Megatrends Product Brief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fund Selection

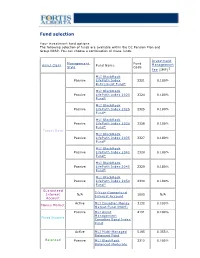

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

Blackrock in France

BlackRock in France Stéphane Sébastien Henri Carole Crozat Lapiquonne Herzog Chabadel BlackRock Country Manager, Chief Operating Chief Investment Officer, Sustainable France, Belgium, Officer, France, France, Belgium & Investing, Head of Luxembourg Belgium, Luxembourg Luxembourg Thematic Research Jean-François Martin Parkes Sylvain Bettina Cirelli Public Policy, Favre-Gilly Mazzocchi Chairman, France, France, Head of Institutional Head of iShares & Belgium, Switzerland & Business, France Wealth, France, Luxembourg Luxembourg Monaco, Belgium, Luxembourg Independent fiduciary asset Connecting client capital to companies and projects We have put nearly EUR185bn2 from investors in France manager and globally to work in the French economy, supporting BlackRock is a leading provider of investment, advisory growth, jobs and innovation. and risk management solutions. Our purpose is to help Renewable energy: Our infrastructure investment more and more people invest in their financial well-being. platform has enabled clients to contribute to financing six As an asset manager, we connect the capital of diverse wind and solar energy projects in France, as well as green individuals and institutions to investments in companies, network heating operator and transport projects. projects and governments. This helps fuel growth, jobs Real estate: With a team of dedicated experts on the and innovation, to the benefit of society as a whole. ground, our real estate team creates value for clients and We have been present in France since 2006 and are local citizens through our investments across Paris, committed to the local market. Our local clients include including 3 Quartiers and Grande Arche. A number of insurers, pensions, official institutions, corporates, projects have earned certificates for their positive traditional and digital banks, and foundations, for whom environmental footprint. -

Blackrock International Limited Annual Best Execution Disclosure

BlackRock International Limited Annual Best Execution Disclosure 2019 June 2020 Contents Introduction Quantitative Analysis Top five entity reports for the transmission of orders Top five entity report for the execution of orders Securities Finance Transactions o Top five entity reports for the execution of orders Qualitative Analysis Equities Shares & Depository Receipts Equity derivatives: Futures & Options admitted to trading on a trading venue Interest rate derivatives: Futures & Options admitted to trading on a trading venue Currency derivatives: Futures & Options admitted to trading on a trading venue Commodities derivatives: Futures & Options admitted to trading on a trading venue Credit derivatives: Futures & Options admitted to trading on a trading venue Securitized derivatives: Warrants and certificate derivatives Equity derivatives: Swaps & other equity derivatives Contracts For Difference Debt instruments: Bonds Debt instruments: Money Market Instruments Interest rate derivatives: Swaps, forwards & other interest rates derivatives Credit derivatives: Other credit derivatives Currency derivatives: Swaps, forwards & other currency derivatives Commodities derivatives: Swaps and other commodities derivatives Structured Finance Instruments Exchange Traded Products Other Instruments Securities Finance Transactions BLACKROCK Annual Best Execution Disclosure 2019 | 2 Introduction The publication of this report is required under the Markets in Financial Instruments Directive 2014/65/EU (“MIFID II”) and it is designed to provide information on the top five execution venues* utilised by BlackRock to execute its clients’ orders, as well as the top five entities to which BlackRock transmitted its clients’ orders for execution. It also includes information on how BlackRock monitors the quality of its clients’ trades’ execution, on BlackRock’s conflicts of interest and other matters, as they relate to the execution by BlackRock of its clients’ trades. -

Closed-End Strategy: Select Opportunity Portfolio 2021-2

Invesco Unit Trusts Closed-End Strategy: Select Opportunity Portfolio 2021-2 A specialty unit trust Trust specifi cs Objective Deposit information The Portfolio seeks to provide current income and the potential for capital appreciation. The Portfolio seeks Public offering price per unit1 $10.00 to achieve its objective by investing in a portfolio consisting of common stocks of closed-end investment 2 companies (known as “closed-end funds”) that invest in various global fixed income and equity securities. Minimum investment ($250 for IRAs) $1,000.00 As indicated by the information publicly available at the time of selection, none of the Portfolio’s closed-end Deposit date 04/07/21 funds employed “structured leverage”4. Termination date 04/05/23 † Distribution dates 25th day of each month Portfolio composition (As of the business day before deposit date) Record dates† 10th day of each month Covered Call High Yield Estimated initial distribution month† 05/21 BlackRock Enhanced Capital and Western Asset High Income Opportunity Term of trust Approximately 24 months Income Fund, Inc. CII Fund, Inc. HIO Historical 12 month distributions† $0.5793 BlackRock Enhanced Equity Dividend Trust BDJ Western Asset High Yield Defi ned Opportunity NLEV212 Sales charge and CUSIPs Columbia Seligman Premium Technology Fund, Inc. HYI Brokerage Growth Fund, Inc. STK Investment Grade Sales charge3 Eaton Vance Tax-Managed Global Diversifi ed Invesco Bond Fund VBF Deferred sales charge 2.25% Equity Income Fund EXG Sector Equity Creation and development fee 0.50% First Trust Enhanced Equity Income Fund FFA Blackrock Health Sciences Trust II BMEZ Total sales charge 2.75% Nuveen Dow 30sm Dynamic Overwrite Fund DIAX Last deferred sales charge payment date 04/10/22 BlackRock Science & Technology Trust II BSTZ Emerging Market Equity CUSIPs BlackRock Utilities, Infrastructure & Power Voya Emerging Markets High Dividend Cash 46148V-26-3 Opportunities Trust BUI Equity Fund IHD Reinvest 46148V-27-1 Tekla Healthcare Investors HQH Historical 12 month distribution rate† 5.79% Global Equity U.S. -

Stfx Enrolment Guide

my money @ work Start saving guide it’s time to save Welcome to my money @ work Millions of Canadians participate in workplace retirement and savings plans. Now, it’s your turn because it’s your money and your future. Saving at work helps you meet your financial goals whether you’re just starting your career, midway through it or close to retirement. And this guide has what you need to get started: practical savings information to help you save and enrol in the Improved Retirement Plan for Teaching, Administration & Other Employees of St. Francis Xavier University. Being part of the Sun Life Financial community has its advantages. From making the most of your workplace plan to helping you plan for your financial future, my money @ work and Sun Life Financial are here for you. To take advantage of your dedicated Sun Life Financial Customer Care Centre representative, call 1-866-733-8612 from 8 a.m. to 8 p.m. ET any business day. Service is available in more than 190 languages. Group Retirement Services are provided by Sun Life Assurance Company of Canada, 2 aSun member Life Financial of the Sun Life Financial group of companies. Three easy steps… 1 READ 4 my money @ work Why save now? My plan What’s in it for me? 2 INVEST 9 my investments A choice of investment approaches Diverse selection of investment options Investment risk profiler 3 ENROL 15 mysunlife.ca It’s action time! We’re with you World of information & tools FORMS 18 my money @ work 3 READ 4 Sun Life Financial my money @ work There is no better way to save for your future than through your plan @ work. -

Pursuing Long-Term Value for Our Clients

Pursuing long-term value for our clients BlackRock Investment Stewardship A look into the 2020-2021 proxy voting year Executive Contents summary 03 By the Voting outcomes numbers Board quality and effectiveness Incentives aligned with value creation 18 Climate and natural capital Strategy, purpose, and financial resilience Company impacts on people Appendix 71 21 This report covers BlackRock Investment Stewardship’s (BIS) stewardship activities — focusing on proxy voting — covering the period from July 1, 2020 to June 30, 2021, representing the U.S. Securities and Exchange Commission’s 12-month reporting period for U.S. mutual funds, including iShares. Throughout the report we commonly refer to this reporting period as “the 2020-21 proxy year.” While we believe the information in this report is accurate as of June 30, 2021, it is subject to change without notice for a variety of reasons. As a result, subsequent reports and publications distributed may therefore include additional information, updates and modifications, as appropriate. The information herein must not be relied upon as a forecast, research, or investment advice. BlackRock is not making any recommendation or soliciting any action based upon this information and nothing in this document should be construed as constituting an offer to sell, or a solicitation of any offer to buy, securities in any jurisdiction to any person. References to individual companies are for illustrative purposes only. BlackRock Investment Stewardship 2 SUMMARY NUMBERS OUTCOMES APPENDIX Executive summary BlackRock Investment Stewardship Our Investment Stewardship (BIS) advocates for sound corporate toolkit governance and sustainable business Engaging with companies models that can help drive the long- How we build our term financial returns that enable our understanding of a clients to meet their investing goals. -

Blackrock UK Income Fund

Annual report BlackRock UK Income Fund For the year ended 28 February 2019 Contents General Information Manager & Registrar General Information 2 BlackRock Fund Managers Limited About the Fund 3 12 Throgmorton Avenue, London EC2N 2DL Investment Objective & Policy 3 Member of The Investment Association and authorised and regulated by the Financial Conduct Authority (“FCA”). Fund Managers 3 Directors of the Manager G D Bamping* C L Carter M B Cook (appointed 2 May 2018) W I Cullen* Significant Events 3 R A Damm (resigned 31 December 2018) R A R Hayes A M Lawrence Risk and Reward Profile 4 L E Watkins (appointed 16 May 2018, resigned 1 March 2019) M T Zemek* Performance Table 5 * Non-executive Director. Classification of Investments 6 Trustee* & Custodian The Bank of New York Mellon (International) Limited Investment Report 8 One Canada Square, London E14 5AL Performance Record 10 Authorised by the Prudential Regulation Authority and regulated by the FCA and the Prudential Distribution Tables 14 Regulation Authority. * On 18 June 2018 the Trustee changed from BNY Mellon Trust & Depositary (UK) Limited to The Bank of New York Mellon (International) Limited. Report on Remuneration 16 Portfolio Statement 22 Investment Manager BlackRock Investment Management (UK) Limited Statement of Total Return 25 12 Throgmorton Avenue, London EC2N 2DL Statement of Change in Net Assets Attributable to Unitholders 25 Authorised and regulated by the FCA. Balance Sheet 26 Securities Lending Agent Notes to Financial Statements 27 BlackRock Advisors (UK) Limited 12 Throgmorton Avenue, London EC2N 2DL Statement of Manager’s Responsibilities 44 Authorised and regulated by the FCA. -

Sun Life Blackrock Canadian Universe Bond Fund This Page Is Intentionally Left Blank Sun Life Blackrock Canadian Universe Bond Fund

SLGI ASSET MANAGEMENT INC. ANNUAL MANAGEMENT REPORT OF FUND PERFORMANCE for the period ended December 31, 2020 Sun Life BlackRock Canadian Universe Bond Fund This page is intentionally left blank Sun Life BlackRock Canadian Universe Bond Fund This annual management report of fund performance contains financial highlights but does not contain the complete financial statements of the investment fund. You can request a free copy of the annual financial statements by calling 1-877-344-1434, by sending an email to us at [email protected] or by writing to us at SLGI Asset Management Inc., 1 York Street, Suite 3300, Toronto, Ontario, M5J 0B6. The financial statements are available on our website at www.sunlifeglobalinvestments.com and on SEDAR at www.sedar.com. Securityholders may also contact us using one of these methods to request a copy of the investment fund’s proxy voting policies and procedures, proxy voting disclosure record or quarterly portfolio disclosure. As of July 20, 2020, Sun Life Global Investments (Canada) Inc. changed its name to SLGI Asset Management Inc. SLGI Asset Management Inc. (the "Manager") is an indirect wholly owned subsidiary of Sun Life Financial Inc. MANAGEMENT DISCUSSION OF FUND The Manager cautions that the current global uncertainty with respect to the spread of the coronavirus (“COVID-19”) and its PERFORMANCE effect on the broader global economy may have a significant impact to the volatility of the financial market. While the Investment Objectives and Strategies precise impact remains unknown, -

Investment Options — Portal I

Retirement Gateway® Group Variable Annuity investment options — Portal I Allocation Portfolios Large Cap Growth (Continued) Mid-Cap Growth (Continued) Short-Term Bonds AXA Aggressive Allocation B Franklin DynaTech R Eaton Vance Atlanta Capital SMID-Cap R EQ/PIMCO Ultra Short Bond IB AXA Conservative Allocation B Franklin Growth R Franklin Small-Mid Cap Growth R American Century Short Dur Inf PrBd R AXA Conservative PLUS Allocation B Janus Forty R Janus Enterprise R International Stocks AXA Growth Strategy IB MFS Growth R1 Lord Abbett Growth Opportunities R3 Developed Markets AXA Moderate Allocation B MFS Massachusetts Investors Growth Stock R1 Neuberger Berman Mid Cap Growth R3 EQ/International Core PLUS IB AXA Moderate PLUS Allocation B Neuberger Berman Guardian R3 Oppenheimer Discovery Mid Cap Growth R EQ/International Equity Index IB AXA/Franklin Templeton Allocation Neuberger Berman Socially Responsive R3 Mid-Cap Value ClearBridge International Value R Managed Volatility IB Prudential Jennison 20/20 Focus R AXA Mid Cap Value Managed Volatility IB Federated InterContinental R American Century One Choice 2020 Portfolio R Prudential Jennison Growth R AXA/Mutual Large Cap Equity Invesco International Growth R American Century One Choice 2025 Portfolio R T. Rowe Price Blue Chip Growth R Managed Volatility IB Janus International Equity R American Century One Choice 2030 Portfolio R T. Rowe Price Growth Stock R Multimanager Mid Cap Value IB Janus Overseas R American Century One Choice 2035 Portfolio R Large Cap Value AB Discovery Value R -

Extracts from the Macquarie Group Limited 2019 Annual Report PDF 6

ANNUAL REPORT Macquarie Group Year ended 31 March 2019 MACQUARIE GROUP LIMITED ACN 122 169 279 50 years of financial service Macquarie’s predecessor organisation, Hill Samuel Australia, opened in Sydney in December 1969 with three staff, capital of $A250,000 and an ambition to provide advisory and investment banking services of an international standard to the Australian market. Today Macquarie is a global financial services group operating in 30 markets providing asset management, leasing and asset financing, retail banking and wealth management, market access, commodity trading, investment banking and principal investment. 2019 Annual General Meeting Macquarie Group Limited’s 2019 Annual General Meeting will be held at 10:30 am on Thursday, 25 July 2019 at the Sheraton Grand Sydney Hyde Park, Grand Ballroom, 161 Elizabeth St, Sydney NSW 2000. Details of the business of the meeting will be contained in the Notice of Annual General Meeting, to be sent to shareholders separately. Cover image Macquarie’s global headquarters at 50 Martin Place, Sydney is a connected, flexible and sustainable workplace and the largest heritage redevelopment of its size to be awarded a Six Star Green Star Rating from the Green Building Council of Australia. Crowning the building with a new steel-frame glass dome, daylight harvesting reduces energy consumption by 40%. Table of 50 years of financial service 6 1 Letter from the Chairman 8 0 Letter from the Managing Director and CEO 10 contents ABOUT Operating and Financial Review 14 Corporate Governance Summary -

Blackrock Global Funds - World Healthscience Fund

July 30, 2021 Sun Life - BlackRock Global Funds - World Healthscience Fund Important Information: • This is one of the investment-linked funds offered under the investment-linked insurance policies issued by Sun Life Hong Kong Limited (“the Company”). Your investments will be subject to the credit risk of the Company. • The premiums paid by you towards the insurance policy will become part of the assets of the Company. You do not have any rights or ownership over any of those assets. Your recourse is against the Company only. • Your return on investments is calculated or determined by the Company with reference to the performance of the underlying funds. • The return of investments under your policy shall be subject to the charges of the scheme and may be lower than the return of the underlying funds. • Investment involves risks and past performance is not indicative of future performance. Investment return may rise as well as fall. Currency movement and market condition may affect the value of investments. • Emerging markets may involve a higher degree of risk than in developed markets and are usually more sensitive to price movements. Prices of the underlying funds may have higher volatility due to investment in emerging markets, financial derivatives instruments or structured instruments, and may involve a greater degree of risk than the conventional securities. • Please do not rely on this material alone. You are advised to read the relevant offering document, and the corresponding prospectuses of the underlying funds for further details and risk factors prior to making any investment decision. Basic Information Calendar Year Performance*3 (US$) Launch Date: November 1, 2013 2020 2019 2018 2017 2016 Inception Unit Price1: US$10.0000 12.74% 22.86% 3.90% 20.36% -8.89% 1 Current Unit Price : US$22.9759 Cumulative Performance3 as at July 30, 2021 (US$) 3 Months YTD 1 Year 3 Years 5 Years Since Launch Investment Objective 5.03% 10.08%16.50% 47.34% 73.15% 129.76% The investment objective of the underlying fund is to maximise total return. -

SRI Fund List

Socially Responsible Funds Socially Responsible Investing is any general investing strategy that considers not only traditional measures of risk and return, but environmental, social, and corporate governance (ESG) factors as well. This list is derived using the Morningstar, Inc.®1 “Sustainable Investment - Overall” data point attribute. Allocation Mutual Funds World Allocation AllianzGI Global Allocation A | PALAX Allocation--30% to 50% Equity AllianzGI Global Allocation C | PALCX Calvert Conservative Allocation A | CCLAX AllianzGI Global Allocation Instl | PALLX Calvert Conservative Allocation C | CALCX AllianzGI Global Allocation R6 | AGASX Calvert Conservative Allocation I | CFAIX Appleseed Institutional | APPIX Eventide Multi-Asset Income C | ETCMX Appleseed Investor | APPLX Eventide Multi-Asset Income I | ETIMX Eventide Multi-Asset Income N | ETNMX Alternative Mutual Funds Allocation--50% to 70% Equity Multialternative 1919 Socially Responsive Balanced A | SSIAX CCM Alternative Income Institutional | CCMNX 1919 Socially Responsive Balanced C | SESLX 1919 Socially Responsive Balanced I | LMRNX Commodities ETFs Calvert Balanced A | CSIFX Calvert Balanced C | CSGCX Commodities Focused Calvert Balanced I | CBAIX iPath® Global Carbon ETN | GRNTF Calvert Moderate Allocation A | CMAAX iPath® Series B Carbon ETN | GRN Calvert Moderate Allocation C | CMACX Calvert Moderate Allocation I | CLAIX Equity ETFs Green Century Balanced | GCBLX Pax Sustainable Allocation Indiv Inv | PAXWX China Region Pax Sustainable Allocation Instl | PAXIX KraneShares