Wal Mart Stores Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Phony Philanthropy of the Walmart Heirs

Legal Disclaimer: UFCW and OUR Walmart have the purpose of helping Wal-Mart employees as individuals or groups in their dealings with Wal-Mart over labor rights and standards and their efforts to have Wal-Mart publically commit to adhering to labor rights and standards. UFCW and OUR Walmart have no intent to have Walmart recognize or bargain with UFCW or OUR Walmart as the representative of Walmart employees. Walmart1Percent.Org WALTON FAMILY “PHILANTHROPY”: A Distraction from the Walmart Economy Americans believe in the power of charitable giving. Eighty-eight percent of American households give to charity, contributing more than $2,000 per year on average.1 Despite their charitable inclinations, most American families, acting on their own, lack the financial resources to make a significant impact on the problems facing our society. The Walton family, majority owner of Walmart, is a notable exception. As members of the richest family in the United States, the Waltons have $140 billion at their disposal—enough wealth to make a positive mark on the world and still leave a fortune for their descendants. The Waltons certainly wish to be seen as a force for good. Their company claims to help people “live better” and the Walton Family Foundation mission statement speaks of “creating opportunity so that individuals and communities can live better in today’s world.”2 But that mission statement seems ironic, given that many of the most acute challenges facing American families in 2014 could rightfully be viewed as symptoms of our “Walmart economy,” characterized by rising inequality and economic insecurity. -

WAL-MART At50

WAL-MART at50 FROM ARKANSAS TO THE WORLD a supplement to . VOL. 29, NO. 27 • JULY 2, 2012 ARKANSASBUSINESS.COM/WALMART50 Fifty years old, and healthy as ever Congratulations, Walmart! And thanks for letting us care for your associates and communities. From one proud Arkansas company to another CONGRATULATIONS TO A GREAT AMERICAN SUCCESS STORY It has been a privilege to travel with Walmart on its remarkable journey, including managing the company’s 1970 initial public offering. From one proud Arkansas company to another, best wishes to all Walmart associates everywhere. INVESTMENT BANKING • WEALTH MANAGEMENT INSURANCE • RESEARCH • SALES & TRADING CAPITAL MANAGEMENT • PUBLIC FINANCE • PRIVATE EQUITY STEPHENS INC. • MEMBER NYSE, SIPC • 1-800-643-9691 STEPHENS.COM WAL-MART at 50 • 3 Wal-Mart: INSIDE: A Homegrown 6 The World of Wal-Mart Mapping the growth of a retail giant Phenomenon 8 Timeline: A not-so-short history of Wal-Mart Stores Inc. Thousands of Arkansans have a Wal-Mart experience to share from the past 50 years that goes far beyond the routine trip to a Supercenter last week. 10 IPO Set the Stage for Global Expansion Wal-Mart is an exciting, homegrown phenomenon engineered by the late Sam Walton, a brilliant businessman who surrounded himself with smart people and proceeded to revolutionize 14 Influx of Workers Transforms retailing, logistics and, indeed, our state and the world. He created a heightened awareness of stock Northwest Arkansas investments as investors from Arkansas to Wall Street watched the meteoric rise in share prices and wondered when the next stock split would occur. -

Taxation of Financial Capital: Is the Wealth Tax the Solution?

Taxation of Financial Capital: Is the W ealth T ax the Solution? Emmanuel Saez UC Berkeley PIIE Inequality Conference October 2019 1 % of national income 100% 200% 300% 400% 500% Thisfigure depicts the 0% 1913 1918 1923 share 1928 Total of total 1933 household wealth (to (to wealth household national income) household 1938 1943 wealth relativewealth to nationalincome Source: 1948 1953 1958 1963 1968 1973 1978 Ma 1983 rke Piketty, Piketty, 1988 val t Saez, and Zucman 1993 ue 1998 2003 2008 (2018). 2013 2018 Top 0.1% Wealth Share Estimates 25% Capitalization Revised capitalization 20% SCF+Forbes 400 15% 10% Estate m ul tiplier 5% (adjusted) 0% 1913 1918 1923 1928 1933 1938 1943 1948 1953 1958 1963 1968 1973 1978 1983 1988 1993 1998 2003 2008 2013 This figure depicts the share of total household wealth owned by the top 0.1% of families (tax units) from various data sources. 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 198 2 198 6 Forbes 400 wealth share 199 0 199 4 199 8 200 2 (% of US 200 6 wealth) 201 0 201 4 201 8 Long-Term Wealth Taxation and Top Wealth Holders Current 2018 wealth ($ billions) Top Wealth Holder Source 1. Jeff Bezos Amazon (founder) 160.0 2. Bill Gates Microsoft (founder) 97.0 3. Warren Buffett Berkshire Hathaway 88.3 4. Mark Zuckerberg Facebook(founder) 61.0 5. Larry Ellison Oracle (founder) 58.4 6. Larry Page Google (founder) 53.8 7. David Koch Koch industries 53.5 8. -

This Year's Edition

CO-AUTHORS: Chuck Collins directs the Program on Inequality and the Common Good at the Institute for Policy Studies, where he also co-edits Inequality.org. His most recent book is Is Inequality in America Irreversible? from Polity Press and in 2016 he published Born on Third Base. Other reports and books by Collins include Reversing Inequality: Unleashing the Transformative Potential of An More Equal Economy and 99 to 1: How Wealth Inequality is Wrecking the World and What We Can Do About It. His 2004 book Wealth and Our Commonwealth, written with Bill Gates Sr., makes the case for taxing inherited fortunes. Josh Hoxie directs the Project on Opportunity and Taxation at the Institute for Policy Studies and co- edits Inequality.org. He co-authored a number of reports on topics ranging from economic inequality, to the racial wealth divide, to philanthropy. Hoxie has written widely on income and wealth maldistribution for Inequality.org and other media outlets. He worked previously as a legislative aide for U.S. Senator Bernie Sanders. Acknowledgements: We received significant assistance in the production of this report. We would like to thank our colleagues at IPS who helped us throughout the report. The Institute for Policy Studies (www.IPS-dc.org) is a multi-issue research center founded in 1963. The Program on Inequality and the Common Good was founded in 2006 to draw attention to the growing dangers of concentrated wealth and power, and to advocate policies and practices to reverse extreme inequalities in income, wealth, and opportunity. The Inequality.org website (http://inequality.org/) provides an online portal into all things related to the income and wealth gaps that so divide us. -

Notice of Annual Shareholders' Meeting and Proxy Statement

2016 Notice of Annual Shareholders’ Meeting and Proxy Statement Friday, June 3, 2016 8:00 a.m., Central time Bud Walton Arena, University of Arkansas, Fayetteville, Arkansas NYSE: WMT “Our Board has the right skills and experience to support the company's strategy.” April 20, 2016 Dear Fellow Shareholders: We are pleased to invite you to attend Walmart’s 2016 maximize our effectiveness as we adapt to evolving Annual Shareholders’ Meeting on June 3, 2016 at 8:00 customer needs. These changes include reducing the a.m. Central Time. If you plan to attend, please see size of the Board while maintaining its independence, page 94 for admission requirements. For those unable changing the composition of Board committees, to join in-person, the meeting will also be webcast at and ensuring that Board and committee agendas www.stock.walmart.com. are focused on Walmart’s strategic priorities. We have revised the Corporate Governance section of Walmart is going through a period of transformation as our proxy statement to provide more information on we make strategic investments to better serve customers these topics (see page 12). Your Board is committed and drive shareholder value. Over the past year, we have to continuous improvement, and in early 2016 we actively engaged with many of our largest institutional engaged a third party consulting firm to help us think shareholders to understand their perspectives on a variety about ways to further improve our effectiveness. The of topics, including corporate strategy, governance, and sentiment from shareholders has been consistent – compensation. We both participated in this engagement effort and we would like to take this opportunity to update that the value, quality, and diversity of our directors you on some of the themes from these discussions, are strategic assets for Walmart. -

2009 Global Sustainability Report

2009 GLOBAL SUstAINABILITY REPORT Now More Than Ever. Corporate Business Profile Wal-Mart Stores, Inc. operates Walmart discount stores, supercenters, Neighborhood Markets and Sam’s Club locations in the U.S. The Company operates in Argentina, Brazil, Canada, Chile, China, Costa Rica, El Salvador, Guatemala, Honduras, India, Japan, Mexico, Nicaragua, Puerto Rico and the United Kingdom. The Company’s common stock is listed on the New York Stock Exchange under the symbol WMT. Business Unit Overview U.S. The Walmart U.S. segment operates retail stores in all 50 states, with discount stores in 47 states, supercenters in 48 states and Sales $255.7 billion Neighborhood Markets in 16 states. From time to time, Walmart Number of Units 3,656 U.S. tests different store formats to meet market demands and As of January 31, 2009 needs. Customers can also purchase a broad assortment of merchandise and services online at www.walmart.com. International InteRNATIONAL A LWAYS LOW PRICES . Our International segment is comprised of our wholly-owned subsidiaries operating in Argentina, Brazil, Canada, Japan, Puerto Sales $98.6 billion Rico and the United Kingdom; our majority-owned subsidiaries Number of Units 3,615* operating in five countries in Central America, and in Chile and * Does not include Bharti Retail in India. India retail locations are owned and operated by Bharti Retail. Wal-Mart India provides Mexico; our joint ventures in India and China; and our other technical support to these stores through a franchise agreement. controlled subsidiaries in China. As of January 31, 2009 Sam’s Club The first Sam’s Club opened its doors in Midwest City, Oklahoma, in 1983. -

Weekly One Liners 6Th to 12Th of April 2020 Weekly One Liners 6Th to 12Th of April 2020

Weekly One Liners 6th to 12th of April 2020 Weekly One Liners 6th to 12th of April 2020 PM, President and MPs Salary Cut by 30% , Odisha becomes 1st state to extend lockdown MPLAD funds suspended for 2 years till 30 April The Union Cabinet approved an ordinance amending the Odisha has become the first state to extend the 21-day salary, allowances and pension of Members of lockdown till April 30. The 21-day nation-wide Parliament Act, 1954, to reduce the allowances and lockdown will end on April 14. Odisha Chief Minister pension by 30% starting April 1, 2020, for a year. All Naveen Patnaik has requested the Centre not to start train Members of Parliament (MPs), including Prime and air services till April 30. The state has also announced Minister Narendra Modi and his Council of Ministers, that all educational institutions in the state will remain would be taking a 30 per cent salary cut due to the impact of the novel coronavirus. Indian President, Vice closed till June 17. President and all state governors have voluntarily Odisha is among the states that have made face masks decided to take a 30 per cent salary cut for a year in view compulsory for people stepping out of their homes. The of the coronavirus outbreak and the expected downturn others are Delhi, Mumbai, Chandigarh and Nagaland. in the economy.The cabinet also approved temporary suspension of MPLAD (Member of Parliament Local Area Development) fund scheme during 2020-21 and 2021-22, IAF airlifts essential drugs to Maldives under and the funds will be used for managing health services ‘Operation Sanjeevani’ and the adverse impact of COVID-19 pandemic in the The Indian Air Force (IAF) has launched ‘Operation country. -

Bloomberg Billionaires Index Order Now, Wear It Tomorrow

Bloomberg the Company & Its Products Bloomberg Anywhere Remote Login Bloomberg Terminal Demo Request Bloomberg Menu Search Sign In Subscribe Bloomberg Billionaires Index Order now, wear it tomorrow. That's next day View profiles for each of the world’s 50de0livery for you* richest people, see the biggest movers, and compare fortunes or track returns. As of July 18, 2018 The Bloomberg Billionaires Index is a daily ranking of the world’s richest people. Details about the calculations are provided in the net worth analysis on each billionaire’s profile page. The figures are updated at the close of every trading day in New York. Rank Name Total net worth $ Last change $ YTD change Country Industry 1 Jeff Bezos $152B +$1.69B +$53.2B United States Technology 2 Bill Gates $95.3B +$5.13M +$3.54B United States Technology 3 Mark Zuckerberg $83.8B +$967M +$11.0B United States Technology 4 Warren Buffett $79.2B -$3.82B -$6.14B United States Diversified 5 Bernard Arnault $75.0B +$252M +$11.7B France Consumer 6 Amancio Ortega $74.9B +$78.3M -$427M Spain Retail 7 Carlos Slim $62.7B -$382M +$1.19B Mexico Diversified 8 Larry Page $58.4B +$630M +$5.98B United States Technology 9 Sergey Brin $56.9B +$608M +$5.78B United States Technology 10 Larry Ellison $55.2B +$359M +$2.12B United States Technology Francoise Bettencourt 11 Meyers $49.2B +$14.1M +$4.73B France Consumer 12 Charles Koch $46.9B +$247M -$1.27B United States Industrial 13 David Koch $46.9B +$247M -$1.27B United States Industrial 14 Jack Ma $44.4B +$317M -$1.08B China Technology 15 Mukesh Ambani $44.0B -

UC San Diego UC San Diego Electronic Theses and Dissertations

UC San Diego UC San Diego Electronic Theses and Dissertations Title A political theory of the firm : why ownership matters Permalink https://escholarship.org/uc/item/9n89r27t Author Clark Muntean, Susan Publication Date 2009 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California UNIVERSITY OF CALIFORNIA, SAN DIEGO A Political Theory of the Firm: Why Ownership Matters A dissertation submitted in partial satisfaction of the requirements for the degree Doctor of Philosophy in Political Science by Susan Clark Muntean Committee in charge: Gary Jacobson, Chair John Cioffi Peter Gourevitch Stephan Haggard Mathew McCubbins Samuel Popkin 2009 Copyright Susan Clark Muntean, 2009 All rights reserved. SIGNATURE PAGE The dissertation of Susan Clark Muntean is approved, and it is acceptable in quality and form for publication on microfilm and electronically: Chair University of California, San Diego 2009 iii DEDICATION In memory of Donald V. Clark (1929-2008) iv EPIGRAPH “To compare the study of business administration with that of political obligation may appear ridiculous at first glance, but a moment’s reflection will reveal that methodologically the two are precisely analogous in their relation to economics on the one hand and to politics on the other.” James M. Buchanan “Marginal Notes on Reading Political Philosophy,” The Calculus of Consent . v TABLE OF CONTENTS SIGNATURE PAGE ....................................................................................................... iii -

2017 REPORT ROAD to INCLUSION Walmart Around the World Doug Mcmillon, President & CEO — Walmart Canada As of Sept

CULTURE DIVERSITY & INCLUSION 2017 REPORT ROAD TO INCLUSION Walmart Around the World Doug McMillon, President & CEO — Walmart Canada As of Sept. 17, 2017 The Road to Market entry: 1994 Units: 410 Inclusion A MESSAGE FROM DOUG MCMILLON United States United Kingdom Market entry: 1962 Market entry: 1999 Units: 5,412 Units: 638 Japan Market entry: 2002 Mexico Units: 337 Market entry: 1991 This is an exciting time to be in retail. Technology is changing how we live, Units: 2,317 work and shop at an unprecedented pace, and customer expectations China Market entry: 1996 are higher than ever. In addition to finding great items at great prices, Units: 424 customers today also expect the shopping experience to be easy, enjoyable Guatemala Nicaragua Market entry: 2005 Market entry: 2005 and fast. To better serve them, we have to be innovative and agile, and Units: 232 Units: 95 India Market entry: 2009 we need a diverse workforce that is representative of those customers. El Salvador Honduras Units: 20 Market entry: 2005 Market entry: 2005 Just as we're reinventing how we serve customers, we have to examine what we Units: 91 Units: 101 We need diverse associates — associates with unique styles, experiences, could be doing better in terms of hiring and promoting associates and leaders identities, ideas and opinions — to help us stay out in front. We have to lead Costa Rica Puerto Rico Brazil with diverse backgrounds. What do we need to be doing — both as a company Market entry: 2005 Units: 48 Market entry: 1995 Units: 244 in talent. Throughout our history, it has always been our associates who have Units: 485 Nigeria Kenya Botswana Zambia Swaziland and as individuals — to make everyone feel his or her perspective is valued? Market entry: 2011 Market entry: 2011 Market entry: 2011 Market entry: 2011 Market entry: 2011 been the key to our success, and it will remain that way in the future. -

WALMART STORES INC Report Created Mar 30, 2020 Page 1 of 7 Walmart Is the World's Largest Retailer

NYSE: WMT WALMART STORES INC Report created Mar 30, 2020 Page 1 OF 7 Walmart is the world's largest retailer. In the fiscal year ended January 31, 2020, sales were $520 billion. Argus Recommendations The company has three segments: Walmart Stores, which accounted for about 66% of sales; Sam's Club, a membership warehouse chain, which comprised 11% of revenue; and the International segment, which generated 23% of sales. The company, based in Bentonville, Arkansas, ended fiscal 2020 with more than Twelve Month Rating SELL HOLD BUY 11,500 retail units in about 27 countries. Groceries are the largest produce category in the U.S. market, at approximately 56% of sales. E-commerce sales grew 37% in FY20 and management expects them to grow Five Year Rating SELL HOLD BUY about 30% in FY21. The fiscal year ends on January 31 for U.S. and Canadian operations. Other operations are generally consolidated using a one month lag on a calendar year basis. Under Market Over Sector Rating Weight Weight Weight Analyst's Notes Argus assigns a 12-month BUY, HOLD, or SELL rating to each stock under coverage. Analysis by Christopher Graja, CFA, March 30, 2020 • BUY-rated stocks are expected to outperform the market (the benchmark S&P 500 Index) on a risk-adjusted basis over the ARGUS RATING: BUY next year. • HOLD-rated stocks are expected to perform in line with the • Maintaining BUY as WMT hires 150,000 to meet demand market. • In this turbulent environment, Argus is recommending that investors dollar-average into existing • SELL-rated stocks are expected to underperform the market long-term positions in the highest-quality stocks. -

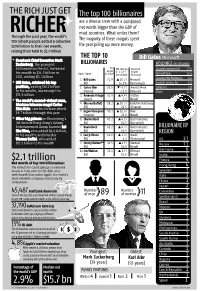

RICHER Most Countries

THE RICH JUST GET The top 100 billionaires are a diverse crew with a combined net worth bigger than the GDP of RICHER most countries. What unites them? Through the past year, the world’s The majority of these moguls spent 100 richest people added a collective $200 billion to their net wealth, the year piling up more money. raising their total to $2.1 trillion THE TOP 10 Bill Gates Microsoft | Facebook Chief Executive Mark Zuckerberg, the youngest BILLIONAIRES HOLDINGS (IN $ BILLION) billionaire on the list, increased Net YTD change, Source of Cascade InvestmentLLC 37.6 his wealth to $24.5 billion in worth, in $ bn* / wealth Rank Name in $ bn* percentage (Industry) MicrosoftCorp. 12.6 2013, adding $12.3 billion Canadian Nat.Railway Co. 4.4 1 Bill Gates 72.9 !10.2 / Microsoft | Bill Gates, retained his top (US) 16.2% (Technology) Republic Services Inc. 3.0 position, adding $10.2 billion 2 Carlos Slim 65.5 "-9.7 / America Movil Ecolab Inc. 2.8 to his wealth, increasing it to (Mexico) -12.9 (Telecom) Others 12.5 $72.9 billion 3 Amancio Ortega 61.9 !4.4 / Inditex | The world’s second-richest man, (Spain) 7.7 (Retail) Mexican telecom mogul Carlos 4 Warren Buffett 58.2 !10.3 / Berkshire Hathaway Slim Helu, saw his fortune shrink (US) 21.5 (Finance) $9.7 billion through this year 5 Ingvar Kamprad 50.3 !10.6 / Ikea (Sweden) 26.8 (Retail) | Other big gainers on Bloomberg’s 6 Charles Koch 45.2 !4.3 / Koch Industries list include Hong Kong’s Galaxy (US) 10.5 (Diversified) Entertainment Group founder Lui 7 David Koch 45.2 !4.3 / Koch Industries BILLIONAIRE