Home Bistro, Inc. (Otc – Hbis)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We Have a Head Start Over Rivals in Rapid Grocery Delivery Market, Says Deliveroo Founder Will Shu

We have a head start over rivals in rapid grocery delivery market, says Deliveroo founder Will Shu D eliveroo‘s co-founder Will Shu believes his firm has a “head start” over rivals in the race to dominate the UK’s speedy grocery delivery market, which is seeing intensifying competition. The fast-growing sector has exploded in 2021, with the likes of Getir, Zapp and Weezy all vying alongside Deliveroo and Uber Eats to be Londoners‘ app of choice for last-minute vegetable and snack deliveries. Adverts for all have popped up everywhere from Instagram to the Tube in recent months, many offering at least £10 off a first order. Most promise to deliver your oat milk within 15 minutes. The sector is estimated to be worth over £14 billion in the UK alone. Deliveroo, which revealed its half-year results on Wednesday, is spending on growth in the space and said it had made “further traction” in the first six months of 2021. Grocery delivery now makes up over 10% of Deliveroo’s UK revenues, and the firm said it had around 1,800 grocery sites live with major partners by July – up from 1,200 at the end of 2020. It offers food from stores including Co-op, Aldi, Waitrose and Whole Foods. READ MORE Tesla sales crash as Chinese choose domestic brands over Musk’s models Battle for Vectura cools as Carlyle pulls plug on bidding war Morrisons makes rare move to close its supermarkets on Boxing Day SPONSORED How the Government’s Plan for Jobs can help Kickstart your career Former investment banker Shu, 41, co-founded the food delivery firm in London in 2013. -

Response: Just Eat Takeaway.Com N. V

NON- CONFIDENTIAL JUST EAT TAKEAWAY.COM Submission to the CMA in response to its request for views on its Provisional Findings in relation to the Amazon/Deliveroo merger inquiry 1 INTRODUCTION AND BACKGROUND 1. In line with the Notice of provisional findings made under Rule 11.3 of the Competition and Markets Authority ("CMA") Rules of Procedure published on the CMA website, Just Eat Takeaway.com N.V. ("JETA") submits its views on the provisional findings of the CMA dated 16 April 2020 (the "Provisional Findings") regarding the anticipated acquisition by Amazon.com BV Investment Holding LLC, a wholly-owned subsidiary of Amazon.com, Inc. ("Amazon") of certain rights and minority shareholding of Roofoods Ltd ("Deliveroo") (the "Transaction"). 2. In the Provisional Findings, the CMA has concluded that the Transaction would not be expected to result in a substantial lessening of competition ("SLC") in either the market for online restaurant platforms or the market for online convenience groceries ("OCG")1 on the basis that, as a result of the Coronavirus ("COVID-19") crisis, Deliveroo is likely to exit the market unless it receives the additional funding available through the Transaction. The CMA has also provisionally found that no less anti-competitive investors were available. 3. JETA considers that this is an unprecedented decision by the CMA and questions whether it is appropriate in the current market circumstances. In its Phase 1 Decision, dated 11 December 20192, the CMA found that the Transaction gives rise to a realistic prospect of an SLC as a result of horizontal effects in the supply of food platforms and OCG in the UK. -

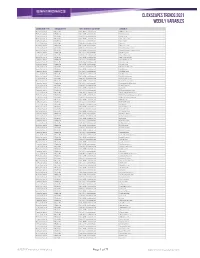

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

2020 Global Consumer Insights Survey China Report So Much Has Been Said About the C-Word These Days

Recover, restart and regrow: How consumer trends ignite transformation in China’s New Retail 2020 Global Consumer Insights Survey China report So much has been said about the C-word these days. All these events took place against a rather unstable Hardly a day went by without news broadcasting cases macro-economic backdrop. China-US trade tensions Foreword of infection, jobless claims, business closures, and so recently flared up with increases in tariff measures, on. airline bans, and other barriers. Aggregate demand weakened and oil prices continued to be volatile. Global supply chains were thrown off kilter following China’s total retail sales of consumer goods in the first worldwide closure of production facilities. Even after half of 2020 declined by 11.4% year on year to 17.2 China resumed capacity subsequently, new factory trillion yuan, according to National Bureau of Statistics. orders from overseas were halted while existing ones were hard to fulfil due to disrupted supply of In the face of macro-economic headwinds, Chinese intermediate products and raw materials. retailers are bearing the brunt of consequences as sales from brick-and-mortar shops plunged during the lockdown of major cities including Wuhan. The average Chinese consumers are left with an uncertain future; their worries include slower growth in living standards, job losses and lower incomes. Figure 1: Business threats to organisations’ growth prospects cited by mainland China CEOs “Somewhat” or 2019 “extremely concerned” 2020 Supply chain disruption 68% 49% Supply chain disruption Volatile energy costs 68% 49% Cyber threats Availability of key skills 64% 47% Changing consumer behaviour Speed of technological change 61% Mainland China 46% Availability of key skills Real estate costs 61% 43% Volatile energy costs Source: PwC’s Global CEO Survey PwC’s Global CEO Survey is conducted every year with CEOs to collect their economic and business outlook for the coming year. -

Food and Tech August 13

⚡️ Love our newsletter? Share the ♥️ by forwarding it to a friend! ⚡️ Did a friend forward you this email? Subscribe here. FEATURED Small Farmers Left Behind in Covid Relief, Hospitality Industry Unemployment Remains at Depression-Era Levels + More Our round-up of this week's most popular business, tech, investment and policy news. Pathways to Equity, Diversity + Inclusion: Hiring Resource - Oyster Sunday This Equity, Diversity + Inclusion Hiring Resource aims to help operators to ensure their tables are filled with the best, and most equal representation of talent possible – from drafting job descriptions to onboarding new employees. 5 Steps to Move Your Food, Beverage or Hospitality Business to Equity Jomaree Pinkard, co-founder and CEO of Hella Cocktail Co, outlines concrete steps businesses and investors can take to foster equity in the food, beverage and hospitality industries. Food & Ag Anti-Racism Resources + Black Food & Farm Businesses to Support We've compiled a list of resources to learn about systemic racism in the food and agriculture industries. We also highlight Black food and farm businesses and organizations to support. CPG China Says Frozen Chicken Wings from Brazil Test Positive for Virus - Bloomberg The positive sample appears to have been taken from the surface of the meat, while previously reported positive cases from other Chinese cities have been from the surface of packaging on imported seafood. Upcycled Molecular Coffee Startup Atomo Raises $9m Seed Funding - AgFunder S2G Ventures and Horizons Ventures co-led the round. Funding will go towards bringing the product to market. Diseased Chicken for Dinner? The USDA Is Considering It - Bloomberg A proposed new rule would allow poultry plants to process diseased chickens. -

Just Eat/Hungryhouse Appendices and Glossary to the Final Report

Anticipated acquisition by Just Eat of Hungryhouse Appendices and glossary Appendix A: Terms of reference and conduct of the inquiry Appendix B: Delivery Hero and Hungryhouse group structure and financial performance Appendix C: Documentary evidence relating to the counterfactual Appendix D: Dimensions of competition Appendix E: The economics of multi-sided platforms Appendix F: Econometric analysis Glossary Appendix A: Terms of reference and conduct of the inquiry Terms of reference 1. On 19 May 2017, the CMA referred the anticipated acquisition by Just Eat plc of Hungryhouse Holdings Limited for an in-depth phase 2 inquiry. 1. In exercise of its duty under section 33(1) of the Enterprise Act 2002 (the Act) the Competition and Markets Authority (CMA) believes that it is or may be the case that: (a) arrangements are in progress or in contemplation which, if carried into effect, will result in the creation of a relevant merger situation, in that: (i) enterprises carried on by, or under the control of, Just Eat plc will cease to be distinct from enterprises carried on by, or under the control of, Hungryhouse Holdings Limited; and (ii) the condition specified in section 23(2)(b) of the Act is satisfied; and (b) the creation of that situation may be expected to result in a substantial lessening of competition within a market or markets in the United Kingdom for goods or services, including in the supply of online takeaway ordering aggregation platforms. 2. Therefore, in exercise of its duty under section 33(1) of the Act, the CMA hereby makes -

FUTURE of FOOD a Lighthouse for Future Living, Today Context + People and Market Insights + Emerging Innovations

FUTURE OF FOOD A Lighthouse for future living, today Context + people and market insights + emerging innovations Home FUTURE OF FOOD | 01 FOREWORD: CREATING THE FUTURE WE WANT If we are to create a world in which 9 billion to spend. That is the reality of the world today. people live well within planetary boundaries, People don’t tend to aspire to less. “ WBCSD is committed to creating a then we need to understand why we live sustainable world – one where 9 billion Nonetheless, we believe that we can work the way we do today. We must understand people can live well, within planetary within this reality – that there are huge the world as it is, if we are to create a more boundaries. This won’t be achieved opportunities available, for business all over sustainable future. through technology alone – it is going the world, and for sustainable development, The cliché is true: we live in a fast-changing in designing solutions for the world as it is. to involve changing the way we live. And world. Globally, people are both choosing, and that’s a good thing – human history is an This “Future of” series from WBCSD aims to having, to adapt their lifestyles accordingly. endless journey of change for the better. provide a perspective that helps to uncover While no-one wants to live unsustainably, and Forward-looking companies are exploring these opportunities. We have done this by many would like to live more sustainably, living how we can make sustainable living looking at the way people need and want to a sustainable lifestyle isn’t a priority for most both possible and desirable, creating live around the world today, before imagining people around the world. -

The Challenges of Online Grocery

EARLY SIGNS OF COST CHALLENGES TO ONLINE GROCERY. JANUARY 2018 THE CHALLENGES OF ONLINE GROCERY JANUARY 2018 On Friday, November 3, 2017, Amazon Fresh according to Bloomberg’s Ellen Huet. She elaborates customers in “select zip codes” across the US that once the higher cost structure is accounted for, received the news that their delivery service would “…it’s unclear where the margin comes from.”8 be terminated. Jack O’Leary of Planet Retail RNG noted, “AmazonFresh has always been an COMPOSITION OF ADDED COSTS OF ONLINE GROCERY economically challenging program to operate without scale,” and, “That scale is tough to reach in (% OF TOTAL) Grocery Home many areas.”1 Rival services such as Peapod and Store Delivery Mailed Instacart have encountered similar struggles to date. Curbside From Meal Kit Cost Driver Pickup Warehouse Service In fact, Peapod was only profitable in three of its 12 markets in 2016 and, on a recent conference call, Jeff Added 14.0% 11.2% Carr, the CFO of Peapod’s parent company Ahold Warehousing Delhaize, remarked, “We’re not happy with Peapod’s Store Shopping 28.9% performance, but we feel confident we’ll be able to Labor improve that performance.”2, 3 Meanwhile, Instacart, Order Assembly 50.4% which delivers groceries from a network of Expenses independent physical stores, is “unit profitable” in Home Delivery 39.5% ten of their 19 markets, meaning that an average Expenses order is profitable in ten markets and unprofitable in Other 71.1% 46.5% 38.4% the other nine.4 This is before overhead expenses Expenses such as corporate administration, marketing, and Source: Sinha, Amithabh and Paul Weitzel. -

Food Delivery Platforms: Will They Eat the Restaurant Industry's Lunch?

Food Delivery Platforms: Will they eat the restaurant industry’s lunch? On-demand food delivery platforms have exploded in popularity across both the emerging and developed world. For those restaurant businesses which successfully cater to at-home consumers, delivery has the potential to be a highly valuable source of incremental revenues, albeit typically at a lower margin. Over the longer term, the concentration of customer demand through the dominant ordering platforms raises concerns over the bargaining power of these platforms, their singular control of customer data, and even their potential for vertical integration. Nonetheless, we believe that restaurant businesses have no choice but to embrace this high-growth channel whilst working towards the ideal long-term solution of in-house digital ordering capabilities. Contents Introduction: the rise of food delivery platforms ........................................................................... 2 Opportunities for Chained Restaurant Companies ........................................................................ 6 Threats to Restaurant Operators .................................................................................................... 8 A suggested playbook for QSR businesses ................................................................................... 10 The Arisaig Approach .................................................................................................................... 13 Disclaimer .................................................................................................................................... -

Amy Pottinger of Caviar and Crayons

BFF with the Chef Season 2 / Episode 5 Amy Pottinger of Caviar and Crayons Nicole S.: Welcome to BFF with the Chef. I'm your host Nicole Schwegman. Aloha friends and foodies, and welcome back. Today I'm stoked to interview Amy Lauren Pottinger, the self-taught chef, food blogger, and caterer behind Caviar and Crayons, a food blog and catering service that focuses on elevated comfort food. Amy gained national attention when she auditioned and landed a spot on season 13 of Food Network Star. Since the show Amy has continued to grow her business and brand, while remaining rooted in her love of food. Amy is the proud military spouse of an Air Force fighter pilot, and she is also the proud mommy of two utterly adorable kiddos. Hey Amy, and welcome to the show. Amy Pottinger: Hey, thanks for having me. Nicole S.: Thank you for coming on. So look, I'm sure people know who you are. If they don't, y'all need to know who she is, okay. Amy Pottinger: I'm 35 and I don't know who I am so it's cool. Nicole S.: This is existentialism with my BFF at the- Amy Pottinger: Right. With food. Nicole S.: Yeah. All right so we just want to jump right into it, and then we'll get started. So tell me about the last meal you cooked for yourself. Amy Pottinger: So as you mentioned, I'm a mom, I have two young kids. And as much as I like to play culinary adventures for my husband and I, they're not always on board. -

China's Rise in Artificial Intelligence

EQUITY RESEARCH | August 31, 2017 Piyush Mubayi +852-2978-1677 [email protected] Goldman Sachs (Asia) L.L.C. Elsie Cheng +852-2978-0820 [email protected] China's Rise in Goldman Sachs (Asia) L.L.C. Heath P. Terry, CFA +1-212-357-1849 [email protected] Artificial Intelligence Goldman Sachs & Co. LLC The New New China Andrew Tilton For the exclusive use of [email protected] +852-2978-1802 China has emerged as a major global contender in the field of AI, the apex [email protected] technology of the information era. In this report, we set out China’s Goldman Sachs (Asia) L.L.C. ambitious top-down plans, the factors (talent, data and infrastructure) Tina Hou that make China unique and the companies (Baidu, Alibaba and Tencent) +86(21)2401-8694 that are making it happen. We believe the development of an ‘intelligent [email protected] economy’ and ‘intelligent society’ by 2030 in China has the potential to Beijing Gao Hua Securities drive productivity improvement and GDP growth in the next two decades. Company Limited Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. -

Youth in Europe Face the Fourth Industrial Revolution: Tactics for Success Overview Content

The Pineapple Report Youth in Europe Face the Fourth Industrial Revolution: Tactics for Success Overview content Tactics State of Play • An International Convention on Digital Rights • A Grand Project for Youth - The Co-Design of e-Government and Social Projection Systems • Update Educational Curricula to Place the Fourth Industrial Revolution in Historical Civic Context • Provide Access to Bandwidth and Interfaces via Digital Inclusion Intelligence • Update Competition Doctrine to Break Up Platform Monopolies and Incentivise Young Page 7 Entrepreneurs • Protect Labour Standards in the Gig Economy to Avoid a Looming Welfare Crisis • Inoculation Theory • Nudge Theory • Transparency of Media Ownership • Professional Self-Regulation / Name and Shame Appendix: Fourth Emotional • Clarify Platforms’ Role in Political Marketing Intelligence • Address the Economics of Manipulation Youth, Europe, Industrial • Civic Education in Formal and Non-Formal Educational Settings Page 17 and Emerging Revolution • Intergenerational Dialogues • Digital Speed Bumps Tech • An Anthropomorphisation Tax • Invest in Research on the Impact of Digital Technologies on Youth Health and Wellness • Boost Consumer and Labour Protections for Digital Products and Services - Regulate Physical Persuasive Design and ‘Dark Patterns’ Intelligence • Regulation on Environmental Impact of Digital Technologies Page 24 • Endorse Intersectionality • Don’t Just Educate, Inspire Creative • Embrace Creative Tools for Digital-Participatory Democracy • Stimulate the Artisan Economy Intelligence • A Basic Income for All Citizens Page 33 Page 3 / 53 The Pineapple Report The Pineapple Report surveys proposals for how young people in Europe can flourish in the emerging Fourth Industrial Revolution.1 Executive Summary In emoji, means, “It’s complicated.” The icon evokes a reminder that certain opportunities, like this one, require a holistic Since the term ‘digital native’ is true for only a select, priv- rather than reductive plan of action.