Align4growth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Rise of the Sharing Economy Impact on the Transportation Space

The rise of the sharing economy Impact on the transportation space In a world of shared assets, changing economics and customer preferences are increasingly driving transportation players not to go it alone. In only a few short years, the sharing economy has become gain a broader user base, pricing may become more a ubiquitous concept. As recently noted in the Wall Street transparent and assets more fungible between traditional Journal, “there’s an Uber for everything now,” ranging from market verticals. This could allow players to expand beyond Shyp, which uses a network of individual providers to pick their traditional lines of business to offer adjacent services, up, pack and ship items using their own cars, to Zeel, which without having to do it the old fashioned way: investing taps a network of independent licensed therapists to offer huge sums of capital to build capabilities and acquire customers same-day, in-home massages.1 While mobile companies. It seems the sharing economy has the power apps have facilitated this type of collaborative consumption, to bring not only customers but also competitors closer changing consumer preferences may be the biggest together. indicator that the sharing economy is here to stay. Younger Indeed, any industry could potentially benefit from, or people in particular embrace the core idea of eschewing be disrupted by, the rise of collaborative consumption and individual ownership, and its accompanying higher costs, in the proliferation of asset-sharing models. However, due favor of on-demand access to a flexible, lower-cost network to its natural fragmentation and asset intensity, the sharing of shared assets or service providers.2 And, these younger economy is especially relevant to core transportation consumers may have more and more networks to choose companies as well as to heavy users of transportation from as pure-play technology companies continue to enter services. -

In the United States District Court for the District of Connecticut

Case 3:15-cv-01550-JAM Document 120 Filed 06/27/17 Page 1 of 45 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF CONNECTICUT CARLOS TAVERAS, individually and on behalf of all others similarly situated, Plaintiff, C.A. No. 3:15-cv-01550-JAM v. XPO LAST MILE, INC. Defendant. XPO LAST MILE, INC. Third-Party Plaintiff, v. EXPEDITED TRANSPORT SERVICES, LLC. Third-Party Defendant. PLAINTIFF’S ASSENTED-TO MOTION FOR FINAL APPROVAL OF A CLASS ACTION SETTLEMENT Plaintiff filed this lawsuit on behalf of himself and a class of similarly situated delivery drivers who performed delivery services for Defendant XPO Last Mile, Inc. in Connecticut pursuant to standard contracts under which they were classified as independent contractors. Plaintiff alleges that XPO’s delivery contractors were actually employees, and based on this misclassification, XPO’s practice of making deductions from its delivery drivers’ pay for such things as damage claims and worker’s compensation violates the Connecticut wage payments laws. Conn. Gen. Stat. Sec. 31-71e. The parties have reached a non-reversionary class action settlement for $950,000. 1 Case 3:15-cv-01550-JAM Document 120 Filed 06/27/17 Page 2 of 45 On March 17, 2017, the Court granted preliminary approval of the proposed settlement, certified a class of individuals who performed delivery services for Defendant XPO Last Mile, Inc. in Connecticut pursuant to contracts that class them as independent contractors, and authorized notice to the class. ECF No. 115. Plaintiff now seeks the Court’s final approval of the proposed class action settlement at the final settlement approval hearing scheduled for July 7, 2017. -

Proposal Educational School Supplies

Solicitation 19-05 REQUEST FOR PROPOSAL EDUCATIONAL SCHOOL SUPPLIES Proposal Office Depot Proposal Region 4 ESC Solicitation 19-05 for Educational School Supplies Texas Regional Print Facility 2230 North Highway 360 Grand Prairie, TX 75050 Our dedicated team of Texas-based print professionals is proud to prepare this proposal to Region 4 ESC’s Evaluation Team for review. Educational School Supplies 19‐05 January 22, 2019 Region 4 Education Service Center 7145 West Tidwell Road Houston, TX 77095 Dear Region 4 ESC Review Committee: We appreciate the opportunity to present you with our comprehensive proposal to Solicitation 19‐05 for Educational School Supplies. Our team has prepared a complete package that will demonstrate our capabilities to provide School Supplies to Region 4 ESC & participating public agencies with unparalleled service, expertise, and unprecedented value and savings. Our team believes our RFP response demonstrates our passion for your business, our enthusiasm to understand and exceed your expectations, and our desire to present a sustainable offer that will allow for the success and growth of all parties. New contract innovations include: Expanded Educational Solutions & Capabilities Increased School Core list by over 1000 items from our current contract offering Innovation pricing strategies to align with the shift in public procurement trends Customizable Core list capabilities for meaningful added values Enhanced Rebate Incentives For more than 30 years Office Depot has been committed to our customers by providing best‐in‐class products and services. Our collective team is dedicated and aligned to the success of Region 4 ESC and all the agencies associated with this contract. -

April 4–5 2019 Pennsylvania Convention Center, Philadelphia

6th Annual April 4–5 2019 Pennsylvania Convention Center, Philadelphia CO-LOCATED WITH FREE EXHIBITION TITLE SPONSORS OPENING TIMES THURSDAY APRIL 4 8:00 AM – 5:00 PM FRIDAY APRIL 5 8:00 AM – 2:00 PM ORGANISED BY REGISTER FREE www.terrapinn.com/homedelivery WELCOME 2 3 CONTENTS All-access vs Free Expo ......................... Page 4 Featured speakers .................................... Page 8 Home Delivery World 2019 All 325+ speakers ..................................... Page 10 Agenda highlights ................................... Page 18 Home Delivery World will gather 2,500 attendees representing retailers, grocers, distributors, manufacturers, city executives, supply chain professionals and carriers. Conference Agenda .................................. Page 32 Pre-conference Workshop ........................ Page 42 Our expo floor features seminar theaters covering 260+ topic areas including last mile Free Expo .................................................... Page 44 & returns, grocery eCommerce, cannabis eCommerce, city mobility, urban logistics, driver safety, freight planning, real estate site selection, transportation and more. Free Expo Highlights ................................. Page 46 Featured Seminar speakers ...................... Page 48 In partnership with Plug & Play Tech Center, we are bringing exciting new startups into Last Mile & Returns the spotlight. Frayt Technologies, Veho, 5 String Logistics, Ladingo, BoxLock, Nauto, Seminar Theater ........................................ Page 50 Truckblox and more, -

Wall Street Journal Article

Amazon, in Threat to UPS, Tries Its Own Deliveries; An Alternative to Shippers Like FedEx and UPS, New Service Could Deliver Goods the Same Day as Purchased Bensinger, Greg . Wall Street Journal (Online) ; New York, N.Y. [New York, N.Y]24 Apr 2014: n/a. ProQuest document link ABSTRACT The move is a shot across the bow of United Parcel Service Inc., FedEx Corp. and the U.S. Postal Service, which now deliver the majority of Amazon packages. Customer-service representatives and former employees say those codes designate Amazon's in-house delivery network. FULL TEXT The future of Amazon.com Inc. is hiding in plain sight in a San Francisco parking lot. Adjacent to recently closed Candlestick Park, Amazon is testing its own delivery network for the "last mile," the final leg of a package's journey to consumers' doorsteps. Trucks loaded with Amazon packages and driven by Amazon-supervised contractors leave for addresses around San Francisco. Similar efforts are under way in Los Angeles and New York. Delivering its own packages will give Amazon, stung by Christmas shipping delays, more control over the shopping experience. It can also help contain shipping expenses, which have grown as a percentage of sales each year since 2009, according to securities filings. On Thursday, Amazon reported another quarter of skimpy profit even as sales increased 23% to $19.74 billion. Shipping costs rose 31%, and it also spent on cloud computing and new initiatives. The company reported a first- quarter profit of $108 million, compared with $82 million a year earlier. -

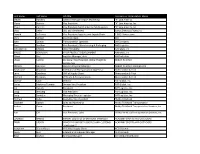

2020 Top 100 For-Hire Carriers Is an Annual Publication Produced by Transport Topics, with Assistance from SJ Consulting Group

COVID-19 Pandemic Muddles Outlook For Top 100 For-Hire Carriers he COVID-19 pandemic has transformed 2020 into a chal- Indianapolis, had ranked No. 38 a year ago. lenging and unprecedented year for the trucking industry. Meanwhile, familiar names continue to dominate the top of the T Freight networks faced major disruptions as businesses tem- 2020 list of North America’s largest for-hire carriers. Parcel giant porarily closed and people stayed home to help contain the spread of UPS Inc. remains firmly entrenched at No. 1, followed closely by the virus, bringing much of the economy to a standstill. rival FedEx Corp. Schneider, meanwhile, cracked the top 5 by edging past YRC Worldwide and Knight-Swift Transportation Holdings. Further down the list, several other carriers made notable jumps. Day & Ross Transportation Group, based in Hartland, New Bruns- Seth Clevenger wick, climbed to No. 37, from No. 46 a year ago. The Canadian car- rier ex panded its dedicated operations in the United States through Managing Editor, Features its April 2019 acquisition of A&S Kinard and Buckler Transport. Refrigerated carrier John Christner Trucking also continued its ascent. The Sapulpa, Okla.-based company’s ranking increased this year to No. 83, from No. 89 a year ago and No. 99 in 2018. Another big mover was Challenger Group, based in Cambridge, This public health crisis has forced North America’s largest for-hire Ontario. The company rose to No. 84, from No. 95 last year, as rev- carriers to adjust their operations while implementing safety mea- enue increased 17.5%. -

First Name Last Name Job Title Company Or Organization Name

First name Last name Job title Company or Organization Name Steven Hawkins General Manager Import Marketing "K" Line America Maria Bodnar Vice President "K" Line America, Inc. Shaun Gannon Vice President North America Field Logistics "K" Line America, Inc. Chas Deller CEO and CHAIRMAN 10XOCEANSOLUTIONS,INC Donald La France Vice President Logistics and Supply Chain 1-800-Flowers.com Chris McNeil Sourcing Agent 3M John Ladwig Transportation Specialist 3M Company Russ Boullion Vice President - Warehousing & Packaging A&R Logistics XIANGMING CHENG CEO/ PRESIDENT AAmetals, Inc BRUCE FERGUSON VP OF PRODUCT DEVELOPMENT AAmetals, Inc Eileen Wei Logistics Manager, Asia AB Electrolux Ulises Carrillo Divisional Vice President, Global Freight & Abbott Nutrition Distribution William Gaiennie Logistics Program Manager Abbott Nutrition International Sarah Jane Chapman International Transportation Supervisor Abercrombie & Fitch Larry Grischow GVP of Supply Chain Abercrombie & Fitch Michael Sherman VP Trade & Transportation Abercrombie & Fitch Gunnar Gose Director ABF Global, Inc. Carlos Martinez-Tomatis Division Vice President ABF Global, Inc. Jim Ingram President ABF Logistics, Inc. Doug Riesberg Vice President ABF Logistics, Inc. Craig Sandefur Managing Director Logistics ABF Logistics, Inc. Michael Kelso Executive Vice President Ability Tri-Modal Elizabeth Gaston Sales and Marketing Ability Tri-Modal Transportation Joshua Owen President Ability Tri-Modal Transportation Services, Inc. Ron Gill Vice President, Sales Ability/Tri-Modal Transportation Services, -

Blue-Grace Franchise LLC 2846 S. Falkenburg Rd. Riverview, FL 33578 Tel: (800) 697-4477 Website

Blue-Grace Franchise LLC 2846 S. Falkenburg Rd. Riverview, FL 33578 Tel: (800) 697-4477 Website: www.mybluegrace.com FRANCHISE DISCLOSURE DOCUMENT Blue-Grace Franchise LLC 2846 S. Falkenburg Rd. Riverview, FL 33578 Tel: (800) 697-4477 Website: www.mybluegrace.com The franchise offered is for the operation of a Blue-Grace® Logistics business providing freight and specialized freight transportation and shipping services. Franchisees may, under certain circumstances, be given the option to provide parcel transportation and shipping services through their Blue-Grace® Logistics business. Franchisees will be authorized to sell freight and parcel (if available) transportation and shipping services to businesses and individuals. The franchise includes the right to use the Blue-Grace® Logistics trademarks, trade dress and operating system. The total investment necessary to begin operation of a Blue-Grace® Logistics business is between $75,000.00 to $156,250.00. This includes $57,500.00 that must be paid to us or an affiliate. This Franchise Disclosure Document summarizes certain provisions of your Franchise Agreement and other information in plain English. Read this Franchise Disclosure Document and all accompanying agreements carefully. You must receive this Franchise Disclosure Document at least 14 calendar days before you sign a binding agreement with, or make any payment to, the franchisor or an affiliate in connection with the proposed franchise sale. Note, however, that no government agency has verified the information contained in this document. You may wish to receive your Franchise Disclosure Document in another format that is more convenient to you. To discuss the availability of disclosures in different forms, contact Blue-Grace® Logistics’ franchise group by mail at 2846 S. -

Echo Global Logistics Vs. Groupon Hype

Disclaimer This research presentation expresses our research opinions, which we have based upon interpretation of certain facts and observations, all of which are based upon publicly available information, and all of which are set out in this research presentation report. Any investment involves substantial risks, including complete loss of capital. Any forecasts or estimates are for illustrative purpose only and should not be taken as limitations of the maximum possible loss or gain. Any information contained in this report may include forward looking statements, expectations, pro forma analyses, estimates, and projections. You should assume these types of statements, expectations, pro forma analyses, estimates, and projections may turn out to be incorrect for reasons beyond Spruce Point Capital Management LLC’s control. This is not investment or accounting advice nor should it be construed as such. Use of Spruce Point Capital Management LLC’s research is at your own risk. You should do your own research and due diligence before making any investment decision with respect to securities covered herein. All figures assumed to be in US Dollars, unless specified otherwise. You should assume that as of the publication date of any presentation, report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our subscribers and clients has a short position in all stocks (and/or are long puts/short call options of the stock) covered herein, including without limitation Echo Global Logistics, Inc. (“ECHO”), and therefore stand to realize significant gains in the event that the price of its stock declines. -

Logistics & Distribution

Logistics & Distribution Mecklenburg County Red Classic_Charlotte Chamber of Commerce Ad_FINAL.pdf 1 8/18/15 10:54 AM C M Y CM MY CY CMY K Red Classic_Charlotte Chamber of Commerce Ad_FINAL.pdf 1 8/18/15 10:54 AM Charlotte’s Market Accessibility Charlotte’s central East Coast location and excellent With all of the support services available, Charlotte provides transportation network provide businesses with a strategic a top-of-the-line connection for moving products and advantage in receiving and shipping goods and services. materials efficiently and conveniently throughout the world. Fifty-eight per cent of the United States population is east Evidence of Charlotte’s significance as a distribution center of the Mississippi River, putting Charlotte within one to can be seen in the more than $17 billion wholesale sales two days shipping time of over half of the country’s major recorded here annually. Factor in the continuing trend of metropolitan markets. Fifty-five of the United States’ top population migration to the Sunbelt states, Charlotte’s position metropolitan areas and 170 million U.S. and Canadian as a distribution center location will only grow stronger in the consumers lie within 650 miles of Charlotte. years to come. Boston Milwaukee Buffalo C Detroit New York M Pittsburgh Chicago Cleveland Philadelphia Y Baltimore CM Columbus Indianapolis MY Washington, D.C. Kansas City Cincinnati CY CMY K St. Louis Charlotte 100 200 Atlanta 300 400 500 600 Population Comparison 650 Mile Radius Pop. (mil.) % of U.S. Tampa Charlotte 167.1 53% Atlanta 149.3 46% Miami (652 miles from New York 121.5 38% Charlotte) Total U.S. -

Transportation Providers of 2017

Logistics Management’s TOP FREIGHT TRANSPORTATION PROVIDERS OF 2017 With the complex economic and global trade environment, logistics professionals are under more pressure than ever to secure the right carriers and transportation service providers— while squeezing as much value as possible out of their transportation network. ® Logistics Management’s TOP FREIGHT TRANSPORTATION welcome PROVIDERS OF 2017 2017 Top Providers: Time to put the best contents to work The U.S. economy Trucking Top 50: Reinventing the fundamentals 4 has taken a step A new breed of leadership is creating a long-term vision to earn strategic forward, capac- relationships with shippers. Solid day-to-day execution and aggressive ity is tightening investment in technology set the direction for trucking’s new guard. across the modes, and the outlook is generally positive Top 30 U.S. Ports: Preparing for the uncertain 11 for growing freight The advent of new carrier alliances and “big ship readiness” will determine volumes through which of the top ports gain share and supply chain advantages. Meanwhile, 2023. Now, more than ever before, savvy logistics managers must hedge their bets to mitigate risk and avoid reliance shippers need to fine-tune the management on a handful of key gateways. of their logistics operations and gain a firmer grasp of rate and capacity levels to keep their supply chains and budgets in balance. 2017 Top 50 U.S. and Global 3PLs 16 To be successful in that endeavor, U.S. shippers must now keep carrier and logis- The trend set over the past few years for mergers and acquisitions has tics service provider relationships top of hardly subsided, and a fresh injection of equity investment is transforming mind. -

Raising BALANCING the Bar WORK & LIFE

Edition 3 | 2019 INSIDE... Raising BALANCING the Bar WORK & LIFE How to be a SHIPPER OF CHOICE MARKETING TO WOMEN Innovative Truck 2019 TECHNOLOGIES TOP COMPANIES UNCONSCIOUS BIAS PHOTO CONTEST WINNERS Accelerate! Recap At United Road, what makes us different makes us better. As the nation’s premier car-hauling expert, we transport over three million vehicles throughout North America each and every year. And what makes us the best, besides Carhaul Acquisition Expands Our Fleet Size Teamwork, New Investments In Equipment And Our North American Footprintour leading edge technology, industry-best capacity,Will andProduce Significant Positive Impacts Kathleen McCann, CEO Pat Riley, Senior Vice President diverse service offerings? Welcome to our newest team members! This edition of On the Road Our recent Over the coming months, you will see the was intentionally delayed because we wantedOUR to wait and PEOPLE. share this acquisition of transfer of truck equipment that is better suited to good news with you: United Road has completed its acquisition of the The Waggoners conduct the business that it was designed to do, carhaul divisionWe of Theinvite Waggoners you toTrucking learn Co. more We are soabout excited tothe women and men Trucking auto resulting in improved productivity and efficiency. welcome such a great group of professionals to our team! transport busi- Day cab quick loaders and high rail units will 2 3 Althoughthat this has make previously the been wheels communicated of United in various Roadways turn. ness expands work in rail ramp and regional locations where they over the last few weeks, it may be helpful to share the highlights of our United Road’s are best suited.