Online Transportation Price War: Indonesian Style

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Market Impacts of Sharing Economy Entrants: Evidence from USA and China

Electronic Commerce Research https://doi.org/10.1007/s10660-018-09328-1 The market impacts of sharing economy entrants: evidence from USA and China Yue Guo1,2 · Fu Xin1 · Xiaotong Li3 © The Author(s) 2019 Abstract This paper studies the link between the difusion of the sharing economy and tra- ditional mature industries by empirically examining the economic impacts of shar- ing economy entrants. This study adds to the ongoing debate over whether and how ride-hailing platforms infuence new car sales in USA and China. Our results sug- gest that the short-term impact of Didi Chuxing’s entry on new car sales is positive. Unlike the efect of Didi Chuxing on new car sales in China, Uber’s entry nega- tively infuences new car sales in USA. The entry of Didi Chuxing is related to a 9.24% increase in new car sales in China and the entry of Uber is related to an 8.1% decrease in new car sales in USA. We further empirically confrm that the impact of ride-hailing companies is trivial in small cities. Keywords Collaborative consumption models · Uber · Didi · Ride-hailing services · Sharing economy · Two-sided platforms 1 Introduction Over the last few years, the rapid proliferation of smartphones and the associated applications have fueled rapid growth of the online sharing economy, such as those of Uber, Airbnb, Lyft, Turo, and Peerby. These emerging online peer-to-peer plat- forms, collectively known as ‘collaborative consumption’, have made a great deal * Fu Xin [email protected] * Xiaotong Li [email protected] Yue Guo [email protected] 1 Hohai Business School, Hohai University, Nanjing, China 2 King’s Business School, King’s College London, London, UK 3 College of Business, University of Alabama in Huntsville, Huntsville, AL 35899, USA Vol.:(0123456789)1 3 Y. -

HIGHLIGHTS the Company

Transportation, Online Food Ordering and Food Delivery| Founded 2012 | Singapore grab.com MARKETPLACE TYPE OF SECURITY: HIGHLIGHTS Equity - Direct Investment DEAL SIZE: • Grab has served more than 187 million users in over 330 cities across eight countries1. $ 3,410,000 MINIMUM INVESTMENT: • In December 2018, Grab claimed to have served 920 million kil- ometers worth of rides to its users that year $ 100,000 • Grab has raised a total of $10.1B in funding over 31 rounds. Their latest funding was raised on Aug 3, 20202 KEY INVESTORS: Mitsubishi UFJ Financial group: • In March 2018 Grab acquired Uber’s operations in Southeast $706 Million Asia and Uber now holds a 28% stake in Grab3. TIS INTEC: $150 Million Booking Holdings: $200 Million Se- ries H funding The Company SoftBank, Didi, Toyota: $2.5 Billion series G funding Grab, is a Singaporean multinational ride-hailing compa- ny headquartered in Queenstown, Singapore. In addition to SoftBank, Didi, Honda: $750 Mil- transportation, the company offers food delivery and digital lion, payments services via a mobile app. Series F funding It currently operates in the Asian countries Didi Chuxing, China Investment of Singapore, Malaysia, Cambodia, Indonesia, Myanmar, Philippi Corp: $350 Million nes, Thailand, Vietnam, and Japan. It is Southeast Asia's first Series E funding "decacorn" (a startup with a valuation of over US$10 billion)4. SoftBank: $250 Million Series D funding Grab’s growth of its “super app” — in which it provides a one- Tiger Global: $65 Million stop shop for consumers to both see to their transportation Series C funding needs, but also other aspects of their connected consumer life, GGV Capital: $15 Million such as eating, entertainment and managing their money — has Series B funding involved the company partnering with a number of other finan- cial giants, including Mastercard, Credit Saison, Chubb, and Vertex Venture: $10 Million ZhongAn Online P&C Insurance Co. -

2020 ESG Report

ESG Report 20202020 An environmental, social, and governanceESG report for investors Report ESG Report 2020 - DRAFT - Company Confidential 1 We are proud to share Uber’s 2020 ESG Report, which highlights our perspective on the environmental, social, and governance (ESG) issues that matter most to our business and our stakeholders—including platform users (drivers, delivery people, merchants, and consumers), employees, cities, regulators, and investors. The report is intended to provide a high-level overview of Uber’s views on, approach to, and performance on key ESG issues. Additional content regarding these issues, and more, can be found on Uber.com. Data is as of December 31, 2019, unless otherwise noted. Narrative may cover material through August 31, 2020. ESG Report 2020 - DRAFT - Company Confidential 2 Table of contents Uber’s purpose 4 Our cultural norms 5 Letter from our CEO 6 Our business 7 About this report 9 Oversight of ESG at Uber 11 Integrity and trust 17 User safety 24 COVID-19 response 27 Driver and delivery person well-being 32 Diversity, inclusion, and culture 35 Local impact 43 Climate change 47 Performance data 53 Notes from performance data 62 Terms used in this report 65 Indexing 67 ESG Report 2020 3 Uber’s Purpose Why we exist To reimagine the way the world moves for the better What we do Make real life easier to navigate for everyone Who we are Fearless optimists: crazy enough to believe, tenacious enough to make it happen ESG Report 2020 4 Our cultural norms Our 8 cultural norms reflect who we are and where we’re going. -

The Ridesharing Revolution: Economic Survey and Synthesis

The Ridesharing Revolution: Economic Survey and Synthesis Robert Hahn and Robert Metcalfe* January 10, 2017 Paper prepared for Oxford University Press Volume IV: More Equal by Design: Economic design responses to inequality. Eds. Scott Duke Kominers and Alex Teytelboym. Abstract Digital ridesharing platforms, such as Uber and Lyft, are part of a broader suite of innovations that constitute what is sometimes referred to as the sharing economy. In this essay, we provide an overview of current research on the economic efficiency and equity characteristics of ridesharing platforms, and provide a research agenda that includes an examination of the natural evolution toward driverless cars. We have three main findings: first, relatively little is known about either the equity and efficiency properties of ridesharing platforms, but this is likely to change as companies and researchers focus on these issues. Second, we may be able to learn something about the likely diffusion and benefits of these technologies from experience with other policies and technologies. Third, while we believe these platforms will do substantially more good than harm, the measurement, distribution, and size of the gains from these technologies requires further research. * Robert Hahn is professor and director of economics at the Smith School at the University of Oxford, a non-resident senior fellow at Brookings, and a senior fellow at the Georgetown Center for Business and Public Policy. Robert Metcalfe is Postdoctoral Research Scholar in Economics at the University of Chicago. We would like to thank Ted Gayer, Jonathan Hall, Scott Kominers, Jonathan Meer, Alex Teytelboym, Scott Wallsten, and Cliff Winston for helpful comments and Julia Schmitz, Brian Campbell and Samantha van Urk for excellent research assistance. -

Uber Technologies Inc.: Managing Opportunities and Challenges

Center for Ethical Organizational Cultures Auburn University http://harbert.auburn.edu Uber Technologies Inc.: Managing Opportunities and Challenges INTRODUCTION Uber Technologies Inc. (Uber) is a tech startup that provides ride sharing services by facilitating a connection between independent contractors (drivers) and riders with the use of an app. Uber has expanded its operations to 58 countries around the world and is valued at around $41 billion. Because its services costs less than taking a traditional taxi, in the few years it has been in business Uber and similar ride sharing services have upended the taxi industry. The company has experienced resounding success and is looking toward expansion both internationally and within the United States. However, Uber’s rapid success is creating challenges in the form of legal and regulatory, social , and technical obstacles. The taxi industry, for instance, is arguing that Uber has an unfair advantage because it does not face the same licensing requirements as they do. Others accuse Uber of not vetting their drivers, creating potentially unsafe situations. An accusation of rape in India has brought this issue of safety to the forefront. Some major cities are banning ride sharing services like Uber because of these various concerns. Additionally, Uber has faced various lawsuits, including a lawsuit filed against them by its independent contractors. Its presence in the market has influenced lawmakers to draft new re gulations to govern this “app-driven” ride sharing system. Legislation can often hinder a company’s expansion opportunities because of the resources it must expend to comply with regulatory requirements. Uber has been highly praised for giving independent contractors an opportunity to earn money as long as they have a car while also offering convenient ways for consumers to get around at lower costs. -

SUPREMECOUR I" 0Rqn^® COUNSEL for APPELLEE, STATE of OHIO

IN THE SUPREME COURT OF OHIO Supreme Court STAT'E OF OHIO Case No. 09-- .® 379 Appellee, On Appeal from the VS. Williams County Court of Appeals, Sixth Appellate District RANDALL D. SNYDER Court of Appeals Appellant. Case No. WM-08-004 MEMORANDUM IN SUPPORT OF JURISDICTION OF APPELLANT RANDALL D. SNYDER WII..T IAM F. KLUGE Atto;^ney Reg. No. 0022433 124 South Metcalf Street Lima, Ohio 45801 (419) 225-5706 Fax No.: (419) 225-6003 COUNSEL FOR APPELLANT, RANDALL D. SNYDER THCsiti'IAS A. THOMPSON, #0068787 Prosos:,Ating Attorney Wiiliains County, Ohio 121(^i:vV: High Street Bryan, Uhio 43506 (419) 636-4411 CLFnk OF COIJRT Fax i`io.: (41 9) 636-3919 SUPREMECOUR I" 0rQN^® COUNSEL FOR APPELLEE, STATE OF OHIO eisii . TABLE OF CONTENTS PAGE EXPL'ANATION OF WHY THIS CASE IS OF PUBLIC OR f.:I2EAT GENERAL INTEREST AND INVOLVES A FELONY . .. .1 STA'mEMENT OF CASE AND FACTS .................................................... I ARGNMENT IN SUPPORT OF PROPOSITION OF LAW .........................6 1tit: Proposition of Law I: Trial counsel's dual representation of the 1 Appellant and Co-Appellant without informed written consent violated Rule 1.7 of the Rules of Professional Conduct and resulted in a violation of the Confrontation Clause pursuant '^, to U.S. v. Bruton (1968), 391 U.S. 128, 88 S. Ct. 1620 ..........................6 Proposition of Law II: Dental records which are not self -authenticating pursuant to R.C. 2317.422 are inadmissible under Evid. R. 901 unless authenticated or identified by a witness with knowledge . .. .. .. .. .. .. .. ...8 Proposition of Law III: A conviction must be reversed and the matter remanded for a new trial when, due to the affirmative defense of self- defense, the conviction is not based upon sufficient evidence and is against the manifest weight of the evidence . -

Download?Doi=10.1.1.133.5901&Rep=Rep1&Type=Pdf Zarei, A

Volume 3, June 2020 ISSN: 2591 - 801X JALT J o g u n r i n h a c l a o Te f & Ap ng plied Learni Vol.3 No.1 (2020) Journal of Applied Learning & Teaching DOI: https://doi.org/10.37074/jalt.2020.3.1 Editor-in-Chief Jürgen Rudolph Editor-in-Chief Jürgen Rudolph, Kaplan Higher Education Singapore Associate Editors Joey Crawford, University of Tasmania Margarita Kefalaki, Communication Institute of Greece Nigel Starck, University of South Australia Shannon Tan, Kaplan Higher Education Singapore Eric Yeo Zhiwei, Kaplan Higher Education Singapore Editorial Board James Adonopoulos, Kaplan Business School, Australia Nelson Ang, Kaplan Higher Education Singapore William Baker, University of Tasmania, Australia Abhishek Bhati, James Cook University, Singapore Rob Burton, Griffith University, Australia Mike Christie, Kaplan Higher Education Singapore Joseph Crawford, University of Tasmania, Australia Ailson De Moraes, Royal Holloway, University of London, UK Fotini Diamantidaki, University College London, UK Michael D. Evans, Kaplan Higher Education Singapore Lucy Gill-Simmen, Royal Holloway, University of London, UK Matt Glowatz, University College Dublin, Ireland Lena Itangata, University of Portsmouth, UK Rhys Johnson, Kaplan Higher Education Singapore Margarita Kefalaki, Communication Institute of Greece Bashar Malkawi, University of Sharjah, United Arab Emirates Paola A. Magni, Murdoch University, Singapore Justin O’Brien, Royal Holloway, University of London, UK Orna O’Brien, University College Dublin, Ireland Can-Seng Ooi, University of Tasmania, -

Response: Just Eat Takeaway.Com N. V

NON- CONFIDENTIAL JUST EAT TAKEAWAY.COM Submission to the CMA in response to its request for views on its Provisional Findings in relation to the Amazon/Deliveroo merger inquiry 1 INTRODUCTION AND BACKGROUND 1. In line with the Notice of provisional findings made under Rule 11.3 of the Competition and Markets Authority ("CMA") Rules of Procedure published on the CMA website, Just Eat Takeaway.com N.V. ("JETA") submits its views on the provisional findings of the CMA dated 16 April 2020 (the "Provisional Findings") regarding the anticipated acquisition by Amazon.com BV Investment Holding LLC, a wholly-owned subsidiary of Amazon.com, Inc. ("Amazon") of certain rights and minority shareholding of Roofoods Ltd ("Deliveroo") (the "Transaction"). 2. In the Provisional Findings, the CMA has concluded that the Transaction would not be expected to result in a substantial lessening of competition ("SLC") in either the market for online restaurant platforms or the market for online convenience groceries ("OCG")1 on the basis that, as a result of the Coronavirus ("COVID-19") crisis, Deliveroo is likely to exit the market unless it receives the additional funding available through the Transaction. The CMA has also provisionally found that no less anti-competitive investors were available. 3. JETA considers that this is an unprecedented decision by the CMA and questions whether it is appropriate in the current market circumstances. In its Phase 1 Decision, dated 11 December 20192, the CMA found that the Transaction gives rise to a realistic prospect of an SLC as a result of horizontal effects in the supply of food platforms and OCG in the UK. -

Grab Marketing Strategy, Research & Development

Grab Marketing Strategy, Research & Development Gabriel Willy Widyatama1, Shankar Chelliah2, Yang Kai3, Yang Yingxing4, Yee Chew Tien5, Wee Choo Mey6, Liem Gai Sin7 University Ma Chung1,7 Jl. Villa Puncak Tidar No.1, Doro, Karangwidoro, Kec. Dau, Malang, Jawa Timur 65151 University Sains Malaysia2,3,4,5,6 11800 Gelugor, Penang, Malaysia Correspondence Email: [email protected] ABSTRACT Grab is a Singapore-based company providing transportation applications available in six countries in Southeast Asia. It utilizes smartphone cloud-based technology to provide ride-hailing and logistics services, food delivery, and courier service. This study proposes to determine and analyze the problems that exist in the Grab company. One of the problems in a company is a competition between companies. One of the competitors is GO-JEK. This research is expected to provide solutions to problems that exist within the company. How to stand out from competitors, attract more customers and drivers, and various training courses for drivers? What should the company decide on the price? In different countries, how should companies operate under different government policies? Keywords: Application, Grab, Marketing, Strategy, Transportation INTRODUCTION Grab Holdings Inc. formerly known as MyTeksi and GrabTaxi, it is a Singapore based transportation company that was originally founded in Malaysia and moved its headquarters to Singapore. Grab is an Uber-like service that offers rides, and on- demand taxi service with flat rate fees based on the city. Grab allows the customer to quickly book a ride from the app, wait for the grab car, and pay the fare through app or by using cash. -

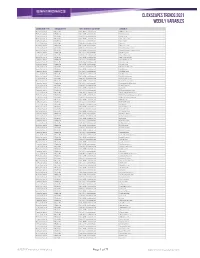

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Platform Economy December, 2018

The rise of the platform economy December, 2018 The rise of the platform economy The platform economy poses significant questions, challenges and opportunities for society, the labour market and organisations The world is going through a new economic revolution, disrupting the economy, businesses, labour markets and our daily lives in a way not seen since the industrial revolution. Driven by technological innovations and increased online connectivity, the role of digital labour market matching is rising. At the heart of this change is the rise of the platform economy1. Workers are finding work through online outsourcing platforms and apps in this so called platform economy. While the gig economy has been talked about for years, the rise of the economy through digital platforms is relatively new. As the platform economy evolves, there are both new opportunities as well as new challenges that arise with heightened complexity. This article explores some of the challenges and future questions related to the rise of the platform economy for both society and organisations tapping into the platform economy. 1 Kenney & Zysman, 2016: 64 What is the platform economy? An increasing number of businesses are starting to adopt the platform business model and its digital strategies in order to remain competitive. Companies such as Airbnb, Uber, Amazon, Google, Salesforce and Facebook are creating online networks that facilitate digital interactions between people. There is a large variation between the function and type of digital platforms available in today’s marketplace, ranging from platforms providing services (e.g., Uber and Airbnb), to products (e.g. Amazon and eBay), to payments (e.g., Square, PayPal), to software development (e.g., Apple, Salesforce) and many more. -

Meituan 美團 (The “Company”) Is Pleased to Announce the Audited Consolidated Results of the Company for the Year Ended December 31, 2020

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability) (Stock code: 3690) ANNOUNCEMENT OF THE RESULTS FOR THE YEAR ENDED DECEMBER 31, 2020 The Board of Directors (the “Board”) of Meituan 美團 (the “Company”) is pleased to announce the audited consolidated results of the Company for the year ended December 31, 2020. These results have been audited by the Auditor in accordance with International Standards on Auditing, and have also been reviewed by the Audit Committee. In this announcement, “we,” “us” or “our” refers to the Company. KEY HIGHLIGHTS Financial Summary Unaudited Three Months Ended December 31, 2020 December 31, 2019 As a As a percentage percentage Year-over- Amount of revenues Amount of revenues year change (RMB in thousands, except for percentages) Revenues 37,917,504 100.0% 28,158,253 100.0% 34.7% Operating (loss)/profit (2,852,696) (7.5%) 1,423,860 5.1% (300.3%) (Loss)/profit for the period (2,244,292) (5.9%) 1,460,285 5.2% (253.7%) Non-IFRS Measures: Adjusted EBITDA (589,128) (1.6%) 2,178,650 7.7% (127.0%) Adjusted net (loss)/profit (1,436,520) (3.8%) 2,270,219 8.1% (163.3%) Year Ended December 31, 2020