Bill of Sale

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Operator's Story Case Study: Guangzhou's Story

Railway and Transport Strategy Centre The Operator’s Story Case Study: Guangzhou’s Story © World Bank / Imperial College London Property of the World Bank and the RTSC at Imperial College London Community of Metros CoMET The Operator’s Story: Notes from Guangzhou Case Study Interviews February 2017 Purpose The purpose of this document is to provide a permanent record for the researchers of what was said by people interviewed for ‘The Operator’s Story’ in Guangzhou, China. These notes are based upon 3 meetings on the 11th March 2016. This document will ultimately form an appendix to the final report for ‘The Operator’s Story’ piece. Although the findings have been arranged and structured by Imperial College London, they remain a collation of thoughts and statements from interviewees, and continue to be the opinions of those interviewed, rather than of Imperial College London. Prefacing the notes is a summary of Imperial College’s key findings based on comments made, which will be drawn out further in the final report for ‘The Operator’s Story’. Method This content is a collation in note form of views expressed in the interviews that were conducted for this study. This mini case study does not attempt to provide a comprehensive picture of Guangzhou Metropolitan Corporation (GMC), but rather focuses on specific topics of interest to The Operators’ Story project. The research team thank GMC and its staff for their kind participation in this project. Comments are not attributed to specific individuals, as agreed with the interviewees and GMC. List of interviewees Meetings include the following GMC members: Mr. -

Hotel Information Madrid 2013 Rev2-1

CALPUFF / ODORS Training Course - Hotel Information Madrid, Spain October 22 - 25, 2013 ____________________________________________________________________________________ Olores.Org will hold a four-day specialist modeling training course on CALPUFF and ODORS on Tuesday October 22 to Friday, October 25, 2013. The course will be run from 8:30 a.m. to 5:30 p.m. each day. Lunch for each day is included in the course fee, as are morning and afternoon tea breaks which will include drinks and snacks. The course will be held at the training institute, MSL Formación in the city of Madrid at: MSL Formación Marqués de Ahumada 5 28028 Madrid Website: http://www.mslformacion.es/ Local contacts in Madrid: Hotels close to the training centre in (Marqu és de Ahumada Street) from Nearby Hotels ♠♠♠ Address €/day NH Parque Avenidas 4 48 Biarritz 2 AC Hotel Avenida de América – 4 61-80 Cartagena 83-85 Marriot Abba Madrid 4 45 Avenida América 32 VP El Madroño 4 49 General Díaz Porlier 101 Silken Puerta de América GL 5 100-160 Avenida de América 41 Directions and Transport Information The Madrid international airport is called Madrid-Barajas Airport (MAD) . Barajas is the name of the small town nearby. From the Madrid-Barajas Airport to the town centre you can come by Metro (3-4€ approx.) or by bus arriving to Avenida de América (1.30€ approx.). Taxi cab fares from Barajas Airport to Madrid centre is about 20-25€. (1€ ~ $1.30 USD). 1 International travelers may also fly to other larger Spanish airports (Malaga, Sevilla or Barcelona El Prat) and then arrive in Madrid by train. -

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

OF MUMBAI METRO RAIL PROJECT of MMRDA. Invitation for Bids(IFB)

MUMBAI METROPOLITAN REGION DEVELOPMENT AUTHORITY CONTRACT NO: MMRDA/7/MMRP/CA-17 DESIGN VERIFICATION, SUPPLY, INSTALLATION, TESTING AND COMMISSIONING OF E&M, FIRE DETECTION AND FIRE SUPPRESSION SYSTEMS INCLUDING DG SETS OF 13 ELEVATED STATIONS (ANDHERI EAST TO OVARIPADA) OF LINE 7 (ANDHERI EAST TO DAHISAR EAST) OF MUMBAI METRO RAIL PROJECT OF MMRDA. Invitation for Bids(IFB) MUMBAI METROPOLITAN REGION DEVELOPMENT AUTHORITY Metro PIU, 1st Floor, A-wing, Old Administrative Building, Bandra-Kurla Complex, Bandra (E), Mumbai –400 051, India Invitation for Bids 1-1 Invitation for Bids (IFB) Date: Loan/ Grant No. and Title: Contract No. and Title: MMRDA/7/MMRP/CA-17: DESIGN VERIFICATION, SUPPLY, INSTALLATION, TESTING AND COMMISSIONING OF E&M, FIRE DETECTION AND FIRE SUPPRESSION SYSTEMS INCLUDING DG SETS OF 13 ELEVATED STATIONS (ANDHERI EAST TO OVARIPADA) OF LINE 7 (ANDHERI EAST TO DAHISAR EAST) OF MUMBAI METRO RAIL PROJECT OF MMRDA. 1.0 Deadline for Submission of Bids: 1. The MMRDA has received financing from the New Development Bank (NDB) towards the cost of “DESIGN VERIFICATION, SUPPLY, INSTALLATION, TESTING AND COMMISSIONING OF E&M, FIRE DETECTION AND FIRE SUPPRESSION SYSTEMS INCLUDING DG SETS OF 13 ELEVATED STATIONS (ANDHERI EAST TO OVARIPADA) OF LINE 7 (ANDHERI EAST TO DAHISAR EAST) OF MUMBAI METRO RAIL PROJECT OF MMRDA.” Part of this financing will be used for payments under the Contract named above. The Mumbai Metropolitan Region Development Authority (MMRDA) (“the Employer”) invites bid from eligible Bidders for the same work. 2. Key details: Approximate cost of work INR 56.06 crore Completion period of the Work 14 (Fourteen) Months From 15.06.2018 to 30.07.2018 (up to 1200 hrs) on e-tendering portal of MMRDA. -

Download 3.94 MB

Environmental Monitoring Report Semiannual Report (March–August 2019) Project Number: 49469-007 Loan Number: 3775 February 2021 India: Mumbai Metro Rail Systems Project Mumbai Metro Rail Line-2B Prepared by Mumbai Metropolitan Development Region, Mumbai for the Government of India and the Asian Development Bank. This environmental monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. ABBREVATION ADB - Asian Development Bank ADF - Asian Development Fund CSC - construction supervision consultant AIDS - Acquired Immune Deficiency Syndrome EA - execution agency EIA - environmental impact assessment EARF - environmental assessment and review framework EMP - environmental management plan EMR - environmental Monitoring Report ESMS - environmental and social management system GPR - Ground Penetrating Radar GRM - Grievance Redressal Mechanism IEE - initial environmental examination MMRDA - Mumbai Metropolitan Region Development Authority MML - Mumbai Metro Line PAM - project administration manual SHE - Safety Health & Environment Management Plan SPS - Safeguard Policy Statement WEIGHTS AND MEASURES km - Kilometer -

Mumbai Metro Rail Systems Project

Report and Recommendation of the President to the Board of Directors Project Number: 49469-007 January 2019 Proposed Loan India: Mumbai Metro Rail Systems Project This is the version of the document approved by ADB’s Board of Directors that excludes information that is subject to exceptions to disclosure set forth in ADB’s Access to Information Policy. CURRENCY EQUIVALENTS (as of 11 January 2019) Currency unit – rupee (₹) ₹1.00 = $0.0141895295 $1.00 = ₹70.474500 ABBREVIATIONS ADB – Asian Development Bank CAG – comptroller and auditor general CTS – comprehensive transport study DMRC – Delhi Metro Rail Corporation EIRR – economic internal rate of return GESI – gender equality and social inclusion JICA – Japan International Cooperation Agency km – kilometer MMR – Mumbai Metropolitan Region MMRDA – Mumbai Metropolitan Region Development Authority O&M − operation and maintenance PAM – project administration manual NOTES (i) The fiscal year (FY) of the Government of India and its agencies ends on 31 March. “FY” before a calendar year denotes the year in which the fiscal year ends, e.g., FY2018 ends on 31 March 2018. (ii) In this report, “$” refers to United States dollars. Vice-President Shixin Chen, Operations 1 Director General Hun Kim, South Asia Department (SARD) Director Ravi Peri, Transport and Communications Division, SARD Team leader Sharad Saxena, Principal Transport Specialist, SARD Team members Cynthia Gutierrez, Associate Project Analyst, SARD Prabhjot Khan, Social Development Officer (Gender), SARD Ma. Laureen Laurito, Senior Social -

Africa 2016 Latin America 2016 Latin America 2015-2016

In 2016 a large catch-up* in infrastructure investments is being confirmed by several Latin American countries, driven by the knowledge that economic growth relies heavily on quality infrastructure. The transport sector is going to firmly benefit from the expected increase in public and private funds. The continent being one of the most urbanized regions in the world, a large focus goes into urban rail projects: Mexico, Guatemala, Paraguay, Colombia, Chile, Brazil… are planning new projects for metro, light rail, high speed rail, monorail and passenger trains. One country is clearly taking the lead: Argentina. Besides boosting its investment climate and PPP laws, Argentina made public the ambitious 8-year 14.187 m USD investment in Buenos Aires` commuter network. Related key projects are the city`s RER and tunneling of the Sarmiento line. The Latin America Passenger Rail Expansion Summit will bring together local and international stakeholders, government officials, operators, developers, architects, consultants and equipment plus solution providers to discuss the current rail sector. *300.000 m USD is what Latam should be investing annually, versus the 150.000 m USD spent annually on infrastructure in the previous 20 years. http://latinamerica.railexpansionsummit.com OUTLOOK SOME OF THE TO BE INVITED DELEGATES Argentina foresees 14187 m USD ANPTrilhos INCOFER, Costa Rica Ministerio de Transporte y Comunicaciones, Peru 14187 investment in AFE Uruguay VLT Carioca Consortium Directorio de Transporte Público Metropolitano, Chile suburban network. FEPASA Paraguay Metro de Santiago, Chile Subterráneos de Buenos Aires SE (SBASE) CPTM São Paulo ANTT Brazil Gobierno Autónomo Municipal Santa Cruz Bolivia STM São Paulo ProInversión Peru Transporte Metropolitano de Barcelona New Rolling stock wagons in use in Metro Rio Metro DF Brazil Ministerio de Transporte Argentina 735-> Buenos Aires. -

Urban Aerial Cable Cars As Mass Transit Systems Case Studies, Technical Specifications, and Business Models

Urban Aerial Public Disclosure Authorized Cable Cars as Mass Transit Systems Case studies, technical specifications, and business models Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Copyright © 2020 by the International Bank for Reconstruction and Development / The World Bank, Latin America and Caribbean region 1818H Street, N.W. Washington DC 20433, U.S.A. www.worldbank.org All rights reserved This report is a product of consultant reports commissioned by the World Bank. The findings presented in this document are This work is available under the Creative based on official sources of information, interviews, data, and Commons Attribution 4.0 IGO license previous studies provided by the client and on the expertise of (CC BY 4.0 IGO). the consultant. The information contained here has been compiled from historical records, and any projections based Under the Creative Commons thereon may change as a function of inherent market risks and Attribution license, you are free to copy, uncertainties. The estimates presented in this document may distribute, transmit, and adapt this therefore diverge from actual outcomes as a consequence of work, including for commercial future events that cannot be foreseen or controlled, including, purposes, under the following but not limited to, adverse environmental, economic, political, or conditions: Attribution—Please cite the market impacts. work as follows: World Bank Group. Urban Aerial Cable Cars as Mass Transit The World Bank does not guarantee the accuracy of the data Systems. Case studies, technical included in this report and accepts no responsibility whatsoever specifications, and business models. for any consequence of their use or interpretation. -

Dubai: CREATING the WORLD’S LONGEST DRIVERLESS NETWORK INSIDE: Light Rail Awards 2012 Special

THE INTERNATIONAL LIGHT RAIL MAGAZINE HEADLINES l Paris tram network reaches 65km l AnsaldoBreda enters Chinese LRT market l Edinburgh tramway to open early? DUBAI: CREATING THE WORLD’S LONGEST DRIVERLESS NETWORK INSIDE: Light Rail Awards 2012 special Olsztyn Halberstadt Poland’s first How do you new-build sustain a system tramway in with a declining over 50 years population? DECEMBER 2012 No. 900 WWW . LRTA . ORG l WWW . TRAMNEWS . NET £3.80 PESA Bydgoszcz SA 85-082 Bydgoszcz, ul. Zygmunta Augusta 11 tel. (+48)52 33 91 104 fax (+48)52 3391 114 www.pesa.pl e-mail: [email protected] Layout_Adpage.indd 1 26/10/2012 16:15 Contents The official journal of the Light Rail Transit Association 448 News 448 DECEMBER 2012 Vol. 75 No. 900 Three new lines take Paris tram network to 65km; www.tramnews.net Mendoza inaugurates light rail services; AnsaldoBreda EDITORIAL signs Chinese technology partnership; München orders Editor: Simon Johnston Siemens new Avenio low-floor tram. Tel: +44 (0)1832 281131 E-mail: [email protected] Eaglethorpe Barns, Warmington, Peterborough PE8 6TJ, UK. 454 Olsztyn: Re-adopting the tram Associate Editor: Tony Streeter Marek Ciesielski reports on the project to build Poland’s E-mail: [email protected] first all-new tramway in over 50 years. Worldwide Editor: Michael Taplin Flat 1, 10 Hope Road, Shanklin, Isle of Wight PO37 6EA, UK. 457 15 Minutes with... Gérard Glas 454 E-mail: [email protected] Tata Steel’s CEO tells TAUT how its latest products offer News Editor: John Symons a step-change reduction in long-term maintenance costs. -

Floating Slab Mats 2020

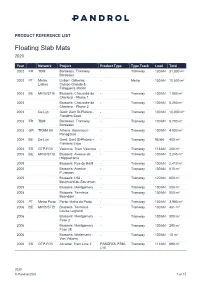

PRODUCT REFERENCE LIST Floating Slab Mats 2020 Year Network Project Product Type Type Track Load Total 2002 FR TBM Bordeaux: Tramway - Tramway 100 kN 31,000 m² Bordeaux 2002 PT Metro Lisbon: Odivelas, - Metro 100 kN 10,000 m² Lisboa Campo Grande & Falagueira station 2003 BE MIVB/STIB Brussels: Chaussée de - Tramway 100 kN 1,800 m² Charleroi - Phase 1 2003 Brussels: Chaussée de - Tramway 100 kN 5,250 m² Charleroi - Phase 2 2003 De Lijn Gent: Gent St-Pieters - - Tramway 100 kN 10,000 m² Flanders Expo 2003 FR TBM Bordeaux: Tramway - Tramway 130 kN 9,700 m² Bordeaux 2003 GR TRAM SA Athens: Kasamouli - - Tramway 100 kN 4,000 m² Panagitsas 2004 BE De Lijn Gent: Gent St-Pieters - - Tramway 95 kN 400 m² Flanders Expo 2004 ES GTP-FGV Valencia: Tram Valencia - Tramway 113 kN 200 m² 2005 BE MIVB/STIB Brussels: Avenue de - Tramway 100 kN 2,245 m² l'Hippodrome 2005 Brussels: Rue du Bailli - Tramway 100 kN 2,410 m² 2005 Brussels: Avenue - Tramway 100 kN 610 m² P.Janson 2005 Brussels: L94 - - Tramway 120 kN 600 m² Boulevard du Souverain 2005 Brussels: Montgomery - Tramway 100 kN 250 m² 2005 Brussels: Terminus - Tramway 100 kN 550 m² Boondael 2005 PT Metro Porto Porto: Metro do Porto - Tramway 100 kN 3,900 m² 2006 BE MIVB/STIB Brussels: Terminus - Tramway 130 kN 481 m² Louise Legrand 2006 Brussels: Montgomery - Tramway 100 kN 300 m² Fase 2 2006 Brussels: Montgomery - Tramway 100 kN 290 m² Fase 2E 2006 Brussels: Wielemans - - Tramway 100 kN 15 m² Van Volxem 2006 ES GTP-FGV Alicante: Tram Line 2 PANDROL FSM- Tramway 113 kN 690 m² L10 2020 © Pandrol 2020 -

The Urban Rail Development Handbook

DEVELOPMENT THE “ The Urban Rail Development Handbook offers both planners and political decision makers a comprehensive view of one of the largest, if not the largest, investment a city can undertake: an urban rail system. The handbook properly recognizes that urban rail is only one part of a hierarchically integrated transport system, and it provides practical guidance on how urban rail projects can be implemented and operated RAIL URBAN THE URBAN RAIL in a multimodal way that maximizes benefits far beyond mobility. The handbook is a must-read for any person involved in the planning and decision making for an urban rail line.” —Arturo Ardila-Gómez, Global Lead, Urban Mobility and Lead Transport Economist, World Bank DEVELOPMENT “ The Urban Rail Development Handbook tackles the social and technical challenges of planning, designing, financing, procuring, constructing, and operating rail projects in urban areas. It is a great complement HANDBOOK to more technical publications on rail technology, infrastructure, and project delivery. This handbook provides practical advice for delivering urban megaprojects, taking account of their social, institutional, and economic context.” —Martha Lawrence, Lead, Railway Community of Practice and Senior Railway Specialist, World Bank HANDBOOK “ Among the many options a city can consider to improve access to opportunities and mobility, urban rail stands out by its potential impact, as well as its high cost. Getting it right is a complex and multifaceted challenge that this handbook addresses beautifully through an in-depth and practical sharing of hard lessons learned in planning, implementing, and operating such urban rail lines, while ensuring their transformational role for urban development.” —Gerald Ollivier, Lead, Transit-Oriented Development Community of Practice, World Bank “ Public transport, as the backbone of mobility in cities, supports more inclusive communities, economic development, higher standards of living and health, and active lifestyles of inhabitants, while improving air quality and liveability. -

What Light Rail Can Do for Cities

WHAT LIGHT RAIL CAN DO FOR CITIES A Review of the Evidence Final Report: Appendices January 2005 Prepared for: Prepared by: Steer Davies Gleave 28-32 Upper Ground London SE1 9PD [t] +44 (0)20 7919 8500 [i] www.steerdaviesgleave.com Passenger Transport Executive Group Wellington House 40-50 Wellington Street Leeds LS1 2DE What Light Rail Can Do For Cities: A Review of the Evidence Contents Page APPENDICES A Operation and Use of Light Rail Schemes in the UK B Overseas Experience C People Interviewed During the Study D Full Bibliography P:\projects\5700s\5748\Outputs\Reports\Final\What Light Rail Can Do for Cities - Appendices _ 01-05.doc Appendix What Light Rail Can Do For Cities: A Review Of The Evidence P:\projects\5700s\5748\Outputs\Reports\Final\What Light Rail Can Do for Cities - Appendices _ 01-05.doc Appendix What Light Rail Can Do For Cities: A Review of the Evidence APPENDIX A Operation and Use of Light Rail Schemes in the UK P:\projects\5700s\5748\Outputs\Reports\Final\What Light Rail Can Do for Cities - Appendices _ 01-05.doc Appendix What Light Rail Can Do For Cities: A Review Of The Evidence A1. TYNE & WEAR METRO A1.1 The Tyne and Wear Metro was the first modern light rail scheme opened in the UK, coming into service between 1980 and 1984. At a cost of £284 million, the scheme comprised the connection of former suburban rail alignments with new railway construction in tunnel under central Newcastle and over the Tyne. Further extensions to the system were opened to Newcastle Airport in 1991 and to Sunderland, sharing 14 km of existing Network Rail track, in March 2002.