CTBUH Research Paper Title: Towards Post-Crisis Tall Buildings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

22 Bishopsgate London EC2N 4BQ Construction of A

Committee: Date: Planning and Transportation 28 February 2017 Subject: Public 22 Bishopsgate London EC2N 4BQ Construction of a building arranged on three basement floors, ground and 58 upper floors plus mezzanines and plant comprising floorspace for use within Classes A and B1 of the Use Classes Order and a publicly accessible viewing gallery and facilities (sui generis); hard and soft landscaping works; the provision of ancillary servicing and other works incidental to the development. (201,449sq.m. GEA) Ward: Lime Street For Decision Registered No: 16/01150/FULEIA Registered on: 24 November 2016 Conservation Area: St Helen's Place Listed Building: No Summary The planning application relates to the site of the 62 storey tower (294.94m AOD) granted planning permission in June 2016 and which is presently being constructed. The current scheme is for a tower comprising 59 storeys at ground and above (272.32m AOD) with an amended design to the top. The tapering of the upper storeys previously approved has been omitted and replaced by a flat topped lower tower. In other respects the design of the elevations remains as before. The applicants advise that the lowering of the tower in the new proposal is in response to construction management constraints in relation to aviation safeguarding issues. The planning application also incorporates amendments to the base of the building, the public realm and to cycle space provision which were proposed in a S73 amendment application and which your Committee resolved to grant on 28 November 2016, subject to a legal agreement but not yet issued. The building would provide offices, retail at ground level, a viewing gallery with free public access at levels 55 and 56 and a public restaurant and bar at levels 57 and 58. -

Title: the Future of Workplace in Vertical Cities: Hanging Gardens, Roof Terraces and Vertical Plazas Author: Stephan Reinke, Di

ctbuh.org/papers Title: The Future of Workplace in Vertical Cities: Hanging Gardens, Roof Terraces and Vertical Plazas Author: Stephan Reinke, Director, Stephan Reinke Architects Limited Subjects: Occupancy/Lifestyle/User Experience Social Issues Vertical Transportation Keywords: Green Walls Public Space Sky Garden Vertical Urbanism Workplace Publication Date: 2020 Original Publication: International Journal of High-Rise Buildings Volume 9 Number 1 Paper Type: 1. Book chapter/Part chapter 2. Journal paper 3. Conference proceeding 4. Unpublished conference paper 5. Magazine article 6. Unpublished © Council on Tall Buildings and Urban Habitat / Stephan Reinke International Journal of High-Rise Buildings International Journal of March 2020, Vol 9, No 1, 71-79 High-Rise Buildings https://doi.org/10.21022/IJHRB.2020.9.1.71 www.ctbuh-korea.org/ijhrb/index.php The Future of Workplace in Vertical Cities: Hanging Gardens, Roof Terraces and Vertical Plazas Stephan C. Reinke FAIA RIBA Director, Stephan Reinke Architects Level 02, 28 Margaret Street, London W1W 8RZ Abstract As the workplace evolves in our vertical cities, the need for “think spaces” and the public realm to meet, create and innovate will become integral to tall buildings. These people places are designed to address the social challenges and enhance the co- working environments which are emerging in the dense urban context of our future cities. The design of sky terraces and the “spaces between” offer a greener, more humane and smarter work environment for the future. The public realm should no longer be held down, fixed to the ground plane, but rather become part and parcel of the upper levels of our workplace centers. -

Unconventional & Pioneering A.K.A. London

UNCONVENTIONAL & PIONEERING A.K.A. LONDON Much like Ziggy Stardust ( A.K.A. D av i d Bowie) this ground breaking London landmark has many alter egos... From an iconic part of the City skyline to one of the most future focused addresses in which to locate a forward thinking business. IT’S TIME TO LOOK AT 30 ST. MARY AXE FROM A WHOLE NEW ANGLE. With options ranging from approx. 5,162 to 41,828 sq ft of world class, office space across 3 spectacular floors, this is also known as your next move. 007 A.K.A. James bond A NATIONAL TREASURE WITH STYLE AND MAGNITUDE The available office floors in this suave building offer dramatic Grade A specification workspaces that make a real statement. A.K.A. THE Gherkin 22 BISHOPSGATE THE LEADENHALL BUILDING SALESFORCE TOWER A.K.A. THE GHERKIN 52 Lime Street 100 BISHOPSGATE The Willis Building 70 St Mary Axe AN ICONIC PART OF THE LONDON CITY SKYLINE A.K.A. THE ULTIMATE COMPANY Imagine positioning your business as part of the London Skyline at an address that everybody knows. 30 St. Mary Axe is your opportunity to join a thriving and diverse community of game changers. Unrivalled WORKSPACE INSPIRING VIEWS AND ALL THE ON-SITE AMENITIES YOU CAN DREAM OF. AS SOME MIGHT SAY, A MORE ENERGISED AND PRODUCTIVE WORKFORCE. Reception CGI double height space Reception CGI available office floor Rum & Coke A.K.A. C u b a L i b r e A new twist on an old favourite Historically known as the Insurance District, the immediate area has since become a magnet for a more eclectic range of sectors, from technology to education and media to finance. -

Experts in Central London Planning & Development

EXPERTS IN CENTRAL LONDON PLANNING & DEVELOPMENT PLANNING & DEVELOPMENT Gerald Eve’s planning and development advisory business is one of the most respected in the UK. Consisting of over 100 professionals, we are one of the only fully integrated planning and development teams in our industry. The vast majority of the team are based in central London, working on some of the capital’s largest and most complex projects. Active in all London Acted for Advised all major central boroughs and the London developers and City of London REITS, including British Land, Derwent London, 50% Great Portland Estates, of London First's property Landsec and Stanhope and housing members We act for all the major London million estates, including The Bedford 15 sq ft £12.5 billion Estates, Capital & Counties Covent Garden, The Church of commercial gross development Commissioners, City of London, floorspace approved value The Crown Estate, Grosvenor Britain & Ireland, The Howard de Walden Estate, The Portman Estate, and Soho Estates 2 EXPERTS IN CENTRAL LONDON PLANNING & DEVELOPMENT OUR CENTRAL LONDON CLIENTS OUR CENTRAL LONDON CLIENTS 3 YOUR INTELLIGENT ADVISOR Gerald Eve is recognised among the UK’s leading experts in planning and development. Our clients look to us to help them realise or improve asset value. One of the largest fully integrated planning and development teams in the sector Deep understanding of the entire planning system Harnessing imaginative strategies and a tenacious approach to optimise outcomes Agile, flexible and adaptable to changing -

Central London Development Pipeline Q2 2017

Central London Development Pipeline Q2 2017 Development Completions - As at Q2 2017, there is 9.45m sq ft of available space under construction across Central London. 1.32 million sq ft of office space completed in Q2 2017, adding 710,000 sq ft of available office space to the market. - For future 2017 development completions, 49% of the space is prelet, rising to 55% for 2018. - 10% of space has been prelet for 2019 completions, the low figure being largely the result of the commencement of 22 Bishopsgate adding 1.275m sq ft of availability to the market. - Total take-up by prelets in Q2 2017 equalled 520,000 sq ft, 17 % of total take-up in the quarter. The largest prelet of the quarter was to WeWork at Two Southbank Place, taking 280,000 sq ft. In the third largest letting of the quarter, NEX took 120,000 sq ft at London Fruit & Wool Exchange. Development Pipeline - Completion Year Oversite developments 7,000,000 at Crossrail stations are 6,000,000 projected to begin 5,000,000 construction following 4,000,000 ticket office completion. Sq Ft 3,000,000 The oversite 2,000,000 developments are 1,000,000 projected to complete in 0 2020. 2017 2018 2019 2020 Available Office Sq Ft (NIA) Let Office Sq Ft (NIA) - The most active market is City Core with 7.98m sq ft of proposed office space under construction. City Fringe, Midtown and West End have 1.74m, 2.47m, & 1.70m sq ft of space under construction respectively. - The market with the highest percentage of prelets is Southbank with only 19% of under construction space still available. -

7390 the London Gazette, 14 November, 1933

7390 THE LONDON GAZETTE, 14 NOVEMBER, 1933 and is hereby appointed liquidator for the pur- Meeting was resumed at 4 p.m., when the follow- pose of such winding-tip." ing Extraordinary Resolution was submitted and At a subsequent Meeting of creditors of the passed unanimously: — above named Company, duly convened, and held " That it has been proved to the satisfaction on the same day at 27, Portland Terrace, of this Meeting that the Company cannot, by Southampton, the creditors confirmed the appoint- reason of its liabilities continue its business, and ment of Mr. Edward Beal as Liquidator of the that it is advisable to wind up the same, and Company in the voluntary winding-up.—Dated accordingly that tihe Company be wound up the 8th day of November, 1933. voluntarily; and that Mr. Harry William Buck- (072) ERNEST T. SPENCE, Chairman. ingham and Mr. Alfred Charles Surrey, be and are hereby appointed Joint Liquidators for the purpose of such winding-up." (105) K. F. BRUMFIT, Chairman, LONDON PETROL CO. Ltd. T an Extraordinary General Meeting of the A Members of the above named Company, duly convened, and held at 39, Victoria Street, J. W. ROBINSON Limited. London, S.W.I, on Tuesday, the 7th November, The Companies Act, 1929. 1933, the following Extraordinary Resolution was T an Extraordinary General Meeting of the duly passed: — A Members of the above named Company, duly " That the Company cannot, by reason of its convened, and held at the offices of J. H. Milner liabilities, continue its business, and that it is & Son, Solicitors, Albion Walk Chambers, Leeds, advisable to wind up the same, and that the in the county of York, on the 8th day of Novem- Company be wound up voluntarily; and that Mr. -

![[Jll] Version 01: 25 11 2020 a Guide to the Art](https://docslib.b-cdn.net/cover/9186/jll-version-01-25-11-2020-a-guide-to-the-art-999186.webp)

[Jll] Version 01: 25 11 2020 a Guide to the Art

22 ART GUIDE [JLL] VERSION 01: 25 11 2020 A GUIDE TO THE ART We have consciously designed 22 Bishopsgate to bring culture and colour into the everyday, working alongside The Contemporary Art Society, Maison Parisienne and a few other renowned creatives, to bring our space to life. These artists sat down to tell us a little more us about what’s on display, and their inspiration for each commission. 22 BISHOPSGATE — Culture Guide 2 OUR ART FOLIAGE INSTALLATIONS KARINE LAVAL https://www.instagram.com/ karinelaval/?hl=en Thanks to Karine’s artwork, much of the Lobby is transformed into an indoor garden. Three storeys tall and filled with imagery of plants, flowers and foliage, the pieces create an immersive ‘organic’ installation in the heart of the City. It was important to her that each installation evoked a sense of light and shadow, creating shifting ‘colourscapes’ as the light changed and played across the walls. The works were made to create a space that brought the outside in, allowing ABOVE: visitors and occupiers to reconnect Karine Laval, with nature, recharge and reflect. Heterotopia 2020 22 BISHOPSGATE — Culture Guide 3 OUR ART LOBBY TAPESTRIES RYAN MOSLEY https://www.instagram.com/ ryanmosley01/?hl=en Ryan has developed a series of 10 artworks for the Lobby. Part wall hangings, part collaged tapestries, the works address 22 Bishopsgate as a place of sanctuary. The artist’s starting point is the blanket. Each blanket features a human figure and is to be viewed like a stage curtain with a changing ‘cast‘ entering around it. Ryan is internationally regarded as a painter, so this commission is a new direction in his practice, as he begins working with textiles. -

Avoid a Void 17

Avoid How landlords are responding to the a void serviced offices boom Glossary Cat A SMEs IFRS 16 Headline Rent A traditional landlord Small and Medium sized IASB standards with (per sq ft) finished product including: Enterprises, businesses an effective date from The rental payment paid raised floors, suspended with fewer than 250 1 January 2019. This under the terms of the ceilings (unless offering employees. requires all leases to be lease following expiry of exposed services), lighting, registered on a company’s the rent free period. fire detection services, Serviced offices balance sheet. heating, ventilation and An alternative to the Net Effective Rent air conditioning to the traditional office lease, SDLT (per sq ft) standardised building with desks/office space Stamp Duty Land Tax The average annual rental planning grid and offered by the operator on is payable on the lease payment over the term of occupancy density. licences for terms typically purchase price and on the the lease adjusted for the from 3 months to 3+ years. value of annual rent. rent free period. Cat B There are various models A usually tenant- available and they are FF&E Wayleave commissioned fit-out of sometimes also known as Loose furniture, fittings A legal agreement that office space, to meet the flexi-space or co-working and equipment. Excludes gives a utility service occupier’s requirements, and generally include a fixed office furniture provider the right to including: kitchen and range of office services included in Cat B costs and install, maintain and amenity space, meeting either included as standard IT, audio visual (AV) and recover infrastructure rooms, fixed furniture, and / or as an optional telecoms equipment. -

Hiscox Ltd Report and Accounts 2020

Hiscox Ltd Report and Accounts 2020 Ownership Passionate, commercial and accountable. Ownership means making it your business.. Why ownership is so important to us Taking ownership means making it your business. It means being passionate, curious and restless, always looking for a better way of doing things. We strive to be the kind of people who take responsibility, are ambitious, accountable, pragmatic, tenacious and proudly high-achieving. In a growing business like ours, taking initiative is something we expect of everyone, regardless of their role. It shows itself in a willingness to speak up, to confront problems, to avoid easy excuses, and to embrace hard work. These are qualities we have always valued and nurtured. But in 2020, Covid-19 meant that instinct to step up and take ownership was more vital than ever before. It is in difficult times that our values are tested, but it is also in difficult times that they prove the greatest guide. Throughout this report, you will find some examples of how we showed ownership in 2020. Hiscox is a diversified international insurance group with a powerful brand, strong balance sheet and plenty of room to grow. We are headquartered in Bermuda, listed on the London Stock Exchange, and currently have over 3,000 staff across 14 countries and 35 offices. Our products and services reach every continent, and we are one of the only insurers to offer everything from small business and home insurance to reinsurance and insurance-linked securities. Chapter 1: Chapter 2: Chapter 3: Chapter 4: A balanced -

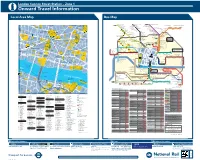

London Cannon Street Station – Zone 1 I Onward Travel Information Local Area Map Bus Map

London Cannon Street Station – Zone 1 i Onward Travel Information Local Area Map Bus Map Palmers Green North Circular Road Friern Barnet Halliwick Park 149 S GRESHAM STREET 17 EDMONTON R 141 1111 Guildhall 32 Edmonton Green 65 Moorgate 12 A Liverpool Street St. Ethelburga’s Centre Wood Green I 43 Colney Hatch Lane Art Gallery R Dutch WALTHAMSTOW F for Reconcilation HACKNEY 10 Church E Upper Edmonton Angel Corner 16 N C A R E Y L A N E St. Lawrence 17 D I and Peace Muswell Hill Broadway Wood Green 33 R Mayor’s 3 T 55 ST. HELEN’S PLACE for Silver Street 4 A T K ING S ’S ARMS YARD Y Tower 42 Shopping City ANGEL COURT 15 T Jewry next WOOD Hackney Downs U Walthamstow E E & City 3 A S 6 A Highgate Bruce Grove RE 29 Guildhall U Amhurst Road Lea Bridge Central T of London O 1 E GUTTER LANE S H Turnpike Lane N St. Margaret G N D A Court Archway T 30 G E Tottenham Town Hall Hackney Central 6 R O L E S H GREEN TOTTENHAM E A M COLEMAN STREET K O S T 95 Lothbury 35 Clapton Leyton 48 R E R E E T O 26 123 S 36 for Whittington Hospital W E LOTHBURY R 42 T T 3 T T GREAT Seven Sisters Lea Bridge Baker’s Arms S T R E E St. Helen S S P ST. HELEN’S Mare Street Well Street O N G O T O T Harringay Green Lanes F L R D S M 28 60 5 O E 10 Roundabout I T H S T K 33 G M Bishopsgate 30 R E E T L R O E South Tottenham for London Fields I 17 H R O 17 Upper Holloway 44 T T T M 25 St. -

Tall Buildings URBAN DESIGN GROUP URBAN

Summer 2016 Urban Design Group Journal 13UR 9 BAN ISSN 1750 712X DESIGN TALL BUILDINGS URBAN DESIGN GROUP URBAN DESIGN GROUP NewsUDG NEWS more than this, with people being seen col- Nottingham and Bristol respectively. VIEW FROM THE lectively because of their ‘social values and Noha Nasser and the awards panel CHAIR responsibilities’. As urban designers we are for• continuing to grow the Urban Design members of a community. We share similar Awards. values and take on the duty of improving the Ben van Bruggen and Amanda Reynolds quality of life for people who live and work for• their ongoing stewardship of the Recog- in cities, towns and villages. nised Practitioner scheme. This is the last View from the Chair that I will I would like to use this last article to Barry Sellers for providing oral evidence write for Urban Design and it gives me an thank people within the Urban Design Group on• the Urban Design Group's behalf at the opportunity to reflect on the last two years community for continuing to strive to raise House of Lords' Built Environment Select of my tenure. The time has flown by! the standards in urban design practice. Lack Committee. At last March’s National Urban Design of space precludes me from mentioning The various regional conveners of events, Awards I pondered with Graham Smith, a everyone but the list includes the following particularly• Paul Reynolds and Philip Cave former lecturer at Oxford Brookes Universi- members of the community: in London; Peter Frankum in Southampton; ty, the use of the word ‘community’ for new Robert Huxford and Kathleen Lucey for Mark Foster and Hannah Harkis in Manches- developments. -

Car Free Day Map-Lores

E C C E J R O N H O PLA H A H NBU M A N T I GHW WELL L RY A Q TR S S S EET E UNDLE TREET T USE S S ARDEN R L A G R S E 43 E S I E S Steps T L H N 78 127-131 T L A EECH OOR T U RHOU Steps S H P L E K B T Project IGHW T 35 L Y R FARRIN GDORHO NR N N STRE CROWN ARDE L The Charterhouse F A Shakespeare M E C A L I S H S E X C H A N G E G Whitechapel O Gallery ’ KNO C O 1 201 E T The R X 67 T Old A S S QUA R E E R TON ARTE A Square School Tower M 2 125 102 ALK L I T T N Barbican L 1 K A TON WODEHAM R H 42 33 Steps Steps 1 I T T Y S T R E E T T S T REE R Farringdon URY 1 E D PRINC ELET B U K F Rookery C S C O 15 A N P EECH 37 S N N 20 T B Lift U 125 STRE E T H M R PRINCEL ET IRBY F T EET T 104 Steps E 32 GARDE R 34 STR E E 26 Bishops Spitalfields S H Steps M O I Cowcross Street E T T E 56 Barbican NSB E E D Centre C 5 E W L E A FOE HITE 30 N Lauderdale I C E T R V R OW R O S S S T R E T P L E Square K 73 S Y R F C C LA S A T 8 Guildhall School of A R Brady Arts & L E C I LK O CKINGTON ST 36 OSS S S H N N E P P PUM E S I A ALDER A CO 85 Tower Defoe S E Market U R T T 1 U PL L P M T I 60 O Barbican Library TREET A E 3 E A L H I 29 C E L AUDERDAL E Music & Drama - E Community A 93 K W R E R R NDSEY House N S T N L E T E S 6 P L ACE R R EET Brick Lane EET T N L S H 29 to 35 90 F S R S R T PEE 2 D ’ T 25 G L A Milton Court M Centre R R ULBO E C D C 89 H REE CLOTH Steps H S 95 A S C Steps Steps Y Jamme Masjid G Barbican I G T W E A 84 A R OURT E S H R ILSO A TREE NHITL L W E R E U A E 87 A ALK E L D KESIDE TER N O N N U 39 T ST S T Finsbury CL U 176