M&A Yearbook 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

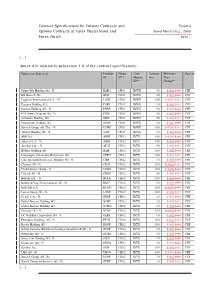

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Sales Prospectus with Integrated Fund Contract Clariden Leu (CH) Swiss Small Cap Equity Fund

Sales Prospectus with integrated Fund Contract Clariden Leu (CH) Swiss Small Cap Equity Fund September 2011 Contractual fund under Swiss law (type "Other funds for traditional investments") Clariden Leu (CH) Swiss Small Cap Equity Fund was established by Swiss Investment Company SIC Ltd., Zurich, as the Fund Management Company and Clariden Leu Ltd., Zurich, as the custodian bank. This is an English translation of the offical German prospectus. In case of discrepancies between the German and English text, the German text shall prevail. Part I Prospectus This Prospectus with integrated Fund Contract, the Simplified Prospectus and the most recent annual or semi-annual report (if published after the latest annual report) serve as the basis for all subscriptions of Shares in this Fund. Only the information contained in the Prospectus, the Simplified Prospectus or in the Fund Contract will be deemed to be valid. 1 General information Main parties Fund Management Company: Swiss Investment Company SIC Ltd. Claridenstrasse 19, CH-8002 Zurich Postal address: XS, CH-8070 Zurich Phone: +41 (0) 58 205 37 60 Fax: +41 (0) 58 205 37 67 Custodian Bank, Paying Agent and Distributor: Clariden Leu Ltd. Bahnhofstrasse 32, CH-8070 Zurich Phone: +41 (0) 844 844 001 Fax: +41 (0) 58 205 62 56 e-mail: [email protected] Website: http://www.claridenleu.com Investment Manager: Clariden Leu Ltd. Bahnhofstrasse 32, CH-8070 Zurich Phone: +41 (0) 844 844 001 Fax: +41 (0) 58 205 62 56 Auditors: KPMG Ltd Badenerstrasse 172, CH-8004 Zurich 2 Information on the Fund 2.1 General information on the Fund Clariden Leu (CH) Swiss Small Cap Equity Fund is an investment fund under Swiss law of the type “Other funds for traditional investments” pursuant to the Swiss Federal Act on Collective Investment Schemes of June 23, 2006. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

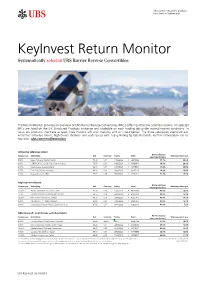

Keyinvest Return Monitor Systematically Selected UBS Barrier Reverse Convertibles

Structured investment products for clients in Switzerland KeyInvest Return Monitor Systematically selected UBS Barrier Reverse Convertibles The Return Monitor provides an overview of UBS Barrier Reverse Convertibles (BRCs) offering attractive potential returns. All selected BRCs are listed on the SIX Structured Products Exchange and tradeable on each trading day under normal market conditions. In focus are products that have at least three months left until maturity and an intact barrier. The three categories examined are: Attractive sideways return, high barrier distance and underlyings with a Buy Rating by UBS Research. Further information can be found on: ubs.com/renditemonitor Attractive sideways return Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 5.50% Bayer / Novartis / Roche / Sanofi 74.30 CHF 14/08/2020 A 39945568 15.1% 30.6% 8.00% CENTRICA PLC / E.ON / Electricite de France 78.70 EUR 10/08/2020 A 42686847 18.7% 28.2% 9.00% Credit Suisse / Deutsche Bank 82.10 CHF 13/07/2020 A 42078534 15.8% 26.3% 9.75% Enel / Fiat Chrysler / UniCredit 85.20 EUR 29/06/2020 39167120 28.3% 23.9% 9.00% Hewlett-Packard / IBM 93.27 USD 06/07/2020 A 42271711 31.2% 15.1% High barrier distance Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 12.00% Alcoa Corporation / US STEEL CORP 96.32 USD 12/06/2020 A 44506090 47.5% 15.3% 7.75% Colgate-Palmolive / Estée Lauder / L'Oréal 98.55 USD 22/06/2020 A 41905920 43.9% 15.4% 10.00% Nike / Under Armour Inc. -

The Private Equity Review

The Private Equity Review Second Edition Editor Kirk August Radke Law Business Research The Private Equity Review Reproduced with permission from Law Business Research Ltd. This article was first published in The Private Equity Review, 2nd edition (published in April 2013 – editor Kirk August Radke). For further information please email [email protected] The Private Equity Review Second Edition Editor Kirk August Radke Law Business Research Ltd THE LAW REVIEWS THE MERGERS AND ACQUISITIONS REVIEW THE RESTRUCTURING REVIEW THE PRIVate COmpetITION ENFORCEMENT REVIEW THE DISPUTE RESOLUTION REVIEW THE EMPLOYMENT LAW REVIEW THE PUBLIC COmpetITION ENFORCEMENT REVIEW THE BANKING REGUlatION REVIEW THE INTERNatIONAL ARBItratION REVIEW THE MERGER CONTROL REVIEW THE TECHNOLOGY, MEDIA AND TELECOMMUNICatIONS REVIEW THE INWARD INVESTMENT AND INTERNatIONAL TAXatION REVIEW THE CORPOrate GOVERNANCE REVIEW THE CORPOrate IMMIGratION REVIEW THE INTERNatIONAL INVESTIGatIONS REVIEW THE PROJECts AND CONSTRUCTION REVIEW THE INTERNatIONAL CAPItal Markets REVIEW THE REAL Estate LAW REVIEW THE PRIVate EQUITY REVIEW THE ENERGY REGUlatION AND Markets REVIEW THE INTELLECTUAL PROpertY REVIEW THE ASSET MANAGEMENT REVIEW THE PRIVATE WEALTH AND PRIVATE CLIENT REVIEW THE MINING laW REVIEW THE EXECUTIVE REMUNeratION REVIEW THE ANTi-BRIBERY AND ANTi-CORRUPTION REVIEW THE Cartels AND LENIENCY REVIEW THE TAX DISPUTES AND LITIGatION REVIEW THE LIFE SCIENCES laW REVIEW www.TheLawReviews.co.uk PUBLISHER Gideon Roberton BUSINESS DEVELOPMENT MANAGERS Adam Sargent, Nick Barette MARKETING MANAGERS Katherine Jablonowska, Thomas Lee, James Spearing PUBLISHING ASSIstaNT Lucy Brewer PRODUCTION COORDINATOR Lydia Gerges HEAD OF EDITORIAL PRODUCTION Adam Myers PRODUCTION EDITOR Anne Borthwick SUBEDITORS Anna Andreoli, Harry Phillips EDITOR-in-CHIEF Callum Campbell MANAGING DIRECTOR Richard Davey Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2013 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Sternbusiness

NON-PROFIT ORG. NEW YORK UNIVERSITY U.S. POSTAGE STERNBUSINESS THE ALUMNI MAGAZINE OF NYU STERN SCHOOL OF BUSINESS / FALL 2017 DEAN HENRY A CHAMPION 0F CHANGE A LOOK AT HOW NYU STERN IS INNOVATING TO DEVELOP FUTURE TALENT cover_UG.indd 117 10/16/17 8:23 AM AFTER EIGHT GRATIFYING YEARS, the moment approaches when I will step down from being Dean and return to full-time research and teaching as a NYU Stern professor. This, therefore, is my finalStern Business message to you in my current A MESSAGE capacity. It’s been an honor to serve the School and to get to know personally so many of you, the best colleagues and alumni in the world. When I arrived at Stern in 2010, times were both challenging and inspira- tional. Despite the still-fragile state of the global economic recovery, hope and FROM THE DEAN determined energy characterized the mood here. I knew I had joined a team of creative, brilliant people ready to apply the power of ideas and harness the potential of individuals to turn challenges into opportunities for business and society. Since then, we have indeed led the way in making sure that business education stays relevant to our changing times, expanding our role as an elite institution with enviable strengths in finance by tapping the innovative spirit for which we are known. You’ll see recent evidence of those efforts on display throughout this issue (starting on page 24). We recently launched two new one-year MBA programs— the Fashion & Luxury MBA (p. 27) and the Tech MBA (p. -

St.Gallen Symposium 2011

CLUSTER 12 St. Gallen Symposium 2011 Just Power Programme st 41 St. Gallen Symposium University of St. Gallen, Switzerland 12–13 May 2011 12–1341 MAY 2011 1 2 Editorial At the 41st St. Gallen Symposium, the International Content 3 Students’ Committee (ISC) addresses a topic of particular importance: “Just Power”, a subject that Just Power promises to be particularly rewarding, because “power” is a truly global force with relevance to Cluster A: The power of politics and arms many of the economic and political fields that the St. Gallen Symposium has been championing for Cluster B: The power of money and ownership decades. The first part of this brochure offers you Cluster C: The power of voice indepth insights into the topic of the 41st St. Gallen Symposium, a theme subdivided into five clusters. Cluster D: The power of leadership and authority Differentiated comments and statements from speakers and Leaders of Tomorrow of the upcoming Cluster E: The power of values and ideas “3 Days in May” offer a thematic glimpse of the topics addressed and present various opinions on “Just Power”. The second half of this brochure People 17 contains the detailed programme which provides an overview of the sessions and the respective speakers Topic Leaders at the symposium. In pursuing our goal of supporting and Leaders of Tomorrow enhancing intergenerational dialogue, this year we are particularly proud to present St. Gallen Connect, a web platform which allows you to easily get in Programme 12–13 May 2011 19 touch with our Leaders of Tomorrow. Furthermore, St. Gallen Connect provides you with an intuitive Programme interface to organise your individual stay at the St. -

Dividend and Compensation Payments in Light of Covid-19 Pandemic

DIVIDEND AND COMPENSATION PAYMENTS IN LIGHT OF COVID-19 PANDEMIC Information as of 18 November 2020 Annual General Meeting 2019 dividend Company Index Short-time work Board compensation Executive compensation (2020) (paid 2020) ABB SMI unchanged (26.03.2020) unchanged CHF 0.80 - 10% reduction of board compensation for the duration of the 10% reduction of salary for the duration of the crisis crisis Adecco SMI unchanged (16.04.2020) unchanged CHF 2.50 yes - - Aevis Other unchanged (30.04.2020) cancelled - - - Alcon SMI unchanged (06.05.2020) postponed to 2021 - - - Also Other unchanged (24.03.2020) unchanged CHF 3.25 - - - ams SMIM unchanged (03.06.2020) - - - - APG/SGA Other unchanged (14.05.2020) cancelled (from CHF 11.00) yes - 20% reduction of base salary Aryzta Other postponed to 15.12.2020 postponed yes 30% reduction of fees for 3 months 30% reduction salary reduction for 3 months (15% for wider leadership team) Autoneum Other unchanged (25.03.2020) cancelled yes - 10% reduction of base salary Baloise SMIM unchanged (24.04.2020) unchanged CHF 6.40 - - - Barry Callebaut SMIM unchanged (09.12.2020) - - - - BB Biotech SMIM unchanged (19.03.2020) unchanged CHF 3.40 - - - Bobst Other unchanged (07.04.2020) unchanged CHF 1.50 - - - Bossard Other unchanged (08.04.2020) reduced by 50% to CHF 2.00 4% reduction of compensation 4% salary reduction Bucher Industries SMIM unchanged (24.04.2020) unchanged CHF 8.00 yes (mainly FR and IT) - - BVZ Other unchanged (16.04.2020) reduced to CHF 7.50 - - - Calida Group Other brought forward to cancelled -

The PEI Africa Forum Assessing a New Decade of Opportunity

MAY TOBEFORE SAVEREGISTER£200 7TH The PEI Africa Forum Assessing a new decade of opportunity Grand Connaught Rooms, London • 15-16 June 2010 Leading industry speakers include: Runa Alam, Andrew Alli, J. Kofi Bucknor, CEO and Partner, Chief Executive R Managing Partner, Development Officer, Kingdom Zephyr Partners Africa Finance Africa Management International LLP Corporation Rod Evison, Dr. Ahmed Heikal, Razia Khan, Managing Director, Chairman and Head of Macroeconomics Africa, Founder, and Regional Head of CDC Group Citadel Capital Research, Africa, Standard Chartered Bank Jeffrey Leonard, David Morley, Martin Poulsen, President and CEO, Partner, Head Chief Private Equity Global Environment of Real Estate, Officer, Private Sector and Fund Actis Microfinance Department, African Development Bank London | New York | Singapore www.peimedia.com/africa10 PEI Media London Sycamore House Sycamore Street London EC1Y 0SG T: +44 20 7566 5444 F: +44 20 7566 5455 PEI Media New York 3 East 28th Street 7th Floor New York, NY 10016 T: +1 212 645 1919 F: +1 212 633 2904 PEI Media Singapore 11 Stamford Road #02-07 Capitol Building Singapore 178884 T: +65 6838 4563 F: +65 6334 4391 London | New York | Singapore www.peimedia.com/africa10 REGISTER The PEI Africa Forum MAY TOBEFORE SAVE£200 7TH Assessing a new decade of opportunity Grand Connaught Rooms, London • 15-16 June 2010 A sample of the experts confirmed to speak: Runa Alam, Andrew Alli, Orli Arav, J. Kofi Bucknor, David Creighton, CEO and Partner, Chief Executive Officer, Head of Project Finance, Managing Partner, President and CEO, Development Partners Africa Finance Frontier Markets Fund Kingdom Zephyr Cordiant Capital International LLP Corporation Managers (FMFM) Africa Management Piers Cumberlege, Riaz Currimjee, Lisa Curtis, Stephen Dawson, Patrick Deasy, Head of Partnership, Managing Director, Director, Co-founder and Chairman, Private Funds Group, World Economic Forum Surya Capital DeRisk Advisory Jacana Venture SJ Berwin Services Partnership Christopher Rod Evison, Coco Ferguson, Ramz Hamzaoui, Dr. -

Results Zrating Study 2019 on Corporate Governance

Zurich, 12 September 2019 Media release Results zRating Study 2019 on Corporate Governance Zürich, 12 September 2019 – Sunrise once again scores highest in this year’s corporate governance ranking followed by Swisscom (81 points) and Lonza (78 points). Due to amendments to the Articles of Association, also induced by activist shareholders, and changes in practices, companies have improved their corporate governance. For the eleventh time since 2009, the zRating Study on corporate governance in Swiss public companies has been published. zRating summarizes the situation regarding shareholders' rights in a company and draws attention to possible conflicts between shareholders and managers. zRating evaluates corporate governance holistically based on 62 criteria from the categories «Shareholders and Capital Structure», «Shareholders' Rights», «Composition Board of Directors/Management and Information Policy», and «Compensation and participation models». The criteria are weighted in a scoring model and evaluated with points. The total maximum of points is 100. 174 listed Swiss companies are analyzed based on Annual Reports 2018 and decisions at General Meetings 2019. Further improvements through amendments to the Articles of Association Once again Sunrise takes first place with 86 points. They had already gained a large lead thanks to amendments to the Articles of Association at the annual general meetings (AGM) in 2017 and 2018, and in 2019 Sunrise was also able to score in the new criteria. Second place went to Swisscom with 81 points and third place to Lonza with 78 points. This year, the boards of directors of Mobilezone, Peach Property and Starrag in particular proposed amendments to the Articles of Association that strengthened shareholders' participation rights. -

Exhibit 1 Pg 1 of 101

12-01676-smb Doc 74-4 Filed 03/28/17 Entered 03/28/17 19:25:16 Exhibit 1 Pg 1 of 101 Exhibit 1 12-01676-smb12-01676-smb Doc Doc 71 74-4 Filed Filed 03/03/17 03/28/17 Entered Entered 03/06/17 03/28/17 14:49:11 19:25:16 Main Exhibit Document 1 Pg Pg 2 1of of101 6 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, Adv. Pro. No. 08-01789 (SMB) Plaintiff-Applicant, SIPA LIQUIDATION v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT FINAL DOCUMENT SECURITIES LLC, CLOSING ADVERSARY PROCEEDING Defendant. In re: BERNARD L. MADOFF, Debtor. IRVING H. PICARD, Trustee for the Liquidation of Bernard L. Madoff Investment Securities LLC, Adv. Pro. No. 12-01676 (SMB) Plaintiff, v. CREDIT SUISSE AG, as successor-in-interest to Clariden Leu AG and Bank Leu AG, Defendant. STIPULATED FINAL ORDER GRANTING MOTION TO DISMISS Plaintiff Irving H. Picard (the “Trustee”), as trustee of the substantively consolidated liquidation proceeding of Bernard L. Madoff Investment Securities LLC (“BLMIS”), under the Securities Investor Protection Act (“SIPA”), 15 U.S.C. §§ 78aaa et seq., and the estate of Bernard L. Madoff, individually, and Credit Suisse AG, as successor-in-interest to Clariden Leu AG and Bank Leu AG (the “Defendant” and, together with the Trustee, the “Parties”), by and through their respective undersigned counsel, state as follows: {11291980:3} 12-01676-smb12-01676-smb Doc Doc 71 74-4 Filed Filed 03/03/17 03/28/17 Entered Entered 03/06/17 03/28/17 14:49:11 19:25:16 Main Exhibit Document 1 Pg Pg 3 2of of101 6 WHEREAS, on May 30, 2012, the Trustee initiated the above-captioned adversary proceeding in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) by filing a Complaint against Credit Suisse AG and Clariden Leu AG.