AMC on JB Technical Swiss Equity Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

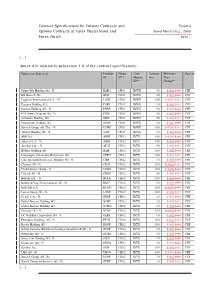

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Julius Baer Multicooperation Annual Report 2005 As at June 30, 2005 (Audited)

Julius Baer Multicooperation Annual Report 2005 as at June 30, 2005 (audited) Subscriptions are only valid if made on the basis of the current Prospectus, the latest Annual Report and the latest Semi-Annual Report if published thereafter. The Articles of Association, the valid Prospectus and the Annual and Semi-Annual Reports may be obtained free of charge at the representative in Switzerland and the respective paying agent. Only the German version of the present Annual Report has been reviewed by the independent auditor. Consequently, the independent auditor's report only refers to the German version of the Report; other versions result from a conscientious translation made under the responsibility of the Board. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Julius Baer Investment Funds Services Ltd., Zurich Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstrasse 36, Postfach, CH - 8010 Zurich Paying agent in Germany: Bank Julius Bär (Deutschland) AG, Messe Turm, Friedrich-Ebert-Anlage 49, Postfach 15 01 52, D - 60061 Frankfurt on the Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Contents Page Organisation and Management 4 Independent Auditor's Report 5 Notes to the Financial Statements 6 Julius Baer Multicooperation (Umbrella Fund) MCOO Julius Baer Multicooperation - Emerging Markets Value Stock Fund HESF Julius Baer Multicooperation -

Sika Annual Report 2011 1 → Content

Online Annual Report 2011 → www.annualreport.sika.com 2011 � Sika Annual Report For Jean Nouvel, a 32000 m² façade clad with 6500 perfectly jointed glass panels. � For Daniel Libeskind, a 1400 m² roof that Freedom of Design Acceleration The precision-designed Sikasil® silicone joints are essential to Sika superplasticizers and shrinkage-reducing admixtures were the glass façade's filigree aesthetic, rigorous color scheme and instrumental in delivering a handsome fair-faced concrete finish environmental control performance. and to keep the tight construction schedule. reads as a fifth façade, sloping at 37° from 90 to 180 meters in height. Turning architects’ visions into reality, drawing on in-depth experience and know-how to translate ideas into buildings and works of art – that is one side to Sika's definition of customer focus. The other is to offer variety, deliver quality and build trust. In all aspects of technology, materials and practical application. Its mission is to create fresh scope for ideas, formal designs and connecting assemblies which, in many cases, are still waiting to be discovered. Sika Annual Report 2011 1 → Content Content Robust Growth Customer Focus 3 Letter to Shareholders 66 Freedom of Design 72 i-Cure Technology Investing in Sika 75 Acceleration 7 Stock price development 9 Risk Management Financial Report 80 Consolidated Financial Statements Strategy & Focus 85 Appendix to the Consolidated 13 Group Strategy Financial Statements 14 The Sika Brand 133 Five-Year Reviews 15 Customers & Markets 140 Sika AG Financial -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

FACTSHEET - AS of 29-Sep-2021 Solactive Swiss Large Cap Index (GTR)

FACTSHEET - AS OF 29-Sep-2021 Solactive Swiss Large Cap Index (GTR) HISTORICAL PERFORMANCE 250 200 150 100 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Solactive Swiss Large Cap Index (GTR) CHARACTERISTICS ISIN / WKN DE000SLA0Q39 / SLA0Q3 Base Value / Base Date 100 Points /18.12.2009 Bloomberg / Reuters SOLSWIGR Index / .SOLSWIGR Last Price 261.33 Index Calculator Solactive AG Dividends Reinvested (Total Return Index) Index Type Total Return Calculation 9:00 am to 10:50 pm (CET), every 15 seconds Index Currency CHF History Available daily back to 18.12.2009 Index Members 20 FACTSHEET - AS OF 29-Sep-2021 Solactive Swiss Large Cap Index (GTR) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -6.42% -2.96% 6.32% 14.83% 11.53% 161.33% Performance (p.a.) - - - - - 8.50% Volatility (p.a.) 12.30% 10.55% 10.05% 11.70% 10.48% 15.34% High 279.26 281.16 281.16 281.16 281.16 281.16 Low 258.11 258.11 246.16 211.99 229.04 78.35 Sharpe Ratio -4.50 -1.09 1.32 1.29 1.50 0.55 Max. Drawdown -7.58% -8.20% -8.20% -8.20% -8.20% -28.42% VaR 95 \ 99 -19.4% \ -34.0% -23.4% \ -43.7% CVaR 95 \ 99 -27.0% \ -41.4% -37.4% \ -65.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES CHF 100.0% CH 100.0% TOP COMPONENTS AS OF 29-Sep-2021 Company Ticker Country Currency Index Weight (%) NESTLE SA NESN SE Equity CH CHF 23.20% ROCHE HOLDING AG ROG SE Equity CH CHF 17.83% NOVARTIS AG NOVN SE Equity CH CHF 14.22% ZURICH INSURANCE GROUP AG ZURN SE Equity CH CHF 4.56% UBS GROUP AG UBSG SE Equity CH CHF 4.09% LONZA GROUP AG LONN SE Equity CH CHF 4.07% ABB LTD-REG -

Julius Baer Multistock Société D'investissement À Capital Variable

Julius Baer Multistock Société d'Investissement à Capital Variable Annual Report as at 30 June 2011 (audited) Subscriptions are carried out solely on the basis of the current prospectus or the simplified prospectus, or the “key investor information”, as soon as it is available, in conjunction with the latest annual report and the latest semi-annual report if published thereafter. The articles of association, the valid prospectus and the simplified prospectus, the annual and semi-annual reports (or the “key investor information”, as soon as it is available), as well as the information based on the SFA guidelines on transparency with regard to management fees, may be obtained free of charge from the representative in Switzerland and/or from the respective paying agent. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Swiss & Global Asset Management AG, Hardstraße 201, CH - 8005 Zurich (new address from 19 September 2011) Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstraße 36, Postfach, CH - 8010 Zurich Paying and information agent in Germany (until 31 December 2010): Bank Julius Bär Europe AG, An der Welle 1, Postfach 15 02 52, D - 60062 Frankfurt am Main Paying agent in Germany (since 1 January 2011): Deka Bank Deutsche Girozentrale, Hahnstraße 55, D - 60528 Frankfurt am Main Information agent in Germany (since 1 January 2011): Swiss & Global Asset Management Kapital AG, Taunusanlage 15, D - 60325 Frankfurt am Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Representative and paying agent in Liechtenstein: LGT Bank in Liechtenstein AG, Herrengasse 12, FL - 9490 Vaduz Trade and Companies Register number: R.C.S. -

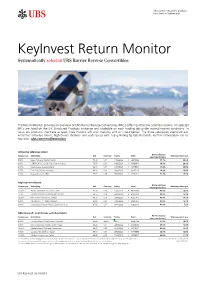

Keyinvest Return Monitor Systematically Selected UBS Barrier Reverse Convertibles

Structured investment products for clients in Switzerland KeyInvest Return Monitor Systematically selected UBS Barrier Reverse Convertibles The Return Monitor provides an overview of UBS Barrier Reverse Convertibles (BRCs) offering attractive potential returns. All selected BRCs are listed on the SIX Structured Products Exchange and tradeable on each trading day under normal market conditions. In focus are products that have at least three months left until maturity and an intact barrier. The three categories examined are: Attractive sideways return, high barrier distance and underlyings with a Buy Rating by UBS Research. Further information can be found on: ubs.com/renditemonitor Attractive sideways return Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 5.50% Bayer / Novartis / Roche / Sanofi 74.30 CHF 14/08/2020 A 39945568 15.1% 30.6% 8.00% CENTRICA PLC / E.ON / Electricite de France 78.70 EUR 10/08/2020 A 42686847 18.7% 28.2% 9.00% Credit Suisse / Deutsche Bank 82.10 CHF 13/07/2020 A 42078534 15.8% 26.3% 9.75% Enel / Fiat Chrysler / UniCredit 85.20 EUR 29/06/2020 39167120 28.3% 23.9% 9.00% Hewlett-Packard / IBM 93.27 USD 06/07/2020 A 42271711 31.2% 15.1% High barrier distance Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 12.00% Alcoa Corporation / US STEEL CORP 96.32 USD 12/06/2020 A 44506090 47.5% 15.3% 7.75% Colgate-Palmolive / Estée Lauder / L'Oréal 98.55 USD 22/06/2020 A 41905920 43.9% 15.4% 10.00% Nike / Under Armour Inc. -

Sika Capital Bv

IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the attached document and you are advised to read this disclaimer carefully before reading, accessing or making any other use of the attached document. In accessing the document you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. The attached document is intended for the addressee only. THE ATTACHED DOCUMENT MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. THE BONDS (THE "BONDS") REFERENCED IN THE ATTACHED DOCUMENT MAY ONLY BE DISTRIBUTED IN "OFFSHORE TRANSACTIONS" TO PERSONS OUTSIDE THE UNITED STATES, AND AS PERMITTED BY, THE US SECURITIES ACT OF 1933 (THE "SECURITIES ACT"). ANY FORWARDING, REDISTRIBUTION OR REPRODUCTION OF THIS DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF BONDS FOR SALE IN THE UNITED STATES OR ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE BONDS HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE SECURITIES ACT, OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES, AND THE BONDS MAY NOT BE OFFERED OR SOLD EXCEPT IN AN OFFSHORE TRANSACTION IN ACCORDANCE WITH RULE 903 OR RULE 904 OF REGULATION S UNDER THE SECURITIES ACT, IN EACH CASE IN ACCORDANCE WITH ANY APPLICABLE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. -

Convertible Bonds Due 2025

NOT FOR DISTRIBUTION IN OR INTO THE UNITED STATES OF AMERICA OR OTHERWISE OTHER THAN TO PERSONS TO WHOM IT CAN LAWFULLY BE DISTRIBUTED—THIS OFFERING IS AVAILABLE ONLY TO ADDRESSEES OUTSIDE OF THE UNITED STATES, SUBJECT TO CERTAIN RESTRICTIONS IMPORTANT: You must read the following before continuing. The following disclaimer applies to the attached prospectus (the "Prospectus") accessed via internet or otherwise received as a result of such access and you are therefore advised to read this disclaimer page carefully before reading, accessing or making any other use of the attached Prospectus. In accessing the attached Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. IN PARTICULAR, ANY SECURITIES TO BE ISSUED HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE "U.S. SECURITIES ACT"), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OF AMERICA OR OTHER JURISDICTION AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES, CANADA, JAPAN, AUSTRALIA OR ITALY OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. YOU ARE NOT AUTHORIZED TO, AND YOU MAY NOT, FORWARD OR DELIVER THE ATTACHED PROSPECTUS, ELECTRONICALLY OR OTHERWISE, TO ANY OTHER PERSON OR REPRODUCE SUCH PROSPECTUS IN ANY MANNER WHATSOEVER. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Dividend and Compensation Payments in Light of Covid-19 Pandemic

DIVIDEND AND COMPENSATION PAYMENTS IN LIGHT OF COVID-19 PANDEMIC Information as of 18 November 2020 Annual General Meeting 2019 dividend Company Index Short-time work Board compensation Executive compensation (2020) (paid 2020) ABB SMI unchanged (26.03.2020) unchanged CHF 0.80 - 10% reduction of board compensation for the duration of the 10% reduction of salary for the duration of the crisis crisis Adecco SMI unchanged (16.04.2020) unchanged CHF 2.50 yes - - Aevis Other unchanged (30.04.2020) cancelled - - - Alcon SMI unchanged (06.05.2020) postponed to 2021 - - - Also Other unchanged (24.03.2020) unchanged CHF 3.25 - - - ams SMIM unchanged (03.06.2020) - - - - APG/SGA Other unchanged (14.05.2020) cancelled (from CHF 11.00) yes - 20% reduction of base salary Aryzta Other postponed to 15.12.2020 postponed yes 30% reduction of fees for 3 months 30% reduction salary reduction for 3 months (15% for wider leadership team) Autoneum Other unchanged (25.03.2020) cancelled yes - 10% reduction of base salary Baloise SMIM unchanged (24.04.2020) unchanged CHF 6.40 - - - Barry Callebaut SMIM unchanged (09.12.2020) - - - - BB Biotech SMIM unchanged (19.03.2020) unchanged CHF 3.40 - - - Bobst Other unchanged (07.04.2020) unchanged CHF 1.50 - - - Bossard Other unchanged (08.04.2020) reduced by 50% to CHF 2.00 4% reduction of compensation 4% salary reduction Bucher Industries SMIM unchanged (24.04.2020) unchanged CHF 8.00 yes (mainly FR and IT) - - BVZ Other unchanged (16.04.2020) reduced to CHF 7.50 - - - Calida Group Other brought forward to cancelled