Keyinvest Return Monitor Systematically Selected UBS Barrier Reverse Convertibles

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

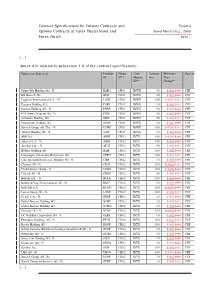

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Dividend and Compensation Payments in Light of Covid-19 Pandemic

DIVIDEND AND COMPENSATION PAYMENTS IN LIGHT OF COVID-19 PANDEMIC Information as of 18 November 2020 Annual General Meeting 2019 dividend Company Index Short-time work Board compensation Executive compensation (2020) (paid 2020) ABB SMI unchanged (26.03.2020) unchanged CHF 0.80 - 10% reduction of board compensation for the duration of the 10% reduction of salary for the duration of the crisis crisis Adecco SMI unchanged (16.04.2020) unchanged CHF 2.50 yes - - Aevis Other unchanged (30.04.2020) cancelled - - - Alcon SMI unchanged (06.05.2020) postponed to 2021 - - - Also Other unchanged (24.03.2020) unchanged CHF 3.25 - - - ams SMIM unchanged (03.06.2020) - - - - APG/SGA Other unchanged (14.05.2020) cancelled (from CHF 11.00) yes - 20% reduction of base salary Aryzta Other postponed to 15.12.2020 postponed yes 30% reduction of fees for 3 months 30% reduction salary reduction for 3 months (15% for wider leadership team) Autoneum Other unchanged (25.03.2020) cancelled yes - 10% reduction of base salary Baloise SMIM unchanged (24.04.2020) unchanged CHF 6.40 - - - Barry Callebaut SMIM unchanged (09.12.2020) - - - - BB Biotech SMIM unchanged (19.03.2020) unchanged CHF 3.40 - - - Bobst Other unchanged (07.04.2020) unchanged CHF 1.50 - - - Bossard Other unchanged (08.04.2020) reduced by 50% to CHF 2.00 4% reduction of compensation 4% salary reduction Bucher Industries SMIM unchanged (24.04.2020) unchanged CHF 8.00 yes (mainly FR and IT) - - BVZ Other unchanged (16.04.2020) reduced to CHF 7.50 - - - Calida Group Other brought forward to cancelled -

Results Zrating Study 2019 on Corporate Governance

Zurich, 12 September 2019 Media release Results zRating Study 2019 on Corporate Governance Zürich, 12 September 2019 – Sunrise once again scores highest in this year’s corporate governance ranking followed by Swisscom (81 points) and Lonza (78 points). Due to amendments to the Articles of Association, also induced by activist shareholders, and changes in practices, companies have improved their corporate governance. For the eleventh time since 2009, the zRating Study on corporate governance in Swiss public companies has been published. zRating summarizes the situation regarding shareholders' rights in a company and draws attention to possible conflicts between shareholders and managers. zRating evaluates corporate governance holistically based on 62 criteria from the categories «Shareholders and Capital Structure», «Shareholders' Rights», «Composition Board of Directors/Management and Information Policy», and «Compensation and participation models». The criteria are weighted in a scoring model and evaluated with points. The total maximum of points is 100. 174 listed Swiss companies are analyzed based on Annual Reports 2018 and decisions at General Meetings 2019. Further improvements through amendments to the Articles of Association Once again Sunrise takes first place with 86 points. They had already gained a large lead thanks to amendments to the Articles of Association at the annual general meetings (AGM) in 2017 and 2018, and in 2019 Sunrise was also able to score in the new criteria. Second place went to Swisscom with 81 points and third place to Lonza with 78 points. This year, the boards of directors of Mobilezone, Peach Property and Starrag in particular proposed amendments to the Articles of Association that strengthened shareholders' participation rights. -

Voting Report 2020

Exercising of Shareholder Rights – Information December 2020 As a result of the adoption of the “Popular Initiative against Fat-Cat Salaries” in 2014, pension funds have an obligation to exercise shareholder rights in the interests of the insured persons and to disclose how the pension funds voted. This regulation applies for public limited companies with registered office in Switzerland and whose shares are listed on a domestic or foreign stock exchange. The Foundation Board of the PensFlex Collective Foundation has incorporated the corresponding regulations into the Art. 3.5 of the Organisational Rules or Art. 4 of the Rules on Investment. A list of the voting record of the PensFlex Collective Foundation in the year 2020 is shown below. Voting Report for PensFlex Sammelstiftung Kauffmannweg 16 6003 Luzern This report summarizes voting behaviour according to the following specifications: Time period: 01.01.2020 - 31.12.2020 Agenda items: Summary of all items on the agenda, i.e. not only the items requiring a vote according to Art. 22 para. 1 ORAb. The voting rights were exercised for the following companies: Perrot Duval 06.02.2020 Kardex 14.04.2020 Novartis 28.02.2020 Tornos 15.04.2020 Dätwyler 11.03.2020 Georg Fischer 15.04.2020 Roche 17.03.2020 Sulzer 15.04.2020 BB Biotech 19.03.2020 Evolva 15.04.2020 Schindler 19.03.2020 Mikron 15.04.2020 Swiss Prime Site 24.03.2020 Ascom 15.04.2020 Implenia 24.03.2020 Kudelski 15.04.2020 Bellevue 24.03.2020 Adecco 16.04.2020 SGS 24.03.2020 Rieter 16.04.2020 ALSO 24.03.2020 Cembra Money Bank 16.04.2020 -

Switzerland Fund A-Chf 31 August 2021

MPR.en.xx.20210831.LU0054754816.pdf For Investment Professionals Only FIDELITY FUNDS MONTHLY PERFORMANCE REVIEW SWITZERLAND FUND A-CHF 31 AUGUST 2021 Portfolio manager: Andrea Fornoni, Alberto Chiandetti Performance over month in CHF (%) Performance for 12 month periods in CHF (%) Fund 1.5 Market index 2.3 MSCI Switzerland Index (Net) Market index is for comparative purposes only. Source of fund performance is Fidelity. Basis: nav-nav with income reinvested, in CHF, net of fees. Other share classes may be available. Please refer to the prospectus for more details. Fund Index Market Environment European equity markets continued to rise in August, driven by strong quarterly earnings and optimism over an economic recovery, supported by high rates of vaccination. At the annual Jackson Hole Symposium, US Federal Reserve Chair Jerome Powell indicated that the central bank is in no rush to tighten its monetary policy. However, gains were capped as data showed that inflation surged to a 10-year high in August, and that further rises were likely, challenging the European Central Bank's (ECB) benign view on price growth. Consumer prices saw an increase of 3% this month (2.2% in July), well above the ECB’s target of 2%, fuelled by rising costs of energy, food and industrial goods. However, the ECB argues that the majority of the inflation increase can be attributed to supply chain constraints and should ease by early next year. There were increased uncertainties surrounding the ECB’s next steps regarding the future of its asset purchase programme, as differences over when to relax stimulus measures grew within the governing council. -

Consumer Products M&A Insights Summer 2014

Consumer Products M&A Insights Summer 2014 To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Contents Foreword 1 Economic outlook – UK 2 Corporate risk appetite 6 Consumer Products M&A Market trend analysis 14 M&A market – By sector 22 Global M&A drivers 32 Deloitte view 34 Our Consumer Business M&A specialists 35 To start a new section, hold down the apple+shift keys and click to release this object and type the section title in the box below. Foreword Welcome to our new Consumer Products M&A Insights However, as has been highlighted previously in our reviews review, that looks to capture both the latest macro- of completed deal activity in the sector, completed deals economic and Consumer Products M&A trends, alongside tend to lag general economic activity – given that deal our perspectives of the M&A environment and the key processes tend to take anywhere between six to nine months factors driving deals within the sector. to complete. In addition, from our analysis, there can be delays of anything up to six months before such deals are Last Summer, in our Consumer Products M&A survey registered, effectively suppressing deal activity in the most (“The return of the feel good factor?”), there were clear recent quarters. So it is only in the next few quarters that we signs that consumer confidence was on the up and that will really see the extent to which the economic upturn in there had been a strong shift in the sentiment of business much of Europe has translated into deals. -

AMC on JB Technical Swiss Equity Portfolio

AMC on JB Technical Swiss Equity Portfolio ISIN: CH0350849797 NAV: 113.60 Currency: CHF Last Rebal.: 03.02.2021 Valor: 35084979 NAV Date: 08.02.2021 Dividend: Reinvested Issuer: Bank Julius Baer CertiMcates: 260’179 gmFt pee: 1.10% Issue Date: 30.10.2017 Aug: CHF 29’478’281 CoFPonents: 20 froduct stratemy The Underlying is a basket representing an actively-managed notional portfolio consisting of concentrated individual equities using the input of JB Technical Research. The notional portfolio includes up to 25 securities which represents JB Technical Research strongest conviction ideas based on their investment process. The notional portfolio is the result of a top-down analysis irrespective of the current in-house macro scenario and sector allocation using purely Technical Analysis. fer1orFance frice C5art 067.hh.w6h8 Y 6).6w.w6wh h Font5 0.26% 2w kee3 5im5 113.60 110 - Font5s 4.12% 2w kee3 lok 78.55 100 h year 4.41% AllYtiFe 5im5 113.60 90 Since 13.60% AllYtiFe lok 78.55 80 incePtion TxD 2.43% ga( drak -29.42% 6 Nov 2 Jul 25 Feb 21 Oct 15 Jun 8 Feb dokn gont5ly Returns fer1orFance Annual 2015 20% 2016 1.60 0.89 2017 2017 2.50 10% 2018 -15.61 2.44 -2.48 -4.00 1.53 1.80 1.48 1.55 0.76 -1.23 -8.35 -3.25 -6.39 2018 2019 23.24 4.91 3.69 1.01 6.58 -5.48 3.50 1.51 -3.18 2.26 2.31 4.02 0.57 2019 0% 2020 4.03 -0.56 -8.11 -10.88 2.30 5.91 2.18 4.47 3.29 2.31 -4.43 8.28 1.00 2020 2021 2.43 -10% -1.35 3.84 2021 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2017 2018 2019 2020 2021 Report as of 9.2.2021 © Julius Baer Group, 2021 1/4 froduct CoFPosition by Asset Class froduct CoFPosition by Country CH - 90.14% Stocks - 95.13% AT - 4.99% Equity - 4.73% North Am.. -

Unterschleißheim, 27

Program BAADER HELVEA SWISS EQUITIES CONFERENCE 10 – 11 January 2019 Grand Resort Bad Ragaz, Switzerland CONTACTS @ BAADER HELVEA Lukas Burkart, Head of Equity Sales T +49 89 5150 1858, [email protected] Andreas von Arx, Head of Equity Research Switzerland T +41 43 388 9257, [email protected] Reto Amstalden, Equity Research T +41 43 388 9261, [email protected] www.baaderbank.com Enable Change in Banking. Baader Helvea Swiss Equities Conference 10 – 11 January 2019 PRESENTING COMPANIES 67 companies have agreed to participate in the Swiss Equities Conference 2019: Bloomberg Reuters Company name ticker ticker Sector Addex Therapeutics ADXN SE ADXN.S Pharma & Healthcare Adecco Group ADEN SE ADEN.S Business Services & Logistics ARBONIA ARBN SE ARBNO.S Construction Ascom ASCN SE ASCN.S Technology Baloise BALN SE BALN.S Banks & Insurance Basilea (one-on-one only) BSLN SE BSLN.S Pharma & Healthcare BB Biotech (one-on-one only) BION SW BION.S Pharma & Healthcare BKW AG BKW SE BKWB.S Utilities Bossard BOSN SE BOS.S Industrials Bucher Industries BUCN SE BUCN.S Industrials Cembra Money Bank CMBN SE CMBN.S Banks & Insurance Clariant CLN SE CLN.S Chemicals COLTENE CLTN SE CLTN.S Pharma & Healthcare Compagnie Financière Tradition (one-on-one only) CFT SE CFT.S Banks & Insurance Conzzeta CON SE CONC.S Industrials Dätwyler Holding Inc. DAE SE DAE.S Technology dormakaba DOKA SE DOKA.S Industrials Dufry DUFN SE DUFN.S Consumer & Retail EFG International EFGN SE EFGN.S Banks & Insurance Evolva (one-on-one only) EVE SE EVE.S Chemicals Galenica -

Mergers & Acquisitions Quarterly Switzerland

Mergers & Acquisitions Quarterly Switzerland First quarter 2014 April 2014 edition DRAFT Contents 1. Introduction 2 2. Swiss M&A market Q1 2014 and outlook 2014 3 3. Private equity statistics: Germany, Switzerland and Austria 6 4. Industry overview ► Chemicals, Construction and Materials 7 ► Energy and Utilities 9 ► Financial Services 11 ► Healthcare 13 ► Industrial Goods and Services 15 ► Media, Technology and Telecommunications 17 ► Retail and Consumer Products 19 5. Deal of the quarter 21 6. Event calender 22 7. EY selection of M&A opportunities 23 8. Your EY M&A team in Switzerland 24 9. Subscription/Registration form 25 All rights reserved — EY 2014 Mergers & Acquisitions Quarterly Switzerland – Q1 2014 1 DRAFT Introduction Dear Reader We are pleased to present the latest edition of our M&A Quarterly Switzerland. This brochure provides a general overview of the Swiss M&A and European private equity market activity in the first quarter of 2014, as well as an outlook for the remainder of 2014. Following a year of subdued performance, the Swiss M&A market got off to a remarkable start in the first three months of 2014, with a significant increase in deal volume despite a decrease in the number of deals. Looking forward, large transactions are expected more often in the Swiss M&A market as executives’ risk appetite for strategic and transformational deals has increased. The favorable financing conditions prevailing at present will help drive this trend, although continuing economic and geopolitical risks in some areas could disrupt the bright outlook. Our next edition of Mergers & Acquisitions Quarterly Switzerland will be available in July 2014. -

Mergers & Acquisitions Quarterly Switzerland

Mergers & Acquisitions Quarterly Switzerland Second Quarter 2013 July 2013 edition Contents 1. Introduction 2 2. Swiss M&A market Q2 2013 and outlook 2013 3 3. Private equity statistics: Germany,Switzerland and Austria 6 4. Industry overview ► Chemicals, Construction and Materials 7 ► Energy, Transportation and Utilities 9 ► Financial Services 11 ► Healthcare 13 ► Industrial Goods and Services 15 ► Media, Technology and Telecommunications 17 ► Retail and Consumer Products 19 5. Deal of the quarter 21 6. EY M&A credentials 22 7. EY selectionof M&A opportunities 23 8. EY M&A contacts in Switzerland 24 9. Event calendar 25 10. Subscription / Registration form 26 All rights reserved —EY 2013 Mergers & Acquisitions Quarterly Switzerland –Q2 2013 1 Introduction Dear reader, we are pleased to provide you with the latest edition of our M&A Quarterly Switzerland. This booklet gives you a general overview of the Swiss M&A and European Private Equity market activity in the second quarter of 2013, as well as an outlook for the remainder of 2013. The Swiss M&A market was characterized by a record low disclosed deal value since 2008 and a corresponding low average deal size in the second quarter of 2013. Nevertheless, with respect to the number of announced transactions, a recovery was observed with slightly more transactions in Q2 2013, compared to the previous quarter. Looking forward, stronger economic fundamentals in connection with the availability of more acquisition opportunities and significant cash reserves might influence the M&A market positively for the remainder of 2013. However, with uncertainty remaining high due to the persisting Euro crisis, M&A activity might still remain subdued.