2019 Review of Shareholder Activism

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Accounts 2013 Annual Report and Accounts 2013

Annual Report and Accounts 2013 Annual Report and Accounts 2013 Brewin Dolphin Holdings PLC, 12 Smithfield Street, London EC1A 9BD T 020 7246 1000 F 020 3201 3001 W brewin.co.uk E [email protected] Brewin Dolphin provides a range of investment management, financial advice and execution only services in the UK and Eire. “Our priorities are clear. They are to reinforce our high standard of service to clients and ensure an improved return to shareholders. Discretionary Investment Management is currently the core of our business model and our mission is to provide a compelling and consistent offering, relevant to all our clients. Over the past decade we have evolved from a stockbroker into a private client investment manager. Our evolution must continue as we strive to become the leading provider of personal Discretionary Wealth Management in the UK.” David Nicol, Chief Executive Investment proposition • Strong client relationships with a long-term track record of personalised service • Growth market with good long-term prospects • New management team with clear goals and a strategy to achieve them • Our strategy will generate value for all stakeholders We are already creating value in 2013 • Total income grew by 9% to £283.7m • Adjusted profit before tax grew by 22% to £52.3m • Adjusted profit margin increased from 16.5% to 18.5% • Discretionary funds under management (FUM) grew by 17% to £21.3bn • Adjusted earnings per share (EPS) grew by 19.2% to 14.9p (2012: 12.5p) • Full year dividend increased by 20% to 8.6p • Total Shareholder Return was 63% Contents Business review Section 1 Business review Financial Highlights 02 Business Highlights 03 Chairman’s Statement 04 Overview of the Business and Strategy 06 Strategic Report 08 A. -

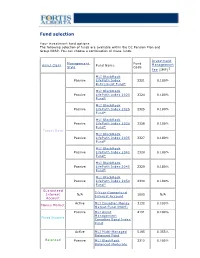

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

MCERA May 5, 2021 Regular Board Meeting Agenda Page 1 of 4 B

AGENDA REGULAR BOARD MEETING MARIN COUNTY EMPLOYEES’ RETIREMENT ASSOCIATION (MCERA) One McInnis Parkway, 1st Floor Retirement Board Chambers San Rafael, CA May 5, 2021 – 9:00 a.m. This meeting will be held via videoconference pursuant to Executive Order N-25-20, issued by Governor Newsom on March 12, 2020, Executive Order N-29-20, issued by Governor Newsom on March 17, 2020, and Executive Order N-35-20, issued by Governor Newsom on March 21, 2020. Instructions for watching the meeting and/or providing public comment, as well as the links for access, are available on the Watch & Attend Meetings page of MCERA’s website. Please visit https://www.mcera.org/retirementboard/agendas-minutes/watchmeetings for more information. The Board of Retirement encourages a respectful presentation of public views to the Board. The Board, staff and public are expected to be polite and courteous, and refrain from questioning the character or motives of others. Please help create an atmosphere of respect during Board meetings. EVENT CALENDAR 9 a.m. Regular Board Meeting CALL TO ORDER ROLL CALL MINUTES April 14, 2021 Board meeting A. OPEN TIME FOR PUBLIC EXPRESSION Note: The public may also address the Board regarding any agenda item when the Board considers the item. Open time for public expression, from three to five minutes per speaker, on items not on the Board Agenda. While members of the public are welcome to address the Board during this time on matters within the Board’s jurisdiction, except as otherwise permitted by the Ralph M. Brown Act (Government Code Sections 54950 et seq.), no deliberation or action may be taken by the Board concerning a non-agenda item. -

Lazard Global Managed Volatililty Fund Commentary

Lazard Global Managed Volatility Fund AUG Commentary 2021 Market Overview e global equity markets continued their historic recovery with a seventh straight monthly gain in August. Momentum was strong as many indices posted multiple all-time highs during the month. e United States, overcoming a decline in consumer condence, continued to lead the major equity markets. Federal Reserve Chairman Jerome Powell calmed investors’ fear of a sharp curtailment in the central bank’s stimulus programs while indicating that economic strength was sufficient for the Fed to consider a modest reduction in its bond repurchase program. e euro area reported surprisingly strong GDP growth for the second quarter, outpacing most major economies, including those of China and the United States. Corporate earnings in Europe recovered further as vaccinations increased and the economy continued to reopen. European sell-side analysts raised their earnings estimates at a historically high rate. Japan also posted a positive month but trailed other markets; its economy grew more than expected in the second quarter, counteracting the effects of the spike in COVID-19 cases that had caused a sell-off in July. e spike will likely temper growth in the third quarter. e favorable economic news and low interest rates benetted the emerging markets, which outpaced the developed markets in August. Sector performance showed only modest dispersion in August, with every sector except materials posting a positive return. Financials were the strongest sector for the month and have taken leadership from energy for the year. Global factor performance was also relatively muted in the month. Risk measures showed mixed results as lower beta stocks and stocks with higher volatility over the past year outperformed. -

Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Accounts and Report Annual

Brewin Dolphin Holdings PLC Holdings Dolphin Brewin Annual Report and Accounts 2015 Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Contents Overview 34 Corporate Responsibility 82 Directors’ Responsibilities 96 Consolidated Cash 02 Highlights 40 Resources and Relationships 83 Independent Auditor’s Report Flow Statement 04 Chairman’s Statement 97 Company Cash Flow Statement Governance Financial Statements 98 Notes to the Financial Strategic Report 44 Chairman’s Introduction 90 Consolidated Income Statement Statements 08 Business Overview to Governance 91 Consolidated Statement of 10 Business Model 46 Directors and their Biographies Comprehensive Income Additional Information 12 Market Environment 48 Corporate Governance Report 92 Consolidated Balance Sheet 148 Five Year Record Continuing 14 Our Strategy 53 Board Risk Committee Report 93 Consolidated Statement of Operations (unaudited) 16 Chief Executive’s Statement 56 Audit Committee Report Changes in Equity 149 Appendix – Calculation of KPIs 20 Measuring Our Performance 62 Nomination Committee Report 94 Company Balance Sheet 150 Glossary 23 Results 64 Directors’ Remuneration Report 95 Company Statement of Changes 151 Shareholder Information 30 Principal Risks and Uncertainties 80 Other Statutory Information in Equity 152 Branch Address List Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Overview Brewin Dolphin provides a range of investment management and financial advice services in the Strategic Report United Kingdom, Channel Islands and the Republic of Ireland. -

LAZARD GROUP LLC (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to 333-126751 (Commission File Number) LAZARD GROUP LLC (Exact name of registrant as specified in its charter) Delaware 51-0278097 (State or Other Jurisdiction of Incorporation (I.R.S. Employer Identification No.) or Organization) 30 Rockefeller Plaza New York, NY 10020 (Address of principal executive offices) Registrant’s telephone number: (212) 632-6000 Securities Registered Pursuant to Section 12(b) of the Act: None Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Blackrock in France

BlackRock in France Stéphane Sébastien Henri Carole Crozat Lapiquonne Herzog Chabadel BlackRock Country Manager, Chief Operating Chief Investment Officer, Sustainable France, Belgium, Officer, France, France, Belgium & Investing, Head of Luxembourg Belgium, Luxembourg Luxembourg Thematic Research Jean-François Martin Parkes Sylvain Bettina Cirelli Public Policy, Favre-Gilly Mazzocchi Chairman, France, France, Head of Institutional Head of iShares & Belgium, Switzerland & Business, France Wealth, France, Luxembourg Luxembourg Monaco, Belgium, Luxembourg Independent fiduciary asset Connecting client capital to companies and projects We have put nearly EUR185bn2 from investors in France manager and globally to work in the French economy, supporting BlackRock is a leading provider of investment, advisory growth, jobs and innovation. and risk management solutions. Our purpose is to help Renewable energy: Our infrastructure investment more and more people invest in their financial well-being. platform has enabled clients to contribute to financing six As an asset manager, we connect the capital of diverse wind and solar energy projects in France, as well as green individuals and institutions to investments in companies, network heating operator and transport projects. projects and governments. This helps fuel growth, jobs Real estate: With a team of dedicated experts on the and innovation, to the benefit of society as a whole. ground, our real estate team creates value for clients and We have been present in France since 2006 and are local citizens through our investments across Paris, committed to the local market. Our local clients include including 3 Quartiers and Grande Arche. A number of insurers, pensions, official institutions, corporates, projects have earned certificates for their positive traditional and digital banks, and foundations, for whom environmental footprint. -

Blackrock International Limited Annual Best Execution Disclosure

BlackRock International Limited Annual Best Execution Disclosure 2019 June 2020 Contents Introduction Quantitative Analysis Top five entity reports for the transmission of orders Top five entity report for the execution of orders Securities Finance Transactions o Top five entity reports for the execution of orders Qualitative Analysis Equities Shares & Depository Receipts Equity derivatives: Futures & Options admitted to trading on a trading venue Interest rate derivatives: Futures & Options admitted to trading on a trading venue Currency derivatives: Futures & Options admitted to trading on a trading venue Commodities derivatives: Futures & Options admitted to trading on a trading venue Credit derivatives: Futures & Options admitted to trading on a trading venue Securitized derivatives: Warrants and certificate derivatives Equity derivatives: Swaps & other equity derivatives Contracts For Difference Debt instruments: Bonds Debt instruments: Money Market Instruments Interest rate derivatives: Swaps, forwards & other interest rates derivatives Credit derivatives: Other credit derivatives Currency derivatives: Swaps, forwards & other currency derivatives Commodities derivatives: Swaps and other commodities derivatives Structured Finance Instruments Exchange Traded Products Other Instruments Securities Finance Transactions BLACKROCK Annual Best Execution Disclosure 2019 | 2 Introduction The publication of this report is required under the Markets in Financial Instruments Directive 2014/65/EU (“MIFID II”) and it is designed to provide information on the top five execution venues* utilised by BlackRock to execute its clients’ orders, as well as the top five entities to which BlackRock transmitted its clients’ orders for execution. It also includes information on how BlackRock monitors the quality of its clients’ trades’ execution, on BlackRock’s conflicts of interest and other matters, as they relate to the execution by BlackRock of its clients’ trades. -

LEVELIZED COST of STORAGE ANALYSIS — VERSION 6.0 Table of Contents

LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS — VERSION 6.0 Table of Contents I INTRODUCTION 1 II LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS V6.0 3 III ENERGY STORAGE VALUE SNAPSHOT ANALYSIS 7 IV PRELIMINARY VIEWS ON LONG-DURATION STORAGE 11 APPENDIX A Supplemental LCOS Analysis Materials 14 B Value Snapshot Case Studies 1 Value Snapshot Case Studies—U.S. 16 2 Value Snapshot Case Studies—International 23 C Supplemental Value Snapshot Analysis Materials 25 I Introduction I INTRODUCTION Introduction Lazard’s Levelized Cost of Storage (“LCOS”) analysis(1) addresses the following topics: Introduction A summary of key findings from Lazard’s LCOS v6.0 Lazard’s LCOS analysis Overview of the operational parameters of selected energy storage systems for each use case analyzed Comparative LCOS analysis for various energy storage systems on a $/kW-year and $/MWh basis Energy Storage Value Snapshot analysis Overview of the Value Snapshot analysis and identification of selected geographies for each use case analyzed Summary results from the Value Snapshot analysis A preliminary view of long-duration storage technologies Selected appendix materials Supplementary materials for Lazard’s LCOS analysis, including methodology and key assumptions employed Supporting materials for the Value Snapshot analysis, including pro forma results for the U.S. and International Value Snapshot case studies Supplementary materials for the Value Snapshot analysis, including additional informational regarding the revenue streams available to each use case Source: Lazard and Roland Berger. 1 Copyright 2020 Lazard (1) Lazard’s LCOS analysis is conducted with support from Enovation Analytics and Roland Berger. This study has been prepared by Lazard for general informational purposes only, and it is not intended to be, and should not be construed as, financial or other advice. -

Closed-End Strategy: Select Opportunity Portfolio 2021-2

Invesco Unit Trusts Closed-End Strategy: Select Opportunity Portfolio 2021-2 A specialty unit trust Trust specifi cs Objective Deposit information The Portfolio seeks to provide current income and the potential for capital appreciation. The Portfolio seeks Public offering price per unit1 $10.00 to achieve its objective by investing in a portfolio consisting of common stocks of closed-end investment 2 companies (known as “closed-end funds”) that invest in various global fixed income and equity securities. Minimum investment ($250 for IRAs) $1,000.00 As indicated by the information publicly available at the time of selection, none of the Portfolio’s closed-end Deposit date 04/07/21 funds employed “structured leverage”4. Termination date 04/05/23 † Distribution dates 25th day of each month Portfolio composition (As of the business day before deposit date) Record dates† 10th day of each month Covered Call High Yield Estimated initial distribution month† 05/21 BlackRock Enhanced Capital and Western Asset High Income Opportunity Term of trust Approximately 24 months Income Fund, Inc. CII Fund, Inc. HIO Historical 12 month distributions† $0.5793 BlackRock Enhanced Equity Dividend Trust BDJ Western Asset High Yield Defi ned Opportunity NLEV212 Sales charge and CUSIPs Columbia Seligman Premium Technology Fund, Inc. HYI Brokerage Growth Fund, Inc. STK Investment Grade Sales charge3 Eaton Vance Tax-Managed Global Diversifi ed Invesco Bond Fund VBF Deferred sales charge 2.25% Equity Income Fund EXG Sector Equity Creation and development fee 0.50% First Trust Enhanced Equity Income Fund FFA Blackrock Health Sciences Trust II BMEZ Total sales charge 2.75% Nuveen Dow 30sm Dynamic Overwrite Fund DIAX Last deferred sales charge payment date 04/10/22 BlackRock Science & Technology Trust II BSTZ Emerging Market Equity CUSIPs BlackRock Utilities, Infrastructure & Power Voya Emerging Markets High Dividend Cash 46148V-26-3 Opportunities Trust BUI Equity Fund IHD Reinvest 46148V-27-1 Tekla Healthcare Investors HQH Historical 12 month distribution rate† 5.79% Global Equity U.S. -

Stfx Enrolment Guide

my money @ work Start saving guide it’s time to save Welcome to my money @ work Millions of Canadians participate in workplace retirement and savings plans. Now, it’s your turn because it’s your money and your future. Saving at work helps you meet your financial goals whether you’re just starting your career, midway through it or close to retirement. And this guide has what you need to get started: practical savings information to help you save and enrol in the Improved Retirement Plan for Teaching, Administration & Other Employees of St. Francis Xavier University. Being part of the Sun Life Financial community has its advantages. From making the most of your workplace plan to helping you plan for your financial future, my money @ work and Sun Life Financial are here for you. To take advantage of your dedicated Sun Life Financial Customer Care Centre representative, call 1-866-733-8612 from 8 a.m. to 8 p.m. ET any business day. Service is available in more than 190 languages. Group Retirement Services are provided by Sun Life Assurance Company of Canada, 2 aSun member Life Financial of the Sun Life Financial group of companies. Three easy steps… 1 READ 4 my money @ work Why save now? My plan What’s in it for me? 2 INVEST 9 my investments A choice of investment approaches Diverse selection of investment options Investment risk profiler 3 ENROL 15 mysunlife.ca It’s action time! We’re with you World of information & tools FORMS 18 my money @ work 3 READ 4 Sun Life Financial my money @ work There is no better way to save for your future than through your plan @ work. -

Kevin Bonebrake Joins Lazard As a Managing Director in Oil and Gas Financial Advisory

KEVIN BONEBRAKE JOINS LAZARD AS A MANAGING DIRECTOR IN OIL AND GAS FINANCIAL ADVISORY NEW YORK, January 11, 2017 – Lazard Ltd (NYSE: LAZ) announced today that Kevin Bonebrake has joined the firm as a Managing Director, Financial Advisory, effective immediately. Based in Houston, he will advise companies in the oil and gas sector on mergers and acquisitions and other financial matters. “As the energy industry continues to undergo transformative change, Lazard has been advising clients on a growing number of both strategic transactions and restructuring assignments,” said Matt Lustig, head of North American Investment Banking at Lazard. “Kevin will be a strong addition to our Houston team and enhance our ability to advise our energy clients worldwide.” Mr. Bonebrake has more than 12 years of energy-sector advisory experience, with a focus on North American independent exploration & production companies, majors and national oil companies. He joins Lazard from Morgan Stanley, where he was most recently a Managing Director in the firm’s Global Natural Resources practice within the Investment Banking Division. Between 2003 and 2009 he worked for Salomon Smith Barney/Citigroup as a member of its Global Energy Investment Banking team. About Lazard Lazard, one of the world’s preeminent financial advisory and asset management firms, operates from 42 cities across 27 countries in North America, Europe, Asia, Australia, Central and South America. With origins dating to 1848, the firm provides advice on mergers and acquisitions, strategic matters, restructuring and capital structure, capital raising and corporate finance, as well as asset management services to corporations, partnerships, institutions, governments and individuals.