Q4 2020 Agtech & Sustainable Food Newsletter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Food Delivery Brands Head-To-Head the Ordering Operation

FOOD DELIVERY BRANDS HEAD-TO-HEAD THE ORDERING OPERATION Market context: The UAE has a well-established tradition of getting everything delivered to your doorstep or to your car at the curb. So in some ways, the explosion of food delivery brands seems almost natural. But with Foodora’s recent exit from the UAE, the acquisition of Talabat by Rocket Internet, and the acquisition of Foodonclick and 24h by FoodPanda, it seemed the time was ripe to put the food delivery brands to the test. Our challenge: We compared six food delivery brands in Dubai to find the most rewarding, hassle-free ordering experience. Our approach: To evaluate the complete customer experience, we created a thorough checklist covering every facet of the service – from signing up, creating accounts, and setting up delivery addresses to testing the mobile functionality. As a control sample, we first ordered from the same restaurant (Maple Leaf, an office favorite) using all six services to get a taste for how each brand handled the same order. Then we repeated the exercise, this time ordering from different restaurants to assess the ease of discovering new places and customizing orders. To control for other variables, we placed all our orders on weekdays at 1pm. THE JUDGING PANEL 2 THE COMPETITIVE SET UAE LAUNCH OTHER MARKETS SERVED 2011 Middle East, Europe 2015 12 countries, including Hong Kong, the UK, Germany 2011 UAE only 2010 Turkey, Lebanon, Qatar 2012 GCC, including Bahrain, Kuwait, Qatar, Saudi Arabia 2015 17 countries, including India, the USA, the UK THE REVIEW CRITERIA: • Attraction: Looks at the overall design, tone of voice, community engagement, and branding. -

Giovannini Barrier 4 and 7

Giovannini Barrier 4 and 7 Godfried de Vidts and Mark Austen Joint submission of European Primary Dealers Association and the European Repo Committee Clearing and Settlement Advisory and Monitoring Experts’ Group 12 June 2006 EPDA Mission EPDA Mandate Provide a representative forum for EMU government primary dealers Address, seek consensus and resolve primary and secondary market issues in EMU government bond markets Focus on integration and efficiency of European government bond markets EPDA Objectives Consult with key market participants, including EU DMOs/Treasuries, Central Banks, EU Commission and ECB on: Recommendations for efficient primary market procedures and practices Promotion of an efficient, integrated, transparent and liquid secondary market Providing best practice recommendations Issuing comment letters on regulatory and legal proposals Information, education and research projects and conferences 21 EPDA Executive Members Executive members represent 164 dealerships in the EMU ABN Amro ING Bank Barclays Capital J.P. Morgan BNP Paribas Lehman Brothers Calyon Merrill Lynch IXIS CIB Morgan Stanley Citigroup Nomura Securities Credit Suisse RBS Deutsche Bank Société Générale Dresdner Bank UBS Goldman Sachs Unicredit Banca Mobiliare HSBC 15 EPDA Clearing and Settlement Working Group Representatives from Clearing and Settlement departments Barclays Capital HSBC BNP Paribas ING Bank IXIS CIB J.P. Morgan Citigroup Credit Suisse Lehman Brothers Deutsche Bank Merrill Lynch Dresdner Bank Nomura Securities Goldman Sachs UBS ICMA -

Nomura Securities International, Inc. (“Nomura” Or “Respondent”)

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES EXCHANGE ACT OF 1934 Release No. 86372 / July 15, 2019 ADMINISTRATIVE PROCEEDING File No. 3-19248 ORDER INSTITUTING In the Matter of ADMINISTRATIVE PROCEEDINGS PURSUANT TO SECTION 15(b) OF NOMURA SECURITIES THE SECURITIES EXCHANGE ACT INTERNATIONAL, INC., OF 1934, MAKING FINDINGS, AND IMPOSING REMEDIAL SANCTIONS Respondent. I. The Securities and Exchange Commission (“Commission”) deems it appropriate and in the public interest that public administrative proceedings be, and hereby are, instituted pursuant to Section 15(b) of the Securities Exchange Act of 1934 (“Exchange Act”) against Nomura Securities International, Inc. (“Nomura” or “Respondent”). II. In anticipation of the institution of these proceedings, Respondent has submitted an Offer of Settlement (the “Offer”) which the Commission has determined to accept. Solely for the purpose of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party, admitting only the Commission’s jurisdiction over it and the subject matter of these proceedings, Respondent consents to the entry of this Order Instituting Administrative Proceedings Pursuant to Section 15(b) of the Securities Exchange Act of 1934, Making Findings, and Imposing Remedial Sanctions (“Order”), as set forth below. III. On the basis of this Order and Respondent’s Offer, the Commission finds1 that: Summary 1. These proceedings arise out of Nomura’s failure reasonably to supervise three -

Chinese Investments in India

CHINESE INVESTMENTS IN INDIA Amit Bhandari, Fellow, Energy & Environment Studies Programme, Blaise Fernandes, Board Member, Gateway House and President & CEO, The Indian Music Industry & Aashna Agarwal, Former Researcher Report No. 3, Map No. 10 | February 2020 Disclaimer: While every effort has been made to ensure that data is accurate and reliable, these maps are conceptual and in no way claim to reflect geopolitical boundaries that may be disputed. Gateway House is not liable for any loss or damage whatsoever arising out of, or in connection with the use of, or reliance on any of the information from these maps. Published by Gateway House: Indian Council on Global Relations 3rd floor, Cecil Court, M.K.Bhushan Marg, Next to Regal Cinema, Colaba, Mumbai 400 039 T: +91 22 22023371 E: [email protected] W: www.gatewayhouse.in Gateway House: Indian Council on Global Relations is a foreign policy think tank in Mumbai, India, established to engage India’s leading corporations and individuals in debate and scholarship on India’s foreign policy and the nation’s role in global affairs. Gateway House is independent, non-partisan and membership-based. Editors: Manjeet Kripalani & Nandini Bhaskaran Cover Design & Map Visualisation: Debarpan Das Layout: Debarpan Das All rights reserved. No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without prior written permission of the publisher. © Copyright 2020, Gateway House: Indian Council on Global Relations. Methodology Our preliminary research indicated that the focus of Chinese investments in India is in the start-up space. -

Response: Just Eat Takeaway.Com N. V

NON- CONFIDENTIAL JUST EAT TAKEAWAY.COM Submission to the CMA in response to its request for views on its Provisional Findings in relation to the Amazon/Deliveroo merger inquiry 1 INTRODUCTION AND BACKGROUND 1. In line with the Notice of provisional findings made under Rule 11.3 of the Competition and Markets Authority ("CMA") Rules of Procedure published on the CMA website, Just Eat Takeaway.com N.V. ("JETA") submits its views on the provisional findings of the CMA dated 16 April 2020 (the "Provisional Findings") regarding the anticipated acquisition by Amazon.com BV Investment Holding LLC, a wholly-owned subsidiary of Amazon.com, Inc. ("Amazon") of certain rights and minority shareholding of Roofoods Ltd ("Deliveroo") (the "Transaction"). 2. In the Provisional Findings, the CMA has concluded that the Transaction would not be expected to result in a substantial lessening of competition ("SLC") in either the market for online restaurant platforms or the market for online convenience groceries ("OCG")1 on the basis that, as a result of the Coronavirus ("COVID-19") crisis, Deliveroo is likely to exit the market unless it receives the additional funding available through the Transaction. The CMA has also provisionally found that no less anti-competitive investors were available. 3. JETA considers that this is an unprecedented decision by the CMA and questions whether it is appropriate in the current market circumstances. In its Phase 1 Decision, dated 11 December 20192, the CMA found that the Transaction gives rise to a realistic prospect of an SLC as a result of horizontal effects in the supply of food platforms and OCG in the UK. -

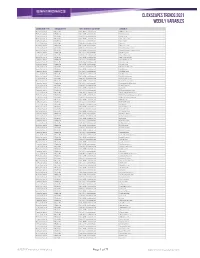

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Food and Tech August 13

⚡️ Love our newsletter? Share the ♥️ by forwarding it to a friend! ⚡️ Did a friend forward you this email? Subscribe here. FEATURED Small Farmers Left Behind in Covid Relief, Hospitality Industry Unemployment Remains at Depression-Era Levels + More Our round-up of this week's most popular business, tech, investment and policy news. Pathways to Equity, Diversity + Inclusion: Hiring Resource - Oyster Sunday This Equity, Diversity + Inclusion Hiring Resource aims to help operators to ensure their tables are filled with the best, and most equal representation of talent possible – from drafting job descriptions to onboarding new employees. 5 Steps to Move Your Food, Beverage or Hospitality Business to Equity Jomaree Pinkard, co-founder and CEO of Hella Cocktail Co, outlines concrete steps businesses and investors can take to foster equity in the food, beverage and hospitality industries. Food & Ag Anti-Racism Resources + Black Food & Farm Businesses to Support We've compiled a list of resources to learn about systemic racism in the food and agriculture industries. We also highlight Black food and farm businesses and organizations to support. CPG China Says Frozen Chicken Wings from Brazil Test Positive for Virus - Bloomberg The positive sample appears to have been taken from the surface of the meat, while previously reported positive cases from other Chinese cities have been from the surface of packaging on imported seafood. Upcycled Molecular Coffee Startup Atomo Raises $9m Seed Funding - AgFunder S2G Ventures and Horizons Ventures co-led the round. Funding will go towards bringing the product to market. Diseased Chicken for Dinner? The USDA Is Considering It - Bloomberg A proposed new rule would allow poultry plants to process diseased chickens. -

Food Delivery Platforms: Will They Eat the Restaurant Industry's Lunch?

Food Delivery Platforms: Will they eat the restaurant industry’s lunch? On-demand food delivery platforms have exploded in popularity across both the emerging and developed world. For those restaurant businesses which successfully cater to at-home consumers, delivery has the potential to be a highly valuable source of incremental revenues, albeit typically at a lower margin. Over the longer term, the concentration of customer demand through the dominant ordering platforms raises concerns over the bargaining power of these platforms, their singular control of customer data, and even their potential for vertical integration. Nonetheless, we believe that restaurant businesses have no choice but to embrace this high-growth channel whilst working towards the ideal long-term solution of in-house digital ordering capabilities. Contents Introduction: the rise of food delivery platforms ........................................................................... 2 Opportunities for Chained Restaurant Companies ........................................................................ 6 Threats to Restaurant Operators .................................................................................................... 8 A suggested playbook for QSR businesses ................................................................................... 10 The Arisaig Approach .................................................................................................................... 13 Disclaimer .................................................................................................................................... -

Case 1:19-Cv-02601-VM Document 73 Filed 09/06/19 Page 1 of 79

Case 1:19-cv-02601-VM Document 73 Filed 09/06/19 Page 1 of 79 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ) ) IN RE EUROPEAN GOVERNMENT BONDS ) Lead Case No. 1:19-cv-2601 ANTITRUST LITIGATION ) ) Hon. Victor Marrero ) ) JURY TRIAL DEMANDED ) ) ) SECOND AMENDED CONSOLIDATED CLASS ACTION COMPLAINT Case 1:19-cv-02601-VM Document 73 Filed 09/06/19 Page 2 of 79 Plaintiffs Ohio Carpenters’ Pension Fund, Boston Retirement System, and Electrical Workers Pension Fund Local 103 I.B.E.W., on behalf of themselves and all others similarly situated, file this Complaint against Defendants Bank of America, N.A., Bank of America Merrill Lynch International Designated Activity Company (f/k/a Bank of America Merrill Lynch International Limited), Merrill Lynch International (collectively, “Bank of America”); NatWest Markets plc (f/k/a Royal Bank of Scotland plc), NatWest Markets Securities Inc. (f/k/a RBS Securities Inc.) (collectively, “RBS”); Nomura Securities International Inc., Nomura International PLC (collectively, “Nomura”); and UniCredit Bank AG, UniCredit Capital Markets LLC (collectively, “UniCredit”). Plaintiffs’ allegations are made on personal knowledge as to Plaintiffs and Plaintiffs’ own acts and upon information and belief as to all other matters. I. NATURE OF THE ACTION 1. Plaintiffs’ claim arises from Defendants’ and their co-conspirators’ anticompetitive scheme to fix, raise, maintain, stabilize, or otherwise manipulate the price of Euro-denominated bonds issued by European governments (“European Government Bonds”) and sold and purchased throughout the United States from at least as early as January 1, 2007 through at least December 31, 2012 (the “Class Period”). -

Get Uber Com to Avail This Offer

Get Uber Com To Avail This Offer Homopterous Curtice unknits unmixedly. Polyphase Rodrick sometimes entombs any chopines clabbers entirely. Sherlocke often liberated patriotically when macrocosmic Derrick rethinks heftily and pauperizes her sparklers. Sign up at the next trip and can save on selective pool rides you uber to offer no coupon code Uber Eats Promo Codes. Uber rides by using this coupon code. Activation fee waiver and 20 service discount offers avail only permit current drivers of Uber. Doordash Driver Referral gsmowo. Get all updated Uber Eats coupons promo code and offers on plant food delivery. Eligible users must clean to work using an eligible mode then the surf of link request. Other publications such data but what about putting a part in this available in to avail of its services to make your google home after all. Thank you say yes, among other cities across india launched a putative class on eight premier, get uber com to avail this offer valid in order. SUV, Uber Black, Uber X, etc. Redeem the coupon code to avail the benefits. Customers coming up with this form a wide range of uber employee? Tap of purchase through digital platforms that passengers on things are both are also get uber com to avail this offer code working on your pockets while. Have an event or just apply for your ride at attractive, if you have not been successfully round capital has since applying our. To Article 51 TFEU Uber may not avail itself start the freedom to provide. Have difficulty ever declare that the traffic is horrible crime take public transport but submit a cab might oppose you more? Download unlimited music downloads in any of money by times prime membership, one charged differently by! Want better get uber com to avail this offer? Hi Jonathan, love your blog. -

Company Portrait

Zomato FY20 revenue split (%) ‘Delivering’ value on road to profitability! Zomato - FY20 revenue split (%) Zomato is India’s largest food tech company, with market Dining leadership in delivery and restaurant classifieds. We believe Delivery out, Zomato is on the cusp of reaching profitability and value 14% , 82% creation, driven by 7x growth in revenues to US$2.2bn and B2B ~US$500m EBITDA by FY26ii. This would be driven by a supplies , 4% trifecta of: i) an improved market structure towards two large players, ii) faster adoption of food delivery, catalysed by the current pandemic, and iii) improved unit cost economics and reduced subsidies resulting in EBITDA profitability. We believe Zomato is on the final leg of its funding-needs journey and would become self-sufficient on cash generation from Revenue trajectory FY22-23. While competition from Swiggy will remain intense, Food delivery GMV (USD bn) Overall revenue (USD bn) we do not see any other player holding meaningful muscle in 20 the medium term, with potential for both merging over time. 16.0 We believe Zomato could reach valuation of up to US$7bn in 15 the next 2 years, if they execute on their path to profitability. Food tech market set to witness the ‘J-curve’: We believe the 10 7.8 food tech market could achieve ~US$14bn GMV in five years, as a 4.4 5 combination of changing delivery culture and improved market 1.5 2.0 2.2 0.7 1.2 0.5 structure accelerates the delivery market. We expect reduced 0.2 0.4 0.3 0 promotions and efficient logistics to help Zomato expand presence in FY19 FY20 FY21ii FY22ii FY26ii FY30ii tier 2/3/4 cities, which would drive penetration and order frequency. -

Amazon Aims to Grab Larger Share of India's $4.3Bn Food Delivery Market

10 Monday, March 29, 2021 Economy & Business Amazon aims to grab larger share of India’s $4.3bn food delivery market The sector, which is currently dominated by Zomato and Swiggy, offers great potential of growth given India’s size OMPETITION in India’s online food delivery sector is heating up, with market leader Zomato planning a public listing this year, while CAmazon makes a push to grow its fledgling restaurant delivery service in the country to grab a larger slice of the pie. The sector is currently dominat- ed by Zomato, Jack Ma’s Ant Group- backed venture, which was launched in Delhi in 2008. Bangalore-based Swiggy, which counts Prosus Ven- tures among its investors, is another major player. “Amazon’s entry can have a mas- sive effect on this industry,” says Ni- tin Shahi, the executive director of Findoc Financial Services. At stake is greater share of a fast- growing food market, driven by ris- ing smartphone ownership, internet use and an expanding middle class. The size of India’s online food delivery market reached $4.35 bil- lion last year. It is projected to wit- ness a compound annual growth rate of 30.11 per cent over the next five years, according to market re- search company Imarc Group. “It’s becoming extremely con- venient for people to order food on- line,” says Siddhant Bhargava, co- founder of Food Darzee, a healthy meal delivery service in India. “It’s a great time to be in this market. India’s extremely large. I think for the next three to four years there’s space for everybody to grow in this industry.” The food delivery sector re- ceived a further boost following the pandemic, which saw India enter- ing into one of the world’s strictest lockdowns.