Amtrak Fleet Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

40Thanniv Ersary

Spring 2011 • $7 95 FSharing tihe exr periencste of Fastest railways past and present & rsary nive 40th An Things Were Not the Same after May 1, 1971 by George E. Kanary D-Day for Amtrak 5We certainly did not see Turboliners in regular service in Chicago before Amtrak. This train is In mid April, 1971, I was returning from headed for St. Louis in August 1977. —All photos by the author except as noted Seattle, Washington on my favorite train to the Pacific Northwest, the NORTH back into freight service or retire. The what I considered to be an inauspicious COAST LIMITED. For nearly 70 years, friendly stewardess-nurses would find other beginning to the new service. Even the the flagship train of the Northern Pacific employment. The locomotives and cars new name, AMTRAK, was a disappoint - RR, one of the oldest named trains in the would go into the AMTRAK fleet and be ment to me, since I preferred the classier country, had closely followed the route of dispersed country wide, some even winding sounding RAILPAX, which was eliminat - the Lewis and Clark Expedition of 1804, up running on the other side of the river on ed at nearly the last moment. and was definitely the super scenic way to the Milwaukee Road to the Twin Cities. In addition, wasn’t AMTRAK really Seattle and Portland. My first association That was only one example of the serv - being brought into existence to eliminate with the North Coast Limited dated to ices that would be lost with the advent of the passenger train in America? Didn’t 1948, when I took my first long distance AMTRAK on May 1, 1971. -

The Signal Bridge

THE SIGNAL BRIDGE Volume 18 NEWSLETTER OF THE MOUNTAIN EMPIRE MODEL RAILROADERS CLUB Number 5B MAY 2011 BONUS PAGES Published for the Education and Information of Its Membership NORFOLK & WESTERN/SOUTHERN RAILWAY DEPOT BRISTOL TENNESSEE/VIRGINIA CLUB OFFICERS LOCATION HOURS President: Secretary: Newsletter Editor: ETSU Campus, Business Meetings are held the Fred Alsop Donald Ramey Ted Bleck-Doran: George L. Carter 3rd Tuesday of each month. Railroad Museum Meetings start at 7:00 PM at Vice-President: Treasurer: Webmaster: ETSU Campus, Johnson City, TN. John Carter Duane Swank John Edwards Brown Hall Science Bldg, Room 312, Open House for viewing every Saturday from 10:00 am until 3:00 pm. Work Nights each Thursday from 5:00 pm until ?? APRIL 2011 THE SIGNAL BRIDGE Page 2 APRIL 2011 THE SIGNAL BRIDGE Page 3 APRIL 2011 THE SIGNAL BRIDGE II scheme. The "stripe" style paint schemes would be used on AMTRAK PAINT SCHEMES Amtrak for many more years. From Wikipedia, the free encyclopedia Phase II Amtrak paint schemes or "Phases" (referred to by Amtrak), are a series of livery applied to the outside of their rolling stock in the United States. The livery phases appeared as different designs, with a majority using a red, white, and blue (the colors of the American flag) format, except for promotional trains, state partnership routes, and the Acela "splotches" phase. The first Amtrak Phases started to emerge around 1972, shortly after Amtrak's formation. Phase paint schemes Phase I F40PH in Phase II Livery Phase II was one of the first paint schemes of Amtrak to use entirely the "stripe" style. -

Northeast Corridor Chase, Maryland January 4, 1987

PB88-916301 NATIONAL TRANSPORT SAFETY BOARD WASHINGTON, D.C. 20594 RAILROAD ACCIDENT REPORT REAR-END COLLISION OF AMTRAK PASSENGER TRAIN 94, THE COLONIAL AND CONSOLIDATED RAIL CORPORATION FREIGHT TRAIN ENS-121, ON THE NORTHEAST CORRIDOR CHASE, MARYLAND JANUARY 4, 1987 NTSB/RAR-88/01 UNITED STATES GOVERNMENT TECHNICAL REPORT DOCUMENTATION PAGE 1. Report No. 2.Government Accession No. 3.Recipient's Catalog No. NTSB/RAR-88/01 . PB88-916301 Title and Subtitle Railroad Accident Report^ 5-Report Date Rear-end Collision of'*Amtrak Passenger Train 949 the January 25, 1988 Colonial and Consolidated Rail Corporation Freight -Performing Organization Train ENS-121, on the Northeast Corridor, Code Chase, Maryland, January 4, 1987 -Performing Organization 7. "Author(s) ~~ Report No. Performing Organization Name and Address 10.Work Unit No. National Transportation Safety Board Bureau of Accident Investigation .Contract or Grant No. Washington, D.C. 20594 k3-Type of Report and Period Covered 12.Sponsoring Agency Name and Address Iroad Accident Report lanuary 4, 1987 NATIONAL TRANSPORTATION SAFETY BOARD Washington, D. C. 20594 1*+.Sponsoring Agency Code 15-Supplementary Notes 16 Abstract About 1:16 p.m., eastern standard time, on January 4, 1987, northbound Conrail train ENS -121 departed Bay View yard at Baltimore, Mary1 and, on track 1. The train consisted of three diesel-electric freight locomotive units, all under power and manned by an engineer and a brakeman. Almost simultaneously, northbound Amtrak train 94 departed Pennsylvania Station in Baltimore. Train 94 consisted of two electric locomotive units, nine coaches, and three food service cars. In addition to an engineer, conductor, and three assistant conductors, there were seven Amtrak service employees and about 660 passengers on the train. -

Amtrak SMP 28603 Mechanical Standards for Operating Privately

Amtrak Equipment Maintenance Department Standard Maintenance Procedure SMP NO.: 28603 ISSUE DATE: January 12, 1982 REVISION DATE: September 13, 2013 TITLE: Mechanical Standard for Operating Privately Owned Cars in Amtrak Trains EQUIPMENT TYPE MAINTENANCE TYPE All Passenger Trains L – Locomotive Locomotives Cars C – Cars All Locomotives All Cars X All Types C All Maintenance – L/C Acela HST Power Car Acela Baggage Daily – L/C AEM-7 Amfleet I Cafe 30 Day – C Cab Car: (Under Cars) Amfleet II Coach Quarterly –L/C Car Movers Auto Carrier Diner Semi-Annual – L/C Commuter Commuter Dinette Annual – L/C F59PHI Freight Lounge 720 Day – L GP38-3 Heritage HEP Sleeper COT&S – C GP15D Horizon Other: Initial Terminal – L/C HHP8 Material Handling Cars Intermediate Terminal – L/C MP15 X Private Cars Modification – L/C Non Powered Control Units Superliner I Overhaul – L/C P32-8 Superliner II Running Repair – L/C P32AC-DM Surfliner Seasonal – C P-40 Talgo Wheels – L/C P-42 Turboliner Facility SW1001 Viewliner Other: SW1200 X Other: Railroad Business Cars SW1500 Turboliner Talgo Other: 1.0 PURPOSE This document describes the Amtrak Mechanical Department requirements for the handling in Amtrak trains of privately owned passenger cars, as well as railroad-owned business cars of freight carriers which have an Amtrak operating agreement. For the purpose of this document, a passenger car is defined as a vehicle meeting Association of American Railroads (AAR) or American Public Transportation Association Standard S-034 for the construction of passenger equipment cars, or similar standard for older cars, for operation in passenger train service, and does not include caboose cars, freight cars, or maintenance of way equipment. -

Senate Hearings Before the Committee on Appropriations

S. HRG. 111–983 Senate Hearings Before the Committee on Appropriations Departments of Transportation and Housing and Urban Development and Related Agencies Appropriations Fiscal Year 2011 111th CONGRESS, SECOND SESSION H.R. 5850/S. 3644 DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT DEPARTMENT OF TRANSPORTATION NATIONAL RAILROAD PASSENGER CORPORATION (AMTRAK) NONDEPARTMENTAL WITNESSES WASHINGTON METROPOLITAN AREA TRANSIT AUTHORITY Departments of Transportation and Housing and Urban Development, and Related Agencies Appropriations, 2011 (H.R. 5850/S. 3644) S. HRG. 111–983 TRANSPORTATION AND HOUSING AND URBAN DEVELOPMENT, AND RELATED AGENCIES AP- PROPRIATIONS FOR FISCAL YEAR 2011 HEARINGS BEFORE A SUBCOMMITTEE OF THE COMMITTEE ON APPROPRIATIONS UNITED STATES SENATE ONE HUNDRED ELEVENTH CONGRESS SECOND SESSION ON H.R. 5850/S. 3644 AN ACT MAKING APPROPRIATIONS FOR THE DEPARTMENTS OF TRANS- PORTATION AND HOUSING AND URBAN DEVELOPMENT, AND RE- LATED AGENCIES FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2011, AND FOR OTHER PURPOSES Department of Housing and Urban Development Department of Transportation National Railroad Passenger Corporation (Amtrak) Nondepartmental witnesses Washington Metropolitan Area Transit Authority Printed for the use of the Committee on Appropriations ( Available via the World Wide Web: http://www.gpo.gov/fdsys U.S. GOVERNMENT PRINTING OFFICE 54–989 PDF WASHINGTON : 2011 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 COMMITTEE ON APPROPRIATIONS DANIEL K. INOUYE, Hawaii, Chairman ROBERT C. BYRD, West Virginia THAD COCHRAN, Mississippi PATRICK J. LEAHY, Vermont CHRISTOPHER S. BOND, Missouri TOM HARKIN, Iowa MITCH MCCONNELL, Kentucky BARBARA A. -

Bilevel Rail Car - Wikipedia

Bilevel rail car - Wikipedia https://en.wikipedia.org/wiki/Bilevel_rail_car Bilevel rail car The bilevel car (American English) or double-decker train (British English and Canadian English) is a type of rail car that has two levels of passenger accommodation, as opposed to one, increasing passenger capacity (in example cases of up to 57% per car).[1] In some countries such vehicles are commonly referred to as dostos, derived from the German Doppelstockwagen. The use of double-decker carriages, where feasible, can resolve capacity problems on a railway, avoiding other options which have an associated infrastructure cost such as longer trains (which require longer station Double-deck rail car operated by Agence métropolitaine de transport platforms), more trains per hour (which the signalling or safety in Montreal, Quebec, Canada. The requirements may not allow) or adding extra tracks besides the existing Lucien-L'Allier station is in the back line. ground. Bilevel trains are claimed to be more energy efficient,[2] and may have a lower operating cost per passenger.[3] A bilevel car may carry about twice as many as a normal car, without requiring double the weight to pull or material to build. However, a bilevel train may take longer to exchange passengers at each station, since more people will enter and exit from each car. The increased dwell time makes them most popular on long-distance routes which make fewer stops (and may be popular with passengers for offering a better view).[1] Bilevel cars may not be usable in countries or older railway systems with Bombardier double-deck rail cars in low loading gauges. -

Colorado Railcar's DMU Brochure

ColoradoColorado RailcarRailcar NewNew DMUDMU Meets the FRA’s newest CFR part 238 specifications Member of APTA’S Built in the USA Colorado Railcar All New Single Level Aero DMU Colorado Railcar’s All New Glass Domed Aero-DMU Proposed For The Alaska Railroad Powered By Twin 600 Horse Power Detroit Diesels With Voith Hydrodynamic Transmissions Meets The FRA’s Newest CFR Part 238 Specifications 2 Colorado Railcar The New, Highly Evolved DMU is Winning Acceptance The DMUs (Diesel Multiple Unit) concept has always been a winner. Today, we are seeing a revival of the RDC/DMUs of the 50’s albeit in a sleeker, safer, environmentally friendlier and more powerful form. And DMUs are garnering favor now for the very same reasons they were popular then; cost advantages, operational flexibility, and reliability. Colorado Railcar, a high-end custom railcar manufacturer, has developed the first and only DMU meeting all FRA, APTA, ADA and AMTRAK requirements. As moderate volume, inter-city, suburban and rural commuter services become more important, the DMU emerges as the most promising solution. Outperforming locomotive hauled consists in flexibility, acceleration, and deceleration, DMUs provide a favorable cost/benefit ratio that is starting to be recognized nationwide. Colorado Railcar’s FRA approved steel tube construction, state-of-the-art engine/drive train and freight compatible structure make it suitable for mixed use with existing freight rail, often a crucial factor in developing cost effective service. Please review the following material on Colorado Railcar’s new DMU that is changing the way America looks at inter-city and suburban commuter rail. -

Appendix 6-B: Chronology of Amtrak Service in Wisconsin

Appendix 6-B: Chronology of Amtrak Service in Wisconsin May 1971: As part of its inaugural system, Amtrak operates five daily round trips in the Chicago- Milwaukee corridor over the Milwaukee Road main line. Four of these round trips are trains running exclusively between Chicago’s Union Station and Milwaukee’s Station, with an intermediate stop in Glenview, IL. The fifth round trip is the Chicago-Milwaukee segment of Amtrak’s long-distance train to the West Coast via St. Paul, northern North Dakota (e.g. Minot), northern Montana (e.g. Glacier National Park) and Spokane. Amtrak Route Train Name(s) Train Frequency Intermediate Station Stops Serving Wisconsin (Round Trips) Chicago-Milwaukee Unnamed 4 daily Glenview Chicago-Seattle Empire Builder 1 daily Glenview, Milwaukee, Columbus, Portage, Wisconsin Dells, Tomah, La Crosse, Winona, Red Wing, Minneapolis June 1971: Amtrak maintains five daily round trips in the Chicago-Milwaukee corridor and adds tri- weekly service from Chicago to Seattle via St. Paul, southern North Dakota (e.g. Bismark), southern Montana (e.g. Bozeman and Missoula) and Spokane. Amtrak Route Train Name(s) Train Frequency Intermediate Station Stops Serving Wisconsin (Round Trips) Chicago-Milwaukee Unnamed 4 daily Glenview Chicago-Seattle Empire Builder 1 daily Glenview, Milwaukee, Columbus, Portage, Wisconsin Dells, Tomah, La Crosse, Winona, Red Wing, Minneapolis Chicago-Seattle North Coast Tri-weekly Glenview, Milwaukee, Columbus, Portage, Wisconsin Hiawatha Dells, Tomah, La Crosse, Winona, Red Wing, Minneapolis 6B-1 November 1971: Daily round trip service in the Chicago-Milwaukee corridor is increased from five to seven as Amtrak adds service from Milwaukee to St. -

All Aboard Indiana October 2018

ALL INDIANA ABOARD The Official Newsletter of the Volume 5, Number 10 October 2018 IN THIS ISSUE: Nickel Plate Express—A New Page Three Central Indiana Excursion Train An Amtrak Trip to Virginia’s Shenandoah National Park By Dagny Zupin, Communications Coordinator, Nickel Plate Express Please come aboard Indiana’s newest passenger rail service! Operating from Atlanta, Indiana, the Page Four Nickel Plate Express provides excursions on 12.6 miles of the historic Nickel Plate Road. Update from Save the Nickel Plate What is Nickel Plate Express? The Nickel Plate Express provides year-round excursions based in Hamilton County. They are a Page Five non-profit managed by parent company Nickel Plate Heritage Railroad. In addition to operating Commentary: Indianapolis excursions, the organization manages a 150-year-old train depot in Arcadia, IN. The depot serves Complicity on Rail as an interactive humanities museum that pays homage to the history of Hamilton County. Nickel Abandonment Reveals a Void Plate Heritage Railroad handles marketing and programming for the Nickel Plate Express, while in Regional Transit Leadership partner organization Atlanta Pacific Railroad provides operational assistance. Page Six Mission: Nickel Plate Heritage Railroad will provide a moving entertainment and education experi- Train, Vehicle Collision ence for all generations Results in Fatality on US 12, County Line Road Atlanta Pacific Railroad, LLC. Atlanta Pacific Railroad, LLC. operates rail service for the Nickel Plate Express. Atlanta Pacific is Page Seven owned by long-time railroad operator, Tom Hoback. Hoback is well known for his ownership and Lafayette Amtrak Station— management of Indiana Rail- Updates road, one of the most successful Bullets from the Board regional railroads in the country. -

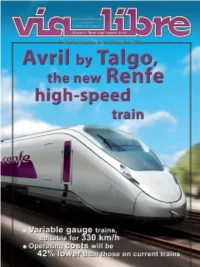

Avril by Talgo. the New Renfe High-Speed Train

Report - New high-speed train Avril by Talgo: Renfe’s new high-speed, variable gauge train On 28 November the Minister of Pub- Renfe Viajeros has awarded Talgo the tender for the sup- lic Works, Íñigo de la Serna, officially -an ply and maintenance over 30 years of fifteen high-speed trains at a cost of €22.5 million for each composition and nounced the award of a tender for the Ra maintenance cost of €2.49 per kilometre travelled. supply of fifteen new high-speed trains to This involves a total amount of €786.47 million, which represents a 28% reduction on the tender price Patentes Talgo for an overall price, includ- and includes entire lifecycle, with secondary mainte- nance activities being reserved for Renfe Integria work- ing maintenance for thirty years, of €786.5 shops. The trains will make it possible to cope with grow- million. ing demand for high-speed services, which has increased by 60% since 2013, as well as the new lines currently under construction that will expand the network in the coming and Asfa Digital signalling systems, with ten of them years and also the process of Passenger service liberaliza- having the French TVM signalling system. The trains will tion that will entail new demands for operators from 2020. be able to run at a maximum speed of 330 km/h. The new Avril (expected to be classified as Renfe The trains Class 106 or Renfe Class 122) will be interoperable, light- weight units - the lightest on the market with 30% less The new Avril trains will be twelve car units, three mass than a standard train - and 25% more energy-effi- of them being business class, eight tourist class cars and cient than the previous high-speed series. -

Transportation: Request for Passenger Rail Bonding -- Agenda Item II

Legislative Fiscal Bureau One East Main, Suite 301 • Madison, WI 53703 • (608) 266-3847 • Fax: (608) 267-6873 Email: [email protected] • Website: http://legis.wisconsin.gov/lfb October 31, 2019 TO: Members Joint Committee on Finance FROM: Bob Lang, Director SUBJECT: Department of Transportation: Request for Passenger Rail Bonding -- Agenda Item II REQUEST On October 3, 2019, the Department of Transportation (DOT) submitted a request under s. 85.061 (3)(b) of the statutes for approval to use $13,248,100 BR in GPR-supported, general obligation bonding from DOT's passenger rail route development appropriation to fund the required state match for a recently awarded Federal Railroad Administration (FRA) grant for the purchase of six single-level coach cars and three cab-coach cars to be placed into service in the Milwaukee- Chicago Hiawatha corridor. BACKGROUND DOT is required to administer a rail passenger route development program funded from a transportation fund continuing appropriation (SEG) and a general fund-supported, general obligation bonding appropriation (BR). From these sources, DOT may fund capital costs related to Amtrak service extension routes (the Hiawatha service, for example) or other rail service routes between the cities of Milwaukee and Madison, Milwaukee and Green Bay, Milwaukee and Chicago, Madison and Eau Claire, and Madison and La Crosse. Under the program, DOT is not allowed to use any bond proceeds unless the Joint Finance Committee (JFC) approves the use of the proceeds and, with respect to any allowed passenger route development project, the Department submits evidence to JFC that Amtrak, or the applicable railroad, has agreed to provide rail passenger service on that route. -

Effect of Vehicle Performance at High Speed and High Cant Deficiency

Proceedings of the ASME/ASCE/IEEE 2011 Joint Rail Conference JRC2011 March 16-18, 2011, Pueblo, Colorado, USA JRC2011-56066 EXAMINATION OF VEHICLE PERFORMANCE AT HIGH SPEED AND HIGH CANT DEFICIENCY Brian Marquis Jon LeBlanc U.S. Department of Transportation, Research and U.S. Department of Transportation, Research and Innovative Technology Administration, Volpe Innovative Technology Administration, Volpe National Transportation Systems Center National Transportation Systems Center Cambridge, Massachusetts, United States Cambridge, Massachusetts, United States Ali Tajaddini U.S. Department of Transportation, Federal Rail Road Administration, Office of Research and Development, Washington D.C., United States ABSTRACT The research for this paper was part of work done for the FRA In the US, increasing passenger speeds to improve trip time to support the FRA Railroad Safety Advisory Committee usually involves increasing speeds through curves. Increasing (RSAC) Track Working Group’s Vehicle Track Interaction speeds through curves will increase the lateral force exerted on (VTI) Task Force. The mission of the VTI task force was to track during curving, thus requiring more intensive track update Parts 213 and 238 of the Code of Federal Regulations maintenance to maintain safety. These issues and other (CFR) regarding rules for high speed (above 90mph) and high performance requirements including ride quality and vehicle cant deficiency (about 5 inches) operations. The task force stability, can be addressed through careful truck design. focused on a number of issues including refinement of VTI Existing high-speed rail equipment, and in particular their safety criteria, track geometry standards, vehicle qualification bogies, are better suited to track conditions in Europe or Japan, procedures and requirements and track inspection in which premium tracks with little curvature are dedicated for requirements, all with a focus on treating the vehicle and track high-speed service.