The E-Commerce Logistics Revolution

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Rise of the Sharing Economy Impact on the Transportation Space

The rise of the sharing economy Impact on the transportation space In a world of shared assets, changing economics and customer preferences are increasingly driving transportation players not to go it alone. In only a few short years, the sharing economy has become gain a broader user base, pricing may become more a ubiquitous concept. As recently noted in the Wall Street transparent and assets more fungible between traditional Journal, “there’s an Uber for everything now,” ranging from market verticals. This could allow players to expand beyond Shyp, which uses a network of individual providers to pick their traditional lines of business to offer adjacent services, up, pack and ship items using their own cars, to Zeel, which without having to do it the old fashioned way: investing taps a network of independent licensed therapists to offer huge sums of capital to build capabilities and acquire customers same-day, in-home massages.1 While mobile companies. It seems the sharing economy has the power apps have facilitated this type of collaborative consumption, to bring not only customers but also competitors closer changing consumer preferences may be the biggest together. indicator that the sharing economy is here to stay. Younger Indeed, any industry could potentially benefit from, or people in particular embrace the core idea of eschewing be disrupted by, the rise of collaborative consumption and individual ownership, and its accompanying higher costs, in the proliferation of asset-sharing models. However, due favor of on-demand access to a flexible, lower-cost network to its natural fragmentation and asset intensity, the sharing of shared assets or service providers.2 And, these younger economy is especially relevant to core transportation consumers may have more and more networks to choose companies as well as to heavy users of transportation from as pure-play technology companies continue to enter services. -

Alibaba: Entrepreneurial Growth and Global Expansion in B2B/B2C Markets

JIntEntrep DOI 10.1007/s10843-017-0207-2 Alibaba: Entrepreneurial growth and global expansion in B2B/B2C markets Syed Tariq Anwar 1 # Springer Science+Business Media, LLC 2017 Abstract The purpose of this case-based research is to analyze and discuss Alibaba Group (hereafter Alibaba) and its entrepreneurial growth and global expansion in B2B/ B2C markets. The paper uses company and industry-specific data and surveys to analyze a fast growing Chinese B2B/B2C firm and its internationalization and expan- sion in global markets. Findings of the work reveal that in a short time, Alibaba has become a major entrepreneurial icon and global player and continues to grow world- wide because of its well-planned business initiatives and B2B/B2C-based business models. The paper also provides implications in the area of international entrepreneur- ship and its related areas. International entrepreneurs need to learn from Alibaba’sfast growing business model and dynamic growth because of its competitive platforms and Web-based strategies which helped the company to target small and medium-sized enterprises (SMEs) in global markets. Within the areas of international entrepreneurship and international business, the paper also provides discussion which deals with the changing e-commerce industry and its future growth and developments. El objetivo de esta investigación basada en casos de negocios es analizar y discutir el Grupo Alibaba (de aquí en adelante Alibaba) y su crecimiento empresarial y la expansión global en mercados de B2B/B2C. El ensayo utiliza estadísticas y encuestas específicas a la compañía e industria para analizar una empresa china B2B/B2C y su internalización y expansión en los mercados globales. -

New Order, New Opportunities on the Rise Page 28

logisticsmgmt.com ERP vs. best-of-breed 44 Expanding into emerging markets 48 Lift Trucks: Financing for July 2013 ® fl exibility 52 2013 STATE OF LOGISTICS New order, new opportunities on the rise Page 28 SPECIAL REPORT: Panama Canal expansion update 68S IT’S 10 O’CLOCK. DO YOU KNOW WHAT YOUR LIFT TRUCK IS DOING? iWAREHOUSE knows. For everything from compliance to warehouse optimization, your operations run smarter with iWAREHOUSE by Raymond®. As the industry’s most comprehensive fleet and warehouse optimization system, iWAREHOUSE automates truck and operator data-capturing. That means you get better productivity, less downtime and increased ROI. And, at the end of the day, a smarter warehouse. Run Better. Manage Smarter. Find out how at raymondcorp.com/iwarehouse. by Raymond Get your daily fix of industry news on logisticsmgmt.com management UPDATE AN EXECUTIVE SUMMARY OF INDUSTRY NEWS USPS remains committed to reducing topped the 1.0 mark since May 2010, when ship- financial burden. In a Webcast last month, ments moved above the 1.0 mark for the first United States Postal Service (USPS) Chief Finan- time since November 2008. And freight expen- cial Officer and Executive Vice President Joseph ditures at 2.383 were down 2.6 percent annually Corbett explained that the service’s financial and up 0.04 percent compared to April. The Cass outlook has “created a crisis of confidence” in Freight Index report observed how these mixed the eyes of the marketplace. He added that the results are an accurate reflection of the ongo- USPS “needs to, as -

Measuring Algorithms in Online Marketplaces

Measuring Algorithms in Online Marketplaces A Dissertation Presented by Le Chen to The College of Computer and Information Science in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Computer Science Northeastern University Boston, Massachusetts May 2017 Dedicated to my courageous and lovely wife. i Contents List of Figures v List of Tables viii Acknowledgments x Abstract of the Dissertation xi 1 Introduction 1 1.1 Uber . 2 1.2 Amazon Marketplace . 4 1.3 Hiring Sites . 7 1.4 Outline . 9 2 Related Work 10 2.1 Online Marketplaces . 10 2.1.1 Price Competition . 10 2.1.2 Fraud and Privacy . 11 2.2 Hiring Discrimination . 11 2.2.1 The Importance of Rank . 12 2.3 Auditing Algorithms . 13 2.3.1 Filter Bubbles . 13 2.3.2 Price Discrimination . 14 2.3.3 Gender and Racial Discrimination . 14 2.3.4 Privacy and Transparency . 15 3 Uber’s Surge Pricing Algorithm 16 3.1 Background . 16 3.2 Methodology . 18 3.2.1 Selecting Locations . 19 3.2.2 The Uber API . 19 3.2.3 Collecting Data from the Uber App . 19 3.2.4 Calibration . 22 3.2.5 Validation . 24 ii 3.3 Analysis . 25 3.3.1 Data Collection and Cleaning . 26 3.3.2 Dynamics Over Time . 27 3.3.3 Spatial Dynamics and EWT . 29 3.4 Surge Pricing . 30 3.4.1 The Cost of Surges . 31 3.4.2 Surge Duration and Updates . 32 3.4.3 Surge Areas . 33 3.4.4 Algorithm Features and Forecasting . -

The Investment Case for Online Retail

The Investment Case for Online Retail Executive Summary Online retail has permanently disrupted the traditional brick-and-mortar store retail landscape as “clicks” have replaced “bricks.” According to research firm eMarketer, global ecommerce is expected to approach $5 trillion this year1, as online retailers have had fertile ground to grow their business in this new era of contactless shopping. In the United States, ecommerce sales grew to $795 billion in 2020, a 32.4% increase over 2019, versus previous forecasts of 18% growth.2 The global coronavirus pandemic has accelerated the pace of ecommerce growth in 2020, propelling online sales to levels not previously expected until 2022—helping existing online retailers expand their dominance in retail. Value-added features such as competitive pricing, shopping convenience, greater product selection and rapid delivery options have solidified online commerce as a disruptive technology that is here to stay. Ever-increasing internet and mobile penetration is one of the key drivers contributing to this growth, enabling more consumers to shop online anywhere and anytime. New technological innovations in electronic payment, rapid delivery, artificial intelligence and voice-assisted shopping, as well as virtual and augmented reality continue to enhance the online shopping experience, further driving the expansion and growth of this investment theme. Additionally, due to the pandemic in 2020, digital commerce added new shoppers that had not previously shopped online, fueling new buying habits such as online grocery, which grew 43%.3 This trend has accelerated traditional retail’s woes, with 30 U.S. retailers having filed for bankruptcy in 2020, on the heels of 17 major retailer bankruptcies in 2019, pre-pandemic.4 Amid this marketplace evolution, online retail has become a transformational and dominant force in global retail. -

Request for Proposals For

REQUEST FOR PROPOSALS FOR: Online Marketplace Pilot Proposal Due: Monday, April 1, 2019 Due to: Aptim Government Solutions, LLC Wisconsin’s Focus on Energy Program Administrator Issued: March 1, 2019 Online Marketplace Pilot RFP Table of Contents Definitions ..................................................................................................................................................... 1 1. RFP Summary Information .................................................................................................................... 6 2. Proposal Checklist ................................................................................................................................. 7 3. Overview of Focus on Energy ................................................................................................................ 8 3.1. Governance Structure of Focus on Energy ................................................................................... 8 4. Program Information ............................................................................................................................ 9 4.1. Program Summary ........................................................................................................................ 9 4.2. Eligible Program Areas and Program Elements to Consider ......................................................... 9 4.2.1. Program Design ..................................................................................................................... 9 4.3. Program Priorities -

E-COMMERCE LOGISTICS in the UNITED STATES Domestic and International Transportation, Warehousing and Fulfillment, Last-Mile Delivery, and Reverse Logistics

E-COMMERCE LOGISTICS IN THE UNITED STATES Domestic and International Transportation, Warehousing and Fulfillment, Last-Mile Delivery, and Reverse Logistics April 2018 Phone: +1-800-525-3915 Website: www.3PLogistics.com Email: [email protected] ABOUT ARMSTRONG & ASSOCIATES, INC. Armstrong & Associates, Inc. (A&A) was established in 1980 to meet the needs of a newly deregulated domestic transportation market. Since then, through its leading third-party logistics (3PL) market research and history of helping companies outsource logistics functions, A&A has become an internationally recognized key information resource for 3PL market research and consulting. A&A’s mission is to have leading proprietary supply chain knowledge and market research not available anywhere else. As proof of its continued work in supporting its mission, A&A’s 3PL market estimates are the most often cited in securities filings by publicly traded 3PLs, media articles and trade publications. In addition, A&A’s email newsletter currently has over 59,000 subscribers globally. A&A’s research complements its consulting activities by providing a continually updated detailed database for analysis. Based upon its unsurpassed knowledge of the 3PL market and the operations of leading 3PLs, A&A has provided strategic planning consulting services to over 30 3PLs, supported 17 closed investment transactions, and provided advice to numerous companies looking to benchmark existing 3PL operations or outsource logistics functions. All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopied, recorded or otherwise, without the prior permission of the publisher, Armstrong & Associates, Inc. -

2020 Top 100 For-Hire Carriers Is an Annual Publication Produced by Transport Topics, with Assistance from SJ Consulting Group

COVID-19 Pandemic Muddles Outlook For Top 100 For-Hire Carriers he COVID-19 pandemic has transformed 2020 into a chal- Indianapolis, had ranked No. 38 a year ago. lenging and unprecedented year for the trucking industry. Meanwhile, familiar names continue to dominate the top of the T Freight networks faced major disruptions as businesses tem- 2020 list of North America’s largest for-hire carriers. Parcel giant porarily closed and people stayed home to help contain the spread of UPS Inc. remains firmly entrenched at No. 1, followed closely by the virus, bringing much of the economy to a standstill. rival FedEx Corp. Schneider, meanwhile, cracked the top 5 by edging past YRC Worldwide and Knight-Swift Transportation Holdings. Further down the list, several other carriers made notable jumps. Day & Ross Transportation Group, based in Hartland, New Bruns- Seth Clevenger wick, climbed to No. 37, from No. 46 a year ago. The Canadian car- rier ex panded its dedicated operations in the United States through Managing Editor, Features its April 2019 acquisition of A&S Kinard and Buckler Transport. Refrigerated carrier John Christner Trucking also continued its ascent. The Sapulpa, Okla.-based company’s ranking increased this year to No. 83, from No. 89 a year ago and No. 99 in 2018. Another big mover was Challenger Group, based in Cambridge, This public health crisis has forced North America’s largest for-hire Ontario. The company rose to No. 84, from No. 95 last year, as rev- carriers to adjust their operations while implementing safety mea- enue increased 17.5%. -

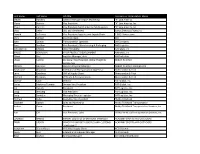

First Name Last Name Job Title Company Or Organization Name

First name Last name Job title Company or Organization Name Steven Hawkins General Manager Import Marketing "K" Line America Maria Bodnar Vice President "K" Line America, Inc. Shaun Gannon Vice President North America Field Logistics "K" Line America, Inc. Chas Deller CEO and CHAIRMAN 10XOCEANSOLUTIONS,INC Donald La France Vice President Logistics and Supply Chain 1-800-Flowers.com Chris McNeil Sourcing Agent 3M John Ladwig Transportation Specialist 3M Company Russ Boullion Vice President - Warehousing & Packaging A&R Logistics XIANGMING CHENG CEO/ PRESIDENT AAmetals, Inc BRUCE FERGUSON VP OF PRODUCT DEVELOPMENT AAmetals, Inc Eileen Wei Logistics Manager, Asia AB Electrolux Ulises Carrillo Divisional Vice President, Global Freight & Abbott Nutrition Distribution William Gaiennie Logistics Program Manager Abbott Nutrition International Sarah Jane Chapman International Transportation Supervisor Abercrombie & Fitch Larry Grischow GVP of Supply Chain Abercrombie & Fitch Michael Sherman VP Trade & Transportation Abercrombie & Fitch Gunnar Gose Director ABF Global, Inc. Carlos Martinez-Tomatis Division Vice President ABF Global, Inc. Jim Ingram President ABF Logistics, Inc. Doug Riesberg Vice President ABF Logistics, Inc. Craig Sandefur Managing Director Logistics ABF Logistics, Inc. Michael Kelso Executive Vice President Ability Tri-Modal Elizabeth Gaston Sales and Marketing Ability Tri-Modal Transportation Joshua Owen President Ability Tri-Modal Transportation Services, Inc. Ron Gill Vice President, Sales Ability/Tri-Modal Transportation Services, -

2013 Top 100 For-Hire

A Word From the Publisher t’s been 32 years since the trucking industry supports “anything that makes it hard to get into was officially “deregulated,” which meant and hard to stay in this industry.” the federal government would no longer Carriers that are able to meet new regulations will regulate freight rates and services. Passage be the ones that prosper in the future, according to of the Motor Carrier Act of 1980 unleashed Williams’ point of view. Ipowerful market forces that continue to reshape the Not surprisingly, there are others who believe that industry today. federal oversight of trucking is going too far. But trucking today is far from being unregulated. “We’re the most over-reregulated industry out In fact, you could argue that it is more regulated there,” said Michael Card, president of Combined than ever before. Transport Inc. and current chairman of American How can that be? Consider that Trucking Associations. over the past three decades, in the Card said the cost of meeting new name of highway safety, the federal regulations, such as driver hours-of- government has mandated drug and service, drug testing and onboard alcohol testing and set minimum li - recorders, will force many carriers censing requirements for drivers, out of business and will discourage funded state-run roadside inspection others from starting up. programs, increased by one hour the “They’re all great regulations, but maximum time a driver can be be - almost all of them have raised the hind the wheel and cut by one hour cost of owning a trucking company,” the maximum time a driver can be he said. -

Echo Global Logistics Vs. Groupon Hype

Disclaimer This research presentation expresses our research opinions, which we have based upon interpretation of certain facts and observations, all of which are based upon publicly available information, and all of which are set out in this research presentation report. Any investment involves substantial risks, including complete loss of capital. Any forecasts or estimates are for illustrative purpose only and should not be taken as limitations of the maximum possible loss or gain. Any information contained in this report may include forward looking statements, expectations, pro forma analyses, estimates, and projections. You should assume these types of statements, expectations, pro forma analyses, estimates, and projections may turn out to be incorrect for reasons beyond Spruce Point Capital Management LLC’s control. This is not investment or accounting advice nor should it be construed as such. Use of Spruce Point Capital Management LLC’s research is at your own risk. You should do your own research and due diligence before making any investment decision with respect to securities covered herein. All figures assumed to be in US Dollars, unless specified otherwise. You should assume that as of the publication date of any presentation, report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our subscribers and clients has a short position in all stocks (and/or are long puts/short call options of the stock) covered herein, including without limitation Echo Global Logistics, Inc. (“ECHO”), and therefore stand to realize significant gains in the event that the price of its stock declines. -

Logistics & Distribution

Logistics & Distribution Mecklenburg County Red Classic_Charlotte Chamber of Commerce Ad_FINAL.pdf 1 8/18/15 10:54 AM C M Y CM MY CY CMY K Red Classic_Charlotte Chamber of Commerce Ad_FINAL.pdf 1 8/18/15 10:54 AM Charlotte’s Market Accessibility Charlotte’s central East Coast location and excellent With all of the support services available, Charlotte provides transportation network provide businesses with a strategic a top-of-the-line connection for moving products and advantage in receiving and shipping goods and services. materials efficiently and conveniently throughout the world. Fifty-eight per cent of the United States population is east Evidence of Charlotte’s significance as a distribution center of the Mississippi River, putting Charlotte within one to can be seen in the more than $17 billion wholesale sales two days shipping time of over half of the country’s major recorded here annually. Factor in the continuing trend of metropolitan markets. Fifty-five of the United States’ top population migration to the Sunbelt states, Charlotte’s position metropolitan areas and 170 million U.S. and Canadian as a distribution center location will only grow stronger in the consumers lie within 650 miles of Charlotte. years to come. Boston Milwaukee Buffalo C Detroit New York M Pittsburgh Chicago Cleveland Philadelphia Y Baltimore CM Columbus Indianapolis MY Washington, D.C. Kansas City Cincinnati CY CMY K St. Louis Charlotte 100 200 Atlanta 300 400 500 600 Population Comparison 650 Mile Radius Pop. (mil.) % of U.S. Tampa Charlotte 167.1 53% Atlanta 149.3 46% Miami (652 miles from New York 121.5 38% Charlotte) Total U.S.