Annual Report 2008 Report Annual A/S Carlsberg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tatarklubben 2021-22

Tatarklubben Top Thinkers for Top Managers The exclusive business club where authors & editors from Harvard Business Review Press present and discuss their latest work with Nordic executives. 2021-2022 Format We inspire leaders to make better decisions by Each event is tailored to the content and style of connecting them with the global thought leaders in each visiting author, but typically contains: management today. The content is presented live and in-person by authors and editors from Harvard • Networking Business Review Press. • Light breakfast or dinner Each month we host a new masterclass. Members • Keynote presentation freely choose which to attend. On a yearly basis we • Table discussions host 12 unique HBR author-led seminars: • Q&A • 6 in-person seminars in Copenhagen and Aarhus • Book signing • 6 virtual seminars Morning seminars (8-10:30) Afternoon seminars (15:30-18:30) Virtual seminars (14-15 & 18-19) 3 Members Membership is available by invitation only for All members are hand picked based on thorough executives from leading organisations in the Nordic research and a personal interview. region. Job Level Company Size Occupation Finance 200-500 Director Comm CXO General Mgt 10K+ Sales 500-1K IT Strategy VP SVP 5K-10K HR 1K-5K Marketing 4 Annual Membership Individual • Access to monthly HBR author-led events (6 virtual + 6 in-person events in CPH & Aarhus) • Access to live streaming of all HBR keynotes + video archive • HBR Press books for all events (hard copy, e-book and audiobook formats) • HBR subscription with magazines & full online access Annual fee: DKK 24,900 (ex. -

Mikael Kamber 9.15 Velkommen V. Palle

KONFERENCEreduce 6. JUNI 2012 ..but use with Aarhus 8.30 Registrering og morgenmad 12.00 Frokost og underholdning 13.00 9 workshop-spor - runde 2 Ordstyrer: Mikael Kamber Vælg en workshop af 45 minutters varighed. 14.00 Kaffepause og netværk (i P-kælderen) 9.15 Velkommen 14.20 Visionerne for Aarhus Kommunes v. Palle Bjerre Rasmussen, sektionsdirektør, byudvikling Byggeri Vest, NCC Construction Aarhus har en ambition om frem mod 2030 at 9.30 Ejerskab skaber vækst og kraft vokse med 75.000 indbyggere. Netop nu oplever ”Hovedkvarters-tænkning” er den almindelige byen intet mindre end et byggeboom af historiske måde at tage fat på. ”Top-down” er nemmest, dimensioner, hvilket vil sige projekter for omkring mens ”bottum-up” er rigtig svært – til gengæld 30 mia. kr. Byudvikling, vækst og klimaudfordring er det i bøvlet, at de gode diskussioner finder er på dagsordenen. sted. ”What’s in it for me” er et vilkår, de fleste v. Arealudviklingschef Bente Lykke Sørensen, kan forholde sig aktivt til, og et godt ejerskab Aarhus Kommune. kan funderes i fremtidens decentrale og fælles- 14.40 Debat skabsbaserede samfund. Debatpanel med Bente Lykke Sørensen/ Aarhus v. Søren Hermansen, Energiakademiet, Samsø Kommune, Kim Behnke/Energinet.dk, Mads 10.10 Kort pause Thimmer/ Innovation Lab, Søren Hermansen/ 10.25 Make more use Energiakademiet, Martin Manthorpe/ NCC. “Make more use” outlines opportunities to com- 15.45 Tak for i dag! pletely change consumption as we know it. First, we change the cycle and economy of produc- tion and consumption. Second, we change the culture of consumption by putting ”new offers” on the street (på engelsk). -

Creating Scandinavian Capitalism” – a New International Business History Course

Paper to the EBHA conference in Frankfurt 2005 “Creating Scandinavian Capitalism” – a new international business history course Draft – please do not quote from this edition By Martin Jes Iversen, Assistant Professor, Centre for Business History, Copenhagen Business School Introduction In March 2005 the H-Business internet web forum for business historians hosted an interesting and intensive on-line debate. The debate concerned the position of business history courses on business schools and the problem of integrating the field in to more traditional business schools programmes. It was the H-net editor David A. Kirsch who made the first reference to an article by David Van Fleet and Daniel Wren entitled “Teaching History in Business Schools, 1982-2003” published in the journal Academy of Management Learning and Education.1 Kirsch referred to some of Van Fleets and Wrens conclusions, and they were indeed not edifying news for the business historical researchers on H-business:2 - the teaching of history in domestic business schools has dropped (from 79% to 51%). - among those that say history is now part of their programs, in 2003 most feel that it should not be, whereas in 1982 most felt that it should be. - respondents from accredited institutions felt that less history of management thought should be taught In order to underscore the point David A. Kirsch also mentioned a few survey responses which Van 3 Fleets and Wrens had received from American business schools: 1 Van Fleet and Wren (2005) 2 Ibid., p. 47. 3 Ibid. P. 51. 1 - we have eliminated teaching history in favour of courses that better prepare our students for scholarly research...it is less important than other topics and we had to make trade-offs given the limited number courses students take while in the program. -

Betonklubbens Nyhedsbrev D. 01.05.19

m Betonklubbens nyhedsbrev d. 01.05.19. Betonklubben. Udgave 73 Se her, se her, se her, se her, Se her, se her, se her, se her, Se her, se her. Har du noget som du synes klubben skal arrangere, noget du gerne vil have op til debat, problemer du synes er på pladserne, akkorderne, firmaerne, en skrivelse/nogle ord du har lavet og som du vil have i nyhedsbrevet, ja alt mellem himmel og jord er du velkommen til at ringe til Tonny eller Rene eller formand for klubben Nikolaj, på 23311722. – 27773550. – 23620832. Eller sende det til e-mail [email protected] Se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her Husk at jord og beton afdelingen (anlæg og byg) har her i september 2019 bestået i 100 år. Så det fejer vi sener på året, der vil komme dato ud sener i år om dette arrangement. Se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her, se her Beton klubben arrangerer igen en fiske dag til Gudenådalens Lystfiskersø, det bliver for medlemmer med familie som må deltage, børn, kærester, ægtefælle, onkel, tanter ja som skreven alt i familien eller en ven. Det bliver afholdt lørdag den 15. juni, vi starter kl. 9 kan man ikke være der til dette tidspunkt møder man bare op når det passer ind i ens program for dagen. -

University of Copenhagen (Njalsgade 102, 2300 Copenhagen S, Denmark)

The making of the Danish liberal drinking style The construction of a "wet" alcohol discourse in Denmark (Paper presented at the Kettil Bruun Society Conf. in Toronto 31th of May - 5th of June 1992) Eriksen, Sidsel Published in: Contemporary Drug Problems Publication date: 1994 Citation for published version (APA): Eriksen, S. (1994). The making of the Danish liberal drinking style: The construction of a "wet" alcohol discourse in Denmark (Paper presented at the Kettil Bruun Society Conf. in Toronto 31th of May - 5th of June 1992). Contemporary Drug Problems, (1), 1-31. Download date: 30. Sep. 2021 +(,121/,1( Citation: 20 Contemp. Drug Probs. 1 1993 Content downloaded/printed from HeinOnline Tue Oct 25 14:07:45 2016 -- Your use of this HeinOnline PDF indicates your acceptance of HeinOnline's Terms and Conditions of the license agreement available at http://heinonline.org/HOL/License -- The search text of this PDF is generated from uncorrected OCR text. -- To obtain permission to use this article beyond the scope of your HeinOnline license, please use: Copyright Information Contemporary Drug Problems/Spring 1993 The making of the Danish liberal drinking style: the construction of a "wet" alcohol discourse in Denmark BY SIDSEL ERIKSEN The author is at the Institute of History of the University of Copenhagen (Njalsgade 102, 2300 Copenhagen S, Denmark). She has written on why temperance history differed in Denmark and in Sweden and recently published a biography of a Danish feminist temperance leader. There is a liberal attitude toward alcohol consumption in Denmark and the country experiences few problems with alcohol abuse. -

ANNUAL REPORT 2018/19 Indhold

ANNUAL REPORT 2018/19 Indhold CONTENTS Aarsleff and how we work 3 34 MANAGEMENT’S 43 FINANCIAL STATEMENT AND STATEMENTS 4 MANAGEMENT’S AUDITOR’S REPORT Financial review 44 Consolidated financial statements 45 REVIEW Management’s statement 34 Parent company financial statements 84 The year in figures 5 Independent auditor’s report 35 Letter from the CEO 6 Financial highlights and ratios for the Group 8 38 THE YEAR 93 COMPANIES IN The year in brief 9 The future financial year 10 AT A GLANCE THE AARSLEFF GROUP Strategic focus areas 12 Marine construction in extreme conditions 38 Focus areas for the three segments 14 Copenhagen’s largest Financial targets, capital structure construction site 39 and distribution policy 16 Significant Aarsleff footprint Construction 18 at Aarhus Ø 40 Pipe Technologies 20 Expansion of Port of Rønne 41 Ground Engineering 22 Building construction in Shareholder information 24 the centre of Reykjavik 42 Corporate governance 26 Commercial risk assessment 27 Internal control and risk management in financial reporting 28 Corporate social responsibility 29 Executive Management and This Annual Report has been prepared in Danish and English. Board of Directors 31 In case of discrepancy, the Danish version shall prevail. Aarsleff Annual report 2018/19 2 Aarsleff how we work AARSLEFF AND HOW WE WORK MARKET LEADER ONE COMPANY PARTNERSHIPS The Aarsleff Group is a building construction and civil engi- The Group’s diverse range of business units are either independ- AND EFFICIENCY neering group with an international scope and a market leading ent companies or departments. Each business unit has different position in Denmark. -

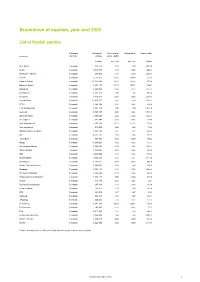

Breakdown of Equities, Year-End 2020

Breakdown of equities, year-end 2020 Listed Danish equities Company Number of Ownership of Voting rights Market value Company domicile equities share capital number per cent per cent DKKm ALK-Abello Denmark 830,794 7.46 4.10 2,077.0 Ambu Denmark 4,818,951 1.91 0.86 1,268.3 AP Moller - Maersk Denmark 253,690 1.27 0.90 3,358.9 Asetek Denmark 2,722,415 10.30 10.30 210.3 Bang & Olufsen Denmark 17,092,036 13.92 13.92 573.6 Bavarian Nordic Denmark 5,904,171 10.11 10.11 1,104.1 Carlsberg Denmark 1,227,664 0.84 0.27 1,197.2 Chr Hansen Denmark 1,381,570 1.06 1.06 865.4 Coloplast Denmark 1,310,347 0.61 0.35 1,218.1 Danske Bank Denmark 13,693,257 1.60 1.60 1,378.2 DFDS Denmark 1,949,162 3.32 3.32 536.4 DSV PANALPINA Denmark 2,281,956 1.00 1.00 2,327.6 Genmab Denmark 1,166,965 0.09 0.09 1,544.8 GN Store Nord Denmark 3,166,046 2.24 2.24 1,542.5 H Lundbeck Denmark 931,964 0.47 0.47 194.6 H+H International Denmark 2,107,893 11.72 11.72 278.2 Huscompagniet Denmark 615,000 3.08 3.08 76.9 INVISIO Communications Denmark 3,183,701 7.22 7.22 589.2 ISS Denmark 4,551,135 2.46 2.46 479.7 Jyske Bank 1 Denmark 455,709 0.63 0.00 106.2 Matas Denmark 1,846,027 4.82 4.82 159.5 Netcompany Group Denmark 1,660,500 3.33 3.33 1,033.7 Nilfisk Holding Denmark 1,436,062 5.29 5.29 189.0 NKT Denmark 2,637,690 6.14 6.14 715.3 Novo Nordisk Denmark 7,546,288 0.32 0.11 3,219.6 Novozymes Denmark 1,724,215 0.61 0.23 602.6 Nordic Transport Group Denmark 1,086,064 4.80 4.80 278.0 Pandora Denmark 2,153,187 2.16 2.16 1,466.3 Per Aarsleff Holding Denmark 2,064,304 10.13 6.34 636.8 Ringkjoebing -

Gtlc2001.Pdf

The Baltic region has a population of 7.6 million and is at the verge Estonia: Liivalaia 8, 15040 Tallinn of accession to the European Union. Here the market grows quicker Phone: +372 6 131355 than almost no other market in the world. Located at the crossroads Fax: +372 6 131545 E-mail: [email protected] of historical trade routes, the region is showing constant progress in www.hansa.ee every aspect of development economic, social, educational and financial. Latvia: Kalku street 26, LV-1050 Riga Phone: +371 7 024154 Hansabank Markets leads the equity market in Fax: +371 7 024400 E-mail: [email protected] Estonia, Latvia and Lithuania with market share www.hbl.lv exceeding 40%. We offer our clients the finest know- Lithuania: how of the area, best research house of the Baltic Gedimino ave 26, LT-2600 Vilnius region by Euromoney, integrated and plugged-in Phone: +370 2 390638 Fax: +370 2 390641 distribution channels and flexibility derived from our E-mail: [email protected] expertise and commitment. Hansabank Markets www.hansabank.lt grows the business through developing Baltic financial markets. Hansabank Markets. Professional choices for professional people. LITHUANIAN COMPANIES NACIONALINË VERTYBINIØ P0PIERIØ BIRÞA Guide to Listed Companies 2001 published by the National Stock Exchange of Lithuania Tel. (+370 2) 72 14 07, 72 15 42, fax (+370 2) 72 48 94 http://www.nse.lt Guide to Listed Companies Editors 2000 Simona Baèkienë Juozas Brigmanas Tomas Kliuèius Jûratë Lauciûtë Agnë Maslauskaitë Arminta Saladþienë Lina Semënaitë Diana Sokolova Design director Gediminas Minderis Assisting in the editorial work Gediminas Balnis Daiva Grigusevièiûtë ISSN 1648-2980 2 LITHUANIAN COMPANIES NATIONAL STOCK EXCHANGE OF LITHUANIA Dear Reader, We are delighted to introduce the fifth edition of the annual publication GUIDE TO LISTED COMPANIES issued by the National Stock Exchange of Lithuania. -

Carlsberg Annual Report Market Overview

Carlsberg Annual Report Market overview 2 1 Our markets Denmark Norway Sweden Finland Poland Germany The Baltic StatesUnited KingdomFrance Switzerland Italy Greece Population (millions) 5.5 5.0 9.4 5.4 38.1 81.4 6.9 62.6 63.2 7.8 60.6 11.2 10.7 19.3 142.4 45.6 16.5 28.6 9.4 9.1 28.7 5.3 7. 2 1,348.1 89.3 6.6 14.4 28.5 1,206.9 Est. GDP/capita PPP (USD) 37,742 53,376 40,614 36,723 20,137 37,936 17,95 8 4 35,974 35,049 43,509 30,166 27,6 24 23,204 13,740 4 16,687 7,19 9 13,060 3,294 14,948 10,217 15,579 59,937 49,342 8,394 3,355 2,659 2,286 1,328 3,703 Est. real GDP growth (%) 1.5 1.7 4.4 3.5 3.8 2.7 4-6.6 1.1 1.7 2.2 0.6 -5.0 -2.2 0.8-2.5 4.3 4.7 6.5 7.1 5.0 0.2 5.2 5.3 6.0 9.5 5.8 8.3 6.7 3.5 7.8 Inflation, avg. consumer prices (%) 3.2 1.7 3.0 3.1 4.0 2.2 4.2-5.1 4.5 2.1 0.7 2.6 2.9 3.4 3.2-11.3 8.9 9.3 8.9 13.1 41.0 9.3 3.2 3.7 5.5 5.5 18.8 8.7 6.4 9.5 10.6 Est. -

Annual Report 2015-16 5

This annual report is a translation of Per Aarsleff Holding A/S’s official Danish annual report. The original Danish text shall take precedence and in case of discrepancy the Danish wording shall prevail. The Aarsleff Group 3 Management’s review Highlights for the Group 5 The year in brief 6 The future financial year and strategic focus areas 8 Long-term financial targets 10 The past year in Construction 12 The past year in Pipe Technologies 14 The past year in ground engineering 16 Information to shareholders 18 Corporate governance 20 Commercial risk assessment 22 Internal control and risk management in financial reporting 24 Corporate social responsibility 26 Executive Management and Board of Directors 28 Management’s statement and independent auditor’s reports Management’s statement 30 Independent auditor’s reports 30 photographers Consolidated financial statements Bank Fotografi Financial review 40 Büro Jantzen Consolidated financial statements 41 Byggeriets Billedbank Financial statements of the parent company 82 Jakob Mark Jan Kofod Winther Addresses 94 Mads Krabbe Fotografi Michael Berg photos taken by employees 27 A 34 27 3 23 A 36 A 38 A 40 26 42 A 28 29 44 46 25 48 62 50 60 52 58 54 56 31 30 A A 27 A A 33 32 D01290K DK:4.53 BK:2.96 A M D4510XP DK: BK:3.09 A D01120K 155 DK:3.28 A BK:2.06 ø800bt-24.6$ D01010K DK:3.32 BK:1.44 ø800bt-23.7$ A Specialists from the Aarsleff Group carry out expan- D kanal 3200x1700 sion of Port of Frederikshavn. -

Fjordenhus, First Building by Acclaimed Artist Olafur Eliasson and His Studio, Opens in Vejle, Denmark

Fjordenhus, first building by acclaimed artist Olafur Eliasson and his studio, opens in Vejle, Denmark - For immediate release - 1 June 2018 Photo: Anders Sune Berg, 2018 Fjordenhus (Fjord House), the first building designed entirely by artist Olafur Eliasson and the ar- chitectural team at Studio Olafur Eliasson, will open on 9 June in Vejle, Denmark. Commissioned by KIRK KAPITAL, the company’s new headquarters offer a contemporary interpretation of the idea of the total work of art, incorporating remarkable site-specific artworks by Eliasson with spe- cially designed furniture and lighting. Rising out of the water, Fjordenhus forges a striking new connection between Vejle Fjord and the city centre of Vejle—one of Jutland peninsula’s thriving economic hubs. As one moves from the train station towards the harbour, Fjordenhus comes into view across the expansive plaza of the man-made Havneøen (The Harbour Island), a mixed-use residential and commercial area cur- rently in development. From here, residents and visitors can access the ground floor of Fjordenhus via a footbridge or stroll along the jetty designed by landscape architect Günther Vogt. The building’s public, double-height entrance level is dedicated to the relation of the building to the water, drawing attention to the plane where the structure plunges beneath the surface, its curved edges framing glimpses of the surrounding shores and harbour. The building is permeated by the harbour itself, and its two aqueous zones are visible from viewing platforms. Both the architectural spaces and Eliasson’s artworks engage in a dialogue with the ever-changing surface of the water. -

Strategic and Financial Valuation of Carlsberg A/S

Strategic and Financial Valuation of Carlsberg A/S Master Thesis – Finance and Strategic Management 30th of September 2011 Cand. merc. FSM Department of Finance Copenhagen Business School Author: Andri Stefánsson Supervisor: Carsten Kyhnauv Strategic and Financial Valuation of Carlsberg A/S Executive summary The main objective of this thesis was to determine the theoretical fair value of one Carlsberg A/S share on the 1st of March 2011. Carlsberg A/S is the world´s 4th largest brewery measured in sales volume and has acquired this position both through organic growth as well as acquisitions of its competitors as a part of the consolidation phase that the brewing industry has undergone in the past 10 years. In order to obtain the necessary understanding of the company´s business model, a strategic analysis was carried out both on an external as well as on an internal level. The strategic analysis showed that Carlsberg has a very strong product portfolio and one of its main strengths was innovation in regards to new products targeting new market segments. Being the 4th largest brewery in the world creates great economies of scale which are of importance. The strategic analysis also showed that the political and economical situation in Russia is of most threat to Carlsberg. The strategic analysis was followed by a financial analysis which showed that all key financial drivers rose upon till 2008 when the recent economic crisis hit and Carlsberg at the same time acquired Scottish & Newcastle. From 2009 the key financial drivers showed improvements both due to Carlsberg being able to make use of the synergies created as a part of the acquisition along with an increase in revenue and lower borrowing costs.