Trian Partners Nominates Four Highly Qualified Candidates for Election to Dupont Board

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1St Quarter Report

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Mid Cap Portfolio March 31, 2021 VIPMID-QTLY-0521 1.799869.117 Schedule of Investments March 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.3% Shares Value Shares Value COMMUNICATION SERVICES – 3.5% Tapestry, Inc. 673,600 $ 27,759,056 Entertainment – 2.3% thredUP, Inc. (b) 26,600 620,578 Activision Blizzard, Inc. 1,187,600 $ 110,446,800 236,705,162 Cinemark Holdings, Inc. (a) 612,400 12,499,084 TOTAL CONSUMER DISCRETIONARY 1,215,512,530 Electronic Arts, Inc. 287,790 38,958,132 Live Nation Entertainment, Inc. (b) 245,500 20,781,575 182,685,591 CONSUMER STAPLES – 5.3% Interactive Media & Services – 0.5% Beverages – 0.6% Bumble, Inc. 39,400 2,457,772 C&C Group PLC (United Kingdom) (b) 7,982,445 30,922,922 IAC (b) 179,700 38,870,907 Monster Beverage Corp. (b) 183,000 16,669,470 41,328,679 47,592,392 Media – 0.7% Food & Staples Retailing – 2.6% Interpublic Group of Companies, Inc. 1,986,185 57,996,602 BJ’s Wholesale Club Holdings, Inc. (b) 1,891,100 84,834,746 Performance Food Group Co. (b) 1,118,796 64,453,838 TOTAL COMMUNICATION SERVICES 282,010,872 U.S. Foods Holding Corp. (b) 1,638,300 62,451,996 211,740,580 CONSUMER DISCRETIONARY – 15.0% Food Products – 1.1% Automobiles – 0.2% Nomad Foods Ltd. (b) 3,382,400 92,880,704 Harley‑Davidson, Inc. 474,400 19,023,440 Household Products – 1.0% Diversified Consumer Services – 0.6% Spectrum Brands Holdings, Inc. -

Drinking Water Compliance Plan

DRINKING WATER COMPLIANCE PLAN CHEMOURS FAYETTEVILLE WORKS RCRA PERMIT NO. NCD047368642-R2-M3 Prepared for: The Chemours Company FC, LLC Corporate Remediation Group 22828 NC Highway 87 W Fayetteville, NC 28306-7332 Prepared by: PARSONS 4701 Hedgemore Drive Charlotte, NC 28209 April 2019 Chemours PN 504552 Parsons PN 449338 DRINKING WATER COMPLIANCE PLAN TABLE OF CONTENTS TABLE OF CONTENTS 1.0 INTRODUCTION ................................................................................................... 1 1.1 Consent Order ................................................................................................... 1 1.2 Call Line ............................................................................................................. 1 2.0 PRIVATE WELL TESTING ................................................................................... 3 2.1 Additional Drinking Water Well Testing .......................................................... 3 2.2 Re-Analysis of Previously-Collected Groundwater Samples ......................... 4 2.3 Annual Re-Testing ............................................................................................ 5 2.4 Provision of Sampling Results ........................................................................ 5 2.5 Verification of Vacant Properties ..................................................................... 5 3.0 INTERIM REPLACEMENT OF PRIVATE DRINKING WATER SUPPLIES .......... 6 3.1 Replacement Drinking Water Supplies ........................................................... -

Economy League of Greater Philadelphia Builds Leadership Team with Addition of Four New Staff Members

FOR IMMEDIATE RELEASE CONTACT: Amanda Piccirilli-Hall 6484-680-1988 [email protected] Economy League of Greater Philadelphia Builds Leadership Team With Addition of Four New Staff Members New staff deepens Economy League’s commitment to social and community challenges, innovative programming and insightful resources to address social and community challenges PHILADELPHIA (Feb. 13, 2020) – The Economy League of Greater Philadelphia, the region’s think-and-do tank that addresses critical issues facing the Greater Philadelphia area, has brought on four new staff members to help the organization continue to provide impactful research, connect diverse leaders, and advance shared solutions. Economy League Executive Director Jeff Hornstein is augmenting the organization’s capacity with two new directors, a program manager and a new office manager. These additions will allow the Economy League to deepen existing initiatives such as the Greater Philadelphia Leadership Exchange and Philadelphia Anchors for Growth & Equity, but also to launch its new Civic Impact Labs program. “I was thrilled by the response to our job descriptions – we had incredibly talented people apply for these positions, and we were fortunate to have our offers accepted by each of our first-choice candidates,” said Hornstein. “With an expanded and energized staff and the launch of our Civic Impact Lab, 2020 is shaping up to be a great year for the Economy League!” Philadelphia Anchors for Growth and Equity (PAGE) Director J’nelle E. Lawrence, MBA will lead the PAGE initiative, a collaborative of Philadelphia’s largest eds-and-meds anchor institutions that leverages their $5.3 billion in annual spend to create job and business growth in disinvested neighborhoods. -

Schedule of Investments: 1.31.21 Holdings

Schedule of Investments January 31, 2021 (Unaudited) Schedule of Investments LSV Small Cap Value Fund LSV Small Cap Value Fund Shares Value (000) Shares Value (000) Automotive (2.5%) Common Stock (99.1%) American Axle & Aerospace & Defense (1.4%) Manufacturing Holdings* 146,500 $ 1,291 1,213 Curtiss-Wright 12,100 $ 1,256 Cooper Tire & Rubber 33,000 2,958 Moog, Cl A 32,500 2,401 Dana 152,800 1,277 Vectrus* 18,000 925 Modine Manufacturing* 101,800 4,582 Winnebago Industries 19,200 1,326 8,065 Agricultural Products (0.9%) Automotive Retail (1.9%) Ingredion 36,900 2,785 Camping World Holdings, Cl A 33,700 1,151 Air Freight & Logistics (0.9%) 2,518 Atlas Air Worldwide Group 1 Automotive 18,300 1,101 Holdings* 43,500 2,254 Penske Automotive Group 18,400 1,298 Park-Ohio Holdings 16,500 465 Sonic Automotive, Cl A 31,700 2,719 6,068 Aircraft (1.2%) Banks (16.2%) 3,102 Hawaiian Holdings 47,000 920 Associated Banc-Corp 172,900 1,271 Bank of NT Butterfield & JetBlue Airways* 88,600 1,384 1,489 Son 45,500 SkyWest 38,200 2,346 3,680 BankUnited 67,700 Berkshire Hills Bancorp 49,800 826 1,243 Apparel Retail (1.7%) Camden National 33,100 1,491 1,608 Cathay General Bancorp 44,100 Foot Locker 36,700 Dime Community 1,739 Genesco* 44,800 Bancshares 45,300 720 Guess? 13,900 323 Federal Agricultural Shoe Carnival 37,700 1,771 Mortgage, Cl C 18,700 1,421 5,441 Financial Institutions 43,990 1,007 First Busey 28,400 587 Apparel, Accessories & Luxury Goods (0.5%) First Commonwealth G-III Apparel Group* 60,400 1,633 Financial 148,900 1,747 First Horizon National -

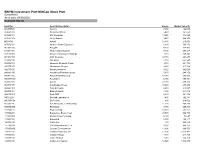

BNYM Investment Port:Midcap Stock Port (Unaudited) As of Date: 09/30/2020 Common Stocks

BNYM Investment Port:MidCap Stock Port (Unaudited) As of date: 09/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002535300 Aaron's 7,450 422,043 00404A109 Acadia Healthcare 5,480 161,550 004498101 ACI Worldwide 13,250 346,223 00508Y102 Acuity Brands 9,470 969,255 BD845X2 Adient 12,480 216,278 00737L103 Adtalem Global Education 6,800 166,872 00766T100 AECOM 4,170 174,473 018581108 Alliance Data Systems 7,130 299,317 01973R101 Allison Transmission Holdings 7,110 249,845 00164V103 AMC Networks 10,710 264,644 023436108 Amedisys 2,760 652,547 025932104 American Financial Group 3,310 221,704 03073E105 AmerisourceBergen 2,220 215,162 042735100 Arrow Electronics 5,620 442,069 04280A100 Arrowhead Pharmaceuticals 5,670 244,150 045487105 Associated Banc-Corp 47,940 605,003 05329W102 Autonation 6,980 369,451 05368V106 Avient 23,030 609,374 053774105 Avis Budget Group 10,600 278,992 05464C101 Axon Enterprise 2,410 218,587 062540109 Bank of Hawaii 4,830 244,012 06417N103 Bank OZK 6,630 141,352 090572207 Bio-Rad Laboratories 1,480 762,881 09073M104 Bio-Techne 880 218,002 05550J101 BJs Wholesale Club Holdings 11,270 468,269 09227Q100 Blackbaud 3,750 209,363 103304101 Boyd Gaming 18,350 563,162 105368203 Brandywine Realty Trust 93,500 966,790 11120U105 Brixmor Property Group 6,300 73,647 117043109 Brunswick 8,150 480,117 12685J105 Cable One 300 565,629 127190304 CACI International, Cl. A 3,980 848,377 12769G100 Caesars Entertainment 11,890 666,553 133131102 Camden Property Trust 11,390 1,013,482 134429109 Campbell Soup 4,440 -

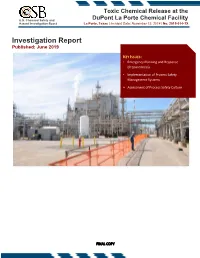

Final Investigation Report: E.I

Toxic Chemical Release at the U.S. Chemical Safety and DuPont La Porte Chemical Facility Hazard Investigation Board La Porte, Texas | Incident Date: November 15, 2014 | No. 2015-01-I-TX Investigation Report Published: June 2019 Investigation Report EY SSUES K I : • Emergency Planning and Response (Preparedness) • Implementation of Process Safety Management Systems • Assessment of Process Safety Culture FINAL COPY Toxic Chemical Release at the DuPont La Porte Chemical Facility U.S. Chemical Safety and Hazard Investigation Board La Porte, Texas | Incident Date: November 15, 2014 | No. 2015-01-I-TX The U.S. Chemical Safety and Hazard Investigation Board (CSB) is an independent federal agency whose mission is to drive chemical safety change through independent investigations to protect people and the environment. The CSB is a scientific investigative organization, not an enforcement or regulatory body. Established by the Clean Air Act Amendments of 1990, the CSB is responsible for determining accident causes, issuing safety recommendations, studying chemical safety issues, and evaluating the effectiveness of other government agencies involved in chemical safety. More information about the CSB is available at www.csb.gov. The CSB makes public its actions and decisions through investigative publications, all of which may include safety recommendations when appropriate. Types of publications include: Investigation Reports: Formal, detailed reports on significant chemical incidents that include key findings, root causes, and safety recommendations Investigation Digests: Plain-language summaries of Investigation Reports Case Studies: Reports that examine fewer issues than Investigation Reports Safety Bulletins: Short publications typically focused on a single safety topic Hazard Investigations: Broader studies of significant chemical hazards Safety Videos: Videos that animate aspects of an incident or amplify CSB safety messages CSB products can be freely accessed at www.csb.gov or obtained by contacting: U.S. -

STUDENT ENGAGEMENT and TALENT GROWTH: the Campus

Fueling Growth: The importance of attracting & retaining early talent February 28, 2020 Agenda 1. Mission 2. Impact 3. Programs 4. Where do we go from here? The Mission Fuel the regional economy by encouraging college students to explore, live and work in Greater Philadelphia A study in 2000 identified the opportunity Enrollment at regional institutions was 213,000 FTE in 2000 Greater Philadelphia ranked 7th in the country in the concentration of college students College attainment in Philadelphia in 2000 was 17.9%, six percentage points lower than the national average 34 College & University Partners 44 Corporate Members Children’s Hospital of Frontline Education Publicis Health Amicus Therapeutics Philadelphia Children's Crisis Treatment Allied Pixel Glenmede Trust Sabre Systems Center AstraZeneca Cigna IKEA SAP Sino-American Business Bancroft Comcast Independence Blue Cross Association Corp. Bender Inc. CSL Behring JP Morgan Chase SPIN Inc. Bentley Systems CubeSmart Juno Search Partners TargetX Campbell Soup Company Deloitte Lutron TherapyNotes CardConnect Dorman Products Merakey University City Science Center CBIZ ELAP Services Pennoni USLI Chamber of Commerce for Employment Practices PHLCVB Vanguard Greater Philadelphia Solutions Public Health Management Chemours Energage WSFS (formerly Beneficial Bank) Corporation A Great Team The Impact 2000-2017: Philadelphia more than doubles young adults with college degrees The Programs: Fall in love with Philadelphia & launch here after you graduate Welcome to Philly Explore Philadelphia Launch your career in Philadelphia Launch your career in Philadelphia WHERE DO WE GO FROM HERE? Coming up…. Annual Meeting of Stakeholders Find IT in Philly, May 4-6, 2020 April 23, 4-7 PM Questions & Discussion Ashlie Thornbury VP, Partnerships, Campus Philly [email protected]. -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

INTA Corporate Member List

Corporate Members Name City State Country 100x Group Hong Kong Hong Kong 1661, Inc. Los Angeles California United States 1-800-Flowers.com, Inc. Carle Place New York United States 3M China Ltd. Shanghai Shanghai China 3M Company Saint Paul Minnesota United States 3M Deutschland GmbH Neuss Germany 3M India Ltd. Bangalore Karnataka India 3M Innovation Singapore Pte Ltd Singapore Singapore 3M KCI San Antonio Texas United States 3M United Kingdom PLC Bracknell Bracknell Forest United Kingdom 7-Eleven, Inc. Irving Texas United States AB Electrolux Stockholm Stockholms län Sweden Västra Götalands AB Volvo Göteborg län Sweden ABB ASEA Brown Boveri Ltd. Zürich Zürich Switzerland Abbott St.Paul Minnesota United States Abbott Laboratories Abbott Park Illinois United States Abbott Products Operations AG Allschwil Switzerland AbbVie Inc. Irvine California United States AbbVie Inc. North Chicago Illinois United States Abercrombie & Fitch Co. New Albany Ohio United States ABRO Industries, Inc. South Bend Indiana United States ACCO Brands Corporation Lake Zurich Illinois United States Activision Blizzard UK Ltd. Slough United Kingdom Activision Blizzard, Inc. Santa Monica California United States Activision Computer Technology Co. Ltd. Shanghai Shanghai China Acushnet Company Fairhaven Massachusetts United States Aderans America Holdings, Inc. Beverly Hills California United States adidas Group Panama Panamá Panama Adidas Group, India Gurgaon Haryana India adidas International Marketing BV Amsterdam Netherlands adidas International, Inc. Portland Oregon United States ADOBE INC. San Jose California United States ADOBE INC. Tokyo Japan Aetna Inc. Hartford Connecticut United States Agilent Technologies, Inc. Santa Clara California United States Ahold Delhaize Licensing Sarl Genève Genève Switzerland AIDA Cruises Rostock Germany Aigle International S.A. -

AQR Large Cap Multi-Style Fund June 30, 2021

AQR Large Cap Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $1,387,475,976 Asset Class Security Description Exposure Quantity Equity 3M Ord Shs 7,441,276 37,463 Equity A O Smith Ord Shs 1,025,630 14,233 Equity Abbott Laboratories Ord Shs 695,580 6,000 Equity AbbVie Ord Shs 2,697,728 23,950 Equity Accenture Ord Shs Class A 4,362,597 14,799 Equity Acuity Brands Ord Shs 8,918,151 47,683 Equity Adobe Ord Shs 10,313,120 17,610 Equity AGCO Ord Shs 11,515,944 88,326 Equity Akamai Technologies Ord Shs 4,961,913 42,555 Equity Alexion Pharmaceuticals Ord Shs 1,495,032 8,138 Equity Alliance Data Systems Ord Shs 2,064,212 19,812 Equity Allstate Ord Shs 17,685,055 135,580 Equity Ally Financial Ord Shs 1,042,902 20,925 Equity Alphabet Ord Shs Class C 25,526,869 10,185 Equity Altria Group Ord Shs 4,006,693 84,033 Equity Amazon Com Ord Shs 45,275,946 13,161 Equity Amerco Ord Shs 1,682,737 2,855 Equity Ameren Ord Shs 696,828 8,706 Equity American Tower REIT 752,070 2,784 Equity Ameriprise Finance Ord Shs 5,602,040 22,509 Equity AmerisourceBergen Ord Shs 535,126 4,674 Equity Amgen Ord Shs 3,192,638 13,098 Equity Anthem Ord Shs 11,568,922 30,301 Equity APPLE 80,896,520 590,658 Equity Applied Material Ord Shs 12,056,296 84,665 Equity Aptiv Ord Shs 1,514,773 9,628 Equity Arrow Electronics Ord Shs 14,585,038 128,130 Equity Associated Bancorp Ord Shs 4,986,757 243,494 Equity Assurant Ord Shs 3,887,945 24,894 Equity Assured Guaranty Ord Shs 411,509 8,667 Equity AT&T 7,072,915 245,758 Equity Autonation Ord Shs 10,369,749 109,374 Equity Bank of New York -

AQR TM Large Cap Multi-Style Fund December 31, 2020

AQR TM Large Cap Multi-Style Fund December 31, 2020 Portfolio Exposures NAV: $303,983,345 Asset Class Security Description Exposure Quantity Equity A O Smith Ord Shs 155,141 2,830 Equity Abbott Laboratories Ord Shs 656,940 6,000 Equity AbbVie Ord Shs 853,021 7,961 Equity Accenture Ord Shs Class A 2,006,093 7,680 Equity Acuity Brands Ord Shs 1,180,022 9,745 Equity Adobe Ord Shs 2,641,134 5,281 Equity AGCO Ord Shs 1,762,736 17,099 Equity Air Lease Ord Shs Class A 353,672 7,962 Equity Akamai Technologies Ord Shs 1,980,951 18,868 Equity Alexion Pharmaceuticals Ord Shs 272,014 1,741 Equity Align Technology Ord Shs 253,831 475 Equity Alliance Data Systems Ord Shs 673,199 9,085 Equity Allstate Ord Shs 3,231,612 29,397 Equity Alphabet Ord Shs Class C 4,391,963 2,507 Equity Altria Group Ord Shs 741,526 18,086 Equity Amazon Com Ord Shs 8,963,071 2,752 Equity Ameren Ord Shs 679,590 8,706 Equity American Tower REIT 314,917 1,403 Equity Ameriprise Finance Ord Shs 2,846,157 14,646 Equity AmerisourceBergen Ord Shs 456,930 4,674 Equity Amgen Ord Shs 307,173 1,336 Equity Anthem Ord Shs 2,466,934 7,683 Equity APPLE 20,015,490 150,844 Equity Applied Material Ord Shs 1,960,218 22,714 Equity ARAMARK Ord Shs 233,112 6,058 Equity Arrow Electronics Ord Shs 2,614,062 26,866 Equity Associated Bancorp Ord Shs 876,489 51,407 Equity Assurant Ord Shs 1,233,608 9,056 Equity Assured Guaranty Ord Shs 272,924 8,667 Equity AT&T 1,748,378 60,792 Equity Autonation Ord Shs 2,362,950 33,858 Equity AutoZone Ord Shs 183,743 155 Equity Bank of New York Mellon Ord Shs 141,325 3,330