Pursuing Long-Term Value for Our Clients

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Development of an Adventist Radio Program for Farmers in Tamil Nadu

Andrews University Digital Commons @ Andrews University Dissertation Projects DMin Graduate Research 2000 Development of an Adventist Radio Program for Farmers in Tamil Nadu Thambiraj Mantharasalam Subbiah Andrews University Follow this and additional works at: https://digitalcommons.andrews.edu/dmin Part of the Practical Theology Commons Recommended Citation Subbiah, Thambiraj Mantharasalam, "Development of an Adventist Radio Program for Farmers in Tamil Nadu" (2000). Dissertation Projects DMin. 572. https://digitalcommons.andrews.edu/dmin/572 This Project Report is brought to you for free and open access by the Graduate Research at Digital Commons @ Andrews University. It has been accepted for inclusion in Dissertation Projects DMin by an authorized administrator of Digital Commons @ Andrews University. For more information, please contact [email protected]. ABSTRACT DEVELOPMENT OF AN ADVENTIST RADIO PROGRAM FOR FARMERS IN TAMIL NADU by Thambiraj Mantharasalam Subbiah Adviser: Nancy Vyhmeister ABSTRACT OF GRADUATE STUDENT RESEARCH Dissertation Andrews University Seventh-day Adventist Theological Seminary Title: THE DEVELOPMENT OF AN ADVENTIST RADIO PROGRAM FOR FARMERS IN TAMIL NADU Name of researcher: Thambiraj M. Subbiah Name and degree of faculty adviser: Nancy Vyhmeister, Ed.D. Date completed: September 2000 Problem Tamil Nadu is one of the states of India located in the southern part. The people who live in the state are called Tamils. Agriculture is the main occupation of this state. About 70 percent of the total population of the state are farmers. Hinduism is the main core of their religion. Hinduism taught them various beliefs, such as salvation by work and transmigration of the soul. At the same time, the farmers are caught up with various traditional beliefs which are very much influenced by their agricultural activities. -

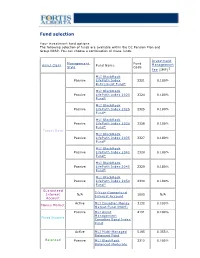

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

Beyond Stewardship: Toward an Agapeic Environmental Ethic

Marquette University e-Publications@Marquette Dissertations, Theses, and Professional Dissertations (1934 -) Projects Beyond Stewardship: Toward an Agapeic Environmental Ethic Christopher J. Vena Marquette University Follow this and additional works at: https://epublications.marquette.edu/dissertations_mu Part of the Ethics in Religion Commons, Philosophy Commons, and the Religious Thought, Theology and Philosophy of Religion Commons Recommended Citation Vena, Christopher J., "Beyond Stewardship: Toward an Agapeic Environmental Ethic" (2009). Dissertations (1934 -). 16. https://epublications.marquette.edu/dissertations_mu/16 BEYOND STEWARDSHIP: TOWARD AN AGAPEIC ENVIRONMENTAL ETHIC by Christopher J. Vena, B.A., M.A. A Dissertation submitted to the Faculty of the Graduate School, Marquette University, in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy Milwaukee, Wisconsin December 2009 ABSTRACT BEYOND STEWARDSHIP: TOWARD AN AGAPEIC ENVIRONMENTAL ETHIC Christopher J. Vena, B.A., M.A. Marquette University, 2009 One of the unfortunate implications of industrialization and the rapid expansion of global commerce is the magnification of the impact that humans have on their environment. Exponential population growth, along with growing technological capabilities, has allowed human societies to alter their terrain in unprecedented and destructive ways. The cumulative effect has been significant to the point that the blame for widespread environmental degradation must be pinned squarely on human shoulders. Because of our dependence on these systems for survival, the threat to the environment is a threat to human life. The root of the ecological crisis is found in human attitudes and behaviors. In the late 1960’s it was suggested that Christianity was a key source of the problem because it promoted the idea of human “dominion” over creation. -

Stewardship and the Kingdom of God

Stewardship and the Kingdom of God Stewardship and the Kingdom of God Copyright © 2001 Ronald Walborn and Frank Chan All rights reserved. Office of Church Stewardship The Christian and Missionary Alliance 8595 Explorer Drive, Colorado Springs, CO 80920 800-485-8979 • www.cmalliance.org TABLE OF CONTENTS Introduction . 1 Ch. 1 — Stewardship Defined . 7 The Concept of Stewardship in the Old Testament . 8 The Concept of Stewardship in the New Testament . 10 Principles of Stewardship . 13 Ch. 2 — Practical Directives on Four Related Issues . 19 Spiritual Warfare . 19 The Health-and-Wealth Gospel . 23 The Spirit of the Tithe . 28 The Stranglehold of Debt . 33 Summary . 41 End Notes . 43 Introduction There is a crisis in Christianity today. Many churches and denominations are struggling to reach their financial goals and fund their visions. We in The Christian and Missionary Alliance are no strangers to this struggle. But the crisis we face is not primarily a struggle of stewardship. It is a crisis of discipleship. Certainly, stewardship flows out of this broader category of discipleship, but the central issue is the totality of what it means to be a follower of Jesus in the twenty-first century. The church in North America has tragically and unknowingly reduced following Jesus to a series of creeds to believe and a group of prayers to be prayed. Lost in our evangelism is the radical call to leave the kingdom of this world and come under the rule and reign of God. Our call to become citizens of the Kingdom of God has made few demands on previous worldly allegiances. -

Consortium for Environmental Stewardship and Sustainability

MEMBER BENEFITS SEMINAR ACTIVITIES • Access to an international and Sustainability Seminar at Kansas State University (CHE 670) interdisciplinary network of organizations and individuals with an interest in This seminar emphasizes the intersections of sustainability; sustainability science, engineering, social • Opportunities to direct and propose science, and economics. The topics covered projects; include water, green engineering, life cycle • Participation in future events; analysis, energy, environmental management, sustainable development, • Opportunities to work with partners on policy, and decision-making. This course is common goals; CESAS available each semester. Access to sustainability information and • resources; and Consortium for • Partner organizations are connected FOR MORE INFORMATION through a consortium website. Environmental Larry Erickson ([email protected]) Stewardship and HOW TO BECOME A Jennifer Anthony ([email protected]) CONSORTIUM PARTNER Blase Leven ([email protected]) Sustainability • Nominate a representative from your Consortium for Environmental organization and provide contact Stewardship and Sustainability (CESAS) information and Internet URL to the Kansas State University consortium 104 Ward Hall • Propose initiatives and invite consortium Manhattan, KS 66506 members to participate 785-532-6519 • Donate to KSU Foundation account [email protected] I24260 for Environmental Stewardship and Sustainability (consortium dues are http://www.engg.ksu.edu/CHSR/sustainability voluntary) /CESAS 20150413 WHAT IS CESAS? CESAS OBJECTIVES 4. Land Management and Use (e.g. erosion, The Consortium for Environmental urban planning, protection) 1. Encourage scientific, social, and policy Stewardship and Sustainability (CESAS) is 5. Agriculture (e.g. crops, animal research in sustainability. a network of partner organizations choosing production, environmental management) 2. Educate students and the public in to work collaboratively to advance environmental stewardship and 6. -

Stewardship Education Best Practices Planning Guide Anie L / Ohio D Nr © Tim D

Stewardship Education Best Practices Planning Guide NR D / OHIO L ANIE D © TIM A Project of the Association of Fish and Wildlife Agencies’ North American Conservation Education Strategy Funded by a Multistate Grant of the Sport Fish and Wildlife Restoration Program May 2008 © LUCAS CAVALHEIRO PHOTO / DREAMSTIME.COM Stewardship Education Best Practices Planning Guide Association of Fish and Wildlife Agencies 444 N. Capitol Street, NW, Suite 725 Washington, DC 20001 202-624-7890 www.fishwildlife.org A Project of the Association of Fish and Wildlife Agencies’ North American Conservation Education Strategy Funded by a Multistate Grant of the Sport Fish and Wildlife Restoration Program Acknowledgments Editor: Phil T. Seng D.J. Case & Associates Mishawaka, Indiana 574-258-0100 May 2008 The Association of Fish and Wildlife Agencies would like to thank the following people for contributing time and expertise to the development of this Guide. The Association’s Conservation Education Strategy “Achieving Excellence” Committee: Nancy Herron, Texas Parks and Wildlife Department, Chair Lorna Domke, Missouri Department of Conservation Barb Gigar, Iowa Department of Natural Resources Suzie Gilley, Virginia Department of Game and Inland Fisheries Michelle Kelly, Minnesota Department of Natural Resources Judy Silverberg, New Hampshire Fish and Game Department Jim Stewart, Recreational Boating and Fishing Foundation Margaret Tudor, Washington Department of Fish and Wildlife Additional reviewers included: Doug Darr, Alabama Wildlife and Freshwater Fisheries -

SERVANT-LEADERSHIP and TAKING CHARGE BEHAVIOR the Moderating Role Offollower Altruism

SERVANT-LEADERSHIP AND TAKING CHARGE BEHAVIOR The Moderating Role ofFollower Altruism -DIRK VAN DIERENDONCK The literature on servant-leadership (SL) advocates that the primary focus of servant-leaders is to meet the needs of others (Greenleaf 1977). Servant-leaders focus on developing employees to their fullest potential in areas of task effectiveness, community stewardship, self-motivation, and future leadership capabilities, and they provide vision and gain credibil ity and trust from followers (Farling, Stone, and Winston 1999). Barbuto and Wheeler (2006) described SL as including an altruistic calling, which is the motivation of leaders to place others' needs and interests ahead of their own, and organizational stewardship, which orients others toward benefiting and serving the community. Research has indeed shown that servant-leadership is related to a variety of followers' attitudes such as job satisfaction, organizational commitment, and organizational citizenship behavior (Van Dierendonck 2011 ). In this study, I will follow the operational definition of servant leadership I was fortunate to help establish (Van Dierendonck and Nuijten 2011) through empirical methods. Nuijten and I developed a measure con sisting of eight dimensions, including empowerment, accountability, humil ity, standing back, authenticity, forgiveness, courage, and stewardship. In essence, our focus on servant-leadership emphasizes that servant-leaders empower and develop people, are willing to retreat into the background and let others shine, hold followers accountable for their work, are willing to let bygones be bygones, dare to take risks, are willing to show what he or she stands for, have an openness to learn and a willingness to admit mistakes, and work for the good of the whole. -

Blackrock in France

BlackRock in France Stéphane Sébastien Henri Carole Crozat Lapiquonne Herzog Chabadel BlackRock Country Manager, Chief Operating Chief Investment Officer, Sustainable France, Belgium, Officer, France, France, Belgium & Investing, Head of Luxembourg Belgium, Luxembourg Luxembourg Thematic Research Jean-François Martin Parkes Sylvain Bettina Cirelli Public Policy, Favre-Gilly Mazzocchi Chairman, France, France, Head of Institutional Head of iShares & Belgium, Switzerland & Business, France Wealth, France, Luxembourg Luxembourg Monaco, Belgium, Luxembourg Independent fiduciary asset Connecting client capital to companies and projects We have put nearly EUR185bn2 from investors in France manager and globally to work in the French economy, supporting BlackRock is a leading provider of investment, advisory growth, jobs and innovation. and risk management solutions. Our purpose is to help Renewable energy: Our infrastructure investment more and more people invest in their financial well-being. platform has enabled clients to contribute to financing six As an asset manager, we connect the capital of diverse wind and solar energy projects in France, as well as green individuals and institutions to investments in companies, network heating operator and transport projects. projects and governments. This helps fuel growth, jobs Real estate: With a team of dedicated experts on the and innovation, to the benefit of society as a whole. ground, our real estate team creates value for clients and We have been present in France since 2006 and are local citizens through our investments across Paris, committed to the local market. Our local clients include including 3 Quartiers and Grande Arche. A number of insurers, pensions, official institutions, corporates, projects have earned certificates for their positive traditional and digital banks, and foundations, for whom environmental footprint. -

Blackrock International Limited Annual Best Execution Disclosure

BlackRock International Limited Annual Best Execution Disclosure 2019 June 2020 Contents Introduction Quantitative Analysis Top five entity reports for the transmission of orders Top five entity report for the execution of orders Securities Finance Transactions o Top five entity reports for the execution of orders Qualitative Analysis Equities Shares & Depository Receipts Equity derivatives: Futures & Options admitted to trading on a trading venue Interest rate derivatives: Futures & Options admitted to trading on a trading venue Currency derivatives: Futures & Options admitted to trading on a trading venue Commodities derivatives: Futures & Options admitted to trading on a trading venue Credit derivatives: Futures & Options admitted to trading on a trading venue Securitized derivatives: Warrants and certificate derivatives Equity derivatives: Swaps & other equity derivatives Contracts For Difference Debt instruments: Bonds Debt instruments: Money Market Instruments Interest rate derivatives: Swaps, forwards & other interest rates derivatives Credit derivatives: Other credit derivatives Currency derivatives: Swaps, forwards & other currency derivatives Commodities derivatives: Swaps and other commodities derivatives Structured Finance Instruments Exchange Traded Products Other Instruments Securities Finance Transactions BLACKROCK Annual Best Execution Disclosure 2019 | 2 Introduction The publication of this report is required under the Markets in Financial Instruments Directive 2014/65/EU (“MIFID II”) and it is designed to provide information on the top five execution venues* utilised by BlackRock to execute its clients’ orders, as well as the top five entities to which BlackRock transmitted its clients’ orders for execution. It also includes information on how BlackRock monitors the quality of its clients’ trades’ execution, on BlackRock’s conflicts of interest and other matters, as they relate to the execution by BlackRock of its clients’ trades. -

Say on Pay Votes and CEO Compensation: Evidence from the UK

Say on Pay Votes and CEO Compensation: Evidence from the UK Fabrizio Ferri* David Maber Harvard Business School Abstract: We examine the effect on CEO pay of new legislation introduced in the United Kingdom at the end of 2002 that mandates an annual, advisory shareholder vote (“say on pay”) on the executive pay report prepared by the board of directors. We find no evidence of a change in the level and growth rate of CEO pay after the adoption of say on pay. However, we document an increase in its sensitivity to poor performance. The effect is more pronounced in firms with high voting dissent but extends more generally to firms with excess CEO pay, regardless of the voting dissent, suggesting that some firms responded to threat of a negative vote by acting ahead of the annual meeting. Evidence on explicit changes to CEO pay contracts made in response to specific shareholder requests confirms a shift toward greater sensitivity of CEO pay to poor performance. These findings are consistent with calls to eliminate “rewards for failure” that led to the introduction of say on pay and may be of interest to regulators and investors who are pondering the merits of say on pay in the US and other countries. * Corresponding Author: Harvard Business School, Harvard University, Soldiers Field, Boston, MA 02138, phone: (617) 495-6925, email: [email protected] We thank Gennaro Bernile, Brian Cadman, Brian Cheffins, Shijun Cheng, Joe Gerakos, Jeffrey Gordon, Yaniv Grinstein, Dhinu Srinivasan, Laura Starks, Randall Thomas and discussants and participants at -

Outrage and Camouflage – an Empirical Examination of the Managerial Power Theory

TECHNISCHE UNIVERSITÄT MÜNCHEN TUM School of Management Chair for Management Accounting Outrage and Camouflage – An Empirical Examination of the Managerial Power Theory Iris Carola Pfeiffer Vollständiger Abdruck der von der Fakultät für Wirtschaftswissenschaften der Technischen Universität München zur Erlangung des akademischen Grades eines Doktors der Wirtschaftswissenschaften (Dr. rer. pol.) genehmigten Dissertation. Vorsitzender: Prof. Dr. Jürgen Ernstberger Prüfer der Dissertation: 1. Prof. Dr. Gunther Friedl 2. Prof. Dr. Michael Kurschilgen Die Dissertation wurde am 19.09.2017 bei der Technischen Universität München eingereicht und durch die Fakultät für Wirtschaftswissenschaften am 15.12.2017 angenommen. Contents List of Tables ...................................................................................................................... IV List of Figures...................................................................................................................... V List of Abbreviations .......................................................................................................... VI 1 Introduction .................................................................................................................. 1 1.1 Motivation ................................................................................................................ 1 1.2 Positioning of the dissertation within compensation research .................................. 2 1.3 Research gap and research questions ................................................................... -

Closed-End Strategy: Select Opportunity Portfolio 2021-2

Invesco Unit Trusts Closed-End Strategy: Select Opportunity Portfolio 2021-2 A specialty unit trust Trust specifi cs Objective Deposit information The Portfolio seeks to provide current income and the potential for capital appreciation. The Portfolio seeks Public offering price per unit1 $10.00 to achieve its objective by investing in a portfolio consisting of common stocks of closed-end investment 2 companies (known as “closed-end funds”) that invest in various global fixed income and equity securities. Minimum investment ($250 for IRAs) $1,000.00 As indicated by the information publicly available at the time of selection, none of the Portfolio’s closed-end Deposit date 04/07/21 funds employed “structured leverage”4. Termination date 04/05/23 † Distribution dates 25th day of each month Portfolio composition (As of the business day before deposit date) Record dates† 10th day of each month Covered Call High Yield Estimated initial distribution month† 05/21 BlackRock Enhanced Capital and Western Asset High Income Opportunity Term of trust Approximately 24 months Income Fund, Inc. CII Fund, Inc. HIO Historical 12 month distributions† $0.5793 BlackRock Enhanced Equity Dividend Trust BDJ Western Asset High Yield Defi ned Opportunity NLEV212 Sales charge and CUSIPs Columbia Seligman Premium Technology Fund, Inc. HYI Brokerage Growth Fund, Inc. STK Investment Grade Sales charge3 Eaton Vance Tax-Managed Global Diversifi ed Invesco Bond Fund VBF Deferred sales charge 2.25% Equity Income Fund EXG Sector Equity Creation and development fee 0.50% First Trust Enhanced Equity Income Fund FFA Blackrock Health Sciences Trust II BMEZ Total sales charge 2.75% Nuveen Dow 30sm Dynamic Overwrite Fund DIAX Last deferred sales charge payment date 04/10/22 BlackRock Science & Technology Trust II BSTZ Emerging Market Equity CUSIPs BlackRock Utilities, Infrastructure & Power Voya Emerging Markets High Dividend Cash 46148V-26-3 Opportunities Trust BUI Equity Fund IHD Reinvest 46148V-27-1 Tekla Healthcare Investors HQH Historical 12 month distribution rate† 5.79% Global Equity U.S.