Irish Foodservice Market Directory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Football Club Years Of

125YEARS OF Cork Constitution FOOTBALL CLUB Edmund Van Esbeck Published by Cork Constitution Football Club, Temple Hill, Cork. Tel: 021 4292 563 i Cork Constitution Football Club wishes to sincerely thank the author, Edmund Van Esbeck and gratefully acknowledges the assistance of the following in the publication of this book: PHOTOGRAPHS Irish Examiner Archieve Sportsfile Photography Inpho Photography Colin Watson Photographey,Montreal, Canada John Sheehan Photography KR Events Martin O’Brien The Framemaker Club Members © Copyright held by suppliers of photographs GRAPHIC DESIGN Nutshell Creative Communication PRINTER Watermans Printers, Little Island, Co. Cork. ii AUTHORS NOTE & ACKNOWLEDGEMENT When the Cork Constitution Club celebrated the centenary of its foundation I had the privilege of writing the history. Now I have been entrusted with updating that chronicle. While obviously the emphasis will be on the events of the last twenty-five years - the most momentous period in the history of rugby union - as a tribute to the founding fathers, the first chapter of the original history will yet again appear. While it would not be practical to include a detailed history of the first 100 years chapter two is a brief resume of the achievements of the first fifty years and likewise chapter three embraces the significant events of the second fifty years in the illustrious history of one of Ireland’s great sporting institutions. There follows the detailed history and achievements, and they were considerable, of the last twenty five years. I owe a considerable debt of gratitude to many people for their help during the compilation of this book. In that regard I would particularly like to thank Noel Walsh, the man with whom I liaised during the writing of the book. -

Investment for Growth for Investment

Total Produce plc Total Annual Report and Accounts 2012 Investment for Growth Total Produce plc Annual Report & Accounts 2012 A Strong & Sustainable Business 2012 A Year of Global Growth Read about Frankort & Koning, our entry into the Read Capespan, Oppenheimer North American about our market new European In 2012 we continued to Pages 24 partnership on expand our global footprint and 25 Pages 14 and 15 Read about our South African investment Pages 18 and 19 Strategy Our Produce: Page 6 Strategy: Page 4 Total Produce 1 Annual Report 2012 We are Europe’s leading fresh produce provider involved in the growing, sourcing, importing, STRONG & packaging, marketing and distribution of hundreds SUSTAINABLE of lines of fresh fruits, vegetables and flowers. Overview Investment Investment: Page 8 Supply Chain: Page 2 Contents Overview Our Business 2 Strategy 4 Our Produce 6 Investment 8 Financial Summary (2006-2012) 10 Growth 12 Business Review Partner Profiles: Page 14 Highlights: Page 3 Partner Profile – Frankort & Koning 14 Chairman’s Statement 16 Partner Profile – Capespan 18 Operating Review 20 Partner Profile – Oppenheimer 24 Finance Review 26 Corporate Social Responsibility 33 Financial Statements Board of Directors and Secretary 34 Directors and Other Information 36 Directors’ Report 37 Corporate Governance Report 40 Audit Committee Report 44 Compensation Committee Report 45 Statement of Directors’ Responsibilities 50 Independent Auditor’s Report 51 Growth Financial Statements 52 Notice of Annual General Meeting 117 Growth: Page 12 Total Produce plc Annual Report and Accounts 2012 2 Our Business Our Supply Chain In a global industry, the route to market is all important. -

Supervalu: How a Brave Local Brand Defied the Forces of Globalisation

SuperValu: How a brave local brand defied the forces of globalisation DDFH&B COMPANY PROFILE AGENCY The DDFH&B Group consists of DDFH&B Advertising, Goosebump, The Reputations Agency, RMG and Mindshare Media – making it one of the largest Irish companies in creative advertising, media buying and customer relationship/digital marketing. Together, they provide channel-neutral, integrated marketing communications campaigns that deliver real, measurable results. They achieve this level of integration by working in a number of small, multi-disciplined teams, calling it ‘fun sizing’. They continue to be one of the most successful agencies in Ireland, working with clients such as Kerry Foods, SuperValu, The National Lottery, eir, Littlewoods, Lucozade and Molson Coors. CLIENT AWARD LONG TERM EFFECTIVENESS Sponsored by GOLD 1 SuperValu: How a brave local brand defied the forces of globalisation DDFH&B INTRODUCTION & BACKGROUND This is a story about long term effectiveness. It is a story about how a brave local retailer with daring ambition wrestled back leadership from Tesco and defied the forces of globalisation. SuperValu was founded in 1979 with a base of just 16 stores, mainly in Munster. While they had grown to 182 stores by 2004, and acquired Superquinn (another Irish retailer) in 2011, they were a retailer with two speeds, an urban speed and a rural speed. The urban speed was still reeling from the Superquinn takeover, when stores were rebranded to SuperValu in 2014. Superquinn had a more premium brand perception, much closer to the Waitrose proposition in the UK. Consumers were in a state of chassis as they felt they were paying convenience store prices in large supermarkets and were unfamiliar with the brand and mistrustful of its quality. -

2018 Annual Report and Form 20-F

Overview Strategy Review Business Performance Governance Financial Statements Supplementary 20-F Disclosures Shareholder Information Index 2018 Annual Report and Form 20-F Overview Strategy Review Business Performance Governance Financial Statements Supplementary 20-F Disclosures Shareholder Information Index CRH Annual Report and Form 20-F I 2018 CRH Annual Report and Form 20-F I 2018 Contents 2018 How our Performance Overview Business Performance Financial Statements Our Global Business in 2018 ....................2 Business Overview .................................26 Independent Auditor’s Reports .............112 Why Invest in Us .......................................4 Finance Director’s Review .......................27 Consolidated Financial Statements .......123 Highlights Chairman’s Introduction ............................5 Segmental Reviews ................................32 Accounting Policies ..............................128 Notes on Consolidated Strategy Review Governance Financial Statements ............................139 €26.8bn Chief Executive’s Review ..........................8 Board of Directors ..................................54 global Sales €25.2bn Strategy ..................................................10 Corporate Governance Report ...............58 Supplementary 20-F Disclosures ......214 Business Model ......................................12 Directors’ Remuneration Report..............68 Shareholder Information ....................238 Measuring Performance ..........................14 Directors’ Report -

The Abuse of Supermarket Buyers

The Abuse of Supermarket Buyer Power in the EU Food Retail Sector Preliminary Survey of Evidence Myriam Vander Stichele, SOMO & Bob Young, Europe Economics On behalf of: AAI- Agribusiness Accountability Initiative Amsterdam, March 2009 Colophon The Abuse of Supermarket Buyer Power in the EU Food Retail Sector Preliminary Survey of Evidence Myriam Vander Stichele (SOMO) & Bob Young (Europe Economics) March 2009 Funding: This publication is made possible with funding from The Dutch Ministry of Foreign Affairs via SOMO and DGOS (Belgian Directorate General for Development Cooperation) via Vredeseilanden (VECO). Published by: AAI - Agribusiness Action Initiatives, formerly called Agribusiness Accountability Initiative The authors can be contacted at: SOMO Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl This document is licensed under the Creative Commons Attribution-NonCommercial-NoDerivateWorks 2.5 License. The Abuse of Supermarket Buyer Power in the EU Food Retail Sector 2 Contents Contents ..........................................................................................................................3 Summary .........................................................................................................................4 Introduction.....................................................................................................................6 1. Abusive buyer power problems are being discussed in many fora while a comprehensive -

Applications Granted

DATE : 21/09/2011 KILKENNY COUNTY COUNCIL TIME : 15:40:28 PAGE : 1 P L A N N I N G A P P L I C A T I O N S PLANNING APPLICATIONS GRANTED FROM 11/09/2011 TO 17/09/2011 in deciding a planning application the planning authority, in accordance with section 34(3) of the Act, has had regard to submissions or observations recieved in accordance with these Regulations; that it is the responsibility of any person wishing to use the personal data on planning applications and decisions lists for direct marketing purposes to be satisfied that they may do so legitimately under the requirements of the Data Protection Acts 1988 and 2003 taking into account of the preferences outlined by applicants in their application FILE APP. DATE M.O. M.O. NUMBER APPLICANTS NAME TYPE RECEIVED DEVELOPMENT DESCRIPTION AND LOCATION DATE NUMBER 10/718 The Aspect Hotel Kilkenny c/o R 23/12/2010 RETENTION PERMISSION for a new bored well to 16/09/2011 420 Clement Gleeson GM on behalf of supplement existing public supply and all associated site the Dirs of PREM Group works the townlands of Springhill and Smithland South Co. Kilkenny 11/189 Stephen & Jean Calnan P 18/04/2011 to construct (1) A single storey extension to the side and 12/09/2011 411 rear (2) A first floor extension over the living area, along with all associated works to an existing bungalow Ballytarsney Mooncoin Co. Kilkenny 11/275 Michael E. Walsh P 02/06/2011 to erect dwellinghouse and all associated works 16/09/2011 419 Ballyhomuck Bigwood Mullinavat Co. -

2015-Annual-Report-Glanbia.Pdf

Glanbia plc Annual Report and Accounts 2015 DELIVERING BETTER NUTRITION FOR EVERY STEP OF LIFE’S JOURNEY Glanbia plc Annual Report and Accounts 2015 HIGHLIGHTS OF 2015 Another year of DOUBLE DIGIT GROWTH Forward-Looking Statements We are pleased to report a sixth consecutive year Glanbia plc (‘the Group’) has made forward-looking of double digit growth. We achieved a reported statements in this Annual Report that are based on management’s beliefs and assumptions and growth of 29.4% in adjusted earnings per share on information currently available to management. Forward-looking statements include, but are not (10.6% increase constant currency). We also achieved limited to, information concerning the Group’s possible or assumed future results of operations, a 29.9% increase in EBITA (10.5% constant currency) business strategies, financing plans, competitive with margin expansion of 160bps (130bps constant position, potential growth opportunities, potential operating performance improvements, the effects currency) and strong operating cashflow of €281.4 of competition and the effects of future legislation or regulations. Forward-looking statements include million. We are increasing our dividend by 10% to all statements that are not historical facts and can be identified by the use of forward-looking 12.1 cent per share. The outlook is positive and terminology such as the words ‘believe,’ ‘develop,’ we are guiding 8% to 10% growth in adjusted ‘ensure,’ ‘arrive,’ ‘achieve,’ ‘anticipate,’ ‘maintain,’ ‘grow,’ ‘aim,’ ‘deliver,’ ‘sustain,’ ‘should’ or the earnings per share, constant currency, for 2016. negative of these terms or similar expressions. Forward-looking statements involve risks, uncertainties and assumptions. -

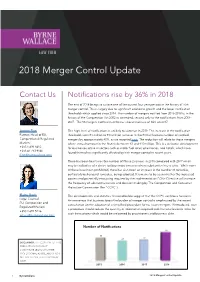

Merger Control Update 2018 Merger Control Update

Merger Control Update 2018 Merger Control Update Contact Us Notifications rise by 36% in 2018 The end of 2018 brings to a close one of the busiest four year periods in the history of Irish merger control. This is largely due to significant economic growth and the lower notification thresholds which applied since 2014. The number of mergers notified from 2015-2018 is, in the history of the Competition Act 2002 as amended, second only to the notifications from 2004- 2007. The 98 mergers notified in 2018 was also an increase of 36% on 2017. Joanne Finn This high level of notifications is unlikely to continue in 2019. The increase in the notification Partner, Head of EU, thresholds from €3 million to €10 million turnover in the ROI will reduce number of notified Competition & Regulated mergers by approximately 40%, as we reported here. The reduction will relate to those mergers Markets where annual turnover in the State is between €3 and €10 million. This is a welcome development +353 1 691 5412 for businesses active in sectors such as motor fuel retail, pharmacies, and hotels, which have +353 87 753 9160 found themselves significantly affected by Irish merger control in recent years. [email protected] There has been four times the number of Phase 2 reviews in 2018 compared with 2017 which may be indicative of a desire to focus more on cases where substantive issues arise. While none of these have been prohibited, there has also been an increase in the number of remedies, particularly behavioural remedies, being adopted. -

Annual Report 2002 1 Financial Highlights

Kerry Group Annual Report & Accounts 2002 2002 at a Glance Sales increased by 25% to c3.8 billion Like-for-like sales growth of 6% EBITDA increased by 18% to c390m Operating profit* increased by 17% to c305m Adjusted profit after tax* up 22% to c189m Adjusted earnings per share* increased by 15.8% to 101.8 cent Final dividend per share up 16.3% to 7.85 cent e273m acquisition programme Free cash flow c232m *before goodwill and exceptionals Our Mission Kerry Group will be a major international specialist food ingredients corporation, a leading international flavour technology company and a leading supplier of added-value brands and customer branded foods to the Irish and UK markets. We will be leaders in our selected markets – excelling in product quality, technical and marketing creativity and service to our customers – through the skills and wholehearted commitment of our employees. We are committed to the highest standards of business and ethical behaviour, to fulfilling our responsibilities to the communities which we serve and to the creation of long-term value for all stakeholders on a socially and environmentally sustainable basis. Contents 2 Financial Highlights 3 Results in Brief 4 Chairman’s Statement 6 Managing Director’s Review 16 Business Review 18 Ireland and Rest of Europe 26 Americas 32 Asia Pacific 34 Financial Review 36 Financial History 37 Directors and Other Information 38 Report of the Directors 47 Independent Auditors’ Report 48 Statement of Accounting Policies 50 Group Financial Statements Kerry Group plc Annual Report -

CDP Ireland Climate Change Report 2015

1 CDP Ireland climate change report 2015 Irish Companies Demonstrating Leadership on Climate Change ‘On behalf of 822 investors with assets of US$95 trillion’ Programme Sponsors Report Sponsor Ireland partner to CDP and report writer 2 3 Contents 04 Foreword by Paul Dickinson Executive Chairman CDP 06 CDP Ireland Network 2015 Review by Brian O’ Kennedy 08 Commentary from SEAI 09 Commentary from EPA 10 Irish Emissions Reporting 12 Ireland Overview 14 CDP Ireland Network initiative 16 The Investor Impact 17 The Climate A List 2015 19 Investor Perspective 20 Investor signatories and members 22 Appendix I: Ireland responding companies 23 Appendix II: Global responding companies with operation in Ireland 27 CDP 2015 climate change scoring partners Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. Clearstream Solutions, and CDP have prepared the data and analysis in this report based on responses to the CDP 2015 information request. No represen- tation or warranty (express or implied) is given by Clearstream Solutions or CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, Clearstream Solutions and CDP do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

Multiple and Symbol Operators: the Battle for Market Leadership in the Irish Grocery Market

Technological University Dublin ARROW@TU Dublin Case Studies School of Retail and Services Management 2002-01-01 Multiple and Symbol Operators: the Battle for Market Leadership in the Irish Grocery Market Edmund O'Callaghan Technological University Dublin, [email protected] Mary Wilcox Technological University Dublin, [email protected] Follow this and additional works at: https://arrow.tudublin.ie/buschrsmcas Part of the Business Commons Recommended Citation O'Callaghan, E., Wilcox, M.:Multiple and Symbol Operators: The battle for Market Leadership in the Irish Grocery Market. Case Study. Irish Marketing Review VOL.14, No.2 This Article is brought to you for free and open access by the School of Retail and Services Management at ARROW@TU Dublin. It has been accepted for inclusion in Case Studies by an authorized administrator of ARROW@TU Dublin. For more information, please contact [email protected], [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-Share Alike 4.0 License Dublin Institute of Technology ARROW@DIT Articles School of Retail and Services Management 1-1-2002 Multiple and Symbol Operators: The battle for Market Leadership in the Irish Grocery Market Edmund O'Callaghan Dublin Institute of Technology, [email protected] Mary Wilcox Dublin Institute of Technology, [email protected] This Other is brought to you for free and open access by the School of Retail and Services Management at ARROW@DIT. It has been accepted for inclusion in Articles by an authorized administrator of ARROW@DIT. For more information, please contact [email protected]. -

Glanbia Reports Improving Trends in Q3 2020

THIRD QUARTER 2020 INTERIM MANAGEMENT STATEMENT Glanbia reports improving trends in Q3 2020 29 October 2020 – Glanbia plc, the global nutrition group (‘Glanbia’ or the ‘Group’), is issuing this Interim Management Statement for the nine month trading period ended 3 October 2020 (“Q3 YTD” or “first nine months of 2020”). Summary Improving trends in Q3 2020 while navigating the challenges resulting from the Covid-19 pandemic; Q3 YTD wholly owned revenues up 1.0% reported. On a like-for-like* basis up 3.1% versus prior year; Good performance from Glanbia Nutritionals (“GN”) maintaining growth trajectory, Q3 YTD like-for-like revenues up 10.9% versus prior year; Foodarom acquisition closed in the third quarter; Improving trends in Glanbia Performance Nutrition (“GPN”) in the third quarter. Q3 2020 like-for-like branded revenue down 2.3% versus Q3 2019 with positive pricing. Q3 2020 EBITA margin in double digits; GPN transformation programme on track and delivering margin improvements; Joint Ventures (“JVs”) continue to deliver a robust performance; Group is in a strong financial position, net debt at Q3 period end improved by €187.7 million versus the prior year with a net debt to EBITDA ratio of 1.95 times; Glanbia announces intention to launch a share buy-back programme of up to €50 million; and In Q4 2020, notwithstanding continued Covid-19 related uncertainty, Glanbia expects GN and JVs to continue to deliver a resilient earnings performance in addition to further sequential improvement in GPN. Commenting today, Siobhán Talbot, Group Managing Director said: “I would like to again acknowledge the tremendous efforts of all my Glanbia colleagues as well as our supplier and customer partners as we navigate the challenges of 2020.