Yearbook 2003

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

En Gemensam SAS-Aktie

En gemensam SAS-aktie Erbjudande från SAS AB (publ) till aktieägarna i SAS Sverige AB (publ) Börsprospekt för SAS AB (publ) Utbytesförhållanden: För varje aktie i SAS Danmark A/S, SAS Norge ASA och SAS Sverige AB erbjuds en ny aktie i SAS AB Anmälningsperiod: 28 maj – 25 juni 2001 Handel med BTA inleds: Omkring den 29 juni 2001 Beräknad första dag för notering av aktier i SAS AB: 6 juli 2001 Informationstillfällen Delårsrapport 2, jan-jun 2001 8 augusti 2001 Delårsrapport 3, jan-sep 2001 7 november 2001 Bokslutskommuniké 2001 februari 2002 Årsredovisning 2001 mars 2002 Miljöredovisning 2001 mars 2002 Handelskoder Reuter Bloomberg Telerate ISIN SAS Danmark A/S (DKK) SASD.CO SAS DC DK; SAS DK 001 022 3 775 SAS Norge ASA (NOK) SASB.OL SASB NO NO; SAS.B NO 000 392 0019 SAS Sverige AB (SEK) SAS.ST SAS SS SE; SAS SE 00 0032 9146 SAS AB SE 00 00 805574 Detta prospekt (”Prospektet”, ”detta Prospekt”) har upprättats av SAS AB med anledning av Erbjudandet (defi- nieras nedan) till aktieägarna i SAS Sverige AB som beskrivs häri samt med anledning av inregistreringen av SAS AB:s aktier på Stockholmsbörsen, Københavns Fondsbørs och Oslo Børs. Motsvarande erbjudanden läm- nas till aktieägarna i SAS Danmark A/S och SAS Norge ASA. Prospekt har upprättats på danska, norska, sven- ska samt engelska. Prospekten riktar sig till aktieägare i SAS Danmark A/S, SAS Norge ASA respektive SAS Sverige AB. Den engelska versionen är en översättning och riktar sig till aktieägare i samtliga ovan nämnda bolag. Den engelska versionen är, förutom i kapitel sex och där inte annat anges, en översättning av det svenska Prospektet. -

WORLD AVIATION Yearbook 2013 EUROPE

WORLD AVIATION Yearbook 2013 EUROPE 1 PROFILES W ESTERN EUROPE TOP 10 AIRLINES SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 R ANKING CARRIER NAME SEATS Lufthansa 1 Lufthansa 1,739,886 Ryanair 2 Ryanair 1,604,799 Air France 3 Air France 1,329,819 easyJet Britis 4 easyJet 1,200,528 Airways 5 British Airways 1,025,222 SAS 6 SAS 703,817 airberlin KLM Royal 7 airberlin 609,008 Dutch Airlines 8 KLM Royal Dutch Airlines 571,584 Iberia 9 Iberia 534,125 Other Western 10 Norwegian Air Shuttle 494,828 W ESTERN EUROPE TOP 10 AIRPORTS SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 Europe R ANKING CARRIER NAME SEATS 1 London Heathrow Airport 1,774,606 2 Paris Charles De Gaulle Airport 1,421,231 Outlook 3 Frankfurt Airport 1,394,143 4 Amsterdam Airport Schiphol 1,052,624 5 Madrid Barajas Airport 1,016,791 HE EUROPEAN AIRLINE MARKET 6 Munich Airport 1,007,000 HAS A NUMBER OF DIVIDING LINES. 7 Rome Fiumicino Airport 812,178 There is little growth on routes within the 8 Barcelona El Prat Airport 768,004 continent, but steady growth on long-haul. MostT of the growth within Europe goes to low-cost 9 Paris Orly Field 683,097 carriers, while the major legacy groups restructure 10 London Gatwick Airport 622,909 their short/medium-haul activities. The big Western countries see little or negative traffic growth, while the East enjoys a growth spurt ... ... On the other hand, the big Western airline groups continue to lead consolidation, while many in the East struggle to survive. -

Heritage, Heroes, Horizons 50 Years of A/TA Tradition and Transformation

AIRLIFT/TANKER QUARTERLY Volume 26 • Number 4 • Fall 2018 Heritage, Heroes, Horizons 50 Years of A/TA Tradition and Transformation Pages 14 2018 A/TA Awards Pages 25-58 A Salute to Our Industry Partners Pages 60-69 Table of Contents 2018 A/TA Board of Offi cers & Convention Staff ..................................................................... 2 A/TA UpFront Chairman’s Comments. ............................................................................................................. 4 President’s Message .................................................................................................................... 5 Secretary’s Notes ........................................................................................................................ 6 AIRLIFT/TANKER QUARTERLY Volume 26 • Number 4 • Fall 2018 The Inexorable March of Time, an article by Col. Dennis “Bud” Traynor, USAF ret ...................7 ISSN 2578-4064 Airlift/Tanker Quarterly is published four times a year by the Features Airlift/Tanker Association, 7983 Rhodes Farm Way, Chattanooga, A Welcome Message from Air Mobility Command Commader General Maryanne Miller ...... 8 Tennessee 37421. Postage paid at St. Louis, Missouri. Subscription rate: $40.00 per year. Change of address A Welcome Message from Air Mobility Command Chief Master Sergeant Larry C. Williams, Jr... 10 requires four weeks notice. The Airlift/Tanker Association is a non-profi t professional Cover Story organization dedicated to providing a forum for people Heritage, Heores, Horizons interested -

Norges Høyesterett

NORGES HØYESTERETT Den 5. mai 2011 avsa Høyesterett dom i HR-2011-00910-A, (sak nr. 2010/1676), sivil sak, anke over dom, Sven Vidar Bottolvs Tore Inge Erlandsen Harald Glebo Jon Hovring Einar Åsmund Nordhagen Viggo Sivertsen Per Harald Hanssen Glenn Olaf Lyche (advokat Alex Borch – til prøve) Per Steinar Horne Hans Oddvar Tofterå (advokat Jon Gisle – til prøve) mot SAS Scandinavian Airlines Norge AS Næringslivets Hovedorganisasjon (partshjelper) (advokat Tron Dalheim – til prøve) STEMMEGIVNING: (1) Dommer Normann: Saken gjelder gyldigheten av oppsigelsene av ti flygere i SAS Norge AS (SAS Norge). Hovedspørsmålet er om det skjedde ulovlig aldersdiskriminering ved utvelgelsen av dem som ble oppsagt. 2 (2) Morselskapet i SAS-konsernet, SAS AB, eier datterselskapene SAS Danmark A/S, SAS Norge AS og SAS Sverige AB. Flyvirksomheten ble opprinnelig drevet gjennom et konsortium eid av datterselskapene kalt Scandinavian Airlines System Denmark Norway Sweden (SAS-konsortiet). I 1989 ble SAS Commuter etablert som et søsterkonsortium til SAS-konsortiet. I 2001 overtok SAS AB aksjene i Braathens ASA. I 2002 ble Widerøe en del av SAS-konsernet, og i 2004 ble SAS Commuter innlemmet i SAS-konsortiet. (3) Med virkning fra 1. januar 2005 ble den norske virksomheten i SAS-konsortiet skilt ut og slått sammen med Braathens ASA til SAS Braathens AS. Selskapet endret senere navn til SAS Scandinavian Airlines Norge AS, og var de ankende parters arbeidsgiver på oppsigelsestidspunktet. (4) I forbindelse med implementeringen av de felles europeiske flysertifikatbestemmelsene ble den øvre grensen for ervervsmessig flysertifikat hevet fra 60 til 65 år, jf. forskrift 20. desember 2000 som trådte i kraft 1. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Sediu Social) Statut Licenţă Crt

Anexa Actualizat: 11.09.2014 Denumire Nr. transportator Adresă (sediu social) Statut licenţă crt. aerian. Nr. Licenta/ Editia 01. – TAROM S.A. Otopeni, Calea Bucureştilor Nr. LO 01 ‐ Licenţa validă ‐ nr. 224 F, jud. Ilfov. Ediţia 3/08.11.2011 02. R.A. Bucureşti, bd. Dimitrie Nr. LO 02 Revocată din Cantemir nr.1, bl. B2, sector 24.05.2013 ROMAVIA 4. Ediţia 3/08.11.2011 03. S.C. GRIVCO AIR S.A. Bucureşti, bd. Ficusului nr. Nr. LTA 03 Revocata din 44 A, sector 1 Ediţia 01/22.10.1999 03.07.2001 04. S.C. ACVILA AIR Bucureşti, str. George Nr. LTA 04 Revocata din ROMANIAN Enescu, nr. 7, sector 1 01.02.2007 CARRIER S.R.L. Ediţia 01/25.10.1999 05. S.C. JARO Bucureşti, Şos. Bucureşti‐ Nr. LTA 05 Revocată din INTERNATIONAL S.A. Ploieşti, nr. 14‐22, bl XIII/2, 30.11.2001 sector 1 Ediţia 1/27.10.1999 06. S.C. AVIATIA Str. Neagoe Vodă 7‐9, bl. UTILITARA 8/3, sc 3, et. 3, sector 1, Nr. LTA 06 Revocată BUCURESTI S.A. Bucureşti Ediţia 1/27.10.1999 06.11.2006 07. S.C. ION ŢIRIAC AIR Otopeni, Calea Bucureştilor Nr. LO 07 S.R.L nr. 224 G, jud. Ilfov. ‐ Licenţa validă ‐ Ediţia 4/07.11.2011 08. S.C. VEG AIR S.A. Bucureşti, bd. Iancu de Nr. LTA 08 Revocată din Hunedoara nr. 4, sector 1 Ediţia 1/02.11.1999 01.03.2000 09. S.C. AIROM 2000 Bucureşti, bd. 1 Mai, nr. Revocată din Nr. -

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

Bureau Enquêtes-Accidents

Bureau Enquêtes-Accidents RAPPORT relatif à l’abordage survenu le 30 juillet 1998 en baie de Quiberon (56) entre le Beech 1900D immatriculé F-GSJM exploité par Proteus Airlines et le Cessna 177 immatriculé F-GAJE F-JM980730 F-JE980730 MINISTERE DE L'EQUIPEMENT, DES TRANSPORTS ET DU LOGEMENT INSPECTION GENERALE DE L'AVIATION CIVILE ET DE LA METEOROLOGIE FRANCE Table des matières AVERTISSEMENT ______________________________________________________________ 6 ORGANISATION DE L’ENQUETE _________________________________________________ 7 S Y N O P S I S_________________________________________________________________ 8 1 - RENSEIGNEMENTS DE BASE _________________________________________________ 9 1.1 Déroulement des vols________________________________________________________ 9 1.2 Tués et blessés ____________________________________________________________ 10 1.3 Dommages aux aéronefs ____________________________________________________ 10 1.4 Autres dommages__________________________________________________________ 10 1.5 Renseignements sur le personnel ____________________________________________ 10 1.5.1. Equipage de conduite du Beech 1900D______________________________________ 10 1.5.1.1. Commandant de bord ________________________________________________ 10 1.5.1.2. Copilote ___________________________________________________________ 12 1.5.2. Pilote du Cessna 177 ____________________________________________________ 13 1.5.3 Contrôleur d'approche de Lorient ___________________________________________ 13 1.5.4 Agent AFIS de Quiberon __________________________________________________ -

The Undisputed Leader in World Travel CONTENTS

Report & Accounts 1996-97 ...the undisputed leader in world travel CONTENTS Highlights of the year 1 Chairman’s Statement 2 THE NEXT Chief Executive’s Statement 5 Board Members 8 The Board and Board Committees DECADEIN FEBRUARY 1997 and the Report of the Remuneration Committee 10 British Airways celebrated 10 years of privatisation, with a Directors’ Report 14 renewed commitment to stay at the forefront of the industry. Report of the Auditors on Corporate Governance matters 17 Progress during the last decade has been dazzling as the airline Operating and Financial established itself as one of the most profitable in the world. Review of the year 18 Statement of Directors’ responsibilities 25 Report of the Auditors 25 Success has been built on a firm commitment to customer service, cost control and Group profit and loss account 26 the Company’s ability to change with the times and new demands. Balance sheets 27 As the year 2000 approaches, the nature of the industry and Group cash flow statement 28 competition has changed. The aim now is to create a new Statement of total recognised British Airways for the new millennium, to become the undisputed gains and losses 29 leader in world travel. Reconciliation of movements in shareholders’ funds 29 This involves setting a new direction for the Company with a Notes to the accounts 30 new Mission, Values and Goals; introducing new services and Principal investments 54 products; new ways of working; US GAAP information 55 new behaviours; a new approach to The launch of privatisation spelt a Five year summaries 58 service style and a brand new look. -

International Westfield Offer

Westfield London VIP invitation VIP shopping experience for your customers at Westfield London bmi, British Midland International has teamed up with Westfield London to offer your customers a fantastic shopping and leisure experience in Central London at Europe’s largest shopping mall. The ultimate destination The Westfield London, near Shepherds Bush, is the capital’s dynamic new shopping and leisure destination – the perfect place to shop, eat and meet. The architecturally stunning environment is a showcase for five anchor stores: Debenhams, Next, M&S, House of Fraser and Waitrose, plus 275 luxury, premium, and high street retailers from Hugo Boss to Links of London. The Village, is home to 40 luxury brands such as Louis Vuitton, Prada, Jimmy Choo, Tiffany, Salvatorre Ferragamo and more. There are nearly 50 exciting places to eat offering a wide choice of cooking styles plus a fully digital state-of-the-art cinema with seating for 3,000 offers the widest possible film choice. VIP invitation Once you have made a bmi booking into London Heathrow, a voucher will automatically be available within your customer’s online booking itinerary. All you need to do is follow a few simple steps: 1. Go to flybmi.com/westfield 2. Retrieve the booking by entering the surname and booking reference 3. Print the itinerary/voucher displayed and pass to your customer To take advantage of a variety of discounts at selected stores and restaurants your customer just needs to take their printed itinerary/voucher to the Concierge Desk at Westfield London and it will be exchanged for a VIP pass. -

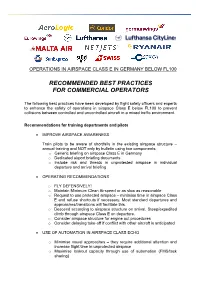

Recommended Best Practices for Commercial Operators

OPERATIONS IN AIRSPACE CLASS E IN GERMANY BELOW FL100 RECOMMENDED BEST PRACTICES FOR COMMERCIAL OPERATORS The following best practices have been developed by flight safety officers and experts to enhance the safety of operations in airspace Class E below FL100 to prevent collisions between controlled and uncontrolled aircraft in a mixed traffic environment. Recommendations for training departments and pilots • IMPROVE AIRSPACE AWARENESS Train pilots to be aware of shortfalls in the existing airspace structure – annual training and NOT only by bulletin using two components: o Generic briefing on airspace Class E in Germany o Dedicated airport briefing documents o Include risk and threats in unprotected airspace in individual departure and arrival briefing • OPERATING RECOMMENDATIONS o FLY DEFENSIVELY! o Maintain Minimum Clean Airspeed or as slow as reasonable o Request to use protected airspace – minimise time in airspace Class E and refuse shortcuts if necessary. Most standard departures and approaches/transitions will facilitate this. o Descend according to airspace structure on arrival. Steep/expedited climb through airspace Class E on departure. o Consider airspace structure for engine out procedures o Consider delaying take-off if conflict with other aircraft is anticipated • USE OF AUTOMATION IN AIRSPACE CLASS ECHO o Minimise visual approaches – they require additional attention and increase flight time in unprotected airspace o Maximise lookout capacity through use of automation (FMS/task sharing) • SEE AND AVOID o Maximise lookout -

LLEP ANNUAL REPORT April 2018 - March 2019 FOREWORD from the CHAIR

LLEP ANNUAL REPORT April 2018 - March 2019 FOREWORD FROM THE CHAIR CONTENTS The Leicester and Leicestershire Enterprise Partnership (LLEP) and its partners have made significant progress over the last 12 months and I am pleased to present our Annual FORWARD FROM THE CHAIR 3 Report for 2018-19 to highlight these achievements. VISION AND PRIORITIES 2018-19 4 2018-19 has been another exciting year. We have Our Enterprise Adviser Network was successful in seen major developments in some of the key becoming one of only twenty Careers Hubs in the MAJOR INVESTMENTS MAP 2018-19 6 investments made by the LLEP, and key changes to country. The Hub was officially launched in January our governance and structure. This year we received 2019 and will help us build on our achievements, GROWTH DEAL 8 an ‘exceptional’ rating for delivery and ‘good’ rating ensuring that every student in Leicester and EUROPEAN STRUCTURAL AND for governance, once again highlighting the strength Leicestershire has the tools to succeed in the world of of our foundations as we continue to create economic work. INVESTMENT FUNDS (ESIF) 10 prosperity in our region. In February, we approved a Growing Places Fund ENTERPRISE ZONES 12 A major milestone for the LLEP came in September loan of £750,000 for Norton Motorcycles – one of 2018, with the opening of MIRA Technology Institute Leicestershire’s most iconic brands. This funding will GROWING PLACES FUND (GPF) 13 (MTI). Built with a £9.5 million grant from our Local help expand Norton’s manufacturing capabilities at ENERGY INFRASTRUCTURE STRATEGY 14 Growth Fund, MTI is at the cutting edge of automotive Donington Hall.