Consumer Products M&A Insights Summer 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

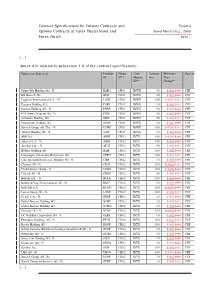

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

CDP Ireland Climate Change Report 2015

1 CDP Ireland climate change report 2015 Irish Companies Demonstrating Leadership on Climate Change ‘On behalf of 822 investors with assets of US$95 trillion’ Programme Sponsors Report Sponsor Ireland partner to CDP and report writer 2 3 Contents 04 Foreword by Paul Dickinson Executive Chairman CDP 06 CDP Ireland Network 2015 Review by Brian O’ Kennedy 08 Commentary from SEAI 09 Commentary from EPA 10 Irish Emissions Reporting 12 Ireland Overview 14 CDP Ireland Network initiative 16 The Investor Impact 17 The Climate A List 2015 19 Investor Perspective 20 Investor signatories and members 22 Appendix I: Ireland responding companies 23 Appendix II: Global responding companies with operation in Ireland 27 CDP 2015 climate change scoring partners Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. Clearstream Solutions, and CDP have prepared the data and analysis in this report based on responses to the CDP 2015 information request. No represen- tation or warranty (express or implied) is given by Clearstream Solutions or CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, Clearstream Solutions and CDP do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

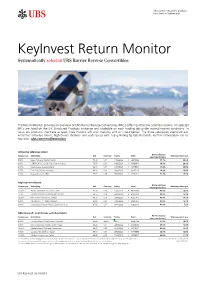

Keyinvest Return Monitor Systematically Selected UBS Barrier Reverse Convertibles

Structured investment products for clients in Switzerland KeyInvest Return Monitor Systematically selected UBS Barrier Reverse Convertibles The Return Monitor provides an overview of UBS Barrier Reverse Convertibles (BRCs) offering attractive potential returns. All selected BRCs are listed on the SIX Structured Products Exchange and tradeable on each trading day under normal market conditions. In focus are products that have at least three months left until maturity and an intact barrier. The three categories examined are: Attractive sideways return, high barrier distance and underlyings with a Buy Rating by UBS Research. Further information can be found on: ubs.com/renditemonitor Attractive sideways return Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 5.50% Bayer / Novartis / Roche / Sanofi 74.30 CHF 14/08/2020 A 39945568 15.1% 30.6% 8.00% CENTRICA PLC / E.ON / Electricite de France 78.70 EUR 10/08/2020 A 42686847 18.7% 28.2% 9.00% Credit Suisse / Deutsche Bank 82.10 CHF 13/07/2020 A 42078534 15.8% 26.3% 9.75% Enel / Fiat Chrysler / UniCredit 85.20 EUR 29/06/2020 39167120 28.3% 23.9% 9.00% Hewlett-Packard / IBM 93.27 USD 06/07/2020 A 42271711 31.2% 15.1% High barrier distance Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 12.00% Alcoa Corporation / US STEEL CORP 96.32 USD 12/06/2020 A 44506090 47.5% 15.3% 7.75% Colgate-Palmolive / Estée Lauder / L'Oréal 98.55 USD 22/06/2020 A 41905920 43.9% 15.4% 10.00% Nike / Under Armour Inc. -

Glanbia Plc 2009 Annual Report

Glanbia plc 2009 Annual Report Glanbia plc Glanbia plc, Glanbia House, Tel +353 56 777 2200 Kilkenny, Ireland. Fax +353 56 777 2222 www.glanbia.com 2009 Annual Report Cautionary statement The 2009 Annual Report contains forward-looking statements. These statements have been made by the Directors in good faith, based on the information available to them up to the time of their approval of this report. Due to the inherent uncertainties, including both economic and business risk factors, underlying such forward- looking information, actual results may differ materially from those expressed or implied by these forward-looking statements. The Directors undertake no obligation to update any forward- looking statements contained in this report, whether as a result of new information, future events, or otherwise. Get more online www.glanbia.com Glanbia plc 2009 Annual Report Contents 1 Overview of Glanbia Introduction 2 Financial results 3 Glanbia at a glance 4 Directors’ report: Business review Chairman’s statement 6 Group Managing Director’s review 8 International growth strategy 10 Operations review US Cheese & Global Nutritionals 14 Dairy Ireland 16 Joint Ventures & Associates 18 Finance review 22 Risk management 28 Our responsibilities 30 Our people 31 Directors’ report: Corporate governance Board of Directors 34 Statement on corporate governance 36 Statement on Directors’ remuneration 46 Other statutory information 54 Statement of Directors’ responsibilities 55 Financial statements Independent auditors’ report to the members of Glanbia -

Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start

eurex circular 2 41/05 Date: Frankfurt, November 30, 2005 Recipients: All Eurex members, CCP members and vendors Authorized by: Daniel Gisler Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start Related Eurex Circulars: 057/05, 230/05 Contact: Customer Support, tel. +49-69-211-1 17 00 E-mail: [email protected] Content may be most important for: Attachment: Ü Front Office / Trading Updated List of CCP-eligible Securities for ISE Ü Middle + Back Office Ü Auditing / Security Coordination With this circular we complement information on the introduction of a Central Counterparty for the Irish stock market scheduled for next Monday, December 5, 2005. The Central Counterparty (CCP) for securities traded in the Xetra order book at Irish Stock Exchange (ISE) originated from a common initiative of Irish Stock Exchange, Euroclear/CRESTCo Limited and Deutsche Börse AG. Eurex Clearing AG, which already renders CCP services for other markets, acts as CCP. The product range for production start on December 5, 2005 comprises Irish stocks and Exchange Traded Funds (ETFs) traded in the Xetra order book at Irish Stock Exchange. Please find attached to this circular an updated list of securities which will be CCP-eligible for ISE effective December 5, 2005. Should you have any questions or require further information, please feel free to contact the Customer Support Team at tel. +49-69-211-1 17 00. Eurex Clearing AG Customer Support Chairman of the Executive Board: Aktiengesellschaft mit Sitz D-60485 Frankfurt/Main Tel. +49-69-211-1 17 00 Supervisory Board: Rudolf Ferscha (CEO), in Frankfurt/Main www.eurexchange.com Fax +49-69-211-1 17 01 Dr. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Case No COMP/M.7220 - CHIQUITA BRANDS INTERNATIONAL/ FYFFES

EN Case No COMP/M.7220 - CHIQUITA BRANDS INTERNATIONAL/ FYFFES Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) in conjunction with Art 6(2) Date: 03/10/2014 In electronic form on the EUR-Lex website under document number 32014M7220 Office for Publications of the European Union L-2985 Luxembourg EUROPEAN COMMISSION Brussels, 3.10.2014 C(2014) 7268 final In the published version of this decision, some information has been omitted PUBLIC VERSION pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general MERGER PROCEDURE description. To the notifying parties: Dear Sir/Madam, Subject: Case M.7220 - Chiquita Brands International/ Fyffes Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 (1) On 14 August 2014, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Chiquita Brands International, Inc. ("Chiquita", the United States) and the undertaking Fyffes plc ("Fyffes", Ireland) merge within the meaning of Article 3(1)(a) of the Merger Regulation (the "Transaction"). Chiquita and Fyffes are collectively referred to as the "Notifying Parties". 1. THE NOTIFYING PARTIES AND THE TRANSACTION (2) Chiquita is a US-based global importer and wholesaler of fresh produce, in particular bananas. In the EEA Chiquita's activities also include the supply of pineapples and other fruit, as well as the provision of banana ripening and shipping services to third 1 OJ L 24, 29.1.2004, p. -

Dividend and Compensation Payments in Light of Covid-19 Pandemic

DIVIDEND AND COMPENSATION PAYMENTS IN LIGHT OF COVID-19 PANDEMIC Information as of 18 November 2020 Annual General Meeting 2019 dividend Company Index Short-time work Board compensation Executive compensation (2020) (paid 2020) ABB SMI unchanged (26.03.2020) unchanged CHF 0.80 - 10% reduction of board compensation for the duration of the 10% reduction of salary for the duration of the crisis crisis Adecco SMI unchanged (16.04.2020) unchanged CHF 2.50 yes - - Aevis Other unchanged (30.04.2020) cancelled - - - Alcon SMI unchanged (06.05.2020) postponed to 2021 - - - Also Other unchanged (24.03.2020) unchanged CHF 3.25 - - - ams SMIM unchanged (03.06.2020) - - - - APG/SGA Other unchanged (14.05.2020) cancelled (from CHF 11.00) yes - 20% reduction of base salary Aryzta Other postponed to 15.12.2020 postponed yes 30% reduction of fees for 3 months 30% reduction salary reduction for 3 months (15% for wider leadership team) Autoneum Other unchanged (25.03.2020) cancelled yes - 10% reduction of base salary Baloise SMIM unchanged (24.04.2020) unchanged CHF 6.40 - - - Barry Callebaut SMIM unchanged (09.12.2020) - - - - BB Biotech SMIM unchanged (19.03.2020) unchanged CHF 3.40 - - - Bobst Other unchanged (07.04.2020) unchanged CHF 1.50 - - - Bossard Other unchanged (08.04.2020) reduced by 50% to CHF 2.00 4% reduction of compensation 4% salary reduction Bucher Industries SMIM unchanged (24.04.2020) unchanged CHF 8.00 yes (mainly FR and IT) - - BVZ Other unchanged (16.04.2020) reduced to CHF 7.50 - - - Calida Group Other brought forward to cancelled -

Irish Foodservice Market Directory

Irish Foodservice Market Directory NOVEMBER 2014 Growing the success of Irish food & horticulture www.bordbia.ie TABLE OF CONTENTS Page No. IRISH FOODSERVICE MARKET DIRECTORY 5 Introduction 5 How to use the Directory 5 Methodology 6 TOP 10 PRODUCER TIPS FOR BUILDING A SUCCESSFUL FOODSERVICE BUSINESS 7 FOODSERVICE MAP 9 COMMERCIAL CHANNELS 11 QUICK SERVICE RESTAURANTS (QSR) 13 AIL Group 14 Domino’s Pizza 18 McDonald’s 21 Subway 24 Supermac’s 26 FORECOURT CONVENIENCE 29 Applegreen 30 Topaz 32 FULL SERVICE RESTAURANTS (FSR) 35 Avoca Handweavers 36 Brambles 39 Eddie Rocket’s 42 Entertainment Enterprise Group 45 Itsa 49 Porterhouse Brewing Company 53 Wagamama 55 COFFEE SHOPS 59 BB’s Coffee and Muffins 60 Butlers Chocolate Café 62 Esquires Coffee House 64 Insomnia 66 MBCC Foods (Ireland) Ltd. T/A Costa Coffee *NEW 68 Quigleys Café, Bakery, Deli 70 streat Cafes (The) 72 HOTELS 75 Carlson Rezidor Hotel Group 76 Choice Hotels Ireland 80 Dalata Management Services 82 The Doyle Collection 87 Limerick Strand Hotel 89 Moran & Bewley’s Hotels 92 PREM Group 95 Talbot Hotel Group *NEW 98 Tifco Hotel Group 100 1 LEISURE/EVENTS 103 Dobbins Outdoor 104 Feast 106 Fitzers Catering Ltd 108 JC Catering 111 Masterchefs Hospitality 113 Prestige Catering Ltd 115 The Right Catering Company 117 With Taste 119 TRAVEL 123 Aer Lingus Catering 124 EFG Catering 128 Gate Gourmet Ireland 131 HMS Host Ireland Ltd 133 Irish Ferries 135 Rail Gourmet 138 Retail inMotion 140 SSP Ireland 142 INSTITUTIONAL (COST) CHANNELS 145 BUSINESS & INDUSTRY (B&I) 147 ARAMARK Ireland 148 Baxter Storey 151 Carroll Foodservices Limited 153 Compass Group Ireland 155 Corporate Catering Services Limited 157 Gather & Gather *NEW 160 KSG 162 Mount Charles Group *NEW 164 Premier Dining 167 Q Café Co. -

Recommended Cash Offer for FYFFES by Sumitomo Corp (PDF/410KB)

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION THIS ANNOUNCEMENT IS BEING MADE PURSUANT TO RULE 2.5 OF THE IRISH TAKEOVER RULES THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR IMMEDIATE RELEASE 9 December 2016 RECOMMENDED CASH OFFER for FYFFES PLC by SWORDUS IRELAND HOLDING LIMITED A WHOLLY-OWNED SUBSIDIARY OF SUMITOMO CORPORATION TO BE IMPLEMENTED BY WAY OF A SCHEME OF ARRANGEMENT UNDER CHAPTER 1 OF PART 9 OF THE COMPANIES ACT 2014 Summary Sumitomo Corporation (“Sumitomo”) and Fyffes plc (“Fyffes”) are pleased to announce that they have reached agreement on the terms of a unanimously recommended cash offer by Sumitomo pursuant to which Swordus Ireland Holding Limited (“Bidco”), a wholly-owned subsidiary of Sumitomo, will acquire the entire issued and to be issued share capital of Fyffes. Under the terms of the Acquisition, Fyffes Shareholders will be entitled to receive: for each Fyffes Ordinary Share €2.23 in cash The Acquisition values the entire issued and to be issued ordinary share capital of Fyffes at approximately €751,365,470. The Acquisition represents a premium of approximately: o 49% to Fyffes’ closing share price of €1.50 on 8 December 2016 (being the last practicable date prior to the publication of this Announcement); o 53% to Fyffes’ volume weighted average share price of approximately €1.46 over the 30 trading day period ending 8 December 2016; o 52% to Fyffes’ volume weighted average share price of approximately €1.47 over the 90 trading day period ending 8 December 2016; and 1 o 37% to Fyffes’ all-time high share price1 of €1.62, which occurred on 22 April 2016. -

Annual Report 2005

A world of dairy foods and nutritional ingredients Annual Report 2005 CONTENTS Page 2 Glanbia Market Positions and Global Locations 4 Divisions and core activities 5 Financial highlights 6 Chairman’s Review 8 Group Managing Director’s Review 12 Operations Review Agribusiness and Property 16 Consumer Foods 22 Food Ingredients 28 Nutritionals 30 International Joint Ventures 34 Corporate Social Responsibility 36 Finance Review 38 Directors and Advisors 41 Report of the Directors 49 Financial Statements Glanbia market positions USA NO.1 US A Barrel Cheese Supplier NO.1 Whey Protein Isolate Supplier NO.3 American Cheddar Cheese Supplier CHICAGO IDAHO Glanbia’s strategy is to build international relevance in cheese, NEW MEXICO MEXICO Global Leading supplier of advanced technology whey proteins and fractions and global locations Ireland NO.1 Dairy Processor NO.1 Liquid Milk and Cream Brands NO.1 Cheese Processor NO.1 Pigmeat Processor IRELAND UK GERMANY dairy-based nutritional ingredients and selected consumer foods. Europe NO.1 Pizza Cheese Supplier CHINA NO.1 Supplier of Key Customised Nutrient Premixes NIGERIA 4 GLANBIA PLC ANNUAL REPORT 2004 Glanbia plc, the international dairy foods and nutritional ingredients Group Glanbia plc has operations in Ireland, Europe and the USA, with International joint ventures in the UK, USA and Nigeria. The Group is organised into three operating divisions of Agribusiness & Property, Consumer Foods and Food Ingredients, which includes the evolving Nutritionals business. Agribusiness & Property Consumer Foods Food Ingredients 12.52% of Group Turnover 26.97% of Group Turnover 60.51% of Group Turnover 13.26% of Group Operating Profit 33.68% of Group Operating Profit 53.06% of Group Operating Profit 12.52% 13.26% 26.97% 33.68% 60.51% 53.06% Agribusiness is the primary Glanbia Consumer Foods This division has operations interface whereby Glanbia trades incorporates liquid milk, chilled of scale in Ireland and the USA with its 5,700 Irish farmer suppliers.