Under- Investment in a Profitable Technology

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rhd Road Network, Rangpur Zone

RHD ROAD NETWORK, RANGPUR ZONE Banglabandha 5 N Tentulia Nijbari N 5 Z 5 0 6 Burimari 0 INDIA Patgram Panchagarh Z Mirgarh 5 9 0 Angorpota 3 1 0 0 5 Z Dhagram Bhaulaganj Chilahati Atwari Z 57 Z 06 5 0 Kolonihat Boda 2 1 Tunirhat Gomnati 3 0 Dhaldanga 7 Ruhea Z 5 N 6 5 Z 5 0 0 Dimla 0 0 2 3 7 9 2 5 6 Z 54 INDIA 5 Debiganj Z50 Sardarhat Z 9 5 0 5 5 Domar Hatibanda Bhurungamari Baliadangi Z N Kathuria Boragarihat Z5 Bahadur Dragha 002 2 Z5 0 7 0 03 5 Thakurgaon Z RLY 7 R 0 Station 58 2 7 7 Jaldhaka 2 5 Bus 6 Dharmagarh Stand Z 5 1 Z Z5 70 029 Z5 Nekmand Z Mogalhat 5 Kaliganj 6 Z5 Tengonmari 17 Nageshwari 2 7 56 4 7 Z 2 09 1 Raninagar Kadamtala 0 Z 0 0 57 5 9 0 Z 0 5 Phulbari Z 5 5 2 Z 5 5 Z Namorihat 0 Kalibari 2 Khansama 16 6 5 56 Z 2 Z Z Aditmari 01 Madarganj 50 Z5018 N509 Z59 4 Ranisonkail N5 08 Tebaria Nilphamari Kishoreganj 8 Z5 Kutubpur 00 008 Lalmonirhat Bhitarbond Z5 Z 2 Z5018 Z5018 Shaptibari 5 2 6 4 Darwani Z 2 6 0 1 0 5 Manthanahat 5 R Z5 Z 9 6 Z 0 00 Pirganj Bakultala 0 Barabari 5 2 5 5 5 1 0 Z Z Z Z5002 7 5 5 Z5002 Birganj 0 0 02 Gangachara N 5 0 5 Moshaldangi Z5020 06 6 06 0 5 0 N 5 Haragach Haripur Z 7 0 N5 Habumorh Bochaganj 0 5 4 Z 2 Z5 61 3 6 5 1 11 Z 5 Taraganj 2 6 Kurigram 0 N Hazirhat 5 Kaharol 5 Teesta 18 Z N5 Ranirbandar N5 Z Kaunia Bridge Rajarhat Z Saidpur Rangpur Shahebganj 5 Beldanga 0 Medical 0 5 Shapla 6 1 more 1 1 more 0 0 5 5 25 Ghagat Z 50 N517 Z Z Bridge Taxerhat N5 Mohiganj 1 2 Mordern 6 4 more 5 02 Z 8 5 Z Shampur 0 Modhupur Z 5 Parbatipur 50 N Sonapukur Badarganj 1 Chirirbandar Z5025 0 Ulipur Datbanga Govt Z5025 Pirgachha College R 5025 Simultala Laldangi 5 Z Kolahat Z 8 Kadamtali Biral Cantt. -

Bangladesh – Hindus – Awami League – Bengali Language

Refugee Review Tribunal AUSTRALIA RRT RESEARCH RESPONSE Research Response Number: BGD30821 Country: Bangladesh Date: 8 November 2006 Keywords: Bangladesh – Hindus – Awami League – Bengali language This response was prepared by the Country Research Section of the Refugee Review Tribunal (RRT) after researching publicly accessible information currently available to the RRT within time constraints. This response is not, and does not purport to be, conclusive as to the merit of any particular claim to refugee status or asylum. Questions 1. Are Hindus a minority religion in Bangladesh? 2. How are religious minorities, notably Hindus, treated in Bangladesh? 3. Is the Awami League traditionally supported by the Hindus in Bangladesh? 4. Are Hindu supporters of the Awami League discriminated against and if so, by whom? 5. Are there parts of Bangladesh where Hindus enjoy more safety? 6. Is Bengali the language of Bangladeshis? RESPONSE 1. Are Hindus a minority religion in Bangladesh? Hindus constitute approximately 10 percent of the population in Bangladesh making them a religious minority. Sunni Muslims constitute around 88 percent of the population and Buddhists and Christians make up the remainder of the religious minorities. The Hindu minority in Bangladesh has progressively diminished since partition in 1947 from approximately 25 percent of the population to its current 10 percent (US Department of State 2006, International Religious Freedom Report for 2006 – Bangladesh, 15 September – Attachment 1). 2. How are religious minorities, notably Hindus, treated in Bangladesh? In general, minorities in Bangladesh have been consistently mistreated by the government and Islamist extremists. Specific discrimination against the Hindu minority intensified immediately following the 2001 national elections when the Bangladesh Nationalist Party (BNP) gained victory with its four-party coalition government, including two Islamic parties. -

European Journal of Geosciences - Vol

EUROPEAN JOURNAL OF GEOSCIENCES - VOL. 02 ISSUE 01 PP. 19-29 (2020) European Academy of Applied and Social Sciences – www.euraass.com European Journal of Geosciences https://www.euraass.com/ejgs/ejgs.html Research Article Assessment of drought disaster risk in Boro rice cultivated areas of northwestern Bangladesh Rukaia-E-Amin Dinaa, Abu Reza Md. Towfiqul Islama* aDepartment of Disaster Management, Begum Rokeya University, Rangpur 5400, Bangladesh Received: 13 June 2019 / Revised: 16 October 2019 / Accepted: 12 January 2020 Abstract Drought risk has become a major threat for sustaining food security in Bangladesh; the particularly northwestern region of Bangladesh. The objective of the study is to assess drought disaster risk on Boro paddy cultivated areas of northwestern Bangladesh using drought disaster risk index (DDRI) model. The sensitivity of Boro paddy to droughts during crop-growing seasons and irrigation recoverability were employed to reflect vulnerability condition. Moreover, the threshold level of the standardized precipitation evapotranspiration index (SPEI) was applied to evaluate the drought hazard on Boro paddy cultivated areas in the northwestern region of Bangladesh. The probability density function (PDF) was used to show the threshold level of drought hazard. The results show that drought hazard is comparatively severe in Ishardi area compared to other northwestern regions of Bangladesh. The drought disaster risk is higher in Ishardi and Rajshahi areas than Rangpur and Dinajpur areas. Although Ishardi area is more prone to high drought risk, at the same time, the recoverability rate is also quicker than any other areas. The relationship between Boro rice yield rates and drought disaster risk is insignificant. -

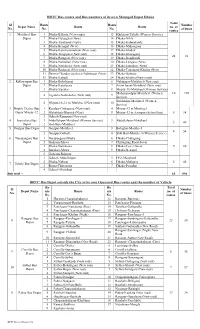

BRTC Bus Routes and Bus Numbers of Its Own Managed Depot Dhaka Total Sl Routs Routs Number Depot Name Routs Routs No

BRTC Bus routes and Bus numbers of its own Managed Depot Dhaka Total Sl Routs Routs Number Depot Name Routs Routs no. of No. No. No. of buses routes 1. Motijheel Bus 1 Dhaka-B.Baria (New routs) 13 Khilgoan-Taltola (Women Service) Depot 2 Dhaka-Haluaghat (New) 14 Dhaka-Nikli 3 Dhaka-Tarakandi (New) 15 Dhaka-Kalmakanda 4 Dhaka-Benapul (New) 16 Dhaka-Muhongonj 5 Dhaka-Kutichowmuhoni (New rout) 17 Dhaka-Modon 6 Dhaka-Tongipara (New rout) 18 Dhaka-Ishoregonj 24 82 7 Dhaka-Ramgonj (New rout) 19 Dhaka-Daudkandi 8 Dhaka-Nalitabari (New rout) 20 Dhaka-Lengura (New) 9 Dhaka-Netrakona (New rout) 21 Dhaka-Jamalpur (New) 10 Dhaka-Ramgonj (New rout) 22 Dhaka-Tongipara-Khulna (New) 11 Demra-Chandra via Savar Nabinagar (New) 23 Dhaka-Bajitpur 12 Dhaka-Katiadi 24 Dhaka-Khulna (New routs) 2. Kallayanpur Bus 1 Dhaka-Bokshigonj 6 Nabinagar-Motijheel (New rout) Depot 2 Dhaka-Kutalipara 7 Zirani bazar-Motijheel (New rout) 3 Dhaka-Sapahar 8 Mirpur-10-Motijheel (Women Service) Mohammadpur-Motijheel (Women 10 198 4 Zigatola-Notunbazar (New rout) 9 Service) Siriakhana-Motijheel (Women 5 Mirpur-10-2-1 to Motijheel (New rout) 10 Service) 3. Double Decker Bus 1 Kendua-Chittagong (New rout) 4 Mirpur-12 to Motijheel Depot Mirpur-12 2 Mohakhali-Bhairob (New) 5 Mirpur-12 to Azimpur (School bus) 5 38 3 Gabtoli-Rampura (New rout) 4. Joarsahara Bus 1 Abdullahpur-Motijheel (Women Service) 3 Abdullahpur-Motijheel 5 49 Depot 2 Shib Bari-Motijheel 5. Gazipur Bus Depot 1 Gazipur-Motijheel 3 Balughat-Motijheel 4 54 2 Gazipur-Gabtoli 4 Shib Bari-Motijheel (Women Service) 6. -

Traditional Institutions As Tools of Political Islam in Bangladesh

01_riaz_055072 (jk-t) 15/6/05 11:43 am Page 171 Traditional Institutions as Tools of Political Islam in Bangladesh Ali Riaz Illinois State University, USA ABSTRACT Since 1991, salish (village arbitration) and fatwa (religious edict) have become common features of Bangladesh society, especially in rural areas. Women and non-governmental development organizations (NGOs) have been subjected to fatwas delivered through a traditional social institution called salish. This article examines this phenomenon and its relationship to the rise of Islam as political ideology and increasing strengths of Islamist parties in Bangladesh. This article challenges existing interpretations that persecution of women through salish and fatwa is a reaction of the rural community against the modernization process; that fatwas represent an important tool in the backlash of traditional elites against the impoverished rural women; and that the actions of the rural mullahs do not have any political links. The article shows, with several case studies, that use of salish and fatwa as tools of subjection of women and development organizations reflect an effort to utilize traditional local institutions to further particular interpretations of behavior and of the rights of indi- viduals under Islam, and that this interpretation is intrinsically linked to the Islamists’ agenda. Keywords: Bangladesh; fatwa; political Islam Introduction Although the alarming rise of the militant Islamists in Bangladesh and their menacing acts in the rural areas have received international media attention in recent days (e.g. Griswold, 2005), the process began more than a decade ago. The policies of the authoritarian military regimes that ruled Bangladesh between 1975 and 1990, and the politics of expediency of the two major politi- cal parties – the Awami League (AL) and the Bangladesh Nationalist Party (BNP) – enabled the Islamists to emerge from the political wilderness to a legit- imate political force in the national arena (Riaz, 2003). -

Bangladesh Fact Sheet

Bangladesh Fact Sheet SEVA’S WORK AT A GLANCE: In country since 2005 | Partners: 3 Country Overview » Located in South Asia » Bangladesh spans 56,977 square miles » Population: 161 million1 » 2020 Human Development Index Ranking: 133rd of 189 countries and UN-recognized territories » Bangladesh currently hosts approximately 1 million Rohingya refugees in Cox’s Bazar District2 Scope of Vision Needs3 Nationwide Eye Care Response » 0.9% of Bangladesh’s population is blind (0.56 » Bangladesh’s Cataract Surgical Rate (CSR) was million), as compared to 0.15% in the United States 1,193 surgeries per million in 2013, as compared to the US CSR of 6,353 » 7.5% of the population has moderate to severe vision impairment or MSVI (12M) as compared to » There were 6.3 ophthalmologists per million 1.25% in the United States people in Bangladesh in 2014 (1,000). » 2% of global blindness » The US has 60 ophthalmologists per million people » There were 7.5 Allied Ophthalmic Personnel (AOP) per million people in 2014 (1,200) VISION NEEDS CATARACT SURGICAL RATE PER MILLION PEOPLE 5.00% 4.65% 4.00% Bangladesh 1,193 3.00% 2.40% WHO Target 3,000 2.20% 2.00% United States 6,353 1.00% 0.56% 0.00% 0 % Pop % Pop Global Global 1,000 7,000 2,000 3,000 5,000 6,000 Blindness MSVI Blindness MSVI 4,000 1 2020 Human Development Report. http://hdr.undp.org/en/countries/profiles/BGD 2 IAPB and Seva. A Situational Analysis: Eye Care Needs of Rohingya refugees and the Affected Bangladeshi Host Population 3 Unless otherwise noted, all country sight statistics from IAPB Vision Atlas: http://atlas.iapb.org/global-action-plan/gap-indicators/ 1 | BANGLADESH FACT SHEET | OCTOBER 2020 BANGLADESH FACT SHEET Seva’s Approach in Bangladesh With the Quasem Foundation, Seva supports low-cost and high-quality comprehensive eye care Bangladesh ranks among the poorest countries in services for the vulnerable populations of Northern the world, with more than one-half of its 161 million Bangladesh. -

Division Zila Upazila Name of Upazila/Thana 10 10 04 10 04

Geo Code list (upto upazila) of Bangladesh As On March, 2013 Division Zila Upazila Name of Upazila/Thana 10 BARISAL DIVISION 10 04 BARGUNA 10 04 09 AMTALI 10 04 19 BAMNA 10 04 28 BARGUNA SADAR 10 04 47 BETAGI 10 04 85 PATHARGHATA 10 04 92 TALTALI 10 06 BARISAL 10 06 02 AGAILJHARA 10 06 03 BABUGANJ 10 06 07 BAKERGANJ 10 06 10 BANARI PARA 10 06 32 GAURNADI 10 06 36 HIZLA 10 06 51 BARISAL SADAR (KOTWALI) 10 06 62 MHENDIGANJ 10 06 69 MULADI 10 06 94 WAZIRPUR 10 09 BHOLA 10 09 18 BHOLA SADAR 10 09 21 BURHANUDDIN 10 09 25 CHAR FASSON 10 09 29 DAULAT KHAN 10 09 54 LALMOHAN 10 09 65 MANPURA 10 09 91 TAZUMUDDIN 10 42 JHALOKATI 10 42 40 JHALOKATI SADAR 10 42 43 KANTHALIA 10 42 73 NALCHITY 10 42 84 RAJAPUR 10 78 PATUAKHALI 10 78 38 BAUPHAL 10 78 52 DASHMINA 10 78 55 DUMKI 10 78 57 GALACHIPA 10 78 66 KALAPARA 10 78 76 MIRZAGANJ 10 78 95 PATUAKHALI SADAR 10 78 97 RANGABALI Geo Code list (upto upazila) of Bangladesh As On March, 2013 Division Zila Upazila Name of Upazila/Thana 10 79 PIROJPUR 10 79 14 BHANDARIA 10 79 47 KAWKHALI 10 79 58 MATHBARIA 10 79 76 NAZIRPUR 10 79 80 PIROJPUR SADAR 10 79 87 NESARABAD (SWARUPKATI) 10 79 90 ZIANAGAR 20 CHITTAGONG DIVISION 20 03 BANDARBAN 20 03 04 ALIKADAM 20 03 14 BANDARBAN SADAR 20 03 51 LAMA 20 03 73 NAIKHONGCHHARI 20 03 89 ROWANGCHHARI 20 03 91 RUMA 20 03 95 THANCHI 20 12 BRAHMANBARIA 20 12 02 AKHAURA 20 12 04 BANCHHARAMPUR 20 12 07 BIJOYNAGAR 20 12 13 BRAHMANBARIA SADAR 20 12 33 ASHUGANJ 20 12 63 KASBA 20 12 85 NABINAGAR 20 12 90 NASIRNAGAR 20 12 94 SARAIL 20 13 CHANDPUR 20 13 22 CHANDPUR SADAR 20 13 45 FARIDGANJ -

Under Threat: the Challenges Facing Religious Minorities in Bangladesh Hindu Women Line up to Vote in Elections in Dhaka, Bangladesh

report Under threat: The challenges facing religious minorities in Bangladesh Hindu women line up to vote in elections in Dhaka, Bangladesh. REUTERS/Mohammad Shahisullah Acknowledgements Minority Rights Group International This report has been produced with the assistance of the Minority Rights Group International (MRG) is a Swedish International Development Cooperation Agency. non-governmental organization (NGO) working to secure The contents of this report are the sole responsibility of the rights of ethnic, religious and linguistic minorities and Minority Rights Group International, and can in no way be indigenous peoples worldwide, and to promote cooperation taken to reflect the views of the Swedish International and understanding between communities. Our activities are Development Cooperation Agency. focused on international advocacy, training, publishing and outreach. We are guided by the needs expressed by our worldwide partner network of organizations, which represent minority and indigenous peoples. MRG works with over 150 organizations in nearly 50 countries. Our governing Council, which meets twice a year, has members from 10 different countries. MRG has consultative status with the United Nations Economic and Minority Rights Group International would like to thank Social Council (ECOSOC), and observer status with the Human Rights Alliance Bangladesh for their general support African Commission on Human and Peoples’ Rights in producing this report. Thank you also to Bangladesh (ACHPR). MRG is registered as a charity and a company Centre for Human Rights and Development, Bangladesh limited by guarantee under English law: registered charity Minority Watch, and the Kapaeeng Foundation for supporting no. 282305, limited company no. 1544957. the documentation of violations against minorities. -

Summary Emergency Appeal Operation Update Bangladesh

Emergency appeal operation update Bangladesh: Floods and Landslides A marooned family in Kurigram looking for shelter on dry land. Photo: BDRCS Emergency appeal n° MDRBD010 GLIDE n° FL-2012-000106-BGD 12-month operation update 5 September 2013 Period covered by this Operation Update: 8 August to 30 June 2013 Appeal target (current): CHF 1,753,139 Appeal coverage: To date, the appeal is 95 per cent covered in cash and kind. The IFRC DREF allocation has been replenished. Appeal history: This Emergency Appeal was launched on 8 August 2012 for CHF 1,753,139 to support Bangladesh Red Crescent Society (BDRCS) to assist 9,500 families (47,500 beneficiaries) for 10 months. The initial operation aimed to complete by 7 June 2013. However, considering the on-going works as well as follow-up activities, the operation asked for a timeframe extension and will continue until 30 September 2013. Thus, A Final Report will be available by 31 December 2013 (three months after the end of operation). On 4 July, CHF 241,041 was allocated from the IFRC Head of Delegation visited cash for work project site in Cox’s Bazar district. Photo: BDRCS. International Federation of Red Cross and Red Crescent Societies (IFRC’s) Disaster Relief Emergency Fund (DREF) to support the Bangladesh Red Crescent Society (BDRCS) in delivering immediate assistance to 5,000 families (25,000 beneficiaries) in eight districts: Bandarban, Cox’s Bazar, Chittagong, Sylhet, Sunamganj, Kurigram, Gaibandha and Jamalpur. Summary In response to the floods and landslides resulting from the torrential rain during June 2012, BDRCS, with the support of IFRC, provided immediate relief and subsequent recovery assistance to the ten most affected districts in the country’s northern and south-eastern regions. -

141-149, 2014 ISSN 1999-7361 Analysis of Variability in Rainfall Patterns in Greater Rajshahi Division Using GIS M

J. Environ. Sci. & Natural Resources, 7(2): 141-149, 2014 ISSN 1999-7361 Analysis of Variability in Rainfall Patterns in Greater Rajshahi Division using GIS M. Shamsuzzoha1, A. Parvez2 and A.F.M.K.Chowdhury3* 1Department of Emergency Management, 2Department of Environmental Science, 3Department of Resource Management, Patuakhali Science and Technology University, Bangladesh; * Corresponding author: [email protected] Abstract The study entitled ‘Analysis of Changes in Rainfall Patterns in Rajshahi Division using GIS’ is an experimental climatological research. The main objectives of the study is to examine the long-term changes in rainfall patterns of Rajshahi Division. Secondary data of rainfall distribution have been collected from Bangladesh Meteorological Department (BMD), Dhaka. The study has analysed monthly, seasonal and annual rainfall distribution pattern from 1962 to 2007 of five selected weather stations namely Bogra, Dinajpur, Ishurdi, Rajshahi and Rangpur. For convenience of analysis, the data has been divided into two halves of time period as 1962-1984 and 1985-2007. Based on GIS, the study gifts the spatial analysis of rainfall patten using Thiessen Polygon Method, Isohytal and Hytograph Method and Percentage Method. It has been found that there is evidence of annual rainfall change with an increasing pattern in Bogra, Dinajpur, Rajshahi and Rangpur. In these four stations, the changing pattern in Rangpur is the highest. Downward shift of annual rainfall shows a decreasing pattern in Ishurdi. The descending order of monthly and seasonal rainfall pattern for Ishurdi, Rajshahi and Rangpur has been found as July > June > September >August > October > April > March > February > November > December. Although Bogra and Dinajpur have contained this trend in the same order from July to March, anomalies pattern has been found for last four months. -

Women, Islam and the State in Bangladesh Subordination and Resistance

Yvonne Preiswerk et Marie Thorndahl (dir.) Créativité, femmes et développement Graduate Institute Publications Women, Islam and the State in Bangladesh subordination and resistance Tazeen Mahnaz Murshid DOI: 10.4000/books.iheid.6526 Publisher: Graduate Institute Publications Place of publication: Graduate Institute Publications Year of publication: 1997 Published on OpenEdition Books: 8 November 2016 Serie: Genre et développement. Rencontres Electronic ISBN: 9782940503735 http://books.openedition.org Electronic reference MAHNAZ MURSHID, Tazeen. Women, Islam and the State in Bangladesh subordination and resistance In: Créativité, femmes et développement [online]. Genève: Graduate Institute Publications, 1997 (generated 25 avril 2019). Available on the Internet: <http://books.openedition.org/iheid/6526>. ISBN: 9782940503735. DOI: 10.4000/books.iheid.6526. WOMEN, ISLAM AND THE STATE IN BANGLADESH SUBORDINATION AND RESISTANCE Tazeen MAHNAZ MURSHID After a period of political oblivion, the religious right in Bangladesh has not only made electoral gains in the early 1990s but also successfully engaged in political alliances which allowed it to campain virtually unopposed for an Islamic state where women could step outdoors only at their own peril. Their many-speared campain included attacks on development organisations which empowered women through offering loans, skills training and employment opportunities. They have argued that female emancipation is not part of God’s plan. Therefore, schools for girls have not remained unscathed. Women who dared to challenge existing social codes, alongside those who did not have, are equally victims of violence and moral censure. These activities were at odds with the development objectives of the state. Yet, at times the role of the state was an ambivalent one. -

Flooding in North-Western Bangladesh

FLOODING IN NORTH‐WESTERN BANGLADESH HCTT JOINT NEEDS ASSESSMENT About this Report Nature of disaster: River and Monsoon Flooding Date of disaster: Initial reports from around the 15th August. JNA Triggered on the 19th August Location: North‐west districts of Lalmonirhat, Nilphamari, Kurigram, Rangpur, Gaibanda. Bogra, Sirajgonj, Jamalpur and Sherpur Assessment by: Multi‐stakeholder participation using the JNA format at Union level and secondary data review Date of Publication: FIRST DRAFT CIRCULATED 31.08.2014 THIS VERSION INCORMPORATING CLUSTER COMMENTS AND ANALYSIS 07.09.2014 Report prepared by: Multi‐stakeholder team Inquiries to: Abdul Wahed (CARE), Mahbub Rahman (CARE), Ahasanul Hoque (ACAPS), Liam Costello (FSC), Jenny Burley (SI) Sandie Walton‐Ellery (ACAPS) Cover photo Jafar Alam, Islamic Relief, Women in Dewanganj (used with their permission) Bangladesh, September 8, 2014 FINDINGS: Joint Needs Assessment: Flooding in north‐western Bangladesh – 08 September 2014 Page 1 CONTENTS 1. Overview of the situation and the disaster ........................................................................................... 6 2. Maps of the affected area ................................................................................................................... 10 3. Priorities reported at Union level ........................................................................................................ 11 3.1 Priorities for immediate assistance............................................................................................