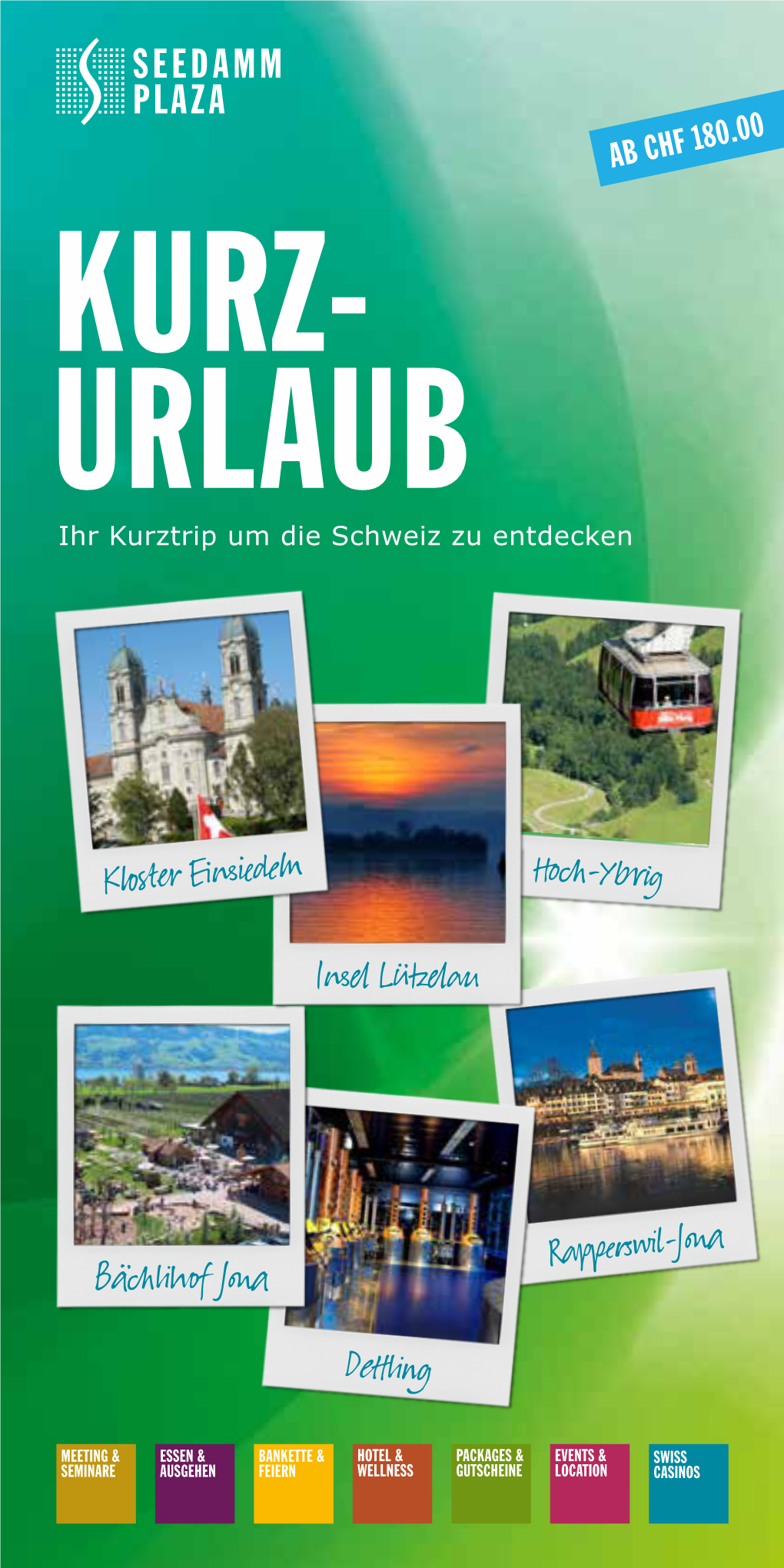

KURZ- URLAUB Ihr Kurztrip Um Die Schweiz Zu Entdecken

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Energie Ausserschwyz AG – Grundausbau

Projekt-/Programmbeschreibung von Projekten/Programmen zur Emissionsverminderung in der Schweiz Energie Ausserschwyz AG – Grundausbau Deckblatt Dokumentversion 1.8 Datum 26. Mai 2020 Gesuchsteller (Unternehmen) Energie Ausserschwyz AG Name, Vorname Urs Rhyner Strasse, Nr. Bodenwiesweg 7 PLZ, Ort 8854 Galgenen Tel. +41 55 450 60 55 E-Mail-Adresse [email protected] Projektentwickler E-Axiom GmbH (Unternehmen) Name, Vorname Tobias Frei Kontaktperson für Rückfragen ja (an Stelle von Gesuchsteller)? nein Tel. +61 603 33 10 E-Mail-Adresse [email protected] Ersteinreichung (Art. 7 CO2-Verordnung) erneute Validierung zur Verlängerung der Kreditierungsperiode (Art. 8a CO2-Verordnung) erneute Validierung aufgrund einer wesentlichen Änderung (Art. 11 Abs. 3 CO2-Verordnung) Diese Projektbeschreibung beruht auf der Vorlage Projektbeschreibung der Geschäftsstelle Kompensation, Version v5.0 / Oktober 2018. Bitte prüfen Sie vor dem Ausfüllen dieser Vorlage, ob die vorliegende Version noch aktuell ist. Die aktuelle Version ist zu finden unter https://www.bafu.admin.ch/bafu/de/home/themen/klima/fachinformationen/klimapolitik/kompensation-von-co2- emissionen/kompensationsprojekte-in-der-schweiz/umsetzung-von-kompensationsprojekten.html Projekt-/Programmbeschreibung von Projekten/Programmen zur Emissionsverminderung in der Schweiz Inhalt 1 Angaben zum Projekt/Programm ......................................................................................................3 1.1 Projekt-/Programmzusammenfassung ...................................................................................3 -

«Zürisee – Uferleben – Leben Am Ufer»

«ZüriSee – Uferleben – Leben am Ufer» Grundlagen, Folgerungen und Massnahmen zur nachhaltigen Aufwertung Zürichsee Landschaftsschutz Die Ufer am Zürichsee verdienen unser Interesse Seelandschaft ist Lebensraum. Seit jeher verändert er sich ständig – durch natürliche Entwicklungen und Eingriffe des Menschen. Wir haben die Chance, den Lebensraum Zürichsee und seine Ufer als Ganzes aktiv mitzugestalten. Weitblick, Wissen um die Zusammenhänge und Interesse für die Belange der Natur schaffen die Voraussetzungen für eine gute Entwicklung. Dieser Prospekt gibt Einblick in die Forschungsarbeit des Projekts «ZüriSee – Uferleben – Leben am Ufer», verweist auf die ökologischen Zusammenhänge, die Veränderungen und ihre Gründe und zeigt Handlungs- und Gestaltungsmöglichkeiten auf. Zürichsee Landschaftsschutz (ZSL) will damit die Menschen am Zürichsee für die Natur in ihrem Lebensraum sensibilisieren und sie motivieren, aktiv an einer positiven Umgestaltung mitzuwirken. Untersuchungen des Lebens am Ufer Mit dem starken Rückgang der Schilfbestände am Ufer des Zürichsees wuchs auch die Sorge um die Erhaltung der intakten Landschaft um den See. Seit 1979 wird der Zustand des Röhrichts am Zürcher Ufer des Zürichsees regelmässig untersucht. Im Rahmen des Programms ZSL konnte die Kartierung der Röhrichtbestände auf die Anrainerkantone St. Gallen und Schwyz ausgedehnt wer- den. Jetzt liegt eine einheitliche Bestandesaufnahme der Ufervegetation für den ganzen See vor. Erhebungen zur Tierwelt, vor allem zu Vögeln und Libellen, ergänzen das Bild. In den letzten vier Jahrzehnten kam aber nicht nur die wissenschaftliche Beobachtung zum Zug. An zahlreichen Stellen des Sees wurden Schutz- und Sanierungsmassnahmen getroffen zur Regenera- tion von Röhrichtbeständen und erodierten Ufern. Allerdings ist der Erfolg dieser Massnahmen noch nicht überall sichtbar. Erfahrungen aus Regenerationsprojekten am Bodensee und am Bielersee konnten einbezogen wer- den. -

Businesspark Freienbach

BusinessPark freienbach GESUNDES KLIMA – STARKE LEISTUNGEN. Repräsentative Büroflächen in erstklassiger Qualität an zentraler Lage in Freienbach SZ WWW.BUSINESSPARK-FREIENBACH.CH GESUNDES KLIMA BusinessPark Zürich Wil freienbach Business Park Freienbach ist ein Neubau, der bezüglich Klima und Flughafen Gesundheit neue Massstäbe setzt. In der Überzeugung, dass sich eine St. Gallen ökologisch hochwertige Bauweise und eine gesunde Umwelt als Er- folgsfaktoren der Zukunft direkt auf die Lebens- und Arbeitsqualität Ihrer Mitarbeitenden auswirken, haben wir uns entschlossen, ganze Zürich Uster Sache zu machen. • MINERGIE-Standard: Dank der Erdsondenwärmepumpe erfolgt die Heizung unabhängig von Gas und Erdöl. Wetzikon Wattwil Meilen • CO2-Neutralität und markant tiefere Heizkosten • Die Komfortlüftung spart Energie, versorgt die Räume mit Frisch- Rüti luft und trägt zum allgemeinen Wohlbefi nden bei. Empfi ndliche Rapperswil Personen und Allergiker werden entlastet. Wädenswil • Hervorragende Flächennutzung, höchste Bauqualität • Ausgezeichnete Anbindung an den öff entlichen und privaten Luzern Chur Verkehr Innerschweiz Zug FREIENBACH • Attraktive Lage zwischen den Schwyzer Hügelzügen und dem Zürichsee; Grünfl ächen und Naherholungsgebiete STARKE LEISTUNGEN Business Park Freienbach ist weit mehr als ein hoch modernes Büro- gebäude. Es bietet in jeder Beziehung erstklassige Leistungen: • Freienbach ist das Steuerparadies am Zürichsee. • Der Wirtschaftsraum Zürich gehört zu den wirtschaftlich stärksten Regionen Europas. Die Wirtschaftszentren Zürich und Zug erreichen Sie in einer halben Stunde, den Flughafen Zurich Airport in 45 Minuten. • Sie geniessen Zugang zu den nahen Forschungs- und Entwick- lungszentren in den Räumen Zürich und Rapperswil. • Die starke Region garantiert Ihnen qualifi zierte und innovative Fach- und Führungskräfte. • 4000 m2 frei unterteilbare Bürofl ächen erfüllen jeden Anspruch. • Mitarbeitern und Kunden stehen auf dem Gelände sowie in der Tiefgarage komfortable Parkplätze zur Verfügung. -

SECA Yearbook 2011 Eayearbook2 SECA 011 Yideas My Mak Ey Ou Ro Nnotes

Next Steps My ideas for2011/12 11 20 ok bo ar SECA Yearbook2011 Ye SECA Swiss Private Equity & Corporate Finance Association Grafenauweg 10 /P.O. Box4332 CH-6304 Zug T: +41 41 724 65 75 F: +41 41 724 65 50 Makeyour ownnotes. [email protected] /www.seca.ch Makeyourown notes. SECAYearbook 2011 SECASECA Ye Yeaarrbbookook 2011 2011 I. Report from the President 3 II. SECA &PrivateEquity in Switzerland 9 III.Chapters &Working Groups 17 ReportingComitéRomand18 ReportingSeedMoney &Venture Capital 19 Reporting Private Equity 31 Reporting Corporate Finance 45 Reporting Legal &Tax 48 IV. Events &Trend Luncheons 69 V. Financial &Audit Report 75 VI. MembershipReporting 79 Full MembeRs80 Associate Members218 Individual Members283 VII. Articles of Association287 VIII. Model Documentations291 IX.Code of Conduct forPrivate Equity Investments293 X. CodeofConduct for CorporateFinanceProfessionals 311 XI. EuropeanAssociations 313 XII. Key Persons 317 2 SECASECA Yea Yearbrbookook 2011 2011 ChapterI Reportfromthe President 3 SECASECA Yea Yearbrbookook 2011 2011 Report fromthe Chairman fend common senseinthe face of asometimes un- structuredand populist political debate. DearMembers and Readers The Swiss Private Equity andCorporate Finance As- The Swiss M&A volumes have stabilised at CHF 86 sociation (SECA) has 328 members and is the leading billion.They are dominated by afew large deals.With advocate for the Swiss-based industry comprising ven- around CHF 5.2 billion in 12 privateequity transac- ture capital through large private equity houses and tions the investment activitystilllags behind the 2004- corporate finance advisors andlawyers. 2008 period. Leadingindicatorslooks encouraging and are set to growin2011. The aftermath of the financial crisisisstill taking its toll on our industry. -

Bulletin of the Swiss-Chinese Chamber of Commerce

Impressum Contents Publication: Quarterly Information Bulletin of the Swiss- 2–3 Chinese Chamber Board of the Chamber and its Chapters of Commerce Circulation: In print approx. 1’200 5 Ex. and also on the Editorial Website. To the Members of the Chamber and of the Chapters in Geneva, Lugano, Beijing and Chamber News CONTENTS Shanghai; among them the leading banks, General Assembly, New Members 6–7 trading companies, in- surances and industrial firms. To Trade Or- ganisations, Govern- Diplomatic Relations ment Departments, leading Chambers of New Chinese Ambassador 8 Commerce in Switzer- Rede des Botschafters an der Generalversammlung 8–10 land, Europe and Swiss-Chinese Trade 2003 11 China. New Appointments 12 Responsible Editors: Susan Horváth, Managing Director Paul Wyss, Chapter Reports Vice President Report from Geneva Chapter 14–15 Report from Legal Chapter 15–17 Swiss-Chinese Cham- ber of Commerce Höschgasse 83 CH-8008 Zurich Switzerland Economy Tel. 01 / 421 38 88 Fax 01 / 421 38 89 Recent Foreign Investments / Joint Ventures 17–18 e-mail: [email protected] In Brief 18–19 Website: www.sccc.ch Various short News 19–20 Swiss-Chinese Trade / First Quarter 2004 21 Printing: Yangtse Delta Region – Economic Situation 22–27 werk zwei Print + Medien Konstanz GmbH P. O. Box 2171 CH-8280 Kreuzlingen Legal Matters Switzerland The New Swiss Rules of International Arbitration 27–28 Tel. 0049/7531/999-1850 New Packing Rules & Requirements 28 www.werkzwei-konstanz.de Arbitration in China: Recent Developments 30 Advertising: Various short News 30–31 Conditions available at the Swiss-Chinese Chamber of Commerce News from Members Deadline for next issue: www.swissinfo.org 32–33 2/04 August 15 Mt. -

Celebrate the Spirit of Street Parade!

Nacht-S-Bahnen ab Winterthur Verkehrsbetriebe der Region So gehts an die Parade – Fahrpläne und wieder zurück Nachtangebot Ab 1 Uhr ZVV-Nachtzuschlag erforderlich. Street Parade Alle Linien haben direkten Anschluss an die S-Bahn Direkt und schnell: S-Bahn, Tram und Bus (Alphabetisch ansteigend nach Umsteigebahnhöfen). bringen jede Raverin und jeden Raver dahin, Damit du da bist, wo dein Takt ist. wo die Party ist. Und sicher wieder nach Hause. Zürich – Triemli – Uitikon Waldegg – Uetliberg (SZU) S10 Winterthur – Andelfingen – Schaffhausen – Stein am Rhein SN3 UMSTEIGE- ZVV- VON BETRIEB NACH ABFAHRTSZEITEN UMSTEIGE- ZVV- VON BETRIEB NACH ABFAHRTSZEITEN Halt an allen Stationen. Zürich HB ab 0 18 1 00 2 00 3 00 4 00 BAHNHOF LINIE BAHNHOF LINIE Fahrpläne S10 S10 S10 S10 S10 S10 Winterthur an 0 39 1 24 2 24 3 24 4 24 Affoltern a. A. N24 SN9 PostAuto Aeugst-Hausen-Ebertswil-Kappel-Hauptikon- 2 33 4 33 Stettbach 743 SN5 VBZ Fällanden, Wigarten° 1 16 alle 30 Min. bis 4 16 Alle Fahrpläne finden Sie unter www.zvv.ch. Zürich HB ab 23 55 0 251 1 05 2 05 3 05 4 052 SN3 SN3 SN3 SN3 Rifferswil (-Knonau) 751 SN5 VBZ Kirche Fluntern° 0 45 alle 60 Min. bis 3 45 1 2 Zusätzlich finden Sie die besten Nachtver- Zürich Triemli an 0 03 0 33 1 13 2 13 3 13 4 13 Winterthur ab 0 44 1 27 2 27 3 27 4 27 N25 SN9 PostAuto Mettmenstetten-Knonau-Hausen-Aeugst 1 33 3 33 752 SN5 VBZ Dübendorf, Kunsteisbahn° 1 16 alle 60 Min. -

Switzerland Tax Alert

International Tax Switzerland Tax Alert 15 April 2014 Cantons announce lower headline tax rates in anticipation of Corporate Tax Reform III Contacts Switzerland is considering a comprehensive corporate tax reform, referred to Jacqueline Hess as the “Corporate Tax Reform III,” that could result in the phasing out of [email protected] certain tax regimes, such as the holding, mixed and domiciliary company regimes between 2018 and 2020. The regimes would be replaced with a Jacques Kistler variety of other measures. [email protected] Ferdinando Mercuri The overriding objective of the contemplated reform is to secure and [email protected] strengthen the tax competitiveness and attractiveness of Switzerland as an international location for corporations. To achieve this objective, the steering Rene Zulauf committee in charge of the reform considers it an imperative that the tax [email protected] system offer competitive tax rates that are accepted internationally. Daniel Stutzmann-Hausmann [email protected] The changes recommended by the steering committee are, in part, a response to concerns raised by the European Commission that some of Switzerland’s tax rules constitute unfair tax competition and are in violation of the 1972 Switzerland-EU Free Trade Agreement. The steering committee has recommended several measures to replace the holding, mixed and domiciliary company regimes that would accomplish the dual goals of tax competitiveness and international acceptance. These measures include: • A “license box” for income arising from the exploitation and use of intellectual property; • A notional interest deduction on equity; and • A general reduction of the headline corporate tax rate (effective combined federal/cantonal/communal rate). -

Agglomerationsprogramm 4. Generation

Verein Agglo Obersee Agglomerationsprogramm 4. Generation Massnahmendokumentation Verkehr – Entwurf, Version für die Vernehmlassung November 20 2. November 2020 Agglomerationsprogramm 4. Generation Obersee / Massnahmen Verkehr – Entwurf, 2. November 2020 Auftraggeber Verein Agglo Obersee Geschäftsstelle Oberseestrasse 10 8640 Rapperswil Erarbeitung Teilprojekte Teilprojekt Städtisches Alltagsnetz asa AG, Rapperswil-Jona; Wälli AG Ingenieure Teilprojekt (MIV) Strassen Gruner AG, Zürich Teilprojekt Freiraum / Siedlungsklima Hager AG, Zürich; ETH Zürich Hauptmandat Beatrice Dürr Remo Fischer Gauthier Rüegg Lara Thomann (Grafik) EBP Schweiz AG Mühlebachstrasse 11 8032 Zürich Schweiz Telefon +41 44 395 16 16 [email protected] www.ebp.ch Druck: 29. Oktober 2020 2020-11_AP4G_Obersee_Massnahmendokumentation_Verkehr_Entwurf_Vernehmlassung.docx Seite 2 Agglomerationsprogramm 4. Generation Obersee / Massnahmen Verkehr – Entwurf, 2. November 2020 Inhaltsverzeichnis 1. Massnahmenübersicht Vorgängergeneration AP 3G 7 2. Massnahmenübersicht AP 4G 8 2.1 Öffentlicher Verkehr / Multimodalität 8 2.2 Strassenverkehr / Verkehrssicherheit 9 2.3 Fuss- und Veloverkehr 10 3. Übergeordnete Massnahmen Öffentlicher Verkehr 11 üMÖV4.1 Infrastrukturerweiterungen Pfäffikon SZ-Siebnen-Wangen 11 üMÖV4.2 Doppelspurausbau Biberbrugg–Schindellegi (Feusisberg) 12 üMÖV4.3 Zweites Gleis Uznach–Schmerikon 13 üMÖV4.4 Zweites Gleis Schmerikon - Rapperswil 14 üMÖV4.5 Vierte Perronkante Uznach 15 üMÖV4.6 Zugfolgezeiten Schmerikon-Rapperswil 16 4. Massnahmen Öffentlicher Verkehr / Multimodalität -

Zürichsee | Lake Zurich

Waldshut (D) S3S 36 Koblenz S1S 6 19 9 Koblenz Dorf KKlingna lingnau DöttingenDöttin u Rietheim ge Bad Zurzach n Rekingen AG Siggenthal iggenthali WWü g Mellikon renlingee NiederweningenNiederweningderweningweeni geen - Rümikon AG n REGENSDORF Kaiserstuhl AG NiederweniNiNNiederweningenweningenwe DoDorfrf S1S 12 2 S1S ZweidleZwei n NeuhausenNeu Rheinf Schöfflisdorf-sddo 15 Brugg AG 5 h Oberweningen ausen Lottstetten (D) ScS NeuNeuhausenchaffhausenh Steinmaurnm JestettenJestetten (D)(D aff HerHerblingen R ThayngenTh h h h b ayng Turgi S3S einf ause ausenlingen Aarau 36 Baden 6 RafzRa e S4S Dielsdorls rff (D al n 42 Lenzburg f l n 2 Wettingen Würrenlos z ) ENGSTRINGEN S1S Glattfelden Eglisau Eglisau Eglisau Eglisau 11 Otelfingen Hüntwangen- 1 Bülac Othmarsingen S6S Niederhasle lii S9S 111 6 NiederglattNiederN S3S Feuerthalen Neuenhof ie 3 9 154 Mägenwil Otelfingen e S4S el S1S Langwiesen h ScS 12 41 d Golfparlflfpfpf k 1 hloss Laufen2 Mellingen Heitersbertersbergg MaM l Schlatt KillwangenKillwanggen-e - t ar Dac Buucchs- Oberglattlatt rt a S1S SpreitSpreitenbaeitenbace chh hahale ch La St. Katharinental 17 Dällikkoonn Wi hsen 7 l ufen Embracbrach-Rorbas l n Diessenhofen Zürich AAndelfinge Dietikkoonn Regensdorf-Wf Watttt Rümlangng S2 ndelfinge Schlattingen Wo Bremga Bremga Beri Rudolfstetten Bremga Beri Bremga hlen Wo FlughafenFllu afen S1S 16 , hlen Zürich Affolterfol n 6 Stein am Rhein n- ko n n- ko Glanzenbnberg EtzwilenEtzw Pfungen n Regensdorf Regensdorf S1S HenggarH StammStammheimi rt rt rt rt Glattbrugtbbrrrugugu g len Wide Dietikon Schliere Wide Chrüzächer 19 enggar en en en Meuchwis en 9 Geiss- 111 ScS hlierenen S29 mheim R en Zürich Seebach h weid Holzerhurd h We We ei Bahnhof Nord Rütihof 110 KATZENSEE S2S HettlingeHett t 9 OssingenOs n n KKloten Winterthur S2S OpfikO KlotenK Balsberl 24 S4S sss i n Schlieren S6 21 oten 4 41 s st Zentrum/ st Grünwald 1 Wülflingen 1 linge Bahnhof Geeringstr. -

Taxation of Local Authorities in the Canton Schwyz These Are Taxation Rates In

Department for Economic Affairs Office for Economy Economic Development Bahnhofstrasse 15 P.O. Box 1187 CH-6431 Schwyz Telefon +41 41 819 16 34 Telefax +41 41 819 16 19 www.schwyz-economy.ch Taxation of local authorities in the Canton Schwyz _____________________________________________ These are taxation rates in percentages of a unit. The unit of progressive income tax for individuals is defined in § 36 of the Taxation Act for the Can- ton Schwyz. The progression stops from a taxable income of CHF 386’000 (single). The unit of pro- portional asset tax is 0.6 per thousand on the taxable asset (§ 48). The unit of proportional profit tax for public limited companies and cooperatives is set out in § 71 of the Taxation Act. It is 1.95 per cent on the taxable net profit with credit of minimal tax. The propor- tional minimal tax is 0.03 per thousand on the taxable equity (§ 82). Overall tax rate 2021 (in percentages of a unit) Local authority / parish Individuals* Legal entities** with RC with Protestant no church tax church tax church tax Wollerau 238 238 230 248.00 Freienbach (Pfäffikon) 239 238 230 248.71 Wollerau-Schindellegi 242 238 230 250.61 Feusisberg-Schindellegi 242 238 230 250.92 Feusisberg 245 238 230 253.12 Altendorf 300 301 285 295.22 Lachen 307 309 293 317.42 Küssnacht-Merlischachen 322 333 315 333.55 Riemenstalden 326 328 300 336.00 Küssnacht 333 333 315 343.00 Küssnacht-Immensee 340 333 315 349.01 Innerthal 353 341 325 361.46 Steinerberg 353 352 320 362.93 Muotathal 356 358 330 366.06 - 39 - Vorderthal 358 346 330 366.61 Alpthal -

Ziegelbrücke Zürich - Thalwil - Zug Stand: 17

FAHRPLANJAHR 2020 720 Zürich - Thalwil - Ziegelbrücke Zürich - Thalwil - Zug Stand: 17. Oktober 2019 S8 S8 S24 75 S27 S8 S24 70 18817 18817 20417 2104 8219 18819 20419 2611 SBB SBB SBB SBB SOB SBB SBB SBB Winterthur Winterthur Zürich Flughafen ab 5 00 5 34 Zürich HB 5 07 5 07 5 21 5 35 5 37 5 51 6 04 Zürich Wiedikon 5 09 5 09 5 24 5 39 5 54 Zürich Enge 5 12 5 12 5 27 5 42 5 57 Zürich Wollishofen 5 14 5 14 5 29 5 44 5 59 Kilchberg 5 17 5 17 5 32 5 47 6 02 Rüschlikon 5 20 5 20 5 35 5 50 6 05 Thalwil 5 23 5 23 5 37 5 44 5 53 6 07 6 13 Thalwil 5 24 5 24 5 38 5 45 5 54 6 08 6 14 Oberrieden Dorf 5 40 6 10 Horgen Oberdorf 5 43 6 13 Baar 5 51 5 58 6 21 Zug 5 54 6 01 6 24 6 27 Oberrieden 5 26 5 26 5 56 Horgen 5 30 5 30 6 00 Au ZH 5 33 5 33 6 03 Wädenswil 5 37 5 37 6 07 Richterswil 5 40 5 40 6 10 Bäch 5 42 5 42 6 12 Freienbach SBB 5 45 5 45 6 15 Pfäffikon SZ 5 49 5 49 6 19 Pfäffikon SZ 6 29 Altendorf 6 32 Lachen 6 34 Siebnen-Wangen 6 09 6 39 Schübelbach-Buttikon 6 11 6 41 Reichenburg 6 14 6 44 Bilten 6 17 6 47 Ziegelbrücke 6 22 6 53 Rapperswil Luzern Luzern 1 / 64 FAHRPLANJAHR 2020 720 Zürich - Thalwil - Ziegelbrücke Zürich - Thalwil - Zug Stand: 17. -

Gemeinde Freienbach Umfasst Die Fünf Dörfer Frei- Enbach, Pfäffikon, Hurden, Bäch Und Wilen

freienbach Fünf Dörfer – eine Gemeinde lebenswert und lebendig Freienbach Herzlich willkommen Sehr geehrte Damen und Herren Die Gemeinde Freienbach umfasst die fünf Dörfer Frei- enbach, Pfäffikon, Hurden, Bäch und Wilen. Die Gemein- de bietet mit ihrer attraktiven Lage am oberen Zürichsee einmalige Wohnlagen sowie eine florierende Wirtschaft mit attraktiven Arbeitsplätzen. Nicht nur die Infrastruk- tur wie der öffentliche Verkehr oder das Schul- und Bil- dungsangebot sind hervorragend. Freienbach bietet auch schönste Naherholungsgebiete direkt vor der Haustüre – Qualitäten, die eine hohe Lebensqualität garantieren. In den letzten Jahren haben wir die Weichen für die Zu- kunft gestellt und unser Angebot stetig ausgebaut und den Bedürfnissen unserer Einwohnerinnen und Einwoh- nern angepasst. Ganz nach dem Motto «lebenswert und lebendig» soll Freienbach ein bevorzugter Wohn- und Arbeitsort sein – für alle Generationen. Mit einer famili- enfreundlichen Politik bauen wir Angebote für Familien laufend aus. Durch moderates Wachstum sowie einer vor- ausschauenden Mobilitäts- und Siedlungsentwicklung er- möglichen wir eine nachhaltige Entwicklung. Fünf Dörfer – eine Gemeinde. Der ländliche Charakter unserer Dörfer inmitten schönster Natur macht unsere Gemeinde aus und soll bewahrt werden. Die Gemeinde Freienbach besticht durch einzigartige Qualitäten, die wir sorgsam pflegen und stärken wollen. Wir laden Sie herzlich auf eine Entdeckungsreise durch die Gemeinde Freienbach ein. Freundliche Grüsse Gemeinderat Freienbach Freienbach Wohnen nach Wunsch – urban oder idyllisch Die Gemeinde Freienbach bietet Die Gemeinde Freienbach liegt ein- Mit der unmittelbaren Nähe zur eine einmalige Wohnlage. Die gebettet in eine attraktive Land- Metro politanregion Zürich, aber auch schaft am Ufer des oberen Zürich- in der Region Zürichsee, stehen eine fünf Dörfer der Gemeinde lie- sees in der Hügellandschaft am Vielzahl hochstehender Freizeit-, Kul- gen an schönster Lage, einge- Fusse des Etzels.