Water Efficiency in New Developments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sellafield What to Do in a Radiation Emergency Booklet

WHAT TO DO IN AN Emergency At Sellafield This information is prepared for everyone within the Detailed Emergency Planning Zone and the Inner Emergency Planning Zone for the Sellafield Site. EMERGENCY INFORMATION Listen to local radio. Monitor social media platforms. Dial the Sellafield Emergency Information Line on 29th September 2021 It is important that you study this booklet carefully and keep it in a safe and prominent place. WHAT TO DO IN AN EMERGENCY Introduction • This booklet gives advice on what to do in the event of an emergency at the Sellafield Site. • Sellafield is Europe’s largest single nuclear site and stores and handles industrial size quantities of radioactive material. Although unlikely, an emergency could occur involving material being stored and processed on the Site. In addition, Sellafield also holds a large inventory of other hazardous substances and again although unlikely an emergency could occur involving the chemicals being utilised on the Site. • It must be stressed that the possibility of such emergencies occurring is remote and that the design and operation of all plants on the site are independently monitored by the Office for Nuclear Regulation (ONR), Health and Safety Executive (HSE) and Environment Agency (EA). • Current assessments of the radiological hazards indicate that areas between 6.1km & 8km from the centre of the Sellafield Site could be the most likely areas to be directly affected during and following a radiation emergency, this area is referred to as the Detailed Emergency Planning Zone (DEPZ). To see its geographical extent please see map A (pg13) & C (pg20). • In addition, other assessments of the chemical hazards indicate that an area up to 2km from the centre of the Sellafield Site could be the most likely area to be directly affected during and following a chemical emergency, this area is referred to as the Inner Emergency Planning Zone (IEPZ). -

CLITHEROE ROAD, WHALLEY Utilities Study Commercial Estates Group 31/01/2013 Revised: 08/02/2013

CLITHEROE ROAD, WHALLEY Utilities Study Commercial Estates Group 31/01/2013 Revised: 08/02/2013 Quality Management Issue/revision Issue 1 Revision 1 Revision 2 Revision 3 Remarks DRAFT DRAFT Date 31/01/2013 08/02/2013 Prepared by C Scott C Scott Signature Checked by C Cozens C Cozens Signature Authorised by C Cozens C Cozens Signature Project number 50600485 50600485 File reference S:\50600485 - Clitheroe Road, S:\50600485 - Clitheroe Whalley\C Road, Whalley\C Documents\Reports\Working\ Documents\Reports\Working 2013 Utilities Study \2013 Utilities Study S:\50600485 - Clitheroe Road, Whalley\C Documents\Reports\Working\2013 Utilities Study Project number: 50600485 Dated: 31/01/2013 2 Revised: 08/02/2013 CLITHEROE ROAD, WHALLEY Utilities Study 31/01/2013 Client Commercial Estates Group Consultant WSP UK Limited Three White Rose Office Park Leeds LS11 0DL UK Tel: +44 (0)11 3395 6200 Fax: +44 (0)11 3395 6201 www.wspgroup.co.uk Registered Address WSP UK Limited 01383511 WSP House, 70 Chancery Lane, London, WC2A 1AF 3 Table of Contents Executive Summary........................................................................... 5 1 Introduction ............................................................................... 6 2 Existing Site .............................................................................. 7 3 Water Supply ............................................................................ 8 4 Gas Supply ............................................................................. 13 5 Electricity Supply .................................................................... -

Compulsory Purchase Order 2016 Core Documents List

6/6/2018 UNITED UTILITIES WATER LIMITED (ECCLES WASTEWATER TREATMENT WORKS) COMPULSORY PURCHASE ORDER 2016 CORE DOCUMENTS LIST The Order CD/CPO/1 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 CD/CPO/2 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Key Plan for Order Map CD/CPO/2.1 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1 CD/CPO/2.2 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1A CD/CPO/2.3 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1B CD/CPO/2.4 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 1C CD/CPO/2.5 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 2 CD/CPO/2.6 The United Utilities Water Limited (Eccles Wastewater Treatment Works) Compulsory Purchase Order 2016 Order Map – Plan 3 CD/CPO/3 UU - Statement of Reasons CD/CPO/4 Minutes of United Utilities Water Limited's Board meeting extract on 21 July 2016 CD/CPO/5 Objection dated 18 November 2016 on behalf of Standard Life Trustee Company Limited CD/CPO/6 Objection dated 20 October 2016 on behalf of MSCCL, PINL, SCPL, CoSCoS and PSLL CD/CPO/7 Statement of Case on behalf of the acquiring authority (1 November -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

FTSE Publications

2 FTSE Russell Publications FTSE 100 Semi Annual Equally 19 August 2021 Weighted Net Tax Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.95 UNITED Fresnillo 0.86 UNITED Prudential 0.92 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 1.06 UNITED GlaxoSmithKline 1.08 UNITED Reckitt Benckiser Group 1.02 UNITED KINGDOM KINGDOM KINGDOM Anglo American 0.91 UNITED Glencore 0.94 UNITED RELX 1.05 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.91 UNITED Halma 1.05 UNITED Rentokil Initial 1.04 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.04 UNITED Hargreaves Lansdown 0.98 UNITED Rightmove 1.09 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.96 UNITED Hikma Pharmaceuticals 1.03 UNITED Rio Tinto 0.96 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 1.11 UNITED HSBC Hldgs 0.94 UNITED Rolls-Royce Holdings 0.9 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.15 UNITED Imperial Brands 0.98 UNITED Royal Dutch Shell A 0.56 UNITED KINGDOM KINGDOM KINGDOM Avast 1.07 UNITED Informa 0.94 UNITED Royal Dutch Shell B 0.49 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 1.08 UNITED InterContinental Hotels Group 0.97 UNITED Royal Mail 0.99 UNITED KINGDOM KINGDOM KINGDOM Aviva 1 UNITED Intermediate Capital Group 0.99 UNITED Sage Group 1.06 UNITED KINGDOM KINGDOM KINGDOM B&M European Value Retail 1.04 UNITED International Consolidated Airlines 0.85 UNITED Sainsbury (J) 1.03 UNITED KINGDOM Group KINGDOM KINGDOM BAE Systems 1 UNITED Intertek -

Ceca Pipeline

CECA North West: Infrastructure Vision A project map for contractors setting out the infrastructure pipeline to 2017 Contents 01 CONTENTS 02 INTRODUCTION 03 nortH west - nationaL inFrastructure PLan 08 LocaL autHorities 12 nationaL ParK autHorities 12 coMBined autHorities 14 LEPS 14 transPort 14 Ports 15 roads 16 raiL 17 aviation 17 deFence 18 oiL & Gas 19 eLectricitY coMPanies & renewaBLes 22 nucLear 23 water 23 EnvironMent 23 BroadBand 24 ceca contact addresses 01 Introduction of Moorside nuclear power station, as well as a new civil engineering framework for Greater Manchester. Given the many and complex routes to market, however, it is important than ever that CECA’s members have easy access to the information they need to take advantage of the opportunities that arise. Moreover, with increased workloads, clients need the region’s SMEs, as well as major contractors, to be equipped to meet their aspirations. The information in what follows is aimed at enabling smaller firms to identify workstreams where their specialist expertise and local workforce can bring real value. This publication has been prepared by CECA to help our members win work in the North West. Since 2010, the Government has sought to rebalance the nation’s economy Guy Lawson FCIM, MIED, Director, by focussing on the renewal of regional infrastructure. CECA North West CECA’s research has found that for each 1,000 jobs that are directly created in infrastructure construction, employment In the North West, the Civil Engineering Contractors’ as a whole rises by 3,053 jobs. Furthermore, every £1 billion Association (CECA) covers the five Local Enterprise of infrastructure construction increases overall economic Partnership (LEP) areas of Cheshire & Warrington, Cumbria, activity by £2.842 billion. -

Lake District Gas Pipe Move Planned to Minimise Disruption

Investors Home Press Releases Media Contacts Home / Press Releases / Lake District gas pipe move planned to minimise disruption National Grid Gas Distribution is moving its pipes to support a project to improve water quality in England's largest natural lake 28 Apr 2017 A six-month scheme to move gas pipes running under the A592, next to Lake Windermere, starts Monday 8 May, with bosses keen to stress that the area remains ‘open’ at all times. National Grid Gas Distribution must move its pipes so that United Utilities can continue its bigger scheme to install a new wastewater pipeline, to improve water quality in England’s largest natural lake. The gas pipes beneath the A592 are exactly where United Utilities needs its new pipe to be, so the gas network has agreed to move its pipes to the other side of the road. National Grid Gas Distribution can only do this work when United Utilities is clear of the area. It therefore has a window between 8 May and 31 October, when the water company returns to start phase two of its three-phase scheme. Traffic lights will be in place as gas teams work in stretches of up to 200m of the road, at any one time. They will start just after the entrance to Storrs Hall Hotel on 8 May and, once that area is completed, will begin moving north. They will finish at Ferry Nab in October. To keep vehicles moving, the lights have in-built technology that constantly monitor and adapt to traffic. There is also the option to manually control the lights at busy periods. -

Aggreko’S Current Hold Valuation As a Moderately Assign I Share, Recommendation Per to Aggreko

Equity Research Aggreko Plc Industrials | European Business Services A Case To Continue Holding the Market Leader 08 February 2021 in Temporary Power Solutions Stock Rating Hold Even after the takeover offer re-pricing, I believe Aggreko’s Industry View valuation does not reflect the full extent of growth Positive opportunities in a recovery environment Price Target GBp 964 Under-appreciated positioning amid the energy transition: The acceleration of various themes, such as de-carbonisation, has the potential to magnify dislocations in certain regions and sectors. Providing scope for above-market rates of growth as temporary power providers are engaged to act as a bridging mechanism for Price (as of 08/02/2021) GBp 851 economies and sectors transitioning away from their legacy power infrastructure. Additionally, though unpredictable, I like the added kicker of large one-off events Potential Upside/Downside +13.2% and believe Aggreko’s scale continues to act as an economic moat for these types of Tickers AGK.LN / AGGK.L contracts. Forecasts: Following management’s Nov-20 strategic update, I forecast a recovery in underlying performance to take place in 2021. This is of course predicated on a Enterprise Value (mGBP) 2,679 gradual easing of COVID-19 lockdown restrictions throughout 2021, which is subject Market Cap (mGBP) 2,180 to the effectiveness of global vaccination roll-outs and government lockdown policies. Shares Outstanding (m) 256 My base case estimates a 8.2% growth in underlying revenue, net of pass-through fuel, for 2021 and further acceleration in 2022 as economic conditions continue Free Float (%) 99% normalise, specifically the events business. -

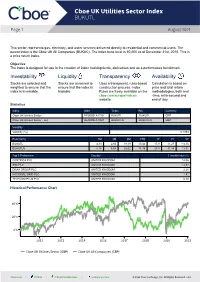

Cboe UK Utilities Sector Index BUKUTL

Cboe UK Utilities Sector Index BUKUTL Page 1 August 2021 Cboe Exchange This sector represents gas, electricity, and water services delivered directly to residential and commercial users. The parent index is the Cboe UK All Companies (BUKAC). The index base level is 10,000 as of December 31st, 2010. This is a price return index. Objective The index is designed for use in the creation of index tracking funds, derivatives and as a performance benchmark. Investability Liquidity Transparency Availability Stocks are selected and Stocks are screened to Uses a transparent, rules-based Calculation is based on weighted to ensure that the ensure that the index is construction process. Index price and total return index is investable. tradable. Rules are freely available on the methodologies, both real cboe.com/europe/indices -time, intra-second and website. end of day. Statistics Index ISIN Ticker RIC Currency Cboe UK Utilities Sector DE000SLA1730 BUKUTL .BUKUTL GBP Cboe UK Utilities Sector - net DE000SLA18M1 BUKUTLN .BUKUTLN GBP Volatility Volatility (1y) 0.1733 Returns(%) 1M 3M 6M YTD 1Y 3Y 5Y BUKUTL 4.13 2.66 18.19 10.42 17.9 11.27 -14.36 BUKUTLN 4.18 5.68 22.02 14.45 23.8 31.48 12.51 Top 5 Performers Country 1 month return % CENTRICA PLC UNITED KINGDOM 14.06 SSE PLC UNITED KINGDOM 12.64 DRAX GROUP PLC UNITED KINGDOM 2.28 NATIONAL GRID PLC UNITED KINGDOM 1.91 TELECOM PLUS PLC UNITED KINGDOM 0.39 Historical Performance Chart 40% 20% 0% 2011 2013 2014 2016 2017 2018 2020 2021 Cboe UK Utilities Sector (GBP) Cboe UK All Companies (GBP) Cboe.com | ©Cboe | /CboeGlobalMarkets | /company/cboe © 2021 Cboe Exchange, Inc. -

New Connections and Developer Services Charges Scheme 2019/2021 Page 1 of 64

New connections and developer services charges scheme 2019/2021 Page 1 of 64 Charges schemes United Utilities Water Limited has published four charges schemes for 2020/2021 charging year. They include the charges to be paid for services provided by us in the course of carrying out our function as a water and sewerage undertaker. Below are details of all the schemes published by us. This scheme is – New connections and developer services charges scheme This charges scheme sets out the charging policies and the charges for the year commencing 1 April 2020, for water supply and sewerage connections and developer services The others are Wholesale water charges scheme This charges scheme sets out the charging policies and the charges for the year commencing 1 April 2020 for wholesale water services Wholesale sewerage charges scheme This charges scheme sets out the charging policies and the charges for the year commencing 1 April 2020 for wholesale sewerage services Household charges scheme This charges scheme sets out the charging policies and the charges for the year commencing 1 April 2020, chargeable to household customers All of the charges schemes shown above, and our Charges statement for New Appointments & Variations are available to download from our website: unitedutilities.com New connections and developer services charges scheme 2020/2021 Page 2 of 93 United Utilities Water Limited – regional map New connections and developer services charges scheme 2020/2021 Page 3 of 93 Contents Scope of this charges scheme .......................................................................... -

United Utilities Group

UNITED UTILITIES GROUP PLC GROUP UTILITIES UNITED United Utilities Group PLC ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2019 MARCH 31 ENDED YEAR THE FOR STATEMENTS FINANCIAL AND REPORT ANNUAL Annual Report and Financial Statements for the year ended 31 March 2019 Cover photo: The cycle of our water and wastewater services, much of which are designed to use gravity to move the water naturally in the most efficient way United Utilities Strategic.indd 3 31/05/2019 18:48:32 Job Number 31 May 2019 6:47 pm Proof Number Job Number 31 May 2019 6:47 pm Proof Number Job Number 31 May 2019 6:47 pm Proof Number Cover photo: The cycle of our water and wastewater services, much of which are designed to use gravity to move the water naturally in the most efficient way Job Number 31 May 2019 6:47 pm Proof Number United Utilities Strategic.indd 4 31/05/2019 18:48:34 ww Contents Chairman and Chief Executive Officer’s review 0 4 2018/19 highlights 0 8 Strategic report What we do 1 2 Our purpose and strategy 1 5 Our marketplace 1 6 Our competitive advantages 1 7 Our economic regulation 1 8 Our business plan submission for 2020–25 1 9 Our business model 2 4 How we create value for stakeholders 3 9 Our planning horizons 4 8 How we measure our performance 5 1 Our performance in 2018/19 5 6 Our risk management 6 8 Governance Corporate governance report Board of directors 8 0 Letter from the Chairman 8 4 Nomination committee report 9 4 Audit committee report 1 0 3 Corporate responsibility committee report 1 1 2 Remuneration committee report -

DRAFT Protecting Shareholder and Natural Value

Protecting shareholder and natural value Biodiversity risk management: towards best practice for extractive and utility companies COVER PAGE WITH IMAGE BACKD HERERA OFTNCE DRAFT CONSOLIDATED 1 This report and the benchmark upon which it is based were designed and written by Annelisa Grigg, Director of the independent consultancy Global Balance, and by Kerry ten Kate, Director, Investor Responsibility, Insight Investment. Acknowledgements The analysis for this survey was greatly assisted by the collaboration of the companies benchmarked, in its design and in checking and supplementing the data used. We greatly appreciate their input and hope that this report and our engagement with them on the basis of their individual results will help them manage biodiversity risks and opportunities to the advantage of the company and of biodiversity. Many thanks also to Assheton Carter of Conservation International; Sally Johnson, Independent Consultant; Mike Kelly, KPMG and to Rachel Crossley, Craig MacKenzie and Rory Sullivan of Insight Investment for their comments on initial drafts of this report. The authors have made their best efforts to ensure the accuracy of the information contained in this report and apologise for any inadvertent errors. 2 Contents Executive summary 4 Section 1. Introduction 10 Section 2. Is biodiversity an issue for business? 11 Section 3. Methodology 14 Section 4. How Insight will use this report 15 Section 5. The benchmark results 16 Section 6. Conclusions and recommendations 35 Appendix 1: Methodology 43 Appendix 2: Benchmark