Schedule of Investments: 1.31.21 Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY U.S

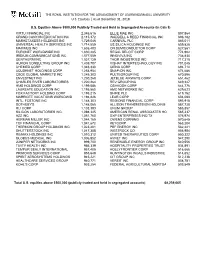

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY U.S. Equities │ As at December 31, 2018 U.S. Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) VIRTU FINANCIAL INC 2,345,616 ELLIE MAE INC 897,864 GRAND CANYON EDUCATION INC 2,115,372 WADDELL & REED FINANCIAL INC 896,182 MARKETAXESS HOLDINGS INC 1,729,046 CARNIVAL PLC 865,011 UNIVERSAL HEALTH SERVICES INC 1,714,559 US SILICA HOLDINGS INC 859,828 MAXIMUS INC 1,635,403 ON SEMICONDUCTOR CORP 827,561 EURONET WORLDWIDE INC 1,630,285 REGAL BELOIT CORP 774,962 IRIDIUM COMMUNICATIONS INC 1,577,559 INNOVIVA INC 738,830 GENTHERM INC 1,527,129 THOR INDUSTRIES INC 717,318 HURON CONSULTING GROUP INC 1,439,707 VISHAY INTERTECHNOLOGY INC 701,045 CHEMED CORP 1,343,330 CIENA CORP 694,714 ACUSHNET HOLDINGS CORP 1,258,954 SNAP-ON INC 674,686 CBOE GLOBAL MARKETS INC 1,245,303 PULTEGROUP INC 670,896 ENVESTNET INC 1,230,268 JETBLUE AIRWAYS CORP 651,462 CHARLES RIVER LABORATORIES 1,220,264 REV GROUP INC 649,247 HMS HOLDINGS CORP 1,199,586 OSHKOSH CORP 644,776 LAUREATE EDUCATION INC 1,195,560 AMC NETWORKS INC 629,623 FOX FACTORY HOLDING CORP 1,195,215 SHIRE PLC 619,182 MARRIOTT VACATIONS WORLDWID 1,194,826 LEAR CORP 604,088 INTL. FCSTONE INC 1,148,303 REGIONS FINANCIAL CORP 593,918 SOTHEBY'S 1,148,065 ALLISON TRANSMISSION HOLDING 587,728 RLI CORP 1,103,393 UNUM GROUP 585,857 SILICON LABORATORIES INC 1,098,345 AMERICAN RENAL ASSOCIATES HO 585,337 AZZ INC 1,051,760 DXP ENTERPRISES INC/TX 576,974 HERMAN MILLER INC 1,044,165 OWENS CORNING 570,645 TCF FINANCIAL -

Thank You! Match Your Gift to GSCM Here’S How

Thank You! Match Your Gift to GSCM Here’s how: Look for your employer in the sample list below. Don’t see them? Ask your HR department if your company matches 1 your gift or donates to your volunteer hours. 2 Follow the necessary steps with your HR department. Let us know if your company will be matching your gift by 3 calling 410.358.9711, Ext. 244 or email us at [email protected]. Here are some of the companies that match gifts: A ConAgra Foods, Inc. H Connexus Energy AT&T HP, Inc. Constant Contact, Inc. AAA Harris Corp. Constellation Brands, Inc. AARP Heller Consulting, Inc. Costco AEGIS Henry Crown & Co. Craigslist, Inc. ARAMARK Henry Luce Foundation CyberGrants, Inc. ATAPCO Hewlett Packard Adobe Systems, Inc. D Highmark, Inc. Advanced Instructional Systems, Inc. Hillman Co. DEMCO, Inc. Allstate Home Depot DMB Associates, Inc. Altria Group, Inc. Honeywell International, Inc. DPL, Inc. American Express Co. Houghton Mifflin Harcourt Co. DTC Global Services, LLC American Fidelity Assurance Corp. Howard S. Wright Constructors DTE Energy American Honda Motor Co., Inc. Humana, Inc. Dell, Inc. American Vanguard Corp. Deutsche Bank AG Ameriprise Financial, Inc I Dodge & Cox Aon Corp. iParadigms, LLC Dolby Laboratories, Inc. Apple ING Financial Services, LLC Dorsey & Whitney LLP Association of American Medical Colleges Ingersoll Rand Dun & Bradstreet Corp. Astoria Bank Investment Technology Group, Inc. Avon Products, Inc. E Itron, Inc. B eBay J eClinicalWorks BP Foundation J.P. Morgan Chase Eli Lilly & Co. Bank of America Corp. JC Penney’s Energen Barnes Group, Inc. Jackson Hewitt Tax Service, Inc. -

1St Quarter Report

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Mid Cap Portfolio March 31, 2021 VIPMID-QTLY-0521 1.799869.117 Schedule of Investments March 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.3% Shares Value Shares Value COMMUNICATION SERVICES – 3.5% Tapestry, Inc. 673,600 $ 27,759,056 Entertainment – 2.3% thredUP, Inc. (b) 26,600 620,578 Activision Blizzard, Inc. 1,187,600 $ 110,446,800 236,705,162 Cinemark Holdings, Inc. (a) 612,400 12,499,084 TOTAL CONSUMER DISCRETIONARY 1,215,512,530 Electronic Arts, Inc. 287,790 38,958,132 Live Nation Entertainment, Inc. (b) 245,500 20,781,575 182,685,591 CONSUMER STAPLES – 5.3% Interactive Media & Services – 0.5% Beverages – 0.6% Bumble, Inc. 39,400 2,457,772 C&C Group PLC (United Kingdom) (b) 7,982,445 30,922,922 IAC (b) 179,700 38,870,907 Monster Beverage Corp. (b) 183,000 16,669,470 41,328,679 47,592,392 Media – 0.7% Food & Staples Retailing – 2.6% Interpublic Group of Companies, Inc. 1,986,185 57,996,602 BJ’s Wholesale Club Holdings, Inc. (b) 1,891,100 84,834,746 Performance Food Group Co. (b) 1,118,796 64,453,838 TOTAL COMMUNICATION SERVICES 282,010,872 U.S. Foods Holding Corp. (b) 1,638,300 62,451,996 211,740,580 CONSUMER DISCRETIONARY – 15.0% Food Products – 1.1% Automobiles – 0.2% Nomad Foods Ltd. (b) 3,382,400 92,880,704 Harley‑Davidson, Inc. 474,400 19,023,440 Household Products – 1.0% Diversified Consumer Services – 0.6% Spectrum Brands Holdings, Inc. -

S P O T L I G H T Pa R T I C I Pa N

SPOTLIGHT PARTICIPANTS 12 Copyright © 2019 Mercer (US) Inc. All rights reserved. ORGANIZATION LISTING 3M (Minnesota Mining & Manufacturing) Atlas Energy Group LLC City of Overland Park, KS Cleveland Indians Baseball Co. A&E Television Networks Auburn University City of Winston-Salem, NC CliftonLarsonAllen, LLP A.O. Smith Corporation Automatic Data Processing California Health Care Foundation CMA CGM (America) LLC American Automobile Association, Inc., The Automobile Club of Southern California Cabot Oil & Gas Corporation CNH Industrial America LLC Accenture LLP AXA XL Cactus Feeders, Inc. CNO Financial Group Accudyne Industries, LLC Badger Meter, Inc. Cadmus Holding Company CNOOC Petroleum U.S.A. Inc. Advance Auto Parts Baltimore Orioles California Endowment, The CNX Resources ADVICS North America, Inc. Bank of the Ozarks, Inc. California ISO Colorado Rockies Baseball Club AECOM Building & Construction Bank of New York Mellon California Wellness Foundation Cobb Electric Membership Corporation AECOM Enterprise Baptist Health - FL Cambia Health Solutions (Regence Group) Coca-Cola Company, Inc., The AECOM Management Services Crestline Hotels & Resorts, LLC Canadian Imperial Bank of Commerce COG Operating, LLC Aera Energy Services Company Barnes & Noble, Inc. Canadian National Cognizant Technology Solutions Corporation Affinity Federal Credit Union BASF Corporation Canadian Pacific Railway CohnReznick LLP AgReserves Inc. Basin Electric Power Co-op Canadian Solar, Inc. Colby College Agri Beef Company Bates College Capital Group Companies, Inc., The Colonial Group, Inc. American International Group, Inc. (AIG) Battelle Memorial Institute Capital One Financial Corporation Columbia Sportswear Company Aimbridge Hospitality Baylor College of Medicine CarMax Auto Superstores, Inc. Columbia University American Institutes for Research BB&T Corporation Carilion Clinic Columbus McKinnon Corporation Air Liquide USA Blue Cross Blue Shield of Kansas Carrix, Inc. -

Drinking Water Compliance Plan

DRINKING WATER COMPLIANCE PLAN CHEMOURS FAYETTEVILLE WORKS RCRA PERMIT NO. NCD047368642-R2-M3 Prepared for: The Chemours Company FC, LLC Corporate Remediation Group 22828 NC Highway 87 W Fayetteville, NC 28306-7332 Prepared by: PARSONS 4701 Hedgemore Drive Charlotte, NC 28209 April 2019 Chemours PN 504552 Parsons PN 449338 DRINKING WATER COMPLIANCE PLAN TABLE OF CONTENTS TABLE OF CONTENTS 1.0 INTRODUCTION ................................................................................................... 1 1.1 Consent Order ................................................................................................... 1 1.2 Call Line ............................................................................................................. 1 2.0 PRIVATE WELL TESTING ................................................................................... 3 2.1 Additional Drinking Water Well Testing .......................................................... 3 2.2 Re-Analysis of Previously-Collected Groundwater Samples ......................... 4 2.3 Annual Re-Testing ............................................................................................ 5 2.4 Provision of Sampling Results ........................................................................ 5 2.5 Verification of Vacant Properties ..................................................................... 5 3.0 INTERIM REPLACEMENT OF PRIVATE DRINKING WATER SUPPLIES .......... 6 3.1 Replacement Drinking Water Supplies ........................................................... -

Capped Buffered Return Enhanced Insight Notes Linked to the J.P

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to completion dated June 2, 2021 June , 2021 Registration Statement Nos. 333-236659 and 333-236659-01; Rule 424(b)(2) JPMorgan Chase Financial Company LLC Structured Investments Capped Buffered Return Enhanced Insight Notes Linked to the J.P. Morgan Basket of Reference Stocks with Potential Exposure to Inflation (June 2021) due July 6, 2023 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. The notes are designed for investors who seek a return of 1.50 times any appreciation of the J.P. Morgan Basket of Reference Stocks with Potential Exposure to Inflation (June 2021) of 45 unequally weighted Reference Stocks, which we refer to as the Basket, up to a maximum return of at least 21.00%, at maturity. The Reference Stocks in the Basket represent the common stocks / common shares / ordinary shares of 45 U.S.-listed companies with potential exposure to inflation in the United States. Investors should be willing to forgo interest and dividend payments and be willing to lose up to 90.00% of their principal amount at maturity. The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. -

NACD Public Company Full Board Members

NACD Public Company Full Board Members: Rank | Company Rank | Company Rank | Company Rank | Company A.O. Smith Corp. Analog Devices Bridge Housing Corporation Clearwire Corp. AAA Club Partners Ansys, Inc. Briggs & Stratton Corp. Cliffs Natural Resources Inc. AARP Foundation Apogee Enterprises, Inc. Brightpoint, Inc. Cloud Peak Energy Inc. Aastrom Biosciences, Inc. Apollo Group, Inc. Bristow Group Inc. CME Group Acadia Realty Trust Applied Industrial Technologies, Broadwind Energy CoBiz, Inc. ACI Worldwide, Inc. Inc. Brookdale Senior Living Inc. Coherent, Inc. Acme Packet, Inc. Approach Resources, Inc. Bryn Mawr Bank Corporation Coinstar, Inc. Active Power, Inc. ArcelorMittal Buckeye Partners L.P. Colgate-Palmolive Co. ADA-ES, Inc. Arch Coal, Inc. Buffalo Wild Wings, Inc. Collective Brands, Inc. Adobe Systems, Inc. Archer Daniels Midland Co. Bunge Limited Commercial Metals Co. Advance Auto Parts ARIAD Pharmaceuticals, Inc. CA Holding Community Health Systems Advanced Energy Industries, Inc. Arkansas Blue Cross Blue Shield CACI International, Inc. Compass Minerals Aerosonic Corp. Arlington Asset Investment Corp. Cal Dive International, Inc. Comverse Technology, Inc. Aetna, Inc. Arthur J. Gallagher & Co. Calamos Asset Management, Inc. Conmed Corp. AFC Enterprises, Inc. Asbury Automobile Cameco Corp. Connecticut Water Service, Inc. AG Mortgage Investment Trust Inc. Aspen Technology, Inc. Cameron ConocoPhillips Agilent Technologies Associated Banc-Corp.5 Campbell Soup Co. CONSOL Energy Inc. Air Methods Corp. Assurant, Inc. Capella Education Co. Consolidated Edison Co. Alacer Gold Corp. Assured Guaranty Ltd. Capital One Financial Corp. Consolidated Graphics, Inc. Alaska Air Group, Inc. ATMI Capstead Mortgage Corp. Consolidated Water Co., Ltd. Alaska Communication Systems Atwood Oceanics, Inc. Cardtronics, Inc. Continental Resources, Inc. Group, Inc. Auxilium Pharmaceuticals Inc. -

Economy League of Greater Philadelphia Builds Leadership Team with Addition of Four New Staff Members

FOR IMMEDIATE RELEASE CONTACT: Amanda Piccirilli-Hall 6484-680-1988 [email protected] Economy League of Greater Philadelphia Builds Leadership Team With Addition of Four New Staff Members New staff deepens Economy League’s commitment to social and community challenges, innovative programming and insightful resources to address social and community challenges PHILADELPHIA (Feb. 13, 2020) – The Economy League of Greater Philadelphia, the region’s think-and-do tank that addresses critical issues facing the Greater Philadelphia area, has brought on four new staff members to help the organization continue to provide impactful research, connect diverse leaders, and advance shared solutions. Economy League Executive Director Jeff Hornstein is augmenting the organization’s capacity with two new directors, a program manager and a new office manager. These additions will allow the Economy League to deepen existing initiatives such as the Greater Philadelphia Leadership Exchange and Philadelphia Anchors for Growth & Equity, but also to launch its new Civic Impact Labs program. “I was thrilled by the response to our job descriptions – we had incredibly talented people apply for these positions, and we were fortunate to have our offers accepted by each of our first-choice candidates,” said Hornstein. “With an expanded and energized staff and the launch of our Civic Impact Lab, 2020 is shaping up to be a great year for the Economy League!” Philadelphia Anchors for Growth and Equity (PAGE) Director J’nelle E. Lawrence, MBA will lead the PAGE initiative, a collaborative of Philadelphia’s largest eds-and-meds anchor institutions that leverages their $5.3 billion in annual spend to create job and business growth in disinvested neighborhoods. -

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

Trian Partners Nominates Four Highly Qualified Candidates for Election to Dupont Board

TRIAN PARTNERS NOMINATES FOUR HIGHLY QUALIFIED CANDIDATES FOR ELECTION TO DUPONT BOARD Referendum On Performance DuPont Board Has Not Held Management Accountable For Repeatedly Missing Promised Revenue And Earnings Targets Newly Revealed Poor Corporate Governance At Chemours Shows Board Disconnect From DuPont Stockholders NEW YORK, January 8, 2015 – Trian Fund Management, L.P. (“Trian”), one of the largest stockholders of E. I. du Pont de Nemours and Company (NYSE: DD) (“DuPont”), announced today that it has nominated four highly qualified candidates for election to the DuPont Board of Directors at the 2015 Annual Meeting of Stockholders. Investment funds managed by Trian currently beneficially own an aggregate of approximately 24.4 million DuPont shares valued at approximately $1.8 billion. Trian believes long-term success requires each of DuPont’s business segments to achieve best-in- class operating metrics. Despite management’s rhetoric about the value of “integrated science,” the reality is that DuPont is struggling operationally: 1) earnings per share are down since 2011; 2) organic revenue growth and margins have underperformed peers in five of the Company’s seven segments; and 3) management has lowered and/or missed its own guidance to Wall Street for the third year in a row while consistently failing to achieve the revenue and margin targets presented at DuPont’s 2011 Investor Day. Trian believes the DuPont Board has not held management accountable for continuing underperformance and repeated failures to deliver publicly stated -

COMPANY INDEX WEIGHT ACI Worldwide Inc 0.22% AECOM 0.40% AGCO Corp 0.23% AMC Networks Inc.-A 0.09% ASGN Incorporated 0.19% Aaron's Inc

COMPANY INDEX WEIGHT ACI Worldwide Inc 0.22% AECOM 0.40% AGCO Corp 0.23% AMC Networks Inc.-A 0.09% ASGN Incorporated 0.19% Aaron's Inc. 0.21% Acadia Healthcare Company Inc 0.16% Acuity Brands Inc 0.25% Adient Inc. 0.13% Adtalem Global Education Inc 0.10% Affiliated Managers Grp 0.22% Alleghany Corp (NY) 0.63% Allegheny Technologies Inc 0.14% Allete Inc 0.23% Allscript Healthcare Solutions Inc 0.08% Amedisys Inc 0.35% American Campus Communities Inc 0.35% American Eagle Outfitters 0.13% American Financial Group 0.46% Antero Midstream Corp 0.08% Apergy Corp 0.11% AptarGroup Inc 0.39% Arrow Electronics Inc 0.35% Arrowhead Pharmaceuticals, Inc 0.23% Ashland Global Holdings Inc 0.26% Associated Banc-Corp (IL) 0.18% AutoNation Inc 0.15% Avanos Medical, Inc 0.08% Avis Budget Group Inc 0.13% Avnet Inc 0.20% Axon Enterprise Inc 0.28% BANK OZK 0.18% BJ's Wholesale Club Holdings 0.14% BancorpSouth Inc (MS) 0.15% Bank of Hawaii Corp 0.20% Bed Bath & Beyond Inc 0.08% Belden Inc 0.11% Bio-Rad Laboratories Inc A 0.44% Bio-Techne Corp 0.42% Black Hills Corp 0.28% Blackbaud Inc 0.21% Boston Beer Inc A 0.20% Boyd Gaming Corp 0.14% Brighthouse Financial Inc 0.27% Brinker Intl Inc 0.09% Brixmor Property Group Inc 0.33% Brown & Brown Inc 0.59% Brunswick Corp 0.29% CACI International Inc 0.37% CDK Global Inc 0.34% CIENA Corp 0.36% CIT Group Inc 0.24% CNO Financial Group Inc 0.16% CNX Resources Corp. -

68560 Bankers Conseco Life Insurance Company

STATEMENT AS OF MARCH 31, 2019 OF THE BANKERS CONSECO LIFE INSURANCE COMPANY ASSETS Current Statement Date 4 1 2 3 December 31 Net Admitted Assets Prior Year Net Assets Nonadmitted Assets (Cols. 1 - 2) Admitted Assets 1. Bonds 448,414,680 448,414,680 441,499,686 2. Stocks: 2.1 Preferred stocks 4,465,600 4,465,600 8,530,271 2.2 Common stocks 315,120 315,120 262,276 3. Mortgage loans on real estate: 3.1 First liens 5,137,566 5,137,566 5,137,566 3.2 Other than first liens 4. Real estate: 4.1 Properties occupied by the company (less $ encumbrances) 4.2 Properties held for the production of income (less $ encumbrances) 4.3 Properties held for sale (less $ encumbrances) 5. Cash ($ 100,661 ), cash equivalents ($ 10,450,000 ) and short-term investments ($ ) 10,550,661 10,550,661 14,369,346 6. Contract loans (including $ premium notes) 5,575,700 20,233 5,555,467 5,445,886 7. Derivatives 8. Other invested assets 4,524,761 4,524,761 2,485,072 9. Receivables for securities 10. Securities lending reinvested collateral assets 11. Aggregate write-ins for invested assets 12. Subtotals, cash and invested assets (Lines 1 to 11) 478,984,088 20,233 478,963,855 477,730,103 13. Title plants less $ charged off (for Title insurers only) 14. Investment income due and accrued 5,324,855 5,324,855 4,950,468 15. Premiums and considerations: 15.1 Uncollected premiums and agents' balances in the course of collection 205,892 1,595 204,297 235,707 15.2 Deferred premiums, agents' balances and installments booked but deferred and not yet due (including $ earned but unbilled premiums) 7,685,519 7,685,519 7,161,985 15.3 Accrued retrospective premiums ($ ) and contracts subject to redetermination ($ ) 16.