Statutory Security of Supply Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digest of United Kingdom Energy Statistics 2017

DIGEST OF UNITED KINGDOM ENERGY STATISTICS 2017 July 2017 This document is available in large print, audio and braille on request. Please email [email protected] with the version you require. Digest of United Kingdom Energy Statistics Enquiries about statistics in this publication should be made to the contact named at the end of the relevant chapter. Brief extracts from this publication may be reproduced provided that the source is fully acknowledged. General enquiries about the publication, and proposals for reproduction of larger extracts, should be addressed to BEIS, at the address given in paragraph XXVIII of the Introduction. The Department for Business, Energy and Industrial Strategy (BEIS) reserves the right to revise or discontinue the text or any table contained in this Digest without prior notice This is a National Statistics publication The United Kingdom Statistics Authority has designated these statistics as National Statistics, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the UK Statistics Authority: Code of Practice for Official Statistics. Designation can be broadly interpreted to mean that the statistics: ñ meet identified user needs ONCEñ are well explained and STATISTICSreadily accessible HAVE ñ are produced according to sound methods, and BEENñ are managed impartially DESIGNATEDand objectively in the public interest AS Once statistics have been designated as National Statistics it is a statutory NATIONALrequirement that the Code of Practice S TATISTICSshall continue to be observed IT IS © A Crown copyright 2017 STATUTORY You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. -

The Dutch Gas Market: Trials, Tribulations and Trends

May 2017 The Dutch Gas Market: trials, tribulations and trends OIES PAPER: NG 118 Anouk Honoré The contents of this paper are the author's sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2017 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-78467-083-2 May 2017 - The Dutch gas market: trials, tribulations and trends 2 Acknowledgements My grateful thanks go to my colleagues at the Oxford Institute for Energy Studies (OIES) for their support, and in particular Howard Rogers and Jonathan Stern for their helpful comments. A really big thank-you to Sybren De Jong and his colleagues for reviewing the paper, answering my questions and giving me constructive observations. I would also like to thank all the sponsors of the Natural Gas Research Programme (OIES) for their useful remarks during our meetings. A special thank you to Liz Henderson for her careful reading and final editing of the paper. Last but certainly not least, many thanks to Kate Teasdale who made all the arrangements for the production of this paper. The contents of this paper do not necessarily represent the views of the OIES, of the sponsors of the Natural Gas Research Programme or of the people I have thanked in these acknowledgments. -

Future UK Gas Security: a Position Paper

Future UK Gas Security: A Position Paper Professor Michael Bradshaw Future UK Gas Security: A Position Paper 1 Find out more about us Visit our website for the latest information on our courses, fees and scholarship opportunities, as well as our latest news, events, and to hear from former and current students what life is really like here at WBS. We’re always happy to talk through any queries you might have. T +44 (0)24 7652 4100 E [email protected] W wbs.ac.uk/go/mbalondon Join our conversation @warwickbschool wbs.ac.uk/go/joinus facebook.com/warwickbschool @warwickbschool warwickbschool 2 Future UK Gas Security: A Position Paper Contents Executive Summary 1 Introduction 3 Midstream Security Challenges 4 Downstream Security of 1.1 A Supply Chain Approach to UK Gas 3.1 Import Pipelines Demand Security 3.2 Onshore Pipelines 4.1 The Current Role of Natural Gas 1.2 Defining Energy Security 3.3 LNG Import Terminals 4.2 UKERC The Future Role of Natural 1.4 The EU’s Energy Security Strategy 3.4 Gas Storage Facilities Gas 1.4 Defining UK Energy Security 3.5 Interconnectors to Continental Europe 4.3 National Grid’s Future Energy 3.6 Interconnection to Ireland Scenario 2 Upstream Security of Supply 3.7 The National Balancing Point 4.4 Other Views in the Future of Gas 2.1 UK Gas Security of Supply 3.8 Future EU/UK Gas Governance 4.5 Decarbonised Gas 2.2 Increasing Import Dependence 3.9 Midstream Brexit Challenges 4.6 Brexit and the Future Role of Gas 2.3 The Role of Russian Gas 2.4 Production at Groningen 5 Conclusions: Brexit and Future 2.5 Prospects for the Future UK Gas Security 2.6 Exports and Interconnection 2.7 States and Markets References 2.8 Assessing UK Gas Security 2.9 Security of Supply Brexit Challenges About UKERC This report is supported by The UK Energy Research Centre (UKERC) the ESRC Impact Acceleration carries out world-class, interdisciplinary Account (Grant reference research into sustainable future energy ES/M500434/1) systems. -

The Political Economy of Energy Transitions

The Political Economy of Energy Transitions “Case studies of natural gas and offshore wind in the Netherlands and the United Kingdom” Student: Steven Blom (s4261690) Project: Master thesis Public Administration Program: Comparative Public Administration (COMPASS) University: Radboud University, Nijmegen, the Netherlands Faculty: Nijmegen School of Management Thesis supervisor Tutors: Dr. J. (Johan) De Kruijf Prof. dr. S. (Sandra) van Thiel Research assignment Client: Dr.ir. R.P.J.M. (Rob) Raven Position: Professor Institutions and Societal Transitions Department: Innovation studies department of Utrecht University Former position: Industrial Engineering & Innovation Sciences - Eindhoven University of Technology [TU/e] th Date: August 11 , 2015 1 Table of contents Abbreviations & acronyms ..................................................................................................................... 5 Prologue .................................................................................................................................................. 6 1. Introduction ........................................................................................................................................ 7 1.1 Introduction ................................................................................................................................... 7 1.2 Chapter’s structure ........................................................................................................................ 7 1.3 Problem description ..................................................................................................................... -

Ofgem's Probe Into Wholesale Gas Prices Appendices

Ofgem’s probe into wholesale gas prices Appendices October 2004 232/04b This report contains Appendices 1 to 5 to the main report on Ofgem’s probe into wholesale gas prices. These Appendices expand on the information and the analysis presented in the main report and can be read as stand alone documents. Table of Contents Appendix 1. October/November 2003 probe: Analysis of causes of reduced UK gas supply ..........................................................................................................................2 Appendix 2. October/ November 2003 probe: European gas supply and the interconnector............................................................................................................ 24 Appendix 3. October/ November 2003: Effects of reduced gas supply on prices ......... 50 Appendix 4. August/September 2004: Analysis of gas prices....................................... 62 Appendix 5. Winter 2004/05 forward gas prices: Analysis .......................................... 80 Appendix 1. October/November 2003 probe: Analysis of causes of reduced UK gas supply 1.1 This chapter presents a summary of Ofgem’s further analysis of the causes of the reduced UKCS gas supply availability in October/November 2003. The section begins by summarising the position in the Interim Report,1 presents Ofgem’s further analysis for each sub-terminal and provides key conclusions. Interim report 1.2 From analysis presented in Ofgem’s Interim Report it was evident that the volumes of gas supplied via six beach terminals (in minimum, maximum and average terms) were significantly lower in October and November 2003 than in the same period of the previous year; both in terms of the total volume of gas delivered and in terms of maximum flow rates. 1.3 At five sub-terminals (Bacton-Tullow, Bacton-Shell, Bacton-Perenco, St Fergus- Shell and Teesside-BP Amoco), flows during October or November 2003 were significantly lower than the same months of 2002 and/or an assessment of the maximum deliverability for Winter 2003/04. -

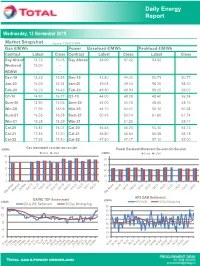

Daily Energy Report

Daily Energy Report Wednesday, 13 November 2019 Market Snapshot Source: TGP/ICE/APX Gas €/MWh Power Baseload €/MWh Peakload €/MWh Contract Latest Close Contract Latest Close Latest Close Day Ahead 14.73 15.05 Day Ahead 48.00 47.42 53.50 - Weekend 15.00 - WDNW - - Dec-19 15.33 15.55 Dec-19 43.80 44.00 50.75 50.77 Jan-20 16.03 16.24 Jan-20 49.05 49.04 58.20 58.10 Feb-20 16.23 16.43 Feb-20 49.90 49.93 59.20 59.02 Q1-10 14.93 16.27 Q1-10 44.00 48.08 48.40 56.24 Sum-20 14.90 15.05 Sum-20 44.00 44.15 48.40 48.10 Win-20 17.95 18.09 Win-20 44.10 44.41 50.10 50.38 Sum-21 16.53 16.58 Sum-21 50.45 50.14 61.60 61.74 Win-21 18.28 18.29 Win-21 - 51.25 - 59.17 Cal-20 15.87 16.01 Cal-20 46.65 46.70 54.30 54.13 Cal-21 17.45 17.40 Cal-21 46.80 46.64 55.35 55.18 Cal-22 17.35 17.40 Cal-22 47.50 47.17 57.10 57.00 €/MWh Gas movement session-on-session Power Baseload Movement Session-On-Session Close Latest €/MWh Close Latest 20 80 15 60 10 40 5 20 0 0 APX DAM Settlement DA/WE TGP Assessment €/MWh €/MWh APX DAM 30 Day Moving Avg DA & WE Settlement 30 Day Moving Avg 16 55 50 12 45 40 8 35 4 30 25 0 20 Daily Energy Report Gas Overview NW Europe DA Assessment TTF vs NBP/ZEE/NCG Basis Source: Thomson Reuters Source: Thomson Reuters ZEE NCG TTF NBP TTF vs ZEE TTF vs NBP NBP vs ZEE €/MWh €/MWh TTF vs NCG NBP vs TTF 18.00 3.0 2.5 16.00 2.0 14.00 1.5 1.0 12.00 0.5 0.0 10.00 -0.5 8.00 -1.0 -1.5 6.00 -2.0 Russian vs Norwegian Flows to NWE Forecasted Continental Demand Source: Thomson Reuters Source: Thomson Reuters GWh/d Total Imports from Norway Russia Main Three Lines -

Price Forecasts in the European Natural Gas Markets

UNIVERSITY OF ST.GALLEN Graduate School of Business, Economics, Law and Social Sciences PRICE FORECASTS IN THE EUROPEAN NATURAL GAS MARKETS Master’s Thesis Referee Prof. Dr. Karl Frauendorfer Co-Referee Prof. Dr. Rolf Wüstenhagen 20. February 2012 Submitted by Claudia Fabini ABSTRACT This master’s thesis investigates the volatility dynamics of the European natural gas market in a recessive economic environment, namely for the period from October 2008 until January 2012. Three gas market areas and their respective trading hub are considered: the National Balancing Point (NBP) in Britain, Zeebrugge in Belgium, and the Transfer Facility (TTF) in the Netherlands. This thesis provides background information about the global and European natural gas market including its crucial interactions between gas, oil, electricity and CO2 markets in Europe. The analysis of the daily spot prices and returns from the three European trading hubs provide useful information on the statistical properties and on the events that affected natural gas prices during the recession and slow recovery of the European economy. The conditional variance and covariances of the returns are estimated using five different models. For the univariate case the symmetric GARCH(1,1), two asymmetric extensions of the GARCH, i.e. EGARCH(1,1) and TGARCH(1,1) are employed. For the multivariate covariance analysis the Constant Conditional Correlation (CCC) and the diagonal BEKK variance specification are estimated. All the models imply a very strong persistency in the volatility process of natural gas returns for the three markets. The volatility is found to react more to unexpected negative returns than to positive ones. -

1 Large Scale Investments in Liberalised Gas Markets: the Case

Oxford Institute for Energy Studies - Natural Gas Research Programme http://www.oxfordenergy.org/gasprog.shtm -------------------------------------------------------------------------------------------------------------------------------- Large Scale Investments in Liberalised Gas Markets: The Case of UK1 Oxford Institute for Energy Studies – Gas Research Programme [email protected] - [email protected] This paper addresses two main questions: 1. Which investments are proceeding and planned in the UK gas market? 2. How are these able to proceed in a fully liberalised gas market given that a major issue for European markets is whether liberalization of gas markets adds to the risk of major investments and therefore the danger of failing to attract large scale long-term supplies. Background: the UK gas market The UK has the largest gas production, the largest market and the only fully liquid open gas market in Europe. The Natural Gas Act in 1986 started liberalization in stages of the entire UK gas market. These reforms were highly successful, resulting in encouragement for producers to produce and sell gas as much gas as possible as fast as possible; the development of a spot gas market; in the creation of a huge market for gas in power generation while at the same time liberalizing the entire gas market down to the residential level. Over the past two decades, gas rose from 23% to 41% of UK energy demand (113 billion cubic meters –bcm- in 2002). It has been self-sufficient, and even a net exporter since 1997. However, by 2002, UK indigenous production had begun to decline and most projections -including those from the 2003 Energy White Paper- suggest that this decline would accelerate over the next 20 years, while gas consumption is envisaged to continue to increase. -

Form 20-F 2006

As filed with the Securities and Exchange Commission on March 7, 2007. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) n REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended: December 31, 2006 OR n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR n SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report . For the transition period from to Commission file number: 1-14688 E.ON AG (Exact name of Registrant as specified in its charter) E.ON AG (Translation of Registrant’s name into English) Federal Republic of Germany E.ON-Platz 1, D-40479 Du¨sseldorf, GERMANY (Jurisdiction of Incorporation or Organization) (Address of Principal Executive Offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares representing Ordinary Shares with no par value New York Stock Exchange Ordinary Shares with no par value New York Stock Exchange* Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

Analysis and Forecast to 2024 Gas 2019 Analysis and Forecast to 2024 Gas Market Report 2019 Foreword

Gas 2019 Analysis and forecast to 2024 Gas 2019 Analysis and forecast to 2024 Gas Market Report 2019 Foreword Foreword In 2018, natural gas played a major role in a remarkable year for energy. Global energy consumption rose at its fastest pace this decade, with natural gas accounting for 45% of the increase, more than any other fuel. Natural gas helped to reduce air pollution and limit the rise in energy-related CO2 emissions by displacing coal and oil in power generation, heating and industrial uses. The global gas narrative varies across regions: cheap and abundant resources in North America; a key contributor to reducing air pollution in the People’s Republic of China; a main feedstock and fuel for industry in emerging Asia; challenged by renewables in Europe; an emerging fuel in Africa and South America. What ties these together is the central position of gas in the global energy mix as one of the key enablers of the energy transition. Natural gas can be part of the solution to a cleaner energy path – both on land and at sea as an alternative marine fuel – but it faces its own challenges. They include ensuring price competitiveness in developing economies, guaranteeing security of supply in increasingly interdependent markets, and continuing the reduction of its environmental footprint, particularly in terms of methane emissions. Natural gas is at the heart of three core areas for the IEA: energy security, clean energy and opening to emerging economies. I hope that this latest edition of the IEA’s outlook for gas markets will help enhance market transparency and enable stakeholders to better understand current and future developments. -

Patrick Heather March 2010

The Evolution and Functioning of the Traded Gas Market in Britain Patrick Heather NG 44 August 2010 i The contents of this paper are the authors‟ sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2010 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-907555-15-2 ii Preface Trading has revolutionised the commercial operation of the British gas market since the mid-1990s, and promises to have a similar impact in Continental Europe in the 2010s. Yet it is very difficult for those outside the industry to understand exactly how gas trading evolved and how it operates. Patrick Heather‟s long experience of trading energy commodities, and the fact that he worked as a gas trader from the start of these activities in the UK, make him an ideal author of this study. Patrick was one of the Gas Programme‟s first research fellows and we have benefitted a great deal from his experience of the commercial side of UK and European gas markets. I am very grateful to him for seeing this paper through to publication. It is a valuable contribution to the gas literature in a very under-researched area of the subject. -

Holland SR 2-07.2

The Oil and Gas Industry in the Netherlands 2007 A Special Report From Oil and Gas Investor and Global Business Reports THE OIL AND GAS INDUSTRY IN THE NETHERLANDS: AN INTRODUCTION The Dutch Way The scene on- and offshore the Netherlands is changing, exposing opportunities that remain in the E&P sector. t is typical of the Dutch to remain so quiet and modest that it is often forgotten that the Netherlands is a major energy-produc- Useful Contacts Iing country. Its diminutive size and no-nonsense approach rarely • The Ministry of Economic Affairs, make waves, but Holland is Europe’s second-largest producer of Directorate for Energy and Telecoms natural gas and the ninth-largest in the world with estimated re- Phone: +31 703798911 serves of between 50- and 60 trillion cubic feet. The country con- www.minez.nl tributes 30% of the European Union’s total gas production. Despite the term “Dutch disease” being coined to illustrate the •The Netherlands Oil and Gas Exploration and Producers potential damage a bonanza of natural resources can have on a Association (NOGEPA) healthy economy, reflecting the situation in Holland in the Phone: +31 703478871 1960s, today Holland is, as it almost always was, a healthy and www.nogepa.nl open economy, outperforming its neighbors and leading the way • Association of Dutch Suppliers in the Oil and Gas Industry in terms of economic reform. Phone: +31 793411981 The bonanza began with the discovery of gas onshore in 1959 www.iro.nl at Groningen Field, the biggest in the world at the time, esti- mated to contain 3 trillion cubic meters of gas.