLINE INFORMATION ACCOUNTING AND REPORTING DIRECTIVE No. 328 Issue Date: 10-1-2018 Effective Date: 01-01-2019 Part: 241 Section: 04 AIR CARRIER GROUPINGS This Accounting and Reporting Directive updates the reporting groups for filing the Form 41 report during calendar year 2019 and replaces Reporting Directive No. 325. From our review, the reporting carrier groupings for the carriers below are updated as indicated: AIR CARRIER: NEW REPORTING GROUP: Aloha Air Cargo Group I - $20 million to $100 million to Group II Express Jet Group III to Group II National Airlines Group I - $20 million to $100 million to Group II Republic Group II to Group III SkyLease Group I - $20 million to $100 million to Group II Swift Group I - $20 million to $100 million to Group II Western Global Group I - $20 million to $100 million to Group II Carriers are grouped according to the operating revenue boundaries contained in Section 04 of Part 241. The current reporting levels are: Group III Over $1 billion; Group II Over $100 million to $1 billion; Group I $100 million and under, Subgroups: Group I - $20 million to $100 million, Group I - Under $20 million. Changes in the reporting groups are effective January 1, 2019. Any questions regarding the groupings should be directed to [email protected]. William Chadwick, Jr. Director Office of Airline Information Attachment ATTACHMENT PAGE 1 OF 3 GROUP III AIR CARRIERS - 17 CARRIER Alaska Airlines Allegiant Air American Airlines Atlas Air -

Boyle County Industrial Reports for Kentucky Counties

Western Kentucky University TopSCHOLAR® Boyle County Industrial Reports for Kentucky Counties 1977 Industrial Resources: Boyle County - Danville Kentucky Library Research Collections Western Kentucky University, [email protected] Follow this and additional works at: https://digitalcommons.wku.edu/boyle_cty Part of the Business Administration, Management, and Operations Commons, Growth and Development Commons, and the Public Affairs, Public Policy and Public Administration Commons Recommended Citation Kentucky Library Research Collections, "Industrial Resources: Boyle County - Danville" (1977). Boyle County. Paper 3. https://digitalcommons.wku.edu/boyle_cty/3 This Report is brought to you for free and open access by TopSCHOLAR®. It has been accepted for inclusion in Boyle County by an authorized administrator of TopSCHOLAR®. For more information, please contact [email protected]. r IHDUSTRIAL RESOURCES DANVILLE ^eiituck/' Ilk DEPARTMENT OF COMMERCE V DANVILLE, KENTUCKY ndex to Industrial Sites--1977 For more detailed data on individual sites, contact Mr. John Bailey, Chairman, Danville Development Corporation, c/o Kentucky Utilities Company, 198 West Broadway, Danville, Kentucky 40422, or the Industrial Development Division, Kentucky Department of Commerce, Capital Plaza Tower, Frankfort, Kentucky 40601. L -Cemetery 'JjS. 150 m nville.'^w 7/, Xer ---'.oOO' K 20 Ac, M^2 I /1 ';Hm^(arg'Cemr -950-^" 950. ^ 477 W \\ 85 Ac, ""RaHilvVoweTT ,7- 17 Ac 5 Ac. LEGEND- 'Limits ! Available Sites Revised Site Number •nd Acr«»9* (Genaral location) / Existing Industries AMERICAN GREETINGS CORP. ROYAL INDUSTRIES FIRESTONE WIRE AND CABLE CO. D. JACKSON OF DANVILLE 1 ^— E. REXNORD, INC. 0 j 1 MILE F. WHIRLPOOL CORP. 6. BLUEGRASS PLANT FOODS 1000 0 1000 2000 3000 4000 FEET H.