October 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

First Name Last Name Job Title Company Or Organization Name

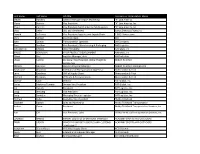

First name Last name Job title Company or Organization Name Steven Hawkins General Manager Import Marketing "K" Line America Maria Bodnar Vice President "K" Line America, Inc. Shaun Gannon Vice President North America Field Logistics "K" Line America, Inc. Chas Deller CEO and CHAIRMAN 10XOCEANSOLUTIONS,INC Donald La France Vice President Logistics and Supply Chain 1-800-Flowers.com Chris McNeil Sourcing Agent 3M John Ladwig Transportation Specialist 3M Company Russ Boullion Vice President - Warehousing & Packaging A&R Logistics XIANGMING CHENG CEO/ PRESIDENT AAmetals, Inc BRUCE FERGUSON VP OF PRODUCT DEVELOPMENT AAmetals, Inc Eileen Wei Logistics Manager, Asia AB Electrolux Ulises Carrillo Divisional Vice President, Global Freight & Abbott Nutrition Distribution William Gaiennie Logistics Program Manager Abbott Nutrition International Sarah Jane Chapman International Transportation Supervisor Abercrombie & Fitch Larry Grischow GVP of Supply Chain Abercrombie & Fitch Michael Sherman VP Trade & Transportation Abercrombie & Fitch Gunnar Gose Director ABF Global, Inc. Carlos Martinez-Tomatis Division Vice President ABF Global, Inc. Jim Ingram President ABF Logistics, Inc. Doug Riesberg Vice President ABF Logistics, Inc. Craig Sandefur Managing Director Logistics ABF Logistics, Inc. Michael Kelso Executive Vice President Ability Tri-Modal Elizabeth Gaston Sales and Marketing Ability Tri-Modal Transportation Joshua Owen President Ability Tri-Modal Transportation Services, Inc. Ron Gill Vice President, Sales Ability/Tri-Modal Transportation Services, -

Logistics & Distribution

Logistics & Distribution Mecklenburg County Red Classic_Charlotte Chamber of Commerce Ad_FINAL.pdf 1 8/18/15 10:54 AM C M Y CM MY CY CMY K Red Classic_Charlotte Chamber of Commerce Ad_FINAL.pdf 1 8/18/15 10:54 AM Charlotte’s Market Accessibility Charlotte’s central East Coast location and excellent With all of the support services available, Charlotte provides transportation network provide businesses with a strategic a top-of-the-line connection for moving products and advantage in receiving and shipping goods and services. materials efficiently and conveniently throughout the world. Fifty-eight per cent of the United States population is east Evidence of Charlotte’s significance as a distribution center of the Mississippi River, putting Charlotte within one to can be seen in the more than $17 billion wholesale sales two days shipping time of over half of the country’s major recorded here annually. Factor in the continuing trend of metropolitan markets. Fifty-five of the United States’ top population migration to the Sunbelt states, Charlotte’s position metropolitan areas and 170 million U.S. and Canadian as a distribution center location will only grow stronger in the consumers lie within 650 miles of Charlotte. years to come. Boston Milwaukee Buffalo C Detroit New York M Pittsburgh Chicago Cleveland Philadelphia Y Baltimore CM Columbus Indianapolis MY Washington, D.C. Kansas City Cincinnati CY CMY K St. Louis Charlotte 100 200 Atlanta 300 400 500 600 Population Comparison 650 Mile Radius Pop. (mil.) % of U.S. Tampa Charlotte 167.1 53% Atlanta 149.3 46% Miami (652 miles from New York 121.5 38% Charlotte) Total U.S. -

Transportation Providers of 2017

Logistics Management’s TOP FREIGHT TRANSPORTATION PROVIDERS OF 2017 With the complex economic and global trade environment, logistics professionals are under more pressure than ever to secure the right carriers and transportation service providers— while squeezing as much value as possible out of their transportation network. ® Logistics Management’s TOP FREIGHT TRANSPORTATION welcome PROVIDERS OF 2017 2017 Top Providers: Time to put the best contents to work The U.S. economy Trucking Top 50: Reinventing the fundamentals 4 has taken a step A new breed of leadership is creating a long-term vision to earn strategic forward, capac- relationships with shippers. Solid day-to-day execution and aggressive ity is tightening investment in technology set the direction for trucking’s new guard. across the modes, and the outlook is generally positive Top 30 U.S. Ports: Preparing for the uncertain 11 for growing freight The advent of new carrier alliances and “big ship readiness” will determine volumes through which of the top ports gain share and supply chain advantages. Meanwhile, 2023. Now, more than ever before, savvy logistics managers must hedge their bets to mitigate risk and avoid reliance shippers need to fine-tune the management on a handful of key gateways. of their logistics operations and gain a firmer grasp of rate and capacity levels to keep their supply chains and budgets in balance. 2017 Top 50 U.S. and Global 3PLs 16 To be successful in that endeavor, U.S. shippers must now keep carrier and logis- The trend set over the past few years for mergers and acquisitions has tics service provider relationships top of hardly subsided, and a fresh injection of equity investment is transforming mind. -

APRIL 2009 Choose the Only Push to Talk That Comes with the Network

SPECIALSECTION WEB_CITE CITY comprehensive Transport & Logistics WEb Directory www.inboundlogistics.com THEMAGAZINEFORDEMAND-DRIVENLOGISTICS•APRIL2009 Choose The Only Push To Talk That Comes With The Network. Make your business instantly more productive by choosing the only Push to Talk service that comes with the Verizon Wireless Network and its reliable voice service. Plus, get coast-to-coast coverage and 24/7 customer service. Verizon Wireless. The smart choice for Push to Talk. Push to Talk is available only with other VZW Push to Talk subscribers; coverage not available everywhere. ©2009 Verizon Wireless. Let Verizon Wireless make your job easier and business more productive. Call 1.800.VZW.4BIZ Click verizonwireless.com/pushtotalk Visit a Verizon Wireless store INTEN RNALL COLLABABORATION page 488 THE MAGAZINE FOR DEMAND DRIVEN LOGISTICS April 2009 • Vol. 29 • No. 4 INSIGHT INPRACTICE 6 CHECKING IN SaaS: A distribution model for READER PROFILE Mike Segal: The Paper Chase tough times? Mike Segal, director of logistics at Sappi Fine Paper North America, 8 DIALOG always keeps one eye on the weather. When you ship paper, water Readers talk back. damage is a constant concern. From his offi ce in Portland, Maine, Segal 14 HOW TO CLOSE THE oversees transportation and warehousing in a network that also includes SUPPLY CHAIN VALUE GAP fi ve regional distribution centers and several smaller facilities. KnowledgeBase sponsored by Panalpina USA, Inc. CASEBOOK GoodSource Finds Instant Gratifi cation 24 IT MATTERS Carlsbad, Calif.-based third-party food distributor GoodSource Solutions’ How e-commerce retailers can build consumer loyalty. new technology serves up its broker’s freshest rate quotes, without the need for phone calls or emails. -

The E-Commerce Logistics Revolution

The e-commerce logistics revolution The technology and processes that are revolutionizing logistics and supply chain operations are helping today’s organizations keep pace with digital commerce. ® When it comes to eCommerce Fulfillment, Bigger is not always better. Who Wins? The giant logistics elephant, or the dynamic supply chain lion that is innovative and fast moving, with expertise to drive cost-to-serve in complex supply chain environments? BE BOLD. CHOOSE THE LION. Learn how LEGACY can add value to your dynamic supply chain LEGACYscs.com The e-commerce welcome logistics revolution E-commerce: Changing the logistics game It’s a vast under- contents statement to say Major modes join e-commerce mix 4 that e-commerce While last mile carriers receive much of the attention, the traditional modal heavyweights has changed the are in charge of connecting the growing web of facilities that enable e-commerce. Today, way the logistics all modes as well as freight intermediaries must be poised for growth and flexible enough to keep evolving. and supply chain game is played. Battle for the last mile 10 In fact, it’s much Established carriers and logistics services providers are clashing with tech-savvy safer to say that the world of digital com- newcomers to gain market share in this critical, final piece in the e-commerce puzzle. merce has introduced more risk and com- Parcel Express Roundtable: plexity than logistics and supply chain professionals have ever faced. Paying for peak performance 14 From rapid order intake to omni-chan- Our panel provides an update on all the market shifts in store for parcel shippers— especially when it comes to pricing, service and managing an e-commerce-centric nel order fulfillment to establishing the supply chain. -

SPONSORSHIP OPPORTUNITIES 1 2019 SPONSOR OPPORTUNITIES | Transportation Marketing and Sales Association

2019 SPONSOR OPPORTUNITIES | Transportation Marketing and Sales Association Demonstrate Your Leadership. Build Your Business. Knowledge. Connections. Recognition. Solutions. 2019SPONSORSHIP OPPORTUNITIES 1 2019 SPONSOR OPPORTUNITIES | Transportation Marketing and Sales Association Enhance Your Visibility, Reputation Our TMSA 2019 Conference Theme: Customer Experience (CX) Through TMSA According to Jeff Davis, founder of Jd2 Consulting and TMSA’s 2018 The Transportation Marketing & Sales Association is the Conference Keynote, 2020 will be year that Customer Experience (CX) only association serving marketing, communications and overtakes price and product as key brand differentiators. sales executives in all market segments in transportation Consider these startling facts about today’s typical CX in the B2B world: and logistics. Through TMSA, members grow professionally, • Organizations recognize the need to take action regarding CX. Yet, expand their industry networks, and gain education on new 75% of B2B organizations engage in isolated, bottom-up initiatives, trends and issues. often with little data other than an innate sense that something is Companies involved with TMSA generate over $500 billion in not quite working and needs to be fixed (Source: Gartner) revenue and invest sizeable sales and marketing budgets to • Although most B2B companies realize that CX is important, fewer maintain and grow their revenue. than a quarter of companies actually emphasize it. (Source: Forbes) Through your membership and sponsorship, you’ll build • 80% of B2B executives believe that offering outstanding CX is directly relationships with leaders and qualified decision-makers of connected to generating better business results and ensuring the this unique marketplace — in part at our 2019 Marketing company has a competitive advantage. -

Align4growth

2018 SPONSORDemonstrate OPPORTUNITIES | Transportation Your Marketing Leadership. and Sales Association Build Your Business. ALIGN4GROWTH Knowledge. Connections. Recognition. Solutions. 2018SPONSORSHIP OPPORTUNITIES 1 2018 SPONSOR OPPORTUNITIES | Transportation Marketing and Sales Association Enhance Your Visibility, Reputation STRATEGY Through TMSA The Transportation Marketing & Sales Association is the Targeting Metrics & Goals Buyer Connection Compensation only association serving marketing, communications and SALES Content in Context Forecasting sales executives in all market segments in transportation and logistics. Through TMSA, members grow professionally, Messaging Buyer Personas MARKETING Content Lead Generation expand their industry networks, and gain education on new Metrics & ROI Product Development trends and issues. Execution Customer Voice OPERATIONS Communication S&OP Companies involved with TMSA generate over $500 billion in Account Mgmt. Incentives revenue and invest sizeable sales and marketing budgets to maintain and grow their revenue. ALIGN4GROWTH Through your membership and sponsorship, you’ll build relationships with leaders and qualified decision-makers of WHY OUR CONFERENCE THEME IS SO RELEVANT this unique marketplace — in part at our 2018 Marketing Everyone wants to sustainably grow profit and revenue, but there is a & Sales Conference in Ft. Myers, Florida June 10-12. critical element missing in most companies: Alignment. Organizational alignment between departments and associates reduces friction and accelerates an organization’s growth and success. Alignment of your 2017 PREMIER SPONSORS company’s value proposition and capabilities with your customers’ needs is essential as well. MEMBER FEEDBACK FROM THE 2017 CONFERENCE (40% of attendees responded): • 48% are likely to buy from a TMSA exhibitor or sponsor within 12 months. • 98.6% said the conference fulfilled their reason for attending.