Volvo Treasury AB (Publ)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Major Order for Volvo Buses in Norway

Volvo Bus Corporation Press Information Major order for Volvo Buses in Norway Volvo Buses in Norway has secured its largest individual order to date. The bus operator Veolia Transport has ordered 173 Volvo buses that will be deployed in traffic operations in the Stavanger area. During the spring, Veolia Transport Sør AS won the procurement process for all public transport in Sør-Rogaland, around Stavanger in southern Norge. There are considerable differences between the traffic to be provided in the various parts of the region, and Veolia Transport needs many different types of vehicles to be able to offer the most effective and productive traffic. Volvo Buses offers an extremely varied range of vehicle types and can deliver exactly the type of buses required by Veolia Transport. The order for Sør-Rogaland applies to 173 buses of the Volvo 7700, Volvo 8500 and Volvo 8700 type. It pertains mainly to low-entry buses with a length of either 12 meters or 14.5 meters, as well as two-axle 12-meter low-floor buses and 18-meter articulated buses. The order also includes three double-deckers based on Volvo’s well- proven B9TL double-decker chassis. The buses will be fitted with 7-liter, 9-liter and 12-liter engines, and certain buses will have Volvo Buses’ 9-liter engine that is fueled by natural gas. Reduced environmental impact The order has distinct environmental characteristics. Since Volvo has chosen catalytic conversion of exhaust fumes, the engines will obviously meet today’s stringent exhaust fume requirements in accordance with Euro 4. -

MÉRLEG Az Üzleti Év Fordulónapja: 2018. December

MÉRLEG Az üzleti év fordulónapja: 2018. december 31. ESZKÖZÖK adatok eFt-ban 2017. 2018. Tétel megnevezése TÉNY TÉNY A. Befektetett eszközök 20 066 056 17 733 040 I. Immateriális javak 412 852 302 107 1. Alapítás-átszervezés aktivált értéke 4 531 2 439 2. Kísérleti fejlesztés aktivált értéke 3. Vagyoni értékű jogok 108 840 73 338 4. Szellemi termékek 299 481 226 330 5. Üzleti vagy cégérték 6. Immateriális javakra adott előlegek 7. Immateriális javak értékhelyesbítése II. Tárgyi eszközök 19 626 062 17 403 791 1. Ingatlanok és a kapcsolódó vagyoni értékű jogok 6 454 775 6 864 887 2. Műszaki berendezések, gépek, járművek 11 570 178 9 532 989 3. Egyéb berendezések, felszerelések, járművek 1 090 553 897 203 4. Tenyészállatok 5. Beruházások, felújítások 467 328 107 997 6. Beruházásokra adott előlegek 43 228 715 7. Tárgyi eszközök értékhelyesbítése III. Befektetett pénzügyi eszközök 27 142 27 142 1. Tartós részesedés kapcsolt vállalkozásban 2. Tartósan adott kölcsön kapcsolt vállalkozásban 3. Tartós jelentős tulajdoni részesedés 4. Tartósan adott kölcsön jelentős tulajdoni részesedési viszonyban álló vállalkozásban 5. Egyéb tartós részesedés 27 142 27 142 6. Tartósan adott kölcsön egyéb részesedési viszonyban álló vállalkozásban 7. Egyéb tartósan adott kölcsön 8. Tartós hitelviszonyt megtestesítő értékpapír 9. Befektetett pénzügyi eszközök értékhelyesbítése 10. Befektetett pénzügyi eszközök értékelési különbözete B. Forgóeszközök 31 159 101 28 079 305 I. Készletek 816 148 903 914 1. Anyagok 811 333 900 171 2. Befejezetlen termelés és félkész termékek 3. Növendék-, hízó- és egyéb állatok 4. Késztermékek 5. Áruk 3 815 3 743 6. Készletekre adott előlegek 1 000 II. Követelések 8 393 530 6 424 403 1. -

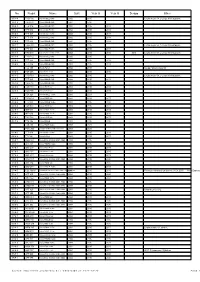

No. Regist Name Built Year O Year O Scrapp Other

No. Regist Name Built Year O Year O Scrapp Other 3514 THG 700 Volvo 8500LE CNG 2002 2015 Liczba mejsc 58, z czego 30 siedzących. 3512 THG 691 Volvo 8500LE CNG 2002 2015 3548 TFU 016 Volvo 8500LE CNG 2002 2015 2018 3541 TFT 952 Volvo 8500LE CNG 2002 2015 2018 3543 TFT 967 Volvo 8500LE CNG 2002 2015 2018 3546 TFT 979 Volvo 8500LE CNG 2002 2015 2018 3544 TFT 970 Volvo 8500LE CNG 2002 2015 2018 3517 THG 709 Volvo 8500LE CNG 2002 2015 Liczba mejsc 58, z czego 30 siedzących. 3542 TFT 961 Volvo 8500LE CNG 2002 2015 2017 3513 THG 697 Volvo 8500LE CNG 12,0m 2002 2015 2016 2019 Liczba mejsc 58, z czego 30 siedzących. 3518 THG 712 Volvo 8500LE CNG 2002 2015 3549 TFT 988 Volvo 8500LE CNG 2002 2015 2018 3545 TFT 976 Volvo 8500LE CNG 2002 2015 2018 TLD 155 Škoda Fabia I 2002 2015 Skoda Fabia Compis 60 5020 TGT 265 Volvo 8700 14,5m 2002 2015 2016 3515 THG 703 Volvo 8500LE CNG 2002 2015 Liczba mejsc 58, z czego 30 siedzących. 3547 TFT 985 Volvo 8500LE CNG 2002 2015 2018 3516 THG 706 Volvo 8500LE CNG 2002 2015 2296 TUH 133 Volvo 9700S 6x2 2003 2015 2015 2293 TUG 700 Volvo 9700S 6x2 2003 2015 2015 TSA 028 Volvo 8700LE 13,7m 2003 2021 2295 TUG 814 Volvo 9700S 6x2 2003 2014 2017 4966 TTJ 049 Volvo 8500LE 12,0m 2003 2015 2016 2294 TUH 022 Volvo 9700S 6x2 2003 2015 2017 2297 IMR-638 Volvo 9700S 14,7m 2003 2015 2015 2290 IMR-636 Volvo 9700S 14,7m 2003 2015 2016 2292 TUH 508 Volvo 9700S 6x2 2003 2015 2015 4975 TTA 196 Volvo 8500LE 2003 2016 2016 TXS 133 Volvo 9700H 12,0m 2003 2021 TWC 292 Scania L94IB 4x2 NB / Vest V25 2003 2021 3540 TFT 949 Volvo 8500LE CNG -

Bussf\366Rteckning \305Land 9 September 2009.Xls

BUSSAR - ÅLAND 11.9.2009 Sammanställd av Bosse Ahlnäs reg.nr. buss nr. tillv.år märke - modell tillverkningsnummer kaross kaross nr. sittpl. + (ståpl.) längd registrerings- + guideplats datum Williams Buss Ab ÅLG 84 10 1999 Scania K124 YS4K4X20001834378 Eagle 560, Lahti 19799 47 + 1 01.04.1999 ÅLP 33 3 2000 Scania K114 YS4K4X20001837157 Eagle 560, Lahti 31900 49 + 1 11.04.2000 ÅLR 44 4 2000 Scania K114 YS4K4X20001838083 Eagle 560, Lahti 33200 49 + 1 31.10.2000 ÅLR 66 6 2000 Scania K114 YS4K4X20001838081 Eagle 560, Lahti 33100 49 + 1 31.10.2000 ÅLK 22 2 2002 Scania K114 YS4K4X20001839739 Flyer 520, Lahti 47502 57 + 1 08.03.2002 ÅLB 11 1 2003 Scania K114 YS2K4X20001843846 Falcon 540, Lahti 62703 47 + 1 29.01.2003 ÅLA 99 9 2003 Scania K114 YS2K6X20001843619 Eagle 560, Lahti 60802 61 + 1 30.10.2003 ÅLC 55 5 2004 Scania K114 YS2K4X20001846310 Eagle, Lahti 75604 45 + 1 05.08.2004 ÅLV 77 7 2008 Scania LK340 YS2K4X20001861556 OmniExpress; Lahti 52408 55 + 1 27.08.2008 W 80 12 2008 Mercedes-Benz Vario 818 D WDB6703741N126804 VDL Kusters, Picardie, NL 25 + 1 29.08.2008 ÅLA 88 8 2008 Scania LK360 YS2K6X20001861619 OmniExpress; Lahti 54308 55 + 1 18.09.2008 11 st Sundqvist Buss Ab ÅLS 40 1996 Volvo B10M 1MA717TA045322 Carrus Fifty, Carrus Ajokki Tampere1591257 58 + 0 14,75 25.06.2003 ÅLB 10 1997 Volvo B10M 1MA717VA047641 Carrus Star 520, Carrus Oy Delta Lieto148721 47 + 1 12,00 15.06.2004 2000 1999 Volvo B10M YV31MA719XA050883 Delta Star 502, Carrus Turku 149034 52 + 1 13,70 22.04.1999 ÅLP 14 2000 Scania K114 YS4K4X20001837174 Delta Star 502, Carrus -

Triplex Windscreen for Buses

LAMITEX CATALOGUE * If you can`t find your bus model - contact us, our company can produce any windscreen on your size Height Width Code Brand and Model (mm) (mm) AJOKKI 873 Ajokki 5000 left 1144 1350 874 Ajokki 5000 right 1144 1350 809 Ajokki 5300 / Delta 200-300 / MAN 333/334 Magirus / MB O307 / WIIMA left 1075 1276 810 Ajokki 5300 / Delta 200-300 / MAN 333/334 Magirus / MB O307 / WIIMA right 1075 1276 1081 Ajokki 6000 left 1220 1410 1082 Ajokki 6000 right 1220 1410 7039 Ajokki 7000 left 1172 1404 7040 Ajokki 7000 right 1172 1404 1171 Ajokki City left / VÖV 1138 1277 1172 Ajokki City right / VÖV 1138 1277 1445 Ajokki Express left 1540 1290 1446 Ajokki Express right 1540 1290 7147 Ajokki Royal 1756 2435 7024 Ajokki Royal left 1755 1210 7025 Ajokki Royal right 1755 1210 1634 Ajokki Victor / Carrus 50 1552 2412 7407 Ajokki Victor / Carrus 50 left 1552 1201 7408 Ajokki Victor / Carrus 50 right 1552 1201 7242 Ajokki Vector 1655 2480 1188 Ajokki Apollo / Delta Star 1429 2518 ARNA 7175 Arna 1005 2535 7245 Arna 1127 2457 AUTOSAN 7392 Autosan 1232 2510 7366 Autosan A0808T Gemini 1716 2435 7418 Autosan A0909L Tramp 1130 2680 7385 Autosan H7-10 Traper 1230 2367 7379 Autosan Lider 1221 2616 7530 Autosan A8V Wetlina 1446 2182 BERKHOF 7026 Berkhof Excellence 2000 lower 1065 2732 7092 Berkhof Excellence 2000 HL upper 1073 2608 7118 Berkhof Excellence 1000 LD 1750 2740 7167 Berkhof Emperor lower 1147 2766 7140 Berkhof Esprite 1598 2630 7246 Berkhof Everest lower 1144 2730 7276 Berkhof 500 1530 2704 7395 Berkhof / Volvo 1640 1994 7444 Berkhoff / DAF -

Szám Rendsz Teljes Név Épül Beszer Selejt Selejt Más

Szám Rendsz Teljes név Épül Beszer Selejt Selejt Más 66439 UC 17409 Volvo B10B / Carrus Star 302 1995 2014 2014 66438 UC 17973 Scania K113TLB Classic III 360 1996 2014 2014 66486 KLI 48186 Mercedes-Benz 814 D / Berg 1998 2014 2014 28.10.1998 UC 19756 pierwsza rej. 18.11.2014 KLI 48186 25346 HAD 381 Volvo B10M / Carrus Star 302 1998 2013 2013 20259 KF 79271 Volvo B12 / Jonckheere Mistral 50 1998 2013 2013 12021 DJ 55907 Mercedes-Benz O550H 1998 2013 2013 25695 NE 78095 Volvo B10M-60 / Vest V25 12,4m 1998 2013 2013 25622 NV 45871 Volvo B10M-60 / Vest V10 12,4m 1999 2013 2014 "Mimmi" 20008 BP 40 732 Mercedes-Benz O550 1999 2013 2014 25059 KF 84580 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2014 25696 AE 21 601 Mercedes-Benz O550H 1999 2013 2013 25353 KF 83875 Volvo B10M-70 / Vest V25 13,7m 1999 2013 2013 20217 BE 49 739 Volvo B10M-60 / Vest V25 12,0m 1999 2013 2014 25623 NV 46041 Volvo B10M-C70 / Carrus Star 302 1999 2013 2013 "Vrang Stivi" 25356 KF 86741 Volvo B10M-70 / Vest V25 13,7m 1999 2013 2013 25351 KF 83857 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25358 DJ 62834 Mercedes-Benz O550H 1999 2013 2013 66488 LCH 60443 Mercedes-Benz 815 D / Berg 1999 2014 2014 25016 KF 84378 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25027 KF 84379 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25039 KF 84578 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25737 HS 80311 Volvo B10M / Carrus Vega 1999 2013 2013 12115 DJ 78740 Mercedes-Benz O550H 1999 2013 2015 20009 CK 36 101 Mercedes-Benz O550 1999 2013 2014 25075 KF 94563 Volvo B10M-60 / Vest V25 12,4m -

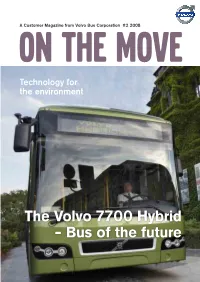

The Volvo 7700 Hybrid – Bus of the Future

OnA Customer Magazine The from Volvo Bus Corporation Move #2 2008 Technology for the environment The Volvo 7700 Hybrid – Bus of the future volvobus_ENG_080805.indd 1 08-09-04 13.21.48 finance for the road ahead If you are investing in a Volvo Bus, quality and safety must be important to you. So we are sure you’ll appreciate Volvo’s funding solutions too. Volvo Financial Services and Volvo Bus offer a unique combination of products and services designed for the industry that can be individually tailored to your business needs – making sure you get the best return on your investment. Contact your local Volvo representative for more information. Volvo Bus and Volvo Financial Services - together you’re in safe hands. volvo buses. when productivity counts 2 ON THE MOVE #2 2008 www.vfsco.com volvobus_ENG_080805.indd 2 08-09-04 13.22.00 The city bus of the future is here 4. Volvo 7700 Hybrid The future of the hybrid: As fuel prices rise and ambitious environmental goals Volvo 7700 Hybrid can give are being set all over the world, the world about us is you fuel savings of up to 30 changing rapidly. This is forcing us to develop alternative per cent. powertrains and opportunities for using alternative fuels. Here at Volvo Bus, we are prioritising the development of fuel-efficient powertrains, which is resulting in some of the lowest fuel consumption on the market with our new Euro 4/EEV powertrains. Now we are taking the next major step towards drastically reducing fuel con- sumption by introducing a hybrid bus which we have 8. -

Stororder För Volvo Bussar I Norge

Volvo Bussar AB Pressinformation Stororder för Volvo Bussar i Norge Volvo Bussar i Norge har fått sin hittills största enskilda order. Operatören Veolia Transport Sør AS har beställt 173 Volvobussar som skall gå i trafik i Stavangerområdet. Veolia Transport Sør AS vann i våras upphandlingen för all kollektivtrafik i Sør- Rogaland runt Stavanger i södra Norge. Trafiken skiljer sig mellan olika delar av området och Veolia Transport har behov av många olika typer av fordon för att kunna erbjuda den mest effektiva och produktiva trafiken. Volvo Bussar har ett mycket brett utbud av fordonstyper och klarar av att leverera det som Veolia Transport behöver. Beställningen till Sør-Rogaland gäller 173 bussar och det är såväl Volvo 7700, Volvo 8500 som Volvo 8700. De flesta är lågentrébussar på såväl 12 som14,5 meters längd och tvåaxliga 12-meters låggolvsbussar samt ledbussar på 18 meter. Beställningen omfattar också tre dubbeldäckare som byggs på Volvos väl beprövade dubbeldäckarchassi B9TL. Motorerna är dieselmotorer på såväl 7-liter som 9-liter och 12-liter och dessutom Volvo Bussars 9-litersmotor som drivs av naturgas. Minskad miljöpåverkan Ordern har en klar miljöprägel. Tack vare att Volvo valt katalytisk avgasrening, klarar motorerna självklart dagens tuffa avgaskrav enligt Euro 4. Samtidigt innebär teknikvalet att bränsleförbrukningen sänks vilket minskar utsläppen av växthusgasen koldioxid. I ordern ingår dessutom 35 gasbussar med utsläppsnivåer som underskrider Euro 5, krav som inte träder i kraft förrän 2009. I uppgörelsen ingår att Volvos återförsäljare Rieber Thorsen Buss og Last AS tar hand om allt underhåll av bussarna i fem år med en möjlig förlängning av underhållskontraktet med upptill 3,5 år. -

Volvo Buses to Close Plant in Tampere, Finland

Volvo Bus Corporation Press Information Volvo Buses to close plant in Tampere, Finland After finalizing the negotiations with employee representatives, Volvo Buses has decided to close the bus body plant in Tampere, Finland. The company will also reorganize operations at the body plant in Turku to increase the competitiveness. In total, 237 employees will be given notice. Currently, Volvo Buses has an overcapacity in its European bus body production system and foresees that this will be the case also in the coming years. The intention is to adjust production capacity as a part of the strategy to strengthen Volvo Buses’ profitability. Volvo Buses European bus body production system consists of the two plants in Finland, in Wroclaw, Poland, and in Säffle, Sweden. The plants in Tampere and Wroclaw both manufacture the Volvo 8700 bus model. The plant in Poland has spare capacity and by concentrating the production of the Volvo 8700 to Wroclaw, Volvo Buses can obtain more cost-efficient production. In Turku, the operations will be reorganized to enhance the competitiveness. The production of the Volvo 9700 coach model in Turku will be focused on the Nordic markets. The production in Tampere will end in August. Volvo Bus Finland has, together with the representatives for the employees, negotiated various supporting measures for the affected employees. During the first quarter, earnings were charged with provisions related to above amounting to SEK 120 million. April 24, 2008 For further information, please contact Per-Martin Johansson, Press Officer, +46 31 322 52 00 [email protected] Visit http://www.thenewsmarket.com/volvogroup to access broadcast-standard video from Volvo Group. -

Finlandia 2017: Treni, Bus E TPL in Generale - 2^ Parte Di G

Finlandia 2017: treni, bus e TPL in generale - 2^ parte di G. Molteni La città di Turku ha una buona rete di tpl urbano esclusivamente su gomma, dopo la cessazione del servizio tranviario avvenuta nel 1972. Centro nevralgico della rete cittadina, come in molte altre località finlandesi, è Kauppatori ( piazza del Mercato ), foto 51, la piazza centrale in cui arrivano e sostano gli autobus di quasi tutte le linee, anche se si tratta soltanto del punto centrale delle varie linee. Foto 51 - Turku, Kauppatori vista da Eerikinkatu. Notare le strisce pedonali curve: nel ciclo semaforico c’ è una fase che da il verde ai soli pedoni in tutte le direzioni, consentendo anche attraversamenti in diagonale A partire dal 1° luglio 2014, il servizio è stato rivisto e riorganizzato a livello sovracomunale, ed ora tutto è coordinato dal consorzio pubblico Föli ( http://www.foli.fi/en ), che programma il servizio, la tariffazione e che tra l’ altro ha imposto una livrea unificata ai ben 9 operatori, livrea che affianca una tonalità aggiornata dello storico giallo ocra della ex municipalizzata del tpl di Turku, al bianco, il tutto completato da un grosso stemma della città, un simil giglio che ricorda una M maiuscola. Föli assicura il servizio in tutta l’ area urbana, che oltre a Turku comprende i comuni di Kaarina, Raisio, Naantali, Lieto e Rusko, e affida i servizi attraverso gare. Le linee propriamente urbane sono 19 più 11 “regionali”, molte delle quali con diverse diramazioni periferiche. Esiste un servizio notturno ( yölinjat ) al venerdi e sabato articolato su 7 linee, con ultime partenze alle 2:30 da Kauppatori per le varie destinazioni. -

Volvo Treasury AB (Publ)

PROSPECTUS VOLVO Volvo Treasury AB (publ) (Incorporated with limited liability under the laws of Sweden) under the guarantee of AB Volvo (pub!) (Incorporated with limited liability under the laws of Sweden) U.S.S15,000,000,000 Euro Medium Term Note Programme On 29th November, 1994 Volvo Treasury AB (publ) (the "Issuer") and Volvo Group Finance Europe B. V ("Volvo Europe") entered into a U.S.$500.000,000 Euro Medium Term Note Programme (the "Programme"). The Programme was subsequently increased on 17th October, 1996. ISth March, 1999, 24th March, 2000, 28th October, 2004, 9th November, 2006 and 16th November, 2007, in each case in accordance with its terms. On 7th August, 1997 Volvo Group Treasury Asia Ltd. (" Volvo Asia") and Volvo Treasury US LLC (" Volvo US") were added as issuers under the Programme. On 2nd October. 1998 the Issuer was substituted in accordance with Condition 18 as an issuer in respect of notes issued prior to 2nd October, 1998 by Volvo Europe, As from 24th November, 1998 Volvo Europe and Volvo Asia have, ceased to be issuers under the Programme in respect of issues made after such date Volvo Asia has no outstanding Notes under the Programme. As from 6th November. 2002. Volvo US has ceased to be an issuer under the Programme in respect of issues made after such date. Volvo US has no outstanding Notes under the Programme. This Prospectus, which is valid for a period of 12 months from the date of publication of this Prospectus, supersedes all previous prospectuses, offering circulars and supplements thereto. Any Notes (as defined below) issued under the Programme after the date hereof are issued subject to the provisions set out herein. -

Skapar Framtidens Transporter Och

VOLVOKONCERNEN ÅRS- OCH HÅLLBARHETSREDOVISNING 2020 SKAPAR FRAMTIDENS TRANSPORTER OCH INFRASTRUKTUR Volvokoncernen 2020 Volvokoncernen www.volvogroup.se EN GLOBAL KONCERN 2020 ÖVERBLICK DETTA ÄR VOLVOKONCERNEN VÅRA KUNDER FÅR SAMHÄLLEN ATT FUNGERA Volvokoncernens mission är att bidra till ökat välstånd med våra transport- och infrastrukturlösningar. Vi utvecklar ständigt våra produkter och tjänster för att skapa mervärde för våra kunder och bidra till ett hållbart samhälle samt till människors välbefinnande och säkerhet. Att driva välstånd socialt, miljömässigt och ekonomiskt innebär att sträva efter transport- och infrastrukturlösningar som är 100% säkra, 100% fossil fria och 100% mer produktiva. Volvokoncernens produkter och tjänster bidrar till mycket av det vi alla förväntar oss av ett väl fungerande samhälle. Våra lastbilar, bussar, motorer, anläggningsmaskiner och finansiella tjänster är delar av flera av de samhällsfunktioner många av oss är beroende av varje dag. De flesta av Volvokoncernens kunder är företag verksamma inom transportindustrin eller i bygg- och anläggningsindustrin. Tillförlitligheten och prestandan i koncernens produkter är viktiga och i många fall avgörande för våra kunders framgång och lönsamhet. PÅ VÄGEN Våra produkter bidrar till att människor har mat på bordet, kan resa till sin destination och vägar att köra på. Våra produkter leve- rerar även gods så att produktionsanläggningar inte står stilla. I TERRÄNGEN Motorer, maskiner och fordon från Volvokoncernen används för att bryta järnmalm, transportera timmer eller frakta sten och grus. Våra industrimotorer driver viktiga bevattningsanlägg- ningar runt om i världen så att odlarnas grödor kan växa. I STADEN Våra bussar tar människor till jobbet eller skolan, lastbilar hämtar sopor och våra industrimotorer används som reservkraft. Våra produkter används också för att bygga bostäder, industrier och idrottsanläggningar.