Form 10-K Halozyme Therapeutics, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Targeting the Epidermal Growth Factor Receptor in EGFR-Mutated Lung Cancer: Current and Emerging Therapies

cancers Review Targeting the Epidermal Growth Factor Receptor in EGFR-Mutated Lung Cancer: Current and Emerging Therapies Karam Khaddour 1,*, Sushma Jonna 1, Alexander Deneka 2 , Jyoti D. Patel 3, Mohamed E. Abazeed 4, Erica Golemis 2 , Hossein Borghaei 5 and Yanis Boumber 3,6,* 1 Division of Hematology and Oncology, University of Illinois at Chicago, Chicago, IL 60612, USA; [email protected] 2 Fox Chase Cancer Center, Program in Molecular Therapeutics, Philadelphia, PA 19111, USA; [email protected] (A.D.); [email protected] (E.G.) 3 Robert H. Lurie Comprehensive Cancer Center, Division of Hematology/Oncology, Feinberg School of Medicine, Northwestern University, Chicago, IL 60611, USA; [email protected] 4 Robert H. Lurie Comprehensive Cancer Center, Department of Radiation Oncology, Feinberg School of Medicine, Northwestern University, Chicago, IL 60611, USA; [email protected] 5 Fox Chase Cancer Center, Department of Hematology and Oncology, Philadelphia, PA 19111, USA; [email protected] 6 Institute of Fundamental Medicine and Biology, Kazan Federal University, 420008 Kazan, Russia * Correspondence: [email protected] (K.K.); [email protected] (Y.B.) Simple Summary: Epidermal growth factor receptor (EGFR) mutations occur in a significant number Citation: Khaddour, K.; Jonna, S.; of lung cancer patients. Treatment outcomes in this subset of patients has greatly improved over the Deneka, A.; Patel, J.D.; Abazeed, M.E.; last decade after the introduction of EGFR tyrosine kinase inhibitors (TKIs), which demonstrated high Golemis, E.; Borghaei, H.; Boumber, Y. efficacy and improved survival in randomized clinical trials. Although EGFR TKIs became the stan- Targeting the Epidermal Growth dard of care in patients with EGFR-mutated lung cancer, resistance almost inevitably develops. -

Interim Report for the First Quarter of 2020

Genmab Announces Financial Results for the First Quarter of 2020 May 6, 2020; Copenhagen, Denmark; Interim Report for the First Quarter Ended March 31, 2020 Highlights DARZALEX® (daratumumab) net sales increased approximately 49% compared to the first quarter of 2019 to USD 937 million, resulting in royalty income of DKK 775 million DARZALEX approved in Europe in combination with bortezomib, thalidomide and dexamethasone for the treatment of adult patients with newly diagnosed multiple myeloma who are eligible for autologous stem cell transplant U.S. FDA approved TEPEZZA™ (teprotumumab-trbw), developed and commercialized by Horizon Therapeutics, for thyroid eye disease U.S. FDA accepted, with priority review, Novartis’ supplemental Biologics License Application for subcutaneous ofatumumab in relapsing multiple sclerosis Anthony Pagano appointed Chief Financial Officer Anthony Mancini appointed Chief Operating Officer “Despite the unprecedented challenges posed by the coronavirus (COVID-19) pandemic, we will continue to invest in our innovative proprietary products, technologies and capabilities and use our world-class expertise in antibody drug development to create truly differentiated products with the potential to help cancer patients. While Genmab is closely monitoring the developments in the rapidly evolving landscape, we are extremely fortunate to have a solid financial foundation and a fabulous and committed team to carry us through these uncertain times,” said Jan van de Winkel, Ph.D., Chief Executive Officer of Genmab. Financial Performance First Quarter of 2020 Revenue was DKK 892 million in the first quarter of 2020 compared to DKK 591 million in the first quarter of 2019. The increase of DKK 301 million, or 51%, was mainly driven by higher DARZALEX royalties. -

HY 2021 Results

Roche HY 2021 results Basel, 22 July 2021 This presentation contains certain forward-looking statements. These forward-looking statements may be identified by words such as ‘believes’, ‘expects’, ‘anticipates’, ‘projects’, ‘intends’, ‘should’, ‘seeks’, ‘estimates’, ‘future’ or similar expressions or by discussion of, among other things, strategy, goals, plans or intentions. Various factors may cause actual results to differ materially in the future from those reflected in forward-looking statements contained in this presentation, among others: 1 pricing and product initiatives of competitors; 2 legislative and regulatory developments and economic conditions; 3 delay or inability in obtaining regulatory approvals or bringing products to market; 4 fluctuations in currency exchange rates and general financial market conditions; 5 uncertainties in the discovery, development or marketing of new products or new uses of existing products, including without limitation negative results of clinical trials or research projects, unexpected side-effects of pipeline or marketed products; 6 increased government pricing pressures; 7 interruptions in production; 8 loss of or inability to obtain adequate protection for intellectual property rights; 9 litigation; 10 loss of key executives or other employees; and 11 adverse publicity and news coverage. Any statements regarding earnings per share growth is not a profit forecast and should not be interpreted to mean that Roche’s earnings or earnings per share for this year or any subsequent period will necessarily match or exceed the historical published earnings or earnings per share of Roche. For marketed products discussed in this presentation, please see full prescribing information on our website www.roche.com All mentioned trademarks are legally protected. -

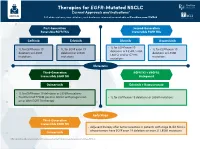

Therapies for EGFR-Mutated NSCLC Current Approvals and Indications1 Full Abbreviations, Accreditation, and Disclosure Information Available at Peerview.Com/CWE40

Therapies for EGFR-Mutated NSCLC 1 Current Approvals and Indications Full abbreviations, accreditation, and disclosure information available at PeerView.com/CWE40 First-Generation Second-Generation Reversible EGFR TKIs Irreversible EGFR TKIs Getinib Erlotinib Afatinib Dacomitinib • 1L for EGFR exon 19 • 1L for EGFR exon 19 • 1L for EGFR exon 19 • 1L for EGFR exon 19 deletions or L858R, S768I, deletions or L858R deletions or L858R deletions or L858R L861Q, and/or G719X mutations mutations mutations mutations Metastatic Third-Generation EGFR TKI + VEGFR2 Irreversible EGFR TKI Antagonist Osimertinib Erlotinib + Ramucirumab • 1L for EGFR exon 19 deletions or L858R mutations • Treatment of T790M-positive NSCLC with progression • 1L for EGFR exon 19 deletions or L858R mutations on or after EGFR TKI therapy Early Stage Third-Generation Irreversible EGFR TKI • Adjuvant therapy after tumor resection in patients with stage IB-IIIA NSCLC whose tumors have EGFR exon 19 deletions or exon 21 L858R mutations Osimertinib 1. https://www.fda.gov/drugs/resources-information-approved-drugs/hematologyoncology-cancer-approvals-safety-notifications. Molecular Testing Guidelines for NSCLC Latest Updates, Best Practices, and Patient-Reported Insights1 Full abbreviations, accreditation, and disclosure information available at PeerView.com/CWE40 Why Test Lung Cancer Patients for Genomic Alterations? • Genomic alterations are common in nonsquamous NSCLC (approximately 50%) • Targeted therapies produce better treatment outcomes (eg, higher response rates, improved -

Antibodies to Watch in 2021 Hélène Kaplona and Janice M

MABS 2021, VOL. 13, NO. 1, e1860476 (34 pages) https://doi.org/10.1080/19420862.2020.1860476 PERSPECTIVE Antibodies to watch in 2021 Hélène Kaplona and Janice M. Reichert b aInstitut De Recherches Internationales Servier, Translational Medicine Department, Suresnes, France; bThe Antibody Society, Inc., Framingham, MA, USA ABSTRACT ARTICLE HISTORY In this 12th annual installment of the Antibodies to Watch article series, we discuss key events in antibody Received 1 December 2020 therapeutics development that occurred in 2020 and forecast events that might occur in 2021. The Accepted 1 December 2020 coronavirus disease 2019 (COVID-19) pandemic posed an array of challenges and opportunities to the KEYWORDS healthcare system in 2020, and it will continue to do so in 2021. Remarkably, by late November 2020, two Antibody therapeutics; anti-SARS-CoV antibody products, bamlanivimab and the casirivimab and imdevimab cocktail, were cancer; COVID-19; Food and authorized for emergency use by the US Food and Drug Administration (FDA) and the repurposed Drug Administration; antibodies levilimab and itolizumab had been registered for emergency use as treatments for COVID-19 European Medicines Agency; in Russia and India, respectively. Despite the pandemic, 10 antibody therapeutics had been granted the immune-mediated disorders; first approval in the US or EU in 2020, as of November, and 2 more (tanezumab and margetuximab) may Sars-CoV-2 be granted approvals in December 2020.* In addition, prolgolimab and olokizumab had been granted first approvals in Russia and cetuximab saratolacan sodium was first approved in Japan. The number of approvals in 2021 may set a record, as marketing applications for 16 investigational antibody therapeutics are already undergoing regulatory review by either the FDA or the European Medicines Agency. -

Halozyme, Inc. Protocol HALO-110-101 Amendment 3 CLINICAL STUDY PROTOCOL Title

Halozyme, Inc. Protocol HALO-110-101 Amendment 3 NCT #: NCT03267940 CLINICAL STUDY PROTOCOL Title: A Phase 1b, Randomized, Open-Label Study of PEGylated Recombinant Human Hyaluronidase (PEGPH20) in Combination With Cisplatin Plus Gemcitabine and PEGPH20 in Combination With Atezolizumab and Cisplatin Plus Gemcitabine Compared With Cisplatin Plus Gemcitabine in Subjects with Previously Untreated, Unresectable, Locally Advanced, or Metastatic Intrahepatic and Extrahepatic Cholangiocarcinoma and Gallbladder Adenocarcinoma Phase 1b Protocol Number: HALO-110-101 Original Protocol Date: 07 March 2017 Protocol Amendment 1 Date: 24 May 2017 Protocol Amendment 2 Date: 12 April 2018 Protocol Amendment 3 Date: 09 April 2019 IND: 102770 Sponsor: Halozyme, Inc. 11388 Sorrento Valley Road San Diego, CA 92121 Office: Confidential: This document and the information it contains are the property of Halozyme, Inc. and are provided for the sole and exclusive use of Investigators in this clinical study. The information in this document may not be disclosed unless such disclosure is required by Federal or applicable State Law or Regulations, or unless there is prior written consent from Halozyme, Inc. Subject to the foregoing, this information may be disclosed only to those persons involved in the clinical investigation who need it, and who share the obligation not to disseminate this information further. Halozyme, Inc. Protocol HALO-110-101 Amendment 3 Placeholder for Approval Signatures Halozyme, Inc. Protocol HALO-110-101 Amendment 3 1. SYNOPSIS Sponsor/Company -

In This Issue

IN THIS ISSUE PD-1 Blockade Is Not Unsafe in Patients with Lung Cancer and COVID-19 • COVID-19 severity and mortality were not • Although PD-1 blockade was not a • This suggests that PD-1 blockade increased in patients with lung cancer risk factor in this population, severity should be used when indicated in patients who received prior PD-1 blockade . and mortality in this group were high . with lung cancer despite COVID-19 . A key issue in oncology of whether patients received the immunotherapy recently or practice during the COVID-19 at any point prior to infection. There was a slight, statistically pandemic is whether PD-1 insignifi cant numeric increase in severity with PD-1 blockade, blockade affects the severity of but controlling for smoking history—which is an expected COVID-19 in patients with can- imbalance in receipt of prior PD-1 blockade and a risk factor cer. PD-1 blockade may increase for severe COVID-19 outcomes—abolished this correlation. COVID-19 severity by contrib- This work suggests that prior PD-1 blockade is not a clinically uting to hyperactive immune meaningful risk factor for worsened COVID-19 outcomes, res ponses to SARS-CoV-2 infec- implying that PD-1 blockade should be used when indicated tion—or, alternatively, may reduce despite the pandemic. Larger studies are needed to more fully severity by enhancing control of initial viral infection. To examine this question. Finally, it should be noted that, in minimize lung cancer as a confounder, Luo and colleagues this study population, more than half of patients with lung assessed the outcomes of concurrent COVID-19 and lung cancer and COVID-19 were hospitalized and almost half of cancer in 69 consecutive patients at a single institution in those hospitalized died, emphasizing the need for studies to New York City. -

![Full Prescribing Information [FDA]](https://docslib.b-cdn.net/cover/8240/full-prescribing-information-fda-1598240.webp)

Full Prescribing Information [FDA]

HIGHLIGHTS OF PRESCRIBING INFORMATION -----------------------------CONTRAINDICATIONS--------------------------------- These highlights do not include all the information needed to use None. (4) RYBREVANT™ safely and effectively. See full prescribing information -------------------------WARNINGS AND PRECAUTIONS---------------------- for RYBREVANT. Infusion-Related Reactions (IRR): Interrupt infusion at the first sign of RYBREVANT (amivantamab-vmjw) injection, for intravenous use IRRs. Reduce infusion rate or permanently discontinue RYBREVANT Initial U.S. Approval: 2021 based on severity. (2.4, 5.1) Interstitial Lung Disease (ILD)/Pneumonitis: Monitor for new or worsening symptoms indicative of ILD. Immediately withhold RYBREVANT in -----------------------------INDICATIONS AND USAGE--------------------------- patients with suspected ILD/pneumonitis and permanently discontinue if RYBREVANT is a bispecific EGF receptor-directed and MET receptor- ILD/pneumonitis is confirmed. (2.4, 5.2) directed antibody indicated for the treatment of adult patients with locally Dermatologic Adverse Reactions: May cause rash including acneiform advanced or metastatic non-small cell lung cancer (NSCLC) with epidermal dermatitis and toxic epidermal necrolysis. Withhold, dose reduce or growth factor receptor (EGFR) exon 20 insertion mutations, as detected by an permanently discontinue RYBREVANT based on severity. (2.4, 5.3) FDA-approved test, whose disease has progressed on or after platinum-based Ocular Toxicity: Promptly refer patients with worsening eye symptoms to chemotherapy. (1, 2.1) an ophthalmologist. Withhold, dose reduce or permanently discontinue This indication is approved under accelerated approval based on overall RYBREVANT based on severity. (5.4) response rate and duration of response. Continued approval for this indication Embryo-Fetal Toxicity: Can cause fetal harm. Advise females of may be contingent upon verification and description of clinical benefit in the reproductive potential of the potential risk to the fetus and to use effective confirmatory trials. -

Brief Report Preclinical Characterization of Mobocertinib

bioRxiv preprint doi: https://doi.org/10.1101/2020.09.28.317560; this version posted September 28, 2020. The copyright holder for this preprint (which was not certified by peer review) is the author/funder. All rights reserved. No reuse allowed without permission. Brief Report Preclinical characterization of mobocertinib highlights the putative therapeutic window of this novel EGFR inhibitor to EGFR exon 20 insertion mutations Pedro E. N. S. Vasconcelos1*; Ikei S. Kobayashi1*; Susumu S. Kobayashi1,2; Daniel B. Costa1* 1 Department of Medicine, Division of Hematology/Oncology, Harvard Medical School, Boston, MA, United States of America; 2 Division of Translational Genomics, Exploratory Oncology Research and Clinical Trial Center, National Cancer Center, Kashiwa, Chiba, Japan. * these authors contributed equally Correspondence to: *Daniel B. Costa, MD, PhD - Division of Medical Oncology, Beth Israel Deaconess Medical Center, 330 Brookline Av., Boston, MA 02215; Phone: 617-667-9236, Fax: 617-975-5665, Email: [email protected] Running Title: Mobocertinib for EGFR exon 20 mutations Category: Brief Report Word count: abstract (246), text (1989), references (15) Figures: 2 Tables: 1 Keywords: lung cancer; EGFR exon 20 insertion; mobocertinib; C797S; ERBB2 Acknowledgements/Funding: This work was funded in part through National Institutes of Health (NIH)/National Cancer Institute (NCI) grants R37 CA218707 (to D. B. Costa), R01 CA240257 (to S. S. Kobayashi) plus Department of Defense LC170223 (to S. S. Kobayashi) Disclosure of Potential Conflicts of interest: DBC reports personal fees (consulting fees and honoraria) and nonfinancial support (institutional research support) from Takeda/Millennium Pharmaceuticals, AstraZeneca, Pfizer and BluePrint Medicine, as well as nonfinancial support (institutional research support) from Merck Sharp and Dohme Corporation, Merrimack Pharmaceuticals, Bristol-Myers Squibb, Clovis Oncology, Spectrum Pharmaceuticals, Tesaro, all outside the submitted work. -

Genmab Announces Financial Results for the First Nine Months of 2020

Genmab Announces Financial Results for the First Nine Months of 2020 November 4, 2020; Copenhagen, Denmark; Interim Report for the First Nine Months Ended September 30, 2020 Highlights • Novartis granted U.S. FDA approval for Kesimpta® (ofatumumab) in relapsing multiple sclerosis • Janssen and European Myeloma Network achieved positive topline results from Phase 3 APOLLO study of daratumumab in relapsed or refractory multiple myeloma • Janssen was granted U.S. FDA approval for DARZALEX® (daratumumab) in combination with carfilzomib and dexamethasone in relapsed or refractory multiple myeloma based on Phase 3 CANDOR study • DARZALEX net sales increased 35% compared to the first nine months of 2019 to USD 2,937 million, resulting in royalty income of DKK 2,898 million for the first nine months of 2020 • Genmab commenced binding arbitration of two matters under daratumumab license agreement with Janssen • Announcement of plan to transition Arzerra® (ofatumumab) to an oncology access program for chronic lymphocytic leukemia patients in the U.S. “Genmab continued to deliver on the promise of improving the lives of patients, with multiple regulatory milestones for Genmab-created products under development by our partners, including the exciting U.S. FDA’s approval of Kesimpta and the 8th U.S. FDA approval for DARZALEX,” said Jan van de Winkel, Ph.D., Chief Executive Officer of Genmab. “During the first nine months of 2020, with our solid financial footing Genmab has continued its focused investment in advancing its proprietary antibody product pipeline and building its capabilities as we evolve into a fully integrated biotech.” Financial Performance First Nine Months of 2020 • Revenue was DKK 8,067 million in the first nine months of 2020 compared to DKK 2,405 million in the first nine months of 2019. -

Antibodies to Watch in 2021 Hélène Kaplona and Janice M

MABS 2021, VOL. 13, NO. 1, e1860476 (34 pages) https://doi.org/10.1080/19420862.2020.1860476 PERSPECTIVE Antibodies to watch in 2021 Hélène Kaplona and Janice M. Reichert b aInstitut De Recherches Internationales Servier, Translational Medicine Department, Suresnes, France; bThe Antibody Society, Inc., Framingham, MA, USA ABSTRACT ARTICLE HISTORY In this 12th annual installment of the Antibodies to Watch article series, we discuss key events in antibody Received 1 December 2020 therapeutics development that occurred in 2020 and forecast events that might occur in 2021. The Accepted 1 December 2020 coronavirus disease 2019 (COVID-19) pandemic posed an array of challenges and opportunities to the KEYWORDS healthcare system in 2020, and it will continue to do so in 2021. Remarkably, by late November 2020, two Antibody therapeutics; anti-SARS-CoV antibody products, bamlanivimab and the casirivimab and imdevimab cocktail, were cancer; COVID-19; Food and authorized for emergency use by the US Food and Drug Administration (FDA) and the repurposed Drug Administration; antibodies levilimab and itolizumab had been registered for emergency use as treatments for COVID-19 European Medicines Agency; in Russia and India, respectively. Despite the pandemic, 10 antibody therapeutics had been granted the immune-mediated disorders; first approval in the US or EU in 2020, as of November, and 2 more (tanezumab and margetuximab) may Sars-CoV-2 be granted approvals in December 2020.* In addition, prolgolimab and olokizumab had been granted first approvals in Russia and cetuximab saratolacan sodium was first approved in Japan. The number of approvals in 2021 may set a record, as marketing applications for 16 investigational antibody therapeutics are already undergoing regulatory review by either the FDA or the European Medicines Agency. -

Amivantamab: a Potent Novel EGFR/C-MET Bispecific Antibody Therapy for EGFR-Mutated Non-Small Cell Lung Cancer

Review Lung Cancer Amivantamab: A Potent Novel EGFR/c-MET Bispecific Antibody Therapy for EGFR-mutated Non-small Cell Lung Cancer Matthew Z Guo,1 Kristen A Marrone,1 Alexander Spira,1,2 Kristine Freeman1,2 and Susan C Scott1 1. Johns Hopkins School of Medicine, Sidney Kimmel Comprehensive Cancer Center, Baltimore, MD, USA; 2. Virginia Cancer Specialists Research Institute, Fairfax, VA, USA; US Oncology Research, The Woodlands TX, USA hile the majority of epidermal growth factor receptor (EGFR) driver mutations in non-small cell lung cancer (NSCLC) are sensitive to treatment with targeted tyrosine kinase inhibitors (TKIs), anti-EGFR TKIs are susceptible to resistance mechanisms through Wsecondary mutations and also lack efficacy against tumours with non-classical EGFR mutations like exon 20 insertions. EGFR exon 20 insertions represent a challenging molecular subtype of NSCLC with no approved targeted therapy options and poor overall prognosis. Similarly, for NSCLC with EGFR mutations that are sensitive to TKIs, there are no approved targeted therapies following progression on a third-generation TKI without an alternative actionable mutation. Amivantamab is a novel, fully human bispecific anti-EGFR/c-MET antibody with clinical efficacy and favourable toxicity against both pre-treated EGFR exon 20 insertion NSCLC and classical EGFR mutations following development of TKI resistance. Preliminary findings from the phase I CHRYSALIS study report a 40% objective response rate with a median duration of response of 11.1 months for patients with pre-treated EGFR exon 20 insertion mutated tumours after platinum- based chemotherapy. Based on these results, the US Food and Drug Administration granted amivantamab accelerated approval in 2021 for treatment of adult patients with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations whose disease has progressed on or after platinum-based chemotherapy.