Annual Report 2004 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tele2 Is Europe´S Leading Alternative Telecom Operator Offering a Wide Range of Products to Consumers Across Europe

ERG Kista 25 January 2008 Response to ERGs draft Common Position on symmetry of fixed/mobile call termination rates Tele2 is Europe´s leading alternative telecom operator offering a wide range of products to consumers across Europe. Tele2´s most important products are mobile telephony and broadband but the company also provides fixed telephony in a number of countries. Tele2 welcomes the opportunity to provide its comments on ERGs draft Common Position (CP) on symmetry of fixed/mobile call termination rates. General As a general remark on the draft CP Tele2 would like to point to the fact that before the question of symmetry regarding termination rates becomes relevant and a potential issue a NRA first must come to the conclusion that at least two operators in a specific country are considered holding SMP-position on their individual networks. This is due to the fact that price regulation of any kind can only be decided as a remedy following a finding of SMP- position according to Article 13 of the Access directive. Court judgments across Europe (e.g. in the UK, Finland and Ireland) show that an SMP assessment is not a mechanical process where the fact that an operator per definition holds a 100 percent market share on the individual market at hand can be used as a sole argument for the conclusion that the operator also holds a SMP-position in the market. The existence of customers with a strong negotiating position, which is exercised to produce a significant impact on competition, will tend to restrict the ability of providers to act independently of their customers. -

Zero-Rating Practices in Broadband Markets

Zero-rating practices in broadband markets Report by Competition EUROPEAN COMMISSION Directorate-General for Competition E-mail: [email protected] European Commission B-1049 Brussels [Cataloguenumber] Zero-rating practices in broadband markets Final report February 2017 Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). LEGAL NOTICE The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. Les informations et opinions exprimées dans ce rapport sont ceux de(s) l'auteur(s) et ne reflètent pas nécessairement l'opinion officielle de la Commission. La Commission ne garantit pas l’exactitude des informations comprises dans ce rapport. La Commission, ainsi que toute personne agissant pour le compte de celle-ci, ne saurait en aucun cas être tenue responsable de l’utilisation des informations contenues dans ce rapport. More information on the European Union is available on the Internet (http://www.europa.eu). Luxembourg: Publications Office of the European Union, 2017 Catalogue number: KD-02-17-687-EN-N ISBN 978-92-79-69466-0 doi: 10.2763/002126 © European Union, 2017 Reproduction is authorised provided the source is acknowledged. -

Annual and Sustainability Report 2020 Content

BETTER CONNECTED LIVING ANNUAL AND SUSTAINABILITY REPORT 2020 CONTENT OUR COMPANY Telia Company at a glance ...................................................... 4 2020 in brief ............................................................................ 6 Comments from the Chair ..................................................... 10 Comments from the CEO ...................................................... 12 Trends and strategy ............................................................... 14 DIRECTORS' REPORT Group development .............................................................. 20 Country development ........................................................... 38 Sustainability ........................................................................ 48 Risks and uncertainties ......................................................... 80 CORPORATE GOVERNANCE Corporate Governance Statement ......................................... 90 Board of Directors .............................................................. 104 Group Executive Management ............................................ 106 FINANCIAL STATEMENTS Consolidated statements of comprehensive income ........... 108 Consolidated statements of financial position ..................... 109 Consolidated statements of cash flows ............................... 110 Consolidated statements of changes in equity .................... 111 Notes to consolidated financial statements ......................... 112 Parent company income statements ................................... -

Telenor ASA – EMTN Base Prospectus 28 June 2013

Base Prospectus Telenor ASA (incorporated as a limited company in the Kingdom of Norway) €7,500,000,000 Debt Issuance Programme Under the Debt Issuance Programme described in this Base Prospectus (the Programme), Telenor ASA (the Issuer or Telenor) may from time to time issue debt securities (the Notes). The aggregate nominal amount of Notes outstanding will not at any time exceed €7,500,000,000 (or the equivalent in other currencies), subject to compliance with all relevant laws, regulations and directives. Notes may be issued in bearer form only (Bearer Notes), in registered form only (Registered Notes) or in uncertificated book entry form cleared through the Norwegian Central Securities Depository, the Verdipapirsentralen (VPS Notes and the VPS respectively). An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see “Risk Factors”. This Base Prospectus comprises a base prospectus for the purposes of Article 5.4 of Directive 2003/71/EC (the Prospectus Directive) as amended (which includes the amendments made by Directive 2010/73/EU (the 2010 PD Amending Directive) to the extent that such amendments have been implemented in a relevant Member State of the European Economic Area), which is necessary to enable investors to make an informed assessment of the assets and liabilities, financial position, profit and losses of the Issuer. Application has been made to the Luxembourg Stock Exchange for the Notes issued under the Programme (other than VPS Notes) during the period of 12 months from the date of this Base Prospectus to be admitted to trading on the Luxembourg Stock Exchange’s regulated market and to be listed on the Official List of the Luxembourg Stock Exchange. -

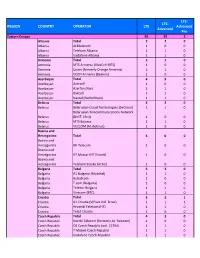

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

Liste a – Datterselskaber Under Telenor

Liste A – Datterselskaber under Telenor ASA Business Registration Owner Company name Country Number share Cinclus Technology AS 963 246 862 100,00% Norway Ci ncl us Technology AS 100,00% Sweden (Branch) Telenor Maritime AS (ex Maritime 985 173 710 98,93% Norway Communications Partner AS) Telenor Maritime Inc. (ex Maritime 260122158 100,00% USA Communications Partner Inc.) Telenor Broadcast 983 935 125 100,00% Norway Holding AS Canal Digital AS 977 273 633 100,00% Norway Canal Digital Danmark 13879842 100,00% Denmark A/S Canal Digital Finland OY 0900990-9 100,00% Finland Canal Digital Norge AS 936 653 820 69,70% Norway Canal Digital Sverige AB 556039-8306 100,00% Sweden Zona vi AS 982 739 845 100,00% Norway Canal Digital Norge AS 936 653 820 30,30% Norway Norkring AS 976 548 973 100,00% Norway Norkring België N.V. 0808.922.491 75,00% Belgium Premium Sports AS 989 656 430 100,00% Norway Telenor Satellite AS (ex Telenor Satellite 974 529 068 100,00% Norway Broadcasting AS) Telenor UK Ltd 03188910 100,00% England Telenor Business 984 400 993 100,00% Norway Partner Invest AS Telenor 983 793 754 100,00% Norway Communication II AS 701Search Pte Ltd 200613507R 33,33% Singapore 702 Search (Thailand) 62160303 33,33% Netherlands B.V. 703 Search (Indonesia) 62160400 31,50% Netherlands B.V. 1 Liste A – Datterselskaber under Telenor ASA Argos Takes Care of It 99,94% Marocco SA Doorstep AS 982 265 460 50,00% Norway Leiv Eiriksson 984 829 906 1,50% Norway Nys kapning AS Telenor Maritime AS (ex Maritime 985 173 710 1,07% Norway Communications Partner AS) Norvestor IV L.P 14,70% Guernsey Oter Invest AS 993 377 953 91,40% Norway Otrum AS 837 088 852 100,00% Norway Otrum Content 100,00% Germany Services GmbH Otrum Finland Oy 358201900600 100,00% Finland Otrum Svenska SE5566032127301 100,00% Sweden AB Otrum, filial af 33156804 100,00% Denmark Otrum Svenska AB Simula School of Res earch and 991 435 646 7,14% Norway Innovation AS Telenor Cloud Services AS (ex Telenor Business 998 027 292 100,00% Norway Internet Services AS) Tel enor Common 13-10-041370 100,00% Hungary Operation Zrt. -

International Media and Communication Statistics 2010

N O R D I C M E D I A T R E N D S 1 2 A Sampler of International Media and Communication Statistics 2010 Compiled by Sara Leckner & Ulrika Facht N O R D I C O M Nordic Media Trends 12 A Sampler of International Media and Communication Statistics 2010 COMPILED BY: Sara LECKNER and Ulrika FACHT The Nordic Ministers of Culture have made globalization one of their top priorities, unified in the strategy Creativity – the Nordic Response to Globalization. The aim is to create a more prosperous Nordic Region. This publication is part of this strategy. ISSN 1401-0410 ISBN 978-91-86523-15-2 PUBLISHED BY: NORDICOM University of Gothenburg P O Box 713 SE 405 30 GÖTEBORG Sweden EDITOR NORDIC MEDIA TRENDS: Ulla CARLSSON COVER BY: Roger PALMQVIST Contents Abbrevations 6 Foreword 7 Introduction 9 List of tables & figures 11 Internet in the world 19 ICT 21 The Internet market 22 Computers 32 Internet sites & hosts 33 Languages 36 Internet access 37 Internet use 38 Fixed & mobile telephony 51 Internet by region 63 Africa 65 North & South America 75 Asia & the Pacific 85 Europe 95 Commonwealth of Independent States – CIS 110 Middle East 113 Television in the world 119 The TV market 121 TV access & distribution 127 TV viewing 139 Television by region 143 Africa 145 North & South America 149 Asia & the Pacific 157 Europe 163 Middle East 189 Radio in the world 197 Channels 199 Digital radio 202 Revenues 203 Access 206 Listening 207 Newspapers in the world 211 Top ten titles 213 Language 214 Free dailes 215 Paid-for newspapers 217 Paid-for dailies 218 Revenues & costs 230 Reading 233 References 235 5 Abbreviations General terms . -

Telenor's Global Impact

Telenor’s Global Impact A Quantification of Telenor’s Impact on the Economy and Society Final KPMG Report 7 November 2016 Document Classification - KPMG Confidential Important notice This document has been prepared by KPMG United Kingdom Plc (“KPMG”) solely for Telenor ASA (“Telenor” or “Addressee”) in accordance with terms of engagement agreed between Telenor and KPMG. KPMG’s work for the Addressee was performed to meet specific terms of reference agreed between the Addressee and KPMG and that there were particular features determined for the purposes of the engagement. The document should not be regarded as suitable to be used or relied on by any other person or any other purpose. The document is issued to all parties on the basis that it is for information only. This document is not suitable to be relied on by any party wishing to acquire rights against KPMG (other than Telenor) for any purpose or in any context. Any party other than Telenor that obtains access to this document or a copy and chooses to rely on this document (or any part of it) does so at its own risk. To the fullest extent permitted by law, KPMG does not accept or assume any responsibility to any readers other than Telenor in respect of its work for Telenor, this document, or any judgements, conclusions, opinions, findings or recommendations that KPMG may have formed or made. KPMG does not assume any responsibility and will not accept any liability in respect of this document to any party other than Telenor. KPMG does not provide any assurance on the appropriateness or accuracy of sources of information relied upon and KPMG does not accept any responsibility for the underlying data used in this document. -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

Manufacturer's Code List Liste Des Codes De Fabricant Liste Der

4-170-687-11(1) English TV Brand Code No. Brand Code No. Brand Code No. Brand Code No. Brand Code No. City 00009 Grandin 00009, 00037, 00218, 00374, 00455, 01583, 00610, Marquant 02056 Profex 00009 Tatung 00037, 00072, 00516, 01248, 01324, 01556, 01720 The following tables show brand names (Brand) Téléviseur Clarivox 00037, 00070, 00418 00451, 00668, 00714, 00715, 00865, 00880, 01037, Mascom 01556 Profi 00009 TCL 01916 Code Fernsehgerät Classic 01308 01298 Mastec 01997 Profilo 01556 TCM 00714, 00808, 01289, 01308, 20001 and their corresponding code numbers ( Clatronic 00009, 00037, 00218, 00264, 00370, 00371, 00714, Grundig 00009, 00036, 00037, 00070, 00195, 00487, 01583, Master’s 01308 Profitronic 00037 Teac 00009, 00037, 00170, 01727, 00264, 00412, 00418, Tv 01324 00411, 00672, 01223, 01248, 01308, 01376, 01149, 00455, 00587, 00451, 00668, 00698, 00712, 00714, No.). 01869, 01916, 01935, 02007, 01531, 01037, 01687, Masuda 00009, 00037, 00218, 00264, 00371 Proline 00037, 00072, 00411, 00625, 00634, 01037, 01376, Clayton 01037 Materin 00858 01545, 01727, 02135 01037, 01149, 01363, 01687, 01755, 01812, 01985, Televisor 02200, 02239 02032, 02168 To set the manufacturer’s code, refer to the CME 01308 Grunkel 01149 Matsui 00009, 00035, 00036, 00037, 00072, 00195, 00208, Prosonic 00037, 00370, 00371, 00374, 00668, 00714, 01324, Televisor 01376, 01531, 01732, 01770, 01847, 01727, 02001, Tec 00009, 00037, 00335 Concorde 00009 GVA 01363 00235, 00335, 00355, 00371, 00455, 00487, 00516, Operating Instructions. 01583, 00714, 00744, 00880, 01037, -

Telenor ASA Fourth Quarter 2002 Content

Telenor ASA Fourth quarter 2002 Content FOURTH QUARTER 2002 Key points 1 Key figures 1 Key figures for the business areas 2 Mobile 3 Networks 6 Plus 6 Business Solutions 7 EDB Business Partner 8 Other business units 9 Corporate functions and group activities 9 Other profit and loss items for the group 9 Taxes 11 Balance sheet 11 US GAAP 11 Outlook for 2003 11 TABLES Profit and loss statement 12 Balance sheet 13 Shareholders equity 13 Cash flow statement 13 Analytical information 14 The business areas 16 Special items 17 Revenues; 2000–2002 Telenor group (NOK in millions) Q1 8,691 Q2 9,145 200020012002 Q3 9,463 Q4 10.273 Q1 10,001 Q2 10,055 Q3 10,064 Q4 15,920 Q1 11,563 Q2 12,011 Q3 12,210 Q4 13,042 0 5,000 10,000 15,000 20,000 Telenor ASA fourth quarter 2002 R KEY POINTS OF THE FOURTH QUARTER 2002 COMPARED TO rata share of total subscriptions including Norway was 12.4 million at THE FOURTH QUARTER 2001 the end of 2002. Telenor’s operations in Sweden were reorganised • 20% growth in revenues excluding gains, to NOK 13,002 million. during the quarter with the purchase of 90% of Utfors AB and 37.2% • EBITDA margin excluding gains and losses increased from 21.0% to of Glocalnet AB. For Business Solutions, the weak market for IT- 27.5%. EBITDA excluding gains and losses was NOK 3,571 million in related activities continues. In Plus, Broadcast shows a positive the fourth quarter 2002. -

Annual Report 2011 On

Annual Report 2 011 Visit our Annual Report 2011 on www.tele2.com! Read more about Tele2 2011 on http://reports.tele2.com/2011/ar. On our website www.tele2.com you always find the latest information. Here we publish our interim reports, our press releases and much more. You will also find links to our European operations. Highlights Full Year 2011 ¡ NET SALES GROWTH FOR THE GROUP aMOUNTED ¡ SIGNIFICanT OPEraTIOnaL PROGRESS IN MarKET TO 7 PERCENT EXCLUDING EXCHanGE raTE AREA CENTraL EUROPE & EUraSIA DIFFERENCES During the year, Tele2 Kazakhstan carried out its successful Net sales amounted to SEK 40,750 (40,164) million corre- launch of new regions and the total customer base amounted sponding to a growth excluding exchange rate difference and to 1,371,000 (332,000) at December 31, 2011. Tele2 Croatia one-off items of 7 percent in the year. EBITDA for the year 2011 reached for the first time free cash-flow breakeven in Q3 2011. amounted to SEK 10,852 (10,284) million, equivalent to an The Baltic countries drove cost cutting throughout the year, EBITDA margin of 27 (26) percent. EBITDA growth excluding thereby maintaining a firm EBITDA margin development. exchange rate differences was 10 percent. ¡ IMPROVED MarGIN DEVELOPMENT IN FIXED ¡ RECORD EBITDA CONTRIBUTION brOADbanD IN MarKET arEA WESTErn EUROPE IN MarKET arEA RUSSIA Tele2 Netherlands expanded its fixed broadband margin further In 2011, Tele2 Russia added 2,198,000 (3,987,000) customers to 33 (31) percent during 2011 thanks to scale benefits from the leading to a total customer base of 20.6 (18.4) million.