Extracts from the Macquarie Group Limited 2019 Annual Report PDF 6

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

10 Year Capital Market Assumptions for 2021

10-Year Capital Market Assumptions Calendar Year 2021 2 10-Year Capital Market Assumptions Overview On an annual basis, BNY Mellon Investor Solutions, LLC develops capital market return assumptions for approximately 50 asset classes around the world. The assumptions are based on a 10-year investment time horizon and are intended to guide investors in developing their long-term strategic asset allocations. Historically, the initial baseline assumptions were derived using consensus views, adjusted to reflect insights regarding global market imbalances based on research from across BNY Mellon. This year we have incorporated the macroeconomic forecasts generated by BNY Mellon Investment Management Global Economic and Investment Analysis Group, led by Chief Economist Shamik Dhar. Given the global pandemic and unprecedented amount of global monetary and fiscal stimulus deployed to support the economic recovery, we believe the incorporation of these probability-weighted forecasts will prove particularly useful given the high degree of coronavirus-related economic uncertainty. Overall, the results of our 2021 10-year capital market assumptions are mixed depending on the asset class when compared to last year’s assumptions (see Exhibit 1). We see stronger equity market returns due to higher growth rates as the economy recovers from the pandemic. Fixed income asset class returns will be extremely limited given how low global bond yields are today. Alternative asset class returns are mixed, with generally lower returns in absolute return or hedged strategies and amplified returns in private markets. Exhibit 1: Snapshot of Risk and Return for the 2021 Capital Market Assumptions 9% U.S. Private Equity US Private Equity EM Equity Equity 2021 Equity 2020 EM Equity 8% Fixed Income 2021 Fixed Income 2020 Alternatives 2021 Alternatives 2020 Int'lIntl Developed Equity Equity USU.S. -

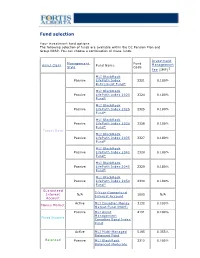

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

Brokerage Transfer

Brokerage Transfer ✓ Use this form to: Mail to: Express delivery only: • Transfer assets to T. Rowe Price Brokerage from another T. Rowe Price T. Rowe Price Mail Code 17150 institution. P.O. Box 17150 4515 Painters Mill Road ✗ Do not use this form to: Baltimore, MD 21297-1150 Owings Mills, MD 21117-4903 • Exchange between T. Rowe Price funds. This stamp indicates a signature guarantee is required. • Change ownership. Use the Change Ownership form. This paper clip indicates you may need to attach documentation. Trust, Estate, Corporation, or Other Entity Name (if applicable) TIN 1 T. Rowe Price Account A separate form is required for each account type or delivering institution. Delivering Firm Name Phone Check One Account Type: ¨ Individual ¨ Traditional or Rollover IRA ¨ Profit Sharing Plan (PSP) ¨ Joint ¨ Roth or Roth Rollover IRA ¨ Money Purchase Delivering Firm Address ¨ Trust ¨ Inherited IRA Pension Plan (MPP) ¨ Estate ¨ Roth Inherited IRA ¨ Individual 401(k) ¨ UGMA/UTMA ¨ SIMPLE IRA ¨ SEP-IRA City State ZIP Code ¨ Corporate or Other Entity For a new account, visit troweprice.com/newaccount to get an account ¨ For more owners, check this box and attach a separate page. number or write “new” and enclose one of these forms: • Brokerage New Account • Brokerage IRA New Account 3 Transfer Instructions • Brokerage Employer-Sponsored Retirement Plan New Account T. Rowe Price Brokerage Account Number Phone NOTE: Your current firm may charge a fee for transferring assets. Check one: ¨ Full transfer. Transfer all identically registered assets in kind. Owner Name (as it appears on statement) Social Security Number (SSN) Assets are moved as is and not sold. -

Lendlease and Aware Super Secure First Urbanization Project in Los Angeles; Grow U.S

Lendlease and Aware Super Secure First Urbanization Project in Los Angeles; Grow U.S. Development Portfolio 3401 S. La Cienega Blvd. site acquisition builds on the company’s $75B+ development pipeline and delivery of substantial urbanization projects in US gateway cities (Los Angeles, December 29, 2020) Lendlease, a leading global real estate and investments company, in partnership with Aware Super, an Australian superannuation fund, announced today that it secured a 3.5-acre transit-oriented, mixed-use development site at 3401 S. La Cienega Blvd in Los Angeles, with the two organizations each holding a 50% interest. This project marks Lendlease’s, and the partnership’s, first development in LA and is further evidence of Lendlease’s specialized skill set in identifying attractive, market- advantageous development opportunities that are ripe for transformation and value conversion. The land was acquired for $92M and the project will have an estimated end value of $600M upon completion. The 500,000-square-foot mid-rise project will feature world class architecture in close proximity to the rapidly growing Culver City submarket. It will include 260 multi-family residential units, 250,000-square-feet of creative office space and ground floor retail. Located adjacent to the La Cienega/Jefferson light rail station, future residents, workers and visitors will enjoy convenient transit access to the beach and Downtown LA. The Exposition Corridor Bike Path, as well as a forthcoming Whole Foods, will offer additional connectivity and attractive amenities for commercial and residential tenants. Lendlease aims to submit an application to the City of Los Angeles in 2021 and is expected to commence delivery in 2023 with development completion slated for 2025. -

Megabang for Megabucks: Driving a Harder Bargain on Megaprojects

Megabang for megabucks Driving a harder bargain on megaprojects Marion Terrill, Owain Emslie, and Lachlan Fox May 2021 Megabang for megabucks: Driving a harder bargain on megaprojects Grattan Institute Support Grattan Institute Report No. 2021-04, May 2021 Founding members Endowment Supporters This report was written by Marion Terrill, Owain Emslie, and Lachlan The Myer Foundation Fox. Nat Manawadu provided extensive research assistance and made National Australia Bank substantial contributions. Susan McKinnon Foundation We would like to thank numerous government and industry participants Affiliate Partners and officials for their helpful comments and insights. Ecstra Foundation The opinions in this report are those of the authors and do not Origin Energy Foundation necessarily represent the views of Grattan Institute’s founding Susan McKinnon Foundation members, affiliates, individual board members, reference group members, or reviewers. The authors are responsible for any errors or Senior Affiliates omissions. Cuffe Family Foundation Grattan Institute is an independent think tank focused on Australian Maddocks public policy. Our work is independent, practical, and rigorous. We aim Medibank Private to improve policy by engaging with decision makers and the broader The Myer Foundation community. Scanlon Foundation We acknowledge and celebrate the First Nations people on whose Trawalla Foundation traditional lands we meet and work, and whose cultures are among the Wesfarmers oldest continuous cultures in human history. Westpac For further information on Grattan’s programs, or to join our mailing list, Affiliates please go to: www.grattan.edu.au. You can make a donation to support Allens future Grattan reports here: www.grattan.edu.au/donate. Ashurst This report may be cited as: Terrill, M., Emslie, O., and Fox, L. -

A SOCIAL DIVIDE ENGAGEMENT IS SOARING November 2017 Edition

A SOCIAL DIVIDE ENGAGEMENT IS SOARING November 2017 Edition ASX 100 Social Media Performance Index 32,860 retweets, shares, comments, likes and other interactions recorded 303 posts analysed across three platforms 100 ASX companies reviewed EXECUTIVE SUMMARY ASX 100 index – Top 20 The 6th edition of our Social Divide Index reveals that RESEARCH OVERVIEW audiences are engaging significantly more with ASX 100 companies who communicate their financial results on FTI Consulting analysed the social media activity of each social media. We recorded a 117% increase in interactions ASX 100 constituent on the three platforms most relevant, with results content compared to our previous report. in our view, to corporate and financial communications – Twitter, LinkedIn and YouTube – at the time of its latest The increase is heavily weighted to the top five businesses, full or half year results announcement. The identified who account for 69% of the total number of engagements results-related activity was measured using three metrics: showing a real gap between ASX 100 companies, and a volume, quality and impact. Scores were given for each huge opportunity for those not taking advantage of social component, which in turn generated an aggregate score. media channels when publishing financial results. More information on the methodology can be found on page 13. This report looks at the best practice tools and techniques used by businesses to extend the reach of their content and make audiences want to engage with them – which leads to a greater opportunity to engage with relevant 1. Qantas Airways 11 Suncorp Group stakeholders. OUR FINDINGS 2. Rio Tinto 12 Orora Qantas topped the list in this year’s ranking in their first 3. -

2005 Market St. Philadelphia, PA 19103-7094 for IMMEDIATE RELEASE DELAWARE

2005 Market St. Philadelphia, PA 19103-7094 FOR IMMEDIATE RELEASE DELAWARE INVESTMENTS GLOBAL DIVIDEND AND INCOME FUND, INC. AND DELAWARE ENHANCED GLOBAL DIVIDEND AND INCOME FUND ANNOUNCE APPROVAL OF PLAN OF REORGANIZATION PHILADELPHIA, September 21, 2011 — The Board of Directors of Delaware Investments Global Dividend and Income Fund, Inc. (NYSE: DGF) (“DGF”) and the Board of Trustees of Delaware Enhanced Global Dividend and Income Fund (NYSE: DEX) (“DEX”) today announced the final results of voting at the Joint Special Meeting of Shareholders (the “Special Meeting”) held on September 21, 2011. Shareholders of each Fund approved an Agreement and Plan of Reorganization (the “Plan of Reorganization”) providing for (i) the acquisition by DEX of substantially all of the assets and certain of the liabilities of DGF, in exchange for newly issued common shares of DEX; (ii) the distribution of such newly issued common shares of DEX to holders of common shares of DGF; and (iii) the dissolution of DGF thereafter. Common shares of DGF would be exchanged for common shares of DEX on a pro rata basis based on the relative net asset values of each Fund’s common shares. This transaction, which is expected to be tax-free, is currently anticipated to close at the close of business on October 21, 2011. In connection with this transaction, shareholders of DGF holding share certificates must send in such certificates before becoming eligible to receive distributions as DEX shareholders. DGF shareholders will be mailed specific instructions on how to send in their certificates. The Fund’s transfer agent, BNY Mellon Shareowner Services, can assist DGF shareholders in this process. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

Macquarie Group Limi Macquarie Group Limited

SUPPLEMENT TO THE OFFERING MEMORANDUM DATED 14 JUNE 2016 MACQUARIE GROUP LIMILIMITEDTED (ABN 94 122 169 279) (incorporated with limited liability in the Commonwealth of Australia) U.S.$10,000,000,000 (or equivalent in other currencies) Debt Instrument Programme ISSUER Macquarie Group Limited DEALERS Australia and New Zealand Banking Group Limited BofA Merrill Lynch Barclays Citigroup Commonwealth Bank of Australia Credit Suisse HSBC ING J.P. Morgan Macquarie Bank International Limited Macquarie Bank Limited National Australia Bank Limited SMBC Nikko Société Générale Corporate & Investment Banking Standard Chartered Bank Westpac Banking Corporation ISSUING & PAYING AGENT Deutsche Bank AG, London Branch CMU LODGING AGENT Deutsche Bank AG, Hong Kong Branch The date of this Supplement is 17 November 2016 1 Pages 1 to 161 (inclusive) and pages 238 to 240 (inclusive) of the Offering Memorandum dated 14 June 2016 comprise a base prospectus of Macquarie Group Limited (ABN 94 122 169 279) (“IssuerIssuerIssuer” or “MGLMGLMGLMGL”) (the “BaseBase ProspectusProspectus”) for the purposes of Article 5.4 of Directive 2003/71/EC, as amended (the “ProspectusProspectus DirectiveDirective”) in respect of unsecured and unsubordinated debt instruments to be admitted to the Official List of the UK Listing Authority (as defined below) and to be admitted to trading on the London Stock Exchange’s regulated market (“PDPD Debt InstrumentsInstruments”). The Base Prospectus was approved by the Financial Conduct Authority (“FCAFCAFCAFCA”) in its capacity as competent -

Blackrock in France

BlackRock in France Stéphane Sébastien Henri Carole Crozat Lapiquonne Herzog Chabadel BlackRock Country Manager, Chief Operating Chief Investment Officer, Sustainable France, Belgium, Officer, France, France, Belgium & Investing, Head of Luxembourg Belgium, Luxembourg Luxembourg Thematic Research Jean-François Martin Parkes Sylvain Bettina Cirelli Public Policy, Favre-Gilly Mazzocchi Chairman, France, France, Head of Institutional Head of iShares & Belgium, Switzerland & Business, France Wealth, France, Luxembourg Luxembourg Monaco, Belgium, Luxembourg Independent fiduciary asset Connecting client capital to companies and projects We have put nearly EUR185bn2 from investors in France manager and globally to work in the French economy, supporting BlackRock is a leading provider of investment, advisory growth, jobs and innovation. and risk management solutions. Our purpose is to help Renewable energy: Our infrastructure investment more and more people invest in their financial well-being. platform has enabled clients to contribute to financing six As an asset manager, we connect the capital of diverse wind and solar energy projects in France, as well as green individuals and institutions to investments in companies, network heating operator and transport projects. projects and governments. This helps fuel growth, jobs Real estate: With a team of dedicated experts on the and innovation, to the benefit of society as a whole. ground, our real estate team creates value for clients and We have been present in France since 2006 and are local citizens through our investments across Paris, committed to the local market. Our local clients include including 3 Quartiers and Grande Arche. A number of insurers, pensions, official institutions, corporates, projects have earned certificates for their positive traditional and digital banks, and foundations, for whom environmental footprint.