Compilación De Disposiciones Aplicables Al MUNICIPIO DE MEDELLÍN N.D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Competing in the Global Truck Industry Emerging Markets Spotlight

KPMG INTERNATIONAL Competing in the Global Truck Industry Emerging Markets Spotlight Challenges and future winning strategies September 2011 kpmg.com ii | Competing in the Global Truck Industry – Emerging Markets Spotlight Acknowledgements We would like to express our special thanks to the Institut für Automobilwirtschaft (Institute for Automotive Research) under the lead of Prof. Dr. Willi Diez for its longstanding cooperation and valuable contribution to this study. Prof. Dr. Willi Diez Director Institut für Automobilwirtschaft (IfA) [Institute for Automotive Research] [email protected] www.ifa-info.de We would also like to thank deeply the following senior executives who participated in in-depth interviews to provide further insight: (Listed alphabetically by organization name) Shen Yang Senior Director of Strategy and Development Beiqi Foton Motor Co., Ltd. (China) Andreas Renschler Member of the Board and Head of Daimler Trucks Division Daimler AG (Germany) Ashot Aroutunyan Director of Marketing and Advertising KAMAZ OAO (Russia) Prof. Dr.-Ing. Heinz Junker Chairman of the Management Board MAHLE Group (Germany) Dee Kapur President of the Truck Group Navistar International Corporation (USA) Jack Allen President of the North American Truck Group Navistar International Corporation (USA) George Kapitelli Vice President SAIC GM Wuling Automobile Co., Ltd. (SGMW) (China) Ravi Pisharody President (Commercial Vehicle Business Unit) Tata Motors Ltd. (India) © 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved. Competing in the Global Truck Industry – Emerging Markets Spotlight | iii Editorial Commercial vehicle sales are spurred by far exceeded the most optimistic on by economic growth going in hand expectations – how can we foresee the with the rising demand for the transport potentials and importance of issues of goods. -

Groupe Renault Sets Its New Strategy for China

PRESS RELEASE Groupe Renault sets its new Strategy for China • Groupe Renault will focus in China on light commercial vehicles (LCV) and electric vehicles (EV). • Groupe Renault will transfer its shares in Dongfeng Renault Automotive Company Ltd (DRAC) to Dongfeng Motor Corporation. DRAC will stop its Renault brand-related activities. • LCV business is operated through Renault Brilliance Jinbei Automotive Co., Ltd. (RBJAC), leveraging Jinbei legacy with Renault know-how. • EV business will be developed through the two existing joint ventures: eGT New Energy Automotive Co., Ltd (eGT) and Jiangxi Jiangling Group Electric Vehicle Co. Ltd (JMEV). Boulogne-Billancourt, April 14th, 2020 - Groupe Renault unveiled today its new strategy for the Chinese Market, building on two of its key pillars: Electric Vehicles (EV) and Light Commercial Vehicles (LCV). Within this new strategy, Groupe Renault activities in China will be driven as follow: About Chinese ICE Passenger Car Market Regarding ICE passenger car, Groupe Renault has entered into a preliminary agreement with Dongfeng Motor Corporation under which Renault transfers its shares to Dongfeng. DRAC will stop its Renault brand-related activities. Renault will continue to provide high quality aftersales service for its 300,000 customers through Renault dealers but also through Alliance synergies. Further development for Renault brand passenger cars will be detailed later within future new mid-term-plan Renault. Furthermore, Renault and Dongfeng will continue to cooperate with Nissan on new generation engines like components supply to DRAC and diesel license to Dongfeng Automobile Co., Ltd. Renault and Dongfeng will also engage in innovative cooperation in the field of intelligent connected vehicles. -

Analysis of the Dynamic Relationship Between the Emergence Of

Annals of Business Administrative Science 8 (2009) 21–42 Online ISSN 1347-4456 Print ISSN 1347-4464 Available at www.gbrc.jp ©2009 Global Business Research Center Analysis of the Dynamic Relationship between the Emergence of Independent Chinese Automobile Manufacturers and International Technology Transfer in China’s Auto Industry Zejian LI Manufacturing Management Research Center Faculty of Economics, the University of Tokyo E-mail: [email protected] Abstract: This paper examines the relationship between the emergence of independent Chinese automobile manufacturers (ICAMs) and International Technology Transfer. Many scholars indicate that the use of outside supplies is the sole reason for the high-speed growth of ICAMs. However, it is necessary to outline the reasons and factors that might contribute to the process at the company-level. This paper is based on the organizational view. It examines and clarifies the internal dynamics of the ICAMs from a historical perspective. The paper explores the role that international technology transfer has played in the emergence of ICAMs. In conclusion, it is clear that due to direct or indirect spillover from joint ventures, ICAMs were able to autonomously construct the necessary core competitive abilities. Keywords: marketing, international business, multinational corporations (MNCs), technology transfer, Chinese automobile industry but progressive emergence of independent Chinese 1. Introduction automobile manufacturers (ICAMs). It will also The purpose of this study is to investigate -

Chapter 2 China's Cars and Parts

Chapter 2 China’s cars and parts: development of an industry and strategic focus on Europe Peter Pawlicki and Siqi Luo 1. Introduction Initially, Chinese investments – across all industries in Europe – especially acquisitions of European companies were discussed in a relatively negative way. Politicians, trade unionists and workers, as well as industry representatives feared the sell-off and the subsequent rapid drainage of industrial capabilities – both manufacturing and R&D expertise – and with this a loss of jobs. However, with time, coverage of Chinese investments has changed due to good experiences with the new investors, as well as the sheer number of investments. Europe saw the first major wave of Chinese investments right after the financial crisis in 2008–2009 driven by the low share prices of European companies and general economic decline. However, Chinese investments worldwide as well as in Europe have not declined since, but have been growing and their strategic character strengthening. Chinese investors acquiring European companies are neither new nor exceptional anymore and acquired companies have already gained some experience with Chinese investors. The European automotive industry remains one of the most important investment targets for Chinese companies. As in Europe the automotive industry in China is one of the major pillars of its industry and its recent industrial upgrading dynamics. Many of China’s central industrial policy strategies – Sino-foreign joint ventures and trading market for technologies – have been established with the aim of developing an indigenous car industry with Chinese car OEMs. These instruments have also been transferred to other industries, such as telecommunications equipment. -

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto “The mountains are high and the emperor is far away.” (Chinese Proverb)1 Title: The Rise of China's Auto Industry: Automobility with Chinese Characteristics Curriculum Project: The project is part of an interdisciplinary course taught in the Political Science Department entitled: The Machine that Changed the World: Automobility in an Age of Scarcity. This course looks at the effects of mass motorization in the United States and compares it with other countries. I am teaching the course this fall; my syllabus contains a section on Chinese Innovations and other global issues. This project will be used to expand this section. Grade Level: Undergraduate students in any major. This course is part of Towson University’s new Core Curriculum approved in 2011. My focus in this course is getting students to consider how automobiles foster the development of a built environment that comes to affect all aspects of life whether in the U.S., China or any country with a car culture. How much of our life is influenced by the automobile? We are what we drive! Objectives and Student Outcomes: My objective in teaching this interdisciplinary course is to provide students with an understanding of how the invention of the automobile in the 1890’s has come to dominate the world in which we live. Today an increasing number of individuals, across the globe, depend on the automobile for many activities. Although the United States was the first country to embrace mass motorization (there are more cars per 1000 inhabitants in the United States than in any other country in the world), other countries are catching up. -

Sustainability Report Bmw Brilliance Automotive Ltd. Contents

2015 SUSTAINABILITY REPORT BMW BRILLIANCE AUTOMOTIVE LTD. CONTENTS CONTENTS INTRODUCTION SUSTAINABILITY MANAGEMENT PRODUCT RESPONSIBILITY Preface 3 1.1 Our management approach 10 2.1 Our management approach 39 Our point of view 4 1.2 Stakeholder engagement 16 2.2 Efficient mobility 44 Highlights 2015 5 1.3 Compliance, anti-corruption and 18 2.3 Product safety 48 An overview of BMW Brilliance 6 human rights 2.4 Customer satisfaction 51 ENVIRONMENTAL PROTECTION SUPPLIER MANAGEMENT EMPLOYEES 3.1 Our management approach 57 4.1 Our management approach 72 5.1 Our management approach 87 3.2 Energy consumption and emissions 59 4.2 Minimising supplier risk 77 5.2 Attractive employer 90 3.3 Waste reduction 63 4.3 Utilising supplier opportunities 83 5.3 Occupational health and safety 96 3.4 Water 68 5.4 Training and development 99 CORPORATE CITIZENSHIP APPENDIX 6.1 Our management approach 107 7.1 About this report 120 6.2 Corporate citizenship 112 7.2 UN Global Compact index 121 7.3 GRI G4 content index 125 2 PREFACE Next, a further step in developing China’s very own new energy vehicle brand. In the future, we will expand our offering of locally developed, produced and environmentally friendly premium vehicles for our Chinese customers. Digitalisation is an important driver for sustainability. We are developing new solutions for intelligent mobility AT BMW BRILLIANCE, WE SEE SUSTAINABILITY AS products and services. At the same time, we are increasing the quality of our products, as well as the speed A KEY TO OUR CONTINUOUS SUCCESS IN CHINA. -

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

Incentives to Invest in New Technology: the Effect of Fuel Economy Standards on China’S Automakers

Incentives to Invest in New Technology: The Effect of Fuel Economy Standards on China’s Automakers Sabrina T. Howell⇤ May 5, 2015 Abstract Technology absorption is critical to emerging market growth. To study this process I exploit fuel economy standards, which compel automakers to either acquire fuel ef- ficiency technology or reduce vehicle quality. With novel, unique data on the Chinese auto market between 1999 and 2012, I evaluate the effect of China’s 2009 fuel economy standards on firms’ vehicle characteristic choices. Through differences-in-differences and triple differences designs, I show that Chinese firms responded to the new policy by manufacturing less powerful, cheaper, and lighter vehicles. Foreign firms manufac- turing for the Chinese market, conversely, continued on their prior path. For example, domestic firms reduced model torque and price by 12% and 13% of their respective means relative to foreign firms. Private Chinese firms outperformed state-owned firms and were less affected by the standards, but Chinese firms in joint ventures with for- eign firms suffered the largest negative effect regardless of ownership. My evidence suggests that fuel economy standards and joint venture mandates - both intended to increase technology transfer - have instead retarded Chinese firms’ advancement up the automotive manufacturing quality ladder. (Click Here for Latest Version and Appendices) JEL classifications: G3, O2, O3, P2, P3, Q4, Q5, L5, L9 ⇤Harvard University. I wish to thank Anthony Saich, Henry Lee, Wang Qing, Lu Mai, Lilei Xu, Ariel Pakes, and Martin Rotemberg. I am grateful to the China State Council Development Research Center for its support and data access. -

State of Automotive Technology in PR China - 2014

Lanza, G. (Editor) Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Shanghai Lanza, G. (Editor); Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Institute of Production Science (wbk) Karlsruhe Institute of Technology (KIT) Global Advanced Manufacturing Institute (GAMI) Leading Edge Cluster Electric Mobility South-West Contents Foreword 4 Core Findings and Implications 5 1. Initial Situation and Ambition 6 Map of China 2. Current State of the Chinese Automotive Industry 8 2.1 Current State of the Chinese Automotive Market 8 2.2 Differences between Global and Local Players 14 2.3 An Overview of the Current Status of Joint Ventures 24 2.4 Production Methods 32 3. Research Capacities in China 40 4. Development Focus Areas of the Automotive Sector 50 4.1 Comfort and Safety 50 4.1.1 Advanced Driver Assistance Systems 53 4.1.2 Connectivity and Intermodality 57 4.2 Sustainability 60 4.2.1 Development of Alternative Drives 61 4.2.2 Development of New Lightweight Materials 64 5. Geographical Structure 68 5.1 Industrial Cluster 68 5.2 Geographical Development 73 6. Summary 76 List of References 78 List of Figures 93 List of Abbreviations 94 Edition Notice 96 2 3 Foreword Core Findings and Implications . China’s market plays a decisive role in the . A Chinese lean culture is still in the initial future of the automotive industry. China rose to stage; therefore further extensive training and become the largest automobile manufacturer education opportunities are indispensable. -

China Economic Update by NAB Group Economics 11 August 2015

China Economic Update by NAB Group Economics 11 August 2015 China’s auto industry may be reaching its Manufacturers (CAAM), the market share of domestic branded vehicles was around 41.5% over the first half of domestic limit, but is not yet ready to take 2015. The largest sales over this period were recorded by on the world Volkswagen, Hyundai-KIA and General Motors, while China’s motor vehicle industry has experienced spectacular China’s largest sellers among domestic brands were SAIC growth over the last decade – reflecting in part a broader and Chang’an (ranked fourth and fifth respectively in the evolution in China’s industrial sector over this period. At a first half of 2015). national level, China is no longer the global factory for low Foreign branded vehicles dominated China’s motor value added, labour intensive manufacturing – having lost vehicle sales in the first half of 2015 competitiveness to a range of emerging economies in Asia Rank Brand Domestic Sales – while production of more complicated, higher value partner(s) (‘000) goods (such as motor vehicles) has expanded. That said, China’s auto manufacturing industry is still in its infancy, 1 Volkswagen SAIC, FAW 1742.9 2 Hyundai-KIA BAIC, Dongfeng 813.4 with producers still some way from having a foothold in 3 General Motors SAIC 789.1 global markets. 4 SAIC 588.0 China’s rise to become a major motor vehicle 5 Chang'an 522.4 manufacturer is a recent phenomenon 6 Toyota FAW, GAC 463.7 7 Nissan Dongfeng 457.8 Although motor vehicle manufacturing has a reasonably 8 Ford Chang'an 429.7 long history in China – there was some limited production 9 Honda Dongfeng, GAC 420.6 in the 1950s and China’s production had overtaken 10 PSA Peugeot Citroën Dongfeng, 368.5 Australia’s by the mid 1980s – China’s emergence as a Chang'an major motor vehicle producer has been a far more recent Source: CAAM, CEIC, NAB Economics phenomenon. -

TRP Programme List July Revision 64

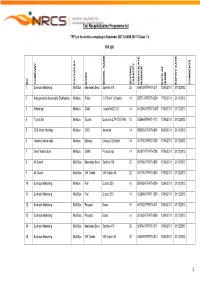

- 1 -Last saved by nthitemd - 1 -19 Taxi Recapitalization Programme list TRP List for vehicles complying to September 2007 & SANS 20107 Clause 7.6 TRP 2009 ISSUE DATE EXPIRY COMMENTS NO COMPANY CATEGORY NAME MODEL NAME SEATING CAPACITY CERTIFICATE NUMBER OF DATE 1 Bustruck Marketing Midi Bus Mercedes Benz Sprinter 518 22 556739-TRP07-0311 13/06/2011 31/12/2013 2 Amalgamated Automobile Distributors Minibus Foton 2.2 Petrol 13 Seater 14 550713-TRP07-0309 17/06/2011 31/12/2013 3 Whallinger Minibus CAM Inyathi XGD 2.2i 14 541394-TRPO7-0609 17/06/2011 31/12/2013 4 Toyota SA Minibus Toyota Quantum 2.7P 15S TAXI 15 555664-TRP07-1110 17/06/2011 31/12/2013 5 CCE Motor Holdings Minibus CMC Amandla 14 550826-TRP07-0609 20/06/2011 31/12/2013 6 Nanfeng Automobile Minibus Ekhaya Ekhaya 2.2i Hatch 14 551700-TRP07-0709 17/06/2011 31/12/2013 7 Great Wall motors Minibus GWM Proteus Mpi 14 551517-TRP07-0709 17/06/2011 31/12/2013 8 Mr Coach Midi Bus Mercedes Benz Sprinter 518 22 551798-TRP07-0809 17/06/2011 31/12/2013 9 Mr Coach Midi Bus VW Crafter VW Crafter 50 22 551799-TRP07-0809 17/06/2011 31/12/2013 10 Bustruck Marketing Minibus Fiat Ducato 250 16 551958-TRP07-0809 13/06/2011 31/12/2013 11 Bustruck Marketing Midi Bus Fiat Ducato 250 19 552898-TRP07-1209 13/06/2011 31/12/2013 12 Bustruck Marketing Midi Bus Peugeot Boxer 19 557082-TRP07-0411 13/06/2011 31/12/2013 13 Bustruck Marketing Midi Bus Peugeot Boxer 16 551959-TRP07-0809 13/06/2011 31/12/2013 14 Bustruck Marketing Midi Bus Mercedes Benz Sprinter 416 22 556740-TRP07-0311 13/06/2011 31/12/2013 15 -

2011 Interim Results Announcement

長城汽車股份有限公司 Great Wall Motor Company Limited * 2011 Interim Results Announcement * for identification purpose only 22 August 2011 Improving little by little every day Disclaimer This presentation is prepared by Great Wall Motor Company Limited (the “Company”) and is solely for the purpose of corporate communication and general reference only. The presentation is not intended as an offer to sell, or to solicit an offer to buy or form any basis of investment decision for any class of securities of the Company in any jurisdiction. All such information should not be used or relied on without professional advice. The presentation is a brief summary in nature and do not purport to be a complete description of the Company, its business, its current or historical operating results or its future prospects. This presentation is provided without any warranty or representation of any kind, either expressed or implied. The Company specifically disclaims all responsibilities in respect of any use or reliance of any information, whether financial or otherwise, contained in this presentation. 2 Improving little by little every day Agenda 1 Performance Highlights 2 Financial Review 3 Business Review 4 Future Prospects 3 Improving little by little every day Performance Highlights Sales volume for 1H 2011 reached 218,288 units, representing a 47.3% YoY growth Revenue for 1 H 2011 amounted to RMB13,670 million, representing a 49.8% YoY growth 1 H 2011 profit attributable to owners of the Company reached RMB1,812 million , representing a 109% YoY growth