Superport Action Plan Delivering Economic Growth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liverpool Cruise Terminal

Liverpool Cruise Terminal Information to inform a Habitat Regulations Assessment (HRA) Appropriate Assessment October 2019 Waterman Infrastructure & Environment Limited Merchants House, Wapping Road, Bristol BS1 4RW, United Kingdom www.watermangroup.com Client Name: Liverpool City Council Document Reference: WIE12464-100-11-3-2-AA Project Number: WIE12464-100 Quality Assurance – Approval Status This document has been prepared and checked in accordance with Waterman Group’s IMS (BS EN ISO 9001: 2008, BS EN ISO 14001: 2004 and BS OHSAS 18001:2007) Issue Date Prepared by Checked by Approved by 10-2-1-HRA November 2017 Niall Machin Simon Dowell Gavin Spowage Associate Director Senior Consultant Associate Director Comments: HRA to support planning application 10-4-1-HRA June 2018 Niall Machin Gavin Spowage Gavin Spowage Associate Director Associate Director Associate Director Comments: HRA to support application for HRO and Marine Licence 11-2-3-AA January 2019 Niall Machin Gavin Spowage Gavin Spowage Associate Director Associate Director Associate Director Comments: HRA and Appropriate Assessment to support application for HRO and Marine Licence 11-3-1-AA October 2019 Niall Machin Gavin Spowage Gavin Spowage Associate Director Associate Director Associate Director Comments: Addressing Natural England consultation responses Disclaimer This report has been prepared by Waterman Infrastructure & Environment Limited, with all reasonable skill, care and diligence within the terms of the Contract with the client, incorporation of our General Terms and Condition of Business and taking account of the resources devoted to us by agreement with the client. We disclaim any responsibility to the client and others in respect of any matters outside the scope of the above. -

Mersey Tunnels Long Term Operations & Maintenance

Mersey Tunnels Long Term Operations & Maintenance Strategy Contents Background ............................................................................................................................................. 1 Strategic Overview .................................................................................................................................. 2 Supporting Economic Regeneration ................................................................................................... 3 Key Route Network ............................................................................................................................. 6 National Tolling Policy ......................................................................................................................... 8 Legislative Context .................................................................................................................................. 9 Mersey Crossing Demand ..................................................................................................................... 12 Network Resilience ........................................................................................................................... 14 Future Demand ................................................................................................................................. 14 Tunnel Operations ................................................................................................................................ 17 Supporting Infrastructure -

Ocean Gateway Technical Report, the Peel Group, October 2009

Technical Report October 2009 Version 2 2 Contents One Introduction 1 Two A functional geography 5 Three Strategic context 11 Four 50 Projects 21 Five Society and economy 27 Six Transport and accessibility 51 Seven Environment and natural economy 75 Eight Establishing the Guiding Principles 89 and Objectives 4 oneIntroduction 1 2 Introduction This Technical Report provides an analysis of the context and rationale This Report cuts across a number of major themes, reflecting the wide ranging for Ocean Gateway. It should be read in conjunction with the main and large scale nature of Ocean Gateway. Sustainability – economic, social and Ocean Gateway Prospectus. environmental – is the principal cross-cutting theme which underpins the Ocean Gateway, both for projects individually and as a headline concept and strategy. The Technical Report is structured as follows: Broad topics considered include economic growth and investment, housing • Chapter 2 – setting out the functional geography of Ocean Gateway; growth, regeneration priorities, social and economic well-being, transport for freight and people, environmental resources and capital, technological • Chapter 3 – a review of the strategic context of the area; innovation and climate change. • Chapter 4 – presents the 50 Projects, and the synergies and linkages In preparing this technical analysis underpinning the Prospectus for Ocean between them; Gateway, spatial boundaries were a key early consideration. As with all major • Chapter 5 – the social and economic context, challenges and spatial initiatives, Ocean Gateway has a footprint that differs depending upon opportunities, and an analysis of key outputs; which particular aspect is being considered. The spatial basis for Ocean Gateway, and a fresh policy approach in its support, are explored in Chapter 2. -

Canada Graving Dock Infill: Non Technical Summary

REPORT Canada Graving Dock Infill: Non- Technical Summary In support of Environmental Permit Application Client: Mersey Docks and Harbour Company Limited Reference: PB9683-RHD-ZZ-XX-TN-Z-0008 Status: S0/P01.01 Date: 22 July 2020 Project related HASKONINGDHV UK LTD. Honeycomb Edmund Street Liverpool L3 9NG United Kingdom Industry & Buildings VAT registration number: 792428892 +44 151 2362944 T +44 151 2272561 F [email protected] E royalhaskoningdhv.com W Document title: Canada Graving Dock Infill: Non-Technical Summary Document short title: Reference: PB9683-RHD-ZZ-XX-TN-Z-0008 Status: P01.01/S0 Date: 22 July 2020 Project name: Canada Graving Dock Infill Project number: PB9683 Author(s): Elspeth Harris Drafted by: Elspeth Harris Checked by: Matt Simpson Date / initials: Approved by: Matt Simpson Date / initials: Classification Project related Disclaimer No part of these specifications/printed matter may be reproduced and/or published by print, photocopy, microfilm or by any other means, without the prior written permission of HaskoningDHV UK Ltd.; nor may they be used, without such permission, for any purposes other than that for which they were produced. HaskoningDHV UK Ltd. accepts no responsibility or liability for these specifications/printed matter to any party other than the persons by whom it was commissioned and as concluded under that Appointment. The integrated QHSE management system of HaskoningDHV UK Ltd. has been certified in accordance with ISO 9001:2015, ISO 14001:2015 and ISO 45001:2018. 22 July 2020 PB9683-RHD-ZZ-XX-TN-Z-0008 -

Merseyside Freight Strategy

The third Local Transport Plan for Merseyside Annex 4 Freight Strategy LTP Support Unit March, 2011 1 2 LTP3 Freight Strategy Key Issues ‐ Port of Liverpool is a major regional and national gateway. ‐ SuperPort has been identified as a transformational programme for Liverpool City Region and its success is of long-term strategic importance for the North West economy. ‐ Of the air quality management areas in Merseyside, three have freight as a major contributor to poor air quality. ‐ Need to reduce carbon emissions from freight transport ‐ Rail paths from the Port of Liverpool are underutilised. This is likely to change as other major planned and committed developments are delivered. Freight- Key Facts Need to improve rail access to key strategic ‐ ‐ The port, airport and sites. associated freight ‐ There is the potential to make greater use infrastructure contributes of waterways in distributing freight. 34,000 jobs and £1.1 billion ‐ The Strategic Freight Network must be of GVA to the Liverpool City maintained. Region every year Use of Intelligent Transport Systems (ITS) to ‐ ‐ 36 million tonnes of freight reduce congestion and improve transported by road in environmental quality and road safety to be Merseyside in 2008 increased. ‐ 30 million tonnes of freight handled by the Port of Setting the scene Liverpool in 2009 1. The movement of goods is vitally important ‐ Liverpool John Lennon in supporting the priorities and economic Airport handled 264 tonnes success of Liverpool City Region. The Multi of freight in 2009 Area Agreement between LCR and the previous government identified a number of freight-related actions. These remain important, despite the abolition of MAAs by the Coalition Government. -

East Wirral(Mersey Estuary)

River Mersey near to Eastham Country Park. East Wirral (Mersey Estuary) The East Wirral route takes you from the start of the Manchester Ship Canal on the banks of the River Mersey, into the woodlands of Eastham Country Park and through the area of industrial heritage of the east coast to Seacombe. Along the route you will pass near to the historic village of Port Sunlight, through the Victorian suburb of Rock Park, past Cammell Lairds Shipyard, and along to Woodside where you can see the world’s first rail tram system. 60 From Woodside Ferry Terminal and the U-boat Story you will pass the docks, the Twelve Quays Irish Ferry Terminal and on towards Seacombe, where you will find Spaceport and the best views of the Liverpool Waterfront World Heritage Site. The River Mersey was once renowned as a polluted river but now it’s not unusual to see seals, porpoise and dolphin in the Mersey. Charter fishing boats regularly pass from the Mersey to Liverpool Bay which has become one of the best inshore cod fishing grounds in north west Europe. 61 East Wirral (Mersey Estuary) Eastham Country Park 1 Eastham Country Park Eastham Country Park holds immense value and is a long- standing, major leisure and nature conservation area. It covers some 43 hectares and it is the last remaining substantial area of undeveloped land with public access on the Wirral bank of the River Mersey between Birkenhead and Ellesmere Port. Its location gives it particular importance as a local amenity, wildlife and educational resource. The site includes approximately 26 hectares of mature mixed deciduous woodland, 8 hectares of amenity grassland, 3 hectares of new plantation woodland and 3 hectares of natural grassland and scrub. -

Liverpool City Region Superport

/H`^HYKZ *VTTLYJPHS9LHS,Z[H[L:LY]PJLZ>VYSK^PKL Submission Document SD22 LIVERPOOL CITY REGION SUPERPORT AN ANALYSIS OF THE SUPPLY OF, AND DEMAND FOR, DISTRIBUTION SPACE WITHIN THE LIVERPOOL CITY REGION MarchT 2014 LIVERPOOL CITY REGION SUPERPORT 2 CONTENTS LIVERPOOL CITY REGION SUPERPORT Contents 1 Introduction .........................................................................................................8 1.1 Assets ..............................................................................................................................................8 1.2 Supply chain .................................................................................................................................. 10 1.3 Competition ................................................................................................................................... 10 1.4 Objectives ...................................................................................................................................... 11 2 Demand ..............................................................................................................12 2.1 Introduction ................................................................................................................................... 12 2.1.1 Shipper power ............................................................................................................................... 13 2.1.2 Retailer revolution ......................................................................................................................... -

Commercial Portfolio Over 300,000 Sq

PeelWirral Commercial Portfolio Over 300,000 sq. ft. of industrial & office space Enter the brochure > Development Location Enterprise Index Aerial Why Wirral? Zone Wirral Waters Peel Contact Wirral Commercial Portfolio Click on the circles to take you to the relevant developments page. Woodside Business Park West Float Industrial Estate Uveco Business Centre Tower Quays Britannia House Birkenhead Land and Yards The Peel International Trade Centre Development Location Enterprise Index Aerial Why Wirral? Zone Wirral Waters Peel Contact Woodside Business Park Woodside Business Park is located in a popular, well established mixed-use business location in Birkenhead. Fronting on to the River Mersey, the property offers occupiers superb views across the river. The development has excellent transport links and is within 300 metres of Hamilton Square train station and just 100 metres of Woodside Ferry Terminal. Woodside Business Park also benefits from easy access to the M53 motorway and A41. Woodside Business Park benefits from: • Good quality accommodation • Competitive rentals Warehouse – Roller shutter and personnel access / integral offices / gas, electricity, water connection / WC facilities / on-site parking Offices - Wide range of offices / open plan and/or private offices / carpeted / central heating / WC facilities /kitchen area / on-site parking / competitive rentals Accommodation Workshop / labs / offices / storage accommodation Workspaces available from 250 sq. ft. – 6,000 sq. ft. (23.2 sq. m. – 557.4 sq. m.) Terms Flexible terms available. Availability Aerial Site Plan Map Details available upon request. Address: Woodside Business Park, Shore Road, Birkenhead, CH41 1EL Click on the above icons to view the relevant item. Development Location Enterprise Index Aerial Why Wirral? Zone Wirral Waters Peel Contact West Float Industrial Estate West Float Industrial Estate is located in a popular, well established commercial location in Wallasey and is an excellent base for trade counter/workshop/warehouse businesses. -

Recent Dock Extensions at Liverpool with a General

2 ELECTIOXS, ETC. [Minutes of Associate ilIembem-continued. JAXESDICEERSOW HUYPIDGE. l FI:A.NI~WALTER SCOTT, Jun., Stud. Inst. JAMESROUTLEDGE JACQUES. l C.E. CHARLESVEREKER LLOYD, A.K.C., ~ ALBIOXTIIOMAS SXELL. l Stud. Inst. C.E. TV.4LTER JOHNSTAYFORD, B.A., B.E. WALTEREDWAED MAY, Stud. Inst. C.E. i JOHXHODGSOX SUAI~T. CHARLESMURRAY, Stud. Inst. C.E. ALLANARCHIBALD CAMPBELL SWINTOX. HARRYPEKX, Stud. Inst. C.E. WILLIAXHEXRY THORPE. LESLIEHUNTER REYNOLDS. ARTHCR WILLIADISOS, Stud. InSt. C.E. LIOWELSALTXARSHE. GEORGEWYLIE, F.C.H. , Associate. Ncbjor LEAXDROCUBILLO. (Paper No. 2433.) Recent Dock Extensions at Liverpool, with a General Description of the MerseyDock Estate,the Port of Liverpool,and the RiverMersey.” By GEORGEFOSBERY LYSTER, M. Inst. C.E. THEspecial characteristics of theRiver Mersey, theimportant positionwhich Liverpool occupies among theleading trading centres of the world, and the rapid development of its commerce are, each and all, so interesting to engineers, that in submitting a Paper descriptive of the most recent dock extensions carried out in the port, the Author has been induced to touch upon each of these points, as a fitting preamble to the more formal and precise description of the special works which form the leading features of the Paper. Few, if any, localities, inthis country at all events, are so favourably situatedfor the construction of a comprehensive system of docks as that of Liverpool, not onlyby reason of its geographical position on the seaboard of the country, with its unrivalled water frontage, but also on account of its proximity to the great manu- faeturing districts, as well as to the coal and mineral fields of the North of England and Wales, with which it is linked by railways and canals, which aresuch important factors in thedevelopment and maintenance of successful trading. -

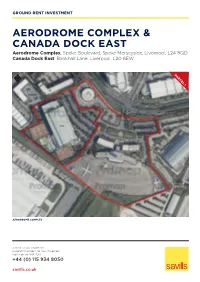

Aerodrome Complex & Canada Dock East

GROUND RENT INVESTMENT AERODROME COMPLEX & CANADA DOCK EAST Aerodrome Complex, Speke Boulevard, Speke Merseyside, Liverpool, L24 8QD Canada Dock East, Bankhall Lane, Liverpool, L20 8EW PARCEL 1 AERODROME COMPLEX SAVILLS NOTTINGHAM Enfield Chambers, 18 Low Pavement Nottingham NG1 7DG +44 (0) 115 934 8050 savills.co.uk PARCEL 2 CANADA DOCK EAST Location Liverpool is the second largest City in the north west of Transport infrastructure is excellent, with direct dual Getmapping plc 2020. Ordnance Survey Crown Copyright 2020. All Rights reserved. Licence number 100022432 the UK. The City Plottedis located Scale - 1:1250 .approximately Paper Size - A4 35 miles west carriageway access to the M62 and M56 and onto the of Manchester and 19 miles north of Chester. National Motorway network. Major road / rail interchange at the Liverpool South Situation Parkway and New Mersey Crossing. International service Aerodrome Complex by sea from the Port of Liverpool and Freeport. In The property forms part of the Estuary Commerce Park addition, there is a regular bus service to the City Centre with extensive linear frontage to the southern side of the and suburbs. A561 Speke Road, immediately north west of Liverpool’s John Lennon Airport and directly opposite New Mersey Canada Dock East Retail and Leisure Park. The property is located to the east of Canada Dock forming part of this established industrial / trade Estuary Commerce Park is recognized both in the north location with direct access off Bankhall Lane, via Derby west and beyond as Liverpool City regions premier Road (A565). location for a variety of business occupiers. Both Sandhills and Bank Hall Railway Stations are within Notably, it is located within 2 miles of Jaguar Land close proximity as is Liverpool City Centre which is Rover Halewood and only 2 minutes from Liverpool approximately 2 miles to the south. -

Agenda Item 4

Agenda Item 4 WIRRAL COUNCIL CABINET – 27 TH NOVEMBER 2008 REPORT OF THE DEPUTY CHIEF EXECUTIVE/DIRECTOR OF CORPORATE SERVICES INTERNATIONAL LINKS EXECUTIVE SUMMARY This report outlines the activity undertaken by the recent Wirral delegation visit to Suzhou, China from the 23 rd – 27 th September 2008. The report also recommends the development of four projects that will build upon the relationship that has been successfully developed. Background 1.1 Cabinet approved on 22 nd May 2008 further work to be undertaken to develop an International Links Strategy, including the establishment of a link with China. A similar discussion took place within the Investment Strategy Board which concluded that a link with China could significantly enhance the delivery of Wirral’s Investment Strategy. A further report was considered by Cabinet on July 9 th 2008 and it was agreed that a delegation should visit Suzhou between 23 rd – 27 th September. 1.2 The City of Suzhou was identified as a city with which it would be advantageous to develop a link. Suzhou is an ancient city with a history of achievement in arts and culture and it is also a major industrial centre and its high tech industries are at the centre of China’s rapid development. Cabinet was clear that the developing relationship be not just economic but should also encompass cultural and social areas such as education, the arts, and tourism. 1.3 The Government of Suzhou had expressed a strong desire to establish formal links with Wirral. Following a meeting in London with Mr Wang Yang, the Director of the Bureau of Foreign Trade and Economic Cooperation, a detailed proposition on what the mutual benefits might be was progressed and Cabinet approved the visit of an appropriate delegation to formalise this activity. -

FUN DAYS for ALL the FAMILY »» How to Get Here

familywIN passes inside! 2012/13 EXPLORE WIRRAL »» MUSEUMS, ART GALLERIES, PARKS & GARDENS, FARMS & MUCH MORE... Hurry up FUN DAYS FOR ALL THE FAMILY »» WWW.VISITWIRRAL.COM/ATTRACTIONS WWW.VISITWIRRAL.COM/ATTRACTIONS How to get here By Rail If you’re travelling to Wirral by train, the Merseyrail network connects to the national rail network via Liverpool Lime Street Station and Chester Railway Station. By Road The M53 motorway forms the spine of Wirral, running from Looking to maximise the North to the South. All Wonders of Wirral attractions are located off the M53. The M53 connects the family fun factor? to the M56, which in turn meets the M6. Both Liverpool and Chester are around 30 minutes’ Then Wirral is for you. drive away, Chester via the motorway, and Liverpool by tunnel, via either the Kingsway (Wallasey), or Queensway Nestling between the River Mersey (Birkenhead) tunnels. A toll applies. and the Dee in North West England the Wirral is full of surprises. With beaches, By Ferry gardens, farms, craft centres, parkland, A direct cross-river service operates between Liverpool, Birkenhead and Seacombe/ Wallasey, seven days a week. museums, art galleries and the famous Mersey Ferry there’s so much to enjoy! Stena Line ferries operate a Belfast route from Birkenhead’s Twelve Quays terminal. Celebrate the changing seasons at Ness Botanic Gardens and Birkenhead Park with spectacular For rail, bus and ferry timetables seasonal colour or jump on a tractor and meet Church Farm’s animals including chicks, alpacas and meerkats. Call Traveline on 0871 200 2233 or visit www.traveline.info or www.merseytravel.gov.uk For history lovers there’s Port Sunlight Museum & Garden Village, Birkenhead Priory and the U-Boat For national rail enquiries Story or for something completely different check Visit www.nationalrail.co.uk out Fort Perch.