Volvo Treasury AB

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Major Order for Volvo Buses in Norway

Volvo Bus Corporation Press Information Major order for Volvo Buses in Norway Volvo Buses in Norway has secured its largest individual order to date. The bus operator Veolia Transport has ordered 173 Volvo buses that will be deployed in traffic operations in the Stavanger area. During the spring, Veolia Transport Sør AS won the procurement process for all public transport in Sør-Rogaland, around Stavanger in southern Norge. There are considerable differences between the traffic to be provided in the various parts of the region, and Veolia Transport needs many different types of vehicles to be able to offer the most effective and productive traffic. Volvo Buses offers an extremely varied range of vehicle types and can deliver exactly the type of buses required by Veolia Transport. The order for Sør-Rogaland applies to 173 buses of the Volvo 7700, Volvo 8500 and Volvo 8700 type. It pertains mainly to low-entry buses with a length of either 12 meters or 14.5 meters, as well as two-axle 12-meter low-floor buses and 18-meter articulated buses. The order also includes three double-deckers based on Volvo’s well- proven B9TL double-decker chassis. The buses will be fitted with 7-liter, 9-liter and 12-liter engines, and certain buses will have Volvo Buses’ 9-liter engine that is fueled by natural gas. Reduced environmental impact The order has distinct environmental characteristics. Since Volvo has chosen catalytic conversion of exhaust fumes, the engines will obviously meet today’s stringent exhaust fume requirements in accordance with Euro 4. -

MÉRLEG Az Üzleti Év Fordulónapja: 2018. December

MÉRLEG Az üzleti év fordulónapja: 2018. december 31. ESZKÖZÖK adatok eFt-ban 2017. 2018. Tétel megnevezése TÉNY TÉNY A. Befektetett eszközök 20 066 056 17 733 040 I. Immateriális javak 412 852 302 107 1. Alapítás-átszervezés aktivált értéke 4 531 2 439 2. Kísérleti fejlesztés aktivált értéke 3. Vagyoni értékű jogok 108 840 73 338 4. Szellemi termékek 299 481 226 330 5. Üzleti vagy cégérték 6. Immateriális javakra adott előlegek 7. Immateriális javak értékhelyesbítése II. Tárgyi eszközök 19 626 062 17 403 791 1. Ingatlanok és a kapcsolódó vagyoni értékű jogok 6 454 775 6 864 887 2. Műszaki berendezések, gépek, járművek 11 570 178 9 532 989 3. Egyéb berendezések, felszerelések, járművek 1 090 553 897 203 4. Tenyészállatok 5. Beruházások, felújítások 467 328 107 997 6. Beruházásokra adott előlegek 43 228 715 7. Tárgyi eszközök értékhelyesbítése III. Befektetett pénzügyi eszközök 27 142 27 142 1. Tartós részesedés kapcsolt vállalkozásban 2. Tartósan adott kölcsön kapcsolt vállalkozásban 3. Tartós jelentős tulajdoni részesedés 4. Tartósan adott kölcsön jelentős tulajdoni részesedési viszonyban álló vállalkozásban 5. Egyéb tartós részesedés 27 142 27 142 6. Tartósan adott kölcsön egyéb részesedési viszonyban álló vállalkozásban 7. Egyéb tartósan adott kölcsön 8. Tartós hitelviszonyt megtestesítő értékpapír 9. Befektetett pénzügyi eszközök értékhelyesbítése 10. Befektetett pénzügyi eszközök értékelési különbözete B. Forgóeszközök 31 159 101 28 079 305 I. Készletek 816 148 903 914 1. Anyagok 811 333 900 171 2. Befejezetlen termelés és félkész termékek 3. Növendék-, hízó- és egyéb állatok 4. Késztermékek 5. Áruk 3 815 3 743 6. Készletekre adott előlegek 1 000 II. Követelések 8 393 530 6 424 403 1. -

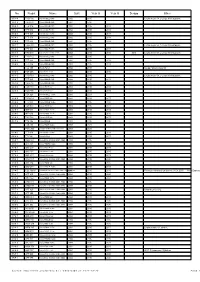

No. Regist Name Built Year O Year O Scrapp Other

No. Regist Name Built Year O Year O Scrapp Other 3514 THG 700 Volvo 8500LE CNG 2002 2015 Liczba mejsc 58, z czego 30 siedzących. 3512 THG 691 Volvo 8500LE CNG 2002 2015 3548 TFU 016 Volvo 8500LE CNG 2002 2015 2018 3541 TFT 952 Volvo 8500LE CNG 2002 2015 2018 3543 TFT 967 Volvo 8500LE CNG 2002 2015 2018 3546 TFT 979 Volvo 8500LE CNG 2002 2015 2018 3544 TFT 970 Volvo 8500LE CNG 2002 2015 2018 3517 THG 709 Volvo 8500LE CNG 2002 2015 Liczba mejsc 58, z czego 30 siedzących. 3542 TFT 961 Volvo 8500LE CNG 2002 2015 2017 3513 THG 697 Volvo 8500LE CNG 12,0m 2002 2015 2016 2019 Liczba mejsc 58, z czego 30 siedzących. 3518 THG 712 Volvo 8500LE CNG 2002 2015 3549 TFT 988 Volvo 8500LE CNG 2002 2015 2018 3545 TFT 976 Volvo 8500LE CNG 2002 2015 2018 TLD 155 Škoda Fabia I 2002 2015 Skoda Fabia Compis 60 5020 TGT 265 Volvo 8700 14,5m 2002 2015 2016 3515 THG 703 Volvo 8500LE CNG 2002 2015 Liczba mejsc 58, z czego 30 siedzących. 3547 TFT 985 Volvo 8500LE CNG 2002 2015 2018 3516 THG 706 Volvo 8500LE CNG 2002 2015 2296 TUH 133 Volvo 9700S 6x2 2003 2015 2015 2293 TUG 700 Volvo 9700S 6x2 2003 2015 2015 TSA 028 Volvo 8700LE 13,7m 2003 2021 2295 TUG 814 Volvo 9700S 6x2 2003 2014 2017 4966 TTJ 049 Volvo 8500LE 12,0m 2003 2015 2016 2294 TUH 022 Volvo 9700S 6x2 2003 2015 2017 2297 IMR-638 Volvo 9700S 14,7m 2003 2015 2015 2290 IMR-636 Volvo 9700S 14,7m 2003 2015 2016 2292 TUH 508 Volvo 9700S 6x2 2003 2015 2015 4975 TTA 196 Volvo 8500LE 2003 2016 2016 TXS 133 Volvo 9700H 12,0m 2003 2021 TWC 292 Scania L94IB 4x2 NB / Vest V25 2003 2021 3540 TFT 949 Volvo 8500LE CNG -

The Volvo Group 2006 by Creating Value for Our Customers

A global group The Volvo Group is one of the leading suppliers of commercial 2 Organization The Volvo Group 2006 4 Volvo in society transport solutions providing products such as trucks, 6 Vision, mission and values buses, construction equipment, drive systems for marine 8 Market overview T By creating value for 10 CEO comment and industrial applications compo- h as well as aircraft engine e our customers, we 12 Our customers’ needs govern our nents. The Volvo Group also offers its customers strategy… V o create value for our 13 1. Profitable growth fi nancial services. l 14 2. Innovation and product development v o 15 3. Highest quality in implementation The Group has about 83,000 employees, production facilities shareholders 16 Financial strategy G in 18 countries, and sales activities in some 180 countries. 18 Leading supplier of commercial r o transport solutions During 2006 Volvo Group sales rose 7% to SEK 248 billion, u 20 Volvo 3P – Development and synergies p SEK 40.20. 24 Volvo Powertrain - Uniform power with earnings per share advancing 25% to The 2 28 Long-term strategy in Asia 0 share is listed on the Stockholm Stock Exchange and on 30 The share 0 6 Sustainable development NASDAQ in the US. 32 Introduction 35 Environmental responsibility 40 Social responsibility Board of Directors’ Report 46 Significant events 50 Financial performance 52 Financial position 54 Cash-flow statement 56 Risk management 59 Business areas 60 Mack Trucks 62 Renault Trucks 64 Volvo Trucks 66 Trucks 68 Buses Information about IFRS 70 Construction Equipment As of January 1, 2005, AB Volvo complies with International Financial Reporting Standards (IFRS), 72 Volvo Penta 74 Volvo Aero previously known as IAS, as adopted by the European Union. -

Volvo Treasury AB (Publ)

PROSPECTUS Volvo Treasury AB (publ) (Incorporated with limited liability under the laws of Sweden) under the guarantee of AB Volvo (publ) (Incorporated with limited liability under the laws of Sweden) U.S.$15,000,000,000 Euro Medium Term Note Programme On 29th November, 1994 Volvo Treasury AB (publ) (the “Issuer”) and Volvo Group Finance Europe B.V. (“Volvo Europe”) entered into a U.S.$500,000,000 Euro Medium Term Note Programme (the “Programme”). The Programme was subsequently increased on 17th October, 1996, 18th March, 1999, 24th March, 2000, 28th October, 2004, 9th November, 2006 and 16th November, 2007, in each case in accordance with its terms. On 7th August, 1997 Volvo Group Treasury Asia Ltd. (“Volvo Asia”) and Volvo Treasury US LLC (“Volvo US”) were added as issuers under the Programme. On 2nd October, 1998 the Issuer was substituted in accordance with Condition 18 as an issuer in respect of notes issued prior to 2nd October, 1998 by Volvo Europe. As from 24th November, 1998 Volvo Europe and Volvo Asia have ceased to be issuers under the Programme in respect of issues made after such date. Volvo Asia has no outstanding Notes under the Programme. As from 6th November, 2002, Volvo US has ceased to be an issuer under the Programme in respect of issues made after such date. Volvo US has no outstanding Notes under the Programme. This Prospectus, which is valid for a period of 12 months from the date of publication of this Prospectus, supersedes all previous prospectuses, offering circulars and supplements thereto. Any Notes (as defined below) issued under the Programme after the date hereof are issued subject to the provisions set out herein. -

Szám Rendsz Teljes Név Épül Beszer Selejt Selejt Más

Szám Rendsz Teljes név Épül Beszer Selejt Selejt Más 66439 UC 17409 Volvo B10B / Carrus Star 302 1995 2014 2014 66438 UC 17973 Scania K113TLB Classic III 360 1996 2014 2014 66486 KLI 48186 Mercedes-Benz 814 D / Berg 1998 2014 2014 28.10.1998 UC 19756 pierwsza rej. 18.11.2014 KLI 48186 25346 HAD 381 Volvo B10M / Carrus Star 302 1998 2013 2013 20259 KF 79271 Volvo B12 / Jonckheere Mistral 50 1998 2013 2013 12021 DJ 55907 Mercedes-Benz O550H 1998 2013 2013 25695 NE 78095 Volvo B10M-60 / Vest V25 12,4m 1998 2013 2013 25622 NV 45871 Volvo B10M-60 / Vest V10 12,4m 1999 2013 2014 "Mimmi" 20008 BP 40 732 Mercedes-Benz O550 1999 2013 2014 25059 KF 84580 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2014 25696 AE 21 601 Mercedes-Benz O550H 1999 2013 2013 25353 KF 83875 Volvo B10M-70 / Vest V25 13,7m 1999 2013 2013 20217 BE 49 739 Volvo B10M-60 / Vest V25 12,0m 1999 2013 2014 25623 NV 46041 Volvo B10M-C70 / Carrus Star 302 1999 2013 2013 "Vrang Stivi" 25356 KF 86741 Volvo B10M-70 / Vest V25 13,7m 1999 2013 2013 25351 KF 83857 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25358 DJ 62834 Mercedes-Benz O550H 1999 2013 2013 66488 LCH 60443 Mercedes-Benz 815 D / Berg 1999 2014 2014 25016 KF 84378 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25027 KF 84379 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25039 KF 84578 Volvo B10M-60 / Vest V25 12,4m 1999 2013 2013 25737 HS 80311 Volvo B10M / Carrus Vega 1999 2013 2013 12115 DJ 78740 Mercedes-Benz O550H 1999 2013 2015 20009 CK 36 101 Mercedes-Benz O550 1999 2013 2014 25075 KF 94563 Volvo B10M-60 / Vest V25 12,4m -

The Volvo 7700 Hybrid – Bus of the Future

OnA Customer Magazine The from Volvo Bus Corporation Move #2 2008 Technology for the environment The Volvo 7700 Hybrid – Bus of the future volvobus_ENG_080805.indd 1 08-09-04 13.21.48 finance for the road ahead If you are investing in a Volvo Bus, quality and safety must be important to you. So we are sure you’ll appreciate Volvo’s funding solutions too. Volvo Financial Services and Volvo Bus offer a unique combination of products and services designed for the industry that can be individually tailored to your business needs – making sure you get the best return on your investment. Contact your local Volvo representative for more information. Volvo Bus and Volvo Financial Services - together you’re in safe hands. volvo buses. when productivity counts 2 ON THE MOVE #2 2008 www.vfsco.com volvobus_ENG_080805.indd 2 08-09-04 13.22.00 The city bus of the future is here 4. Volvo 7700 Hybrid The future of the hybrid: As fuel prices rise and ambitious environmental goals Volvo 7700 Hybrid can give are being set all over the world, the world about us is you fuel savings of up to 30 changing rapidly. This is forcing us to develop alternative per cent. powertrains and opportunities for using alternative fuels. Here at Volvo Bus, we are prioritising the development of fuel-efficient powertrains, which is resulting in some of the lowest fuel consumption on the market with our new Euro 4/EEV powertrains. Now we are taking the next major step towards drastically reducing fuel con- sumption by introducing a hybrid bus which we have 8. -

Catálogo De Accesorios Toda La Oferta En Un Clic

CATÁLOGO DE ACCESORIOS TODA LA OFERTA EN UN CLIC LA VOLONTÉVOLUNTAD DE DE RENAULT RENAULT TRUCKS TRUCKS ES ESTESTAR D’ÊTRE SIEMPRE TOUJOURS AL LADO PLUS DE SUSPROCHE CLIENTES Y DEDAR SES RESPUESTA CLIENTS ETA SUS DE SATISFAIRENECESIDADES. ÍNDICE AU MIEUX LEURS BESOINS. SOMMAIRE Con este planteamiento, y con el objetivo de OPTIMIZACIÓN Dansfacilitar cet su esprit día a et día, parce Renault que RenaultTrucks le Trucks propone OPTIMISATIONPAGE 5 souhaiteuna amplia faciliter gama votre de accesorios vie au quotidien, de calidad PAGE X nousque satisfarán vous proposons todas sus ici uneexpectativas. gamme complète SEGURIDAD d’accessoires de qualité qui sauront satisfaire PAGE 25 vosEn unos exigences pocos les clics plus podrá diverses. encontrar el accesorio que mejor se adapte a sus SÉCURITÉ Quenecesidades, ce soit pour tanto améliorer si se trata les de performances mejorar el PAGEVIDA A X BORDO derendimiento votre véhicule, del vehículo protéger como le chauffeur, de proteger PAGE 39 lesal conductor, usagers de los la usuarios route et lesde lamarchandises carretera transportées,o las mercancías privilégier transportadas, le confort o bien PERSONALIZACIÓN dessi desea chauffeurs priorizar à bord, la comodidad rendre votre de los véhicule VIEPAGE À BORD59 plusconductores unique : ovous personalizar trouverez el en vehículo. quelques PAGE X clics l’accessoire qui répond à chacune de vos attentes. ÍNDICE POR VEHÍCULOS PAGE 68 ÍNDICE POR PRODUCTOS PAGEPERSONNALISATION 100 PAGE X APÉNDICES PAGE 104 4 ACCESORIOS RENAULT TRUCKS OPTIMIZACIÓN MEJORA -

Stororder För Volvo Bussar I Norge

Volvo Bussar AB Pressinformation Stororder för Volvo Bussar i Norge Volvo Bussar i Norge har fått sin hittills största enskilda order. Operatören Veolia Transport Sør AS har beställt 173 Volvobussar som skall gå i trafik i Stavangerområdet. Veolia Transport Sør AS vann i våras upphandlingen för all kollektivtrafik i Sør- Rogaland runt Stavanger i södra Norge. Trafiken skiljer sig mellan olika delar av området och Veolia Transport har behov av många olika typer av fordon för att kunna erbjuda den mest effektiva och produktiva trafiken. Volvo Bussar har ett mycket brett utbud av fordonstyper och klarar av att leverera det som Veolia Transport behöver. Beställningen till Sør-Rogaland gäller 173 bussar och det är såväl Volvo 7700, Volvo 8500 som Volvo 8700. De flesta är lågentrébussar på såväl 12 som14,5 meters längd och tvåaxliga 12-meters låggolvsbussar samt ledbussar på 18 meter. Beställningen omfattar också tre dubbeldäckare som byggs på Volvos väl beprövade dubbeldäckarchassi B9TL. Motorerna är dieselmotorer på såväl 7-liter som 9-liter och 12-liter och dessutom Volvo Bussars 9-litersmotor som drivs av naturgas. Minskad miljöpåverkan Ordern har en klar miljöprägel. Tack vare att Volvo valt katalytisk avgasrening, klarar motorerna självklart dagens tuffa avgaskrav enligt Euro 4. Samtidigt innebär teknikvalet att bränsleförbrukningen sänks vilket minskar utsläppen av växthusgasen koldioxid. I ordern ingår dessutom 35 gasbussar med utsläppsnivåer som underskrider Euro 5, krav som inte träder i kraft förrän 2009. I uppgörelsen ingår att Volvos återförsäljare Rieber Thorsen Buss og Last AS tar hand om allt underhåll av bussarna i fem år med en möjlig förlängning av underhållskontraktet med upptill 3,5 år. -

Adblue En.Pdf

BODYWORK FITTING GUIDE 1/400 English edition 07/2007 Recommendation "changing of position of AdBlue components" © RENAULT TRUCKS — 2007 1 / 35 9/13/2007 TABLE OF CONTENTS 1. Changing of position of AdBlue components - 1.1. Introduction ......................................................................................................................... 3/35 - 1.2. Changes to the regulations................................................................................................ 4/35 - 1.3. The RENAULT TRUCKS choice .........................................................................................6/35 - 1.4. General features of the AdBlue circuit..............................................................................9/35 - 1.5. Changing of position of the AdBlue pump .....................................................................16/35 - 1.6. Changing of position of the AdBlue reservoir................................................................21/35 - 1.7. Table of AdBlue pipes....................................................................................................... 25/35 - 1.8. Installation of AdBlue piping bundles.............................................................................28/35 - 1.9. Table of wiring harnesses ................................................................................................ 29/35 © RENAULT TRUCKS — 2007 2 / 35 9/13/2007 1. Changing of position of AdBlue components 1.1. Introduction The aim of this document is to supply all the information and -

CATALOGUE ACCESSOIRES Toute L’Offre En Un Clic

CATALOGUE ACCESSOIRES Toute l’offre en un clic www.renault-trucks.com LA VOLONTÉ DE RENAULT TRUCKS EST D’ÊTRE TOUJOURS PLUS PROCHE DE SES CLIENTS ET DE SATISFAIRE AU MIEUX LEURS BESOINS. SOMMAIRE Dans cet esprit et parce que Renault Trucks OPTIMISATION souhaite faciliter votre vie au quotidien, PAGE X5 nous vous proposons ici une gamme complète d’accessoires de qualité qui sauront satisfaire vos exigences les plus diverses. SÉCURITÉ Que ce soit pour améliorer les performances PAGE X33 de votre véhicule, protéger le chauffeur, les usagers de la route et les marchandises transportées, privilégier le confort des chauffeurs à bord, rendre votre véhicule VIE À BORD plus unique : vous trouverez en quelques PAGE X53 clics l’accessoire qui répond à chacune de vos attentes. PERSONNALISATION PAGE X81 4 RENAULT TRUCKS ACCESSOIRES OPTIMISATION POUR DE MEILLEURES PERFORMANCES RENAULT TRUCKS ACCESSOIRES 5 77 11 211 614 Attelage avec rotule démontable sans outil (doté d’un KITS système antivol) Grâce à sa rotule démontable sans D’ATTELAGE outils, cet attelage devient invisible et permet de préserver l’esthétique de votre véhicule. Poids tractable maximum autorisé 2000 Kg. Conçus pour un usage intensif, 50 01 875 487 Renault Trafic II traitement anticorrosion Kit d’attelage Trafic II par poudrage époxy. Kit d’attelage comprenant : un corps 77 11 427 557 d’attelage, un kit faisceau spécifique Attelage nu 7 broches, un kit de visserie, Peut recevoir indifféremment des un sachet visserie sans chrome 6, crochets standards ou la chape une plaque d’identification rivetée d’attelage. Poids tractable maximum sur le produit, un support prise, un autorisé 2000 kg. -

Catálogo De Accesorios Toda La Oferta En Un Clic

CATÁLOGO DE ACCESORIOS TODA LA OFERTA EN UN CLIC LA VOLONTÉVOLUNTAD DE DE RENAULT RENAULT TRUCKS TRUCKS ES ESTESTAR D’ÊTRE SIEMPRE TOUJOURS AL LADO PLUS DE SUSPROCHE CLIENTES Y DEDAR SES RESPUESTA CLIENTS ETA SUS DE SATISFAIRENECESIDADES. ÍNDICE AU MIEUX LEURS BESOINS. SOMMAIRE Con este planteamiento, y con el objetivo de OPTIMIZACIÓN Dansfacilitar cet su esprit día a et día, parce Renault que RenaultTrucks le Trucks propone OPTIMISATIONPAGE 5 souhaiteuna amplia faciliter gama votre de accesorios vie au quotidien, de calidad PAGE X nousque satisfarán vous proposons todas sus ici uneexpectativas. gamme complète SEGURIDAD d’accessoires de qualité qui sauront satisfaire PAGE 25 vosEn unos exigences pocos les clics plus podrá diverses. encontrar el accesorio que mejor se adapte a sus SÉCURITÉ Quenecesidades, ce soit pour tanto améliorer si se trata les de performances mejorar el PAGEVIDA A X BORDO derendimiento votre véhicule, del vehículo protéger como le chauffeur, de proteger PAGE 39 lesal conductor, usagers de los la usuarios route et lesde lamarchandises carretera transportées,o las mercancías privilégier transportadas, le confort o bien PERSONALIZACIÓN dessi desea chauffeurs priorizar à bord, la comodidad rendre votre de los véhicule VIEPAGE À BORD59 plusconductores unique : ovous personalizar trouverez el en vehículo. quelques PAGE X clics l’accessoire qui répond à chacune de vos attentes. ÍNDICE POR VEHÍCULOS PAGE 68 ÍNDICE POR PRODUCTOS PAGEPERSONNALISATION 100 PAGE X APÉNDICES PAGE 104 4 ACCESORIOS RENAULT TRUCKS OPTIMIZACIÓN MEJORA