Phase 3 Report on Implementing the Oecd Anti-Bribery Convention in Luxembourg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

INTEGRATION ISSUES Your Commune Guide Your Commune Guide

Q3 2014 INTEGRATION ISSUES Your Commune Guide Your Commune Guide By Neel A. Chrillesen Photos: © Ville de Luxembourg The Luxembourgish communes have however, please keep in mind this is not existed for many, many centuries—long a comprehensive list. At the end of this before the birth of the current Grand booklet, you will also find a list of other Duchy. Whereas the Luxembourgish places where you can seek assistance state in its present form has existed and get relevant information. since the London Treaty of 1839, some What is the Bureau de la population? communes go back as far as the early Middle Ages. Every commune has a Biergeramt or Bureau de la population (and, if you live Following the latest wave of commune in Luxembourg City, a Bierger-Center). mergers in 2012, today there are 106 This is the Residents’ Registration Of- communes in Luxembourg. They are fice, which delivers all certificates, offi- the smallest administrative division in cial documents and identity papers you the country. Indeed, the Grand Duchy may need when living in the Grand Du- is divided into three districts (Diekirch, chy. In many communes, it’s situated in Grevenmacher and Luxembourg), which the same location as the town hall and are subdivided into 12 cantons which, in the general communal administration turn, are divided into communes. The office. You can find the contact informa- most populated ones are Luxembourg, tion of any commune in Luxembourg at Esch-sur-Alzette and Differdange, fol- www.guichet.public.lu. lowed by Dudelange, Pétange, Sanem and Hesperange. Do EU nationals need a resident permit? The organization of the communes in Luxembourg is based on the principal No. -

À/In Diekirch 81, Avenue De La Gare L- 9233 DIEKIRCH

Vente nationale Nationaler de feuillus Laubholzverkauf le jeudi, 20 décembre 2018 am Donnerstag, dem 20. Dezember 2018 à 14 :00 heures um 14 :00 Uhr à/in Diekirch 81, avenue de la Gare L- 9233 DIEKIRCH 81, av. de la Gare L- 9233 DIEKIRCH (vis-à-vis de la gare ferroviaire) Le catalogue à remplir se Der auszufüllende Katalog trouve sur le site internet du befindet sich auf der Internetseite ministère : des Ministeriums: https://environnement.public.lu/fr/emweltprozeduren/forets/vente_de_bois.html N’hésitez pas à nous contacter pour l’envoi Gerne schicken wir Ihnen ein Exemplar zu. d’un exemplaire. Tel. : 00352 80 33 72 – 1 Aperçu des lots mis en vente le 20/12/2018 Ubersicht der am20/12/2018 zum Verkauf angebotenen Lose Arrondissement Lot Vol.(-)m3 Vol.(+)m3 Unité Essence Baumart Triage vendu vol. Los ou Stères. ou stères Forstrevier sur écorce verkaufte vol. ACE 101 31,44 37,76 m3 chêne Eiche SCHIEREN 102 2,56 2,89 m3 chêne Eiche SCHIEREN 103 20,76 24,35 m3 chêne Eiche SCHIEREN 104 36,53 43,55 m3 chêne Eiche MEDERNACH AS 201 55,24 59,44 m3 érable Ahorn ESCH/ALZETTE 202 45,87 49,46 m3 frêne Esche ESCH/ALZETTE ACO 301 290,09 333,5 m3 chêne Eiche STEINFORT 302 153,93 173,26 m3 chêne Eiche BOEVANGE 303 166,91 191,34 m3 chêne Eiche MAMER ACE 601 307,62 327,75 m3 hêtre Buche LAROCHETTE 602 217,86 233,92 m3 hêtre Buche LAROCHETTE 603 332,78 360,04 m3 hêtre Buche MEDERNACH 604 274,79 296,63 m3 hêtre Buche SCHIEREN 605 44,18 47,86 m3 hêtre Buche SCHIEREN 606 121,85 131,76 m3 hêtre Buche SCHIEREN 607 167,85 179,59 m3 hêtre Buche TANDEL 608 380,38 -

DWE 2004 04 Orc1.Pdf

Index • 'I • Editorial 2 Résumé de la séance du Conseil Communal du 20 septembre 2004 4 Résumé de la séance du Conseil Communal du 25 novembre 2004 8 Centrale de cogénération avec réseau de chauffage urbain à Diekirch 12 Grundwasserüberwachungsstation von Diekirch 15 Nationalen Dag vum Barn 16 SIDEC-Info: Collectes de déchets 17 'Commissariat de Proximité' vun Dikrich 18 Laissez-nous déblayer la neige 19 Lassen Sie uns den Schnee wegraumen 20 Internet pour tous I Maison Neiers 21 Conception / Photos: LEZARTS - Diekirch Bierbrauer und Malzer in Diekirch 22 Ben BLUM Imprimé sur papier recyclé Informations culturelles 30 Couverture: D'Chrêschtdagsbeliichtung an der Informations générales 31 Grussgaass Couverture arrière: Die Zeit zwischen den Befreiungen Malterie Drüssel im Spiegel des kommunalen , . Deliberationsregisters (11.11.-16.12. :t9~44) 32 Deiwelselter 4/2004 1 ~- '""- .. Editorial Editorial ,.·• .,.,.. ... ; A senger Sëtzung vum 25. November huet de Schnii virun der Dir ze schëppen. (lnformatiounen dozou Gemengerot de Projet vun engem Blockheizkraftwierk och an dësem Bulletin) . (BHKW) gestëmmt, dat an 2 Jar a Betrib geholl soli ginn. Am Kader vu senger Aktioun géint de lokale Chômage Heimat dréit eis Gemeng am Kader vum «Kyoto huet de CIGR och nei Buden fir den Dikricher Protokoll» derzou bai, datt 43% manner C02 an Chrëschtmaart gebaut. d'Atmosphar geblos an 33% manner Primar-Energie gebraucht gëtt. (Weider Detailler fannt dir an engem Ee neie Sécherheetsplang, deen d'Gemeng mat der speziellen Artikel vun dësem Bulletin). Polizei ofgeschwat huet, gesait vir, datt «d'Police de Proxim ité» an de «Centre d'intervention» méi Prasenz an An der Tëschenzait ass den Dossier fir de Bau vun eisem eiser Stad weisen . -

Project Factsheet

PROJECT FACTSHEET www.list.lu/en/research/project/nordstad-emovin/ Nordstad-eMovin Bringing citizen-focused electromobility solutions to Luxembourg’s Nordstad region Local interest in e-mobility is growing, and a number of new projects are being organised across the country. The Nordstad-eMovin project will make Nordstad the first region in Luxembourg to provide electric car andpedelec (electric power-assisted bicycles) sharing to its residents with the installation of a network of public charging stations, and will help inspire other regions to follow suite. Providing new options for travel over short distances, the network will be integrated with the public transportation system. Context With six communes north of Luxembourg City, Nordstad’s administration wanted to make it easier and more attractive, as well as more environmentally-friendly, for residents and tourists to move within the region. This led to the development of the Nordstad- eMovin demonstration project, which will install infrastructure for electric car and pedelec sharing at strategic central locations in the five communes of Bettendorf, Colmar-Berg, Diekirch, Ettelbruck and Schieren. Innovation Luxembourg Institute of Science and Technology (LIST) will provide support to Nordstad during the installation of the customised infrastructure as well as provide IT services for the charging stations. Each station will provide charging facilities powered by green energy for two e-cars and four pedelecs, with a total fleet of around thirty e-cars and thirty pedelecs. The 24/7 short-term rental service will be designed to be practical, affordable and flexible for both residents and visitors. As one of the first e-mobility projects at LIST, and in Luxembourg, aiming at installing citizen-focused electromobility infrastructure, Nordstad-eMovin will showcase LIST’s expertise in this domain and lead to other mobility projects in the future. -

EDU Letter Template

Europol Public Information Management Board Membership September 2017 Chairperson Mr Priit Pärkna Intelligence Management and Investigation Estonian Police and Border Guard Board Member State MB member Department/Agency/Ministry Alternate MB member Department/Agency/Ministry Austria Ms Regine International Police Cooperation - Mr Christian Wandl International Police Cooperation Wieselthaler- Federal Police Ministry of Interior Buchmann Ministry of Interior Belgium Mr Peter De International Police Cooperation - Mr Frederik Van Oost International Police Cooperation - Buysscher Federal Police Federal Police Ministry of Interior Ministry of Interior Bulgaria Mr Valentin International Operational Cooperation Ms Kremena Peneva Head of LB Bulgaria Vasilev Kostov Directorate Platikanova-Nenova Ministry of Interior Croatia Mr Ante Orlović Criminal Police Directorate Mr Dalibor Jurić Sector for Criminal Police Support Cyprus Mr Demetris European Union and International Ms Maria Charalambous European Union and International Demetriou Police Cooperation Directorate Police Cooperation Directorate Czech Republic Ms Šárka International Police Cooperation - Mr Václav Rukner International Police Cooperation - Havránková Police Presidium Police Presidium Ministry of Interior Ministry of Interior Estonia Mr Ivo Kolk Head of Intelligence Management Ms Mirja Virve Estonian Liaison Bureau Bureau Police and Border Guard Board Finland Mr Timo Antero National Police Board Ms Marja Kartila National Police Board Saarinen Ministry of Interior Ministry of Interior -

552 Diekirch - Ettelbruck - Consthum

552 Diekirch - Ettelbruck - Consthum N° de courses 3448 4168 4528 4888 5308 5608 5968 6328 6748 7048 7408 7768 Régime de circulation Ó ( ( ( ( FC ( ( ( ( FC ( ( ( Exploitant Meyers Meyers Meyers Meyers Meyers Meyers Meyers Meyers Meyers Meyers Meyers Meyers DIEKIRCH, Neie Kolleisch 11:58 15:58 DIEKIRCH, Kluuster 12:02 16:03 DIEKIRCH, Gare 12:04 16:05 DIEKIRCH, Lorentzwues 12:06 16:07 INGELDORF, Café de la Station 12:07 16:09 ERPELDANGE (ETTELBRUCK), Laduno 12:08 16:10 ERPELDANGE (ETTELBRUCK), An der Gewan 12:09 16:11 ETTELBRUCK, Gare routière 2 06:48 08:48 09:48 10:48 | 12:48 13:48 14:48 | 16:48 17:48 18:48 ERPELDANGE (ETTELBRUCK), Beim Dreieck 06:50 08:50 09:50 10:50 | 12:50 13:50 14:50 | 16:50 17:50 18:50 ERPELDANGE (ETTELBRUCK), Beim Schlass 06:52 08:52 09:52 10:52 12:10 12:52 13:52 14:52 16:11 16:52 17:52 18:52 ERPELDANGE (ETTELBRUCK), Bei der Kiirch 06:52 08:52 09:52 10:52 12:10 12:52 13:52 14:52 16:12 16:52 17:52 18:52 ERPELDANGE (ETTELBRUCK), Beim Hôtel 06:53 08:53 09:53 10:53 12:11 12:53 13:53 14:53 16:13 16:53 17:53 18:53 DIEKIRCH, Friedhaff 06:57 08:57 09:57 10:57 12:15 12:57 13:57 14:57 16:17 16:57 17:57 18:57 HOSCHEID-DICKT, Um Pëtz 07:06 09:06 10:06 11:06 12:24 13:06 14:06 15:06 16:26 17:06 18:06 19:06 HOSCHEID-DICKT, Um Wald 07:07 09:07 10:07 11:07 12:25 13:07 14:07 15:07 16:27 17:07 18:07 19:07 SCHINKER, Ennert Schinker 07:08 09:08 10:08 11:08 12:26 13:08 14:08 15:08 16:28 17:08 18:08 19:08 SCHINKER, Um Rank 07:09 09:09 10:09 11:09 12:27 13:09 14:09 15:09 16:29 17:09 18:09 19:09 HOLZTHUM, Ferme Theves 07:10 09:10 10:09 -

Participants Pearls in Policing Conference 2013 • Mr. Aalbersberg

Participants Pearls in Policing Conference 2013 Mr. Aalbersberg (Pieter-Jaap), Chief Constable, Amsterdam Regional Division, The Netherlands Mr. Abu Bakar (Khalid), Inspector General, Royal Malaysia Police, Malaysia Mr. Arunachalam (Su), Deputy Inspector General of Police, CBI, ACB, Chennai, India Mr. Beraia (Irakli), Director of Reforms and Development Agency, Georgia Mr. Blair (William), Chief of Police, Toronto Police Service, Canada Mr. Bouman (Gerard), Commissioner of the National Police of the Netherlands (NPN), The Netherlands Professor Bruggeman (Willy), Professor of Police Science, Benelux University & President of the Belgian Federal Police Board, Belgium (Academic) Ms. Coninsx (Michèle), President, Eurojust Mr. Danino (Yochanan), Commissioner, National Israeli Police, Israel Professor Haberfeld (Maria), Professor and Chair of the John Jay College of Criminal Justice, United States of America (Academic) Mr. Højbjerg (Jens Henrik), Commissioner, Denmark Professor Hoogenboom (Bob), Professor of Forensic Business, Nyenrode University, The Netherlands (Academic) Mr. Humlegård (Odd Reidar), National Commissioner, National Police, Norway Mr. Khoo Boon Hui, former Interpol President Mr. Leijtens (Hans), Commander, Royal Netherlands Marechaussee, The Netherlands Mr. Lewis (Chris), Commissioner, Ontario Provincial Police, Canada Mr. LO Wai-Chung (Stephen), Director of Crime & Security, Hong Kong Police Force, Hong Kong Ms Merckx (Gwen), Chief Constable, Belgian Local Police, Belgium Mr. Nettgen (Romain), Director General, Grand Ducal Police, Luxembourg Mr. Ng (Peter), Commissioner, Singapore Police Force (SPF), Singapore Mr. Pearce (Trevor), Director General, Serious Organised Crime Agency (SOCA), United Kingdom Mr. Pérez (Emile), Head of the International Department, National Police, France Mr. Perkins (Kevin), Deputy Director, Federal Bureau of Investigation (FBI), United States of America Mr. Prasarnrajkit (Watcharapol), Deputy Commissioner General, Royal Thai Police, Thailand Mr. -

Rentabikefolder EN 2020

Bourscheid Fouhren Bastendorf Reisdorf Diekirch Bettendorf Erpeldange BORN ROSPORT Wallendorf- Camping Um Salzwaasser Camping du Barrage pont 9, rue du Camping | L-6660 Born 1, rue du Camping | L-6580 Rosport Dillingen Bollendorf- pont (+352) 73 01 44 | [email protected] (+ 352) 73 01 60 | [email protected] Ettelbrück Scale Schieren Opening hours: Opening hours: Stegen Ermsdorf Beaufort Grundhof 01/04-14/06 Wednesday-Sunday Monday to Saturday 01/07-31/08: 09:00- Berdorf 08:30-12:00/14:00-18:00 12:00/13:00-18:00 | Sunday 9:00-12:00 Berg Medernach 15/06-31/08: 7/7 08:00-12:00/14h00-18h00 www.rosport-tourism.lu Cruchten 01/09-23/12 Wednesday-Sunday: Waldbillig Steinheim Nommern Echternach 10:00-12:00/14:00-16:00 Christnach Rosport www.campingumsalzwaasser-born.lu WALDBILLIG MÜLLERTHAL Osweiler Touristcenter Heringer Millen Larochette Müllerthal Hinkel 1, rue des Moulins | L-6245 Mullerthal CONSDORF (+ 352) 87 89 88 | [email protected] Consdorf Camping La Pinède Born Heffingen 33, rue Buergkapp | L-6211 Consdorf Opening hours: Mersch Mompach (+352) 79 02 71 | [email protected] 09:30-16:30 Bech Herborn Fischbach 12/04-02/11: Wednesday-Sunday Graulinster Opening hours: 27/05-13/09: 7/7 Moersdorf 15/03-14/11: 08:00-20:00 www.mullerthal-millen.lu Berbourg www.visitconsdorf.lu Lintgen Altinster Junglinster Wasserbillig REISDORF WALLENDORF-PONT Bourglinster Biwer ECHTERNACH Hotel Dimmer Youth Hostel 4, Grenzwee | L-9392 Wallenduerfer-Bréck Mertert Gonderange Betzdorf Chemin vers Rodenhof | L-6487 Echternach (+352) 83 62 20 -

24.08.2021 Page 1 Powered by Gebietsausdehnung Von Provinz Von DIEKIRCH Und Entsprechende Bevölkerungsdichte, Geschlechterverte

26.09.2021 Karten, Analysen und Statistiken zur ansässigen Bevölkerung Bevölkerungsbilanz, Bevölkerungs- und Familienentwicklung, Altersklassen und Durchschnittsalter, Familienstand und Ausländer Skip Navigation Links LUSSEMBURGO / DIEKIRCH / Provinz von DIEKIRCH Powered by Page 1 L'azienda Contatti Login Urbistat on Linkedin Adminstat logo DEMOGRAPHIE WIRTSCHAFT RANGLISTEN SUCHEN LUSSEMBURGO Gemeinden Nebeneinander anzeigen >> Bettendorf Ettelbruck Bourscheid Feulen Diekirch Mertzig Erpeldange- Reisdorf sur-Sûre Schieren Vallée de l'Ernz Provinzen CLERVAUX REDANGE DIEKIRCH VIANDEN WILTZ Regionen Powered by Page 2 DIEKIRCH GREVENMACHER L'azienda Contatti Login Urbistat on Linkedin Adminstat logo LUXEMBOURG DEMOGRAPHIE WIRTSCHAFT RANGLISTEN SUCHEN LUSSEMBURGO Provinz von Diekirch Gebietsausdehnung von Provinz von DIEKIRCH und entsprechende Bevölkerungsdichte, Geschlechterverteilung der Bevölkerung und Anzahl der dort ansässigen Familien, Durchschnittsalter und Ausländeranteil GEBIET DEMOGRAPHISCHE DATEN (JAHR 2017) Region DIEKIRCH Abkürzung DK Einwohner (N.) 32.543 Gemeinde Diekirch Familien (N.) 12.659 Hauptort Männer (%) 52,1 Gemeinden in 10 Provinz Frauen (%) 47,9 Fläche (km²) 204,89 Ausländer (%) 41,1 Bevölkerungsdichte Durchschnittsalter 158,8 0,0 (Einwohner je km²) (Jahre) Durchschnittliche jährliche +1,67 Abweichung in % (2013/2017) AUSWIRKUNG MÄNNER, BEVÖLKERUNGSBILANZ FRAUEN UND AUSLÄNDER (JAHR 2017) (JAHR 2017) Powered by Page 3 ^L'azienda Contatti Login Urbistat on Linkedin Adminstat logo DEMOGRAPHIE WIRTSCHAFT RANGLISTEN SUCHEN LUSSEMBURGO Natürliches Bevölkerungswachstum [1], Migrationssaldo [2] Natürliches Bevölkerungswachstum= Geburten und Sterbefälle ^ Migrationssaldo = eingeschriebene und gelöschte Personen Ranglisten Provinz von diekirch die 5 Die Gemeinden mit der höchsten Bevölkerungsdichte sind: Ettelbruck, Diekirch, Bettendorf, Vallée de l'Ernz e Erpeldange-sur-Sûre ist am 4auf Platz… 12 provinzen nach demographischer Dimension ist am 7auf Platz… 12 provinzen nach Durchschnittsalter Address Contacts Lussemburgo AdminStat 41124 Via M. -

Secondary Victimization Policies & Practices

EUROPEAN CRIME PREVENTION NETWORK EUCPN Toolbox Series No. 7 Preventing Secondary Victimization policies & practices In the framework of the project ‘‘The development of the observatory function of the European Centre of Expertise on Crime Prevention within the EUCPN’. EUCPN Secretariat, March 2016, Brussels With financial support from the Prevention of and Fight against Crime Programme of the European Union European Commission – Directorate-General Home Affairs Preventing Secondary Victimization Policies & practices Preface The seventh toolbox in the series published by the EUCPN Secretariat focuses on the topic chosen by the Latvian presidency, namely Secondary Victimization. In recent years the Latvian police has taking huge steps in making the police officers aware of the phenomena and providing them with a guideline in how to prevent Secondary Victimization. They wanted to share the knowledge of this experience with the other Member States of the network and see if there were other good practices that they could use. The toolbox is divided into three parts: policy and legislation, a guideline of good and promising practices and examples from practices. All 3 parts of the toolbox are important however the most emphasis is put on the second part. Within this part of the toolbox, the focus is on the different steps of the justice system a victim has to go through. The EUCPN Secretariat made a ‘matrix’ which shows the different steps of the justice system. For each step in the judicial system, we have tried to formulate the most pressing needs of the victims, the EU minimal standards provided through the legislations discussed in part 1 and we have also formulated good practices gathered in the Member States. -

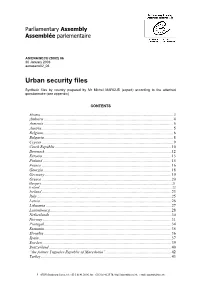

Urban Security Files

Parliamentary Assembly Assemblée parlementaire AS/ENA/SECU (2002) 06 30 January 2003 aenasecu02_06 Urban security files Synthetic files by country prepared by Mr Michel MARCUS (expert) according to the attached questionnaire (see appendix) CONTENTS Albania ............................................................................................................................................................. 3 Andorra ................................................................................................................................4 Armenia ................................................................................................................................5 Austria .................................................................................................................................. 5 Belgium................................................................................................................................. 6 Bulgaria................................................................................................................................8 Cyprus .................................................................................................................................. 9 Czech Republic................................................................................................................... 10 Denmark ............................................................................................................................. 12 Estonia............................................................................................................................... -

The Eventful Life of the Canton of Vianden

The eventful life of the canton of Vianden by Georges EICHER, www.luxroots.com, June 2020 Below is the map of the Duchy of Luxembourg prior to 1659 with the later 3 divisions: 1659: Peace of the Pyrenees, the southern part is ceded to France. 1815: Congress of Vienna, the eastern part to Prussia (later Germany). 1839: the western part to Belgium Von Furfur - Own work, inspired by tickets of Luxembourg, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=82616224 After the annexation of our country by France in 1794, the former Duchy of Luxembourg formed part of the French Republic and later the French Empire as a département of the Forêts (Forests Department). The Department of Forests was divided into 4 arrondissements (Luxembourg, Diekirch, Bitburg and Neufchâteau), 27 cantons and 383 communes. Learn more at wikipedia: https://fr.wikipedia.org/wiki/Forêts_(département) One of these 27 cantons was Vianden with the following communes: - On the eastern part, which was ceded up from 1815 by decision of the Congress of Vienna to Prussia (later Germany): the former municipalities of Geichlingen, Körperich, Kruchten, Nusbaum, Roth, and Wallendorf, (which today all belong to the municipality of Südeifel). - In the West, the municipalities of that time: Consthum, Fouhren, Hosingen, Hoscheid, Landscheid, and Stolzembourg. As already mentioned above, the municipalities of the eastern part were ceded to Prussia in 1815, including the village of Keppeshausen, which until then belonged to the municipality of Stolzembourg. In 1823/24, large municipal mergers took place throughout the country, including in the canton of Vianden: - The municipality of Landscheid is affiliated to the municipality of Hoscheid.