Response: Just Eat Takeaway.Com N. V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Davivienda Arrives at Super App Rappi to Revolutionize the Way Money Is Managed

Davivienda arrives at Super App Rappi to revolutionize the way money is managed: • With an innovative product offering, a bank and a delivery and e-commerce platform join experiences and trust to make payments, purchases, transfers, and to save and handle money. • Rappi is a SuperAPP that innovatively integrates everything from supermarket shopping to transportation solutions; now, introducing money management; all in one place. • RappiPay Davivienda is designed for the Pay Generation: a generation we all belong to, because we live experiences and manage finances from our mobile phones. Bogota, May 2019. All the innovation of Davivienda and Latin America´s Super App Rappi come together to bring Colombians new experiences and possibilities to make purchases and manage money easily and reliably. From now on, actions such as making purchases at Rappi, paying for a hamburger by scanning a QR code, transferring money to a friend to pay off a debt, withdrawing cash at an ATM using a mobile phone or making local and international purchases with the Rappi Visa debit card will be possible from one place: RappiPay Davivienda. Beyond being an innovative payment model, Rappi Pay Davivienda, transforms the path towards the future opening of payment ecosystems between Fintechs and Banks. This alliance enhances digital and secure payments in Colombia, lowers access and transaction costs, reduces the use of cash, and strengthens businesses and entrepreneurs in the country, both in e-commerce and in conventional stores, thanks to its features and benefits. Joining RappiPay Davivienda does not require paperwork or being a Davivienda customer. The process is as simple as downloading Rappi, activating RappiPay Davivienda on the App, and adding money either through another RappiPay Davivienda, by electronic transfer from any bank, through an authorized agent or at any Davivienda branch. -

Templeton Global Equity Income Fund August 31, 2021

FTIF - Templeton Global Equity Income Fund August 31, 2021 FTIF - Templeton Global Equity August 31, 2021 Income Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date B4TX8S1 AIA GROUP LTD 70,295 $839,367 1.10% N/A N/A 012653101 ALBEMARLE CORP 7,404 $1,752,822 2.31% N/A N/A 025816109 AMERICAN EXPRESS CO 12,293 $2,040,146 2.68% N/A N/A BYPBS67 ARCELORMITTAL SA 14,303 $479,701 0.63% N/A N/A 0989529 ASTRAZENECA PLC 11,321 $1,323,868 1.74% N/A N/A 084670702 BERKSHIRE HATHAWAY INC 2,308 $659,557 0.87% N/A N/A 09857L108 BOOKING HOLDINGS INC 520 $1,195,828 1.57% -

The Four Horsemen of the Restaurant Apocalypse?

The Four Horsemen of the Restaurant Apocalypse? How lessons from the travel industry’s response to online travel agencies may enable restaurants to survive (and hopefully thrive) in a delivery-heavy future. by Zach Goldstein, CEO and Founder, Thanx The Original Mel’s diner is a Northern California legend. Now at 22 locations, the classic drive-up service is long-gone, just one of many necessary adaptations for a restaurant that celebrated its 70-year anniversary two years ago. The latest evolution may be most challenging yet. “In our first two years on the delivery platforms, revenue went up 20% year-over-year. It was the largest top-line growth we’ve experienced in two decades,” said Tony Bendana, restaurant industry veteran and current Chief Operating Officer of The Original Mel’s which is listed in four third-party delivery apps today — Doordash, Uber Eats, Grubhub, and Postmates. “But when we looked at how much profit we were making, it hadn’t moved.” Tony Bendana, COO at The Original Mel’s What follows is an in-depth study of the massive disruption facing restaurants today, broken into the following sections: Restaurants Are Digitizing 04 More than $200B in restaurants sales will come through digital channels (including third-party marketplaces) by 2022 The Question of Incrementality 05 Because of high take-rates, many restaurants are questioning whether delivery marketplaces are friend or foe We’ve Seen This Story Before: Hotels and Online Travel Agencies 08 OTAs grew rapidly and ultimately stole share from hotels themselves The -

Track Screen Ads on Swiggy Overview of Swiggy

Track Screen Ads on Swiggy Overview of Swiggy Swiggy ( www.swiggy.com) is an online food ordering and delivery platform that allows customers to order food from restaurants near them. Presence in ~ 12 - 14 MM transacting 200+ cities pan India users visiting every month 40 MM orders / month pan ~50%* market share in India food delivery Double digit MOM growth PAN India 100K+ transacting restos ~25% on board conversion rate Top 7 cities of Swiggy * Market Share nos. are as per reports shared by RedSeer Consulting Why customers love Swiggy ? Swiggy’s Growth Story Swiggy ( www.swiggy.com) has grown phenomenally over the past 24 months (clocking ~11X growth). With expansions in new geographies & more verticals, Swiggy’s growth story is poised to become stronger ~11X Growth Reach the audience that matters to you, at scale Monthly transacting base of ~10 mn users High stickiness on the platform, with an average ordering frequency of 3+ per user Young (18-44MF) Urban Digitally active & Engaged (Top 50 cities) Transacting users Users Food & Beverage context Hyperlocality Strategic post-transaction video ad units to ensure higher engagement • Non-skip, Autoplay, Clickable video unit • Average Monthly Reach: 10mn+ • Average Monthly impressions on track screen: 30mn+ • Average completion rate: 70% • Avg. CTR: 0.2- 0.4% Video unit in Landscape Mode Video unit in Portrait Mode Reinforce brand message or drive performance with display ad units • Display units in standalone as well as carousal format to create the full brand story • Average Monthly Reach: 10mn+ • Average Monthly impressions on track screen: 30mn+ • Avg. CTR on Display: 0.3 – 0.5% Brands across categories have seen results with Swiggy’s in-app ad units BFSI E-commerce Auto / OTT (Customer Acquisition) (Sale / Offer Awareness) (Launch Amplification) Thank You Annexure 1: Display Unit specifications • Card dimensions: 1280 x 1000px • No CTA button on the creative • Carousal Title: Upto 30 characters (incl. -

Chinese Investments in India

CHINESE INVESTMENTS IN INDIA Amit Bhandari, Fellow, Energy & Environment Studies Programme, Blaise Fernandes, Board Member, Gateway House and President & CEO, The Indian Music Industry & Aashna Agarwal, Former Researcher Report No. 3, Map No. 10 | February 2020 Disclaimer: While every effort has been made to ensure that data is accurate and reliable, these maps are conceptual and in no way claim to reflect geopolitical boundaries that may be disputed. Gateway House is not liable for any loss or damage whatsoever arising out of, or in connection with the use of, or reliance on any of the information from these maps. Published by Gateway House: Indian Council on Global Relations 3rd floor, Cecil Court, M.K.Bhushan Marg, Next to Regal Cinema, Colaba, Mumbai 400 039 T: +91 22 22023371 E: [email protected] W: www.gatewayhouse.in Gateway House: Indian Council on Global Relations is a foreign policy think tank in Mumbai, India, established to engage India’s leading corporations and individuals in debate and scholarship on India’s foreign policy and the nation’s role in global affairs. Gateway House is independent, non-partisan and membership-based. Editors: Manjeet Kripalani & Nandini Bhaskaran Cover Design & Map Visualisation: Debarpan Das Layout: Debarpan Das All rights reserved. No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without prior written permission of the publisher. © Copyright 2020, Gateway House: Indian Council on Global Relations. Methodology Our preliminary research indicated that the focus of Chinese investments in India is in the start-up space. -

Food Delivery Service in Question: the Development Of

Food Delivery Service in Question: The Development of Foodpanda in Taiwan and Its Problems about Labor Rights By Yu-Hsin Chang 張羽欣 Submitted to the Faculty of Department of International Affairs in partial fulfillment of the requirements for the degree of Bachelor of Arts in International Affairs Wenzao Ursuline University of Languages 2021 WENZAO URSULINE UNIVERSITY OF LANGAUGES DEPARTMENT OF INTERNATIONAL AFFAIRS This senior paper was presented by Yu-Hsin Chang 張羽欣 It was defended on November 28, 2020 and approved by Reviewer 1: Mark Lai, Associate Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ Reviewer 2: Ren-Her Hsieh, Associate Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ Advisor: Yu-Hsuan Lee, Assistant Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ i Copyright © by Yu-Hsin Chang 張羽欣 2021 ii Food Delivery Service in Question: The Development of Foodpanda in Taiwan and Its Problems about Labor Rights Yu-Hsin Chang, B.A. Wenzao Ursuline University of Languages, 2021 Abstract In 2019, the food delivery platforms were sweeping across Taiwan. However, food delivery employees had experienced a series of problems. For example, a common traffic accident might risk their lives by catching more orders. Thus, the thesis’ focus is on employees’ working experience in the case of Foodpanda. The study explores how Foodpanda is becoming a new business and work through survey and in-depth interview with Foodpanda employees. I have a major finding of this study. It shows a sense of relative autonomy argued by the employees who choose this work because it is a flexible job that is very suitable for people who do not want to be restricted by time. -

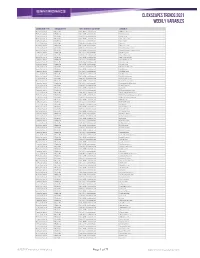

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

List of Brands

Global Consumer 2019 List of Brands Table of Contents 1. Digital music 2 2. Video-on-Demand 4 3. Video game stores 7 4. Digital video games shops 11 5. Video game streaming services 13 6. Book stores 15 7. eBook shops 19 8. Daily newspapers 22 9. Online newspapers 26 10. Magazines & weekly newspapers 30 11. Online magazines 34 12. Smartphones 38 13. Mobile carriers 39 14. Internet providers 42 15. Cable & satellite TV provider 46 16. Refrigerators 49 17. Washing machines 51 18. TVs 53 19. Speakers 55 20. Headphones 57 21. Laptops 59 22. Tablets 61 23. Desktop PC 63 24. Smart home 65 25. Smart speaker 67 26. Wearables 68 27. Fitness and health apps 70 28. Messenger services 73 29. Social networks 75 30. eCommerce 77 31. Search Engines 81 32. Online hotels & accommodation 82 33. Online flight portals 85 34. Airlines 88 35. Online package holiday portals 91 36. Online car rental provider 94 37. Online car sharing 96 38. Online ride sharing 98 39. Grocery stores 100 40. Banks 104 41. Online payment 108 42. Mobile payment 111 43. Liability insurance 114 44. Online dating services 117 45. Online event ticket provider 119 46. Food & restaurant delivery 122 47. Grocery delivery 125 48. Car Makes 129 Statista GmbH Johannes-Brahms-Platz 1 20355 Hamburg Tel. +49 40 2848 41 0 Fax +49 40 2848 41 999 [email protected] www.statista.com Steuernummer: 48/760/00518 Amtsgericht Köln: HRB 87129 Geschäftsführung: Dr. Friedrich Schwandt, Tim Kröger Commerzbank AG IBAN: DE60 2004 0000 0631 5915 00 BIC: COBADEFFXXX Umsatzsteuer-ID: DE 258551386 1. -

Online Transportation Price War: Indonesian Style

CORE Metadata, citation and similar papers at core.ac.uk Provided by Klaipeda University Open Journal Systems SAKTI HENDRA PRAMUDYA ONLINE TRANSPORTATION PRICE WAR: INDONESIAN STYLE ONLINE TRANSPORTATION PRICE WAR: INDONESIAN STYLE Sakti Hendra Pramudya1 Universitas Bina Nusantara (Indonesia), University of Pécs (Hungary) ABStrAct thanks to the brilliant innovation of the expanding online transportation companies, the Indonesian people are able to obtain an affor- dable means of transportation. this three major ride-sharing companies (Go-Jek, Grab, and Uber) provide services which not only limited to transportation service but also providing services for food delivery, courier service, and even shopping assistance by utili- zing gigantic armada of motorbikes and cars which owned by their ‘driver partners’. these companies are competing to gain market share by implementing the same strategy which is offering the lowest price. this paper would discuss the Indonesian online trans- portation price war by using price comparison analysis between three companies. the analysis revealed that Uber was the winner of the price war, however, their ‘lowest price strategy’ would lead to their downfall not only in Indonesia but in all of South East Asia. KEYWOrDS: online transportation companies, price war, Indonesia. JEL cODES: D40, O18, O33 DOI: http://dx.doi.org/10.15181/rfds.v29i3.2000 Introduction the idea of ride-hailing was unfamiliar to Indonesian people. Before the inception (and followed by the large adoption) of smartphone applications in Indonesia, the market of transportation service was to- tally different. the majority of middle to high income Indonesian urban dwellers at that time was using the conventional taxi as their second option of transportation after their personal car or motorbike. -

Food and Tech August 13

⚡️ Love our newsletter? Share the ♥️ by forwarding it to a friend! ⚡️ Did a friend forward you this email? Subscribe here. FEATURED Small Farmers Left Behind in Covid Relief, Hospitality Industry Unemployment Remains at Depression-Era Levels + More Our round-up of this week's most popular business, tech, investment and policy news. Pathways to Equity, Diversity + Inclusion: Hiring Resource - Oyster Sunday This Equity, Diversity + Inclusion Hiring Resource aims to help operators to ensure their tables are filled with the best, and most equal representation of talent possible – from drafting job descriptions to onboarding new employees. 5 Steps to Move Your Food, Beverage or Hospitality Business to Equity Jomaree Pinkard, co-founder and CEO of Hella Cocktail Co, outlines concrete steps businesses and investors can take to foster equity in the food, beverage and hospitality industries. Food & Ag Anti-Racism Resources + Black Food & Farm Businesses to Support We've compiled a list of resources to learn about systemic racism in the food and agriculture industries. We also highlight Black food and farm businesses and organizations to support. CPG China Says Frozen Chicken Wings from Brazil Test Positive for Virus - Bloomberg The positive sample appears to have been taken from the surface of the meat, while previously reported positive cases from other Chinese cities have been from the surface of packaging on imported seafood. Upcycled Molecular Coffee Startup Atomo Raises $9m Seed Funding - AgFunder S2G Ventures and Horizons Ventures co-led the round. Funding will go towards bringing the product to market. Diseased Chicken for Dinner? The USDA Is Considering It - Bloomberg A proposed new rule would allow poultry plants to process diseased chickens. -

Just Eat/Hungryhouse Appendices and Glossary to the Final Report

Anticipated acquisition by Just Eat of Hungryhouse Appendices and glossary Appendix A: Terms of reference and conduct of the inquiry Appendix B: Delivery Hero and Hungryhouse group structure and financial performance Appendix C: Documentary evidence relating to the counterfactual Appendix D: Dimensions of competition Appendix E: The economics of multi-sided platforms Appendix F: Econometric analysis Glossary Appendix A: Terms of reference and conduct of the inquiry Terms of reference 1. On 19 May 2017, the CMA referred the anticipated acquisition by Just Eat plc of Hungryhouse Holdings Limited for an in-depth phase 2 inquiry. 1. In exercise of its duty under section 33(1) of the Enterprise Act 2002 (the Act) the Competition and Markets Authority (CMA) believes that it is or may be the case that: (a) arrangements are in progress or in contemplation which, if carried into effect, will result in the creation of a relevant merger situation, in that: (i) enterprises carried on by, or under the control of, Just Eat plc will cease to be distinct from enterprises carried on by, or under the control of, Hungryhouse Holdings Limited; and (ii) the condition specified in section 23(2)(b) of the Act is satisfied; and (b) the creation of that situation may be expected to result in a substantial lessening of competition within a market or markets in the United Kingdom for goods or services, including in the supply of online takeaway ordering aggregation platforms. 2. Therefore, in exercise of its duty under section 33(1) of the Act, the CMA hereby makes -

Meituan 美團 (The “Company”) Is Pleased to Announce the Audited Consolidated Results of the Company for the Year Ended December 31, 2020

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability) (Stock code: 3690) ANNOUNCEMENT OF THE RESULTS FOR THE YEAR ENDED DECEMBER 31, 2020 The Board of Directors (the “Board”) of Meituan 美團 (the “Company”) is pleased to announce the audited consolidated results of the Company for the year ended December 31, 2020. These results have been audited by the Auditor in accordance with International Standards on Auditing, and have also been reviewed by the Audit Committee. In this announcement, “we,” “us” or “our” refers to the Company. KEY HIGHLIGHTS Financial Summary Unaudited Three Months Ended December 31, 2020 December 31, 2019 As a As a percentage percentage Year-over- Amount of revenues Amount of revenues year change (RMB in thousands, except for percentages) Revenues 37,917,504 100.0% 28,158,253 100.0% 34.7% Operating (loss)/profit (2,852,696) (7.5%) 1,423,860 5.1% (300.3%) (Loss)/profit for the period (2,244,292) (5.9%) 1,460,285 5.2% (253.7%) Non-IFRS Measures: Adjusted EBITDA (589,128) (1.6%) 2,178,650 7.7% (127.0%) Adjusted net (loss)/profit (1,436,520) (3.8%) 2,270,219 8.1% (163.3%) Year Ended December 31, 2020