Results Zrating Study 2019 on Corporate Governance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2 CONTENTS #TogetherStrong Highlights 3 #TogetherStrong is a tag-name that covers #TogetherStrong aptly describes how we countless initiatives we took to address progressed through and emerged from this Letter to shareholders 7 pressing needs in the dental community extraordinary year. Management commentary 11 in 2020. Straumann Group in brief 12 Strategy in action 17 #TogetherStrong is forward-looking; it Products, solutions and services 21 It started with a website offering scientific expresses purpose, teamwork, courage, Innovation 26 and practical information to help Markets 29 determination, perseverance, moving Business performance (Group) 35 customers and staff through the corona forward and succeeding in turbulent Business performance (Regions) 38 virus crisis. Soon it became a holistic, Business performance (Financials) 44 surroundings – themes that are captured Share performance 46 omni-channel response including a in the pictures and contents of this report. Risk management 49 massive education platform. Sustainability report 57 The #TogetherStrong concept has Corporate governance 80 extended to thousands of activities Compensation report 107 and millions of communications. It demonstrates how the events of 2020 Financial report 123 fuelled our resourcefulness, innovation Appendix 184 and passion for creating opportunities. Global Reporting Initiative (GRI) 185 GRI content -

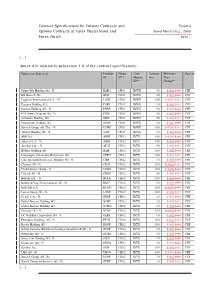

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

2017 Annual General Meeting Invitation, Proxy Statement and Annual Report

2017 Annual General Meeting Invitation, Proxy Statement and Annual Report TO OUR SHAREHOLDERS WE’VE COME A LONG WAY… So, we have come a long way. Which gives us an opportunity to put this company - now in its 35th year - When we meet people from outside Logitech, we often into a broader perspective as we look ahead. For both hear, “Wow, you really had a terrific year!”, or “What a of us, it’s an anniversary of sorts this year. Guerrino turnaround this past year or two!”. celebrates 20 years at Logitech in a few months and Bracken celebrates his first five. Let’s step back and think The truth is we started down this road five years ago. about the world in which we now play. After all, you’re That was Fiscal Year 2013, when retail sales in constant reading this because you’re interested in what’s ahead. currency fell -7% year on year. TOOLS ENHANCE OUR LIVES We made changes to our strategy, our culture and our team. And since then we’ve systematically and Let’s step way back to the dawn of humanity; even before Letter to Shareholders passionately worked toward our goal to become a design history was recorded. Our earliest tools were knives, company. A design company is not one focused on spears, the wheel, jugs and more. They enabled us to do fashion or beautiful products (although our products are things we couldn’t do on our own and became stepping beautiful). It’s a company that puts the consumer at the stones for new advances. -

Ishares SMIM® ETF (CH)

Creatiedatum 26 sep 2021 iShares SMIM® ETF (CH) Morningstar Analyst Rating™ Morningstar Categorie Index Benchmark van het fonds Morningstar Rating™ Morningstar Categorie™ MSCI Switzerland Small Cap NR SIX SMI Mid TR CHF QQQ Aandelen Zwitserland Small/Mid CHF Cap Wordt gebruikt in dit rapport als index 22.5 Beleggingsdoelstelling Groei van 10000 (EUR) 20.0 Fonds The Fund aims to achieve a return on your investment 17.5 Index which reflects the return of the Swiss Market Index Mid 15.0 Categorie (SMIM®), the Fund's benchmark index. The benchmark 12.5 is weighted in accordance with the free-float value of 10.0K Swiss equities with an average market capitalization. 2016 2017 2018 2019 2020 08/21 Rendement It comprises the 30 largest, most liquid stocks on the Swiss equity market that are not included in the SMI®. 7.80 20.94 -14.18 39.86 5.73 24.44 Fonds The index is calculated on a real-time basis in CHF. -4.88 -3.57 8.55 6.10 -7.41 1.49 +/- Index -5.01 2.62 1.22 7.68 -4.43 0.43 +/- Categorie - - - - - - Percentiel Score Risicomaatstaven Rendementen (24 sep 2021) Rend % +/-Idx +/-Cat Kwartaalrendementen 1e kw 2e kw 3e kw 4e kw Alpha 0.64 Sharpe Ratio 0.81 3 Maanden 2.82 -5.79 -2.87 2021 6.42 10.54 - - Beta 0.97 Std Deviatie 17.18 6 Maanden 15.68 -1.12 -2.47 2020 -18.87 13.98 4.79 9.11 R-kwadraat 90.70 3-jr Risico Bov gem 1 jaar 36.75 -0.79 0.35 2019 16.62 7.47 4.33 6.96 Informatie Ratio 0.03 5-jr Risico Bov gem 3 jr gean. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

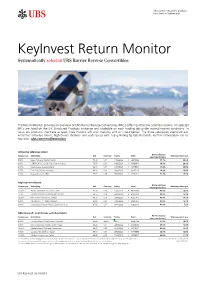

Keyinvest Return Monitor Systematically Selected UBS Barrier Reverse Convertibles

Structured investment products for clients in Switzerland KeyInvest Return Monitor Systematically selected UBS Barrier Reverse Convertibles The Return Monitor provides an overview of UBS Barrier Reverse Convertibles (BRCs) offering attractive potential returns. All selected BRCs are listed on the SIX Structured Products Exchange and tradeable on each trading day under normal market conditions. In focus are products that have at least three months left until maturity and an intact barrier. The three categories examined are: Attractive sideways return, high barrier distance and underlyings with a Buy Rating by UBS Research. Further information can be found on: ubs.com/renditemonitor Attractive sideways return Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 5.50% Bayer / Novartis / Roche / Sanofi 74.30 CHF 14/08/2020 A 39945568 15.1% 30.6% 8.00% CENTRICA PLC / E.ON / Electricite de France 78.70 EUR 10/08/2020 A 42686847 18.7% 28.2% 9.00% Credit Suisse / Deutsche Bank 82.10 CHF 13/07/2020 A 42078534 15.8% 26.3% 9.75% Enel / Fiat Chrysler / UniCredit 85.20 EUR 29/06/2020 39167120 28.3% 23.9% 9.00% Hewlett-Packard / IBM 93.27 USD 06/07/2020 A 42271711 31.2% 15.1% High barrier distance Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 12.00% Alcoa Corporation / US STEEL CORP 96.32 USD 12/06/2020 A 44506090 47.5% 15.3% 7.75% Colgate-Palmolive / Estée Lauder / L'Oréal 98.55 USD 22/06/2020 A 41905920 43.9% 15.4% 10.00% Nike / Under Armour Inc. -

2019 Switzerland Spencer Stuart Board Index

2019 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. Spencer Stuart is one of the world’s leading executive search consulting firms. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning more than 60 offices, over 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2020 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword -

Swiss Leader Index Price Index Index

BLUE-CHIP INDICES 1 SWISS LEADER INDEX PRICE INDEX INDEX Index description Key facts The SLI Swiss Leader Index includes the 30 most liquid stocks traded in the » "In order to achieve the stated index objective SIX Swiss Ex-change defines Swiss equity market, the developments of which are reflected by the SPI® the general principles that govern the index methodology. SIX Swiss Family. Consequently, the index weighting of a given issue is limited by Exchange publishes the index objective and rules for all indices. means of a 9/4,5 capping model. In other words, the weighting of each of the four companies with the largest market capitalisation is capped at a » Representative: the development of the market is represented by the maximum of 9 %. The weightings of all lower-ranked companies are if index necessary capped at 4.5 %. This limitation will be calculated by applying a » Tradable: the index components are tradable in terms of company size capping factor, which as a general rule will remain constant for a three- and market month period. The SLI offers a number of advantages: for investors, the capping feature improves their stock- and sector specific diversification and, » Replicable: the development of the index can be replicated in practise with because the new index fulfils Swiss, EU and US regulatory requirements, a portfolio new markets can be opened with products based on the SLI. That, in turn, generates liquidity for the stocks included in the basket. » Stable: high index continuity » Rules-based: index changes and calculations -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Dividend and Compensation Payments in Light of Covid-19 Pandemic

DIVIDEND AND COMPENSATION PAYMENTS IN LIGHT OF COVID-19 PANDEMIC Information as of 18 November 2020 Annual General Meeting 2019 dividend Company Index Short-time work Board compensation Executive compensation (2020) (paid 2020) ABB SMI unchanged (26.03.2020) unchanged CHF 0.80 - 10% reduction of board compensation for the duration of the 10% reduction of salary for the duration of the crisis crisis Adecco SMI unchanged (16.04.2020) unchanged CHF 2.50 yes - - Aevis Other unchanged (30.04.2020) cancelled - - - Alcon SMI unchanged (06.05.2020) postponed to 2021 - - - Also Other unchanged (24.03.2020) unchanged CHF 3.25 - - - ams SMIM unchanged (03.06.2020) - - - - APG/SGA Other unchanged (14.05.2020) cancelled (from CHF 11.00) yes - 20% reduction of base salary Aryzta Other postponed to 15.12.2020 postponed yes 30% reduction of fees for 3 months 30% reduction salary reduction for 3 months (15% for wider leadership team) Autoneum Other unchanged (25.03.2020) cancelled yes - 10% reduction of base salary Baloise SMIM unchanged (24.04.2020) unchanged CHF 6.40 - - - Barry Callebaut SMIM unchanged (09.12.2020) - - - - BB Biotech SMIM unchanged (19.03.2020) unchanged CHF 3.40 - - - Bobst Other unchanged (07.04.2020) unchanged CHF 1.50 - - - Bossard Other unchanged (08.04.2020) reduced by 50% to CHF 2.00 4% reduction of compensation 4% salary reduction Bucher Industries SMIM unchanged (24.04.2020) unchanged CHF 8.00 yes (mainly FR and IT) - - BVZ Other unchanged (16.04.2020) reduced to CHF 7.50 - - - Calida Group Other brought forward to cancelled -

2018 Switzerland Spencer Stuart Board Index

2018 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. At Spencer Stuart, we know how much leadership matters. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning 57 offices, 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2019 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword 4 HigHligHtS 6 In tHe SpotligHt: in tHe new erA For boArdS, culture iS key 10 our Survey ApproAcH 11 BoArd Size And compoSition 22 BoArd governAnce 26 remunerAtion 29 compAriSon tAbleS 30 International comparison 36 Board composition 40 Board remuneration in 2017 44 Spencer StuArt in SwitzerlAnd 2018 Switzerland Spencer Stuart board index 1 Foreword The Spencer Stuart Board Index is an annual study that analyses aspects of board governance among major listed companies, including composition, committees and remuneration. -

Voting Report 2020

Exercising of Shareholder Rights – Information December 2020 As a result of the adoption of the “Popular Initiative against Fat-Cat Salaries” in 2014, pension funds have an obligation to exercise shareholder rights in the interests of the insured persons and to disclose how the pension funds voted. This regulation applies for public limited companies with registered office in Switzerland and whose shares are listed on a domestic or foreign stock exchange. The Foundation Board of the PensFlex Collective Foundation has incorporated the corresponding regulations into the Art. 3.5 of the Organisational Rules or Art. 4 of the Rules on Investment. A list of the voting record of the PensFlex Collective Foundation in the year 2020 is shown below. Voting Report for PensFlex Sammelstiftung Kauffmannweg 16 6003 Luzern This report summarizes voting behaviour according to the following specifications: Time period: 01.01.2020 - 31.12.2020 Agenda items: Summary of all items on the agenda, i.e. not only the items requiring a vote according to Art. 22 para. 1 ORAb. The voting rights were exercised for the following companies: Perrot Duval 06.02.2020 Kardex 14.04.2020 Novartis 28.02.2020 Tornos 15.04.2020 Dätwyler 11.03.2020 Georg Fischer 15.04.2020 Roche 17.03.2020 Sulzer 15.04.2020 BB Biotech 19.03.2020 Evolva 15.04.2020 Schindler 19.03.2020 Mikron 15.04.2020 Swiss Prime Site 24.03.2020 Ascom 15.04.2020 Implenia 24.03.2020 Kudelski 15.04.2020 Bellevue 24.03.2020 Adecco 16.04.2020 SGS 24.03.2020 Rieter 16.04.2020 ALSO 24.03.2020 Cembra Money Bank 16.04.2020