Hellofresh Dials up Data Analytics to Meet Demand

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Response: Just Eat Takeaway.Com N. V

NON- CONFIDENTIAL JUST EAT TAKEAWAY.COM Submission to the CMA in response to its request for views on its Provisional Findings in relation to the Amazon/Deliveroo merger inquiry 1 INTRODUCTION AND BACKGROUND 1. In line with the Notice of provisional findings made under Rule 11.3 of the Competition and Markets Authority ("CMA") Rules of Procedure published on the CMA website, Just Eat Takeaway.com N.V. ("JETA") submits its views on the provisional findings of the CMA dated 16 April 2020 (the "Provisional Findings") regarding the anticipated acquisition by Amazon.com BV Investment Holding LLC, a wholly-owned subsidiary of Amazon.com, Inc. ("Amazon") of certain rights and minority shareholding of Roofoods Ltd ("Deliveroo") (the "Transaction"). 2. In the Provisional Findings, the CMA has concluded that the Transaction would not be expected to result in a substantial lessening of competition ("SLC") in either the market for online restaurant platforms or the market for online convenience groceries ("OCG")1 on the basis that, as a result of the Coronavirus ("COVID-19") crisis, Deliveroo is likely to exit the market unless it receives the additional funding available through the Transaction. The CMA has also provisionally found that no less anti-competitive investors were available. 3. JETA considers that this is an unprecedented decision by the CMA and questions whether it is appropriate in the current market circumstances. In its Phase 1 Decision, dated 11 December 20192, the CMA found that the Transaction gives rise to a realistic prospect of an SLC as a result of horizontal effects in the supply of food platforms and OCG in the UK. -

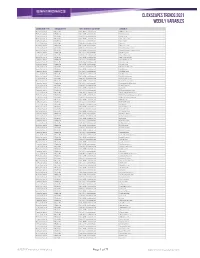

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Food and Tech August 13

⚡️ Love our newsletter? Share the ♥️ by forwarding it to a friend! ⚡️ Did a friend forward you this email? Subscribe here. FEATURED Small Farmers Left Behind in Covid Relief, Hospitality Industry Unemployment Remains at Depression-Era Levels + More Our round-up of this week's most popular business, tech, investment and policy news. Pathways to Equity, Diversity + Inclusion: Hiring Resource - Oyster Sunday This Equity, Diversity + Inclusion Hiring Resource aims to help operators to ensure their tables are filled with the best, and most equal representation of talent possible – from drafting job descriptions to onboarding new employees. 5 Steps to Move Your Food, Beverage or Hospitality Business to Equity Jomaree Pinkard, co-founder and CEO of Hella Cocktail Co, outlines concrete steps businesses and investors can take to foster equity in the food, beverage and hospitality industries. Food & Ag Anti-Racism Resources + Black Food & Farm Businesses to Support We've compiled a list of resources to learn about systemic racism in the food and agriculture industries. We also highlight Black food and farm businesses and organizations to support. CPG China Says Frozen Chicken Wings from Brazil Test Positive for Virus - Bloomberg The positive sample appears to have been taken from the surface of the meat, while previously reported positive cases from other Chinese cities have been from the surface of packaging on imported seafood. Upcycled Molecular Coffee Startup Atomo Raises $9m Seed Funding - AgFunder S2G Ventures and Horizons Ventures co-led the round. Funding will go towards bringing the product to market. Diseased Chicken for Dinner? The USDA Is Considering It - Bloomberg A proposed new rule would allow poultry plants to process diseased chickens. -

Food Delivery Platforms: Will They Eat the Restaurant Industry's Lunch?

Food Delivery Platforms: Will they eat the restaurant industry’s lunch? On-demand food delivery platforms have exploded in popularity across both the emerging and developed world. For those restaurant businesses which successfully cater to at-home consumers, delivery has the potential to be a highly valuable source of incremental revenues, albeit typically at a lower margin. Over the longer term, the concentration of customer demand through the dominant ordering platforms raises concerns over the bargaining power of these platforms, their singular control of customer data, and even their potential for vertical integration. Nonetheless, we believe that restaurant businesses have no choice but to embrace this high-growth channel whilst working towards the ideal long-term solution of in-house digital ordering capabilities. Contents Introduction: the rise of food delivery platforms ........................................................................... 2 Opportunities for Chained Restaurant Companies ........................................................................ 6 Threats to Restaurant Operators .................................................................................................... 8 A suggested playbook for QSR businesses ................................................................................... 10 The Arisaig Approach .................................................................................................................... 13 Disclaimer .................................................................................................................................... -

Home Bistro, Inc. (Otc – Hbis)

Investment and Company Research Opportunity Research COMPANY REPORT January 28, 2021 HOME BISTRO, INC. (OTC – HBIS) Sector: Consumer Direct Segment: Gourmet, Ready-Made Meals www.goldmanresearch.com Copyright © Goldman Small Cap Research, 2021 Page 1 of 16 Investment and Company Research Opportunity Research COMPANY REPORT HOME BISTRO, INC. Pure Play Gourmet Meal Delivery Firm Making All the Right Moves Rob Goldman January 28, 2021 [email protected] HOME BISTRO, INC. (OTC – HBIS - $1.25) COMPANY SNAPSHOT INVESTMENT HIGHLIGHTS Home Bistro provides high quality, direct-to- Home Bistro is a pure play gourmet meal consumer, ready-made gourmet meals delivery firm enjoying outsized growth and could at www.homebistro.com, which includes meals emerge as one of the stars of the multi-billion- inspired and created by celebrity “Iron Chef” Cat dollar industry. HBIS’s approach and model Cora. The Company also offers restaurant quality represent a major differentiator and should drive meats and seafood through its Prime enviable sales and profit, going forward. Chop www.primechop.co and Colorado Prime brands. The HBIS positioning as the go-to, high-end, high quality provider is further enhanced via its KEY STATISTICS exclusive relationship with celebrity Iron Chef Cat Cora. HBIS now offers meals inspired and created by Cat alongside its world class chef- Price as of 1/27/21 $1.25 prepared company entrees. $6.0147 - 52 Week High – Low $0.192 M&A of HBIS competitors illustrates the Est. Shares Outstanding 11.4M underlying value for the Company and its Market Capitalization $24,3M segment. Nestle bought a competitor for up to $1.5 Average Volume 1,136 billion to get a footprint in the space. -

Hellofresh Extends Its Preferences Menu to Offer 'Quick and Easy

HelloFresh extends its preferences menu to offer ‘Quick and Easy’ recipes for customers HelloFresh customers now have even more choice as the preferences menu is extended to include ‘Quick and Easy’ recipes; delicious, nutritious food on the table in under 30 minutes. From Teriyaki Chicken with Coco-Nutty Rice & King Cabbage to Spiced Buttery Sea Bass, every dish in the ‘Quick and Easy’ menu has been designed with busy people in mind. From unpacking the ingredients and food prep through to the cooking and plating up, dinner can be on the table in a flash using the most delicious ingredients. All of HelloFresh’s ‘Quick and Easy’ recipes are presented on easy to use recipe cards with step- by-step instructions and pictures to guide you through, so even the most basic of cooks can whip up a delicious meal in no time. HelloFresh’s ‘Quick and Easy’ recipes allow you to rustle up something fast that still offers a healthy, nutritious and delicious dinner option. “Our ‘Quick and Easy’ box is a speedy solution for those nights when you want dinner on the table quickly but still want something delicious and nutritious to eat” says Patrick Drake, co-founder and Head Chef of HelloFresh. “Cooking at home with HelloFresh you know exactly what goes into each meal you have - so there is no hidden sugar or high salt levels you don’t know about. And best of all, it is fun and on the table in under 30 minutes.” In addition to the ‘Quick and Easy’ option, customers can also choose the following from the preferences menu; - Chef’s Choice (Head Chef Patrick’s favourite recipes of the week) - Fish Free - Pork Free If you want to mix it up, customers can still swap meals around on top of their preferences. -

Annual Report 2019

ANNUAL REPORT 2019 – HelloFresh SE – HELLOFRESH AT A GLANCE 3 months 3 months 12 months 12 months ended ended ended ended Key Figures 31-Dec 19 31-Dec 18 YoY growth 31-Dec 19 31-Dec-18 YoY growth Key Performance Indicators Group Active customers (in millions) 2.97 2.04 45.3% Number of orders (in millions) 10.54 7.42 42.0% 37.45 27.07 38.3% Orders per customer 3.6 3.6 - Meals (in millions) 79.6 54.7 45.6% 281.1 198.4 41.7% Average order value (EUR) (Exc. Retail) 48.6 48.6 0.0% Average order value constant currency (EUR) (Exc. Retail) 47.8 48.6 (1.7%) USA Active customers (in millions) 1.78 1.09 63.0% Number of orders (in millions) 5.98 3.84 55.7% 20.74 14.94 38.8% Orders per customer 3.4 3.5 (4.5%) Meals (in millions) 40.5 25.2 60.4% 138.2 99.2 39.3% Average order value (EUR) (Exc. Retail) 49.1 50.6 (3.0%) Average order value constant currency (EUR) (Exc. Retail) 47.6 50.6 (5.9%) International Active customers (in millions) 1.18 0.95 24.9% Number of orders (in millions) 4.56 3.58 27.4% 16.71 12.13 37.8% Orders per customer 3.9 3.8 2.0% Meals (in millions) 39.1 29.4 32.9% 142.9 99.2 44.0% Average order value (EUR) (Exc. Retail) 48.0 46.4 3.3% Average order value constant currency (EUR) (Exc. -

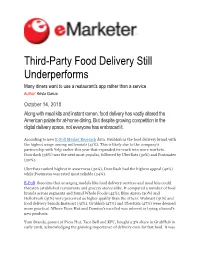

Third-Party Food Delivery Still Underperforms

Third-Party Food Delivery Still Underperforms Many diners want to use a restaurant's app rather than a service Author: Krista Garcia October 14, 2018 Along with meal kits and instant ramen, food delivery has vastly altered the American palate for at-home dining. But despite growing competition in the digital delivery space, not everyone has embraced it. According to new E-Poll Market Research data, Grubhub is the food delivery brand with the highest usage among millennials (41%). This is likely due to the company's partnership with Yelp earlier this year that expanded its reach into more markets. Doordash (36%) was the next most popular, followed by UberEats (32%) and Postmates (30%). UberEats ranked highest in awareness (32%), DoorDash had the highest appeal (42%) while Postmates was rated most reliable (24%). E-Poll theorizes that emerging models like food delivery services and meal kits could threaten established restaurants and grocery stores alike. It compared a number of food brands across segments and found Whole Foods (42%), Blue Apron (30%) and HelloFresh (31%) were perceived as higher quality than the others. Walmart (31%) and food delivery brands Instacart (31%), Grubhub (27%) and UberEats (27%) were deemed more practical. Where Pizza Hut and Domino's excelled was interest in trying a brand's new products. Yum Brands, parent of Pizza Hut, Taco Bell and KFC, bought a 3% share in GrubHub in early 2018, acknowledging the growing importance of delivery even for fast food. It was also a data play. Traditional restaurants have lacked access to consumer buying habits available to digital brands like UberEats or DoorDash. -

Food Tech Invest Report 2021

Food Tech Invest Report 2021 How startups, corporates and investors jointly shape the food industry What is this report about? The food industry is catching up compared to other industries which provide great potential for innovation • Although food and beverage is the second-largest Average consumer spending in Europe everyday cost for consumers in Europe behind Housing & 29% housing and energy, it is mainly other industries Energy that have been transformed by startups so far. Food & 22% ? • After Booking.com, Uber, and Zalando changed the Beverage travel, mobility, and fashion industries, there is now a lot of momentum in the food industry. Health 18% • Therefore, together with the venture capital fund Good Mobility 11% Seed Ventures and data provider Dealroom, we sort through current market developments in the food Education 9% tech ecosystem • We provide insightful data and specific examples Travel 6% focussing on the DACH region and present impulses for participation in emerging technologies and Fashion 6% business models. 2 1 Food and Venture Capital Top 5 investment trends 2 Content in Europe Activities of established 3 companies in the DACH region 4 Contact Food and venture capital Innovative players were the winners in 2020 The year of Corona has accelerated consumer behavior in favor of innovative and digital companies Stock price developments (01/2020 – 01/2021) • While food industry heavyweights have lost value on the stock market in the Corona year, tech companies such Winners as Hellofresh, Ocado, and Blue Apron have seen their valuations skyrocket. • The stock market developments are an expression of changing consumer behavior: online-driven delivery +207% +110% +95% +81% +19% services and platforms, in particular, were able to reach new customer groups and grow strongly even during the lockdown. -

Q4 2020 Agtech & Sustainable Food Newsletter

AgTech & Sustainable Food Market Update Q4 2020 Precision Software & Innovative Crop Science Sustainable Food Agriculture Sensing Farming © Nomura AgTech & Sustainable Food News & Transactions Corporate ■ Bacardi announced it would use 100% biodegradable plastic bottles by 2023 to replace Announcements the 80mm bottles it produces annually (Food Dive) in Q4 2020 ■ Cascades, a manufacturer of packaging products, announced the release of a thermoform food tray made from 100% recycled fibers (Recycling Today) ■ CIBO announced the launch of CIBO Impact, a platform to help farmers generate and sell carbon credits based on regenerative farming practices and an online marketplace for other entities to purchase the credits (GAI) Nomura Greentech’s ■ Farmers Edge, a developer of agricultural software, announced a partnership with Take: Radicle, a provider of business insight services, to launch a carbon credit program (AFN) ■ Strong traction from corporate buyers has ■ FBN, a developer of a Ag-based information network for farmers, announced a program validated the to connect farmers and developers of biological inputs to perform scaled trials (AFN) economic potential of ■ Finance Earth, an impact investor, announced its Blue Impact Fund, a U.K.-based fund agricultural carbon focused on ocean conservation through sustainable seafood production (GAI) credits and will help drive the growth of ■ GrainChain, a developer of a decentralized agricultural transaction platform, announced the U.S. carbon a partnership with Mastercard to track commodities across the supply chain (Agriculture) market ■ Impossible Foods, a producer of plant-based meat, announced it would expand into Hong Kong, Singapore and other Asian markets to compete with Beyond Meat (AFN) ■ Indigo Ag, a developer of agricultural technology, announced the first commitments from large global brands to purchase verified agricultural carbon credits (PrecisionAg) ■ Meat-Tech 3D, an Israel-based developer of 3D-printed cell-based meat, filed paperwork with the SEC to begin the process of launching a U.S. -

To Fit Your the 7 LEVELS OF

THE 7 LEVELS OF MEAL PREP to fit your TIME ENERGY MONEY You have three basic resources in life: TIME ENERGY MONEY Here's a brief guide to choosing how you should meal prep, based on the resources you have. LEVEL 1 EXCELLENT Grow it Yourself EXCELLENT SCARCE PROCESS: > Build a garden; buy seeds & top toil > Kitchen: mint, rosemary, basil, thyme > Balcony: tomatoes, kale, cucumber, zucchini > Garden: apples, lemons, carrots, corn, avocado PAYOFF: > $15-30/week for the average garden *$680 (yield) - $240 (set-up), via Journal of Extension; Apr. 2014, Vol. 52 (2) LEVEL 2 GOOD Grocery Store GOOD TIGHT PROCESS: > Pick it up yourself > Cook it from scratch > Examples: Whole Foods, Urban Fare, Safeway, SaveOnFoods, Walmart, Superstore, No Frills COST: > $50-300/week LEVEL 3 DECENT Grocery Delivery DECENT OKAY PROCESS: > Order online > Cook it from scratch > Examples: Spud, Instacart, InABuggy COST: > $100-350/week LEVEL 4 TIGHT Prepped Delivery DECENT DECENT PROCESS: > Order online > Ready to cook & serve > Examples: HelloFresh, FreshPrep COST: > $150-400/week LEVEL 5 TIGHT Pre-Cooked Delivery LOW GOOD PROCESS: > Order online > Reheat & eat > Examples: Frankie's Meals, FitnessFoods, Vancouver Muscle Meals, Eat Your Cake COST: > $200-550/week LEVEL 6 TIGHT Hot Meal Delivery LOW GREAT PROCESS: > Order online > Tip & eat > Examples: Uber Eats, DoorDash, Foodora, Skip The Dishes, GrubHub COST: > $300-850/week LEVEL 7 LIMITED Personal Chef LIMITED FLUSH PROCESS: > Pick out your favourite recipes (anything) > Go to the kitchen and eat > Examples: Thomas Davidson (Vancouver) COST: > $1,000-3,000/week ASK YOURSELF: Which have I been optimizing for? Which should I be optimizing for? AND THEN GO DO THAT. -

EXHIBIT R Hellofresh Sees Meal Kit Demandcase Surge1:19-Cv-12608-WGY As Shift to Online Continues -Document BBC News 85-19 Filed 05/04/21 Page 2 of 6 5/4/21, 1�24 PM

Case 1:19-cv-12608-WGY Document 85-19 Filed 05/04/21 Page 1 of 6 EXHIBIT R HelloFresh sees meal kit demandCase surge1:19-cv-12608-WGY as shift to online continues -Document BBC News 85-19 Filed 05/04/21 Page 2 of 6 5/4/21, 1(24 PM Sign in Home News Sport Reel Worklife Travel Future Culture More Search Home Coronavirus Video World US & Canada UK Business Tech Science Stories Entertainment & Arts More Business Market Data New Economy New Tech Economy Companies Entrepreneurship Technology of Business Economy CEO Secrets Global Car Industry Business of Sport ADVERTISEMENT Welcome to BBC News, America’s most trusted news source. Register HelloFresh sees meal kit demand Top Stories surge as shi3 to online continues India opposition calls for full national lockdown 11 hours ago Comments The prime minister is resisting a nationwide lockdown due to the potential economic impact. Coronavirus pandemic 2 hours ago Bill and Melinda Gates have 'agreed estate split' 4 hours ago Arrests made a3er 97 migrants found in Texas home 4 hours ago HELLOFRESH Meal kit delivery firm HelloFresh has seen a big jump in customer numbers ADVERTISEMENT as it continues to benefit from the trend of ordering food online seen during the pandemic. https://www.bbc.com/news/business-56977643 Page 1 of 5 HelloFresh sees meal kit demandCase surge1:19-cv-12608-WGY as shift to online continues -Document BBC News 85-19 Filed 05/04/21 Page 3 of 6 5/4/21, 1(24 PM It said it had 7.3 million active users globally in the first three months of 2021, up 74.2% from a year earlier.