Potential: Geraldton Airport?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Residential Pilot Training Academy Development

RESIDENTIAL PILOT TRAINING ACADEMY DEVELOPMENT OPPORTUNITY | 2018 PREFACE Economic development of East and With strong consensus across the capital city of Western Australia, a 50 South East Asia, India and Africa has global aviation sector on the sustained minute airline flight away. seen rapid growth of International and demand for new pilots for the next The City of Greater Geraldton invites National airline services. two decades, clear opportunity exists financiers, international carriers, and Boeing estimate that in the period for development and commercial operators of major pilot training schools, 2017-2036 the global aviation sector operation of new airline pilot training to consider Geraldton as an ideal site for will require an additional 637,000 airline academies. development of a globally significant pilots, of which 253,000 will be required A major pilot training academy requires pilot training academy. in the Asia-Pacific Region. use of an airport with uncongested skies, air space free from military Mayor Shane Van Styn The need for pilots (plus aircraft support CITY OF GREATER GERALDTON engineers and technicians, and cabin airspace restrictions, an all-year flying crew) to support the anticipated growth climate, and a stable, safe environment. in aviation comes at the same time as Located on the west coast of Australia, the emergence of newer aircraft types Geraldton Airport meets those essential with new technologies and enhanced needs. mission capabilities, replacing existing Servicing a regional city with 40,000 types, requiring training and type population, the airport hosts regular certification for current airline captains public transport services by Qantas and first officers. -

Review of Regulated Regular Public Transport Air Routes in Western Australia Final Public Report 2015 MINISTER’S FOREWORD

Department of Transport Review of Regulated Regular Public Transport Air Routes in Western Australia Final Public Report 2015 MINISTER’S FOREWORD Aviation services are important for Western Australia’s social and economic wellbeing. The State Government’s key objective is to ensure the community has Regular Public Transport (RPT) intrastate air services that are safe, affordable, efficient and effective. The inaugural Western Australian State Aviation Strategy, endorsed by the State Government in February 2015, supports the vision to maintain and develop quality air services that are essential to regional and remote communities in WA (DoT, 2015). The State Government’s position is to take a months, receiving a total of 43 submissions from light‑handed approach to the regulation of air various stakeholder groups, including airlines, routes where feasible. Less regulation of air routes local governments, state government agencies, fosters opportunities for competition that may the resource industry, and peak tourism and result in reduced airfares, increased diversity in business bodies, as well as from members of air services and more choice for travellers, as well the general public. In addition, there has been as reducing ‘red tape’. However, the State has significant engagement with stakeholders and an obligation to balance this perspective with the communities through ongoing regional Aviation need to maintain marginal air services for regional Community Consultation Group meetings. and remote towns within WA. The submissions and consultations have This Final Report on intrastate services builds assisted the State Government to form a final upon the position paper released for public recommendation for the future of each of the eight comment as part of the Review of Regulated reviewed routes. -

Engine Failure Involving Fokker 100, VH-FWI, 41 Km South East of Geraldton Airport, Western Australia on 9 July 2019

Engine failure involving Fokker 100, VH-FWI 41 km south-east of Geraldton Airport, Western Australia on 9 July 2019 ATSB Transport Safety Report Aviation Occurrence Investigation (Defined) AO-2019-033 Final – 4 February 2021 Cover photo: Copyright ® TommyNg (Planespotters.net) Released in accordance with section 25 of the Transport Safety Investigation Act 2003 Publishing information Published by: Australian Transport Safety Bureau Postal address: PO Box 967, Civic Square ACT 2608 Office: 62 Northbourne Avenue Canberra, ACT 2601 Telephone: 1800 020 616, from overseas +61 2 6257 2463 Accident and incident notification: 1800 011 034 (24 hours) Email: [email protected] Website: www.atsb.gov.au © Commonwealth of Australia 2021 Ownership of intellectual property rights in this publication Unless otherwise noted, copyright (and any other intellectual property rights, if any) in this publication is owned by the Commonwealth of Australia. Creative Commons licence With the exception of the Coat of Arms, ATSB logo, and photos and graphics in which a third party holds copyright, this publication is licensed under a Creative Commons Attribution 3.0 Australia licence. Creative Commons Attribution 3.0 Australia Licence is a standard form licence agreement that allows you to copy, distribute, transmit and adapt this publication provided that you attribute the work. The ATSB’s preference is that you attribute this publication (and any material sourced from it) using the following wording: Source: Australian Transport Safety Bureau Copyright in material obtained from other agencies, private individuals or organisations, belongs to those agencies, individuals or organisations. Where you want to use their material you will need to contact them directly. -

Mid West REGIONAL BLUEPRINT

Mid West REGIONAL BLUEPRINT A 2050 growth and development strategy for an intergenerational, global, innovative and dynamic Mid West region that attracts and retains talent and investment AUGUST 2015 |(!" 02(! p SHIRE OF MURCHISON !( " S Barrel Well H I R E MID WEST REGIONAL BLUEPRINT SHIRE OF NORTHAMPTON O OF CAPRICORN F TROPIC Y D A Robertson Range )"# Lake Disappointment L AN G SHIRE OF L O O (! CHAPMAN VALLEY !( ED NORTHAMPTON H " Wandanooka T R A PO SHBU MULLEWA (! RTO RIVER Chapman N O Solar Farm T Oakajee|" !" E |" T U CITY 0F O "'A Narngulu Attapulgite R |"(! GERALDTON GREATER GERALDTON Y p)"H Narngulu Synthetic Rutile A FF F Greenwood River COLLIER RANGE W )"F Geraldton Brick !" H Solar Farm NATIONAL PARK G Alinta Wind Farm !" " Bundy Bunna I H Mumbida Wind Farm !" SHIRE OF (! Thaduna Mount Horner MINGENEW SHIRE OF MORAWA '! K æ C Næ 4 " O ß Koolanooka ËN" T Yardarino !( !( p )"# S æ MINGENEW (! # " " 4 MORAWA ) Dongara æ Ë" (! " 4 æ | Centauri 1 G DONGARA Ë" !" Koolanooka South ASCO Lake Burnside p æ æ Xyris, Xyris South YNE æ æ " Sandfire - VER 4 I " " R 4 4 '! " | " æ 4 4 (! | Ë" (! Hovea æË"ææ Ë" ?! Sandfire - Degrussa " Ë" Ë" 4 | æ " Degrussa 4 | ?! Ë" æ Apium Jingemia Ë" G § ?! Eremia Grosvenor IN HIGHWAY # # Evandra # Plutonic )" Dongara - Irwin HMS ?! N EL æ !( Degrussa - NBARR " U æ Tarantula Nææ4 p Peak Hill G " " " Three Springs 4 Ë æ 4 AN æ | N Beharra Springs North Great Western Cliff Head Ë" Ëæ" 4 " Beharra Springs PERENJORI G C SHIRE OF WILUNA Ë" "' o !( T " THREE SPRINGS "' Mt Seabrook Yulga Jinna ld T fi e SHIRE -

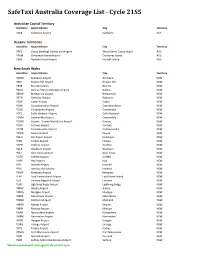

Safetaxi Australia Coverage List - Cycle 21S5

SafeTaxi Australia Coverage List - Cycle 21S5 Australian Capital Territory Identifier Airport Name City Territory YSCB Canberra Airport Canberra ACT Oceanic Territories Identifier Airport Name City Territory YPCC Cocos (Keeling) Islands Intl Airport West Island, Cocos Island AUS YPXM Christmas Island Airport Christmas Island AUS YSNF Norfolk Island Airport Norfolk Island AUS New South Wales Identifier Airport Name City Territory YARM Armidale Airport Armidale NSW YBHI Broken Hill Airport Broken Hill NSW YBKE Bourke Airport Bourke NSW YBNA Ballina / Byron Gateway Airport Ballina NSW YBRW Brewarrina Airport Brewarrina NSW YBTH Bathurst Airport Bathurst NSW YCBA Cobar Airport Cobar NSW YCBB Coonabarabran Airport Coonabarabran NSW YCDO Condobolin Airport Condobolin NSW YCFS Coffs Harbour Airport Coffs Harbour NSW YCNM Coonamble Airport Coonamble NSW YCOM Cooma - Snowy Mountains Airport Cooma NSW YCOR Corowa Airport Corowa NSW YCTM Cootamundra Airport Cootamundra NSW YCWR Cowra Airport Cowra NSW YDLQ Deniliquin Airport Deniliquin NSW YFBS Forbes Airport Forbes NSW YGFN Grafton Airport Grafton NSW YGLB Goulburn Airport Goulburn NSW YGLI Glen Innes Airport Glen Innes NSW YGTH Griffith Airport Griffith NSW YHAY Hay Airport Hay NSW YIVL Inverell Airport Inverell NSW YIVO Ivanhoe Aerodrome Ivanhoe NSW YKMP Kempsey Airport Kempsey NSW YLHI Lord Howe Island Airport Lord Howe Island NSW YLIS Lismore Regional Airport Lismore NSW YLRD Lightning Ridge Airport Lightning Ridge NSW YMAY Albury Airport Albury NSW YMDG Mudgee Airport Mudgee NSW YMER Merimbula -

Improving the Accuracy of Hourly Satellite-Derived Solar Irradiance by Combining with Dynamically Downscaled Estimates Using Generalised Additive Models ⇑ Robert J

Solar Energy 135 (2016) 854–863 Contents lists available at ScienceDirect Solar Energy journal homepage: www.elsevier.com/locate/solener Improving the accuracy of hourly satellite-derived solar irradiance by combining with dynamically downscaled estimates using generalised additive models ⇑ Robert J. Davy , Jing R. Huang, Alberto Troccoli CSIRO Oceans and Atmosphere, GPO Box 3023, Canberra, ACT 2601, Australia article info abstract Article history: The gridded hourly solar irradiance derived from satellite imagery by the Australian Bureau of Received 10 September 2015 Meteorology represents the current state of the art in quantification of the long-term solar resource Received in revised form 14 June 2016 for locations where no ground measurements are available. Using nonparametric regression, we test Accepted 20 June 2016 the potential for the satellite-derived global horizontal irradiance and direct normal irradiance to be Available online 1 July 2016 improved by combining with irradiance that has been dynamically downscaled using a numerical weather prediction (NWP) model. NWP irradiance, together with the satellite irradiance, solar zenith Keywords: angle and their interaction terms are used as inputs to generalised additive models (GAM) using smooth- Clear sky index ing splines. The spatial weighting of these empirical models according to distance is also tested. Cross val- DNI GHI idation with ground measurements indicates that RMSE can be improved by a few percent over the Insolation satellite-derived irradiance. The addition of dynamically downscaled irradiance as a GAM predictor fur- ther improves RMSE by a few percent, depending on location. When these empirical models are weighted spatially over large distances (hundreds of kilometres), the results are more equivocal. -

G Ger Ral Ldt Ton N Air Rpo Ort T

GERALDTON AIRPORT MASTER PLAN To 2030 (Update: February 2015) CITY OF GREATER GERALDTON, WESTERN AUSTRALIA Geraldton Airport Master Plan 2012‐2030 [Version 2.1: February 2015] 1 Contents Master Plan Technical Amendments .................................................................................................. 5 EXECUTIVE SUMMARY ............................................................................................................................ 6 INTRODUCTION .................................................................................................................................. 8 City of Greater Geraldton ................................................................................................................... 8 Stakeholder & Community Consultation ............................................................................................ 8 State Aviation Strategy ....................................................................................................................... 9 AIRPORT DESCRIPTION ................................................................................................................ 11 Infrastructure Investments 2012‐2014 ............................................................................................. 15 Air Transport Operations .................................................................................................................. 16 Runways ........................................................................................................................................... -

WA Aviation Strategy 2020 DRAFT DRAFT

DRAFT WA Aviation Strategy 2020 DRAFT DRAFT Minister’s Foreword Access to affordable airfares is central to the liveability of our regional towns. Regional air services help reduce isolation, are essential to health services, and play a key role in supporting economic development and job creation in the regions. The Hon. Rita Saffioti MLA Minsiter for Transport Western Australia’s isolation and sheer distances Aviation has, and will continue to play a key make aviation an integral part of our State’s role in our State’s prosperity. Efficient and economic and social wellbeing. affordable air services are crucial not only to the community but also to the tourism and This draft WA Aviation Strategy 2020 (the resources sectors that rely on air services to Strategy) is a blueprint for advancing aviation in get in and out of Perth. Western Australia and sets out a practical policy approach for the aviation industry in WA into the Aviation in WA operates in a complex future. The McGowan Government came into environment involving airlines, airports, industry, office with a commitment to address community community and all levels of government. At concerns about high regional airfares, and this a State Government level, our policies and Strategy delivers on that commitment. regulatory environment need to foster airfares that are affordable to those who rely on Access to affordable airfares is central to the them, and we need to ensure that our airport liveability of our regional towns. Regional air infrastructure is fit for purpose and continues to services help reduce isolation, are essential support future growth in the aviation industry. -

G Ger Ral Ldt Ton N Air Rpo Ort T

GERALDTON AIRPORT MASTER PLAN To 2030 (Update: February 2016) CITY OF GREATER GERALDTON, WESTERN AUSTRALIA Geraldton Airport Master Plan 2012‐2030 [Version 2.2: February 2016] 1 Contents Master Plan Technical Amendments .................................................................................................. 5 EXECUTIVE SUMMARY ............................................................................................................................ 6 INTRODUCTION .................................................................................................................................. 8 City of Greater Geraldton ................................................................................................................... 8 Stakeholder & Community Consultation ............................................................................................ 8 AIRPORT DESCRIPTION ................................................................................................................ 10 Infrastructure Investments 2012‐2016 ............................................................................................. 14 Air Transport Operations .................................................................................................................. 16 Runways ............................................................................................................................................ 16 Main Runway 03/21 ..................................................................................................................... -

Ordinary Meeting of Council Minutes 27 November 2012

ORDINARY MEETING OF COUNCIL MINUTES 27 NOVEMBER 2012 ORDINARY MEETING OF COUNCIL MINUTES 27 NOVEMBER 2012 TABLE OF CONTENTS 1 ACKNOWLEDGEMENT OF COUNTRY .............................................................................. 3 2 DECLARATION OF OPENING ............................................................................................... 3 3 ATTENDANCE ........................................................................................................................... 3 4 RESPONSE TO PREVIOUS PUBLIC QUESTIONS TAKEN ON NOTICE ....................... 4 5 PUBLIC QUESTION TIME ...................................................................................................... 5 6 APPLICATIONS FOR LEAVE OF ABSENCE .................................................................... 12 7 PETITIONS, DEPUTATIONS OR PRESENTATIONS ....................................................... 12 8 DECLARATIONS OF CONFLICTS OF INTEREST .......................................................... 12 9 CONFIRMATION OF MINUTES OF PREVIOUS COUNCIL MEETING – AS CIRCULATED .......................................................................................................................... 12 10 ANNOUNCEMENTS BY THE CHAIR (WITHOUT DISCUSSION) ................................. 13 11 SIGNIFICANT STRATEGIC MATTERS ............................................................................. 14 TF033 ADOPTION OF GERALDTON AIRPORT MASTER PLAN ...................................... 14 SC069 PROPOSED LOCAL PLANNING SCHEME AMENDMENT – DEVELOPMENT -

Section 20: Background and Existing Airspace

New Runway Project PRELIMINARY DRAFT MAJOR DEVELOPMENT PLAN VOLUME C: AIRSPACE MANAGEMENT PLAN SECTIONS 19-26 MAY 2018 19 Airspace Management Plan Introduction New Runway Project | Volume C: Airspace Management Plan 15 20 Background and Existing Airspace Management 16 New Runway Project | Preliminary Draft Major Development Plan May 2018 20 Background and Existing Airspace Management 20Background and Existing Airspace Management This section provides background information to assist in understanding why aircraft fly where they do. Detail is also provided on the following areas: • How does weather affect airport operations? • What are air traffic control operating procedures? • How are flight paths designed? New Runway Project | Volume C: Airspace Management Plan 17 20 Background and Existing Airspace Management London Dubai Hong Kong Singapore access opportunity choice more cheaper more airlines airfares destinations more seats due to more compe- more options for available tition all travellers PERTH 20.1 Introduction 20.2 Airport International services are the lifeblood of the State’s international The New Runway Project (NRP) Operating Hours tourism industry and the comprises the construction of a new Perth Airport operates 24 hours, employment it supports. A reduced runway up to 3,000 metres long seven days a week, providing an level of international air services parallel to the existing main runway essential link for business and leisure that would arise from restrictions on (03L/21R). travel, and meeting the needs of: Perth Airport would therefore have • regional communities and the This section provides background profound impacts on tourism and all resource sector, information on considerations those who depend on that industry. -

City of Greater Geraldton

PRODUCTIVITY COMMISSION: ECONOMIC REGULATION OF AIRPORT SERVICES DRAFT INQUIRY REPORT AUGUST 2011 SUBMISSION BY CITY OF GREATER GERALDTON 23 September 2011 Submission To: Productivity Commission Locked Bag 2, Collins Street East Melbourne VIC 8003 Email: [email protected] City of Greater Geraldton 1 Contents 1. Executive Summary ......................................................................................................................... 4 1.1 Key points in this submission: ................................................................................................. 4 1.2 Further Studies of Regional Airports ....................................................................................... 6 2. Introduction .................................................................................................................................... 7 3. Background: Geraldton Airport ...................................................................................................... 7 4. City Acquisition of Additional Land for Airport Needs .................................................................. 10 5. The WA Intra‐State Air Services Context & Geraldton ................................................................. 11 5.1 Geraldton Change from Regulated to De‐regulated RPT Airport ......................................... 11 5.2 How is this relevant to the Commission’s work? .................................................................. 13 5.3 What did being a State‐Regulated Airport Mean? ..............................................................