Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

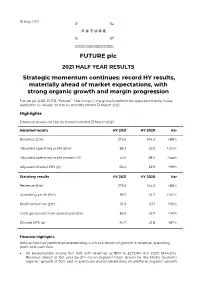

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

Trends in U.S. Oil and Natural Gas Upstream Costs

Trends in U.S. Oil and Natural Gas Upstream Costs March 2016 Independent Statistics & Analysis U.S. Department of Energy www.eia.gov Washington, DC 20585 This report was prepared by the U.S. Energy Information Administration (EIA), the statistical and analytical agency within the U.S. Department of Energy. By law, EIA’s data, analyses, and forecasts are independent of approval by any other officer or employee of the United States Government. The views in this report therefore should not be construed as representing those of the Department of Energy or other federal agencies. U.S. Energy Information Administration | Trends in U.S. Oil and Natural Gas Upstream Costs i March 2016 Contents Summary .................................................................................................................................................. 1 Onshore costs .......................................................................................................................................... 2 Offshore costs .......................................................................................................................................... 5 Approach .................................................................................................................................................. 6 Appendix ‐ IHS Oil and Gas Upstream Cost Study (Commission by EIA) ................................................. 7 I. Introduction……………..………………….……………………….…………………..……………………….. IHS‐3 II. Summary of Results and Conclusions – Onshore Basins/Plays…..………………..…….… -

The Future of U.S. Commercial Imagery VISION IMPLEMENTATION

» INTERNATIONAL COMPETITION » NEW CONCERNS ABOUT PRIVACY SUMMER 2012 THE OFFICIAL MAGAZINE OF THE UNITED STATES GEOSPATIAL INTELLIGENCE FOUNDATION Crossroads The Future of U.S. Commercial Imagery VISION IMPLEMENTATION At L-3 STRATIS, we help organizations make the technological and cultural changes needed to implement their vision. Our innovative cyber, intel and next generation IT solutions enable your mission, while reducing costs and improving the user experience. Find out more. Contact [email protected] or visit www.L3STRATIS.com STRATIS L-3com.com contents summer 2012 2 | VANTAGE POINT Features 27 | MEMBERSHIP PULSE Introducing the new Accenture upgrades to USGIF strategic partner. trajectory magazine. 9 | AT A CROSSROADS 4 | INTSIDER Proposed cuts to NGA’s EnhancedView 28 | GEN YPG News updates plus high- program revive the commercial Beacon of Hope and YPG lights from got geoint? imagery debate. work together to help By Kristin Quinn rebuild New Orleans. 6 | IN MOTION Small Business Advisory 30 | HORIZONS Working Group hosts Reading List, Peer Intel, 16 | THE $4B GLOBAL PIE luncheon with guest Calendar. speakers from NGA. New competition is forming in the commercial data marketplace. 32 | APERTURE 8 | ELEVATE By Brad Causey Canada has it. Germany Mizzou’s Center for has it. Italy has it. Back in Geospatial Intelligence the U.S., SAR? goes beyond academics. 22 | PIGEONHOLED Privacy policies threaten advances ON THE COVER Cover image of Dallas, Texas, in technology. courtesy of GeoEye. Image has By Jim Hodges been altered with permission for editorial purposes. trAJectorYmAGAZIne.com eXcLusIVes VIDEO PODCAST PANEL “What can you do with Exclusive interview Recap of the Space geography?” National with Kevin Pomfret, Enterprise Council's Geographic video director of the Centre panel on the impor- featuring Keith for Spatial Law and tance of commercial Masback of USGIF. -

Future of Defense Task Force Report 2020 Cover Photo Credit: NASA Future of Defense Task Force

draft Future of Defense Task Force Report 2020 Cover photo credit: NASA Future of Defense Task Force FUTURE OF DEFENSE TASK FORCE September 23, 2020 The Honorable Adam Smith Chairman House Armed Services Committee 2216 Rayburn House Office Building Washington, D.C. 20515 The Honorable William “Mac” Thornberry Ranking Member House Armed Services Committee 2216 Rayburn House Office Building Washington, D.C. 20515 Dear Chairman Smith and Ranking Member Thornberry: Thank you for your support in standing up the Future of Defense Task Force. We are pleased to present you with our final report. Sincerely, Seth Moulton Jim Banks Chair Chair Future of Defense Task Force Future of Defense Task Force Susan Davis Scott DesJarlais Member of Congress Member of Congress Chrissy Houlahan Paul Mitchell Member of Congress Member of Congress Elissa Slotkin Michael Waltz Member of Congress Member of Congress Future of Defense Task Force Table of Contents PROLOGUE ............................................................................................... 1 TASK FORCE MEMBERS ........................................................................ 3 FINDINGS .................................................................................................. 5 RECOMMENDATIONS ........................................................................... 7 EXECUTIVE SUMMARY ....................................................................... 13 EVIDENCE .............................................................................................. 21 EMERGING -

Loudoun County Public Schools

LOUDOUN COUNTY PUBLIC SCHOOLS DEPARTMENT OF BUSINESS & FINANCIAL SERVICES PROCUREMENT AND RISK MANGEMENT DIVISION 21000 Education Court, Suite #301 Ashburn, VA 20148 Phone (571) 252-1270 Fax (571) 252-1432 July 1, 2021 Contract Information Title: Magazine and Periodical Subscription Service IFB/RFP Number: IFB #I21332 Supersedes: IFB #I17142 Vendor Name: Debarment Form: Required: No Form on File: Not Applicable Contractor Certification: Required: No Form on File: Not Applicable Virginia Code 22.1-296.1 …the school board shall require the contractor to provide certification that all persons who will provide such services have not been convicted of a felony or any offense involving the sexual molestation or physical or sexual abuse or rape of a child. Pricing: See attached Pricing Sheet(s) Contract Period: July 1, 2021 – June 30, 2022 Contract Renewal New Number: Number of Renewals 4 Remaining: Procurement Contact: Pixie Calderwood Procurement Director: Andrea Philyaw LOUDOUN COUNTY PUBLIC SCHOOLS DEPARTMENT OF BUSINESS & FINANCIAL SERVICES PROCUREMENT AND RISK MANAGEMENT SERVICES 21000 Education Court, Suite #301 Ashburn, VA 20148 Phone (571) 252-1270 Fax (571) 252-1432 June 28, 2021 NOTICE OF AWARD IFB #I21332 Magazine and Periodical Subscription Services Loudoun County Public Schools is awarding IFB #I21332 Magazine and Periodical Subscription Services to EBSCO Information Services of Birmingham, AL. We appreciate your interest in being of service to the Loudoun County Public Schools. Andrea Philyaw Procurement Director LOUDOUN COUNTY PUBLIC SCHOOLS IFB #I21332 MAGAZINES AND PERIODICALS SUBSCRIPTION SERVICE Package 1: Library Office Print & Online Line Awarded UoM Title Name Format Publisher Name ISSN # Item Price 1EAComputers in Libraries Print Information Today, Inc. -

A Serious Game for Learning Enterprise Resource Planning

MD01 ME59N Execute MRP Convert to purchase order Purchaseorder 405 Independent requirement MIGO Post goods 401 receipts 406 MD61 Goods receipt Create forecast DB CR MIRO 707 Raw mat GR/IR Post invoice DB CR 407 Domestic ZCS02 sale revenues ChangeBOM F-53 Raw material DB CR consumption Post payment DB CR Cash Acc. Rec. DB CR Inventorysold productchange GR/IR Acc. Pay. DB CR Investments DB CR DB CR Factoryproduction output 410 Acc. Pay. Cash DB CR Acc. Rec. Revenues DB CR DB CR CO41 Finished Prod. 409 products output Mass release DB CR Invoice 414 production order DB CR Cons. Raw MD07 raw material DB CR Release Manufacturing Game DB CR VF01 Inventory Finished production order change product Production Create billing DB CR order 411 DeliveryA Serious413 Game for Learning Enterprise Resource Planning Concepts DB CR Investments Cash CO15 DB CR 305 VL01N Conrm production Create delivery powered by ERPsim FB50 Acquiring assembly line h t tp : //e rp sim.he c. ca Compatible with SAP™ ERP ECC 6.0 & 6.4 Pierre-Majorique Léger, Ph.D.Powered by ERPsim Jacques Robert, Ph.D. Robert Pellerin, ing., Ph.D. Gilbert Babin, Ph.D. Bret Wagner, Ph.D. ISBN: 978-0-9866653-0-1 This book contains references to the products of SAP AG, Dietmar- Hopp-Allee 16, 69190 Walldorf, Germany. The names of these products are registered and/or unregistered trademarks of SAP AG. SAP AG is neither the author nor the publisher of this book and is not responsible for its content. All rights reserved. Copying or distributing in print or electronic forms without written permission of HEC Montréal is prohibited. -

Alternatives for Future U.S. Space-Launch Capabilities Pub

CONGRESS OF THE UNITED STATES CONGRESSIONAL BUDGET OFFICE A CBO STUDY OCTOBER 2006 Alternatives for Future U.S. Space-Launch Capabilities Pub. No. 2568 A CBO STUDY Alternatives for Future U.S. Space-Launch Capabilities October 2006 The Congress of the United States O Congressional Budget Office Note Unless otherwise indicated, all years referred to in this study are federal fiscal years, and all dollar amounts are expressed in 2006 dollars of budget authority. Preface Currently available launch vehicles have the capacity to lift payloads into low earth orbit that weigh up to about 25 metric tons, which is the requirement for almost all of the commercial and governmental payloads expected to be launched into orbit over the next 10 to 15 years. However, the launch vehicles needed to support the return of humans to the moon, which has been called for under the Bush Administration’s Vision for Space Exploration, may be required to lift payloads into orbit that weigh in excess of 100 metric tons and, as a result, may constitute a unique demand for launch services. What alternatives might be pursued to develop and procure the type of launch vehicles neces- sary for conducting manned lunar missions, and how much would those alternatives cost? This Congressional Budget Office (CBO) study—prepared at the request of the Ranking Member of the House Budget Committee—examines those questions. The analysis presents six alternative programs for developing launchers and estimates their costs under the assump- tion that manned lunar missions will commence in either 2018 or 2020. In keeping with CBO’s mandate to provide impartial analysis, the study makes no recommendations. -

The Future of the Drone Economy

The Future of the Drone Economy A comprehensive analysis of the economic potential, market opportunities, and strategic considerations in the drone economy A Report From Levitate Capital 1 Disclaimer The information contained herein is intended for general informational purposes only, does not take into account the reader’s specific circumstances, and may not reflect the latest developments. Certain information contained herein has been obtained from third-party sources, which although believed to be accurate, has not been independently verified by Levitate Capital. Further, certain information (including forward-looking statements and economic and market information) has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Levitate Capital does not assume any responsibility for the accuracy or completeness of such information. Levitate Capital does not undertake any obligation to update the information contained herein as of any future date. Levitate Capital LLC disclaims, to the fullest extent, any liability for the accuracy and completeness of the information in this document and for any acts and omissions made on such information. Levitate Capital has invested in a few companies mentioned in this paper, including but not limited to: Dedrone, Elroy Air, Matternet, Shield AI, Skydio, Skyports, and Volocopter. 2 Executive Summary $ Billions 90 40 15 2020 2025 2030 Global Market Fastest Growth The global drone Enterprise will economy will grow remain the fastest from $15B to $90B growing segment by 2030 until 2025. Logistics will become the fastest after 2025 Largest Segment Largest Region Defense will Asia-Pacific will remain the largest remain the largest segment until non-defense 2024. -

State of the Space Industrial Base 2020 Report

STATE OF THE SPACE INDUSTRIAL BASE 2020 A Time for Action to Sustain US Economic & Military Leadership in Space Summary Report by: Brigadier General Steven J. Butow, Defense Innovation Unit Dr. Thomas Cooley, Air Force Research Laboratory Colonel Eric Felt, Air Force Research Laboratory Dr. Joel B. Mozer, United States Space Force July 2020 DISTRIBUTION STATEMENT A. Approved for public release: distribution unlimited. DISCLAIMER The views expressed in this report reflect those of the workshop attendees, and do not necessarily reflect the official policy or position of the US government, the Department of Defense, the US Air Force, or the US Space Force. Use of NASA photos in this report does not state or imply the endorsement by NASA or by any NASA employee of a commercial product, service, or activity. USSF-DIU-AFRL | July 2020 i ABOUT THE AUTHORS Brigadier General Steven J. Butow, USAF Colonel Eric Felt, USAF Brig. Gen. Butow is the Director of the Space Portfolio at Col. Felt is the Director of the Air Force Research the Defense Innovation Unit. Laboratory’s Space Vehicles Directorate. Dr. Thomas Cooley Dr. Joel B. Mozer Dr. Cooley is the Chief Scientist of the Air Force Research Dr. Mozer is the Chief Scientist at the US Space Force. Laboratory’s Space Vehicles Directorate. ACKNOWLEDGEMENTS FROM THE EDITORS Dr. David A. Hardy & Peter Garretson The authors wish to express their deep gratitude and appreciation to New Space New Mexico for hosting the State of the Space Industrial Base 2020 Virtual Solutions Workshop; and to all the attendees, especially those from the commercial space sector, who spent valuable time under COVID-19 shelter-in-place restrictions contributing their observations and insights to each of the six working groups. -

Registered No: 3757874

23 November 2018 Future plc Double-digit organic growth and a year of material international expansion Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes results for the year ended 30 September 2018. Financial highlights ● Substantial growth in Group revenue; up 48% to £124.6m (2017: £84.4m), of which 11% is organic growth1 o Strong performance in Media revenue, up 88% to £64.2m (2017: £34.1m), of which 40% is organic growth1 ▪ Digital display grew 63% to £31.8m ▪ eCommerce increased 104% to £18.2m ▪ Events grew 148% to £12.9m o Magazine revenue up 20% to £60.4m (2017: £50.3m), driven by the acquisition of the Haymarket titles ● US revenue up 109% to £39.9m (2017: £19.1m), of which 28% is organic growth; UK revenue up 38% to £92.5m (2017: £67.2m), of which 6% is organic growth ● Online Revenue Per User (RPU), a key metric, has increased in both the UK by 26% to £1.68 and the US by 32% to £0.96 as we monetise our audiences more effectively across both territories. ● Adjusted EBITDA2 increased 88% to £20.7m (2017: £11.0m), reflecting margin expansion through change in revenue mix and revenue growth across both Media and Magazine divisions ● Continued growth of Adjusted operating profit up 108% to £18.5m (2017: £8.9m) before share-based payments, amortisation of acquired intangibles, non-trading foreign exchange gains and exceptional items of £13.2m (2017: £8.1m); statutory operating profit up to £5.3m (2017: £0.8m) ● Adjusted EPS increased by 33% to 26.2p per share (2017: 19.7p per share -

Future Plc Annual Report and Accounts 2014

2014 Future plc Annual Report and Accounts 01 Future plc Group overview Future plc is an international media group and leading digital publisher, listed on the London Stock Exchange (symbol: FUTR). These highlights refer to the Group’s annual results for the year ended 30 September 2014. Strategic Report Continuing Revenue Net Cash 01 Group overview 02 Chairman’s statement 03 Chief Executive’s review £66.0m £ 7. 5 m 05 Business model 2013: £82.6m 2013: Net Debt £(6.9)m 07 What we do 08 Business review 09 Risks and uncertainties 11 Corporate responsibility Continuing EBITDAE Continuing Loss before tax Financial Review £(7.0)m £(35.4)m 13 Financial review 2013: £(0.6)m 2013: £(2.2)m Corporate Governance Continuing EBITE Continuing Exceptional items 17 Board of Directors 19 Directors’ report 23 Corporate Governance report 29 Directors’ remuneration report £(10.3)m £(24.3)m 41 Independent auditors’ report 2013: £(3.4)m 2013: £2.6m Financial Statements Continuing Digital Advertising Continuing Users 45 Financial statements 82 Notice of Annual General Meeting 87 Investor information 66% 57m of total advertising revenues (2013: 61%) a month (+10% year-on-year) EBITDAE represents EBITE represents Exceptional items for earnings before interest, earnings before 2014 above includes tax, depreciation, interest, tax, impairment impairment of intangible amortisation, impairment and exceptional items. assets of £16.8m. and exceptional items. Annual Report and Accounts 2014 02 Strategic Report Chairman’s statement Transformational Year This has been a year of signifi cant change for Future and the fi nancial results in 2014 do not refl ect the transformational activity that has been implemented. -

How Can We Accelerate the Insertion of Leading-Edge Technologies Into Our Military Weapons Systems?

How Can We Accelerate the Insertion of Leading-Edge Technologies Into Our Military Weapons Systems? Naval Postgraduate CRUSER Workshop April 5, 2021 George Galdorisi (Captain- U.S. Navy retired) Naval Information Warfare Center, Pacific Dr. Sam Tangredi (Captain U.S. Navy – retired) U.S. Naval War College 1 How Can We Accelerate the Insertion of Leading-Edge Technologies Into Our Military Weapons Systems? Executive Summary At the highest levels of U.S. intelligence and military policy documents, there is universal agreement that the United States remains at war, even as the conflicts in Iraq and Afghanistan wind down. As the cost of capital platforms—especially ships and aircraft—continues to rise, the Department of Defense is increasingly looking to procure comparatively inexpensive systems as important assets to supplement the Joint Force. As the United States builds a force structure to contend with high-end threats, it has introduced a “Third Offset Strategy” to find ways to gain an asymmetric advantage over potential adversaries. One of the key technologies embraced by this strategy is that of unmanned systems. Both the DoD and the DoN envision a future force with large numbers of relatively inexpensive unmanned systems complementing manned platforms. The U.S. military’s use of these systems—especially armed unmanned systems—is not only changing the face of modern warfare, but is also altering the process of decision-making in combat operations. These systems are evolving rapidly to deliver enhanced capability to the warfighter and seemed poised to deliver the next “revolution in military affairs.” Big data, artificial intelligence and machine learning represent some of the most cutting-edge technologies today, and will likely be the dominant technologies for the next several decades and beyond.