H2O Retailing / 8242

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Progress of the Medium-Term Management Plan Making Steady Progress to Reach Our Management Goals Ahead of Schedule

Interview with the President Progress of the Medium-Term Management Plan Making steady progress to reach our management goals ahead of schedule The concept behind the Medium-Term Why has the Group set the goal of improving Estimates adjusted from the Medium-Term fiscal 2016 is expected to exceed the previous plan’s target of Management Plan the interest-bearing debt/EBITDA ratio to Management Plan: fiscal 2016 forecast 7.0 times to 6.8 times. We are steadily taking steps to reach these On the occasion of the management integration of Hankyu around seven times? Current estimates indicate that we will achieve our goals slightly management goals as early as possible. and Hanshin, the Group formulated and announced the six- To answer this question, I will once again explain the manage- ahead of schedule and forecasts have been adjusted accordingly. year Hankyu Hanshin Holdings Group 2007 Medium-Term ment indicators that the Group is aiming for. Operating income for the fiscal 2016 target year is forecast to Management Plan (fiscal 2008–fiscal 2013), for which we estab- The Group’s mainstay railway and real estate leasing surpass the previous plan (¥83.0 billion) by ¥2.0 billion to ¥85.0 Over six years have passed since the management integration lished yearly adjusted estimates and implemented initiatives to businesses generate stable cash flows. Yet, these businesses billion, reflecting currently robust railway operation revenue and of Hankyu Holdings, Inc. and Hanshin Electric Railway Co., Ltd. in achieve the plan’s targets. This plan was intended to clarify the are characterized by the need to own large amounts of fixed higher rental income mainly from the Umeda Hankyu Building. -

H2o Retailing Corporation Financial Report 2020

H2O RETAILING CORPORATION FINANCIAL REPORT 2020 Contents FINANCIAL REPORT for the 101st fiscal term I. Overview of the Company .........................................................................................................................................2 1. Summary of business results ............................................................................................................................................. 2 2. History ............................................................................................................................................................................... 4 3. Description of business ...................................................................................................................................................... 6 4. Overview of subsidiaries and associates............................................................................................................................ 9 5. Information about employees .......................................................................................................................................... 12 II. Overview of Business .............................................................................................................................................14 1. Management policies, management environment and issues to be resolved, etc. ......................................................14 2. Business risk ......................................................................................................................................................15 -

H2O Retailing / 8242

H2O Retailing / 8242 COVERAGE INITIATED ON: 2020.04.30 LAST UPDATE: 2021.06.24 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. H2O Retailing / 8242 RCoverageCoverage LAST UPDATE: 2021.06.24 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 -

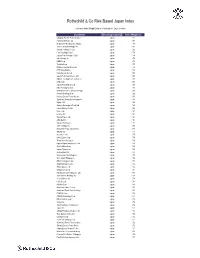

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

H2O Retailing / 8242

H2O Retailing / 8242 COVERAGE INITIATED ON: 2020.04.30 LAST UPDATE: 2021.07.15 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. H2O Retailing / 8242 RCoverageCoverage LAST UPDATE: 2021.07.15 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 -

Fuji Media Holdings, Inc. (The "Company") Will Be Held As Described Below and You Are Cordially Invited to Attend the Meeting

(Translation) Securities Code: 4676 June 1, 2017 To the Shareholders: NOTICE OF THE 76TH ORDINARY GENERAL MEETING OF SHAREHOLDERS Dear Shareholders: We would like to express our appreciation for your continued good offices. Please take notice that the 76th Ordinary General Meeting of Shareholders of Fuji Media Holdings, Inc. (the "Company") will be held as described below and you are cordially invited to attend the meeting. Since voting rights can be exercised in writing or via the Internet even if you are not present at the meeting, please go over the Reference Documents for the General Meeting of Shareholders set forth below and exercise your voting rights. Yours very truly, Hisashi Hieda, Chairman and Chief Executive Officer Fuji Media Holdings, Inc. 4-8, Daiba 2-chome, Minato-ku, Tokyo Description 1. Date and hour: June 28 (Wednesday), 2017, at 10:00 a.m. (Reception will start at 9:00 a.m.) 2. Place: Grand Nikko Tokyo Daiba (Formerly called Hotel Grand Pacific Le Daiba) B1, Palais Royal 6-1, Daiba 2-chome, Minato-ku, Tokyo 3. Matters forming the objects of the meeting: Matters to be reported: 1. Report on the business report, the consolidated financial statements and the results of audit of the consolidated financial statements by the account auditors and the Audit & Supervisory Board for the 76th fiscal year (from April 1, 2016 to March 31, 2017) 2. Report on the non-consolidated financial statements for the 76th fiscal year (from April 1, 2016 to March 31, 2017) Matters to be resolved: Proposition No. 1: Appropriation of retained earnings Proposition No. -

H2O Retailing / 8242

R H2O Retailing / 8242 COVERAGE INITIATED ON: 2020.04.30 LAST UPDATE: 2021.09.01 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. H2O Retailing / 8242 RCoverageCoverage LAST UPDATE: 2021.09.01 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- -

The Railway Market in Japan

www.EUbusinessinJapan.eu The Railway Market in Japan September 2016 Lyckle Griek EU-JAPAN CENTRE FOR INDUSTRIAL COOPERATION - Head office in Japan EU-JAPAN CENTRE FOR INDUSTRIAL COOPERATION - OFFICE in the EU Shirokane-Takanawa Station bldg 4F Rue Marie de Bourgogne, 52/2 1-27-6 Shirokane, Minato-ku, Tokyo 108-0072, JAPAN B-1000 Brussels, BELGIUM Tel: +81 3 6408 0281 - Fax: +81 3 6408 0283 - [email protected] Tel : +32 2 282 0040 –Fax : +32 2 282 0045 - [email protected] http://www.eu-japan.eu / http://www.EUbusinessinJapan.eu / http://www.een-japan.eu www.EUbusinessinJapan.eu Contents 1. Executive summary .................................................................................................................................................... 2 2. Introduction ............................................................................................................................................................... 3 3. Market structure........................................................................................................................................................ 4 a. Network overview (technical characteristics) ...................................................................................................... 4 b. Public & private operators .................................................................................................................................... 6 c. Large operators ................................................................................................................................................... -

Message to Our Shareholders 2007

Message to Our Shareholders 2007 Hankyu Department Stores, Inc. Contents ・To Our Shareholders ・The shift to a holding company structure ・Management integration with Hanshin Department Store ・Topics ・Redevelopment project near JR Oimachi Station ・Uni-President Hankyu Department Store in Kaohsiung, Taiwan ・Preparing to expand the scale of supermarket operations ・Launch of joint use of Persona Card and Hanshin's Emerald Card ・Settlement report (from 1st April 2006 to 31st March 2007) ・Corporate data To Our Shareholders During fiscal 2006, our Group saw both revenues and earnings increase. Performance was driven by curtailment of revenue losses arising from diminished sales space following the launch of reconstruction works at Umeda Main Store in the previous fiscal year, by increased revenues at other branches, and by opening of new supermarkets and the acquisition of retailer Nissho Corp. (now Hankyu Nissho Store). We made steady progress in the development of business infrastructure and expansion of operational scale as we pursued long-term business goals, grouped as the Grand Prix 10 (GP10) Plan. In addition to the acquisition of Nissho, we decided to open a new store in New Hakata Station Building, scheduled to open its doors in the spring of 2011, and rebuild multiple-use buildings within the redevelopment project near JR Oimachi Station in Tokyo’s Shinagawa Ward. We also established of Hanshoku Co., Ltd. as an President and Representative Director intermediary holding company to oversee our growing supermarket operations. Nobuaki Nitta In negotiations launched in September 2006 for our business alliance with The Hanshin Department Store, Ltd., we came to the conclusion that integrating our businesses would be the most efficient way forward for both of us. -

Stoxx True Exposure™ Japan 75% Index

STOXX TRUE EXPOSURE™ JAPAN 75% INDEX Components1 Company Supersector Country Weight (%) Softbank Group Corp. Telecommunications Japan 5.30 Nippon Telegraph & Telephone C Telecommunications Japan 3.16 KDDI Corp. Telecommunications Japan 2.94 SOFTBANK Telecommunications Japan 2.14 Itochu Corp. Industrial Goods & Services Japan 2.08 Sumitomo Mitsui Financial Grou Banks Japan 1.97 Oriental Land Co. Ltd. Travel & Leisure Japan 1.96 Central Japan Railway Co. Industrial Goods & Services Japan 1.83 East Japan Railway Co. Industrial Goods & Services Japan 1.60 M3 Health Care Japan 1.31 Aeon Co. Ltd. Personal Care, Drug & Grocery Stores Japan 1.31 Mitsui Fudosan Co. Ltd. Real Estate Japan 1.29 Daiwa House Industry Co. Ltd. Consumer Products & Services Japan 1.16 Secom Co. Ltd. Industrial Goods & Services Japan 1.00 Nitori Co. Ltd. Retail Japan 0.99 Sumitomo Realty & Development Real Estate Japan 0.97 Orix Corp. Financial Services Japan 0.97 JAPAN POST HOLDINGS Insurance Japan 0.82 Dai-ichi Life Holdings Insurance Japan 0.81 ASAHI GROUP HDGS Food, Beverage & Tobacco Japan 0.80 Z HOLDINGS Technology Japan 0.79 Obic Co. Ltd. Technology Japan 0.72 NEC Corp. Technology Japan 0.69 MS&AD Insurance Group Holdings Insurance Japan 0.69 JAPAN EXCHANGE GROUP Financial Services Japan 0.68 Sompo Holdings Insurance Japan 0.68 ENEOS HOLDINGS Energy Japan 0.65 SG HOLDINGS Industrial Goods & Services Japan 0.64 West Japan Railway Co. Industrial Goods & Services Japan 0.64 Sekisui House Ltd. Consumer Products & Services Japan 0.64 BANDAI NAMCO HOLDINGS INC. Consumer Products & Services Japan 0.63 Nomura Research Institute Ltd. -

Members Club Guide

ENGLISH MEMBERS CLU B GU I DE Terms of Membership of the Hankyu-Hanshin-Daiichi Hotel Group Members' Club Article 11. Loss or Theft of or Damage to the Hotel Card Article 1. Membership Requirements 1.In the case of the loss or theft of or damage to the Hotel Card, please contact the administration office of the 1. A "Member" refers to an individual who accepted the Terms of Membership of the Hankyu-Hanshin-Daiichi Hotel Group Members' Club ("Administration Office"). Hankyu-Hanshin-Daiichi Hotel Group Members' Club ("Terms of Membership"), applied for 2.To have the Hotel Card reissued, please apply to the Administration Office or any of the Hotels. In the case of membership to Hankyu Hanshin Hotels Co., Ltd. ("Company"), has been admitted by the Company, application to the Administration Office, the Company will verify the Member's registered personal information and has received a Hankyu-Hanshin-Daiichi Hotel Group Members' Club Card ("Hotel Card") on loan. Membership will be granted to persons aged 18 or over. The date of birth and other similar information be transferred to the new Hotel Card. In the case of application to any of the Hotels, a new Hotel Card with no may be checked for admission purposes. balance will be issued on the spot, and upon the checking of the applicant's personal information by the Administration Office, the points balance will be transferred to the new Hotel Card. The Hotel Card will not be Article 2. Use of the Hotel Card 1.Members may receive services from hotels of the Hankyu-Hanshin-Daiichi Hotel Group ("Hotels") upon presentation of the Hotel Card. -

Stoxx True Exposure™ Japan 75% Index

STOXX TRUE EXPOSURE™ JAPAN 75% INDEX Components1 Company Supersector Country Weight (%) KDDI Corp. Telecommunications JP 4.30 Nippon Telegraph & Telephone C Telecommunications JP 4.28 Central Japan Railway Co. Travel & Leisure JP 3.12 East Japan Railway Co. Travel & Leisure JP 2.99 NTT DoCoMo Inc. Telecommunications JP 2.52 Mitsui Fudosan Co. Ltd. Real Estate JP 2.10 Seven & I Holdings Co. Ltd. Retail JP 1.94 Ono Pharmaceutical Co. Ltd. Health Care JP 1.78 Daiwa House Industry Co. Ltd. Personal & Household Goods JP 1.60 Oriental Land Co. Ltd. Travel & Leisure JP 1.41 Secom Co. Ltd. Industrial Goods & Services JP 1.32 Mitsubishi Electric Corp. Industrial Goods & Services JP 1.26 Dai-ichi Life Insurance Co.Ltd Insurance JP 1.26 Orix Corp. Financial Services JP 1.21 Sumitomo Realty & Development Real Estate JP 1.18 MS&AD Insurance Group Holdings Insurance JP 1.11 Shionogi & Co. Ltd. Health Care JP 1.07 ASAHI GROUP HDGS Food & Beverage JP 1.01 West Japan Railway Co. Travel & Leisure JP 1.00 Daito Trust Construction Co. L Real Estate JP 0.99 Aeon Co. Ltd. Retail JP 0.97 Tokyo Gas Co. Ltd. Utilities JP 0.87 Chubu Electric Power Co. Inc. Utilities JP 0.82 SUMITOMO MITSUI TRUST HOLDINGS Banks JP 0.78 Tokyu Corp. Travel & Leisure JP 0.77 Yamato Holdings Co. Ltd. Industrial Goods & Services JP 0.77 JX Holdings Inc. Oil & Gas JP 0.73 Resona Holdings Inc. Banks JP 0.73 Nippon Building Fund Inc. Real Estate JP 0.73 JAPAN EXCHANGE GROUP Financial Services JP 0.72 Japan Real Estate Investment C Real Estate JP 0.69 Taisei Corp.