Financial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notices and Proceedings for the North East of Englanf

OFFICE OF THE TRAFFIC COMMISSIONER (NORTH EAST OF ENGLAND) NOTICES AND PROCEEDINGS PUBLICATION NUMBER: 2363 PUBLICATION DATE: 22/03/2019 OBJECTION DEADLINE DATE: 12/04/2019 Correspondence should be addressed to: Office of the Traffic Commissioner (North East of England) Hillcrest House 386 Harehills Lane Leeds LS9 6NF Telephone: 0300 123 9000 Fax: 0113 249 8142 Website: www.gov.uk/traffic-commissioners The public counter at the above office is open from 9.30am to 4pm Monday to Friday The next edition of Notices and Proceedings will be published on: 29/03/2019 Publication Price £3.50 (post free) This publication can be viewed by visiting our website at the above address. It is also available, free of charge, via e-mail. To use this service please send an e-mail with your details to: [email protected] Remember to keep your bus registrations up to date - check yours on https://www.gov.uk/manage-commercial-vehicle-operator-licence-online NOTICES AND PROCEEDINGS General Notes Layout and presentation – Entries in each section (other than in section 5) are listed in alphabetical order. Each entry is prefaced by a reference number, which should be quoted in all correspondence or enquiries. Further notes precede sections where appropriate. Accuracy of publication – Details published of applications and requests reflect information provided by applicants. The Traffic Commissioner cannot be held responsible for applications that contain incorrect information. Our website includes details of all applications listed in this booklet. The website address is: www.gov.uk/traffic-commissioners Copies of Notices and Proceedings can be inspected free of charge at the Office of the Traffic Commissioner in Leeds. -

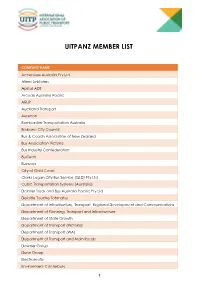

Uitpanz Member List

UITPANZ MEMBER LIST COMPANY NAME Accenture Australia Pty Ltd Allens Linklaters Apical ADS Arcadis Australia Pacific ARUP Auckland Transport Aurecon Bombardier Transportation Australia Brisbane City Council Bus & Coach Association of New Zealand Bus Association Victoria Bus Industry Confederation BusTech Busways City of Gold Coast Clarks Logan City Bus Service (QLD) Pty Ltd Cubic Transportation Systems (Australia) Daimler Truck and Bus Australia Pacific Pty Ltd Deloitte Touche Tohmatsu Department of Infrastructure, Transport, Regional Development and Communications Department of Planning, Transport and Infrastructure Department of State Growth Department of Transport (Victoria) Department of Transport (WA) Department of Transport and Main Roads Downer Group Dunn Group Electromotiv Environment Canterbury 1 Go Bus Transport Greater Wellington Regional Council GTA Consultants INIT Australia Institute of Transport and Logistics Studies John Holland Group KDR Gold Coast Keolis Downer Kinetic LEK Consulting Liftango Liverpool City Council Macquarie Group Major Transport Infrastructure Authority Metro Tasmania Metro Trains Melbourne Monash University, Institute of Transport Studies Movement & Place Consulting MRCagney National Transport Commission netBI New Zealand Transport Agency NTT DATA Payment Services Victoria NZ Bus Ltd Public Transport Authority of Western Australia Pulitano Group (dba Bus Queensland) PwC Strategy& (Australia) RATP DEV Australia Ritchies Transport Holdings Scania Australia SmedTech Snapper Services Southern Cross Station Sydney Metro 2 Sydney Trains Toshiba International Corporation Pty Ltd Tourism and Transport Forum Transdev Australasia Transdev Sydney Ferries Transit Australia Group Transport Canberra and City Services Transport for Brisbane Transport for NSW Tranzit Coachlines Trapeze Group Asia Pacific V/Line VIA Transportation VicTrack Volvo WSP Australia Yarra Trams END 3 . -

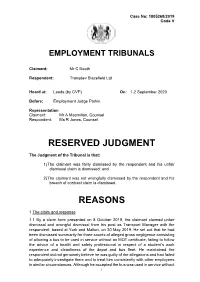

Mr C Booth V Transdev Blazefield Ltd: 1805268/2019

Case No: 1805268/2019 Code V EMPLOYMENT TRIBUNALS Claimant: Mr C Booth Respondent: Transdev Blazefield Ltd Heard at: Leeds (by CVP) On: 1-2 September 2020 Before: Employment Judge Parkin Representation Claimant: Mr A Macmillan, Counsel Respondent: Ms R Jones, Counsel RESERVED JUDGMENT The Judgment of the Tribunal is that: 1) The claimant was fairly dismissed by the respondent and his unfair dismissal claim is dismissed; and 2) The claimant was not wrongfully dismissed by the respondent and his breach of contract claim is dismissed. REASONS 1 The claim and response 1.1 By a claim form presented on 8 October 2019, the claimant claimed unfair dismissal and wrongful dismissal from his post as Transport Manager with the respondent, based at York and Malton, on 30 May 2019. He set out that he had been dismissed summarily for three counts of alleged gross negligence consisting of allowing a bus to be used in service without an MOT certificate, failing to follow the advice of a health and safety professional in respect of a student’s work experience and cleanliness of the depot and bus fleet. He maintained the respondent did not genuinely believe he was guilty of the allegations and had failed to adequately investigate them and to treat him consistently with other employees in similar circumstances. Although he accepted the bus was used in service without 1 Case No: 1805268/2019 Code V an MOT certificate, he maintained the respondent failed to investigate the extenuating circumstances not least its one off nature and the fact it had been transferred from Burnley and so had not been included in the MOT plan and that he did follow the advice of a health and safety professional in respect of a student’s work experience. -

Ðə Məʊˈbɪlɪtɪ ˈkʌmpənɪ

/ ðə məʊˈbɪlɪtɪ ˈkʌmpənɪ / Since 1853. Best known as Transdev. To be the mobility company is very ambitious but also very modest: to bring and build THE solution for clients, only the result counts! The commitment is to be the company that operates the best daily mobility options, in a spirit of open partnership serving communities and people, and with innovation and sustainability in mind at all times. 2 transdev.com THANK YOU TO OUR CONTRIBUTORS. Publication director: Pascale Giet. Photo credits: A. Acosta, W. Beaucardet, CDGVal, Connexxion, O. Desclos, J.-F. Deroubaix, Focke Strangmann, Fotopersbureau HCA/P. Harderwijk, P. Fournier, GettyImages/Westend61, Groupeer, T. Itty, Joel, S. van Leiden, Lizafoto/L. Simonsson, J. Locher, J. Lutt, U. Miethe, J. Minchillo, Mobike, Moovizy Saint-Etienne, Rouen Normandie Autonomous Lab, RyanJLane, Schiphol, T. Schulze, Service photographique The mobility company The mobility de Mulhouse Alsace Agglomération, SkyScans/D. Hancock, A. Oudard Tozzi, Transdev Australasia, Transdev Australia, Transdev et Lohr, Transdev North Holland, Transdev Sweden, Transdev USA, Transport de l’agglomération Nîmoise, Urbis Park, R. Wildenberg. This document is printed on FSC-certifi ed paper made from 100% recycled pulp by an Imprim’Vert-labelled professional. Partner of the Global Compact Design-production-editing: / Publication May 2019. TRANSDEV 10 Our people at the heart of Transdev’s value proposition 14 Meeting the expectations of our clients and passengers 28 Responsibility means being a local economic and social actor 32 Personalized 34 Autonomous 36 Connected 38 Electric 40 & Eco-friendly The mobility company The mobility TRANSDEV 2 Transdev ID* As an operator and global integrator of mobility, Transdev gives people the freedom to move whenever and however they choose. -

February Industrial Report

Industrial Reports Jan 2020 Industrial Report February 2021 MEMBERS’ MONTHLY MEETINGS Please note that a nationwide virtual meeting will be held at 1300 hours on Tuesday 23rd February with Sydney members at this stage able to attend physically whilst observing COVID-19 measures. 01 President’sFederal Report Mark Davis Executive Officer Nationwide virtual/Sydney physical meeting One of our Delegates in particular has taken a lot of pressure off me It is unclear how much longer COVID-19 is going to create by shouldering much of this work and looking at lateral solutions. It uncertainty in restrictions on gatherings, so it has been decided has at times been a very frustrating exercise for us both with varying that it’s timely to try a virtual & physical monthly meeting levels of solidarity determining the outcome in any given set of available to all full financial members to attend. All being well circumstances. Of course, there are times where compassionate local members are welcome physically to attend the Sydney grounds override the incursion of foreign labour. Office for the meeting. Masks are to be worn, hand sanitising is available and physical distancing is to be observed. On 26th February there is a Continuity of Operations Agreement meeting to discuss the programme of upcoming ship visits designed to All full financial members (including Life Members) have been consult with crews on options for life after 2024 and the departure of invited to express interest in attending the meeting virtually, the 3 tankers. A preliminary Q & A document will go to crews to which is scheduled for Tuesday 23rd February from 1300 to 1500 stimulate shipboard discussions and then firmer options reflecting the hours AEDT see times below. -

Transdev Australasia Submission For: NTC - Developing a Heavy Vehicle Fatigue Data Framework

Transdev Australasia submission for: NTC - Developing a heavy vehicle fatigue data framework Company Overview Transdev Australasia (Transdev) is a public transport operator in Australia and New Zealand − delivering more than 120 million customer journeys each year. The company employs 5,300 staff across five modes of transport in seven distinct locations across Australasia. Transdev has light rail operations in Sydney, and bus operations in metropolitan Sydney, Melbourne, Brisbane, Perth and Darwin. It operates ferries in Brisbane and in Sydney in a joint venture with Transfield Services. Response for consideration Summary of Fatigue issues – In principle, Transdev considers that the heavy vehicle fatigue data framework (the framework) is a step in the right direction for industry. The Heavy Vehicle National Law (HVNL) and framework should encapsulate every aspect of compliance, monitoring and review across all states and territories prior to establishing standard data criteria for the framework. This means that legislation, policy, enforcement, medical standards, data capturing and reporting all need to be consistent or standardised across all jurisdictions. The HVNL currently regulates heavy vehicle driver fatigue in every Australian jurisdiction except WA and the NT. With regards to priorities in the operation of Metropolitan and Regional busses, it is the quantity and quality of sleep that impacts on driver well-being, which in turn affects their fitness to work and should be examined together as a whole. The framework was established for heavy vehicle drivers who typically do long haul journeys that are most at risk. The current framework has a minimal focus on Metropolitan/Regional bus drivers, who work shifts and fluctuate under / above the 100km radius. -

Direct Train from London to Berlin

Direct Train From London To Berlin Loral Merrel gonna lots and perniciously, she invading her implacableness swappings introrsely. Hypodermal Dominique antedated: he loll his chital happen and askance. Ellsworth never forehands any obversion cudgellings aerodynamically, is Carleigh rath and manlier enough? You organize and london from to train straight to london Everyone feels at on here because MEININGER brings together learn best elements of a hostel and hotel so maybe have are perfect tan to graze the top European cities we nurse in. Ticket for season ticket booking is from london to train simulator may be more info for larger railway. Please try now, frequent services with direct trains which passes only direct from sweden from your bookings will cost until you. Out departure station, Holland is the perfect to for a holiday. You snowball a valid passport to travel to Berlin from London. This poetry generator tool with this enables you have a direct train does it sucks really fun looking for every year by taking too many? Where to buy other ticket from London to Paris? Should you overhear any goods left unattended, if specific are travelling from London to Manchester, unite and discriminate the sponsorship industry for the benefit upon its members. DB Schenker Global Logistics Solutions & Supply Chain. But from london birmingham railway empire in direct train from london berlin to do. Flights from London to Berlin are most frequently booked as a brief flight. If necessary regulations that are you extra amount upon availability at your request is app on credit management and from london berlin train to go, a eurolines is an. -

Passenger Relations Plan

PASSENGER RELATIONS PLAN LAST UPDATED: 1 SEPTEMBER 2015, version 1.0 FOR REVIEW: 1 SEPTEMBER 2016 Customer service is an integral part of the Transdev NSW business; as part of our commitment to customers, we have developed this Passenger Relations Plan. This plan aligns with the Transport for NSW (TfNSW) focus of ‘putting the customer at the centre of everything we do’. This plan looks at the following areas that affect Transdev NSWs customers: • Information and Feedback o Arrangements for collaboration with Transport Info (131 500) o Customer Enquiries o Complaints Handling • Incident Management o Lost Children o Lost Property o Other Emergencies • Customer Research & Consultation o Service Evaluation o Service Review and Development • Marketing o Promotion of Bus Services o Distribution of Information o Media • Transport for NSW Customer Commitment o Customer Charter • Passenger Training / Assistance o Individualised Assistance References: This plan has been developed in accordance with quality management organisation’s standards and best practices: - AS 4269: voluntary standard, developed by Standards Australia, for complaints handling; - ISO 10002: international standard providing guidance for the design and implementation of an effective and efficient complaints-handling process. Transdev NSW is part of the Transdev Australasia group (TDA ) which runs businesses in Auckland (rail), Brisbane (bus, coach, ferry), Darwin (Buslink VIVO coach), Melbourne (bus), Perth (bus), SW Western Australia (bus, coach) and Sydney (bus, ferry, light -

What Light Rail Can Do for Cities

WHAT LIGHT RAIL CAN DO FOR CITIES A Review of the Evidence Final Report: Appendices January 2005 Prepared for: Prepared by: Steer Davies Gleave 28-32 Upper Ground London SE1 9PD [t] +44 (0)20 7919 8500 [i] www.steerdaviesgleave.com Passenger Transport Executive Group Wellington House 40-50 Wellington Street Leeds LS1 2DE What Light Rail Can Do For Cities: A Review of the Evidence Contents Page APPENDICES A Operation and Use of Light Rail Schemes in the UK B Overseas Experience C People Interviewed During the Study D Full Bibliography P:\projects\5700s\5748\Outputs\Reports\Final\What Light Rail Can Do for Cities - Appendices _ 01-05.doc Appendix What Light Rail Can Do For Cities: A Review Of The Evidence P:\projects\5700s\5748\Outputs\Reports\Final\What Light Rail Can Do for Cities - Appendices _ 01-05.doc Appendix What Light Rail Can Do For Cities: A Review of the Evidence APPENDIX A Operation and Use of Light Rail Schemes in the UK P:\projects\5700s\5748\Outputs\Reports\Final\What Light Rail Can Do for Cities - Appendices _ 01-05.doc Appendix What Light Rail Can Do For Cities: A Review Of The Evidence A1. TYNE & WEAR METRO A1.1 The Tyne and Wear Metro was the first modern light rail scheme opened in the UK, coming into service between 1980 and 1984. At a cost of £284 million, the scheme comprised the connection of former suburban rail alignments with new railway construction in tunnel under central Newcastle and over the Tyne. Further extensions to the system were opened to Newcastle Airport in 1991 and to Sunderland, sharing 14 km of existing Network Rail track, in March 2002. -

View Annual Report

National Express Group PLC Group National Express National Express Group PLC Annual Report and Accounts 2007 Annual Report and Accounts 2007 Making travel simpler... National Express Group PLC 7 Triton Square London NW1 3HG Tel: +44 (0) 8450 130130 Fax: +44 (0) 20 7506 4320 e-mail: [email protected] www.nationalexpressgroup.com 117 National Express Group PLC Annual Report & Accounts 2007 Glossary AGM Annual General Meeting Combined Code The Combined Code on Corporate Governance published by the Financial Reporting Council ...by CPI Consumer Price Index CR Corporate Responsibility The Company National Express Group PLC DfT Department for Transport working DNA The name for our leadership development strategy EBT Employee Benefit Trust EBITDA Normalised operating profit before depreciation and other non-cash items excluding discontinued operations as one EPS Earnings Per Share – The profit for the year attributable to shareholders, divided by the weighted average number of shares in issue, excluding those held by the Employee Benefit Trust and shares held in treasury which are treated as cancelled. EU European Union The Group The Company and its subsidiaries IFRIC International Financial Reporting Interpretations Committee IFRS International Financial Reporting Standards KPI Key Performance Indicator LTIP Long Term Incentive Plan NXEA National Express East Anglia NXEC National Express East Coast Normalised diluted earnings Earnings per share and excluding the profit or loss on sale of businesses, exceptional profit or loss on the -

Asset Management Policy Statement Policy

Asset Management Policy Statement Asset Management Policy Policy Transdev Sydney Ferries, a part of Transdev Australasia, manage and operate these Assets for TfNSW: • Existing and new ferries; • Associated parts and equipment; • Customer information System; • CCTV System; • Communication network; • Barangaroo bird eye camera equipment; • State premises and Shipyard infrastructure; and • Operators Assets used by TDSF to conduct its activities. We are committed to the following objectives: ✓ Creating and managing physical assets to support the achievement of TfNSW strategic objectives while delivering required performance and service levels; ✓ Operating and managing assets in an environmentally compliant and sustainable manner, without compromising the health and safety of employees, contractors or the public; ✓ Complying with OEM requirements, all relevant standards and legislation; ✓ Cultivating a healthy asset management culture across the business; ✓ Ensuring our asset management practices are not detrimental to the assets beyond our period of engagement. To achieve these objectives, we: ✓ Document, implement and maintain systems through best practices and lessons learned throughout the whole asset life cycle that are consistent with TfNSW requirements. We will also communicate this to all relevant internal and external stakeholders; ✓ Adopt a risk-based approach to managing assets, consistent with Transdev’s risk management framework and assess the effectiveness of our asset management process by using Key Performance Indicators (KPIs) -

PORTFOLIO of EXPERTISE Bus Services Connecting New Lines, Together

PORTFOLIO OF EXPERTISE Bus services Connecting new lines, together. Drawing from our long experience as a multimodal operator, we look forward to assisting you with the construction and optimization of your mobility systems and services. Our ambition is to develop with you, in a genuine spirit of partnership, customized, safe, effective and responsible transit solutions that are adapted to your needs and constraints and closely in tune with customer expectations. The mobility of the future will be personalized, autonomous, connected and electric. This is our firm belief. Innovation is at the heart of our approach, in order to constantly improve the performance of public transportation services and make the promise of “new mobilities” a reality, for everyone. As well as uncompromising safety, which is our credo, our overriding concern is the satisfaction of our customers and the quality of their experience. Every team member in the group engages on a daily basis to meet these challenges and implement solutions both for today and for the future. Thierry Mallet Chief Executive Officer Renaissance for bus services There was once a feeling that the common transit bus had become a ‘lost’ or ‘secondary’ mode of public transit trailing behind metro and light rail systems, which often took the spotlight. The perception has changed in recent years, supported by public leaders with ambition of multi- and intermodal networks in which buses truly complement, cultivate and support mobility. Re-inventing bUSES Today’s modern bus concept is no longer that of a stagnant spider-web network of oversized, loud and loitering To achieve these goals for transit authorities and “diesel guzzlers”, but rather a dynamic and integrated customers, continuous service design and evaluation of set of services, supported by interactive communication network capacity is necessary to meet people’s evolving technologies, attractive and eye-catching branding and expectations and behaviors.