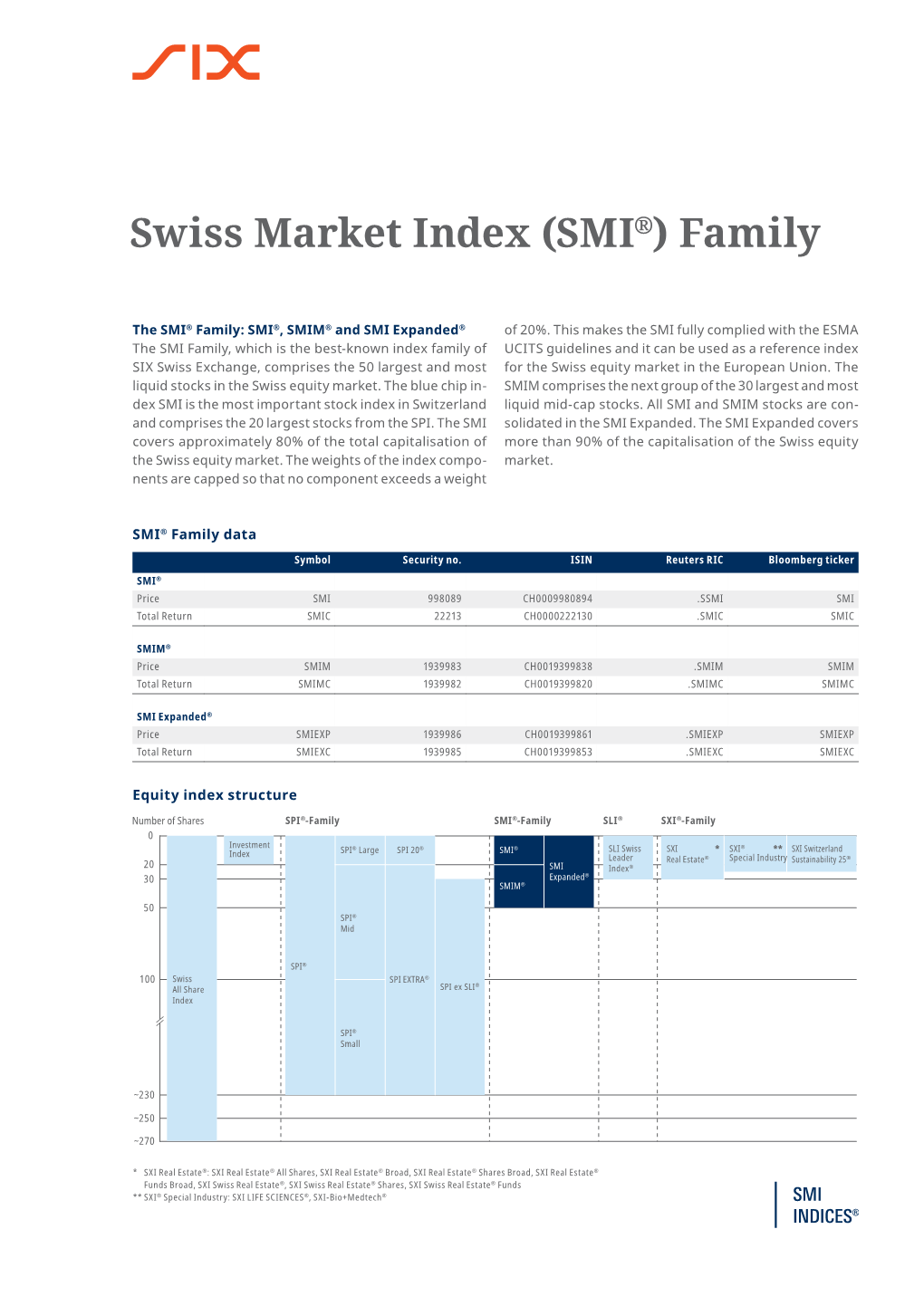

Swiss Market Index (SMI®) Family

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2 CONTENTS #TogetherStrong Highlights 3 #TogetherStrong is a tag-name that covers #TogetherStrong aptly describes how we countless initiatives we took to address progressed through and emerged from this Letter to shareholders 7 pressing needs in the dental community extraordinary year. Management commentary 11 in 2020. Straumann Group in brief 12 Strategy in action 17 #TogetherStrong is forward-looking; it Products, solutions and services 21 It started with a website offering scientific expresses purpose, teamwork, courage, Innovation 26 and practical information to help Markets 29 determination, perseverance, moving Business performance (Group) 35 customers and staff through the corona forward and succeeding in turbulent Business performance (Regions) 38 virus crisis. Soon it became a holistic, Business performance (Financials) 44 surroundings – themes that are captured Share performance 46 omni-channel response including a in the pictures and contents of this report. Risk management 49 massive education platform. Sustainability report 57 The #TogetherStrong concept has Corporate governance 80 extended to thousands of activities Compensation report 107 and millions of communications. It demonstrates how the events of 2020 Financial report 123 fuelled our resourcefulness, innovation Appendix 184 and passion for creating opportunities. Global Reporting Initiative (GRI) 185 GRI content -

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

CS ETF (CH) on SLI Holding AG, Novartis AG and UBS AG

Simplified Prospectus • October 2011 ® the SLI® as at August 15, 2011 were as follows: Nestlé SA, Roche CS ETF (CH) on SLI Holding AG, Novartis AG and UBS AG. The composition of the index is Subfund of the Umbrella Fund of the Category periodically updated by SIX Swiss Exchange. “Other Funds for Traditional Investments” Risk Profile of the Subfund Simplified Prospectus The value of the Subfund’s investments is governed by the market value of investments at any given time. Depending on the prevailing stock October 2011 market trend and the performance of the stocks held in the portfolio, the net asset value can fluctuate considerably. The possibility of a depreciation Distribution in Switzerland and Liechtenstein in value over longer periods cannot be ruled out. There is no guarantee that the investors will receive a certain return and that they will be able to return their units to the fund management company for redemption at a certain price. When redeeming units, it is possible that an investor will not Note recoup the amount originally invested in the Subfund. This simplified prospectus contains a summary of the key information on CS ETF (CH) on SLI®1 (the “Subfund”). The legal and financial aspects Performance of the Subfund (in %) are governed conclusively by the full sales prospectus with integrated fund (change in the net asset value where distributions are reinvested) contract. These govern, among other things, the rights of the investors, the duties and obligations of the fund management company and the 40.0% custodian bank, and the investment policy of the Fund. -

Nextgen WEALTH MANAGERS 30.06.2020

ESG Swiss Equities Certificate NextGen WEALTH MANAGERS 30.06.2020 Objective & Strategy ESG Swiss Equities certificate invests in a financial and ESG criteria scored weighted index. The index tracks Swiss financially sound companies that generate investment performance and integrate corporate social responsability, ethics and sustainability characteristics in order to have a long term positive environmental, social, governance (ESG) impact. It aims to be a reference by providing a specific solution that allows capital markets to redirect investment flows toward a more sustainable economy. Only companies with a financial and ESG score equal or above the median are eligible for inclusion in the ESG Swiss Equities Index. The dynamic strategy is based upon a synthetic notional investment allocation and reallocation in the Index Components following a specific and monitored process of eligibility defined by NextGen Wealth Managers SA. Monthly Comment Classification In June, the ESG Swiss Equities certificate registered a performance of 2.78% compared to Asset Type Equities May's 2.78%. The certificate’s benchmark, the Swiss Performance Index (SPI), performed Region Switzerland positively at 1.55% against 2.86% in the previous month. Since the beginning of the year, the Style ESG Systematic two baskets stand at -8.11% for the certificate and -3.13% for the benchmark. Since inception, cumulated performances are respectively at 12.34% and 34.73% (representing annualized performances of 2.72% and 7.12%) for annualized volatilities of 13.07% and 9.59%. The portfolio's allocation in large capitalization companies remains around 36% against 9% in middle capitalization companies and 54% in small capitalization companies. -

Richemont & Its Maisons

PUBLIC at a glance PUBLIC CONTENTS 3 THE GROUP AT A GLANCE 8 HOW WE OPERATE 12 CORPORATE SOCIAL RESPONSIBILITY 18 OUR LATEST FIGURES 23 APPENDIX PUBLIC * THE GROUP AT A GLANCE *End March 2020 **Dec 2020 Founded A leading luxury in 1988 goods group CHF 42 bn** € 14 bn € 1.5 bn € 2.4 bn Market capitalisation Sales Operating profit Net cash Top 8 SMI Top 3 JSE 3 PUBLIC THE GROUP AT A GLANCE * *End September 2020 25 Maisons and businesses Over 35 000 Employees (including over 8 000 in Switzerland) 7 Schools 9 Main Foundations 2 186 Boutiques supported (of which 1 179 internal) Richemont Headquarters by architect Jean Nouvel, Geneva 4 PUBLIC FROM THE PAST INTO THE FUTURE 206 187 173 152 127 114 101 68 25 18 1755 1814 1830 1833 1845 1847 1860 1868 1874 1893 1906 1919 1928 1952 1983 1995 2001 2002 2015 2021 * 265 190 175 160 146 114 92 37 19 5 *Both YOOX and NET-A-PORTER were founded in 2000 5 PUBLIC 1988 – 2020: UNIQUE PORTFOLIO MOSTLY BUILT BY ACQUISITIONS 1988 1990’s 2000’s 2010’s 2020’s 6 10 15 24 25 6 PUBLIC A WORLDWIDE PRESENCE * *End March 2020 Sales by geographical area Japan Middle East and Africa 8% 7% Americas 20% Europe Operating in 30% Europe 36 Europe locations Asia Pacific 35% 2 166 boutiques Cartier store in Cannes, France 7 PUBLIC HOW WE OPERATE PUBLIC WHAT WE STAND FOR Our Corporate culture is determined by the Collegiality Freedom principles we live by They affect what we do and why we do it They shape how we behave every day — in all areas Solidarity Loyalty of our business 9 PUBLIC HOW OUR BUSINESS OPERATES We work as business partners Headquarters Our Maisons and businesses SEC Strategy, Capital Allocation are directly in charge of: Strategic Product & Guide the Maisons by verifying that decisions on Products, Communication Committee Communication and Distribution are appropriate and consistent with . -

Press Release

Press release Zurich/Geneva, 17 April 2019 Global Powers of Luxury Goods: Swiss luxury companies are taking the digital path to accelerate growth • The sales of the world’s Top 100 luxury goods companies grew by 11% and generated aggregated revenues of USD 247 billion in fiscal year 2017 • Richemont, Swatch Group and Rolex remain in the top league of Deloitte’s Global Powers of Luxury Goods ranking • All Swiss companies in the Top 100 returned to growth in FY2017, but with only 8% increase, they lagged behind the whole market for the third time in a row • Luxury goods companies are making significant investments in digital marketing and the use of social media to engage their customers Despite the recent slowdown of economic growth in major markets including China, the Eurozone and the US, the luxury goods market looks positive. In FY2017, the world’s Top 100 luxury goods companies generated aggregated revenues of USD 247 billion, representing composite sales growth of 10.8%, according to Deloitte’s 2019 edition of Global Powers of Luxury Goods. For comparison, in FY2016 sales were USD 217 billion and annual sales growth was as low as 1.0%. Three-fourth of the companies (76%) reported growth in their luxury sales in FY2017, with nearly half of these recording double-digit year-on-year growth. Switzerland and Hong Kong prevail in the luxury watches sector Looking at product sectors, clothing and footwear dominated again in FY2017, with a total of 38 companies. The multiple luxury goods sector represented the largest sales share (30.8%), narrowly followed by jewellery and watches (29.6%). -

Ishares SMI®

For Professional Clients Only. iShares SMI® ETF (CH) CSSMI August Factsheet Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug- 2021 All other data as at 07-Sep-2021 Investors should read the Key Investor Information Document and Prospectus prior to investing. Capital at risk. All financial investments involve an element of risk. Therefore, the value The Fund seeks to track the performance of an index composed of the 20 largest Swiss companies. of your investment and the income from it will vary and your initial investment amount cannot Effective from 18 September 2017, the maximum weighting to any one stock is restricted to 18% on be guaranteed. a quarterly basis KEY FACTS Asset Class Equity KEY BENEFITS Fund Base Currency CHF Share Class Currency CHF Targeted exposure to the 20 largest Swiss companies 1 Fund Launch Date 06-Oct-1999 Direct investment into blue-chip companies representative of leaders in Switzerland Share Class Launch Date 06-Oct-1999 2 Benchmark Swiss Market Index (SMI®) 3 Single country and large market capitalisation companies exposure ISIN CH0008899764 Total Expense Ratio 0.35% Distribution Type Ad-Hoc Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. Domicile Switzerland This means the Fund is more sensitive to any localised economic, market, political or regulatory Methodology Replicated events. The value of equities and equity-related securities can be affected by daily stock market Product Structure Physical movements. Other influential factors include political, economic news, company earnings and Rebalance Frequency Quarterly significant corporate events. Counterparty Risk: The insolvency of any institutions providing UCITS No services such as safekeeping of assets or acting as counterparty to derivatives or other Use of Income Distributing instruments, may expose the Fund to financial loss. -

2017 Annual General Meeting Invitation, Proxy Statement and Annual Report

2017 Annual General Meeting Invitation, Proxy Statement and Annual Report TO OUR SHAREHOLDERS WE’VE COME A LONG WAY… So, we have come a long way. Which gives us an opportunity to put this company - now in its 35th year - When we meet people from outside Logitech, we often into a broader perspective as we look ahead. For both hear, “Wow, you really had a terrific year!”, or “What a of us, it’s an anniversary of sorts this year. Guerrino turnaround this past year or two!”. celebrates 20 years at Logitech in a few months and Bracken celebrates his first five. Let’s step back and think The truth is we started down this road five years ago. about the world in which we now play. After all, you’re That was Fiscal Year 2013, when retail sales in constant reading this because you’re interested in what’s ahead. currency fell -7% year on year. TOOLS ENHANCE OUR LIVES We made changes to our strategy, our culture and our team. And since then we’ve systematically and Let’s step way back to the dawn of humanity; even before Letter to Shareholders passionately worked toward our goal to become a design history was recorded. Our earliest tools were knives, company. A design company is not one focused on spears, the wheel, jugs and more. They enabled us to do fashion or beautiful products (although our products are things we couldn’t do on our own and became stepping beautiful). It’s a company that puts the consumer at the stones for new advances. -

Why Switzerland?

Why Switzerland? Marwan Naja, AS Investment Management January, 2010 I. Executive Summary Swiss Equities Have Outperformed: Here is a fact you probably did not know: The Swiss equity market has arguably been the best performing developed world market over the past 20, 10, 5 and 2 years. The SPI Index, which incorporates over 200 Swiss stocks, is the best performing index in Swiss Franc (“CHF”), US Dollars (“USD”), Euro (“EUR”) and British Pounds (“GBP”) over the past 20 years1,10 years, 5 years, and 2 years when compared to similar broad-based total return indices in the United States (S&P 500 Total Return), the United Kingdom (FTSE 350 Total Return), Germany (CDAX), France (SBF 120 Total Return) and Japan (TOPIX Total Return)2. For most of these periods the magnitude of the outperformance is significant. Furthermore, the Swiss market has exhibited attractive risk characteristics including lower volatility than comparable markets. Figure 1: SPI 20 Year Performance (red) Compared to Major Developed Indices in CHF3 1 The 20 year comparable excludes the EUR which has not existed for that duration and the French SBF 120 TR which was established in 1990 and has underperformed the SPI over the 19 year period. 2 The Swiss market is the best performer in our local currency comparison (stripping out the foreign exchange effects) over 20 years and marginally trails the FTSE 350 for the 10 year, 5 year and 2 year comparisons. 3 Source of all graphs is Bloomberg unless otherwise indicated. Why Switzerland? AS Investment Management Contents I. Executive Summary ............................................................................................................ 1 Swiss Equities Have Outperformed ................................................................................... -

Ishares SMIM® ETF (CH)

Creatiedatum 26 sep 2021 iShares SMIM® ETF (CH) Morningstar Analyst Rating™ Morningstar Categorie Index Benchmark van het fonds Morningstar Rating™ Morningstar Categorie™ MSCI Switzerland Small Cap NR SIX SMI Mid TR CHF QQQ Aandelen Zwitserland Small/Mid CHF Cap Wordt gebruikt in dit rapport als index 22.5 Beleggingsdoelstelling Groei van 10000 (EUR) 20.0 Fonds The Fund aims to achieve a return on your investment 17.5 Index which reflects the return of the Swiss Market Index Mid 15.0 Categorie (SMIM®), the Fund's benchmark index. The benchmark 12.5 is weighted in accordance with the free-float value of 10.0K Swiss equities with an average market capitalization. 2016 2017 2018 2019 2020 08/21 Rendement It comprises the 30 largest, most liquid stocks on the Swiss equity market that are not included in the SMI®. 7.80 20.94 -14.18 39.86 5.73 24.44 Fonds The index is calculated on a real-time basis in CHF. -4.88 -3.57 8.55 6.10 -7.41 1.49 +/- Index -5.01 2.62 1.22 7.68 -4.43 0.43 +/- Categorie - - - - - - Percentiel Score Risicomaatstaven Rendementen (24 sep 2021) Rend % +/-Idx +/-Cat Kwartaalrendementen 1e kw 2e kw 3e kw 4e kw Alpha 0.64 Sharpe Ratio 0.81 3 Maanden 2.82 -5.79 -2.87 2021 6.42 10.54 - - Beta 0.97 Std Deviatie 17.18 6 Maanden 15.68 -1.12 -2.47 2020 -18.87 13.98 4.79 9.11 R-kwadraat 90.70 3-jr Risico Bov gem 1 jaar 36.75 -0.79 0.35 2019 16.62 7.47 4.33 6.96 Informatie Ratio 0.03 5-jr Risico Bov gem 3 jr gean. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

Julius Baer Multistock

JULIUS BAER MULTISTOCK A SICAV UNDER LUXEMBOURG LAW PROSPECTUS 31 DECEMBER 2011 Subscriptions are validly made only on the basis of this Prospectus or the Key Investor Information Document in conjunction with the most recent annual report and the most recent semi-annual report where this is published after the annual report. No information other than that contained in this Prospectus or the Key Investor Information Document may be given. PROSPECTUS - 2 - JULIUS BAER MULTISTOCK TABLE OF CONTENTS 1. Introduction..................................................................................................................................................5 2. Organisation and management...................................................................................................................8 3. Investment objectives and policy..................................................................................................................10 4. Investor profile...........................................................................................................................................34 5. Investment limits........................................................................................................................................35 6. Special investment techniques and financial instruments ........................................................................41 6.1 Options on securities....................................................................................................................................