The Andhra Pradesh

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GRMB Annual Report 2017-18

Government of India Ministry of Water Resources, RD & GR Godavari River Management Board ANNUAL REPORT 2017-18 GODAVARI BASIN – Dakshina Ganga Origin Brahmagiri near Trimbakeshwar, Nasik Dist., Maharashtra Geographical Area 9.50 % of Total GA of India Area & Location Latitude - 16°19’ to 22°34’ North Longitude – 73°24’ to 83° 4’ East Boundaries West: Western Ghats North: Satmala hills, the Ajanta range and the Mahadeo hills East: Eastern Ghats & the Bay of Bengal South: Balaghat & Mahadeo ranges stretching forth from eastern flank of the Western Ghats & the Anantgiri and other ranges of the hills and ridges separate the Gadavari basin from the Krishna basin. Catchment Area 3,12,812 Sq.km Length of the River 1465 km States Maharashtra (48.6%), Telangana (18.8%), Andhra Pradesh (4.5%), Chhattisgarh (10.9%), Madhya Pradesh (10.0%), Odisha (5.7%), Karnataka (1.4%) and Puducherry (Yanam) and emptying into Bay of Bengal Length in AP & TS 772 km Major Tributaries Pravara, Manjira, Manair – Right side of River Purna, Pranhita, Indravati, Sabari – Left side of River Sub- basins Twelve (G1- G12) Dams Gangapur Dam, Jayakwadi dam, Vishnupuri barrage, Ghatghar Dam, Upper Vaitarna reservoir, Sriram Sagar Dam, Dowleswaram Barrage. Hydro power stations Upper Indravati 600 MW Machkund 120 MW Balimela 510 MW Upper Sileru 240 MW Lower Sileru 460 MW Upper Kolab 320 MW Pench 160 MW Ghatghar pumped storage 250 MW Polavaram (under 960 MW construction) ANNUAL REPORT 2017-18 GODAVARI RIVER MANAGEMENT BOARD 5th Floor, Jalasoudha, Errum Manzil, Hyderabad- 500082 FROM CHAIRMAN’S DESK It gives me immense pleasure to present the Annual Report of Godavari River Management Board (GRMB) for the year 2017-18. -

GRMB Annual Report 2018-19 | 59

Government of India Ministry of Jal Shakti Department of Water Resources, River Development & Ganga Rejuvenation Godavari River Management Board GODAVARI RIVER Origin Brahmagiri near Trimbakeshwar, Nashik Dist., Maharashtra Geographical Area 9.50 % of Total Geographical Area of India Location Latitude – 16°19’ to 22°34’ North Longitude – 73°24’ to 83° 40’ East Boundaries West: Western Ghats North: Satmala hills, Ajanta range and the Mahadeo hills East: Eastern Ghats & Bay of Bengal South: Balaghat & Mahadeo ranges, stretching from eastern flank of Western Ghats & Anantgiri and other ranges of the hills. Ridges separate the Godavari basin from Krishna basin. Catchment Area 3,12,812 Sq.km. Length of the River 1465 km States Maharashtra, Madhya Pradesh, Chhattisgarh, Odisha, Karnataka, Telangana, Andhra Pradesh and Puducherry (Yanam). Length in AP & TS 772 km Major Tributaries Pravara, Manjira, Manair – Right side of River Purna, Pranhita, Indravati, Sabari – Left side of River Sub- basins Twelve (G1- G12) Select Dams/ Head works Gangapur Dam, Jayakwadi Dam, Srirama Sagar, Sripada across Main Godavari Yellampally, Kaleshwaram Projects (Medigadda, Annaram & Sundilla barrages), Dummugudem Anicut, Polavaram Dam (under construction), Dowleswaram Barrage. Hydro power stations Upper Indravati 600 MW Machkund 120 MW Balimela 510 MW Upper Sileru 240 MW Lower Sileru 460 MW Upper Kolab 320 MW Pench 160 MW Ghatghar pumped storage 250 MW Polavaram (under 960 MW construction) ANNUAL REPORT 2018-19 GODAVARI RIVER MANAGEMENT BOARD 5th Floor, Jalasoudha, -

GRMB Annual Report 2016-17

Government of India Ministry of Water Resources, River Development & Ganga Rejuvenation Godavari River Management Board, Hyderabad ANNUAL REPORT 2016-17 ANNUAL REPORT 2016-17 GODAVARI RIVER MANAGEMENT BOARD th 5 Floor, Jalasoudha, ErrumManzil, Hyderabad- 500082 PREFACE It is our pleasure to bring out the first Annual Report of the Godavari River Management Board (GRMB) for the year 2016-17. The events during the past two years 2014-15 and 2015-16 after constitution of GRMB are briefed at a glance. The Report gives an insight into the functions and activities of GRMB and Organisation Structure. In pursuance of the A.P. Reorganization Act, 2014, Central Government constituted GRMB on 28th May, 2014 with autonomous status under the administrative control of Central Government. GRMB consists of Chairperson, Member Secretary and Member (Power) appointed by the Central Government and one Technical Member and one Administrative Member nominated by each of the Successor State. The headquarters of GRMB is at Hyderabad. GRMB shall ordinarily exercise jurisdiction on Godavari river in the States of Telangana and Andhra Pradesh in regard to any of the projects over head works (barrages, dams, reservoirs, regulating structures), part of canal network and transmission lines necessary to deliver water or power to the States concerned, as may be notified by the Central Government, having regard to the awards, if any, made by the Tribunals constituted under the Inter-State River Water Disputes Act, 1956. During the year 2016-17, GRMB was headed by Shri Ram Saran, as the Chairperson till 31st December, 2016, succeeded by Shri S. K. Haldar, Chief Engineer, NBO, CWC, Bhopal as in-charge Chairperson from 4th January, 2017. -

Chapter-3 Inter State Aspects

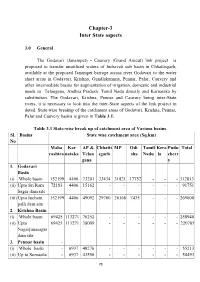

Chapter-3 Inter State aspects 3.0 General The Godavari (Janampet) - Cauvery (Grand Anicut) link project is proposed to transfer unutilised waters of Indravati sub basin in Chhattisgarh, available at the proposed Janampet barrage across river Godavari to the water short areas in Godavari, Krishna, Gundlakamma, Pennar, Palar, Cauvery and other intermediate basins for augmentation of irrigation, domestic and industrial needs in Telangana, Andhra Pradesh. Tamil Nadu directly and Karnataka by substitution. The Godavari, Krishna, Pennar and Cauvery being inter-State rivers, it is necessary to look into the inter-State aspects of the link project in detail. State-wise breakup of the catchment areas of Godavari, Krishna, Pennar, Palar and Cauvery basins is given in Table 3.1. Table 3.1 State-wise break up of catchment area of Various basins. Sl. Basins State wise catchment area (Sq.km) No Maha Kar AP & Chhatti MP Odi Tamil Kera Pudu Total rashtra nataka Telan sgarh sha Nadu la cherr gana y 1. Godavari Basin (i) Whole basin 152199 4406 73201 33434 31821 17752 - - - 312813 (ii) Upto Sri Ram 72183 4406 15162 - - - - - - 91751 Sagar dam site (iii) Upto Incham 152199 4406 49092 29700 26168 7435 - - - 269000 palli dam site 2. Krishna Basin (i) Whole basin 69425 113271 76252 - - - - - - 258948 (ii) Upto 69425 113271 38009 - - - - - - 220705 Nagarjunasagar dam site 3. Pennar basin - (i) Whole basin - 6937 48276 - - - - - - 55213 (ii) Up to Somasila - 6937 43556 - - - - - - 50493 78 Detailed Project Report of Godavari (Janampet) – Cauvery Grand Anicut) link project dam site 4. Cauvery basin (i) Whole basin - 34273 - - - - 43867 2866 149 81155 (ii) Up to Grand - 34273 - - - - 36008 2866 - 73147 Anicut site Source: Water balance studies of NWDA 3.1 Godavari basin Godavari is the largest river in South India and the second largest in India. -

Government of Andhra Pradesh Appropriation

Presented to State Legislature on 30 MARCH 2010 GOVERNMENT OF ANDHRA PRADESH APPROPRIATION ACCOUNTS 2008-2009 TABLE OF CONTENTS Page No. Introductory (iii) Summary of Appropriation Accounts 2 Certificate of the Comptroller and Auditor General of India 10 APPROPRIATION ACCOUNTS I. State Legislature 12 II. Governor and Council of Ministers 16 III. Administration of Justice 18 IV. General Administration and Elections 23 V. Revenue, Registration and Relief 32 VI. Excise Administration 49 VII. Commercial Taxes Administration 53 VIII. Transport Administration 56 IX. Fiscal Administration, Planning, Surveys and Statistics 58 X. Home Administration 87 XI. Roads, Buildings and Ports 90 XII. School Education 127 XIII. Higher Education 155 XIV. Technical Education 169 XV. Sports and Youth Services 176 XVI. Medical and Health 180 XVII. Municipal Administration and Urban Development 216 XVIII. Housing 236 XIX. Information and Public Relations 241 XX. Labour and Employment 245 XXI. Social Welfare 253 (i) XXII. Tribal Welfare 265 XXIII. Backward Classes Welfare 273 XXIV Minority Welfare 279 XXV. Women, Child and Disabled Welfare 283 XXVI. Administration of Religious Endowments 291 XXVII. Agriculture 293 XXVIII. Animal Husbandry and Fisheries 315 XXIX. Forest, Science, Technology and Environment 335 XXX. Co-operation 346 XXXI. Panchayat Raj 354 XXXII. Rural Development 369 XXXIII. Major and Medium Irrigation 381 XXXIV Minor Irrigation 446 XXXV. Energy 457 XXXVI. Industries and Commerce 461 XXXVII. Tourism, Art and Culture 476 XXXVIII. Civil Supplies Administration 484 XXXIX. Information Technology and Communications 489 XL. Public Enterprises 495 Appendix-I. Grant-wise details of expenditure met from advances from the Contingency Fund which were not recouped to the Fund before the close of the year 496 Appendix II. -

Finance Accounts

Presented to State Legislature on 30 MARCH 2010 GOVERNMENT OF ANDHRA PRADESH FINANCE ACCOUNTS 2008-2009 GOVERNMENT OF ANDHRA PRADESH FINANCE ACCOUNTS 2008-2009 TABLE OF CONTENTS PAGE(S) CERTIFICATE OF THE COMPTROLLER AND AUDITOR GENERAL OF INDIA 1(i) - 1(ii) INTRODUCTORY ... 2 - 4 PART I - SUMMARISED STATEMENTS No. 1 Summary of Transactions ... 6 - 33 No. 2 Capital Outlay outside the Revenue Account - ... 34 - 39 (i) Progressive Capital Outlay to end of 2008-2009 No. 3 Financial Results of Irrigation works ... 40 No. 4 Debt Position - ... 41 - 44 (i) Statement of Borrowings (ii) Other Obligations (iii) Service of Debt No. 5 Loans and Advances by State Government - ... 45 - 48 (i) Statement of Loans and Advances (ii) Recoveries in Arrears No. 6 Guarantees given by the Government for repayment of loans, etc., raised by Statutory Corporations, Local Bodies and other Institutions ... 49 - 55 No. 7 Cash balances and investment of cash balances ... 56 - 58 No. 8 Summary of balances under Consolidated Fund, Contingency Fund and Public Account ... 59 - 61 Notes to Accounts ... 62 - 66 PART II - DETAILED ACCOUNTS AND OTHER STATEMENTS A. Revenue and Expenditure No. 9 Statement of Revenue and Expenditure for the year 2008-2009 expressed as a percentage of total revenue/total expenditure ... 68 - 71 ( i ) PAGE(S) No.10 Statement showing the distribution between Charged and Voted Expenditure ... 72 No.11 Detailed Account of Revenue Receipts and Capital Receipts by minor heads ... 73 - 97 No.12 Detailed Account of Revenue Expenditure by minor heads and Capital Expenditure by Major Heads ... 98 - 150 No.13 Detailed Statement of Capital Expenditure during and to the end of 2008-2009 .. -

Legal Instruments on Rivers in India Vol II

FOR OFFICE USE ONLY AWARDS OF INTER-STATE WATER DISPUTES TRIBUNALS CENTRAL WATER COMMISSION INTER STATE MATTERS DIRECTORATE-1 NEW DELHI JANUARY, 2018 PREFACE India has been endowed with considerable water resources through numerous small and large rivers. Some of the larger Indian Rivers like the Indus or the Ganga- Brahmaputra-Meghna are international rivers. These and most of the other rivers are the inter-State rivers. Of the total geographical area of India, approximately 95% of the area is under international or inter-State rivers. The water resources development of these rivers takes place within the legal framework of development of the inter-State rivers. A sufficient familiarity with this legal framework (that is both its generalities and the specifics of a particular problem) is therefore, an essential pre-requisite for anyone interested in Planning, Development, Operation and Management of water resources of these rivers. The basic legal instruments which need to be referred to in this context can be classified as:- 1. The Constitutional provisions relevant to inter-State rivers. 2. Treaties or agreements between India and other countries in regard to development of international rivers/ basins. 3. The Laws enacted by the Parliament in connection with the development, use and regulation of inter-State rivers. 4. The awards and the proceedings of the inter-State water disputes tribunals set up by the Central Government. 5. Notifications, Resolutions, Orders etc. issued by the Central Government in pursuance of the Laws or Tribunal awards, setting up agencies, machineries or procedures to deal with inter-State rivers, from time to time. -

Sixth Five Year Plan 1980-85

SIXTH FIVE YEAR PLAN 1980-85 ANDHRA PRADESH DRAFT—VOL. Ill N IEPA DC SN0826 “T h ? 1 STATEMENTS G en er a l P age GH-I Heads of Development O-itlays and expenditure GN-II Development Schemes, Projects-outlay and expenditure 7 GN-III Targets of production and physical achievements 25 GH-IV Minimum Needs Programme—Outlay and expenditure 45 GM-Y Targets and physical achievements-pKysical programmes—Minimum Needs Programme 46 GM-VI Centrally Sponsored Schemes—Outlays 49 EMPLOYMENT. 57 irrigation : \ S tatement— IF . I .. 72 S tatement— IF . II „ „ „ 77 S tatement—I.F III «» „ 82 Statement— IF. VII „ 89 Statement— IF , VIII 90 Statement—IF, IX .. „ „ 91 Statement— IF , X «. .. „. 92 Statement—IF. XI „ 93 Statement— IF . XIV «. ... „ 94 1480-1 DRAFT SIXTH FIVE-YEAR PLAN 1980-85 Statement GN—1 H ea d s o f D ev e l o m e .-jt — S t a t e ’s O u t l a y s & E x p e n d it u r e (Rs in lakhs) 1980-81 1980-1985 1981-1982 A _A- . r - * . Head o f Development 1 9 79-80 Approved Anticipated Proposed Capital Proposed Capital Actuals outlay Expenditure outlay content outlay content ( 1) (2 ) (3) (4) (5) (6) (7) ( 8) A gricu lturu and A llied Services : 1. Research :■ nd Education 6 5 .1 4 6 5 .0 0 6 5 .0 0 4 6 0 .0 0 7 0 .0 0 2 . C'op Husbandry 1 2 5 .2 6 2 8 6 .5 1 286.51 3,700.00 6 3 .0 0 300.00 16.00 3. -

1 Government of Andhra Pradesh & Government Of

GOVERNMENT OF ANDHRA PRADESH & GOVERNMENT OF TELENGANA GENERAL ADMINISTRATION (SR) DEPARTMENT Circular Memo No FSA/01/2014 dated 30 September 2014 Subject: Andhra Pradesh Reorganisation Act 2014 – Allocation of State Services Employees – Action Plan Background 1. The Government of India in their order No. 27/13/2013-SR (S) dated 29 March 2014, has established an Advisory Committee for the State Government Employees, other than All India Services, as provided under Section 80 of Andhra Pradesh Reorganisation Act 2014. The Advisory Committee has, after extensive consultations, formulated draft Guidelines for allocation of state services employees between the States of Andhra Pradesh and Telangana. The draft guidelines were published for general information of all concerned on 25 July 2014 and are currently under consideration of the Government of India. 2. In notification No. GA (SR) / 2014/ 07 / Guidelines dated 14 August 2014, the Committee published the sanctioned cadre strength in different categories of state services in the secretariat and heads of departments (office of the Head of the Departments and the field level allocable posts) of the combined State of Andhra Pradesh as on 1 June 2014. The list included the total posts and vacancies existing on 1 June 2014 based on the information furnished by the concerned head of the department (HoD) duly validated with the database of posts sanctioned by the Council of Ministers maintained by the Finance (HRM) Department. 3. The final allocation of posts and personnel between the State of Telangana and Andhra Pradesh in respect of State Services (other than All India Services) would have to be undertaken in terms of Sections 77 to 82 of the Andhra Pradesh Reorganisation Act 2014. -

GRMB Annual Report 2019-20

Government of India Ministry of Jal Shakti Department of Water Resources, River Development & Ganga Rejuvenation GODAVARI RIVER MANAGEMENT BOARD ANNUAL REPORT 2019-20 5th Floor, Jalasoudha, Errumanzil, Hyderabad-500082 FROM CHAIRMAN’S DESK It gives me immense pleasure to present the Annual Report of Godavari River Management Board (GRMB) for the year 2019-20. In exercise of the powers conferred by sub-sections (1), (4) and (5) of Section 85 of the Andhra Pradesh Reorganisation Act, 2014, the Central Government through Gazette Notification dated 28th May, 2014 constituted the Godavari River Management Board for the administration, regulation, maintenance and operation of such projects on Godavari river, as may be notified by the Central Government from time to time.The Annual Report for the year 2019-20 chronicles the various activities undertaken by the Board during the year. The 8th meeting of GRMB was held in August 2019 wherein important administrative, financial and technical issues were deliberated and decisions taken. The Revised Recruitment Rules formulated to recruit supporting officials from the State Governments were approved. The decision on installation of Telemetry System to begin with on Inter- State border points was taken to enable assess the water availability/ usage at strategic points in Godavari Basin and thereby enhancing transparency and goodwill between the party States. The support and cooperation of Government of India and both the State Governments in facilitating smooth functioning of GRMB is gratefully acknowledged. The strength of the GRMB lies in its human resources and their commitment to excel. The performance of the Board during the year has been quite encouraging. -

National Fisheries Development Board

LIST OF RELEASES DONE FOR THE STATE OF ANDHRA PRADESH UNDER THE COMPONENT RFD Unspent Sanction Year of Sanctioned Released UCs Remittence SL.No Organisation Physical details Balance Project Status Year Release Amount Amount Received Received Amount 1 DoF, Govt. of AP 2008-09 2008-09 Fingerling stocking in 7138 ha. 21.10 21.10 21.10 0.00 0.00 Completed 2 DoF, Govt. of AP 2008-09 2008-09 Fingerling stocking in 236329 ha. 1625.04 1625.04 900.54 724.51 0.00 Completed 2nd year stocking in 6 reservoirs with an TWSA of 3 DoF, Govt. of AP 2009-10 2009-10 24.72 24.72 24.72 0.00 0.00 Completed 117827 ha with fingerlings in 2009-10 Ist year stocking in two reservoirs TWSA-1527ha 4 DoF, Govt. of AP 2010-11 2010-11 11.45 11.45 11.45 0.00 0.00 Completed and EWSA-1145 ha. Second year stocking in Ten reservoirs TWSA- 5 DoF, Govt. of AP 2010-11 2010-11 148.48 148.48 115.26 33.22 0.00 Completed 103197 ha. And EWSA-60761 ha. Third year stocking Six reservoirs TWSA-107895 6 DoF, Govt. of AP 2010-11 2010-11 151.91 151.91 17.16 134.74 0.00 Completed ha and EWSA-59387 ha. Training on Reservoir management and Pen 7 DoF, Govt. of AP 2010-11 2010-11 culture to 1710 fishermen in 67 batches. 20.72 20.72 20.72 0.00 0.00 Completed 1ST year stocking in 13 reservoirs; second year 8 DoF, Govt. -

Baseline Studies for WUE WALAMTARI.Pdf

Sanction of Projects S. Name of the Date of Amount State No. Project Sanction Sanctioned (lakhs) 1 Rallapadu 19 –12–2015 36.18 AP 2 Peddavagu 19 –12–2015 36.18 TS 3 Torrigadda 20 –01-2016 36.18 AP 4 Thatipudi 20 –01-2016 36.18 AP 5 Guntur Channel 20 –01-2016 36.18 AP 6 Vengalarayasagaram 20 –01-2016 36.18 AP 7 Vattivagu 20 –01-2016 36.18 TS 8 Thaliperu 20 –01-2016 36.18 TS 9 Sathnala 20 –01-2016 36.18 TS 10 Musi 20 –01-2016 36.18 TS Medium Irrigation Projects - Telangana State Sl. Name of the Name of the Project No. District 1 Musi Project Nalgonda 2 Peddavagu Project Khammam 3 Sathnala Project Adilabad 4 Thaliperu Project Khammam 5 Vattivagu Project Adilabad Medium Irrigation Projects - Andhra Pradesh Sl. Name of the Name of the Project No. District 1 Guntur Channel Project Guntur 2 Rallapadu Project Prakasam 3 Thatipudi Project Vizianagaram 4 Torrigedda Project East Godavari 5 Vengalarayasagaram Project Vizianagaram Locations of Ten Medium Irrigation Projects Dr. B. Krishna Rao Director (Agriculture& Research) Telangana State Andhra Pradesh Team Team K. Sunitha A. Sailaja (DEE) (ADA) A. Srinivas Goud V. Anil Kumar Reddy (AEE) (AEE) H. Sandeep K. Sushanth B. Sumanth Reddy P. Sravanthi (RA) Ch. Krishna (RA) (SRF) Reddy (SRF) (SRF) Planning workshops S. No. Name of the Project Date of Planning No. of Officials Workshop Attended 1 Rallapadu 23 – 01 - 2016 19 2 Peddavagu 23 – 01 - 2016 3 Musi 19 – 04 - 2016 4 Vattivagu 19 – 04 - 2016 35 5 Thaliperu 19 – 04 - 2016 6 Sathnala 19 – 04 - 2016 7 Torrigadda 20 – 04 - 2016 8 Thatipudi 20 – 04 -