Takashimaya / 8233

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

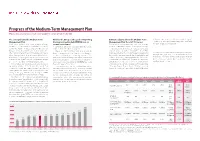

Progress of the Medium-Term Management Plan Making Steady Progress to Reach Our Management Goals Ahead of Schedule

Interview with the President Progress of the Medium-Term Management Plan Making steady progress to reach our management goals ahead of schedule The concept behind the Medium-Term Why has the Group set the goal of improving Estimates adjusted from the Medium-Term fiscal 2016 is expected to exceed the previous plan’s target of Management Plan the interest-bearing debt/EBITDA ratio to Management Plan: fiscal 2016 forecast 7.0 times to 6.8 times. We are steadily taking steps to reach these On the occasion of the management integration of Hankyu around seven times? Current estimates indicate that we will achieve our goals slightly management goals as early as possible. and Hanshin, the Group formulated and announced the six- To answer this question, I will once again explain the manage- ahead of schedule and forecasts have been adjusted accordingly. year Hankyu Hanshin Holdings Group 2007 Medium-Term ment indicators that the Group is aiming for. Operating income for the fiscal 2016 target year is forecast to Management Plan (fiscal 2008–fiscal 2013), for which we estab- The Group’s mainstay railway and real estate leasing surpass the previous plan (¥83.0 billion) by ¥2.0 billion to ¥85.0 Over six years have passed since the management integration lished yearly adjusted estimates and implemented initiatives to businesses generate stable cash flows. Yet, these businesses billion, reflecting currently robust railway operation revenue and of Hankyu Holdings, Inc. and Hanshin Electric Railway Co., Ltd. in achieve the plan’s targets. This plan was intended to clarify the are characterized by the need to own large amounts of fixed higher rental income mainly from the Umeda Hankyu Building. -

H2O Retailing / 8242

H2O Retailing / 8242 COVERAGE INITIATED ON: 2020.04.30 LAST UPDATE: 2021.06.24 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. H2O Retailing / 8242 RCoverageCoverage LAST UPDATE: 2021.06.24 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 -

Message to Our Shareholders 2007

Message to Our Shareholders 2007 Hankyu Department Stores, Inc. Contents ・To Our Shareholders ・The shift to a holding company structure ・Management integration with Hanshin Department Store ・Topics ・Redevelopment project near JR Oimachi Station ・Uni-President Hankyu Department Store in Kaohsiung, Taiwan ・Preparing to expand the scale of supermarket operations ・Launch of joint use of Persona Card and Hanshin's Emerald Card ・Settlement report (from 1st April 2006 to 31st March 2007) ・Corporate data To Our Shareholders During fiscal 2006, our Group saw both revenues and earnings increase. Performance was driven by curtailment of revenue losses arising from diminished sales space following the launch of reconstruction works at Umeda Main Store in the previous fiscal year, by increased revenues at other branches, and by opening of new supermarkets and the acquisition of retailer Nissho Corp. (now Hankyu Nissho Store). We made steady progress in the development of business infrastructure and expansion of operational scale as we pursued long-term business goals, grouped as the Grand Prix 10 (GP10) Plan. In addition to the acquisition of Nissho, we decided to open a new store in New Hakata Station Building, scheduled to open its doors in the spring of 2011, and rebuild multiple-use buildings within the redevelopment project near JR Oimachi Station in Tokyo’s Shinagawa Ward. We also established of Hanshoku Co., Ltd. as an President and Representative Director intermediary holding company to oversee our growing supermarket operations. Nobuaki Nitta In negotiations launched in September 2006 for our business alliance with The Hanshin Department Store, Ltd., we came to the conclusion that integrating our businesses would be the most efficient way forward for both of us. -

H2O Retailing / 8242

H2O Retailing / 8242 COVERAGE INITIATED ON: 2020.04.30 LAST UPDATE: 2021.08.16 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. H2O Retailing / 8242 RCoverageCoverage LAST UPDATE: 2021.08.16 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 -

Hankyu Hanshin Holdings 2020

Hankyu Hanshin Holdings 2020 https://www.hankyu-hanshin.co.jp/en/ Printed in Japan Hankyu Hanshin Holdings Group Management Philosophy Message from the Top Management What we try to achieve In October 2006, Hankyu Hanshin Holdings was established as a result of the management integration of Hankyu Holdings and Hanshin Electric Railway. Since then, the Hankyu Hanshin Holdings Group has worked in unison to heighten the competitiveness of each business. At the same time, the Group Mission has used its collective strength to increase its overall profitability and grow its earnings. In conjunction By delivering “Safety and Comfort” and “Dreams and Excitement”, with these efforts, we have steadily improved our financial position. we create satisfaction among our customers and contribute to society. However, the business environment of the Group is likely to change significantly as the population of areas served by its railway lines declines due to falling birth rates and an aging population, and as the lifestyles and conditions of everyday life evolve with the progress of technological innovation. What is important to us Aiming to become a corporate group that can focus strongly on sustained growth even in such an environment, we announced the Hankyu Hanshin Holdings Group Long-Term Management Vision for Values 2025 (fiscal 2026) in 2017. We have also formulated a medium-term management plan, which covers 1 Customer First fiscal 2019 through fiscal 2022, as concrete actions for the realisation of the long-term vision, and are Everything we do is for the customer. That’s where it all starts. steadily advancing measures based on the plan. -

Interim Financial Results FY2009

Interim 2010/02 Financial Results 09 Oct. 2009 ・ Statements contained herein regarding cost and revenue projections reflect our judgment based on information currently available, and involve a number of risks and uncertainties. It should be noted that actual results could differ significantly from the cost and revenue projections stated herein due to a variety of factors. Significant factors that could affect actual performance include but are not limited to the economic environment surrounding the department store industry, market trends, and exchange rate fluctuations. I. Interim 2010/02 Financial Highlights 1 II. Projected 2010/02 Financial Highlights 5 III. Structural Reforms Marketing Reforms 9 SG&A Expenses Reforms 13 Group Reforms 14 IV. Growth Strategy 15 I. Interim 2010/02 Financial Highlights Consolidated performance ( Yen in Million ) 1H FY2009 YoY Change from Projection Operating Revenue 428,864 - 59,352 - 12.2% - 7,935 - 1.8% SG&A expenses 127,553 - 8,383 - 6.2% - 2,247 - 1.7% Operating Income 5,213 - 8,875 - 63.0% - 1,387 - 21.0% Ordinary Income 7,244 - 8,943 - 55.2% - 756 - 9.5% Net Income 3,073 - 5,715 - 65.0% + 73 + 2.4% Operating Revenue A double-digit fall centered on the core domestic department store business, including Takashimaya Space Create Co., Ltd., and Takashimaya (Singapore) Ltd. (down 3.7 billion), which was strongly affected by foreign exchange. Non-consolidated Takashimaya and major subsidiaries, including Takashimaya Space Create Co., Ltd. and Takashimaya (Singapore) Ltd., also fell below plan. SG&A expenses Significantly reduced, given the effects of the structural reforms of our domestic department stores, etc. -

11. Development in Kansai Urban Area (PDF, 156KB)

WEST JAPAN RAILWAY COMPANY CORPORATE OPERATING CONTENTS BUSINESS DATA OTHER Fact Sheets 2019 OVERVIEW ENVIRONMENT 11 Business Development in Kansai Urban Area DEVELOPMENT in KANSAI URBAN AREA (As of March 2019) DEVELOPMENT in OSAKA LOOP LINE AREA JR Kyoto Line Osaka Higashi Line Tanikawa Umekoji-Kyotonishi (northern part) New station Shin-Osaka Hanaten – Shin-Osaka Opened in March 2019 Yamashina Kusatsu Relocate a portion of a Opened in March 2019 Ibaraki Station branch line of the Tokaido Kyoto Line underground and improvement and Kyoto development inside JR Kobe Line open a new station Railway Osaka Spring 2023 Opened in April 2018 Museum Hanaten Opened in Kyobashi Gakkentoshi Line April 2016 Himeji Maya New station Opened in Shin-Osaka Nara Line Nishikujo March 2016 Double track JR Tozai Line Kakogawa II stage JR Soujiji Spring 2023 Naniwasuji Line Shin-Kobe New station Yumeshima Umekita (Osaka) underground Kyobashi Opened in (Candidate site for station – JR Namba Higashi-Himeji Sannomiya March 2018 World Expo 2025 and Spring 2031 New station an integrated resort) Opened in Amagasaki Nara JR-Namba March 2016 Kobe Nishi-Akashi Osaka Tennoji Kizurikamikita Osaka New station Oji Higashi Line Opened in (southern part) March 2018 Takada Tennoji Yamatoji Line Kansai-airport Kyuhoji : JR-West related MAJOR PROJECTS facilities HOTEL • Naniwasuji Line • Relocate a portion of a branch line of • Osaka Higashi Line construction project VISCHIO OSAKA the Tokaido Line underground and by GRANVIA Project overview open a new station Project overview · Total cost: Approx. 330.0 billion yen · Total cost: Approx. 120.0 billion yen Project overview · length: Approx. -

Umeda 1-1 Project Dai Hanshin Building and Shin Hankyu Building Rebuilding Projects

Special Enhance value along rail lines including the Umeda area Feature Umeda 1-1 Project Dai Hanshin Building and Shin Hankyu Building Rebuilding Projects Overview of Main Upgraded Public Facilities Located Nearby Implementation of projects symbolic of the integration of Hankyu and Hanshin ■ This project involves rebuilding the Dai Hanshin Building (in which the Hanshin Department Store’s Umeda Flagship The vicinity of the Dai Hanshin Building and Shin Hankyu Building Diagram of Upgraded Area Store is located) and the opposite Shin Hankyu Building into an integrated complex. A new high-rise building approxi- features an upgraded three-level (underground, ground level, JR Osaka Sta. mately 190m high will be built on a prime location facing Umeda (Osaka) Station. deck level) pedestrian network that improves the comfort and South Gate Bldg. Umeda conveniences of pedestrian spaces and, in turn, contributes to Hankyu Bldg. the revitalisation of the immediate area and the rest of Osaka city. Hanshin Umeda Sta. HERBIS ENT Osaka Overview of Umeda 1-1 Project Dai-ichi Dai Hanshin Bldg. Widen and perform regular maintenance of Seimei Bldg. Sta. Umeda Higashi Line Tanimachi east-west underpass (the urban development Hilton Hotel project’s passageway No.1 in front of Osaka We will undertake this rebuilding project using the space above promote the development of a comfortable, superior-quality Osaka Shin Hankyu Bldg. Underground Station) Marubiru the road separating the Dai Hanshin Building and Shin Hankyu community by undertaking this project in conjunction with Umeda DT Make surrounding sites barrier free Yotsubashi Line Nishi Umeda Sta. Tower Building. This is the first time that an area specified for urgent upgrades to surrounding public facilities. -

Osaka Kita Sony Authorized Dealers 大阪 キタ

Osaka Kita Sony Authorized Dealers 大阪 キタ JR Tokaido Line Tokaido JR Ohbayashi Camera Money Exchange [Travelex] 01 Ha Hotel Hankyu Umeda カメラの大林 nk International Center yu A duty-free shop with a selection of digital cameras and digital K Bldg. o b camcorders. Saiseikai e & Hotel Nakatsu K 5 min from Osaka Sta 06-6341-8091 Mido-Suji y Hospital o Umeda Loft Green t o Plaza 9:00-20:00 (Sat 10:00-19:30, Sun/National Holidays L NU Chayamachi i Osaka n 10:00-19:00) /1-3 Jan closed e s CC Visa, Master DUTY FREE New Umeda City Osaka Yayoi Kaikan Hankyu-Umeda Yodobashi Camera Umeda Umeda Sky Bldg. Hotel Landmark Hotel New Hankyu 02 Umeda Annex ヨドバ シカメラ マル チメディア 梅 田 Yodobashi Camera 02 Hankyu This home electronics and camera retail store is one of the Umeda Ings Uniqlo largest in Japan with a stock of more than 850,000 products. DHC Osaka Yodobashi Umeda The Westin Osaka Hotel 1 min from Osaka Sta or Umeda Sta 06-4802-1010 Hep Five Shin Mido-Suji Ilmonte 9:30-21:30 / Open all year round Hotel Granvia Osaka Hotel New Hankyu Osaka Osaka CC Visa, Master TAX REFUND Umeda Umeda Herbis Plaza ENT Hankyu Daimaru Osaka Umeda Sonezaki Hearton Hotel Osaka Police KKR Hotel Nishi-Umeda Station Umeda Hanshin-Umeda Hotel Hanshin Department Store Monterey Hilton Shin-Hankyu Bldg. Higashi-Umeda Osaka Osaka E~ma Osaka Daiichi Hotel Umeda Nishi-Umeda OS Hotel Herbis Umeda DT Sonezaki 01 Ichiba Plaza Tower Hotel The Breezé Hokke Club Ritz-Carlton Breezé Osaka JR Osaka Loop Line Osaka Kita-Shinchi Ekimae Daini Bldg. -

Places of Employment of Graduates from Faculty/Graduate School (Master's Program) (FY2016) Faculty of Letters/Graduate School of Humanities ● Japan Post Bank Co., Ltd

Places of Employment of Graduates from Faculty/Graduate School (Master's Program) (FY2016) Faculty of Letters/Graduate School of Humanities ● Japan Post Bank Co., Ltd. ● East Japan Railway Company ● Kinki District Transport Bureau ● Daiwa Securities Co., Ltd. ● OSAKA GAS URBAN DEVELOPMENT Co., Ltd. ● Kinki Regional Development Bureau ● Nippon Life Insurance Company ● Mitsubishi Electric Corporation ● Hokkaido Regional Development Bureau ● The Dai-ichi Life Insurance Company, Limited ● Hyogo Prefectural High School ● Kobe City Office ● Toyota Motor Corp. ● Osaka Prefectural High School ● Hyogo Prefecture Government ● The Kansai Electric Power Co., Inc. ● Kumamoto Prefectural High School ● Akita Prefecture Government ● Shinchosha Co. ● Nagoya Immigration Bureau ● Fukui Prefecture Government ● KDDI CORPORATION ● Osaka Immigration Bureau ● Gifu Prefecture Government Faculty of Intercultural Studies/Graduate School of Intercultural Studies ● University of Hyogo ● Osaka City Office ● SHIMIZU CORPORATION ● National University of Laos NUOL ● Takarazuka City Office ● Mizuho Financial Group, Inc. ● Ministry of Foreign Affairs of Japan ● Kyoto City Office ● The Senshu Ikeda Bank, Ltd. ● ANA WINGS CO., LTD. ● Nantan City Miyama Tourism Bureau ● MURATA SK CORPORATION ● INPEX CORPORATION ● Japan Agricultural Co operatives ● Fujitsu Limited ● Toyota Motor Corp. ● Osaka Immigration Bureau ● Hankyu Corporation ● KYODO NEWS ● Sojitz Corporation ● Asahi Mutual Life Insurance Company ● Itochu Corp. ● NTT Docomo, Inc. ● Obic Co., Ltd. Faculty of Human Development/Graduate School of Human Development and Environment ● Hitachi, Ltd. ● Sumitomo Mitsui Banking Corporation ● Ministry of Land, Infrastructure, Transport and Tourism ● Mitsubishi Electric Corporation ● Mizuho Financial Group, Inc. ● Ministry of Justice ● Toyota Motor Corp. ● The Bank of Tokyo-Mitsubishi UFJ, Ltd. ● Family Court ● Ajinomoto AGF, Inc. ● Japan Post Bank Co., Ltd. ● Hyogo Prefecture Government ● Asahi Kasei Corporation. ● Sompo Japan Nipponkoa Insurance Inc. -

Osaka's Umeda Area, Driving the Group's Growth

Interview with the President the Umeda area. On the contrary, we believe that building retail Hanshin Building and Shin Hankyu Building. This is the first time Osaka’s Umeda area, spaces that enhance the attractiveness of Umeda on the whole that an “area specified for urgent urban regeneration work” in will expand this market and draw more customers than ever accordance with the Act on Special Measures concerning Urban driving the Group’s growth before. Regeneration is being used to ease regulations on aboveground Through these efforts, Umeda is undergoing a significant construction. In addition, we will promote the development of The Umeda Hankyu Building and GRAND FRONT OSAKA have been completed at last. transformation. Looking ahead, however, we must further evolve a comfortable, superior-quality community by undertaking this The Umeda 1-1 Project has made significant progress, which is intended to further enhance the Umeda into a highly competitive area on the international stage project in conjunction with upgrades to surrounding public attractiveness of the Umeda area. that gathers together and fosters exchanges among people, facilities. commodities and currencies not only from Kansai and Japan, The Umeda area is the Group’s most important business base. but Asia and numerous other overseas regions. One initiative to Accordingly, we are keenly aware of the role we play in this area. Among the major projects undertaken under the Medium-Term informal tenancy commitments), the subsequent rental income achieve this is the Umeda 1-1 Project, which involves rebuilding Looking ahead, we will work in tandem with the government Management Plan, we finally completed the rebuilding of has begun to contribute to overall earnings. -

11. Development in Kansai Urban Area (PDF, 209KB)

WEST JAPAN RAILWAY COMPANY CORPORATE OPERATING CONTENTS BUSINESS DATA OTHER Fact Sheets 2017 OVERVIEW ENVIRONMENT 11 Business Development in Kansai Urban Area DEVELOPMENT in KANSAI URBAN AREA *New station names are provisional. (As of May 2017) MAJOR PROJECTS Tanikawa JR Shichijyo* • Relocate a portion of a branch line of • Osaka Higashi Line construction project New station the Tokaido Line underground and Spring 2019 Yamashina open a new station Project overview Ibaraki Station Kyoto · Total cost: Approx. 120.0 billion yen improvement and Kyoto Project overview development inside (excl. opening of new stations) Railway · Total cost: approx. 69.0 billion yen station Spring 2018 Museum · length: Approx. 20.3 km · Length: approx. 2.4 km Opened in · No. of stations: 14 (incl. existing stations) April 2016 · New station plan: underground station with Himeji Maya New station two unattached platforms and four train lines Project leaders Opened in Shin-Osaka Nara Line · Construction: Osaka Soto-Kanjo Railway Co., Ltd. Project leaders March 2016 Double track · Operations: West Japan Railway Company Kakogawa Spring 2023 · Construction: City of Osaka, West Japan Railway Company Project timeline Shin-Kobe JR Soujiji* New station · Operations: West Japan Railway Company Jun. 1999 Construction started on southern part Higashi-Himeji Kyobashi Spring 2018 (Hanaten-Kyuhoji) Sannomiya Project timeline New station Nov. 2007 Construction started on northern part Opened in Nara Nov. 2015 Construction started Kobe Amagasaki (Shin Osaka-Hanaten) March 2016