Patrick Heather March 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Interconnector Pipeline a Key Link in Europe's Gas Network

The Interconnector Pipeline A Key Link in Europe’s Gas Network Mark Futyan Oxford Institute of Energy Studies March 2006 Mark Futyan is a postgraduate student at Columbia Business School in New York. He previously worked for Interconnector (UK) Limited between 2001 and 2005. During this period, he was involved in a variety of engineering and commercial projects. For information or questions on this research, please contact: [email protected]. Copyright © 2006 Mark Futyan The contents of and views expressed in this paper are the author’s sole responsibility. They do not necessarily represent the Oxford Institute for Energy Studies or any of its members, nor do they represent the views of Interconnector (UK) Limited. ISBN 1-901795-44-6 ii Preface The Interconnector pipeline has rarely been out of the news since it was first proposed in the early 1990s. It is probably not too much of an exaggeration to say that it has transformed short term trading in north west Europe, causing companies to enter into commercial behaviour that they had not previously considered possible or, in some cases, desirable. Equally interesting were predictions (before it was built) that the project was likely to be a waste of time, followed by periodic claims that: gas was flowing in the wrong direction; that larger or smaller volumes of gas should be flowing; and that shippers on one side or the other were responding inappropriately to price signals. For a gas research programme this made the Interconnector a particularly suitable research project which fits perfectly into our work on European gas issues. -

Statutory Security of Supply Report

Statutory Security of Supply Report A report produced jointly by DECC and Ofgem November 2010 Statutory Security of Supply Report � A report produced jointly by DECC and Ofgem Presented to Parliament pursuant to section 172 of the Energy Act 2004 Ordered by the House of Commons to be printed 4th November 2010 HC 542 LONDON: THE STATIONERY OFFICE £14.75 � © Crown copyright 2010 You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit http://www.nationalarchives.gov.uk/doc/open-government-licence/ or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or e-mail: [email protected]. � Any enquiries regarding this publication should be sent to us at Department of Energy & Climate Change, 3 Whitehall Place, London SW1A 2HD. � This publication is also available on http://www.official-documents.gov.uk/ � ISBN: 9780102969238 � Printed in the UK for The Stationery Office Limited on behalf of the Controller of Her Majesty’s Stationery Office � ID: 2397258 11/10 � Printed on paper containing 75% recycled fibre content minimum. � Contents Contents � Section 1 Introduction 1 Section 2 Executive Summary 3 Section 3 Electricity 5 Section 4 Gas 22 Section 5 Oil 42 Section 6 Glossary 47 The information contained in this report constitutes general information about the outlook for energy markets. It is not intended to constitute advice for any specific situation. While every effort has been made to ensure the accuracy of the report,the opinions judgements, projections and assumptions it contains and on which it is based are inherently uncertain and subjective such that no warranty is given that the report is accurate, complete or up to date. -

Electricity) and 2009/73/EC (Gas)

2016 Great Britain and Northern Ireland National Reports to the European Commission National Reports in relation to Directives 2009/72/EC (Electricity) and 2009/73/EC (Gas) Ofgem 2016 National Report to the European Commission Overview All National Regulatory Authorities (NRAs) are obliged to report annually to the European Commission, in accordance with Directives 2009/72/EC (Electricity Directive) and 2009/73/EC (Gas Directive). The structure of the report is agreed at the Council of European Energy Regulators (CEER). Ofgem is the UK Office of Gas and Electricity Markets. It is governed by the Gas and Electricity Markets Authority (the Authority).1 The terms ‘the Authority’, ‘Ofgem’, ‘us’ and ‘we’ are used interchangeably in this document. The Northern Ireland National Report is in the second section of this UK response. The Great Britain (GB) report covers: Developments in the GB energy markets in 2015 and Quarter I + II of 2016; The regulation and performance of the GB electricity and gas markets along the themes of network regulation, promoting competition, and security of supply Our compliance with the Electricity and Gas Directives on consumer protection and dispute settlement Since GB energy markets have been fully liberalised and the regulatory structures in place for a number of years, this report is intended as an updated version of the submissions made since 2007. The structure of this report and much of the information remains unchanged, although latest data is supplied. Finally, for further information on Ofgem’s activities, please consult our Annual Reports. The 2015-16 Ofgem Annual Report is available at the link below.2 Contacts: Sean Hennity Ryan McLaughlin Ofgem, EU Coordination Ofgem, Head of European Wholesale Markets 9 Millbank, London, SW1 3GE 9 Millbank, London, SW1 3GE 0207 3269 9951 020 3269 9615 [email protected] [email protected] 1 The Authority determines strategy, sets policy priorities and takes decisions on a range of matters, including price controls and enforcement. -

Annual Review 2007 Delivering Gas to the North of England Northern Gas Networks

Annual Review 2007 Delivering gas to the North of England Northern Gas Networks 2 Annual Review 2007 Corporate Directory Northern Gas Networks Limited 1100 Century Way Thorpe Park Business Park Colton LEEDS LS15 8TU Telephone: 0113 397 5300 Facsimile: 0113 397 5301 Website: www.northerngasnetworks.co.uk Gas Emergencies: Call 0800 111 999* at any time. *All calls are recorded and may be monitored. 27 Phone 0113 397 5300 The National Gas Emergency Service is available 24 hours Web www.northerngasnetworks.co.uk a day, every day. FREEPHONE 0800 111 999*. *All calls are recorded and may be monitored Annual Review 2007 Contents The Year under Review 4 Chief Executive Offi cer’s Review 6 Ownership Structure 10 Business Strategy 11 Business Review 13 Performance Review 17 Corporate Governance 20 The Management Team 21 Board of Directors 23 Results Summary 2007 26 Corporate Directory 27 3 Northern Gas Networks The Year under Review In the second full calendar year of operations Northern Gas Networks continued to develop within the UK’s energy industry. Building on solid foundations, the company delivered improvements in its fi nancial effi ciency, in health and safety and in its customer service, positioning the organisation as one of the leaders in the UK gas industry. 4 Annual Review 2007 The company won a prestigious Utility Award for the work in delivering the new suite of computer systems which underpin daily operations. Northern Gas Networks delivers gas through 37,000km of Notable achievements during 2007 include the fi nalisation pipes to around 2.6m homes and businesses in the North of of the fi ve-year Price Control Review, under which Ofgem England, an area of 27,000 square miles covering northern sets the company’s revenue and operational targets for Cumbria, the North East and much of Yorkshire. -

A14 - Our Whole Systems Strategy 1

Final RIIO-2 Business Plan Submission December 2019 Appendix A14 - Our Whole Systems Strategy 1 Page left intentionally blank. Final RIIO-2 Business Plan Submission December 2019 Appendix A14 - Our Whole Systems Strategy 2 Foreword This document outlines Northern Gas Networks’ Whole Systems Strategy. This strategy addresses Ofgem’s business plan guidance for us to provide information on our approach to enabling whole systems solutions in our RIIO-2 Business Plan. We have developed this strategy in conjunction with key whole systems stakeholders. Importantly, NGN is committed to supporting the achievement of the UK’s net zero emission targets and our Whole Systems Strategy sets out how we intend to contribute. The purpose of this document has been to assist us with: • determining our role in the whole systems landscape; • determining how we will interact with other stakeholders in the creation of an integrated energy system; and • defining the actions that we will need to take to deliver against our objectives. We also note the interactions between this document, our Environmental Action Plan, Innovation Strategy and Customers in Vulnerable Situations Strategy: • Environmental Action Plan – this is the primary regulatory document that sets out the environmental impacts of our business operations as well as short-term initiatives to reduce these impacts and our long-term strategy to contribute to the net zero emission targets by 2050, for the benefit of customers. • Innovation Strategy – this sets out our approach to delivering innovation in RIIO-2 (particularly in relation to enabling the achievement of our net zero emission targets and supporting customers in vulnerable situations), with a focus on the benefits provided to customers. -

Digest of United Kingdom Energy Statistics 2017

DIGEST OF UNITED KINGDOM ENERGY STATISTICS 2017 July 2017 This document is available in large print, audio and braille on request. Please email [email protected] with the version you require. Digest of United Kingdom Energy Statistics Enquiries about statistics in this publication should be made to the contact named at the end of the relevant chapter. Brief extracts from this publication may be reproduced provided that the source is fully acknowledged. General enquiries about the publication, and proposals for reproduction of larger extracts, should be addressed to BEIS, at the address given in paragraph XXVIII of the Introduction. The Department for Business, Energy and Industrial Strategy (BEIS) reserves the right to revise or discontinue the text or any table contained in this Digest without prior notice This is a National Statistics publication The United Kingdom Statistics Authority has designated these statistics as National Statistics, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the UK Statistics Authority: Code of Practice for Official Statistics. Designation can be broadly interpreted to mean that the statistics: ñ meet identified user needs ONCEñ are well explained and STATISTICSreadily accessible HAVE ñ are produced according to sound methods, and BEENñ are managed impartially DESIGNATEDand objectively in the public interest AS Once statistics have been designated as National Statistics it is a statutory NATIONALrequirement that the Code of Practice S TATISTICSshall continue to be observed IT IS © A Crown copyright 2017 STATUTORY You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. -

The Dutch Gas Market: Trials, Tribulations and Trends

May 2017 The Dutch Gas Market: trials, tribulations and trends OIES PAPER: NG 118 Anouk Honoré The contents of this paper are the author's sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2017 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-78467-083-2 May 2017 - The Dutch gas market: trials, tribulations and trends 2 Acknowledgements My grateful thanks go to my colleagues at the Oxford Institute for Energy Studies (OIES) for their support, and in particular Howard Rogers and Jonathan Stern for their helpful comments. A really big thank-you to Sybren De Jong and his colleagues for reviewing the paper, answering my questions and giving me constructive observations. I would also like to thank all the sponsors of the Natural Gas Research Programme (OIES) for their useful remarks during our meetings. A special thank you to Liz Henderson for her careful reading and final editing of the paper. Last but certainly not least, many thanks to Kate Teasdale who made all the arrangements for the production of this paper. The contents of this paper do not necessarily represent the views of the OIES, of the sponsors of the Natural Gas Research Programme or of the people I have thanked in these acknowledgments. -

Future UK Gas Security: a Position Paper

Future UK Gas Security: A Position Paper Professor Michael Bradshaw Future UK Gas Security: A Position Paper 1 Find out more about us Visit our website for the latest information on our courses, fees and scholarship opportunities, as well as our latest news, events, and to hear from former and current students what life is really like here at WBS. We’re always happy to talk through any queries you might have. T +44 (0)24 7652 4100 E [email protected] W wbs.ac.uk/go/mbalondon Join our conversation @warwickbschool wbs.ac.uk/go/joinus facebook.com/warwickbschool @warwickbschool warwickbschool 2 Future UK Gas Security: A Position Paper Contents Executive Summary 1 Introduction 3 Midstream Security Challenges 4 Downstream Security of 1.1 A Supply Chain Approach to UK Gas 3.1 Import Pipelines Demand Security 3.2 Onshore Pipelines 4.1 The Current Role of Natural Gas 1.2 Defining Energy Security 3.3 LNG Import Terminals 4.2 UKERC The Future Role of Natural 1.4 The EU’s Energy Security Strategy 3.4 Gas Storage Facilities Gas 1.4 Defining UK Energy Security 3.5 Interconnectors to Continental Europe 4.3 National Grid’s Future Energy 3.6 Interconnection to Ireland Scenario 2 Upstream Security of Supply 3.7 The National Balancing Point 4.4 Other Views in the Future of Gas 2.1 UK Gas Security of Supply 3.8 Future EU/UK Gas Governance 4.5 Decarbonised Gas 2.2 Increasing Import Dependence 3.9 Midstream Brexit Challenges 4.6 Brexit and the Future Role of Gas 2.3 The Role of Russian Gas 2.4 Production at Groningen 5 Conclusions: Brexit and Future 2.5 Prospects for the Future UK Gas Security 2.6 Exports and Interconnection 2.7 States and Markets References 2.8 Assessing UK Gas Security 2.9 Security of Supply Brexit Challenges About UKERC This report is supported by The UK Energy Research Centre (UKERC) the ESRC Impact Acceleration carries out world-class, interdisciplinary Account (Grant reference research into sustainable future energy ES/M500434/1) systems. -

The Political Economy of Energy Transitions

The Political Economy of Energy Transitions “Case studies of natural gas and offshore wind in the Netherlands and the United Kingdom” Student: Steven Blom (s4261690) Project: Master thesis Public Administration Program: Comparative Public Administration (COMPASS) University: Radboud University, Nijmegen, the Netherlands Faculty: Nijmegen School of Management Thesis supervisor Tutors: Dr. J. (Johan) De Kruijf Prof. dr. S. (Sandra) van Thiel Research assignment Client: Dr.ir. R.P.J.M. (Rob) Raven Position: Professor Institutions and Societal Transitions Department: Innovation studies department of Utrecht University Former position: Industrial Engineering & Innovation Sciences - Eindhoven University of Technology [TU/e] th Date: August 11 , 2015 1 Table of contents Abbreviations & acronyms ..................................................................................................................... 5 Prologue .................................................................................................................................................. 6 1. Introduction ........................................................................................................................................ 7 1.1 Introduction ................................................................................................................................... 7 1.2 Chapter’s structure ........................................................................................................................ 7 1.3 Problem description ..................................................................................................................... -

Ofgem's Probe Into Wholesale Gas Prices Appendices

Ofgem’s probe into wholesale gas prices Appendices October 2004 232/04b This report contains Appendices 1 to 5 to the main report on Ofgem’s probe into wholesale gas prices. These Appendices expand on the information and the analysis presented in the main report and can be read as stand alone documents. Table of Contents Appendix 1. October/November 2003 probe: Analysis of causes of reduced UK gas supply ..........................................................................................................................2 Appendix 2. October/ November 2003 probe: European gas supply and the interconnector............................................................................................................ 24 Appendix 3. October/ November 2003: Effects of reduced gas supply on prices ......... 50 Appendix 4. August/September 2004: Analysis of gas prices....................................... 62 Appendix 5. Winter 2004/05 forward gas prices: Analysis .......................................... 80 Appendix 1. October/November 2003 probe: Analysis of causes of reduced UK gas supply 1.1 This chapter presents a summary of Ofgem’s further analysis of the causes of the reduced UKCS gas supply availability in October/November 2003. The section begins by summarising the position in the Interim Report,1 presents Ofgem’s further analysis for each sub-terminal and provides key conclusions. Interim report 1.2 From analysis presented in Ofgem’s Interim Report it was evident that the volumes of gas supplied via six beach terminals (in minimum, maximum and average terms) were significantly lower in October and November 2003 than in the same period of the previous year; both in terms of the total volume of gas delivered and in terms of maximum flow rates. 1.3 At five sub-terminals (Bacton-Tullow, Bacton-Shell, Bacton-Perenco, St Fergus- Shell and Teesside-BP Amoco), flows during October or November 2003 were significantly lower than the same months of 2002 and/or an assessment of the maximum deliverability for Winter 2003/04. -

Hull Core Strategy - Contacts List (As at July 2011)

Hull Core Strategy - Contacts List (as at July 2011) Introduction This report provides details about the contacts made during the development of the Hull Core Strategy. It includes contact made at each plan making stage, as follows: • Issues and Options – August 2008 • Emerging Preferred Approach – February 2010 • Core Strategy Questionnaire – September 2010 • Spatial Options – February 2011 • Core Strategy Publication Version – July 2011 A list of Hull Development Forum members (as at July 2011) is also enclosed. This group has met over 15 times, usually on a quarterly basis. The report also sets out the specific and general organisations and bodies that have been contacted, in conformity with the Council’s adopted Statement of Community Involvement. Specific groups are indicated with an asterisk. Please note contacts will change over time. Issues and Options – August 2008 (Letter sent to Consultants/Agents) Your Ref: My Ref: PPI/KG/JP Contact: Mr Keith Griffiths «Title» «First_Name» «Surname» Tel: 01482 612389 «Job_Title» Fax: 01482 612382 Email: [email protected] «Org» th «Add1» Date: 4 August 2008 «Add2» «Add3» «Town» «Postcode» Dear Sir/Madam Hull Core Strategy - issues, options and suggested preferred option Please find enclosed the ‘Hull Core Strategy issues, options and suggested preferred option’ document for your consideration. Your views should be returned to us by the 5 September, 2008 by using the form provided. In particular, could you respond to the following key questions: 1. What do you think to the issues, objectives, options and suggested preferred option set out in the document? 2. How would you combine the options? 3. -

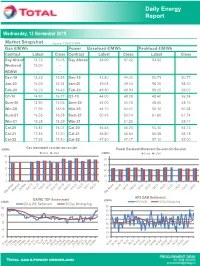

Daily Energy Report

Daily Energy Report Wednesday, 13 November 2019 Market Snapshot Source: TGP/ICE/APX Gas €/MWh Power Baseload €/MWh Peakload €/MWh Contract Latest Close Contract Latest Close Latest Close Day Ahead 14.73 15.05 Day Ahead 48.00 47.42 53.50 - Weekend 15.00 - WDNW - - Dec-19 15.33 15.55 Dec-19 43.80 44.00 50.75 50.77 Jan-20 16.03 16.24 Jan-20 49.05 49.04 58.20 58.10 Feb-20 16.23 16.43 Feb-20 49.90 49.93 59.20 59.02 Q1-10 14.93 16.27 Q1-10 44.00 48.08 48.40 56.24 Sum-20 14.90 15.05 Sum-20 44.00 44.15 48.40 48.10 Win-20 17.95 18.09 Win-20 44.10 44.41 50.10 50.38 Sum-21 16.53 16.58 Sum-21 50.45 50.14 61.60 61.74 Win-21 18.28 18.29 Win-21 - 51.25 - 59.17 Cal-20 15.87 16.01 Cal-20 46.65 46.70 54.30 54.13 Cal-21 17.45 17.40 Cal-21 46.80 46.64 55.35 55.18 Cal-22 17.35 17.40 Cal-22 47.50 47.17 57.10 57.00 €/MWh Gas movement session-on-session Power Baseload Movement Session-On-Session Close Latest €/MWh Close Latest 20 80 15 60 10 40 5 20 0 0 APX DAM Settlement DA/WE TGP Assessment €/MWh €/MWh APX DAM 30 Day Moving Avg DA & WE Settlement 30 Day Moving Avg 16 55 50 12 45 40 8 35 4 30 25 0 20 Daily Energy Report Gas Overview NW Europe DA Assessment TTF vs NBP/ZEE/NCG Basis Source: Thomson Reuters Source: Thomson Reuters ZEE NCG TTF NBP TTF vs ZEE TTF vs NBP NBP vs ZEE €/MWh €/MWh TTF vs NCG NBP vs TTF 18.00 3.0 2.5 16.00 2.0 14.00 1.5 1.0 12.00 0.5 0.0 10.00 -0.5 8.00 -1.0 -1.5 6.00 -2.0 Russian vs Norwegian Flows to NWE Forecasted Continental Demand Source: Thomson Reuters Source: Thomson Reuters GWh/d Total Imports from Norway Russia Main Three Lines