05 Top Global Mfg Paper New.Qxp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bio-Johng-Sik-Choi-Mahindra-19-07

Johng-sik Choi President and CEO- Ssangyong Motor Co Johng-sik Choi majored in business management at Seoul National University and earned his Master’s degree from the Graduate School of Public Administration, Seoul National University. He started his career at Hyundai Motors in 1977, serving as Head of Planning Office, Head of Marketing, Vice President & Director of Hyundai Motor Canada, and Executive Director of Hyundai Motor America. He joined Ssangyong Motor in January 2010 as Vice President and Head of Sales & Marketing, and successfully launched a series of face-lifted models and new products such as the Korando and Tivoli which reflected the customer needs and market trend. He plays a key role in helping the company regain market share. In 2013, Ssangyong recorded its highest-ever yearly revenue and exports volumes. Referred to as a global sales master and automotive expert with 40 years of experience in the automotive industry, he is credited with driving growth and presenting a future vision for Ssangyong as a prestigious global automaker. Thank you Connect with us at www.mahindra.com Disclaimer Mahindra & Mahindra herein referred to as M&M, and its subsidiary companies provide a wide array of presentations and reports, with the contributions of various professionals. These presentations and reports are for informational purposes and private circulation only and do not constitute an offer to buy or sell any securities mentioned therein. They do not purport to be a complete description of the markets conditions or developments referred to in the material. While utmost care has been taken in preparing the above, we claim no responsibility for their accuracy. -

Automobile Industry in India 30 Automobile Industry in India

Automobile industry in India 30 Automobile industry in India The Indian Automobile industry is the seventh largest in the world with an annual production of over 2.6 million units in 2009.[1] In 2009, India emerged as Asia's fourth largest exporter of automobiles, behind Japan, South Korea and Thailand.[2] By 2050, the country is expected to top the world in car volumes with approximately 611 million vehicles on the nation's roads.[3] History Following economic liberalization in India in 1991, the Indian A concept vehicle by Tata Motors. automotive industry has demonstrated sustained growth as a result of increased competitiveness and relaxed restrictions. Several Indian automobile manufacturers such as Tata Motors, Maruti Suzuki and Mahindra and Mahindra, expanded their domestic and international operations. India's robust economic growth led to the further expansion of its domestic automobile market which attracted significant India-specific investment by multinational automobile manufacturers.[4] In February 2009, monthly sales of passenger cars in India exceeded 100,000 units.[5] Embryonic automotive industry emerged in India in the 1940s. Following the independence, in 1947, the Government of India and the private sector launched efforts to create an automotive component manufacturing industry to supply to the automobile industry. However, the growth was relatively slow in the 1950s and 1960s due to nationalisation and the license raj which hampered the Indian private sector. After 1970, the automotive industry started to grow, but the growth was mainly driven by tractors, commercial vehicles and scooters. Cars were still a major luxury. Japanese manufacturers entered the Indian market ultimately leading to the establishment of Maruti Udyog. -

Market Evaluation for Resource Efficiency and Re-Use of Secondary Raw Materials in the Automotive Sector

Knowledge Partners: Market Evaluation for Resource Efficiency and Re-use of Secondary Raw Materials in the Automotive Sector Implemented by: On Behalf of: Imprint Published by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH Registered offices: Bonn and Eschborn, Germany B-5/2, Safdarjung Enclave New Delhi 110 029 India T: +91 11 49495353 E: [email protected] I: www.giz.de Responsible Mr. Uwe Becker E: [email protected] Authors GIZ Abhijit Banerjee, Karan Mehrishi, Manjeet Singh Saluja, Rachna Arora, Uwe Becker TERI Jai Kishan Malik, Nitya Nanda, Shilpi Kapur, Souvik Bhattacharjya, Suneel Pandey IFEU Claudia Kamper, Juergen Giegrich, Monika Dittrich VDI Anke Niebaum Research Partner Ernst and Young New Delhi, India August 2015 Disclaimer: All information/data contained herein is obtained from authentic sources believed to be accurate and reliable. This report is based on the data and information gathered by conducting stakeholder consultation, data made available by ACMA and secondary desktop research of information available in public domain. Reasonable skill care and diligence exercised in carrying out analysis and report preparation. This report is not be deemed as any undertaking, warranty or certificate. This report is solely for Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH together with its knowledge partners TERI and IFEU and should not be used, circulated, quoted or otherwise referred to for any other purpose, nor included or referred to in whole or in part in any document without prior written consent. -

(SKD) Production and Sales and Marketing Strategy in the Russian Far East*

The Northeast Asian Economic Review Vol. 2, No. 2, October 2014 39 A Study of Semi Knock Down (SKD) Production and Sales and Marketing Strategy in the Russian Far East* Eiko Tomiyama † Abstract The obective of this study is to reconsider strategies for entering markets in emerging nations by analyzing entry into emerging nations based on Semi Knock own (SK) production and the approach adopted toward local sales and marketing. sing case studies of SK production in ladivostok, ussia undertaken by the automobile manufacturers Ssangong of the K and Toyota and azda of Japan, this study analyzed and examined each company’s mode of entry and sales and marketing strategy. t ascertained that while Ssangong entrusts the whole of its SK production to the local contractor, azda and Toyota of Japan have training staff leaders stationed there permanently to ensure thorough quality control in addition, whereas Ssangong entrusts all of its sales and marketing to the local contractor, azda and Toyota have established whollyowned subsidiaries to carry out local sales and marketing, demonstrating the importance that these companies attach to such activities. Keywords: SKD production, CKD production, outsourced production, sales and marketing, value chain Introduction In February 2013, Toyota Motor Corporation (Toyota) began Semi Knock Down (SKD) production in Vladivostok in Russia’s Far East, at Sollers-Bussan, a joint venture between local automobile manufacturer Sollers and Mitsui & Co., Ltd. SsangYong Motor Company (SsangYong) and Mazda Motor Corporation (Mazda) have also been conducting SKD production at Sollers in Vladivostok since 2009 and 2012, respectively. In SKD production, the parts are first partly assembled into units and components in the home country, before being exported as a kit and assembled into the finished product locally. -

State of Automotive Technology in PR China - 2014

Lanza, G. (Editor) Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Shanghai Lanza, G. (Editor); Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Institute of Production Science (wbk) Karlsruhe Institute of Technology (KIT) Global Advanced Manufacturing Institute (GAMI) Leading Edge Cluster Electric Mobility South-West Contents Foreword 4 Core Findings and Implications 5 1. Initial Situation and Ambition 6 Map of China 2. Current State of the Chinese Automotive Industry 8 2.1 Current State of the Chinese Automotive Market 8 2.2 Differences between Global and Local Players 14 2.3 An Overview of the Current Status of Joint Ventures 24 2.4 Production Methods 32 3. Research Capacities in China 40 4. Development Focus Areas of the Automotive Sector 50 4.1 Comfort and Safety 50 4.1.1 Advanced Driver Assistance Systems 53 4.1.2 Connectivity and Intermodality 57 4.2 Sustainability 60 4.2.1 Development of Alternative Drives 61 4.2.2 Development of New Lightweight Materials 64 5. Geographical Structure 68 5.1 Industrial Cluster 68 5.2 Geographical Development 73 6. Summary 76 List of References 78 List of Figures 93 List of Abbreviations 94 Edition Notice 96 2 3 Foreword Core Findings and Implications . China’s market plays a decisive role in the . A Chinese lean culture is still in the initial future of the automotive industry. China rose to stage; therefore further extensive training and become the largest automobile manufacturer education opportunities are indispensable. -

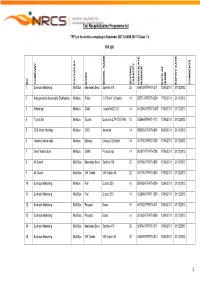

TRP Programme List July Revision 64

- 1 -Last saved by nthitemd - 1 -19 Taxi Recapitalization Programme list TRP List for vehicles complying to September 2007 & SANS 20107 Clause 7.6 TRP 2009 ISSUE DATE EXPIRY COMMENTS NO COMPANY CATEGORY NAME MODEL NAME SEATING CAPACITY CERTIFICATE NUMBER OF DATE 1 Bustruck Marketing Midi Bus Mercedes Benz Sprinter 518 22 556739-TRP07-0311 13/06/2011 31/12/2013 2 Amalgamated Automobile Distributors Minibus Foton 2.2 Petrol 13 Seater 14 550713-TRP07-0309 17/06/2011 31/12/2013 3 Whallinger Minibus CAM Inyathi XGD 2.2i 14 541394-TRPO7-0609 17/06/2011 31/12/2013 4 Toyota SA Minibus Toyota Quantum 2.7P 15S TAXI 15 555664-TRP07-1110 17/06/2011 31/12/2013 5 CCE Motor Holdings Minibus CMC Amandla 14 550826-TRP07-0609 20/06/2011 31/12/2013 6 Nanfeng Automobile Minibus Ekhaya Ekhaya 2.2i Hatch 14 551700-TRP07-0709 17/06/2011 31/12/2013 7 Great Wall motors Minibus GWM Proteus Mpi 14 551517-TRP07-0709 17/06/2011 31/12/2013 8 Mr Coach Midi Bus Mercedes Benz Sprinter 518 22 551798-TRP07-0809 17/06/2011 31/12/2013 9 Mr Coach Midi Bus VW Crafter VW Crafter 50 22 551799-TRP07-0809 17/06/2011 31/12/2013 10 Bustruck Marketing Minibus Fiat Ducato 250 16 551958-TRP07-0809 13/06/2011 31/12/2013 11 Bustruck Marketing Midi Bus Fiat Ducato 250 19 552898-TRP07-1209 13/06/2011 31/12/2013 12 Bustruck Marketing Midi Bus Peugeot Boxer 19 557082-TRP07-0411 13/06/2011 31/12/2013 13 Bustruck Marketing Midi Bus Peugeot Boxer 16 551959-TRP07-0809 13/06/2011 31/12/2013 14 Bustruck Marketing Midi Bus Mercedes Benz Sprinter 416 22 556740-TRP07-0311 13/06/2011 31/12/2013 15 -

China Autos Driving the EV Revolution

Building on principles One-Asia Research | August 21, 2020 China Autos Driving the EV revolution Hyunwoo Jin [email protected] This publication was prepared by Mirae Asset Daewoo Co., Ltd. and/or its non-U.S. affiliates (“Mirae Asset Daewoo”). Information and opinions contained herein have been compiled in good faith from sources deemed to be reliable. However, the information has not been independently verified. Mirae Asset Daewoo makes no guarantee, representation, or warranty, express or implied, as to the fairness, accuracy, or completeness of the information and opinions contained in this document. Mirae Asset Daewoo accepts no responsibility or liability whatsoever for any loss arising from the use of this document or its contents or otherwise arising in connection therewith. Information and opin- ions contained herein are subject to change without notice. This document is for informational purposes only. It is not and should not be construed as an offer or solicitation of an offer to purchase or sell any securities or other financial instruments. This document may not be reproduced, further distributed, or published in whole or in part for any purpose. Please see important disclosures & disclaimers in Appendix 1 at the end of this report. August 21, 2020 China Autos CONTENTS Executive summary 3 I. Investment points 5 1. Geely: Strong in-house brands and rising competitiveness in EVs 5 2. BYD and NIO: EV focus 14 3. GAC: Strategic market positioning (mass EVs + premium imported cars) 26 Other industry issues 30 Global company analysis 31 Geely Automobile (175 HK/Buy) 32 BYD (1211 HK/Buy) 51 NIO (NIO US/Buy) 64 Guangzhou Automobile Group (2238 HK/Trading Buy) 76 Mirae Asset Daewoo Research 2 August 21, 2020 China Autos Executive summary The next decade will bring radical changes to the global automotive market. -

Download Automotive Patent Trends 2019 – Technologies

A U T O M O T I V E P A T E N T T R E N D S 2 0 1 9 Cipher Automotive is the only patent intelligence software that includes a taxonomy of over 200 technologies critical to the future of the car AU T O M O T I V E @ C I P H E R . A I Cipher Automotive Patent Trends 2019 provides a strategic overview of patented technologies in Foreword the sector. Patent intelligence is critical at a time when there is an accelerating shifrom conventional technologies to connectivity, autonomy, shared services and electrification. It is not only the OEMs and their suppliers who are investing billions in automotive R&D, but an entire network of technology companies and a vast swathe of start-ups that are now able to participate at a time when barriers to entry have been lowered. These dynamics are placing increasing pressure on legal, intellectual property and R&D teams alike. We have now reached the point where there are over two million new patents published a year, and it is harder than ever to understand whether the patents you own are the ones that truly serve your business objectives. Advances in AI have made it possible to access information about who owns patented technology. The analysis of technologies and companies in the pages that follow were generated in less than 4 hours - by a machine that does not tire, drink coffee or take holidays. Nigel Swycher, CEO and Steve Harris, CTO This section covers nine technology areas within the automotive industry, identifies the top patent Section 1: owners, shows the growth of patenting, highlights a few important technologies within each area, and includes league tables across the major geographies. -

Asian Auto Newsletter Feb 2001.P65

ASIA IS A BUSINESS IMPERATIVE NOW MORE THAN EVER ASIAN AUTOMOTIVE NEWSLETTER Issue 23, February 2001 A bimonthly newsletter of developments in the auto and auto components markets CONTENTS CHINA/HK INTRODUCTION .............................................. 1 DaimlerChrysler is planning to sign a LOI by CHINA / HONG KONG ................................. 1 February 2001 with First Autoworks (FAW), one INDIA ..................................................................... 2 of Chinas leading state-owned vehicle companies. The INDONESIA ........................................................ 2 two companies aim to set up a 50:50 JV, which will JAPAN ..................................................................... 2 manufacture trucks and buses. The agreement comes KOREA ................................................................... 3 as a disappointment to Volkswagen, which itself is MALAYSIA ............................................................ 4 looking for a Chinese partner in bus and truck THAILAND .......................................................... 4 production, particularly given Volkswagens and FAWs FOCUS: Daewoo components suppliers .......... 5 longstanding partnership in auto manufacturing. (January 23, 2001) Shanghai Automotive Group and General Motors have negotiated to buy 51% and 35% respectively of INTRODUCTION Liuzhou Wuling Automotive Co Ltds B-shares to be issued in 2001. Negotiations between the three Daewoo Motors bankruptcy has adversely impacted companies are scheduled to conclude in March -

China Annex VI

Annex I. Relations Between Foreign and Chinese Automobile Manufacturers Annex II. Brands Produced by the Main Chinese Manufacturers Annex III. SWOT Analysis of Each of the Ten Main Players Annex IV. Overview of the Location of the Production Centers/Offices of the Main Chinese Players Annex V. Overview of the Main Auto Export/Import Ports in China Annex VI. An Atlas of Pollution: The World in Carbon Dioxide Emissions Annex VII. Green Energy Vehicles Annex VIII. Further Analysis in the EV vehicles Annex IX. Shifts Towards E-mobility Annex I. Relations Between Foreign and Chinese Automobile Manufacturers. 100% FIAT 50% Mitsubishi Guangzhou IVECO 50% Beijing Motors 50% Hyundai 50% GAC Guangzhou FIAT GAC VOLVO 91.94% Mitsubishi 50% 50% 50% 50% 50% (AB Group) Guangzhou BBAC 50% Hino Hino Dongfeng DCD Yuan Beiqi 50% 50% NAVECO Invest Dongfeng NAC Yuejin 50% Cumins Wuyang 50% Guangzhou GAC Motor Honda 50% Yuejin Beiqi Foton Toyota 50% Cumins DET 50% 55.6% 10% 20% 50% Beiqi DYK 100% Guangzhou Group Motors 50% 70% Daimler Toyota 30% 25% 50% 65% Yanfeng SDS shanghai 4.25% 100% 49% Engine Honda sunwin bus 65% 25% visteon Holdings Auto 50% (China) UAES NAC Guangzhou 50% Beilu Beijing 34% Denway Automotive 50% Foton 51% 39% motorl Guangzhou 50% Shanghai Beiqi Foton Daimler 100% 30% 50% VW BAIC Honda Kolben 50% 90% Zhonglong 50% Transmission 50% DCVC schmitt Daimler Invest 100% 10% Guangzhou piston 49% DFM 53% Invest Guangzhou Isuzu Bus 100% Denway Beiqi 33.3% Bus GTE GTMC Manafacture xingfu motor 50% 20% SAIC SALES 100% 20% 100% 100% DFMC 100% Shanghai -

The Way of Chery to Achieve the Most Successful Auto

THE WAY OF CHERY TO ACHIEVE THE MOST SUCCESSFUL AUTO BRAND IN CHINA Thesis Yan Tao Degree Programme in International Business International Marketing Management SAVONIA UNIVERSITY OF APPLIED SCIENCES Business and Administration, Varkaus Degree Programme, Bachelor of Business Administration, International Business, International Marketing Management Author Yan Tao Title of Study The Way of Chery to Achieve the Most Successful Auto Brand in China Type of Project Date Pages Thesis 14.12.2010 62+3 Supervisor of Study Executive organization Virpi Oksanen Abstract The automobile market in China is in the state of growth. The development of new energy vehicles and the automobile industry is taking place in the forms of regrouping and restructuring. This offers Chery a great opportunity to develop and promote the brand. As one of the most influential and famous auto brand, Chery Auto has achieved an extraordinary growth rate and has become the pride of Chinese national automobile industry. Nevertheless, there is still certain potential in product quality, service and business culture which develops the brand image further. In consequence, issues regarding to manufacturing, service and business culture are needed to improve and strengthening. However, the brand advantage of Chery Auto is not protruding. Compared with international automotive corporations, Chery Auto is not dominant in brand recognition and brand core value. Furthermore, multi-brand strategy leads to dilution of major brands. There are many sub-brands under Chery; nevertheless, no sub-brand achieves big sales. None of Chery Auto’s four sub-brands, Chery, Rely, Karry or Riich, is dominant in the automobile market. Its position in market is not stable. -

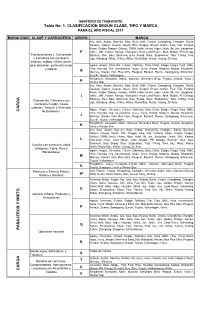

P ASAJ E ROS Y MIX to CA RGA Tabla No. 1. CLASIFICACIÓN

MINISTERIO DE TRANSPORTE Tabla No. 1. CLASIFICACIÓN SEGÚN CLASE, TIPO Y MARCA PARA EL AÑO FISCAL 2011 MODALIDAD CLASE Y CARROCERIA GRUPO MARCA Aro, Asia, Austin, Barreiro, Baw, Bock Wall, Chana, Changfeng, Changhe, Dacia, Daewoo, Datsun, Desoto, Deutz, Dfm, Dragon, Ernest Gruber, Faw, Fiat, Forland, Foton, Golden Dragon, Goleen, GWM, Hafei, Hersa, Higer, Huali, Ifa, Jac, Jiangchan, F Jinbei, JMC, Kaizer, Kamaz, Kiamaster, Kraz, Land Rover, Man, Mudan, PH Omega, Tractocamiónes y Camionetas Ramírez, Reo, Saic, Sinotruck, Sisu, Skoda, Steyr, Studebaker, Tata, T-King, Tmd, y Camiónes con carrocería Uaz, Wartburg, White, Willco, Willys, World Star, Xinkai, Yutong, ZX Auto estacas, estibas, niñera, panel, picó, planchón, portacontenedor Agrale, Ample, Chevrolet, Citroen, Daihatsu, Dina, Delta, Dodge, Fargo, Ford, GMC, y reparto. Hino, Hyundai, Kia, International, Isuzu, Iveco, Honda, Magirus, Mazda, Mitsubishi, G Mercury, Nissan, Non Plus Ultra, Peugeot, Renault, Renno, Ssangyong, Schacman, Suzuki, Toyota, Volkswagen Freigthliner, Kenworth, Mack, Marmon, Mercedes Benz, Pegaso, Scania, Volvo y H Wester Star Aro, Asia, Austin, Barreiro, Baw, Bock Wall, Chana, Changfeng, Changhe, Dacia, Daewoo, Datsun, Desoto, Deutz, Dfm, Dragon, Ernest Gruber, Faw, Fiat, Forland, Foton, Golden Dragon, Goleen, GWM, Hafei, Hersa, Higer, Huali, Ifa, Jac, Jiangchan, I Jinbei, JMC, Kaizer, Kamaz, Kiamaster, Kraz, Land Rover, Man, Mudan, PH Omega, Camionetas, Camiónes con Ramírez, Reo, Saic, Sinotruck, Sisu, Skoda, Steyr, Studebaker, Tata, T-King, Tmd, Uaz, Wartburg,